Professional Documents

Culture Documents

Cash Program

Uploaded by

yummy90Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Program

Uploaded by

yummy90Copyright:

Available Formats

AP-2: Audit Program for Cash

Company Balance Sheet Date

The company has the following general ledger accounts that are classified in the cash caption of the balance sheet. General Ledger Account Number Bank Account Number Authori ed Check !igner

Description

Audit Program for Cash Company Balance Sheet Date

Audit "b#ecti$es Audit %rocedures for Consideration *(NANC(AL !TAT+,+NT A!!+-T("N!

+&" +)istence or occurrence. .&A .aluation or allocation.

N&A 'orkpaper %erformed (nde) by

C -&"

Completeness. -ights and obligations.

%&D

%resentation and disclosure.

A/D(T "B0+CT(.+! A. -&"2. Cash e)ists and is owned by the client 1assertions +&" and

B. Cash balances reflect a proper cutoff of receipts and disbursements 1assertions +&"3 C3 and .&A2. C. Cash balances as presented in the balance sheet properly reflect all cash and cash items on hand3 in transit3 or on deposit with third parties 1assertions +&"3 C3 and %&D2. D. Cash balances are properly classified in the financial statements3 and any restrictions on the a$ailability of funds are properly disclosed 1assertions -&" and %&D2. (D+NT(*(CAT("N C"D+! The letters preceding each of the abo$e audit ob#ecti$es3 i.e.3 A3 B3 etc.3 ser$e as identification codes. These codes are presented in the left column labeled Audit "b#ecti$es when a procedure accomplishes an ob#ecti$e. (f the alpha code appears in a bracket3 e.g.3 4A53 4B53 etc.3 the audit procedure only secondarily accomplishes the ob#ecti$e. (f an asterisk precedes a procedure3 it is a preliminary step or a follow up step that does not accomplish an ob#ecti$e. BA!(C %-"C+D/-+! A 6. /sing the standard A(C%A bank confirmation form3 re7uest confirmation as of the audit date for each bank account. Also re7uest confirmation of material cash in sa$ings institutions3 certificates of deposit3 and compensating balances. -etain copies of all confirmations in the workpapers. ,ail second re7uests if necessary. %ractical Considerations8 :. A sample standard bank confirmation form is pro$ided at CL9

(f the client only has a few bank accounts3 confirmations

should generally be sent for e$ery account. ;owe$er3 if the client has one or two primary accounts and numerous secondary accounts that ha$e minimal acti$ity3 confirmations might only be re7uested for the primary accounts. *or the accounts not confirmed3 the bank balance shown on the bank reconciliation can simply be agreed to the bank statement. (n addition to the standard bank confirmation form to confirm deposit accounts 1for e)ample3 checking accounts3 sa$ings accounts3 or certificates of deposit2 the auditor should consider separately confirming details of e)isting cash9related matters such as the following with the appropriate official of the financial institution responsible for the client<s account8 Compensating balance re7uirements or restrictions on withdrawals of funds 1see sample letter at CL9:=2. Automatic in$estment ser$ices. Cash management ser$ices.

Certificates of deposit held in safekeeping 1see additional procedures section2. Normally3 account numbers or certificate of deposit numbers to be confirmed should be listed. Bank account numbers are often incorrectly listed3 thus you may want to check these before mailing. -etain a copy of your bank confirmation re7uest in case a second mailing is necessary. (n lieu of a second mailing3 consider whether a phone call to the bank may be more effecti$e. >The Confirmation and Correspondence Control? at C@9AB can be used to monitor the status of confirmations. (nefficiencies can be a$oided by relying on alternati$e procedures for confirmations not recei$ed. -ather than incur significant time trying to follow up on nonresponses 1or incorrect responses2 for secondary accounts3 the auditor might elect to simply agree the bank balance per the bank reconciliation to the bank statement. C A. Determine those bank accounts for which subse7uent

period cutoff bank statements may be necessary and re7uest from the bank1s2 by letter that such cutoff statements be mailed directly to our 1auditors<2 post bo).

Acct. Name D No.

Bank Address

Cutoff %eriod

%ractical Considerations8 CL9B pro$ides a sample letter.

