Professional Documents

Culture Documents

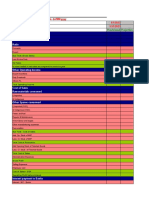

Income Statement

Uploaded by

rroy7250 ratings0% found this document useful (0 votes)

31 views2 pagesRevenue Gross sales (all numbers in $000) current month % of sales less sales returns and allowances Net sales Cost of Sales Beginning inventory Current Month Amount % of Sales Amount Year to date plus goods purchased / manufactured Total goods available less ending inventory Total cost of goods sold Gross profit (loss) Operating Expenses Selling current month. Amount % Year to date Commissions Advertising Depreciation Total selling expenses General / Administrative Salaries and wages Employee benefits Payroll taxes Insurance Rent. Depreciations and amortization

Original Description:

Original Title

income statement

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRevenue Gross sales (all numbers in $000) current month % of sales less sales returns and allowances Net sales Cost of Sales Beginning inventory Current Month Amount % of Sales Amount Year to date plus goods purchased / manufactured Total goods available less ending inventory Total cost of goods sold Gross profit (loss) Operating Expenses Selling current month. Amount % Year to date Commissions Advertising Depreciation Total selling expenses General / Administrative Salaries and wages Employee benefits Payroll taxes Insurance Rent. Depreciations and amortization

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views2 pagesIncome Statement

Uploaded by

rroy725Revenue Gross sales (all numbers in $000) current month % of sales less sales returns and allowances Net sales Cost of Sales Beginning inventory Current Month Amount % of Sales Amount Year to date plus goods purchased / manufactured Total goods available less ending inventory Total cost of goods sold Gross profit (loss) Operating Expenses Selling current month. Amount % Year to date Commissions Advertising Depreciation Total selling expenses General / Administrative Salaries and wages Employee benefits Payroll taxes Insurance Rent. Depreciations and amortization

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Income Statement

Revenue Gross sales

(all numbers in $000)

[Company Name] Year to Date Amount

Current Month Amount % of Sales

Less sales returns and allowances

Net sales Cost of Sales Beginning inventory Current Month Amount % of Sales Amount Year to Date

Plus goods purchased/manufactured

Total goods available

Less ending inventory

Total cost of goods sold Gross profit (loss) Operating Expenses

Selling

Current Month Amount % of Sales Amount

Year to Date

Salaries and wages Commissions Advertising Depreciation Total selling expenses

General/Administrative

Salaries and wages Employee benefits Payroll taxes Insurance Rent Utilities Depreciation and amortization Office supplies Travel and entertainment Postage Equipment maintenance and rental Interest Furniture and equipment Total General/Administrative expenses Total operating expenses Net income before taxes Taxes on income Net income after taxes Extraordinary gain or loss Income tax on extraordinary gain Net Income (Loss)

[Period ending date] Year to Date % of Sales

Year to Date % of Sales

Year to Date % of Sales

You might also like

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Financial Projections TemplateDocument17 pagesFinancial Projections Templatedeepscribd100% (1)

- Income Statement TemplateDocument1 pageIncome Statement TemplateJocoser NguyenNo ratings yet

- SBV Financial StatementsDocument17 pagesSBV Financial Statementsbhundofcbm0% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Auto Dealer KPIsDocument18 pagesAuto Dealer KPIsnkrishnan1984No ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Two-Year Comparative Income Statement 1Document1 pageTwo-Year Comparative Income Statement 1Thalia Sanders100% (1)

- Accounting For Merchandising BusinessDocument17 pagesAccounting For Merchandising BusinessFeroz AhmadNo ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet Formatvicky3230No ratings yet

- Profit and Loss Forecast v1.0Document4 pagesProfit and Loss Forecast v1.0Jessica AngelinaNo ratings yet

- P & L Bookmybread Year 1 Year 2Document2 pagesP & L Bookmybread Year 1 Year 2Ramanjit SinghNo ratings yet

- Income Statement TemplateDocument4 pagesIncome Statement TemplateAnonymous gFcnQ4goNo ratings yet

- In Come Statement TemplateDocument2 pagesIn Come Statement TemplaterrmmvbNo ratings yet

- Income Statement1Document1 pageIncome Statement1James HohoasiNo ratings yet

- Income Statement: Less Sales Returns and AllowancesDocument1 pageIncome Statement: Less Sales Returns and AllowancesAnyone AnywhereNo ratings yet

- Income StatementDocument1 pageIncome Statementapi-251439918No ratings yet

- Income Statement 1Document2 pagesIncome Statement 1api-276044694No ratings yet

- Pro Forma Income StatementDocument6 pagesPro Forma Income StatementinfosurenNo ratings yet

- Annual Projected Profit and Loss: January February March April May JuneDocument4 pagesAnnual Projected Profit and Loss: January February March April May JuneTheresia NgaswagaNo ratings yet

