Professional Documents

Culture Documents

Maturity FormOUE

Maturity FormOUE

Uploaded by

AeRis Blancaflor BalsitaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maturity FormOUE

Maturity FormOUE

Uploaded by

AeRis Blancaflor BalsitaCopyright:

Available Formats

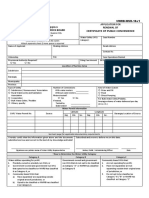

Form No.

R RE ET T- -2 20 01 11 1- -1 11 1- -0 03 3

Date Revised: 2012-06-27

APPLICATION FOR RETIREMENT AND OTHER SOCIAL INSURANCE BENEFITS

(Please read instructions at the back)

________________________

Date

THE PRESIDENT & GENERAL MANAGER

Government Service Insurance System

Financial Center, Roxas Blvd., Pasay City 1308

Sir:

For the information of the System, I hereby declare to the best of my knowledge the following:

*Last Name *First Name *Middle Name *GSIS ID No.

*Date of Birth:

Place of Birth:

Civil Status:

Married Single Separated Widow

*Residence/Complete Mailing Address:

If married,

name of

spouse:

*Last Name *First Name *Middle Name

Email Address: Contact No. *Cellphone No.

I have the honor to apply for:

Retirement benefits under the retirement mode marked below, effective _____________________________

Under RA 660

( ) Below age 60, monthly annuity payable annually for 5 years

( ) Aged 60 to below 63, 3 year lump sum, 2 years balance payable on the 63

rd

birthday; monthly annuity after the 5

year guaranteed period

( ) Aged 63 and above, 5-year lump sum, monthly annuity after the 5-year guaranteed period

Under PD 1146 Old-Age Benefits:

( ) Monthly annuity

( ) Lump sum of 60 x Basic Monthly Pension (BMP), and BMP after 5 years

Under RA 8291 Retirement Benefits:

OPTION 1: ( ) Lump sum of 60 x BMP, and BMP after 5 years

OPTION 2: ( ) Cash benefit of 18 x BMP and BMP to start on date of retirement

Under RA 1616 ( ) Refund of Retirement Premiums

If you opted to retire under a retirement scheme with an immediate pension, you are qualified to avail of the Choice of Loan Amortization Schedule

for Pensioners (CLASP). The remaining balance of your outstanding obligation shall be restructured as a loan with an interest rate of 10% per

annum compounded annually (paca). Please indicate your choices below:

Please deduct from the proceeds of my retirement benefit the amount equivalent to: _________________________________ (please choose

among the following: a) 100%; b) 75%; c) 50%; or d) 25%), as payment for my outstanding obligations with the GSIS, with a repayment term of:

_________________ (please choose among the following: a) 1 year; b) 2 years; or c) 3 years).

Separation Benefits Effectivity Date: __________________ Unemployment Benefits Effectivity Date: __________________

(See back portion of this form for Eligibility Requirements and Conditions for Retirement, Separation/Unemployment Benefits)

Cash Surrender/Termination Value in view of, my: ] Maturity Benefits Policy Number: _______________________

[ ] resignation [ ] retirement

[ ] separation from the government service on ____________________.

State other reason/s : _________________________________________

Policy Number : _____________________________________________

Mandatory Field

For those applying for Retirement benefits only:

I have not availed of benefits under other law/s similar to the claim covered by this application for __________________ (retirement, separation,

etc.) benefits under RA 8291; or

I have availed of ___________________ benefits under ___________________, which are similar to the benefits covered by this application for

________________ (retirement, separation, etc.) benefits under RA 8291, in the amount of P______________________.

Very truly yours,

___________________________________________

Signature of Applicant over Printed Name

TO BE FILLED UP BY THE PERSONNEL OFFICER OF THE AGENCY (NOT TO BE FILLED UP WHEN FILING FOR MATURITY BENEFIT CLAIM)

The undersigned hereby certifies that M_________________________________________________________________, an employee of this office

and who has/has not reached the compulsory age of retirement, who is in active status has filed for CSV resigned from this agency

applied for Separation Benefit and has been separated from the service retired from the service has applied for unemployment benefit

and has been involuntarily separated from the service as a result of: abolition/reorganization of his office; abolition of his position in this

agency, effective _______________________________, and this office was duly informed of such.