Normally3 a small business will ha$e one primary bank account used for general receipts and disbursements for which a cutoff may be re7uested. "ther accounts may not ha$e sufficient transaction $olume to necessitate testing by using a cutoff bank statement. (f possible3 procedures that use cutoff bank statements should be timed to allow the return of the statement without interruption of the client<s normal operations. A3 B3 C3 4D5 :. "btain copies of each account<s bank reconciliation for the workpapers and perform the following procedures8 a. Trace the bank balance on the reconciliation to the standard bank confirmation recei$ed from the bank 1or the balance per bank

statement for any accounts not confirmed2. b. Trace the reconciled book balance to the general ledger3 trial balance3 or lead schedule as applicable. c. Test the clerical accuracy of the reconciliation and detail supporting schedules. d. -e$iew the cash receipts and disbursement ledgers for each bank account for a reasonable period 1normally fi$e business days before and after the balance sheet date2 or perform other appropriate procedures to identify interbank transfer checks and deposits3 then $isually determine recording in proper period. !pecifically determine that8 162 Transfers between each ledger were recorded in the same period3 i.e.3 all before9year end transfers were recorded in each ledger before year end3 and $ice9$ersa for post9year end transfers. 1A2 Transfers not clearing the bank in the same accounting period as they were initiated are properly reflected as reconciling items on bank reconciliations. Note: (f interbank transfers during this period are too numerous to make a $isual determination feasible3 consider an additional procedure to prepare a transfer schedule. e. -e$iew the nature and e)tent of the reconciling items 1primarily deposits in transit and outstanding checks2 for reasonableness. *or bank accounts with unusual items or a large $olume of reconciling items3 perform the following procedures using a cutoff or subse7uent month bank statement8 162 Compare the beginning bank balance on the cutoff bank statement to the bank reconciliation. (n$estigate any differences. 1A2 Trace deposits in transit per the bank reconciliation to deposits in the cutoff bank statement noting reasonableness of the time period between book and bank recording. 1:2 (nspect selected canceled checks returned with the cutoff

bank statement. Trace checks dated before the balance sheet date to the list of outstanding checks. 1B2 (nspect the dates that checks cleared the bank. (n$estigate any large or unusual outstanding checks that cleared with the cutoff statement3 but took a long time to clear3 and&or outstanding checks that did not clear 1still outstanding2. !uch checks may be more properly designated accounts payable if they were dated before year end3 but not mailed until after year end. 1E2 Determine the propriety of other reconciling items as deemed necessary. %ractical Considerations8 These procedures should be performed for accounts that ha$e significant acti$ity or unusual items. *or most small businesses3 these procedures will only be necessary for the main operating account. (n recent years3 some banks ha$e abandoned the practice of returning canceled checks to the client with the monthly bank statement. !uch banks may send the auditor canceled checks or copies of such checks with the cutoff statement if the client makes a special re7uest to appropriate bank personnel well in ad$ance of the cutoff period. The auditor might confirm the details of disbursements with payees listed in the client<s records as an alternati$e to e)amining a canceled check. f. *or sa$ings account balances and certificates of deposit3 tie confirmation amounts to general ledger amounts. Consider the possibility of unrecorded interest or substitution of certificate numbers. %ractical Considerations8 Audit inefficiencies often occur because of poorly prepared bank reconciliations. ;a$e the client clearly document the following8 The date and deposit slip total for each deposit in transit.

The check number3 date written3 payee3 and amount of each outstanding check in lieu of the fre7uently recei$ed adding

machine tape. The nature and cause of each ma#or reconciling item3 including the date the item first appeared. *or some small businesses3 the nature and e)tent of reconciling items3 i.e.3 deposits in transit and outstanding checks3 in most bank accounts are insignificantF accordingly3 additional procedures are unnecessary. This would be true for most small imprest payroll bank accounts. ;owe$er3 the nature and e)tent of reconciling items in the general account normally re7uire additional procedures. D B. -e$iew the confirmation1s2 recei$ed from the bank or other financial institutions along with loan and debt agreements3 corporate minutes3 and in7uiries of management and determine whether8 1Coordinate this work with your debt and contingency procedures in other program areas.2 a. Accounts are sub#ect to withdrawal restrictions.

b. There are related guarantees3 endorsements and&or letters of credit3 including guarantee arrangements for related parties. c. There are amounts designated for special purposes.

