Professional Documents

Culture Documents

Ks Payroll Worksheet

Ks Payroll Worksheet

Uploaded by

api-2544048510 ratings0% found this document useful (0 votes)

55 views1 pageOriginal Title

ks payroll worksheet

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

55 views1 pageKs Payroll Worksheet

Ks Payroll Worksheet

Uploaded by

api-254404851Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

1

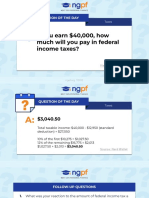

PAYROLL SHEET

Name: Katelynn Raymond

40 Hours @ Straight Time

Total Gross Pay $40,000 (How much did we agree that you were making?)

Deductions:

State/Federal Taxes (30%) $12,000

Medical Ins. (10%) $4,000

401K Contribution (5%) $2,000

Total Deductions $18,000

Subtract your total Deductions from your Gross Pay. This is your Net Pay or take-home pay.

*Net Pay $22,000

*Your net pay will be used to complete the Budget Worksheet.

You might also like

- Full Payroll Summary: Net PayDocument2 pagesFull Payroll Summary: Net PayJuan Ignacio Ramirez JaramilloNo ratings yet

- Notice of Assessment 2022 03 17 11 16 57 195191Document4 pagesNotice of Assessment 2022 03 17 11 16 57 195191api-676582318No ratings yet

- UntitledDocument6 pagesUntitledLarry SoongNo ratings yet

- Payroll Deductions: Pay. These Deductions May Include, Among Others, The FollowingDocument11 pagesPayroll Deductions: Pay. These Deductions May Include, Among Others, The FollowingheenimNo ratings yet

- Income Tax Banggawan Chapter 10Document18 pagesIncome Tax Banggawan Chapter 10Earth Pirapat100% (5)

- Computation of TaxDocument17 pagesComputation of TaxJo LouiseNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Bus Math-Module 5.5 Standard DeductionsDocument67 pagesBus Math-Module 5.5 Standard Deductionsaibee patatagNo ratings yet

- Standard DeductionDocument58 pagesStandard DeductionJoseph Gabriel EstrellaNo ratings yet

- Anthony Guzman Virelas - Rat Race Part 1Document4 pagesAnthony Guzman Virelas - Rat Race Part 1api-513818653No ratings yet

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Document5 pagesIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoNo ratings yet

- Introduction To Financial ManagementDocument9 pagesIntroduction To Financial ManagementRitesh ShreshthaNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (34)

- GAD Briefing: May 16, 2017 2017 REALTORS® Legislative Meetings & Trade ExpoDocument45 pagesGAD Briefing: May 16, 2017 2017 REALTORS® Legislative Meetings & Trade ExpoNational Association of REALTORS®No ratings yet

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- Tutorial 8 AnswerDocument3 pagesTutorial 8 AnswerHaidahNo ratings yet

- Goodwill California 2012 FINAL W PG - SDocument36 pagesGoodwill California 2012 FINAL W PG - SAsad BilalNo ratings yet

- Taxes Exam Review Part 1Document5 pagesTaxes Exam Review Part 1kateverettNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (42)

- 2015 Brackets & Planning Limits (Janney)Document5 pages2015 Brackets & Planning Limits (Janney)John CortapassoNo ratings yet

- Taxes QoD - If You Make $40,000, How Much Will You Pay in Federal Income TaxesDocument3 pagesTaxes QoD - If You Make $40,000, How Much Will You Pay in Federal Income TaxesJofred Collazo CarrilloNo ratings yet

- Task 1Document2 pagesTask 1Joel Christian MascariñaNo ratings yet

- Quiz in Public Finance and Fiscal PolicyDocument2 pagesQuiz in Public Finance and Fiscal PolicyLloyd SapiniNo ratings yet

- City of Hoboken SFY 2010Document12 pagesCity of Hoboken SFY 2010Mile Square ViewNo ratings yet

- Tax Relief ProgramDocument8 pagesTax Relief ProgramJK BCNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- SALOMON-CASE - STUDY (Repaired)Document8 pagesSALOMON-CASE - STUDY (Repaired)kylaasio8No ratings yet