_____________________________________________ _________________________________________________ __________________

Signature of Personnel Officer over Printed Name Name of Agency/Last Office Before Retirement Date

__________________________________________________________________________________

Address of Agency

Please indicate if you will avail of the Portability Law: ( ) NO ( ) YES, (if yes, please accomplish also the Application Form for Portability Law

Right Thumbmark

Latest 1x1 Picture

(within the last 3

months)

WARNING: Direct or indirect commission of fraud, collusion, falsification, misrepresentation of facts, or any other kind of anomaly in the

accomplishment of this form, or in obtaining any benefit under this application shall be subject to administrative and/or cri minal action.

It is understood that the entire outstanding balance of my policy loan as well as the arrearages and balances of my other loans and

accountabilities with the GSIS which are due and demandable shall be deducted from the said benefit pursuant to RA 8291 and the

existing policies of the GSIS.

INSTRUCTIONS:

1. Ensure that the application form is properly filled up.

2. Agency to submit two (2) copies of the accomplished application form to the nearest GSIS/Handling Office.

TERMS AND CONDITIONS

I. RETIREMENT

A. ELIGIBILITY REQUIREMENTS

1. Member shall be entitled to the retirement benefit, provided he/she is separated from the service at the time of application, and on condition that:

Under RA 660

1. He/She has been in the service on or before May 31, 1977; and,

2. He/She must be on permanent status at the time of retirement with continuous service for the last three (3) years

prior to retirement and has made contributions for at least five (5) years.

3. He/She has met the age and service requirements as indicated below:

Age 52 53 54 55 56 57 58 59 60 61 62 63 64 65

YOS 35 34 33 32 31 30 28 26 24 22 20 18 16 15

Under PD 1146

1. He/She should have been separated/retired on or before June 23, 1997;

2. He/She has rendered at least fifteen (15) years of service in the government;

Under RA 8291

1. He/She should have been separated/retired on or after June 24, 1997;

2. He/She has rendered at least fifteen (15) years of service in the government;

3. He/She is at least sixty (60) years of age at the time of retirement; and,

4. He/She is not receiving a monthly pension benefit due to permanent total disability.

5. He/she must not be a uniformed personnel of PNP, BJMP and BFP.

Under RA 1616

1. He/She has been in the service on or before May 31, 1977;

2. He/She, regardless of age, must have at least twenty (20) years of service in the government at the time of

retirement.

3. He/She must have rendered continuous service for the last three (3) years and must not incur leave without pay

of more than one (1) year except in cases of death, disability, abolition or phase-out of position due to

reorganization: Provided, that teachers are allowed more than one (1) year leave without pay under Magna

Carta for Teachers.

2. Request for conversion from one mode of retirement to another shall not be allowed.

3. The retirement proceeds shall at all times be subject to deduction for any outstanding indebtedness the member may have incurred with the

GSIS, subject to existing policies.

B. CONDITIONS FOR RECEIPT OF MONTHLY PENSION

Upon reaching the age 60, or after the end of the 5-year guaranteed period, the qualified pensioner is required to personally appear at GSIS

Office nearest his/her place of residence. He/She shall be required to fill up a request for commencement of pension and afterwards enroll for the

GSIS UMID-Compliant eCARD/Kiosk transaction card. Previously registered old age pensioners and survivorship pensioners shall no longer be

required to comply with the Annual Renewal of Active Status (ARAS) except: 1) Pensioners on suspended status as of April 30, 2011 and has not

renewed active status as of present date; and 2) Pensioners whose birth month falls in CY 2011 on the months of February, March or April. The

pensioners living abroad or in the ARMM Region shall be required to comply with the Annual Renewal of Active Status (ARAS) on their birth month

every year via Skype.

II. SEPARATION

A. ENTITLEMENT TO SEPARATION BENEFITS UNDER RA 8291

A member who has accumulated a minimum of three (3) years creditable service shall be entitled to separation benefit upon resignation or separation

under the following terms:

1. For member with at least three (3) years but less than fifteen (15):

A cash payment equivalent to one hundred percent (100%) of the average monthly compensation for every year of creditable service the

member has paid contributions, but not less than Twelve Thousand Pesos (P12,000), payable upon reaching sixty (60) years of age or upon

separation, whichever comes later.

2. For member with at least fifteen (15) years of service and less than sixty (60) years of age upon separation:

a. A cash payment equivalent to eighteen (18) times the basic monthly pension, payable at the time of resignation or separation;

b. An old-age pension benefit equal to the basic monthly pension, payable monthly for life upon reaching age 60.