d. Amounts are restricted in any manner3 including minimum balance re7uirements of loan agreements or debt ser$ice funds established by debt indentures3 or compensating balances maintained for or by related parties. e. Amounts are appropriately classified as cash3 cash e7ui$alents3 or other short9term in$estments. C E. After performing all appropriate procedures3 return cutoff bank statements and obtain a receipt from the client e$idencing their return. G. Consider the need to apply one or more additional procedures. The decision to apply additional procedures should be based on a consideration of whether information obtained or misstatements detected by performing substanti$e tests or from

other sources during the audit alter your #udgment about the need to obtain a further understanding of control acti$ities3 the assessed le$el of risk of material misstatements 1whether caused by error or fraud23 and on an e$aluation of whether the basic procedures ha$e been sufficient to achie$e the audit ob#ecti$es. Attach audit program sheets to document additional procedures. %ractical Considerations8 Certain common additional procedures relating to the following topics are illustrated following this program8 Cut9off bank statement not recei$ed. (nterbank transfers. ,aterial cash on hand. Certificates of deposit. (nade7uate segregation of duties o$er cash disbursements. Accounts closed during the year. %roof of cash.

%ractitioners may refer to %%C<s Guide to *raud (n$estigations for more e)tensi$e fraud detection procedures if it is suspected that the financial statements are materially misstated due to fraud. C H. Consider whether procedures performed are ade7uate to respond to identified fraud risk factors. (f fraud risk factors or other conditions are identified that re7uire an additional audit response3 consider those risk factors or conditions and the auditor<s response in connection with the performance of !tep 66 in A%96b. %ractical Consideration8 !pecific responses to identified fraud risk factors are addressed in indi$idual audit programs. (n connection with e$aluation and other completion procedures in A%96b3 the auditor considers the need to perform additional procedures based on the results of procedures performed in the indi$idual audit programs and the cumulati$e knowledge gained from performing those procedures.

I. Consider whether the results of audit procedures indicate reportable conditions in internal control and3 if so3 add to the memo of points for the communication of reportable conditions. 1!ee section 6E=B for e)amples of reportable conditions3 and see C@96I for a worksheet that can be used to document the points as they are encountered during the audit.2 C"NCL/!("N 'e ha$e performed procedures sufficient to achie$e the audit ob#ecti$es for cash3 and the results of these procedures are ade7uately documented in the accompanying workpapers. 1(f you are unable to conclude on any ob#ecti$e3 prepare a memo documenting your reason.2

Additional Audit Procedures for Cash

Instructions: Additional procedures will occasionally be necessary on some small business engagements. The following listing3 although not all9inclusi$e3 represents common additional procedures and their related ob#ecti$es.

Cutoff Bank !tatement Not -ecei$ed C (f a cutoff 1or subse7uent month2 bank statement that was not recei$ed directly from the bank by the auditor is used to perform additional procedures3 consider the following procedures to pro$e the cutoff bank statement8 a. (nspect the cutoff bank statement for erasures or alterations and determine the clerical accuracy of the statement totalsF and

b. *oot the paid checks and deposit slips supporting the bank statement and compare the totals to the corresponding totals on the bank statement. %ractical Considerations8 +normous time can be wasted performing this step. (f you only plan to use the cutoff statement to e)amine a few significant reconciling items identified during procedures in !tep :3 a proof of the cutoff would generally not be warranted. (f you pro$e the statement and it includes a large number of paid checks3 if possible3 remo$e fi$e checks at random and ha$e the client foot the balance of the paid checks to a >blind total.? Add your fi$e check total to the client<s total and tie to the bank statement.

(nterbank Transfers B (f there are numerous interbank transfers that cannot be ade7uately tested by $isual comparisons3 prepare for the workpapers a bank transfer schedule with the following column headings8 J J J J J J J J Name of disbursing bank. Check number or other reference. Amount. Date disbursed per books. Date disbursed per bank. Name of recei$ing bank. Date deposited per books. Date deposited per bank.

%erform the following8 a. -e$iew the cash receipts and disbursements #ournals3 bank

statements3 and related paid checks 1including the cutoff bank statement2 for a reasonable period 1normally fi$e business days2 before and after year end. -ecord material interbank transfers on the transfer schedule. b. -e$iew the schedule to determine that the deposit and disbursement side of each transfer is recorded in the proper period. !ee that incomplete transfers 1those not consummated and completed in the same accounting period2 are properly reflected as reconciling items on the bank reconciliations. %ractical Consideration8 %reparation of an interbank transfer schedule may detect mo$ements of large amounts of cash among bank accounts with no apparent business purpose. !uch mo$ements might be a red flag to the auditor3 particularly if the auditor has already determined that additional procedures are necessary based on his or her consideration of the risk of material misstatement due to fraud3 and may indicate that the client is kiting or committing other types of fraud.

