Professional Documents

Culture Documents

Corsair Capital Q2 2011

Uploaded by

ac0 ratings0% found this document useful (0 votes)

9 views5 pagescorsair capital investor letter q2 2011

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcorsair capital investor letter q2 2011

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views5 pagesCorsair Capital Q2 2011

Uploaded by

accorsair capital investor letter q2 2011

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Corsair Capital Management, LLC

350 Madison Avenue, 9

th

Floor

New York, NY 10017

This letter is not a research report or recommendation to buy or sell the securities mentioned herein. The examples herein are illustrations of ways in

which Corsair Capital Management, LLC and its affiliates have examined or may examine opportunities. Corsair Capital Management, LLC and its

affiliates may, at any time, buy or sell any of the securities mentioned in this letter and may change its long or short position at any time without

providing any notification of such changes. It should not be assumed that any trading activities pursued in the future will be profitable and may in fact

result in losses.

July 15, 2011

Dear Limited Partner:

For the second quarter ended June 30, 2011, Corsair Capital was up an estimated 0.2%* net, after

all fees and expenses, bringing our 2011 performance to 6.2%*. Since inception in January

1991, Corsair Capital`s compounded net annual return is 15.3%.

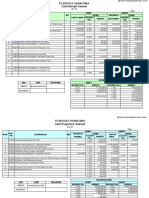

Corsair Capital (net) S&P 500 Russell 2000

2Q11 return 0.2% 0.1% -1.6%

YTD return 6.2% 6.0% 6.2%

Annualized since inception (1991) 15.3% 9.2% 10.9%

Total return since inception (1991) 1749% 510% 731%

* Returns are based on investments made at fund inception and using the highest possible fee schedule. Returns for investors in

these or any of the Corsair funds are most accurately provided in the monthly capital statements.

As we noted in our last quarterly letter, the market started 2011 on firm footing despite risks

posed by political instability, higher commodity prices, and major natural disasters. Easier credit

and financial conditions, continued progress in private sector deleveraging, improving labor

market conditions, and other signs of economic stability pushed equity indices higher. However,

markets reversed course in May as economic indicators pointed to slower global growth.

Supply-chain disruptions related to the Japanese earthquake and temporary spikes in gasoline

and commodity prices experienced in Q1 likely had a larger impact on GDP than investors

initially anticipated. Fortunately, recent data suggest that the temporary Japan-related disruptions

explain a large portion of the recent slowdown in U.S. industrial activity. Vehicle production has

since ramped up sharply, the June ISM manufacturing index surprised to the upside, and

commodity prices have returned to manageable levels that provide consumers breathing room to

spend or save. Despite these improvements, slow GDP growth through the first half of the year

has stymied gains in employment.

Amid this slowdown, U.S. and Eurozone solvency concerns continue to weigh on markets.

Deficit reduction negotiations in the U.S. have stalled, and the market is still waiting for

meaningful reform to our fiscal policies. Along similar lines, European policymakers continue to

debate various means of reducing Greece`s debt burden while minimizing potential contagion

fears. In addition, the market has begun to Iocus on Italy`s deteriorating Iinancials, and spreads

on periphery countries` sovereign debt have moved meaningfully higher. These spreads will

likely remain high unless greater clarity on support packages convinces the market Eurozone

governments have constructed a true solution.

m

a

r

k

e

t

f

o

l

l

y

This letter brought to you via MarketFolly.com

This letter is not a research report or recommendation to buy or sell the securities mentioned herein. The examples herein are illustrations of ways in

which Corsair Capital Management, LLC and its affiliates have examined or may examine opportunities. Corsair Capital Management, LLC and its

affiliates may, at any time, buy or sell any of the securities mentioned in this letter and may change its long or short position at any time without

providing any notification of such changes. It should not be assumed that any trading activities pursued in the future will be profitable and may in fact

result in losses.

As the global recovery progresses (albeit slowly), the path is proving to be more uneven than

expected across industries and geographies. For instance, while interest rates in the U.S. have

declined to historic lows, China and other countries have raised rates multiple times to combat

inflation. There seems to be a delicate balance worldwide between stimulating economic growth

and keeping prices of basic necessities within an affordable range. Even Chairman Bernanke

admits, 'It`s not clear we can get substantial improvements in payrolls without some additional

inIlation risk. We believe this uncertainty only increases general investor skittishness and

market volatility.

A number of our core names positively contributed to the portfolio during the quarter, offsetting

weaker performance posted by some cyclical holdings. We remain confident our holdings can

outperform the market through the economic cycle. So long as capital markets remain open, we

remain well positioned to take advantage of opportunities that arise from companies going

through change and transition.

