Professional Documents

Culture Documents

The Online Revolution: Cover Story

The Online Revolution: Cover Story

Uploaded by

sambi619Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Online Revolution: Cover Story

The Online Revolution: Cover Story

Uploaded by

sambi619Copyright:

Available Formats

Cover Story

THE ONLINE REVOLUTION

E-commerce has taken off in an unexpectedly big way in India, especially in the travel and tourism segment. Millions of Indians prefer booking airline and railway tickets online. The stateowned Indian Railway Catering and Tourism Corporation Ltd (IRCTC) has emerged as one of the largest online sites and dozens of new online travel sites are being set up, write Aarti Gupta and Shivkamal.

-COMMERCE transactions, particularly in the business-toconsumer (B2C) domain, are on an upswing in India, as both businesses and consumers realise the benet of online transactions. Growing Internet (especially broadband) connectivity is fuelling growth for online services. The roll-out of broadband services by many telecommunication service providers in hundreds of cities and towns across India has given a big boost to e-commerce. At the other end of the value chain, public and private sector banks in the country today offer online banking facilities to their customers, along with a clutch of other services including settling of utility bills, taxes, third-party payments and other transactions. The relative ease of online payments through credit cards or through Internet banking facilities has enabled rapid growth in e-commerce transactions. The huge investments made by banks in ensuring secure online transactions have added to the comfort level of consumers. As portals and Internet sites adopt enhanced security features, e-commerce transactions are on the rise. The International Market Research Bureau (IMRB), a leading market research

consultancy, recently released a report on Indias e-commerce potential. According to Internet in India (I-Cube), the report focussing on the Indian e-commerce market in 2008, there are several verticals: * Travel, comprising travel aggregators, tour operators, hotels and railways * E-tailing, comprising online retailers and online auctions * Classieds, comprising jobs, matrimony, property, automobiles and the general category * Paid content subscription, comprising research, articles and exclusive videos * Digital downloads, from Internet to mobile phones Based on our discussions with various stakeholders, the size of B2C e-commerce industry for the year 2006-07 was computed to be around US$1.5 billion, says the report. It predicted a 30 per cent year-on-year growth for the following year, with revenues of about US$2 billion. There are about 7 .9 million active online buyers in India, of which 80 per cent buy travel products. The online travel industry is the largest contributor to the B2C e-commerce segment, estimated to be around US$1.5

Cover StorY

billion by the end of 2007-08. The entry of low-cost carriers has given a boost to online travel portals.These airlines sell their tickets online to consumers, by-passing intermediaries to cut commission costs. E-commerce witnessed exponential growth in India in 2008, particularly in online ticket transactions. Today millions of consumers are buying air, train, bus and movie tickets over the Internet. The largest player in e-commerce today is the Indian Railway Catering and Tourism Corporation (IRCTC), a public sector undertaking fully owned by the Ministry of Railways. Its online ticket booking facility is a mega hit with passengers, even with those who do not have Internet connections at home. For this segment, or those who do not have access to credit cards or online bank accounts, IRCTC has appointed agents across the country to facilitate online bookings. With the IRCTC pushing electronic booking of train tickets and scores of

With structured funding available, we can also foray into hotel, rail and bus bookings.

Vinay Gupta,

ceo, Viaworld.in

online travel portals entering the business, the share of tickets sold online in the total revenues of Indian Railways doubled to nearly 30 per cent in 2008-09. The corporation, which sold 18.9

million tickets online during 2007-08, more than doubled the gure the following year. The estimated gross sales for 2008-09 were at US$730 million, making IRCTC the largest contributor to e-commerce in the country. The entry of travel portals such as Cleartrip, Ezeego1 and Yatra into the train tickets booking business has given customers more options. Although travel portals together account for a minuscule chunk of the overall e-bookings of the railways, they are popular with the relatively afuent travellers. For instance, both Cleartrip and Yatra have an AC to non-AC bookings ratio of 70:30, while for IRCTC, the ratio is the opposite. In the airline sector, travel portals such as Makemytrip.com (one of the oldest), Cleartrip, Yatra, Travelguru, Arzoo (started by Hotmail co-founder Sabeer Bhatia), Ezeegoo1 and ixigo, among others, are the preferred medium for many to book tickets.