B. PRESCRIPTIVE PERIOD FOR FILING OF SEPARATION BENEFIT

Application for separation benefits must be filed within 4 years from the date of separation as provided for under RA 8291.

III. UNEMPLOYMENT BENEFIT

A. CONDITIONS FOR ENTITLEMENT

1. A member shall be entitled to the unemployment benefit in the form of monthly cash payments if all the conditions below are satisfied:

1.1 He/She was a permanent employee at the time of separation;

1.2 His/Her separation was involuntary due to the abolition of his/her office or position resulting from reorganization; and,

1.3 He/She has been paying the contributions for at least one (1) year prior to separation.

2. A member who has rendered at least 15 years of service will be entitled to the separation benefits described in RA 8291, instead of

unemployment benefit.

3. Application for unemployment benefit must be filed within 4 years from the date of unemployment as provided for under RA 8291.

B. AMOUNT, DURATION AND PAYMENT OF BENEFIT

1. Unemployment benefits in the form of monthly cash payments equivalent to fifty percent (50%) of the average monthly compensation shall be

paid to permanent employee who is involuntarily separated from the service due to the abolition of his office or position usually resulting from

reorganization: Provided, that he/she has been paying integrated contributions for at least one (1) year prior to separation. Unemployment

benefit shall be paid in accordance with the following schedule:

Contribution Made Benefit Duration

1 year but less than 3 years 2 months

3 or more years but less than 6 years 3 months

6 or more years but less than 9 years 4 months

9 or more years but less than 11 years 5 months

11 or more years but less than 15 years 6 months

2. Those entitled to more than two (2) months of Unemployment Benefits shall initially receive two (2) monthly payments. A seven-day waiting

period shall be imposed on succeeding monthly payments to determine whether the separated member has found gainful employment either in

the public or private sector. In this regard, the member is required to immediately notify the GSIS at anytime he/she finds gainful employment or

re-enters the salaried workforce within the period of the benefit. If the member fails to report to GSIS his/her reemployment and continues to

illegally receive the benefit, administrative and/or criminal action shall be instituted by the GSIS against the member.

3. All accumulated unemployment benefits paid to the employee during his/her entire membership with the GSIS shall be deducted from the

separation benefits to which the member may be entitled to upon his voluntary resignation or separation.

You might also like

- Full David Brock Confidential Memo On Fighting Trump Gray OCRedDocument49 pagesFull David Brock Confidential Memo On Fighting Trump Gray OCRedstarina2No ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- Authorization Form For Querying FinalDocument1 pageAuthorization Form For Querying FinalApril NNo ratings yet

- Contract To Sell Lumina Final SigDocument3 pagesContract To Sell Lumina Final SigShella VamNo ratings yet

- Business SignatoryDocument2 pagesBusiness SignatoryYangee PeñaflorNo ratings yet

- Gsis Ra 8291Document2 pagesGsis Ra 8291Karen Faith MallariNo ratings yet

- Deed of Sale of Motor Vehicle Know All MDocument2 pagesDeed of Sale of Motor Vehicle Know All MMarcos Bumagat Gardoce Jr.No ratings yet

- Salaries of Public School Teachers and Nurses To IncreaseDocument2 pagesSalaries of Public School Teachers and Nurses To IncreaseChandi Tuazon SantosNo ratings yet

- FAQ On SALN Final March2016Document8 pagesFAQ On SALN Final March2016Julius AlemanNo ratings yet

- CONTRACT of LEASE - 4x4 Lot - Orcullo - BacaronDocument2 pagesCONTRACT of LEASE - 4x4 Lot - Orcullo - Bacaronjephone enteriaNo ratings yet

- Accounting and Business ServicesDocument1 pageAccounting and Business ServicesJam UsmanNo ratings yet

- Waiver of LiabilityDocument1 pageWaiver of LiabilityAnne RoraldoNo ratings yet

- Application Form For ACR I-CARD NEW PDFDocument2 pagesApplication Form For ACR I-CARD NEW PDFButch AmbataliNo ratings yet

- Affidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyDocument2 pagesAffidavit (Sample) : This Is A Sample. Please Prepare Pursuant To The Actual Situation of The CompanyAlmira SalsabilaNo ratings yet

