Professional Documents

Culture Documents

108 Sol 0502

Uploaded by

Rewa ShankarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

108 Sol 0502

Uploaded by

Rewa ShankarCopyright:

Available Formats

May 2002 Examination Subject 108 :- Finance and Financial Reporting Indicative solutions

1D 2B 3D 4A 5C 6E 7C 8A 9A 10 B 11 D 12 C 13 E 14 B 15 B 16 C 17 E 18 D 19 E 20 A 21 A 22 D 23 A 24 D 25 E 26) Life insurance companies are major institutional investors and, collectively, are amongst the very largest institutions. The companies collect cash from policy holders and invest this in the long term. Policy holders will normally be offered the expectation of a future bonus based on the profits of the company. This has the effect of requiring insurance companies to seek out investment opportunities which both offer the prospect of maintaining the real purchasing power of their deposits and also a realistic expectation of capital growth. Insurance companies are also subject to a number of regulatory constraints on the nature of their investments. These are partly attributable to the need to maintain solvency margins in accordance with regulations.

Any other relevant points.

27) Inflation: expectations of higher inflation are likely to lead to higher gilt yields and vice versa. Short term interest rates: reduction in short term interest will reduce yields on short gilts longer gilts yields may reduce by less or even rise if reduction in interest rates is viewed as a sign of monetary easing. Fiscal deficit: increasing PSBR is likely to put upward pressure on gilt yields, especially in the maturities in which the government is concentrating most of its funding. Exchange Rate: changes in the exchange rate will affect the demand from overseas investors and will alter the relative attractiveness of domestic and overseas bonds. Financial institutions: changes to institutional cash flow and investment policy will affect demand for, and hence the price of, gilts. Alternative Investments: the relative attractiveness of alternative investments eg equities, overseas bonds. [ 28) Increase in stock values: the value shown in the profit and loss account for increase in stocks of finished goods and work in progress will be positive if the money value of stocks held is increased due to inflation even if the real volume of stocks held is constant. This will tend to overstate profits. Depreciation: the depreciation charge will be calculated using the historic cost of the assets. This will tend to overstate profits. Interest payments: a company may receive interest on its investments, and pay interest on its loan capital. In times of inflation, part of the interest payment is really compensation for the erosion of the real value of capital. For a company that pays out more interest than it receives, profits will tend to be understated in times of high inflation. Value of assets: the real value of all the companys assets will be eroded by inflation if their values stay constant in nominal terms. Consistency over time: profits and asset values might be increasing in money terms. But it would not be immediately obvious how much was due to a real increase in the scale of a companys operations and how much was simply due to inflation. Comparison between years is therefore difficult when using historic cost accounts.

29) i) Share capital is the most flexible form of finance. The payment of dividend is entirely at the discretion of the directors. If the dividends are withheld for any reason then the shareholders have no direct sanctions against the company, other than the right to sell their shares on the open market. Issuing fresh share capital also makes it easier to raise further finance by borrowing. This is because lenders are usually keen to see the company maintain a sensible relationship between debt and equity. If the company fails then the lenders must be repaid in full before the shareholders receive anything. If the shareholders have financed a large proportion of the share capital then this protects the lenders from the loss of their principal. Share capital tends to be a rather expensive form of finance. This is because shareholders bear a much higher risk than lenders. They have to be rewarded with a substantial return in order to motivate them to accept this level of risk. In addition, the company does not receive any tax relief on dividends whereas loan interest is tax deductible. Issuing additional share capital will also tend to dilute the sense of ownership and control enjoyed by the present shareholders. They might be willing to forego the opportunity to expand if doing so would make them accountable to outside shareholders. Any other relevant points. (ii) The company ought to consider an offer for sale. This would involve selling new shares to the general public at a fixed price which was determined by the directors. The advantage of this is that it raises additional capital at the same time as introducing the company to the stock exchange. There is relatively little risk of this type of transaction going wrong because the company would sell the shares via an issuing house. The issuing house would act as an intermediary between the company and the public. In the first instance, the issuing house would purchase the shares from the company and then resell them to the public. This means that the company knows in advance how much the issue will generate because the issuing house is responsible for any lack of demand and will be left holding any unsold shares. The use of an issuing house also provides the company with a source of experience and advice in the selection of other professionals and in the coordination of their various efforts. Well before the offer for sale, the company will engage an issuing house. The issuing house will try to generate interest in the launch, e.g. by publicising positive news that might be picked up by the financial press. In the weeks before the launch, the issuing house will advise on the price that should be set. This will normally be a reasonably conservative figure, if only because a higher issue price would involve a greater risk for the issuing house and that might result in higher fees and premia.