10

Cover StorY

We started FlipKart.com because we felt the need for a good online book store.

co-founder, FlipKart.com

Binny Bansal,

The growing business of travel portals continues to attract funding from venture funds. Bangalore-based Viaworld.in, a full-service travel company, which was founded by a team of engineers in 2006, recently raised US$5 million from NEA Indo US Ventures, a venture capital rm. With structured funding available, we can make investments and also foray into hotel, rail and bus bookings, says Vinay Gupta, ceo, Viaworld.in. Its travel network is spread across 290 cities and it issues 5,000 tickets a day. With over 3,000 agents registered with it, the company has one of the widest networks in India today. The company was also the rst to introduce mobile-based

search for fare details and ticketing on all airlines and reservation kiosks. The success of travel sites has spawned a whole new range of portals with e-commerce as their business model: FlipKart.com (online book purchase), Asklaila.com (information search) and redbus.in (bus ticket booking) have been launched by entrepreneurs from Indias IT hub Bangalore, all of whom have been successful in securing funding from private equity rms. Falling under the category of e-tailing (an online form of retailing) these portals are witnessing robust growth. According to the IMRB report, it grew from US$180 million in 2006-07 to US$230 million a

The scope to grow is huge

Indian Railway Catering and Tourism Corporation (IRCTC), a state-owned enterprise, is today one of the largest e-commerce players in the country, raking in about US$730 million of a total e-commerce market estimated to be between US$1.5 billion and US$2 billion in 2008-09 through online booking of train tickets. This was a remarkable growth of over 120 per cent over the previous years revenues of US$355 million. As many as 1,60,000 e-tickets are booked on the IRCTC site on an average every day, translating into a trafc load of 3,00,000 passengers a day. Nalin Shinghal, director, tourism and marketing, IRCTC, in an interview with Aarti Gupta. How has IRCTC grown over the last few years? We have been steadily adding features to our online booking service. When we started in 2002, one could just do the booking and get an i-ticket, while the physical ticket was delivered through a courier. In 2005, we started the system of e-ticket booking online and taking a print-out; this can be done just three hours before a trains scheduled departure. Then, in May 2008, we started e-tickets even for the wait-listed category. Trafc, as a result, is growing by leaps and bounds year-on-year. Last year, IRCTC reported a 160 per cent increase in throughput (an e-commerce term to measure the amount of data transferred) and this year there has been a 120 per cent increase. How has IRCTC managed that kind of growth, considering PC and Internet penetration is still low in the country? We realise that the largest volumes are in the sleeper class, but most of these passengers do not have access to a PC or a credit card. So what we have done is to appoint agents across the country. These include petrol pump owners, cyber-caf or PCO operators, or even those who are part of a state government e-governance project. There are about 50,000 agents who book tickets for passengers for a minimal fee of Rs. 10 (or about 20 US cents) a ticket, for those who do not have access to a computer or a credit card. This channel is already giving us 30 per cent of our business. And we are in the process of expanding that reach. What kind of e-commerce opportunities are there for IRCTC? The potential is huge. An estimated 17 million people undertake travel in India every day, of which the reserved travel market is about a million-strong. We are currently tapping only about a fourth of the total reserved rail trafc travel; so the scope to grow is huge. We are expanding our product offerings. We launched our travel portal, railtourismindia.com, about two years ago, to position IRCTC as a one-stop travel shop. The portal offers tour packages, cab rentals and hotel reservations. Unlike other travel sites, our focus is on the valuefor-money segment these are typically people who like to travel in the sleeper class and stay in hotels in the sub-US$20 category. Because of the range of offerings, our portal last year won the national tourism award. In a short time, the portal did business worth almost US$6 million last year. We are hopeful of soon doubling or tripling that gure. We attempt to offer an entire assortment of products. In addition to the complete range of chartered hill packages over ve regions Darjeeling Himalayan, Nilgiri Mountain, Kangra Valley, KalkaShimla and Matheran we launched a fortnightly special train service, called the Mahaparinirvana, between October and March (the peak tourist season) last year. There are about 400 million Buddhists the world over and India is amongst the few destinations of interest for them. Instead of going on back-breaking road rides to Bihar and eastern UP , where many areas of Buddhist interest lie, the overseas traveller would prefer to use a good train service. The trail is picking up and we have had bookings being done from as far as the US, Chile, Argentina, Japan and Kazakhstan.

