Professional Documents

Culture Documents

Derivative Report 04 July 2014

Uploaded by

PalakMisharaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivative Report 04 July 2014

Uploaded by

PalakMisharaCopyright:

Available Formats

DAILY DERIVATIVE

REPORT

4

TH

JULY 2014

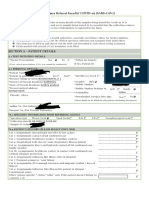

NIFTY FUTURE WRAP

31

ST

JULY 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

NIFTY

S1-7700 R1- 7760

NIFTY

SPOT

7714.80 7706.80 -0.13

S2-7635 R2-7790

NIFTY

FUTURES

7739.10 7749.85 -0.14

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

7651 7698 7718 7746 7766 7794 7841

DAILY DERIVATIVE REPORT

BANK NIFTY FUTURE WRAP

31

ST

JULY 2014

SYMBOL SUPPORT RESISTANCE PARTICULARS CMP PRE CLOSE %CHANGE

BANK NIFTY

S1-15360 R1-15690

BANK NIFTY

SPOT

15451.65 15431.50 -0.25

S2-15180 R2-15750

BANK NIFTY

FUTURES

15564.90 15598.35 -0.21

TREND STRATEGY

BULLISH BUY ON DIPS

PIVOT POINTS

S3 S2 S1 P R1 R2 R3

15280 15429 15497 15578 15645 15726 15875

DAILY DERIVATIVE REPORT

FUTUREs FRONT

Long Build Up (Fresh Longs) Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

GLENMARK 1,390.00 1,974.00 42.0 613.55 6.0

BHARATFORG 2,638.00 3,050.00 15.6 671.50 1.2

DABUR 2,049.00 2,337.00 14.1 193.30 3.2

ARVIND 3,404.00 3,813.00 12.0 244.35 3.8

Short-Covering Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

PFC 4,770.00 4,548.00 [4.7] 320.80 0.5

AUROPHARMA 20,027.00 19,957.00 [0.4] 773.85 2.2

COALINDIA 15,647.00 15,608.00 [0.3] 396.60 0.4

UPL 3,902.00 3,900.00 [0.1] 343.55 1.7

Short Build Up Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

GMRINFRA 15,635.00 23,791.00 52.2 31.10 [8.1]

JPASSOCIAT 16,337.00 19,196.00 17.5 72.25 [5.1]

M&MFIN 5,693.00 6,588.00 15.7 275.95 [3.1]

HCLTECH 10,353.00 11,474.00 10.8 1,475.50 [1.2]

Long Unwinding Open Interest Price

Script Prev. OI Cur. OI % Chg. OI LTP Price % Chg

RECLTD 4,270.00 4,073.00 [4.6] 371.65 [0.4]

HEROMOTOCO 6,224.00 6,079.00 [2.3] 2,606.85 [0.8]

- - - - - -

- - - - - -

DAILY DERIVATIVE REPORT

Top Gainers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK GLENMARK 31-Jul-14 614.25 6.1 1,057.00

FUTSTK UCOBANK 28-Aug-14 113.50 5.9 104.00

FUTSTK UCOBANK 31-Jul-14 112.80 5.8 25,560.00

FUTSTK GLENMARK 28-Aug-14 616.55 5.6 1.50

Top Losers: Future Contract

Type Underlying Exp. Date Last Price Chg (%) OI ('000s)

FUTSTK GMRINFRA 25-Sep-14 31.75 [9.5] 60.00

FUTSTK GMRINFRA 28-Aug-14 31.40 [8.2] 1,400.00

FUTSTK GMRINFRA 31-Jul-14 31.20 [7.8] 238,710.00

FUTSTK JPPOWER 31-Jul-14 22.60 [5.2] 66,495.00

FII Trends In Future

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX FUTURES

30,160 31,389 [47.41] 287.058 11,007

STOCK FUTURES

83,192 64,066 663.94 1,476.228 55,880

DAILY DERIVATIVE REPORT

OPTIONs FRONT

Top Gainers: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTSTK PTC 31-Jul-14 2.25 115.00 CE

OPTSTK GMRINFRA 31-Jul-14 0.50 27.50 PE

OPTSTK GLENMARK 31-Jul-14 35.00 600.00 CE

OPTSTK BHARATFORG 31-Jul-14 90.00 590.00 CE

Top Looser: Options

Inst

Type

Underlying

Expiry

Date

Last

Price[Rs.]

Strike

Price[Rs.]

