Professional Documents

Culture Documents

International Accounting

Uploaded by

Owen Zhang0 ratings0% found this document useful (0 votes)

16 views26 pagesThis document contains a multiple choice exam with questions about various topics relating to international business management. Some of the topics covered in the questions include budgeting and performance evaluation practices in different countries, factors that affect the comparability of financial performance between subsidiaries, types of foreign exchange exposure, and approaches to transfer pricing and multinational information technology strategies. The exam also includes some true/false questions testing understanding of related concepts.

Original Description:

free

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a multiple choice exam with questions about various topics relating to international business management. Some of the topics covered in the questions include budgeting and performance evaluation practices in different countries, factors that affect the comparability of financial performance between subsidiaries, types of foreign exchange exposure, and approaches to transfer pricing and multinational information technology strategies. The exam also includes some true/false questions testing understanding of related concepts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views26 pagesInternational Accounting

Uploaded by

Owen ZhangThis document contains a multiple choice exam with questions about various topics relating to international business management. Some of the topics covered in the questions include budgeting and performance evaluation practices in different countries, factors that affect the comparability of financial performance between subsidiaries, types of foreign exchange exposure, and approaches to transfer pricing and multinational information technology strategies. The exam also includes some true/false questions testing understanding of related concepts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 26

Exercises for Chapter 7

Multiple Choice Questions

1.

A number of macroeconomic variables can adversely affect comparability of the fina

ncial performance of

subsidiaries in different countries. These include:

a.

The levels of inflation in countries.

b.

The levels of political stability in countries.

c.

The labor situation in countries.

d.

All of the above.

e.

Only (a) and (b).

2.

Research studies comparing budgeting and performance evaluation practices in Japa

n and the United States

have found that:

a.

the length of time spent in preparing budgets was higher in the U.S. than in Japan.

b.

U.S. firms tended to focus on profitability measures while Japanese firms tended to f

ocus on sales

volume and market share.

c.

the compensation and promotion of U.S. managers was more likely to be impacted b

y their budget

performance than were those of Japanese managers.

d.

All of the above.

e.

Only (b) and (c) above.

3.

Managers who refrain from active management of foreign exchange risk may do so f

or a variety of reasons,

including:

a.

they consider the use of risk management instruments such as currency options and

swaps as

speculative.

b.

they claim that foreign currency exposures cannot be measured with precision.

c.

they argue that all business is risky and the firm gets rewarded for bearing risk.

d.

they assert that the firm's balance sheet is hedged on an accounting basis.

e.

All of the above.

4.

Managers actively engaged in foreign exchange risk management cite the following b

enefits:

a.

Since there is a direct relationship between a company's risk and its cost of capital a

less volatile

earnings stream reduces its cost of capital.

b.

A less volatile earnings stream has the potential for tax savings under certain tax reg

imes.

c.

Hedging activities can help securities analysts get a more precise value of the firm's

assets.

d.

All of the above.

e.

Only (a) and (b) above.

5.

The main types of foreign exchange exposure are:

a.

translation exposure

b.

transaction exposure

c.

operating exposure

d.

currency exposure

e.

Only (a), (b), and (c) above.

6.

The main foreign currency risk hedging instruments available to companies are:

a.

forward contracts, currency options, currency futures, political risk insurance.

b.

forward contracts, currency options, money market hedges, currency futures.

c.

currency futures, commodities futures, political risk insurance, stock options.

d.

forward contracts, stock options, political risk insurance, currency futures.

e.

currency options, currency futures, commodities futures, stock options.

7.

The main internal constituents of a company that are likely to be affected by its trans

fer pricing policies

are:

a.

senior management of the company.

b.

shareholders of the company.

c.

domestic tax authorities.

d.

All of the above.

e.

Only (a) and (b) above.

8.

The main external constituents of a company that are likely to be affected by its tran

sfer pricing policies

are:

a.

domestic tax authorities

b.

foreign tax authorities

c.

joint venture partners

d.

All of the above.

e.

Only (b) and (c) above.

9.