11

Cover StorY

A one-stop online travel shop

Since its launch in January 2006, Yatra.com, a leading travel portal, has carved out a niche for itself as a one-stop online travel shop, one of the fastest growing in the industry. The total value of ticket transactions recorded by it shot up to US$250 million in 2008, from US$100 million a year earlier. When co-founder and ceo Dhruv Shringi (who has grown the company from three members to 700 at present), decided to take that leap into the unknown over three years ago, he decided to do things a little differently from other online companies such as Cleartrip and travelguru, which started operations around the same time. Instead of relying solely on venture capital funding Norwest Venture Partners and Intel Capital are among its investors Yatra brought on board strategic partners such as Reliance Capital and the TV 18 group to establish the credibility of the brand. Shringi spoke to Aarti Gupta about where the online travel business is headed in India, and whether the slowdown is adversely impacting the industry. Do you think e-commerce has established itself in India? What kind of growth do you foresee for travel e-commerce in the coming years? Travel e-commerce is the single-largest category, accounting for 70 per cent of all e-commerce. At US$1 billion of business grossed last year, online travel accounted for 6 to 7 per cent of the total travel market. Though it is still a predominantly ofine sector, growth has been an impressive 25 to 30 per cent annually from a negligible base in 2005, when it was an extremely fragmented industry. We have just seen an S curve growth with a kink in the middle and the other S curve should kick in by 2010 with increasing PC and Internet penetration,

Dhruv Shringi

We see huge potential and rapid growth in e-coMMerce over the neXt decade

E-commerce in India and China will grow as people want to use the Internet to cut costs.

founder, Alibaba.com

AskLaila.com, a Bangalore-based local information search engine service, was founded by Kiran Konduri and Shriram Adukoorie in December 2006. The company secured funding of US$12 million from Matrix Partners India, LightSpeed Venture Partners and SVB India Capital Partners Fund in two rounds of funding. An interview with Adukoorie. What kind of growth has your company witnessed over the last two years? We established AskLaila to bridge the gap in the availability of timely and accurate local information and to allow users to search, discover and evaluate local services and businesses on convenient and easy-to-use mediums. We have expanded to Mumbai, Delhi, Chennai, Hyderabad and Kolkata. We have also introduced AskLaila for mobile phone users. Recently, we entered into a strategic partnership with Airtel to power all its city search services. Today, the AskLaila-powered Airtel city search reaches more than 30 million users across six cities. The Airtel-AskLaila service is available across three screens the mobile (Airtels mobile service), the PC (Airtels broadband service) and TV (Airtel DTH). Every day we receive responses from consumers and local businesses on the quality of our service or improvements they seek in the form of data enhancements. We welcome feedback sincerely as it tells us the audience is seeking local information and trust us to deliver that well.

Jack Ma,

12

Cover StorY

and explosion of broadband. By 2015, we should be about 20 per cent of the total travel market. E-commerce should take off in a big way in India, because of limited physical infrastructure. There are issues, though, of poor last-mile connectivity here. What kind of growth has your company seen over the last two years? We have grown two-and-a-half times in the last two years, the fastest in the industry. Calendar year 2007 was our rst complete year of operations and our total transactions were worth US$100 million. In 2008, our transactions were worth US$250 million. What we are trying to do is to migrate the customer, who may be a rst-time yer or credit-card user, to more valueadded products. Our ticket-size is increasing as a result. So we try to get a domestic ight user which is the mainstay of the business to graduate to bookings for hotels and holidays within the country and abroad.