OPT Type

OPTIDX NIFTY 25-Jun-15 0.10 4,000.00 PE

OPTSTK HDFC 31-Jul-14 0.50 840.00 PE

OPTSTK SAIL 31-Jul-14 0.40 125.00 CE

OPTSTK BHARATFORG 31-Jul-14 4.00 590.00 PE

FII Trends In Options

Script

BUY

[RS.CR]

SELL

[RS.CR]

NET POSITIONS

[RS.CR]

CONTRACTS

['000S]

VALUE

[RS.CR]

INDEX OPTIONS

120,304 110,590 395.67 1,209.853 46,192

STOCK OPTIONS

35,984 36,180 [12.26] 61.101 2,305

DAILY DERIVATIVE REPORT

PUT CALL RATIO: STOCK OPTION (OI WISE)

PUT CALL RATIO: STOCK OPTION (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

MARUTI 301,750.00 275,000.00 1.10

UBL 11,250.00 12,250.00 0.92

SUNTV 8,000.00 9,000.00 0.89

YESBANK 732,000.00 850,000.00 0.86

PUT CALL RATIO: STOCK OPTION (VOLUME WISE)

SCRIPT PUT CALL RATIO

BATAINDIA 3,000.00 1,750.00 1.71

MARUTI 199,125.00 178,250.00 1.12

YESBANK 406,000.00 450,000.00 0.90

CENTURYTEX 273,000.00 325,000.00 0.84

PUT CALL RATIO: INDEX FUTURES (OPEN INTEREST WISE)

SCRIPT PUT CALL RATIO

NIFTY 30,272,900.00 32,169,750.00 0.94

BANKNIFTY 1,134,800.00 1,565,400.00 0.72

- - - -

PUT CALL RATIO: INDEX FUTURES (VOLUME WISE)

SCRIPT PUT CALL RATIO

NIFTY 31,304,250.00 31,369,700.00 1.00

BANKNIFTY 652,275.00 748,325.00 0.87

- - - -

DAILY DERIVATIVE REPORT

The information and views in this report, our website & all the service we provide are believed to

be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion.

Users have the right to choose the product/s that suits them the most.

Use of this report in no way constitutes a client/advisor relationship, all information we

communicate to you (the subscriber) either through our Web site or other forms of

communications, are purely for informational purposes only.

We recommend seeking individual investment advice before making any investment, for you are

assuming sole liability for your investments. Capital Stars will in no way have discretionary

authority over your trading or investment accounts.

All rights reserved.

OFFICE: - +91 731 4757600

MOB: +91 92000 99927

PHONE: +91 731 6790000

Email: info@capitalstars.com

CAPITAL STARS FINANCIAL

RESEARCH PRIVATE LIMITED

PLOT NO. 12, SCHEME NO. 78, PART II

VIJAYNAGAR INDORE 452001 (MP)

DAILY DERIVATIVE REPORT

CONTACT US

DISCLAIMER

You might also like

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 30 June 2014Document8 pagesDerivative Report 30 June 2014PalakMisharaNo ratings yet

- Derivative Report 24 June 2014Document8 pagesDerivative Report 24 June 2014PalakMisharaNo ratings yet

- Derivative Report 02 July 2014Document8 pagesDerivative Report 02 July 2014PalakMisharaNo ratings yet

- Derivative Report 01 July 2014Document8 pagesDerivative Report 01 July 2014PalakMisharaNo ratings yet

- Derivative Report 27 June 2014Document8 pagesDerivative Report 27 June 2014PalakMisharaNo ratings yet

- Derivative Report 25 June 2014Document8 pagesDerivative Report 25 June 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report13 June 2014Document8 pagesDerivative Report13 June 2014PalakMisharaNo ratings yet

- Derivative Report 17 June 2014Document8 pagesDerivative Report 17 June 2014PalakMisharaNo ratings yet

- Derivative Report12 June 2014Document8 pagesDerivative Report12 June 2014PalakMisharaNo ratings yet

- Derivative Report16 June 2014Document8 pagesDerivative Report16 June 2014PalakMisharaNo ratings yet

- Derivative Report 23 June 2014Document8 pagesDerivative Report 23 June 2014PalakMisharaNo ratings yet

- Derivative Report 20 June 2014Document8 pagesDerivative Report 20 June 2014PalakMisharaNo ratings yet

- Derivative Report 28 MAY 2014Document8 pagesDerivative Report 28 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 18 June 2014Document8 pagesDerivative Report 18 June 2014PalakMisharaNo ratings yet

- Derivative Report 30 MAY 2014Document8 pagesDerivative Report 30 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 27 MAY 2014Document8 pagesDerivative Report 27 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 23 MAY 2014Document8 pagesDerivative Report 23 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 3rd June 2014Document8 pagesDerivative Report 3rd June 2014PalakMisharaNo ratings yet

- Derivative Report 26 MAY 2014Document8 pagesDerivative Report 26 MAY 2014PalakMisharaNo ratings yet

- Special Research Report On NickelDocument8 pagesSpecial Research Report On NickelPalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 20 MAY 2014Document8 pagesDerivative Report 20 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 02 MAY 2014Document8 pagesDerivative Report 02 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 22 MAY 2014Document8 pagesDerivative Report 22 MAY 2014PalakMisharaNo ratings yet

- Derivative Report 30 April 2014Document8 pagesDerivative Report 30 April 2014PalakMisharaNo ratings yet

- Agri Weekly Report 21st AprilDocument9 pagesAgri Weekly Report 21st AprilPalakMisharaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Difference between Especially and SpeciallyDocument2 pagesDifference between Especially and SpeciallyCarlos ValenteNo ratings yet