,aterial Cash on ;and A (f cash on hand is material in relation to the financial statements taken as a whole3 or if there are significant negotiable securities in the custody of the client3 consider performing the following additional procedures8 a. Count the cash fund 1or obser$e and list the securities2 in the presence of a client representati$e. b. ;a$e the client representati$e sign a receipt that all cash 1securities2 was returned to his or her custody intact. c. Tie amounts counted to general ledger balances or lists of securities. %ractical Considerations8 (n most small businesses3 cash on hand is immaterial and should not be counted3 unless it is at the client<s re7uest.

CL9G presents a >-eceipt for Cash Counted by Auditor3? and CL96E presents a >-eceipt for !ecurities Counted by Auditor.?

Certificates of Deposit A3 4D5 +)amine significant certificates of deposit on hand and compare to bank confirmations. %ractical Considerations8 This procedure pro$ides additional assurance as to whether certificates of deposit ha$e been pledged to secure indebtedness. (f certificates of deposit are held in safekeeping by the financial institution3 the auditor should consider sending a separate confirmation to the financial institution to $erify that the certificates of deposit are held in safekeeping in the client<s name. The confirmation letter at CL96H may be used for this purpose.

(nade7uate !egregation of Duties "$er Cash Disbursements C (f the client has inade7uate segregation of duties for the cash disbursements function3 consider the need for the following additional procedures8 a. "btain bank confirmations and cutoff bank statements for additional accounts. b. +)pand tests of reconciling items.

c. -e$iew selected checks for unusual payees3 endorsements3 addresses3 or amounts. Document the items tested. d. -e$iew cash disbursements for an e)tended period prior to year end. %ractical Considerations8 These additional procedures might be appropriate if the auditor3 based on his or her consideration of fraud risk factors3

decides to modify procedures to consider material fraudulent3 unauthori ed disbursements 1such as $endor or payroll disbursements2. !ee also the additional procedures in A%9K and A%9 6:. A lack of segregation of duties is a particular concern if the employee is authori ed to sign checks or is authori ed to sign for the owner&manager 1for e)ample3 by using a signature stamp23 the employee recei$es bank statements directly and reconciles bank accounts3 and checks are not re$iewed by other personnel or the owner&manager. A common method perpetrators use to misappropriate cash when there is an inade7uate segregation of duties for cash disbursements is to make checks payable to cash3 themsel$es3 or a third party to pay a personal bill. The perpetrator then enters the disbursement in the books of the company3 as being paid to a common $endor of the company3 and charges the payment to an e)pense account or cost of goods sold account that normally has a large balance. -e$iew of cancelled checks for unusual payees and comparing the payee to the cash disbursement records is a procedure designed to detect this type of fraud. The auditor should also consider the need to communicate the lack of segregation of duties as a reportable condition or material weakness in accordance with !A! No. G=. !ection 6G=A discusses the issue further.

Accounts Closed During the Lear C (f considered necessary3 send standard bank confirmations for accounts closed during the year. %ractical Consideration8 (n addition to confirming bank accounts open at year9end3 some auditors send confirmations for all bank accounts closed during the year. The main purpose for this procedure is to detect unrecorded debt. ;owe$er3 it is the authors< opinion that this procedure is not the most effecti$e for detecting unrecorded liabilities. Detail audit testing and analytical procedures on other balance sheet and income statement accounts should generally be

ade7uate to detect any material unrecorded debt.

%roof of Cash C (f the auditor3 based on his or her consideration of fraud risk factors3 decides to modify procedures related to cash balances3 consider performing a proof of cash. %ractical Considerations8 A proof of cash is an e)panded $ersion of a bank reconciliation. (t pro$ides four reconciliations on one formM -econciliation of the beginning9of9period balances per the bank statement and the books. -econciliation of the current period cash receipts per the bank statement to the corresponding items in the general ledger. -econciliation of the current period cash disbursements per the bank statement to the corresponding items in the general ledger. -econciliation of the end9of9period balances per the bank statement to the books. %ractitioners may refer to %%C<s Guide to *raud (n$estigations for more e)tensi$e fraud detection procedures if it is suspected that the financial statements are materially misstated due to fraud.