- Sublease FormatDocument6 pagesSublease FormatMarieTeeNo ratings yet

- SDFGSDF 23 Q 4 SDFGDSFDocument1 pageSDFGSDF 23 Q 4 SDFGDSFAdventist Hospital DavaoNo ratings yet

- Spa Bir TransferDocument3 pagesSpa Bir TransferElamar de Leon100% (1)

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Deed of Donation: (Name of Partner/Donor)Document2 pagesDeed of Donation: (Name of Partner/Donor)Oscar MatelaNo ratings yet

- SSS RS - 5Document1 pageSSS RS - 5Anid AzertsedNo ratings yet

- Doas Lot 1824-d TanzaDocument4 pagesDoas Lot 1824-d TanzaDilynNo ratings yet

- Sample Contract To SellDocument2 pagesSample Contract To SellJM BermudoNo ratings yet

- Certificate of EmploymentDocument1 pageCertificate of EmploymentJanine VeranoNo ratings yet

- Abandonment and Illegal DismissalDocument3 pagesAbandonment and Illegal Dismissalangie_ahatNo ratings yet

- 1905 (Encs) 2000Document4 pages1905 (Encs) 2000Loss Pokla100% (1)

- Manual of Regulations For Non-Bank Financial Institutions: Section 4 of This CircularDocument2 pagesManual of Regulations For Non-Bank Financial Institutions: Section 4 of This CircularRaysun ArellanoNo ratings yet

- Form 1594777111Document1 pageForm 1594777111Evcillove Mangubat100% (1)

- SSS R3 Contribution Collection List in Excel FormatDocument2 pagesSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- Japan Guarantee Letter - CompanionsDocument1 pageJapan Guarantee Letter - CompanionsChoboiNo ratings yet

- Contract of LeaseDocument5 pagesContract of LeasebibemergalNo ratings yet

- Deed of Absolute Sale BalbinaDocument2 pagesDeed of Absolute Sale BalbinaZoren A. Del MundoNo ratings yet

- TRAIN Comparative Table 20170111 11AMDocument33 pagesTRAIN Comparative Table 20170111 11AMButch kevin adovasNo ratings yet

- MC28 FormsDocument4 pagesMC28 FormsDeborah Micah PerezNo ratings yet

- OCA Circular No. 74 2010Document11 pagesOCA Circular No. 74 2010angelahernalNo ratings yet

- Acknowledgement of DebtDocument1 pageAcknowledgement of DebtAtty Leandro B SalcedoNo ratings yet

- Application For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesDocument2 pagesApplication For The New Penalty Condonation Program On Mandatory Monthly Savings (MS) RemittancesCrizetteTarcena50% (2)

- Buy Sale Agreement 123ZDocument5 pagesBuy Sale Agreement 123ZcefuneslpezNo ratings yet

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1No ratings yet

- Confirmation of Lease / Authority To Construct For Smart CellsiteDocument2 pagesConfirmation of Lease / Authority To Construct For Smart CellsiteJan Brian Guillena BangcayaNo ratings yet

- 2021-11 Annex D REQUEST FORM DISLODGING - Res - 0Document1 page2021-11 Annex D REQUEST FORM DISLODGING - Res - 0NASSER DUGASANNo ratings yet

- Republic of The Philippines Application For: National Water Resources Board Renewal ofDocument2 pagesRepublic of The Philippines Application For: National Water Resources Board Renewal ofMark PesiganNo ratings yet

- 1903 January 2018 ENCS FinalDocument4 pages1903 January 2018 ENCS FinalJames E. NogoyNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth (Saln) : Joint Filing Separate Filing Not ApplicableDocument4 pagesSworn Statement of Assets, Liabilities and Net Worth (Saln) : Joint Filing Separate Filing Not ApplicableDanivieNo ratings yet

- Extrajudicial Settlement of Estate in The PhilippinesDocument4 pagesExtrajudicial Settlement of Estate in The PhilippinesDon Astorga Dehayco0% (1)

- Certification of CorrectnessDocument1 pageCertification of CorrectnesskennethNo ratings yet

- Special Power of AttorneyDocument3 pagesSpecial Power of AttorneyalaricelyangNo ratings yet

- Lessee's Information FormDocument1 pageLessee's Information FormguiaNo ratings yet

- Bir Ruling (Da - (C-179) 464-09)Document4 pagesBir Ruling (Da - (C-179) 464-09)E ENo ratings yet

- Evergreen Field Trip WaiverDocument2 pagesEvergreen Field Trip WaiverAndrew J. MoeNo ratings yet