- DOCS-#165539-v8-Technical Manual FOB4 TS Section 5 - MaintenanceDocument108 pagesDOCS-#165539-v8-Technical Manual FOB4 TS Section 5 - MaintenanceBME AOHNo ratings yet

- Grammar Notes-February2017 - by Aslinda RahmanDocument41 pagesGrammar Notes-February2017 - by Aslinda RahmanNadia Anuar100% (1)

- Basic of Seismic RefractionDocument43 pagesBasic of Seismic Refractionfitriah wulandariNo ratings yet

- Consumer PerceptionDocument61 pagesConsumer PerceptionPrakhar DwivediNo ratings yet

- English 9Document26 pagesEnglish 9Joann Gaan YanocNo ratings yet

- Feedback Control of Dynamic Systems Franklin 7th Edition Solutions ManualDocument36 pagesFeedback Control of Dynamic Systems Franklin 7th Edition Solutions Manualkilter.murk0nj3mx100% (31)

- (Nano and Energy) Gavin Buxton - Alternative Energy Technologies - An Introduction With Computer Simulations-CRC Press (2014) PDFDocument302 pages(Nano and Energy) Gavin Buxton - Alternative Energy Technologies - An Introduction With Computer Simulations-CRC Press (2014) PDFmarcosNo ratings yet

- MPU 2232 Chapter 5-Marketing PlanDocument27 pagesMPU 2232 Chapter 5-Marketing Plandina azmanNo ratings yet

- Too Early! by Anton Pavlovich ChekhovDocument4 pagesToo Early! by Anton Pavlovich Chekhovapi-19787590No ratings yet

- Introduction To Human Anatomy & Physiology: Prepared by Mr. Abhay Shripad Joshi Yash Institute of Pharmacy AurangabadDocument18 pagesIntroduction To Human Anatomy & Physiology: Prepared by Mr. Abhay Shripad Joshi Yash Institute of Pharmacy AurangabadMourian AmanNo ratings yet

- Product Catalog Encoders en IM0038143Document788 pagesProduct Catalog Encoders en IM0038143Eric GarciaNo ratings yet

- Far Eastern University Institute of Tourism and Hotel Management Tourism Management Program 1 Semester A.Y. 2019 - 2020Document46 pagesFar Eastern University Institute of Tourism and Hotel Management Tourism Management Program 1 Semester A.Y. 2019 - 2020Mico BolorNo ratings yet

- 7.3 Mechanical DigestionDocument5 pages7.3 Mechanical DigestionelizabethNo ratings yet

- Sample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Document2 pagesSample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Praveen KumarNo ratings yet

- Quick Reference To Psychotropic Medications: AntidepressantsDocument2 pagesQuick Reference To Psychotropic Medications: AntidepressantsNaiana PaulaNo ratings yet

- PREXC Operational Definition and Targets CY 2019 - 2020Document12 pagesPREXC Operational Definition and Targets CY 2019 - 2020iamaj8No ratings yet

- Samples For Loanshyd-1Document3 pagesSamples For Loanshyd-1dpkraja100% (1)

- Assessment of Concrete Strength Using Flyash and Rice Husk AshDocument10 pagesAssessment of Concrete Strength Using Flyash and Rice Husk AshNafisul AbrarNo ratings yet

- FINANCIAL REPORTSDocument34 pagesFINANCIAL REPORTSToni111123No ratings yet

- To Quantitative Analysis: To Accompany by Render, Stair, Hanna and Hale Power Point Slides Created by Jeff HeylDocument94 pagesTo Quantitative Analysis: To Accompany by Render, Stair, Hanna and Hale Power Point Slides Created by Jeff HeylNino NatradzeNo ratings yet

- APMP Certification Syllabus and Program V3.1 March 2019 PDFDocument20 pagesAPMP Certification Syllabus and Program V3.1 March 2019 PDFMuhammad ZubairNo ratings yet

- The Mini-Guide To Sacred Codes and SwitchwordsDocument99 pagesThe Mini-Guide To Sacred Codes and SwitchwordsJason Alex100% (9)

- Chapter Three 3.0 Research MethodologyDocument5 pagesChapter Three 3.0 Research MethodologyBoyi EnebinelsonNo ratings yet

- Aruksha ResumeDocument2 pagesAruksha Resumeapi-304262732No ratings yet

- Netutils ToturialDocument35 pagesNetutils ToturialLuis SanchoNo ratings yet

- Sample Prayer For Final Thesis DefenseDocument6 pagesSample Prayer For Final Thesis Defensefjfyj90y100% (2)

- Ebola Research ProposalDocument10 pagesEbola Research ProposalChege AmbroseNo ratings yet

- A Critical Review: Constructive Analysis in English and Filipino 1 SEMESTER 2021-2022Document4 pagesA Critical Review: Constructive Analysis in English and Filipino 1 SEMESTER 2021-2022roseNo ratings yet

- Dreamers Chords by Jungkook (정국) tabs at Ultimate Guitar ArchiveDocument4 pagesDreamers Chords by Jungkook (정국) tabs at Ultimate Guitar ArchiveLauraNo ratings yet