The following is a list of the external constituents of a firm's transfer pricing policies:

a.

employees, shareholders, suppliers, and customers.

b.

domestic tax authorities, joint venture partners, competitors, and customers.

c.

foreign tax authorities, joint venture partners, customers, and shareholders.

d.

domestic tax authorities, foreign tax authorities, employees, and suppliers.

e.

competitors, suppliers, customers, and managers of foreign subsidiaries.

10.

The main transfer pricing approaches are:

a.

market based methods

b.

cost based methods

c.

negotiated transfer prices.

d.

All of the above.

e.

Only (a) and (b) above.

11.

The main transfer pricing methods for the sale and transfer of tangible items are:

a.

the comparable uncontrolled price method.

b.

the resale price method

c.

the cost plus method

d.

the comparable profits method

e.

All of the above.

12.

The main transfer pricing methods for intangible assets are:

a.

the comparable uncontrolled transaction method

b.

the comparable profit method

c.

the resale price method

d.

All of the above.

e.

Only (a) and (b) above.

13.

Which of the following is an advantage to a company of entering into an Advance Pri

cing Agreement:

a.

It removes some of the uncertainty of how transfer prices will be treated for tax pur

poses.

b.

It makes the relationship between the company and the tax authority less adversaria

l.

c.

It reduces the company's record keeping burden.

d.

All of the above.

e.

Only (a) and (b) above.

14.

Which of the following is a disadvantage to a company of entering into an Advance P

ricing Agreement

(APA):

a.

The taxpayer may have to divulge proprietary information as part of the APA proces

s.

b.

It does not protect the company from subsequent scrutiny of its transfer pricing acti

vities.

c.

The monetary cost of entering into an APA can be considerable.

d.

All of the above.

e.

Only (a) and (c) above.

15.

Research evidence cited in the chapter shows that some of the main factors cited by

companie

s in their

choice of transfer pricing approach include:

a.

overall profitability of the company.

b.

differentials in income tax rates among countries.

c.

restrictions imposed by countries on repatriation of profits or dividends.

d.

competitive position of subsidiaries in foreign countries.

e.

All of the above.

16.

In the area of information technology, the main areas of differences between multina

tional companies and

domestic companies are:

a.

factors affecting system design.

b.

factors affecting system operation.

c.

factors affecting regulation.

d.

All of the above.

e.

Only (b) and (c) above.

17.

Identify the approaches that can help provide a match between a firm's global busin

ess strategy and its

global information technology system.

a.

Independent global operations system.

b.

Parent mandated system

c.

Cooperative system

d.

Integrated system

e.

All of the above.

18.

As relates to a multinational information technology strategy, which of the following

statements is true of

the independent global operations system?

a.

Under this approach the parent prescribes the information technology choices of su

bsidiaries.

b.

Under this approach the information technology system is integrated globally.

c.

An advantage is that it permits greater local responsiveness.

d.

An advantage is that it makes it easy for the multinational company to implement gl

obal initiatives and

strategies.

e.

None of the above.

19.

As relates to a multinational information technology strategy, which of the following

statements is true of

the parent mandated system?

a.

Under this approach subsidiaries are fairly autonomous.

b.

The equipment used in information systems reflects local communications standard

s and offerings as

well as local availability of trained personnel.

c.

This approach is responsive to local needs and customs.

d.

This approach facilitates global strategies and coordination.

e.

This approach offers a greater chance of local acceptance.

20.

As relates to a multinational information technology strategy, which of the following

statements is not true

about the cooperative system?

a.

Under this approach the parent influences rather than mandates the information tec

hnology choices of

its subsidiaries.

b.

Joint application development efforts are undertaken between various entities withi

n the group.

c.

Subsidiaries have latitude in modifying applications developed centrally to better fit

the local

environment.

d.

An advantage of this approach is that systems developed cooperatively are more like

ly to be used by

subsidiaries.

e.

An advantage of this approach is that the development period is short and the end pr

oduct is fully

integrated.

True/False Questions

1.