Portfolio Updates

Innophos ('IPHS), the thesis for which we laid out in the appendix of our Q3 2010 letter, rallied

this quarter after posting Q1 adjusted EPS of $1.17 (reported EPS of $1.08), ahead of consensus

expectations of $1.00. Higher product pricing and improving product mix in Mexico contributed

to the company`s strong perIormance. We continue to expect IPHS will earn approximately

$5.00 of adjusted EPS in 2012 and surpass current market expectations. The stock is trading

roughly 10x our 2012 EPS estimate, and we believe the company deserves a 15x multiple given

the quality of the business model and strength of the balance sheet. The stock ended the quarter

at $48.80.

We mentioned in our last letter Expedia ('EXPE) had sold off in Q1 following weather related

travel disruptions, negative FX impacts, and a growing perception of competitive risk in the

online travel industry. Once these pressures abated in Q2, EXPE announced its intention to

separate into two publicly traded companies, whereby TripAdvisor, which offers higher growth

potential and higher margin services would become an independent entity and Expedia would

continue operating as the world`s largest online travel agency. The company also recently

resumed its share buyback program, and EXPE rallied to end the quarter at $28.99.

Maiden Holdings ('MHLD), a specialty reinsurance company we have also highlighted in past

letters, posted strong gains as management continued to execute on its plan to deliver stable

results to shareholders. MHLD`s newly acquired international operations proved additive to EPS,

and MHLD overall generated solid underwriting returns. In addition to strong operational

performance, MHLD completed an accretive financing transaction by retiring their expensive

trust preferred securities. The company currently has a book value of $10.65/share and is

expected to earn $1.30 for 2012. MHLD ended the quarter at $9.10.

KAR Auction Services ('KAR) positively contributed to the portfolio after reporting strong Q1

results and completing a debt refinancing to replace both its existing revolver and senior notes.

On our estimates, the stock has traded at an undeserved discount to its peers, and we believe its

m

a

r

k

e

t

f

o

l

l

y

This letter is not a research report or recommendation to buy or sell the securities mentioned herein. The examples herein are illustrations of ways in

which Corsair Capital Management, LLC and its affiliates have examined or may examine opportunities. Corsair Capital Management, LLC and its

affiliates may, at any time, buy or sell any of the securities mentioned in this letter and may change its long or short position at any time without

providing any notification of such changes. It should not be assumed that any trading activities pursued in the future will be profitable and may in fact

result in losses.

earnings multiple will expand as market participants recognize the company`s very strong Iree

cash flow generation. KAR faces just one main competitor in each of its two operating segments,

and this duopolistic structure should enable KAR to maintain and expand margins. We believe

KAR can earn towards $1.50 of adjusted EPS by 2012. The stock closed the quarter at $18.91.

Pace Oil & Gas ('PCE), which was formed in 2010 through the merger of Midnight Oil

Exploration and the upstream assets of Provident Energy, ended Q2 down in sympathy with most

small cap energy peers. PCE trades at a steep discount to its NAV of approximately $15.00,

despite its transition to an oil-focused company from a gas-focused one. The company's current

low valuation gives little credit to its growing oil production, abundant drilling opportunities, and

potential long-term benefit from a rebound in natural gas prices. While we continue to believe

the spread between PCE`s NAV and stock price will narrow over time, the company has

encountered higher amounts of water than expected at its Haro Pekisko asset. We have

conservatively excluded this resource from our NAV estimate despite its huge resource potential.

PCE recently announced plans to repurchase up to 5% of its shares to take advantage of its

current market valuation. The stock closed the quarter at $7.65.

We continue to be optimistic about the opportunity set in front of us. As we have described in

recent letters, the tumultuous activity of the last couple of years is resulting in an increase in

interesting corporate strategic activity.

Thank you for your continued support and confidence. The attached Appendix is a write-up of a

recent investment. Please feel free to call us with any questions you may have at (212) 389-

8240.

Sincerely,

Corsair Capital Management

m

a

r

k

e

t

f

o

l

l

y

This letter is not a research report or recommendation to buy or sell the securities mentioned herein. The examples herein are illustrations of ways in

which Corsair Capital Management, LLC and its affiliates have examined or may examine opportunities. Corsair Capital Management, LLC and its

affiliates may, at any time, buy or sell any of the securities mentioned in this letter and may change its long or short position at any time without

providing any notification of such changes. It should not be assumed that any trading activities pursued in the future will be profitable and may in fact

result in losses.

Appendix TNS I nc. TNS $15.85)

TNS, an international communications company, supplies many leading organizations in the

global payments and financial industries with networking, integrated data and voice services.

TNS also provides extensive telecommunications network solutions to service providers. Below

is a brief overview oI the company`s reporting segments. We think the stock is undervalued

because management disenfranchised investors after missing guidance in 2010, and the company

is incurring startup losses in a recently acquired new product line.