Are e-retailers enhancing their investments in new technology to boost efciency, speed and security? Todays users are the early adopters of ecommerce and for the industry to thrive, the buying experience has to change. Hotels are a bespoke product unlike booking for ights. What we have done, as a result, is to make online buying easier. We were the rst ones to shoot videos of more than 1,000 budget hotels, plotting these on maps and co-relating these to points of tourist interest and to get feedback from actual users. Another rst we have introduced is to have tied up with hotels to allow customers to pay later at the hotels; they need to pay only 10 per cent of the deposit while booking online. All these e-features involve investments in technology. We have UK-based CyberSource, a leading provider of secure online payment and risk management solutions, looking into our Internet security mechanisms. Execution technology and user interface are of criti-

cal importance in e-commerce. How has the slowdown impacted business for online travel companies like yours? My view is that consumers have nancially not taken as bad a hit as consumer condence has. Holidays are moving, for example, from Europe to the Far-East; so ticket size is down from US$2,000 to about US$950. Passenger numbers are holding up but not revenue. Last year, 100 million people made 400 million trips on the domestic circuit, and while that may not change signicantly, inbound trafc has denitely slowed down. How much of Yatras business comes from overseas? We still derive almost 80 per cent of business from domestic travellers, but the overseas business, until the slowdown, was growing 10 to 15 per cent month-onmonth. We should be able to see that segment contribute about one-fourth of the business by September 2010.

Shriram Adukoorie

Do you see e-commerce establish itself in India? Will there be rapid growth over the coming years? India is perhaps in the initial wave of ecommerce as far as the long-tail merchant is concerned. (Long tail is an e-commerce term, referring to items that sell in low quantities, but overall generate large revenues). Though corporate India, especially the manufacturing industry, has embraced e-commerce by automating large parts of its supply chain, a large part of the consumer side of the service economy is not automated. Newer start-ups are realising that there has to be a signicant difference in the value proposition of products and services sold online in terms of price, ease of purchase, multiple payment mechanisms and post-sale customer service. This will denitely increase consumers trust in ecommerce transactions and will improve online transactions. We see huge potential and rapid growth in ecommerce over the next decade.

Are consumers condent about the security of these transactions? Consumers today are much more condent and comfortable with security issues of conducting transactions on the Internet. Credit card companies have added extra layers of passwords to enhance security. I would say online transactions security is not such a big issue anymore. Are e-retailers enhancing investments in new technology to boost efciency, speed and security? A mature market like the US has understandably realised the basic tenet of eretailing transactions alone do not help; relationships do. The technology, efciency, speed and security aspects of Indian e-retailers cannot be faulted we are almost as good as e-retailers elsewhere in the world. Focussing on the back-end in terms of fullment and customer service will probably be far more benecial for Indian players than any online technology adoption.

13

Cover StorY

With its huge growth potential, India is a very important and strategic market for Alibaba.com.

ceo, Alibaba.com

David Wei,

year later. For instance, FlipKart.com, a Bangalore-based online book shop, is growing at a rapid pace, and expects sales of US$4.2 million this year, up from just US$1 million in 2008. The rm was set up in 2007 by Sachin Bansal and Binny Bansal, computer science graduates from the Indian Institute of Technology (IIT), Delhi, who worked for a while with Amazon India. We started FlipKart.com because we felt the need for a good online book store, says Binny. E-commerce is one of the toughest sectors to get into in India. According to him, the market for online book shopping was around US$5.25 million in 2007-08 and is growing rapidly. Another buoyant segment is online classieds, which saw revenues of US$170 million in 2007-08. Similarly, online subscriptions are also witnessing brisk growth, though from a smaller base. It saw a 50 per cent growth in 2007-08, touching revenues of US$6.3 million. Along with the PC-based Internet access, mobile-based Internet access is expected to drive growth of the B2C and