If the budget is to motivate employees and to help create goal congruence between e

mployees and the

organization then it must provide reasonable targets for the employees to attain.

2.

Additional considerations must be factored into designing budget and performance

evaluation systems for

subsidiaries in other countries.

3.

In certain situations companies may need to include non-financial criteria instead of

financial criteria based

on what they perceive to be the primary role of the foreign subsidiary in the firm's o

verall strategy.

4.

An important benefit of non-financial measures is that they can be reported on a tim

ely basis and problems

identified can be addressed promptly before they negatively affect the company's fin

ancial pe

rformance.

5.

If a multinational company has a centralized treasury operation at headquarters wit

h exclusive authority to

manage foreign currency risk then the parent's currency is the one that ought to be

used for evaluating

foreign subsidiaries.

6.

The type of transfer pricing policies within an organization have no impact on the pr

ofitability of each

subsidiary engaged in intra-firm activity.

7.

For a company that has subsidiaries in a number of countries, comparability might b

e a desired ingredient

of a transfer pricing system.

8.

If multinational companies are to suitably motivate and reward the managers of thei

r foreign subsidiaries it

is critical that they distinguish between manager performance and subsidiary perfor

mance.

9.

Research studies that have compared budgeting and performance evaluation practic

es have found that the

average length of time spent in preparing budgets is greater in Japanese companies t

han in U.S. companies.

10.

Research studies that have compared budgeting and performance evaluation practic

es have found that U.S.

companies tend to focus on profitability measures of performance while Japanese fir

ms tend to focus on

sales volume and market share.

11.

Research studies that have compared budgeting and performance evaluation practic

es have found that U.S.

firms use budget variances primarily to evaluate managers while Japanese firms use

budget variances

primarily for the timely recognition of problems and to improve next period's budge

t.

12.

There is research evidence that British firms tend to focus on control systems to imp

rove short term profits

while Japanese firms focused more on long term strategic planning and emphasized

growth in market

share.

13.

A recent study found that while management accounting practices of Australian com

panies emphasize cost

control tools at the manufacturing stage, Japanese companies pay much greater atte

ntion to cost planning

and cost reduction tools at the production design stage.

14.

In conducting multinational capital budgeting analysis, one way to handle the additi

onal risk from projects

based abroad is to add a foreign risk premium to the discount rate that would be use

d for a domestic

project.

15.

In conducting multinational capital budgeting analysis, one way to handle the additi

onal risk from pro

jects

based abroad is to adjust the cash flows for the foreign project to reflect the addition

al uncertainty.

16.

The additional complexities resulting from doing business abroad must be incorpora

ted in the capital

budgeting analysis by adjusting either the discount rate or the expected life of the in

vestment.

17.

Some managers refrain from actively managing foreign currency risk because they c

onsider risk

management instruments such as currency options and futures to be speculative.

18.

Management should only devote resources to managing foreign exchange risk if the

benefits to the

company exceed the cost of implementing such a program.

19.

Managers actively engaged in foreign exchange risk management argue that since th

ere is a direct relation

between risk and the required rate of return a less volatile earnings stream reduces t

he firm's cost of capital.

20.

A forward contract is the right and the obligation to buy or sell a currency at a set ex

change rate on a set

date in the future.

21.

In a foreign currency option, the right to buy currency is

a put

and the right to sell currency is

a call.

22.

The only objective under a multinational transfer pricing policy is to minimize the fir

m's global tax

liability.

23.

Joint venture partners in other countries are never impacted by a multinational com

pany's transfer pricing

policies.

24.

In international business, dumping is generally said to occur when a firm sells produ

cts at much higher

prices in foreign markets than it does in its domestic market.

25.

With the improvement in information technology and the growing cooperation betw

een tax authorities in

various countries, the level of monitoring of multinational companies is likely to dec

rease.