- Annual Projected Profit and Loss: January February March April May JuneDocument4 pagesAnnual Projected Profit and Loss: January February March April May JuneTheresia NgaswagaNo ratings yet

- AnnualProjectedProfit Loss-ServicesDocument4 pagesAnnualProjectedProfit Loss-ServicesNizwa KhalifaNo ratings yet

- Business Budget: Income Less ExpensesDocument6 pagesBusiness Budget: Income Less ExpensesedinosNo ratings yet

- Sample Income Statement For School ReunionDocument3 pagesSample Income Statement For School ReunionCrystalFaithNo ratings yet

- K P I T Cummins Infosystems Limited: Financials (Standalone)Document8 pagesK P I T Cummins Infosystems Limited: Financials (Standalone)Surabhi RajNo ratings yet

- Commencing: Insert Date HereDocument67 pagesCommencing: Insert Date HereMichael AthertonNo ratings yet

- 12-Month Business BudgetDocument10 pages12-Month Business Budgetrohanrajore00No ratings yet

- Year-End Tax Plan1Document1 pageYear-End Tax Plan1Dana A Daspit ConteNo ratings yet

- Sales Units Jan Feb Mar Apr May Jun: Cash Budget - TemplateDocument4 pagesSales Units Jan Feb Mar Apr May Jun: Cash Budget - TemplateReeshi UbiNo ratings yet

- Sales Units Jan Feb Mar Apr May Jun: Cash Budget - TemplateDocument4 pagesSales Units Jan Feb Mar Apr May Jun: Cash Budget - TemplateMohammed AbdoNo ratings yet

- Sales Units Jan Feb Mar Apr May Jun: Cash Budget - TemplateDocument4 pagesSales Units Jan Feb Mar Apr May Jun: Cash Budget - TemplateAli HajirassoulihaNo ratings yet

- Cash Budget TemplateDocument4 pagesCash Budget TemplateBhumika BhardwajNo ratings yet

- Task 5 - 2020571670 - Ayush - KandariDocument8 pagesTask 5 - 2020571670 - Ayush - Kandariayush kandariNo ratings yet

- Jawaban Cash FlowDocument1 pageJawaban Cash FlowChoiru IbadilhaqNo ratings yet

- Cash Flow FormatDocument2 pagesCash Flow Formatrajesh shekarNo ratings yet

- Schedule of Expected Cash Collections: Master BudgetingDocument14 pagesSchedule of Expected Cash Collections: Master BudgetingAniruddha RantuNo ratings yet

- Budgeted Income StatementDocument1 pageBudgeted Income StatementJackie S LaymanNo ratings yet

- FS - Auto Workshop FeasibilityDocument45 pagesFS - Auto Workshop Feasibilitywaqas_baloch_10% (1)

- Fsa FinalDocument8 pagesFsa Finalasifrahi143No ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- Kunci Jawaban Black and WhiteDocument18 pagesKunci Jawaban Black and WhitefebrythiodorNo ratings yet

- Book 1Document6 pagesBook 1gogaNo ratings yet

- Itc - ImibDocument20 pagesItc - ImibYash RoxsNo ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet FormatMadan GoreNo ratings yet

- Cost Sheet FormatDocument5 pagesCost Sheet Formatvicky3230No ratings yet

- Tax PresentationDocument39 pagesTax Presentationtap4awhileNo ratings yet

- Cost Sheet ProformaDocument4 pagesCost Sheet ProformaMorerpNo ratings yet

- Arctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetDocument4 pagesArctic Products Company Balance Sheet at 6/30/2010: Cash Budget WorksheetbgamejNo ratings yet

- Risk Management - Initial BaselineDocument10 pagesRisk Management - Initial BaselineLeroyAlicandroNo ratings yet

- Modül Business Decisions and EconomicsDocument60 pagesModül Business Decisions and Economicsmuhendis_8900No ratings yet

- Income Statement ABC Company For The Month Ended: RevenueDocument3 pagesIncome Statement ABC Company For The Month Ended: RevenueKalim Ullah KhanNo ratings yet

- SBV Financial StatementsDocument18 pagesSBV Financial StatementsAmsalu WalelignNo ratings yet

- Small Business Cash Flow Projection: (Company Name)Document1 pageSmall Business Cash Flow Projection: (Company Name)MrbudakbaekNo ratings yet

- Cma Format - 29.08.2022 - 12.13PMDocument12 pagesCma Format - 29.08.2022 - 12.13PMShreeRang ConsultancyNo ratings yet

- RatiosDocument2 pagesRatiossunshine9016No ratings yet

- Glossary FinanceDocument4 pagesGlossary FinanceGerencia ComercialNo ratings yet