Additional Audit Procedures for Cash Beginning Balance in Initial Audit

Company Balance Sheet Date

Audit "b#ecti$es Audit %rocedures for Consideration

N&A 'orkpaper %erformed (nde) by

Instructions: Additional procedures will be necessary in an initial audit. These procedures are applied to opening balances and differ depending whether you are relying on your re$iew of a predecessor<s work or placing no reliance on a predecessor<s audit. 1!ection 6I=: discusses considerations when replacing a predecessor auditor3 including a discussion of what the term reliance means when used in this program.2 These procedures may be applied in con#unction with the basic procedures applied to the ending balance. The asterisks preceding the procedures indicate that they are an intermediate step in achie$ing audit ob#ecti$es for the ending balance. C 6. (f a predecessor<s audit of the prior period<s financial statements is to be relied on8 a. !can the predecessor<s cash workpapers and determine whether the predecessor confirmed each bank account and tested the client<s reconciliations and cash cutoff. b. (n$estigate large or unusual reconciling items that had not cleared at the time the predecessor audited cash. C A. (f no reliance on a predecessor<s audit is planned or possible8 a. !can copies of the client<s reconciliations of each bank account made at the close of the prior period. b. Trace balances in the reconciliations to bank statements and the general ledger. c. Trace large or unusual reconciling items to subse7uent bank statements and consider the need for additional in$estigation. %ractical Considerations8 'atch for indications of an improper cutoff3 i.e.3 recording cash disbursements of the current period as transactions of the prior period to impro$e the current ratio of the prior period<s financial statements. (f the client<s reconciliations for the prior period were poorly

prepared3 re7uest that they be redone in the same format as re7uested for the current period. 1!ee practical considerations for basic procedure :.2

You might also like

- Project IN AuditingDocument9 pagesProject IN AuditingToniNo ratings yet

- Chapter IDocument13 pagesChapter IGavebriel MarianoNo ratings yet

- Module 3 Income Tax On IndividualsDocument77 pagesModule 3 Income Tax On IndividualsAriza CastroverdeNo ratings yet

- FACTS: On November 8, 2001 Ruperta C. Palaganas (Ruperta), A Filipino Who BecameDocument3 pagesFACTS: On November 8, 2001 Ruperta C. Palaganas (Ruperta), A Filipino Who BecameLizzette Dela PenaNo ratings yet

- Tests of ControlsDocument6 pagesTests of ControlsEvan RoymanNo ratings yet

- Batas Pambansa BLG 22Document19 pagesBatas Pambansa BLG 22Samn Pistola CadleyNo ratings yet

- CHAPTER 22-Audit Evidence EvaluationDocument27 pagesCHAPTER 22-Audit Evidence EvaluationIryne Kim PalatanNo ratings yet

- Notes On Chattel MortgageDocument9 pagesNotes On Chattel Mortgagekazuke1103No ratings yet

- Substantive Audit For AssetsDocument7 pagesSubstantive Audit For AssetsHenry MapaNo ratings yet

- Philippine Standards On Auditing 220 RedraftedDocument20 pagesPhilippine Standards On Auditing 220 RedraftedJayNo ratings yet

- Balance Sheet ReconciliationsDocument6 pagesBalance Sheet ReconciliationsvidushigargeNo ratings yet

- Auditing: Module 4 Forming An Opinion and Reporting On Financial StatementsDocument48 pagesAuditing: Module 4 Forming An Opinion and Reporting On Financial StatementsJohn Archie AntonioNo ratings yet

- Agustin vs. InocencioDocument2 pagesAgustin vs. InocencioJose IbarraNo ratings yet

- Scope of AuditDocument2 pagesScope of AuditFaiz Ur RehmanNo ratings yet

- Tax ReviewerDocument39 pagesTax ReviewerLuigiMangayaNo ratings yet

- Tax BT Introduction To VATDocument5 pagesTax BT Introduction To VATJoshua Phillip TorcedoNo ratings yet

- BankingDocument8 pagesBankingAw LapuzNo ratings yet

- Civ 2 Cases - Contracts Part 1Document45 pagesCiv 2 Cases - Contracts Part 1Rolan Jeff Amoloza LancionNo ratings yet