consumer-to-consumer (C2C) e-commerce industry. With an increase in the number of mobile subscribers, there has been a rise in digital downloads to the mobile phone. With the surge in the usage of GPRS-enabled mobile handsets, the size of the digital downloads market increased from US$35 million in 2006-07 to US$53 million at end of 2007-08, according to the IMRB report. Analysts say the next phase of growth in e-commerce would be marked by localised product offerings and making content available in various Indian languages. Indias growing e-commerce business is also attracting international players. For Alibaba.com, Chinas top e-commerce company (which sells everything from automobiles to fashion accessories and machinery to toys), India is now one of the fastest-growing international markets. According to Jack Ma, founder of Alibaba, e-commerce has not been affected by the global nancial crisis. In fact, e-commerce in India and China will grow even faster because people will

14

Cover StorY

ConsuMers are certainlY More coMFortable now with e-coMMerce

RedBus was started in Bangalore in 2005 by a group of techies, all alumni of the Birla Institute of Technology and Science (BITS), Pilani, and employed with leading IT companies. During Diwali holidays, one of them wanted to visit his home town. As he did not know his schedule until the end, taking a bus was the only choice. But despite visiting several agents, he could not get a ticket. This triggered off the thought of setting up a portal to book bus tickets online. They started writing the code for the software, put together a business plan and presented it to the Bangalore chapter of The Indus Entrepreneurs (TiE), which helped the launch of redBus.in. An interview with Phanindra Sama, the ceo. What kind of growth has your company witnessed over the last two years? We have grown multi-fold in the last two years. The gross bookings this year are 500 per cent higher than the previous year, when it was about 900 per cent higher than the year before. Do you see e-commerce establish itself in India? Will there be rapid growth over the coming years? I cannot say that e-commerce is established in India yet. However, the good news is that it is growing. Many people are now using facilities such as Internet banking, which, in turn, makes customers comfortable with e-commerce transactions. Broadband has to be made accessible and affordable for ecommerce growth. Are consumers now condent about the security of these transactions and is that the reason for the spurt in online deals? Consumers are certainly more comfortable than they were earlier. One reason for increase in online deals is that companies are increasingly adopting the hybrid (online, ofine and mobile) model for sale and fulllment. Are e-retailers enhancing their investments in new technology, to boost efciency, speed and security? I guess e-retailers are maintaining status quo - given the economic situation. I am not aware of increased spends in new technology. Some of the changes that we are seeing on the look and feel of the websites of e-retailers are a result of programs that were triggered off in the past.

want to use the power of the Internet to cut costs and gain access to more global suppliers and buyers, says Ma, whose rm reported a 138 per cent growth in its India user base in 2008. Last year, Alibaba entered into a strategic partnership with Infomedia India Ltd, Indias leading yellow pages and special interest publishing rm, aimed at helping small and medium enterprises (SMEs) take advantage of the services of the worlds leading B2B e-commerce company. With its huge growth potential, India is a very important and strategic market for Alibaba.com and is a top priority for our global expansion plans, notes David Wei, ceo, Alibaba. com. According to the rm, more than 3 million of the over 8 million SMEs in the country are engaged in B2B trade. With telecommunications majors rolling out bre optic networks in a big way and expanding their broadband coverage in India, e-commerce transactions will continue to see rapid growth over the coming years. The potential for online transactions both B2C and B2B is indeed huge in the country.

