Professional Documents

Culture Documents

P46: Employee Without A Form P45: Section One

P46: Employee Without A Form P45: Section One

Uploaded by

Viral PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P46: Employee Without A Form P45: Section One

P46: Employee Without A Form P45: Section One

Uploaded by

Viral PatelCopyright:

Available Formats

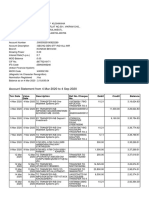

P46: Employee without a form P45

Section one

To be completed by the employee

Please complete section one and then hand the form back to your present employer. If you later receive a form P45 from your previous employer, hand it to your present employer. Use capital letters when completing this form.

Your details

National Insurance number This is very important in getting your tax and benefits right Date of birth DD MM YYYY

9 8

0 1

4 6

C

Address House or flat number

Title enter MR, MRS, MISS, MS or other title

MR.

Surname or family name

1 9

Rest of address including house name or flat name

A T E L

P A R K L

A N E Y H I L L

W E M B L E R

First or given name(s)

O A D M B L E Y

R A

L K U M A R

W E

Postcode

H

Gender. Enter 'X' in the appropriate box Male

A 9

S B

Female

Your present circumstances

Read all the following statements carefully and enter 'X' in the one box that applies to you. A This is my first job since last 6 April and I have not been receiving taxable Jobseeker's Allowance, Employment and Support Allowance or taxable Incapacity Benefit or a state or A occupational pension. OR B This is now my only job, but since last 6 April I have had another job, or have received taxable Jobseeker's Allowance, Employment and Support Allowance or Incapacity Benefit. I do not receive a state B or occupational pension. OR C I have another job or receive a state or C occupational pension.

Student Loans

If you left a course of Higher Education before last 6 April and received your first Student Loan instalment on or after 1 September 1998 and you have not fully repaid your Student Loan, enter 'X' in box D. (Do not enter X in box D if you are repaying your Student Loan by agreement with the Student Loans Company to make monthly payments through D your bank or building society account.)

Signature and date

I can confirm that this information is correct

Signature

V.S. Patel

Date DD MM YYYY

2 0

1 3

P46

Page 1

HMRC 10/09

Section two

To be completed by the employer

File your employee's P46 online at www.hmrc.gov.uk/employers/doitonline Use capital letters when completing this form. Guidance on how to fill it in, including what to do if your employee has not entered their National Insurance number on page 1, is at www.hmrc.gov.uk/employers/working_out.htm and in the E13 Employer Helpbook Day-to-day payroll.

Employee's details

Date employment started DD MM YYYY Works/payroll number and department or branch (if any)

Job title

Employer's details

Employer PAYE reference Office number Reference number Address Building number

/

Employer name Rest of address

Postcode

Tax code used

If you do not know the tax code to use or the current National Insurance contributions (NICs) lower earnings limit, go to www.hmrc.gov.uk/employers/rates_and_limits.htm

Enter 'X' in the appropriate box Box A Emergency code on a cumulative basis Box B Emergency code on a non-cumulative Week 1/Month 1 basis Box C Code BR

Tax code used If Week 1 or Month 1 applies, enter 'X' in this box

Send this form to your HM Revenue & Customs office on the first pay day. If the employee has entered 'X' in box A or box B, on page 1, and their earnings are below the NICs lower earnings limit, do not send the form until their earnings reach the NICs lower earnings limit.