- Sales Part 10: Coverage of Discussion: Assignment of Credit and Other Incorporeal RightsDocument15 pagesSales Part 10: Coverage of Discussion: Assignment of Credit and Other Incorporeal RightsAmie Jane MirandaNo ratings yet

- AACONAPPS1 - Chapter 8 - Overview of Risk-Based Audit ProcessDocument15 pagesAACONAPPS1 - Chapter 8 - Overview of Risk-Based Audit ProcessClarisse Angela PostreNo ratings yet

- Philippine National Bank v. AmoresDocument6 pagesPhilippine National Bank v. AmoresRoemma Kara Galang PaloNo ratings yet

- Toa 1405Document5 pagesToa 1405chowchow123No ratings yet

- Philippine Standard On Auditing 300Document6 pagesPhilippine Standard On Auditing 300HavanaNo ratings yet

- Torts 1Document491 pagesTorts 1Jon SnowNo ratings yet

- Case Digest Pale - The 35 CasesDocument16 pagesCase Digest Pale - The 35 CasesAntoinette Janellie TejadaNo ratings yet

- Marquez v. Elisan, G.R. No. 194642, April 06, 2015 PDFDocument2 pagesMarquez v. Elisan, G.R. No. 194642, April 06, 2015 PDFJaime Rariza Jr.No ratings yet

- Updates From The PRBoADocument68 pagesUpdates From The PRBoAJofritz ValleNo ratings yet

- 84 - Tagatac v. JimenezDocument4 pages84 - Tagatac v. JimenezJude Raphael S. FanilaNo ratings yet

- 1.0 General Principles of TaxationDocument65 pages1.0 General Principles of TaxationChristopher De GuzmanNo ratings yet

- Chapter 1 Introduction To TaxationDocument70 pagesChapter 1 Introduction To TaxationPrincess Diane VicenteNo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Aud TheoryDocument9 pagesAud TheoryYaj CruzadaNo ratings yet

- Question and Answer True or FalseDocument10 pagesQuestion and Answer True or FalseGie Bernal Camacho100% (1)

- EBC - Understand The Business TemplateDocument6 pagesEBC - Understand The Business TemplateBenjie AquinoNo ratings yet

- QB 2015 CH 1 Lecture - Introduction To QuickBooks and Company FilesDocument102 pagesQB 2015 CH 1 Lecture - Introduction To QuickBooks and Company FilesFadi Alshiyab100% (1)

- Operating Segment: Pfrs 8Document28 pagesOperating Segment: Pfrs 8Giellay OyaoNo ratings yet

- Tax 1 Syllabus Part 1 PDFDocument9 pagesTax 1 Syllabus Part 1 PDFJoesil Dianne SempronNo ratings yet

- Local Government of Laoac/Urdaneta City University School of Law Re: Legal Aid Extension ProgramDocument7 pagesLocal Government of Laoac/Urdaneta City University School of Law Re: Legal Aid Extension ProgramOffice AcadNo ratings yet

- Auditing Theory1 1Document14 pagesAuditing Theory1 1JPIA MSU-IITNo ratings yet

- Substantive Audit Testing: Expenditure Cycle: Multiple ChoiceDocument20 pagesSubstantive Audit Testing: Expenditure Cycle: Multiple ChoiceMark Dwayne MalonzoNo ratings yet

- Cash Receipts CycleDocument4 pagesCash Receipts CycleYenNo ratings yet

- Powers of CorporationDocument10 pagesPowers of CorporationJoanna Canlubo JamitoNo ratings yet

- Managing Corporate Governance:: Legal/Regulatory Environment and Corporate Governance Practices in The PhilippinesDocument17 pagesManaging Corporate Governance:: Legal/Regulatory Environment and Corporate Governance Practices in The Philippinesmayank.sabharwal6317No ratings yet

- Foreign Currency Deposit Act of The PhilippinesDocument14 pagesForeign Currency Deposit Act of The PhilippinestheaNo ratings yet

- People vs. TibayanDocument7 pagesPeople vs. TibayanannelyseNo ratings yet

- At - 005 Internal ControlDocument7 pagesAt - 005 Internal ControlDea Lyn BaculaNo ratings yet

- The Professional Practice of AccountingDocument38 pagesThe Professional Practice of AccountingMargie Abad SantosNo ratings yet