The company is required to publish a prospectus, which is a formal document required by the stock exchange. This is a detailed document containing a wealth of historical and forecast information, both financial and non- financial. This information will also be supported by a number of assurances from the companys external auditors. The prospectus will also state the offer price for the shares. The prospectus will be reproduced in at least one national newspaper and may be distributed in other ways. Anyone wishing to purchase shares can do so during the period immediately after the publication of the prospectus. Hopefully, the offer price was set at a level that would encourage investment and the issue will be over-subscribed. This means that the issuing house will have to decide on the most appropriate basis for the allocation of shares. Finally, the successful applicants will receive letters of acceptance. Official trading on the stock exchange can take place on the day after the acceptance letters are posted.

30) XYZ Profit and Loss Account for the year ended 31 March 1999 Sales Cost of sales Gross profit Administration Distribution 600.0 330.8 269.2 33.0 51.5 84.5 184.7 124.7 102.7 Dividend Balance brought forward 80.0 22.7 83.0 105.7 XYZ balance sheet as at 31 March 1999 Fixed assets Current assets Stock 9.0 Debtors 70.0 Prepaid expense 2.0 81.0 Current liabilities Bank o/d Proposed dividend Taxation 3.0 80.0 22.0

Operating profit Interest 60.0 Net profit before taxation Taxation 22.0

555.7

Creditors Net current liabilities Loan

26.0 131.0 50.0

300.0 205.7 Share capital Profit and loss account 100.0 105.7 205.7 Working Fixed assets Factory Machinery Vehicles Total Gross block Dep upto the year Dep for the year Net block 290.0 22.0 5.8 262.2 290.0 80.0 29.0 181.0 220.0 70.0 37.5 112.5 800.0 172 72.3 555.7

Cost of sales Opening stock Purchases Closing stock Factory depreciation Machinery depreciation Factory rates and insurance Manufacturing wages Administration Office rates and insurance Admin wages Distribution Delivery wages Vehicles - depreciation

8.0 220.0 -9.0 5.8 29.0 15.0 62.0 330.8 12.0 21.0 33.0 14.0 37.5 51.5

You might also like

- Chapter 15 SolutionsDocument11 pagesChapter 15 Solutionsagctdna501750% (2)

- Dividend Policy and Internal FinancingDocument14 pagesDividend Policy and Internal FinancingMichaela San Diego0% (1)

- 21A4050095 Phạm Tiến Đạt Exam09 MWGDocument9 pages21A4050095 Phạm Tiến Đạt Exam09 MWGdat phanNo ratings yet

- Estate and Gift Tax OutlineDocument26 pagesEstate and Gift Tax OutlineDaniela Pretus100% (2)

- Dave & Buster's FAQ v5.0Document44 pagesDave & Buster's FAQ v5.0Brian50% (2)

- Afm Revision NotesDocument50 pagesAfm Revision NotesNaomi KabutuNo ratings yet

- PM AssignmentDocument22 pagesPM AssignmentEmuyeNo ratings yet

- Comment Type QuestionsDocument38 pagesComment Type QuestionsgoforcsNo ratings yet

- CFINDocument10 pagesCFINAnuj AgarwalNo ratings yet

- Chapter 3 PDFDocument24 pagesChapter 3 PDFCarlos PadillaNo ratings yet

- RWJ (9th Edition) Chapter 15Document11 pagesRWJ (9th Edition) Chapter 15CristinaNo ratings yet

- CF 3rd AssignmentDocument6 pagesCF 3rd AssignmentAnjum SamiraNo ratings yet

- Financial Management: Assignment: 1Document8 pagesFinancial Management: Assignment: 1Shashank SinghNo ratings yet

- Financial ManagementDocument7 pagesFinancial ManagementShibu ShashankNo ratings yet

- BB0022: Capital and Money Market Assignment Set - IDocument3 pagesBB0022: Capital and Money Market Assignment Set - IRajesh SinghNo ratings yet

- Blain Kitchenware CF CaseDocument25 pagesBlain Kitchenware CF CaseAnurag Chandel67% (3)

- My Project Faisal (DR Farooq Ajaz)Document8 pagesMy Project Faisal (DR Farooq Ajaz)Jahangir AhmedNo ratings yet

- CH 6Document91 pagesCH 6EyobedNo ratings yet

- 2 The Various Sources of Finance 2Document6 pages2 The Various Sources of Finance 2Imran SiddNo ratings yet

- Corporate Finance Assignment 2Document7 pagesCorporate Finance Assignment 2manishapatil25No ratings yet