Point of Sale - TNS provides data transport to/from payment processors from/to endpoints like

credit card machines etc. The US side of this business has been challenged recently, but the rest

of world (ROW) is growing. Management expects this to grow 1-3% with much of the growth

coming from ROW. The US portion of this segment is facing strong headwinds from a new

competitor and from potential legislation to lower debit fees.

Financial services - TNS provides direct data/voice connections to/from financial institutions and

their clients. This business was a great growth engine until 2008 but has since declined. TNS

now believes this segment is again positioned to achieve 8-10% growth with much of that

coming from the international side.

Telecommunications services - TNS provides network services primarily with their SS7 offering,

registry, information/ID (caller ID database) and roam/clearing services. Some of these segments

will see growth (roaming), others will decline, but overall management expects this segment to

grow 4-6% top-line over the long term.

Acquired by TNS in late 2010 for $50mm, Cequint provides software technology to deliver

caller ID to mobile phones and has two core products, CityID and NameID. CityID provides city

and state information to the mobile device, while NameID provides the name of person calling.

AT&T has already launched CityID for select phones, and T-Mobile features NameID on its

website and plans to offer the service for $3.99/month. We estimate that TNS gets ~40% of the

economics with approximately 80% gross margins in line with software peers. Over the longer

term, if we assume 10% of US mobile customers pick up NameID and pricing is reduced to

$0.99/month, this could add ~$2.00/share of EPS (indeed, this feature may well be bundled as

part of a carrier's standard monthly services). It is important to note that a rollout could take a

few years as the technology will only be rolled out on new devices, but the upside potential here

is quite large.

We believe shares of TNS are undervalued and will begin to appreciate as the company executes

on its plan and certain catalysts occur over the next few quarters. The company has given

guidance for calendar 2011 EPS of $2.10, and we believe this is achievable. However, embedded

in this guidance is a $0.10/share loss related to Cequint. Excluding this expense, TNS core

adjusted earnings of $2.20 implies the stock is trading at approximately 7.5x 2011 EPS. If

Cequint contributes to earnings in 2012 as management expects, we believe the company can

earn $2.50+ and easily trade at a 12-15x multiple.

m

a

r

k

e

t

f

o

l

l

y

MarketFolly.com - Your Source For Hedge Fund Tracking

This letter is not a research report or recommendation to buy or sell the securities mentioned herein. The examples herein are illustrations of ways in

which Corsair Capital Management, LLC and its affiliates have examined or may examine opportunities. Corsair Capital Management, LLC and its

affiliates may, at any time, buy or sell any of the securities mentioned in this letter and may change its long or short position at any time without

providing any notification of such changes. It should not be assumed that any trading activities pursued in the future will be profitable and may in fact

result in losses.

While tracking communications businesses such as TNS often proves difficult, we believe the

problems impacting previous quarters are mostly under control. Our research and discussions

with TNS management suggest the company can return to steady growth. Given the company`s

strong free cash flow generation, earnings stability, attractive operating leverage and low

maintenance capex, we think the stock is worth at least 10x this year`s earnings, which translates

to an implied $22.00 stock price excluding the value of Cequint.

The balance sheet has ~$330m of net debt or under 2.5x net debt/EBITDA. The company has run

at higher debt levels in the past, and we believe TNS can comfortably handle as much as 3.5x.

TNS repurchased $22m of stock in 2010 and expects to repurchase another $30mm in 2011. The

company may also consider paying out a one-time special dividend which it has done in the past.

Valuation summary:

2011 EPS Guidance Midpoint $2.10

Cequint Adjustment 0.10

Core Normalized Earnings Power $2.20

Price / Earnings Multiple 10.0 x

Fair Value $22.00

Potential Cequint Value $5.00 - $20.00

Total TNS Value $27.00 - $42.00

Current Stock Price $15.85

Potential Return 70% - 165%

m

a

r

k

e

t

f

o

l

l

y

Click here for more hedge fund letters on MarketFolly.com

You might also like

- The Harvey Mudd Guide To Graduate School in Computer ScienceDocument7 pagesThe Harvey Mudd Guide To Graduate School in Computer Scienceigumnov979No ratings yet

- PIMCO - Investment Outlook - July 2010Document2 pagesPIMCO - Investment Outlook - July 2010acNo ratings yet

- Lily HuDocument2 pagesLily HuacNo ratings yet

- GLG - 2011.06.20 - Emerging Markets As An Asset ClassDocument10 pagesGLG - 2011.06.20 - Emerging Markets As An Asset ClassacNo ratings yet

- Business Model Canvas PosterDocument1 pageBusiness Model Canvas Posterosterwalder75% (4)

- A Brief History of The Chinese Growth Modelc2Document9 pagesA Brief History of The Chinese Growth Modelc2acNo ratings yet

- Aqr On Understanding Managed Futures (Winter 2010)Document10 pagesAqr On Understanding Managed Futures (Winter 2010)acNo ratings yet