- Sale Lopez To Anuran - Dors PDFDocument3 pagesSale Lopez To Anuran - Dors PDFMars Rañola-CamilonNo ratings yet

- Deed of Absolute Sale GarciaDocument26 pagesDeed of Absolute Sale GarciaSampaguita RamosNo ratings yet

- Agreement For Lease: Know All Men by These PresentsDocument1 pageAgreement For Lease: Know All Men by These PresentsDaisuke InoueNo ratings yet

- Consent To SubleaseDocument1 pageConsent To SubleaseWilliam GulfanNo ratings yet

- Appealing Real Property Tax Assessments by Rachelle Ann CDocument4 pagesAppealing Real Property Tax Assessments by Rachelle Ann CEsme Kylie Dela CruzNo ratings yet

- EJS MemoDocument3 pagesEJS MemoGigi AngNo ratings yet

- HR 107 A Retirement Form PDFDocument6 pagesHR 107 A Retirement Form PDFLexNo ratings yet

- Administer PropertyDocument1 pageAdminister PropertyHannahQuilangNo ratings yet

- Moa PDFDocument2 pagesMoa PDFarman gonzagaNo ratings yet

- Caesar R. Dulay CommissionerDocument1 pageCaesar R. Dulay CommissionerJomar ViconiaNo ratings yet

- GSIS Cash Surrender ValueDocument2 pagesGSIS Cash Surrender ValueJertom CarloNo ratings yet

- Application For RetirementDocument2 pagesApplication For RetirementDavid Danio JrNo ratings yet

- UP 2011 Crim TipsDocument3 pagesUP 2011 Crim TipscrisjavaNo ratings yet

- Special Penal LawsffffffssDocument195 pagesSpecial Penal LawsffffffsscrisjavaNo ratings yet

- RPN Qualitative Presentation 2.11.20Document34 pagesRPN Qualitative Presentation 2.11.20crisjavaNo ratings yet

- P2226 BAR - Agenda For WebDocument8 pagesP2226 BAR - Agenda For WebcrisjavaNo ratings yet

- Dost 2017Document29 pagesDost 2017crisjavaNo ratings yet

- Yorac Law Firm Announcement - UPDocument1 pageYorac Law Firm Announcement - UPcrisjavaNo ratings yet

- Illegal Logging Us-DojDocument58 pagesIllegal Logging Us-DojcrisjavaNo ratings yet

- Team2 - Rizal's Life in Paris and GermanyDocument26 pagesTeam2 - Rizal's Life in Paris and GermanycrisjavaNo ratings yet

- Graduate Education Delivery: Frequently Asked QuestionsDocument5 pagesGraduate Education Delivery: Frequently Asked QuestionscrisjavaNo ratings yet

- Faculty Marked Assignment No. 4: MM 214 Corporate Planning and Project ManagementDocument2 pagesFaculty Marked Assignment No. 4: MM 214 Corporate Planning and Project ManagementcrisjavaNo ratings yet

- Role of PHE ReportDocument22 pagesRole of PHE ReportcrisjavaNo ratings yet

- 40th SSEAYP - Batch Dinner Sponsorship - 2003 - AldecoaDocument1 page40th SSEAYP - Batch Dinner Sponsorship - 2003 - AldecoacrisjavaNo ratings yet

- CMO No. 13 S. 2014 Revised Guidelines For The Implementation of StuFAPs Effective AY 2014 2015 PDFDocument9 pagesCMO No. 13 S. 2014 Revised Guidelines For The Implementation of StuFAPs Effective AY 2014 2015 PDFWenggirl MalabananNo ratings yet

- Regional Office V, Legazpi City, Albay: Office of The President Commission On Higher EducationDocument2 pagesRegional Office V, Legazpi City, Albay: Office of The President Commission On Higher EducationcrisjavaNo ratings yet

- Nonsmoking PolicyDocument1 pageNonsmoking PolicycrisjavaNo ratings yet

- Proposed Mid-Year OP Report Schedule: Dates Activity Persons/Offices in ChargeDocument1 pageProposed Mid-Year OP Report Schedule: Dates Activity Persons/Offices in ChargecrisjavaNo ratings yet

- San Carlos City DivisionDocument6 pagesSan Carlos City DivisionJimcris HermosadoNo ratings yet