- Sourcing Money May Be Done For A Variety of ReasonsDocument24 pagesSourcing Money May Be Done For A Variety of ReasonsFelix Amirth RajNo ratings yet

- Solutions Manual Corporate Finance RossDocument11 pagesSolutions Manual Corporate Finance RossRijalul KamalNo ratings yet

- Gainesboro Machine Tools Corporatio1Document7 pagesGainesboro Machine Tools Corporatio1Endrit Avdullari100% (1)

- Dividend Policy: Chapter ObjectivesDocument2 pagesDividend Policy: Chapter ObjectivesMundixx TichaNo ratings yet

- Dividend Discount ModelDocument9 pagesDividend Discount ModelVatsal SinghNo ratings yet

- The Other Questions 22052023Document33 pagesThe Other Questions 22052023Anjanee PersadNo ratings yet

- Corporate Finance Assignment 1Document6 pagesCorporate Finance Assignment 1Kûnãl SälîañNo ratings yet

- Cfa Level 2 - Test Bank With SolutionsDocument14 pagesCfa Level 2 - Test Bank With SolutionsAditya BajoriaNo ratings yet

- Assignment IN Macroeconomics: Submitted By: Jastine Quiel G. EusebioDocument12 pagesAssignment IN Macroeconomics: Submitted By: Jastine Quiel G. EusebioJhaz EusebioNo ratings yet

- Introduction To Corporate Finance, Megginson, Smart and LuceyDocument6 pagesIntroduction To Corporate Finance, Megginson, Smart and LuceyGvz HndraNo ratings yet

- Public FinanceDocument26 pagesPublic FinanceVarshini NagarajuNo ratings yet

- Sources of FinanceDocument85 pagesSources of Financeyashchauhan100% (1)

- Sources of FinanceDocument13 pagesSources of FinancekushalskNo ratings yet

- Intro To Finance NotesDocument9 pagesIntro To Finance NotesAzeemAhmedNo ratings yet

- Chapter 7 - Sources of FinanceDocument12 pagesChapter 7 - Sources of FinanceSai SantoshNo ratings yet

- FM Module 4 Capital Structure of A CompanyDocument6 pagesFM Module 4 Capital Structure of A CompanyJeevan RobinNo ratings yet

- Capital Markets: AssignmentDocument8 pagesCapital Markets: AssignmentRamanathan MssNo ratings yet

- Finance ExamDocument9 pagesFinance ExamTEOH WEN QINo ratings yet

- Chapter 7 - Homework & Solution: Answers To QuestionsDocument15 pagesChapter 7 - Homework & Solution: Answers To QuestionsSumera SarwarNo ratings yet

- Corporate Finance MBA20022013Document244 pagesCorporate Finance MBA20022013Ibrahim ShareefNo ratings yet

- Financial Technologies TheoriesDocument10 pagesFinancial Technologies Theoriesfirst breakNo ratings yet

- Dividend Policy: Answers To Concept Review QuestionsDocument6 pagesDividend Policy: Answers To Concept Review Questionsmeselu workuNo ratings yet

- 1 - 2 Essay FMDocument11 pages1 - 2 Essay FMPhương Chi VũNo ratings yet

- Debt&eqiutyDocument5 pagesDebt&eqiutyRafidul IslamNo ratings yet

- Maf 603 (Dividend Policy)Document5 pagesMaf 603 (Dividend Policy)culaini sayongNo ratings yet

- Ch9 Financial Management XII 2Document33 pagesCh9 Financial Management XII 2Keshvi AggarwalNo ratings yet

- The AssignmentDocument4 pagesThe AssignmentWalter NwaimoNo ratings yet

- Fmi Lecture 3Document22 pagesFmi Lecture 3shakirNo ratings yet

- Corporate Finance BasicsDocument27 pagesCorporate Finance BasicsAhimbisibwe BenyaNo ratings yet

- Unit Iii-1Document13 pagesUnit Iii-1Archi VarshneyNo ratings yet

- Strategic Financial Management - V - STDocument9 pagesStrategic Financial Management - V - STWorlex zakiNo ratings yet

- Lecture - Sources of FinanceDocument27 pagesLecture - Sources of FinanceNelson MapaloNo ratings yet

- DJMD SjdnajkDocument14 pagesDJMD Sjdnajksuhaib shaikhNo ratings yet

- Solutions Corporate FinanceDocument28 pagesSolutions Corporate FinanceUsman UddinNo ratings yet

- Investments An Introduction 10Th Edition Mayo Solutions Manual Full Chapter PDFDocument39 pagesInvestments An Introduction 10Th Edition Mayo Solutions Manual Full Chapter PDFWilliamCartersafg100% (10)