- RR Cereal Secrets Grain Traders Agriculture 30082012 enDocument80 pagesRR Cereal Secrets Grain Traders Agriculture 30082012 enzhengzheng89No ratings yet

- A Guide To Casino Mathematics: Robert C. Hannum University of DenverDocument12 pagesA Guide To Casino Mathematics: Robert C. Hannum University of DenverNaveen Ramaswamy100% (3)

- Prologue Apr 2013Document8 pagesPrologue Apr 2013acNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Economic Influences On Logistics - Business Case Study 2023Document3 pagesEconomic Influences On Logistics - Business Case Study 2023Bowie LeckieNo ratings yet

- Amarylis Putri - KERTAS KERJA JURNAL - Sent2Document6 pagesAmarylis Putri - KERTAS KERJA JURNAL - Sent2SatriaArdya10No ratings yet

- Personal Lease Adam LightfootDocument9 pagesPersonal Lease Adam Lightfootaaakinkumi115No ratings yet

- Letter of AcceptanceDocument2 pagesLetter of AcceptanceDisha DarjiNo ratings yet

- Manila City - Ordinance No. 8330 s.2013Document5 pagesManila City - Ordinance No. 8330 s.2013Franco SenaNo ratings yet

- Toppan Merrill Technology ListDocument2 pagesToppan Merrill Technology ListKilty ONealNo ratings yet

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- Strategic Analysis and ChoiceDocument13 pagesStrategic Analysis and ChoiceAbhitak MoradabadNo ratings yet

- Hyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDDocument23 pagesHyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDwalterwatts010985wqa100% (129)

- SIP Report Atharva SableDocument68 pagesSIP Report Atharva Sable7s72p3nswtNo ratings yet

- Review of Related Literature OutlineDocument4 pagesReview of Related Literature OutlineSiote ChuaNo ratings yet

- "E20" Surface Mount Productivity Improvement Project - Phase 1Document51 pages"E20" Surface Mount Productivity Improvement Project - Phase 1JAYANT SINGHNo ratings yet

- Change Management at UnileverDocument10 pagesChange Management at UnileverAnika JahanNo ratings yet

- DIVYA VISHWAKARMA Construction IndustryDocument87 pagesDIVYA VISHWAKARMA Construction IndustryNITISH CHANDRA PANDEYNo ratings yet

- Ebook Business Law and The Regulation of Business 11Th Edition Mann Test Bank Full Chapter PDFDocument37 pagesEbook Business Law and The Regulation of Business 11Th Edition Mann Test Bank Full Chapter PDFelizabethclarkrigzatobmc100% (9)

- SMP A3 PDFDocument6 pagesSMP A3 PDFMarlyn OrticioNo ratings yet

- Proof of Residence LeaseDocument13 pagesProof of Residence Leaseapi-366174595No ratings yet

- Steps in Forecasting ProcessDocument7 pagesSteps in Forecasting Processstephanie roswellNo ratings yet

- Press Release JFSL and Blackrock Agree To Form JVDocument3 pagesPress Release JFSL and Blackrock Agree To Form JVvikaskfeaindia15No ratings yet

- Use Case: From Wikipedia, The Free EncyclopediaDocument6 pagesUse Case: From Wikipedia, The Free EncyclopediaLisset Garcia PerezNo ratings yet

- Notes On Intellectual Property (Ip) Law: Mylene I. Amerol - MacumbalDocument41 pagesNotes On Intellectual Property (Ip) Law: Mylene I. Amerol - MacumbalAlain BarbaNo ratings yet

- A Review On Power Plant Maintenance and OperationaDocument5 pagesA Review On Power Plant Maintenance and OperationaWAN MUHAMMAD IKHWANNo ratings yet

- Evolution of Accounting Standard in The PhillipinesDocument7 pagesEvolution of Accounting Standard in The PhillipinesJonathan SiguinNo ratings yet

- Inquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPDocument10 pagesInquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPNeil GillespieNo ratings yet

- Day 1 Preparation AssignmentDocument2 pagesDay 1 Preparation AssignmentKevin KimNo ratings yet

- Midterm International Economics 2023Document4 pagesMidterm International Economics 2023Nhi Nguyễn YếnNo ratings yet

- Eco 211 HandoutDocument62 pagesEco 211 HandoutHannah CokerNo ratings yet

- BIT 4206 ICT in Business and Society-1Document85 pagesBIT 4206 ICT in Business and Society-1James MuthuriNo ratings yet

- Major Project - AmolDocument47 pagesMajor Project - AmolAmol ShikariNo ratings yet

- Presentation 4 - Cost & Management Accounting - March 10, 209 - 3pm To 6pmDocument45 pagesPresentation 4 - Cost & Management Accounting - March 10, 209 - 3pm To 6pmBhunesh KumarNo ratings yet