Exercises for Chapter 7 Multiple Choice Questions

1. A number of macroeconomic variables can adversely affect comparability of the fi

nancial performance of

subsidiaries in different countries. These include: a. The levels of inflation in countri

es. b. The levels of political stability in countries. c. The labor situation in countries.

d. All of the above. e. Only (a) and (b). 2. Research studies comparing budgeting and

performance evaluation practices in Japan and the United States

have found that: a. the length of time spent in preparing budgets was higher in the U

.S. than in Japan. b. U.S. firms tended to focus on profitability measures while Japane

se firms tended to focus on sales

volume and market share.

c. the compensation and promotion of U.S. managers was more likely to be impacted

by their budget

performance than were those of Japanese managers.

d. All of the above. e. Only (b) and (c) above. 3. Managers who refrain from active m

anagement of foreign exchange risk may do so for a variety of reasons,

including: a. they consider the use of risk management instruments such as currenc

y options and swaps as

speculative.

b. they claim that foreign currency exposures cannot be measured with precision. c.

they argue that all business is risky and the firm gets rewarded for bearing risk. d. t

hey assert that the firm's balance sheet is hedged on an accounting basis. e. All of th

e above. 4. Managers actively engaged in foreign exchange risk management cite the

following benefits: a. Since there is a direct relationship between a company's risk a

nd its cost of capital a less volatile

earnings stream reduces its cost of capital.

b. A less volatile earnings stream has the potential for tax savings under certain tax

regimes. c. Hedging activities can help securities analysts get a more precise value of

the firm's assets. d. All of the above. e. Only (a) and (b) above. 5. The main types of f

oreign exchange exposure are: a. translation exposure b. transaction exposure c. op

erating exposure d. currency exposure

e. Only (a), (b), and (c) above.

6. The main foreign currency risk hedging instruments available to companies are: a

. forward contracts, currency options, currency futures, political risk insurance. b. fo

rward contracts, currency options, money market hedges, currency futures. c. curre

ncy futures, commodities futures, political risk insurance, stock options. d. forward

contracts, stock options, political risk insurance, currency futures. e. currency optio

ns, currency futures, commodities futures, stock options.

7. The main internal constituents of a company that are likely to be affected by its tra

nsfer pricing policies

are: a. senior management of the company. b. shareholders of the company. c. dome

stic tax authorities. d. All of the above. e. Only (a) and (b) above. 8. The main extern

al constituents of a company that are likely to be affected by its transfer pricing polic

ies

are: a. domestic tax authorities b. foreign tax authorities c. joint venture partners d

. All of the above. e. Only (b) and (c) above. 9. The following is a list of the external c

onstituents of a firm's transfer pricing policies: a. employees, shareholders, supplier

s, and customers.

b. domestic tax authorities, joint venture partners, competitors, and customers. c. fo

reign tax authorities, joint venture partners, customers, and shareholders. d. domest

ic tax authorities, foreign tax authorities, employees, and suppliers. e. competitors, s

uppliers, customers, and managers of foreign subsidiaries. 10. The main transfer pri

cing approaches are: a. market based methods b. cost based methods

c. negotiated transfer prices. d. All of the above.

e. Only (a) and (b) above.

11. The main transfer pricing methods for the sale and transfer of tangible items are:

a. the comparable uncontrolled price method. b. the resale price method c. the cost

plus method

d. the comparable profits method e. All of the above.

12. The main transfer pricing methods for intangible assets are: a. the comparable u

ncontrolled transaction method b. the comparable profit method c. the resale price

method d. All of the above.

e. Only (a) and (b) above.

13. Which of the following is an advantage to a company of entering into an Advance

Pricing Agreement: a. It removes some of the uncertainty of how transfer prices will

be treated for tax purposes. b. It makes the relationship between the company and t

he tax authority less adversarial. c. It reduces the company's record keeping burden.

d. All of the above.

e. Only (a) and (b) above.