- International Financial Reporting Standards (IFRS)Document10 pagesInternational Financial Reporting Standards (IFRS)soorajsooNo ratings yet

- Ifrs 9 Financial at Fair Value - FVTPL and FvtociDocument2 pagesIfrs 9 Financial at Fair Value - FVTPL and Fvtocironnelson pascual100% (2)

- Golden Merchandising v. EquitableDocument5 pagesGolden Merchandising v. EquitableJulianNo ratings yet

- 20 CIR Vs Lincoln Philippine LifeDocument7 pages20 CIR Vs Lincoln Philippine LifeInez Monika Carreon PadaoNo ratings yet

- Sales DigestDocument6 pagesSales DigestpasmoNo ratings yet

- Cash and Cash EquivalentsDocument43 pagesCash and Cash EquivalentsInsatiable LifeNo ratings yet

- LGU NGAS Chapter 1 and 2Document24 pagesLGU NGAS Chapter 1 and 2Lail PDNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Acc 415-s6Document11 pagesAcc 415-s6194098 194098No ratings yet

- Audit Test - ReceivablesDocument22 pagesAudit Test - ReceivablesRachael RuNo ratings yet

- Auditing TheoryDocument46 pagesAuditing Theorymandaresiokyleangelou22.svcNo ratings yet

- Sample Audit ProgramDocument9 pagesSample Audit Programjanyanjanyan67% (3)

- Arens AAS17 SM 22Document17 pagesArens AAS17 SM 22Nurul FarzanaNo ratings yet

- Lalitha SahasranamamDocument40 pagesLalitha Sahasranamamkaushik100% (24)

- Lalitha PancharatnamDocument2 pagesLalitha PancharatnamDS100% (1)

- Durga Sahasranam - Also Known As The Parvati Sahasranam and As The Devi Sahasranam (From The Kurma Purana)Document23 pagesDurga Sahasranam - Also Known As The Parvati Sahasranam and As The Devi Sahasranam (From The Kurma Purana)Bhaskar GunduNo ratings yet

- LAKSHMI AshtakamDocument2 pagesLAKSHMI AshtakamshilamvoraNo ratings yet

- Lakshmi 2Document1 pageLakshmi 2api-3828505No ratings yet

- Mahavakyas Sanskrit PDFDocument1 pageMahavakyas Sanskrit PDFgpdharan100% (1)

- Mahalakshmi Stotram From Padma PuranaDocument4 pagesMahalakshmi Stotram From Padma Purananvc_vishwanathan100% (1)

- Lalita Sahasranama SmallDocument15 pagesLalita Sahasranama Smallchaturvedisureshraju7676No ratings yet

- MANGALAkavachamDocument1 pageMANGALAkavachamapi-3828505No ratings yet

- Lakshmi SahasranamamDocument19 pagesLakshmi Sahasranamamur2good100% (1)

- RAHU StotramDocument1 pageRAHU Stotramapi-3828505No ratings yet

- God As Divine MotherDocument86 pagesGod As Divine MotherDakini Goddess100% (1)

- Origins of Vedic CivilizationDocument44 pagesOrigins of Vedic Civilizationrajan_8097% (30)

- Navagraha StotraDocument2 pagesNavagraha Stotratempo97217483No ratings yet

- Radha Krishna Sahasranam From The Narada PuranaDocument28 pagesRadha Krishna Sahasranam From The Narada PuranaMurariDasNo ratings yet

- Ramana PuranamDocument59 pagesRamana Puranamapi-3828505100% (1)

- PSHIKSHA2Document6 pagesPSHIKSHA2api-3828505No ratings yet

- Shan 2 Cut PHRDocument19 pagesShan 2 Cut PHRapi-3828505No ratings yet

- RudramDocument21 pagesRudramapi-3828505100% (1)

- PingalaDocument5 pagesPingalaapi-3828505No ratings yet

- SHIKSHA PhoneticsDocument5 pagesSHIKSHA PhoneticsRavindra ShindeNo ratings yet

- SHIVA Sahasranama From MahabharatDocument16 pagesSHIVA Sahasranama From MahabharatRupeshSavaliyaNo ratings yet