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocument10 pagesFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelNo ratings yet

- Importance of Forecasting For A FirmDocument5 pagesImportance of Forecasting For A Firmsimran kaurNo ratings yet

- Paper FMDocument8 pagesPaper FMmuzzammil ishfaqNo ratings yet

- There Are Many Different Motivations To Source MoneyDocument7 pagesThere Are Many Different Motivations To Source MoneyJamaica RamosNo ratings yet

- Dividend Policy AfmDocument10 pagesDividend Policy AfmPooja NagNo ratings yet

- Dividend Investing for Beginners & DummiesFrom EverandDividend Investing for Beginners & DummiesRating: 5 out of 5 stars5/5 (1)

- 929 Vimala InvoicegstDocument1 page929 Vimala InvoicegstMugesh KumarNo ratings yet

- 25 Questions On DCF ValuationDocument4 pages25 Questions On DCF ValuationZain Ul AbidinNo ratings yet

- Saraiva Livreiros S.A. - Under Judicial Reorganization (Formerly "Saraiva S.A. Livreiros Editores")Document73 pagesSaraiva Livreiros S.A. - Under Judicial Reorganization (Formerly "Saraiva S.A. Livreiros Editores")Mizael RobertoNo ratings yet

- 18 Mindanao II Geothermal Partnership v. CIR. (Padiernos)Document2 pages18 Mindanao II Geothermal Partnership v. CIR. (Padiernos)Michelle Fellone100% (1)

- Bersamin Tax CasesDocument2 pagesBersamin Tax CasesJustine EspinolaNo ratings yet

- Abf Ar 2017Document178 pagesAbf Ar 2017ahmedNo ratings yet

- C.P. 1691 L 2018Document5 pagesC.P. 1691 L 2018drtunioNo ratings yet

- Quasi ContractDocument22 pagesQuasi ContractRanjith PrakashNo ratings yet

- Haldirams Market Entry Strategies: A Report On Finding Emerging Market and Preparing Market Entry StrategyDocument21 pagesHaldirams Market Entry Strategies: A Report On Finding Emerging Market and Preparing Market Entry StrategyHarsh Upadhyay100% (1)

- 2014 Budget SummaryDocument271 pages2014 Budget SummaryTeresa Frederick100% (1)

- Buy Vs Lease Car CalculatorDocument1 pageBuy Vs Lease Car CalculatorLCNo ratings yet

- Prof Tax Challan ViiiDocument1 pageProf Tax Challan ViiiRahul ManalNo ratings yet

- JSW SteelDocument34 pagesJSW SteelShashank PatelNo ratings yet

- Business Environment-By (THR) Habeeb SirDocument25 pagesBusiness Environment-By (THR) Habeeb SirHabeebur Rahman T (THR)No ratings yet

- Rabbi's Speech Called Hateful: Llaacckk Ooff TtrruussttDocument28 pagesRabbi's Speech Called Hateful: Llaacckk Ooff TtrruussttSan Mateo Daily JournalNo ratings yet

- Accounting EntriesDocument5 pagesAccounting EntriesNASEER ULLAHNo ratings yet

- Assignment - 403Document7 pagesAssignment - 403achal.yadav125No ratings yet

- Macroeconomics Final ExamDocument9 pagesMacroeconomics Final ExamMahabbat DzhenbekovaNo ratings yet

- Accounting ProjectDocument33 pagesAccounting Projectapi-353552300100% (1)

- Daily Opening and Closing Market RateDocument3 pagesDaily Opening and Closing Market RateRAMODSNo ratings yet

- Glimpses of Fiscal States in Sub-Saharan AfricaDocument29 pagesGlimpses of Fiscal States in Sub-Saharan Africamick mooreNo ratings yet

- Incorporation or LLC Formation ChecklistDocument8 pagesIncorporation or LLC Formation Checklistnancyfallon100% (1)

- Rmo 1984Document139 pagesRmo 1984Mary graceNo ratings yet

- 1604 CFDocument8 pages1604 CFNette CutinNo ratings yet

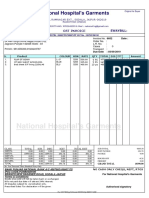

- National Hospital's GarmentsDocument1 pageNational Hospital's GarmentsShekhar GuptaNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- StudentDocument16 pagesStudentJaeDukAndrewSeoNo ratings yet

- E-Auctions - MSTC Limited-IOBL BGBG-01.12.2020Document4 pagesE-Auctions - MSTC Limited-IOBL BGBG-01.12.2020mannakauNo ratings yet