- Columbus Tubes 2018 Catalogue V3 PDFDocument34 pagesColumbus Tubes 2018 Catalogue V3 PDFAlex StihiNo ratings yet

- Marketing CommunicationDocument29 pagesMarketing CommunicationTahir Meo100% (1)

- Tc01204008e JG-310+Document5 pagesTc01204008e JG-310+Americo GuerreroNo ratings yet

- Building Data Capacity For Patient-Centered Outcomes ResearchDocument368 pagesBuilding Data Capacity For Patient-Centered Outcomes Researchtechindia2010No ratings yet

- Autoignition Temperature Measurements of Hydrogen MixturesDocument7 pagesAutoignition Temperature Measurements of Hydrogen MixturesAlly EnemmyNo ratings yet

- Report or Study About EarthquakeDocument13 pagesReport or Study About EarthquakeNico Jumao-asNo ratings yet

- InfixDocument23 pagesInfixSumant LuharNo ratings yet

- Crim Law Digest 28 UpDocument30 pagesCrim Law Digest 28 UpJin Yangyang50% (2)

- Pipe Hangers, Supports and Accessories Base Price ListDocument56 pagesPipe Hangers, Supports and Accessories Base Price ListBrian AlbarracínNo ratings yet

- Internet Sex Work Beyond The Gaze by Campbell, Rosie Cunningham, Stewart Pitcher, Jane Sanders, Teela Scoular, JaneDocument183 pagesInternet Sex Work Beyond The Gaze by Campbell, Rosie Cunningham, Stewart Pitcher, Jane Sanders, Teela Scoular, JanePablo CaraballoNo ratings yet

- Wireless and Mobile Communications: Abhijit Bhowmick Sense VIT, Vellore, TN, IndiaDocument28 pagesWireless and Mobile Communications: Abhijit Bhowmick Sense VIT, Vellore, TN, IndiaAANCHALNo ratings yet

- Buoyancy Notes 2013Document37 pagesBuoyancy Notes 2013tvishal8No ratings yet

- PS2 SolDocument9 pagesPS2 SolrteehaNo ratings yet

- See The List Below Which Entails Textbooks by SubjectDocument5 pagesSee The List Below Which Entails Textbooks by SubjectVeer MaharajNo ratings yet

- Simio and Simulation 6eDocument547 pagesSimio and Simulation 6eYasser MohamedNo ratings yet

- Hope 4Document34 pagesHope 4Ma Leolisa Sapalo SencilNo ratings yet

- FRE 20101201 Dec 2010Document250 pagesFRE 20101201 Dec 2010Esteban Cabrera100% (1)

- SONY XC-75 - 73e CameraDocument6 pagesSONY XC-75 - 73e Camerastefanrik5148No ratings yet

- Research On Multi Channel Marketing of EmbroideryDocument6 pagesResearch On Multi Channel Marketing of EmbroideryEditor IJTSRDNo ratings yet

- Cutting Tools: Your Partner For Clever ToolingDocument9 pagesCutting Tools: Your Partner For Clever ToolingPalade LucianNo ratings yet

- Design Modelling and Impact Analysis of Polyurea Based Kevlar Hybrid Composite LaminateDocument5 pagesDesign Modelling and Impact Analysis of Polyurea Based Kevlar Hybrid Composite LaminateSang Ka KalaNo ratings yet

- Physical Characteristics of F L O C S - I - The Floc Density Function and Aluminium FlocDocument11 pagesPhysical Characteristics of F L O C S - I - The Floc Density Function and Aluminium FlocIgnacio PerezNo ratings yet

- WHO Health Workers ClassificationDocument14 pagesWHO Health Workers Classificationkotrae100% (1)

- DENG 611 - Assignment1Document2 pagesDENG 611 - Assignment1Abdulrhaman AlrimiNo ratings yet

- BRKUCC-2059 - Designing and Deploying Cisco UCCXDocument72 pagesBRKUCC-2059 - Designing and Deploying Cisco UCCXnunomgtorresNo ratings yet

- Accounting and Finance Manager Job Description: ResponsibilitiesDocument2 pagesAccounting and Finance Manager Job Description: ResponsibilitiesAspire SuccessNo ratings yet

- CraneFork Study GuideDocument8 pagesCraneFork Study GuidePrasanth VarrierNo ratings yet

- Job Costing and Batch CostingDocument12 pagesJob Costing and Batch Costinglc17358No ratings yet