- TROTACADocument2 pagesTROTACAneerajkrsnaNo ratings yet

- RIGVEDDocument2 pagesRIGVEDRaj AstrologerNo ratings yet

- Yagna Phala Stotram Details - Blossom MagazineDocument4 pagesYagna Phala Stotram Details - Blossom MagazineAnand SharmaNo ratings yet

- Tìm Hiểu Về KSNBDocument21 pagesTìm Hiểu Về KSNBTrần Văn TẹoNo ratings yet

- Bahrain: Middle - EastDocument5 pagesBahrain: Middle - EastMuhammad AbdullahNo ratings yet

- 334 625 1 SMDocument12 pages334 625 1 SMKhusus DewasaNo ratings yet

- MBA Project Report On ICICI BankDocument71 pagesMBA Project Report On ICICI BankCyberfun50% (2)

- Path-Pradarshak 2023-24 EnglishDocument157 pagesPath-Pradarshak 2023-24 Englishnutandevi913585No ratings yet

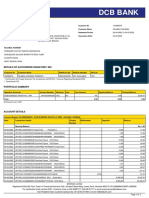

- DCB Bank: Statement of AccountDocument2 pagesDCB Bank: Statement of AccountEshaan AnandNo ratings yet

- TRM ResumeDocument8 pagesTRM ResumeJustin PageNo ratings yet

- Jaiib-Ppb-Recollected QuestionsDocument23 pagesJaiib-Ppb-Recollected QuestionsAvijit GhoshNo ratings yet

- Invoice SO2803216714Document1 pageInvoice SO2803216714shreyasgurung1517No ratings yet

- White Label AtmDocument5 pagesWhite Label AtmAliza SayedNo ratings yet

- General LedgerDocument3 pagesGeneral LedgerMelvin Carvajal MasambiqueNo ratings yet

- AmmetlifeDocument7 pagesAmmetlifeEcho WackoNo ratings yet

- Final PMJJY FormDocument1 pageFinal PMJJY FormKannan IT KeralaNo ratings yet

- What Is Driving Negative US Swap SpreadsDocument2 pagesWhat Is Driving Negative US Swap SpreadsRichNo ratings yet

- Finance BIS & FMI SheetDocument12 pagesFinance BIS & FMI SheetSouliman MuhammadNo ratings yet

- MCQ Banking and InsuranceDocument39 pagesMCQ Banking and InsuranceUmesh SalokNo ratings yet

- TB Items To Be AllocatedDocument16 pagesTB Items To Be AllocatedMohammed Nawaz ShariffNo ratings yet

- Account StatementDocument4 pagesAccount StatementgrtrNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- FAC 310 TEST 1 2023 Final With SolutionDocument10 pagesFAC 310 TEST 1 2023 Final With SolutionGrechen UdigengNo ratings yet

- Accounting For Special Transactions: Adrian T. NovalDocument32 pagesAccounting For Special Transactions: Adrian T. Novalkwyncle100% (5)

- Role of Financial Markets and InstitutionsDocument30 pagesRole of Financial Markets and InstitutionsĒsrar BalócNo ratings yet

- IAS 29 - NotesDocument29 pagesIAS 29 - NotesJyNo ratings yet

- Reliance Industries Training PresentationDocument31 pagesReliance Industries Training PresentationMahesh KumarNo ratings yet

- Lecture 2A Purpose of Financial StatementsDocument14 pagesLecture 2A Purpose of Financial StatementsParadoxicalNo ratings yet

- Sba 504 Loan Program Fact SheetDocument3 pagesSba 504 Loan Program Fact SheetStephen GallutiaNo ratings yet

- F M4 V3 KJZ Ci TZ 3 VD UDocument3 pagesF M4 V3 KJZ Ci TZ 3 VD UMahidhar RemataNo ratings yet

- ABC PracticeSet1 2020-2Document5 pagesABC PracticeSet1 2020-2heyheyNo ratings yet

- Cover: A Report ONDocument2 pagesCover: A Report ONAKASH DEEP MINZ (PGP 2016-18)No ratings yet

- LIC Housing Finance PDFDocument66 pagesLIC Housing Finance PDFOmkar Chavan100% (1)

- Prof 3 (Final) : If The Partnership Agreement Provides For The Division of Losses Only. Profits Should Be DividedDocument22 pagesProf 3 (Final) : If The Partnership Agreement Provides For The Division of Losses Only. Profits Should Be DividedTifanny MallariNo ratings yet