14. Which of the following is a disadvantage to a company of entering into an Advanc

e Pricing Agreement

(APA): a. The taxpayer may have to divulge proprietary information as part of the A

PA process. b. It does not protect the company from subsequent scrutiny of its transf

er pricing activities. c. The monetary cost of entering into an APA can be considerabl

e. d. All of the above. e. Only (a) and (c) above. 15. Research evidence cited in the ch

apter shows that some of the main factors cited by companies in their

choice of transfer pricing approach include: a. overall profitability of the company. b

. differentials in income tax rates among countries. c. restrictions imposed by countr

ies on repatriation of profits or dividends. d. competitive position of subsidiaries in f

oreign countries. e. All of the above. 16. In the area of information technology, the m

ain areas of differences between multinational companies and

domestic companies are: a. factors affecting system design. b. factors affecting syste

m operation. c. factors affecting regulation. d. All of the above. e. Only (b) and (c) ab

ove. 17. Identify the approaches that can help provide a match between a firm's glob

al business strategy and its

global information technology system. a. Independent global operations system. b.

Parent mandated system c. Cooperative system d. Integrated system e. All of the ab

ove. 18. As relates to a multinational information technology strategy, which of the fo

llowing statements is true of

the independent global operations system? a. Under this approach the parent prescr

ibes the information technology choices of subsidiaries. b. Under this approach the i

nformation technology system is integrated globally. c. An advantage is that it permi

ts greater local responsiveness. d. An advantage is that it makes it easy for the multi

national company to implement global initiatives and

strategies.

e. None of the above.

19. As relates to a multinational information technology strategy, which of the follow

ing statements is true of

the parent mandated system? a. Under this approach subsidiaries are fairly autono

mous. b. The equipment used in information systems reflects local communications

standards and offerings as

well as local availability of trained personnel.

c. This approach is responsive to local needs and customs. d. This approach facilitat

es global strategies and coordination. e. This approach offers a greater chance of loc

al acceptance. 20. As relates to a multinational information technology strategy, whic

h of the following statements is not true

about the cooperative system? a. Under this approach the parent influences rather t

han mandates the information technology choices of

its subsidiaries.

b. Joint application development efforts are undertaken between various entities wi

thin the group. c. Subsidiaries have latitude in modifying applications developed cen

trally to better fit the local

environment.

d. An advantage of this approach is that systems developed cooperatively are more l

ikely to be used by

subsidiaries.

e. An advantage of this approach is that the development period is short and the end

product is fully

integrated. True/False Questions

1. If the budget is to motivate employees and to help create goal congruence betwee

n employees and the

organization then it must provide reasonable targets for the employees to attain. 2.

Additional considerations must be factored into designing budget and performance

evaluation systems for

subsidiaries in other countries. 3. In certain situations companies may need to inclu

de non-financial criteria instead of financial criteria based

on what they perceive to be the primary role of the foreign subsidiary in the firm's o

verall strategy. 4. An important benefit of non-financial measures is that they can be

reported on a timely basis and problems

identified can be addressed promptly before they negatively affect the company's fin

ancial performance. 5. If a multinational company has a centralized treasury operati

on at headquarters with exclusive authority to

manage foreign currency risk then the parent's currency is the one that ought to be

used for evaluating foreign subsidiaries. 6. The type of transfer pricing policies withi

n an organization have no impact on the profitability of each

subsidiary engaged in intra-firm activity. 7. For a company that has subsidiaries in a

number of countries, comparability might be a desired ingredient

of a transfer pricing system. 8. If multinational companies are to suitably motivate an

d reward the managers of their foreign subsidiaries it

is critical that they distinguish between manager performance and subsidiary perfor

mance. 9. Research studies that have compared budgeting and performance evaluati

on practices have found that the

average length of time spent in preparing budgets is greater in Japanese companies t

han in U.S. companies.