Page 2

You might also like

- P46: Employee Without A Form P45: Section OneDocument2 pagesP46: Employee Without A Form P45: Section Onedeepika505No ratings yet

- P 46Document2 pagesP 46Charlotte JamesNo ratings yet

- P46: Employee Without A Form P45: Section OneDocument1 pageP46: Employee Without A Form P45: Section OnepolaxNo ratings yet

- P45 - HM R&CDocument3 pagesP45 - HM R&Cdmitrykrylov34No ratings yet

- p46 Is A Really Cooll BookDocument1 pagep46 Is A Really Cooll BooksamyoeNo ratings yet

- Ion Onl Y: Copy For HM Revenue & CustomsDocument4 pagesIon Onl Y: Copy For HM Revenue & CustomsM Muneeb SaeedNo ratings yet

- Starter Checklist About This Form:: Last Name or Family Name First Name (S)Document4 pagesStarter Checklist About This Form:: Last Name or Family Name First Name (S)Anca IroaiaNo ratings yet

- Claim For Repayment of Tax When You Have Stopped Working: Your Income Since Leaving Your Last EmploymentDocument2 pagesClaim For Repayment of Tax When You Have Stopped Working: Your Income Since Leaving Your Last EmploymentbvkettNo ratings yet

- Maternity Benefit FormDocument12 pagesMaternity Benefit Formapi-259279833No ratings yet

- Maternity Benefit: What Do I Need To Complete This Application Form?Document16 pagesMaternity Benefit: What Do I Need To Complete This Application Form?Vlad PerjuNo ratings yet

- Td1 Fill 23eDocument2 pagesTd1 Fill 23eCornelius AgbogunNo ratings yet

- Ssp1-Interactive 230910 001341Document3 pagesSsp1-Interactive 230910 001341Tyna MutuligaNo ratings yet

- 000 - P46 New Starter ChecklistDocument4 pages000 - P46 New Starter ChecklistcallejerocelesteNo ratings yet

- 2023 - 2024 Starter - Checklist - Dimitrios KosmidisDocument3 pages2023 - 2024 Starter - Checklist - Dimitrios KosmidismoomisNo ratings yet

- About This Form: Starter ChecklistDocument2 pagesAbout This Form: Starter ChecklistcallejerocelesteNo ratings yet

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Flexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)Document9 pagesFlexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)ErmintrudeNo ratings yet

- Ca 3916Document5 pagesCa 3916GenovevaShtereva100% (1)

- Starter - ChecklistDocument3 pagesStarter - ChecklistHamtha NoordeenNo ratings yet

- Form p50Document2 pagesForm p50Carlos ResendeNo ratings yet

- Ca 3916Document4 pagesCa 3916Fernando Mochales GutiérrezNo ratings yet

- Starter Checklist - HMRCDocument4 pagesStarter Checklist - HMRChope petersNo ratings yet

- Payroll Tax Declaration ENGDocument2 pagesPayroll Tax Declaration ENGЕвгений БодякинNo ratings yet

- TD1Document2 pagesTD1AmandaNo ratings yet

- P46 Titled UK DocymentDocument2 pagesP46 Titled UK DocymentgrungeshoesNo ratings yet

- Student Employees: Income TaxDocument1 pageStudent Employees: Income Tax16479No ratings yet

- How Do I File My 8843 Tax Form?: Instruction Page Only. Do Not Mail With Your Tax ReturnDocument8 pagesHow Do I File My 8843 Tax Form?: Instruction Page Only. Do Not Mail With Your Tax ReturnThành NguyễnNo ratings yet

- US Internal Revenue Service: p967 - 1996Document5 pagesUS Internal Revenue Service: p967 - 1996IRSNo ratings yet

- Jobkeeper Employee Nomination Notice: Section ADocument2 pagesJobkeeper Employee Nomination Notice: Section AAnonymous H8viqHlM3wNo ratings yet

- The Fook Yoo Chronicles, V1Document948 pagesThe Fook Yoo Chronicles, V1heuristicNo ratings yet

- Rent Supplement: Application Form ForDocument8 pagesRent Supplement: Application Form ForVasile E. UrsNo ratings yet

- Ssp1 InteractiveDocument5 pagesSsp1 InteractiveAdam KruzynskiNo ratings yet

- Election To Stop Contributing To The Canada Pension Plan, or Revocation of A Prior ElectionDocument2 pagesElection To Stop Contributing To The Canada Pension Plan, or Revocation of A Prior ElectionbatmanbittuNo ratings yet