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesDocument3 pagesTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiNo ratings yet

- S Corp vs. Sole Prop - LLC Tax Savings CalculatorDocument1 pageS Corp vs. Sole Prop - LLC Tax Savings CalculatorsomdivaNo ratings yet

- Math SignDocument5 pagesMath SignaliyaNo ratings yet

- Impact of Proposed 2009 Tax IncreaseDocument1 pageImpact of Proposed 2009 Tax IncreaseNathan Benefield100% (1)

- NYPA Report Corporate Spending - 2010.02.04Document4 pagesNYPA Report Corporate Spending - 2010.02.04mahexaminerNo ratings yet

- Business Organization and TaxesDocument22 pagesBusiness Organization and TaxesChieMae Benson QuintoNo ratings yet

- Find The Amount Given ThatDocument8 pagesFind The Amount Given ThatGeorgeAruNo ratings yet

- Payroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFDocument37 pagesPayroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFhebexuyenod8q100% (6)

- Payroll Canadian 1st Edition Dryden Test BankDocument38 pagesPayroll Canadian 1st Edition Dryden Test Bankriaozgas3023100% (15)

- W27.2 WorksheetDocument3 pagesW27.2 Worksheetadham000mostafa.egNo ratings yet

- Fabm 2 12 1002 PSDocument64 pagesFabm 2 12 1002 PSTin CabosNo ratings yet

- ASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&ADocument96 pagesASC 740 Income Tax Accounting Challenges in 2013: Presenting A Live 110-Minute Teleconference With Interactive Q&Agir botNo ratings yet

- ACC 4020 - SU - W3 - A2 - Moore - DDocument6 pagesACC 4020 - SU - W3 - A2 - Moore - DRosalia Anabell Lacuesta100% (1)

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsEsther LiuNo ratings yet

- Ecu - 08606 Lecture 5Document23 pagesEcu - 08606 Lecture 5DanielNo ratings yet

- Freelance Guide Americas SBDCDocument42 pagesFreelance Guide Americas SBDCPrince TognizinNo ratings yet

- Payroll and Contribution Rates Employers PDFDocument2 pagesPayroll and Contribution Rates Employers PDFNicquainCTNo ratings yet

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- Case Study 3 Wake Up and Smell The CoffeeDocument25 pagesCase Study 3 Wake Up and Smell The CoffeeCheveem Grace Emnace100% (1)

- Budget Workshop 3 FY 2022Document41 pagesBudget Workshop 3 FY 2022Dan LehrNo ratings yet

- T11F CHP 03 1 Income Sources 2011Document140 pagesT11F CHP 03 1 Income Sources 2011jessie1614No ratings yet

- Power Notes: Current LiabilitiesDocument28 pagesPower Notes: Current LiabilitiesmorheenNo ratings yet

- Module 13Document5 pagesModule 13Carla Mae F. DaduralNo ratings yet

- LEGT2751 Lecture 1Document14 pagesLEGT2751 Lecture 1reflecti0nNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument22 pagesSolutions To End-Of-Chapter ProblemsKalyani GogoiNo ratings yet

- Unit11 1 - Taxationcalculationspratice 1Document5 pagesUnit11 1 - Taxationcalculationspratice 1api-260512563No ratings yet

- Chapter 1 SolutionsDocument3 pagesChapter 1 Solutionshassan.muradNo ratings yet

- Tim Hart Financial Plan FPLN 365 Spring 2017Document13 pagesTim Hart Financial Plan FPLN 365 Spring 2017api-377996169No ratings yet

- Chapter 15 & 17 Q & SDocument7 pagesChapter 15 & 17 Q & Sgabie stgNo ratings yet

- An Analysis of The House GOP Tax Plan PDFDocument37 pagesAn Analysis of The House GOP Tax Plan PDFDavid carlssonNo ratings yet

- Ch04solution ProbDocument13 pagesCh04solution ProbdenisNo ratings yet

- Austin ISD FY2012 Preliminary Budget PresentationDocument33 pagesAustin ISD FY2012 Preliminary Budget PresentationKUTNewsNo ratings yet