15

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Andhra Bank Challan Oct12Document1 pageAndhra Bank Challan Oct12nareshjangra397No ratings yet

- Industrial RevolutionDocument56 pagesIndustrial RevolutionMarvinGarcia0% (1)

- Tugas 10.1 Kelas 10Document4 pagesTugas 10.1 Kelas 10WiyokoNo ratings yet

- Globalization-Market Integration-NotesDocument13 pagesGlobalization-Market Integration-NotesCheskaNo ratings yet

- ACC7 HO 1 Segmented-ISDocument2 pagesACC7 HO 1 Segmented-ISDonna Clarisse BlacerNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument9 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureLalayadav LalayadavNo ratings yet

- About High Point Village:: - Interested Applicants Need ToDocument4 pagesAbout High Point Village:: - Interested Applicants Need ToawennerlindNo ratings yet

- Channel Name Show Production Address: Yeh Rishta Kya Kehlata Hai Director's Kut ProductionsDocument4 pagesChannel Name Show Production Address: Yeh Rishta Kya Kehlata Hai Director's Kut ProductionsBhupendra SinghNo ratings yet

- Iaea Tecdoc Series: Potential Interface Issues in Spent Fuel ManagementDocument174 pagesIaea Tecdoc Series: Potential Interface Issues in Spent Fuel ManagementSuraj VinayNo ratings yet

- Mrunal Banking: RRB Amendment Bill, Small Banks-Payment BanksDocument10 pagesMrunal Banking: RRB Amendment Bill, Small Banks-Payment BanksPrateek BayalNo ratings yet

- Trade-Off Analysis in NFRDocument19 pagesTrade-Off Analysis in NFRk_wun_leeNo ratings yet

- Crushing Principles and Equipment: by Evgueni Porokhovoi. 2019Document53 pagesCrushing Principles and Equipment: by Evgueni Porokhovoi. 2019DubistWhite100% (1)

- Salary Sheet With Attendance Register 1Document2 pagesSalary Sheet With Attendance Register 1yavay42918No ratings yet

- Stat Assignment 2Document5 pagesStat Assignment 2SellKcNo ratings yet

- Final PrintDocument35 pagesFinal PrintManoharNo ratings yet

- DOHA & MIGADocument20 pagesDOHA & MIGAsamatapmNo ratings yet

- Current Challenges With Inflation in NigeriaDocument23 pagesCurrent Challenges With Inflation in Nigeriajamessabraham2No ratings yet

- Swift Whitepaper Supply Chain Finance 201304Document8 pagesSwift Whitepaper Supply Chain Finance 201304Rami Al-SabriNo ratings yet

- Presentation On Textile Sector Report: Presented byDocument29 pagesPresentation On Textile Sector Report: Presented byshailesh0000No ratings yet

- User Manual 13-14 Sec Dep PaymentsDocument36 pagesUser Manual 13-14 Sec Dep Paymentsajaytiwari2779No ratings yet

- Contoh Cue Card MCDocument4 pagesContoh Cue Card MCDini Larasati PonidinNo ratings yet

- GN No.4 The Petroleum (Victoria Philemon Rutakara) (Construction Approval)Document3 pagesGN No.4 The Petroleum (Victoria Philemon Rutakara) (Construction Approval)Mathias MhinaNo ratings yet

- Atom EconomyDocument17 pagesAtom EconomyAshrith Reddy100% (1)

- #6 Experience ListDocument3 pages#6 Experience Listkemas biruNo ratings yet

- Bank ReconciliationDocument118 pagesBank ReconciliationShaheen SultanaNo ratings yet

- Major ProjectDocument10 pagesMajor ProjectbsrashikumaraNo ratings yet

- StyreneDocument3 pagesStyreneelainejournalistNo ratings yet

- Merton Council Tax Bands and Rates - KFH PDFDocument1 pageMerton Council Tax Bands and Rates - KFH PDFJoe ShearsNo ratings yet

- Floresca V Evangelista 96 SCRA 130Document2 pagesFloresca V Evangelista 96 SCRA 130yannie isananNo ratings yet

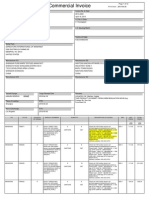

- Commercial Invoice: Consignee L/C Issuing BankDocument12 pagesCommercial Invoice: Consignee L/C Issuing Bankmz007No ratings yet