- Child Care Application: Keep For Your Records InstructionsDocument14 pagesChild Care Application: Keep For Your Records InstructionsLaToya CrossNo ratings yet

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSNo ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- Statutory Sick Pay Claim Form ssp1Document6 pagesStatutory Sick Pay Claim Form ssp1k.a.smithniNo ratings yet

- 2020 Personal Tax Credits Return: Country of Permanent ResidenceDocument2 pages2020 Personal Tax Credits Return: Country of Permanent ResidencejackNo ratings yet

- US Internal Revenue Service: p967 - 1998Document6 pagesUS Internal Revenue Service: p967 - 1998IRSNo ratings yet

- Financial Affidavit BlankDocument10 pagesFinancial Affidavit BlankNicole FloresNo ratings yet

- F 4852Document2 pagesF 4852IRSNo ratings yet

- Claiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseDocument9 pagesClaiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseErmintrudeNo ratings yet

- td1 Fill 20eDocument2 pagestd1 Fill 20ekenishaskinnerzNo ratings yet

- Family Leave Insurance Claim FormDocument8 pagesFamily Leave Insurance Claim FormMassNo ratings yet

- Use These Notes To Help You Fill in The Employment Pages of Your Tax ReturnDocument4 pagesUse These Notes To Help You Fill in The Employment Pages of Your Tax ReturnLucca HeartNo ratings yet

- Your Extras and Medical Claim Form: SECTION A: Your DetailsDocument3 pagesYour Extras and Medical Claim Form: SECTION A: Your DetailsTGNo ratings yet

- Dctaxform PDFDocument2 pagesDctaxform PDFMuhammadOwaisKhanNo ratings yet

- App Form Hospital Doctors HOS203-1510Document16 pagesApp Form Hospital Doctors HOS203-1510gmantzaNo ratings yet

- Part-Time Job Incentive (PTJI) : Your Own DetailsDocument4 pagesPart-Time Job Incentive (PTJI) : Your Own DetailsKillian O'connorNo ratings yet

- US Internal Revenue Service: p967 - 2005Document7 pagesUS Internal Revenue Service: p967 - 2005IRSNo ratings yet

- pd24 09eDocument2 pagespd24 09eTommy DuNo ratings yet

- PLEASE READ THESE GUIDANCE - Before Completing Your FormDocument4 pagesPLEASE READ THESE GUIDANCE - Before Completing Your FormPopa NiculinaNo ratings yet

- Notice To Employee Instructions For Employee: WWW - SSA.govDocument1 pageNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalNo ratings yet

- Federal Tax Return FormDocument8 pagesFederal Tax Return FormKING ZeusNo ratings yet

- IRS Notice 1446Document1 pageIRS Notice 1446Courier JournalNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Return From Sickness Holiday QuestionnaireDocument1 pageReturn From Sickness Holiday QuestionnaireFrancisco RamirezNo ratings yet

- Return To Work Interview RecordDocument5 pagesReturn To Work Interview RecordFrancisco Ramirez100% (1)

- Annual Holiday Application Form: Name: DateDocument4 pagesAnnual Holiday Application Form: Name: DateFrancisco RamirezNo ratings yet

- Monthly Holidays Schedule: Father's DayDocument9 pagesMonthly Holidays Schedule: Father's DayFrancisco RamirezNo ratings yet

- Employee Absence Reporting RulesDocument3 pagesEmployee Absence Reporting RulesFrancisco RamirezNo ratings yet

- Certificate of AbsenceDocument1 pageCertificate of AbsenceFrancisco RamirezNo ratings yet

- Leaver AdviceDocument1 pageLeaver AdviceFrancisco RamirezNo ratings yet

- Cir V AlgueDocument10 pagesCir V AlgueEver AlcazarNo ratings yet

- Tax Clearance - FAQDocument5 pagesTax Clearance - FAQSarmila RavichandranNo ratings yet

- Order Confirmation - Aaron'sDocument3 pagesOrder Confirmation - Aaron'sRyan MentonNo ratings yet

- FDBDNZFGMJFH MdsfsdfsDocument187 pagesFDBDNZFGMJFH Mdsfsdfsshri100% (1)

- Rumahweb Indonesia - Invoice #2810900Document2 pagesRumahweb Indonesia - Invoice #2810900Aria WibowoNo ratings yet

- Income From House Property-6Document9 pagesIncome From House Property-6s4sahithNo ratings yet

- Document PDFDocument3 pagesDocument PDFMJA50% (2)

- JioMart Invoice 1696865111803Document1 pageJioMart Invoice 1696865111803Akshay KumarNo ratings yet

- A Project Report On Direct TaxDocument53 pagesA Project Report On Direct Taxrani26oct84% (44)

- 1599215034384b2ZER5wBrqu7jnlh PDFDocument14 pages1599215034384b2ZER5wBrqu7jnlh PDFKuldeep KushwahaNo ratings yet

- Tax Remedies: (Lecture Notes)Document27 pagesTax Remedies: (Lecture Notes)WilsonNo ratings yet

- Marcoeconomic PracticeDocument17 pagesMarcoeconomic PracticeJames WangNo ratings yet

- SURVEY QUESTIONNAIRE - Online BankingDocument4 pagesSURVEY QUESTIONNAIRE - Online BankingEstrada, Jemuel A.No ratings yet

- Deduction Under Income Tax Act 1961Document5 pagesDeduction Under Income Tax Act 1961Suman kushwahaNo ratings yet

- ST 3Document2 pagesST 3Hudasenna ChannelNo ratings yet

- People Interactive (I) PVT LTD: Payslip For The Month of Mar 2019Document1 pagePeople Interactive (I) PVT LTD: Payslip For The Month of Mar 2019Joe JEe KAyNo ratings yet

- Central Azucarera de Don Pedro Vs CTA 20 SCRA 344Document4 pagesCentral Azucarera de Don Pedro Vs CTA 20 SCRA 344Kimberly SendinNo ratings yet

- Dutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshDocument2 pagesDutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshNur NobiNo ratings yet

- Tax 301 Income Taxation Module 1 8Document163 pagesTax 301 Income Taxation Module 1 8Rica Miña100% (2)

- Banking Law NotesDocument50 pagesBanking Law NotesSYAMALA YASHWANTH REDDYNo ratings yet

- Chapter Five: E-Commerce Payment SystemsDocument17 pagesChapter Five: E-Commerce Payment SystemsAgmasie TsegaNo ratings yet

- Dit Sem V SolnDocument10 pagesDit Sem V Solnmaaz11052020No ratings yet

- Tax Invoice: Bhadrak Gstin/Uin: 21AAKFP2695N1ZR State Name: Odisha, Code: 21Document1 pageTax Invoice: Bhadrak Gstin/Uin: 21AAKFP2695N1ZR State Name: Odisha, Code: 21Ashish ParidaNo ratings yet

- Carrier: Delhivery: Deliver To FromDocument1 pageCarrier: Delhivery: Deliver To FromnayeemNo ratings yet

- Billing Details:: Salsabeel Purification & Distributing Drinking Water LLCDocument4 pagesBilling Details:: Salsabeel Purification & Distributing Drinking Water LLCN CambNo ratings yet

- About Card Payments Regulation - Questions & Answers RBADocument12 pagesAbout Card Payments Regulation - Questions & Answers RBASamNo ratings yet

- Voucher Form For NGODocument1 pageVoucher Form For NGOjoy elizondoNo ratings yet

- CIR V St. Lukes DigestDocument2 pagesCIR V St. Lukes DigestTrisha Dela RosaNo ratings yet

- BSNL BILLDocument6 pagesBSNL BILLSamba NalamalaNo ratings yet

- Business and Transfer TaxationDocument22 pagesBusiness and Transfer TaxationNicole Rivera100% (1)