10. Research studies that have compared budgeting and performance evaluation pra

ctices have found that U.S.

companies tend to focus on profitability measures of performance while Japanese fir

ms tend to focus on sales volume and market share. 11. Research studies that have c

ompared budgeting and performance evaluation practices have found that U.S.

firms use budget variances primarily to evaluate managers while Japanese firms use

budget variances primarily for the timely recognition of problems and to improve ne

xt period's budget. 12. There is research evidence that British firms tend to focus on

control systems to improve short term profits

while Japanese firms focused more on long term strategic planning and emphasized

growth in market share. 13. A recent study found that while management accounting

practices of Australian companies emphasize cost

control tools at the manufacturing stage, Japanese companies pay much greater atte

ntion to cost planning and cost reduction tools at the production design stage. 14. In

conducting multinational capital budgeting analysis, one way to handle the addition

al risk from projects

based abroad is to add a foreign risk premium to the discount rate that would be use

d for a domestic project. 15. In conducting multinational capital budgeting analysis,

one way to handle the additional risk from projects

based abroad is to adjust the cash flows for the foreign project to reflect the addition

al uncertainty. 16. The additional complexities resulting from doing business abroad

must be incorporated in the capital

budgeting analysis by adjusting either the discount rate or the expected life of the in

vestment. 17. Some managers refrain from actively managing foreign currency risk b

ecause they consider risk

management instruments such as currency options and futures to be speculative. 18.

Management should only devote resources to managing foreign exchange risk if the

benefits to the

company exceed the cost of implementing such a program. 19. Managers actively en

gaged in foreign exchange risk management argue that since there is a direct relatio

n

between risk and the required rate of return a less volatile earnings stream reduces t

he firm's cost of capital. 20. A forward contract is the right and the obligation to buy

or sell a currency at a set exchange rate on a set

date in the future. 21. In a foreign currency option, the right to buy currency is a put

and the right to sell currency is a call. 22. The only objective under a multinational tr

ansfer pricing policy is to minimize the firm's global tax

liability. 23. Joint venture partners in other countries are never impacted by a multin

ational company's transfer pricing

policies. 24. In international business, dumping is generally said to occur when a fir

m sells products at much higher

prices in foreign markets than it does in its domestic market. 25. With the improvem

ent in information technology and the growing cooperation between tax authorities

in

various countries, the level of monitoring of multinational companies is likely to dec

rease.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- TCQT-1Document8 pagesTCQT-1uyên vươngNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Risk ManagementDocument7 pagesRisk ManagementKhalid Mishczsuski Limu100% (1)

- Strategic Management & Business Policy Ch 8 Strategy FormulationDocument6 pagesStrategic Management & Business Policy Ch 8 Strategy FormulationAbigail LeronNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Analyzing Management Services and Cost-Volume-Profit AnalysisDocument16 pagesAnalyzing Management Services and Cost-Volume-Profit AnalysisChristian Clyde Zacal ChingNo ratings yet

- Final MockboardDocument16 pagesFinal MockboardChristian Clyde Zacal ChingNo ratings yet

- Compre ExamDocument11 pagesCompre Examena20_paderangaNo ratings yet

- The Comprehensive Guide for Minority Tech Startups Securing Lucrative Government Contracts, Harnessing Business Opportunities, and Achieving Long-Term SuccessFrom EverandThe Comprehensive Guide for Minority Tech Startups Securing Lucrative Government Contracts, Harnessing Business Opportunities, and Achieving Long-Term SuccessNo ratings yet

- Dwnload Full Cost Management A Strategic Emphasis 8th Edition Blocher Test Bank PDFDocument35 pagesDwnload Full Cost Management A Strategic Emphasis 8th Edition Blocher Test Bank PDFlauritastadts2900100% (15)

- BSA 3102 Management Accounting PRELIMS PDFDocument20 pagesBSA 3102 Management Accounting PRELIMS PDFRyzel BorjaNo ratings yet

- Finman Test Bank2Document11 pagesFinman Test Bank2ATHALIAH LUNA MERCADEJAS100% (1)

- Chapter 1 Homework Assignment Fall 2018Document8 pagesChapter 1 Homework Assignment Fall 2018Marouf AlhndiNo ratings yet

- BusFin ExamDocument16 pagesBusFin ExamBlessel Rose PaquinganNo ratings yet

- Income Statement Format and PresentationDocument52 pagesIncome Statement Format and PresentationIvern BautistaNo ratings yet

- Accounts Exam Self Study Questions Chap1Document11 pagesAccounts Exam Self Study Questions Chap1pratik kcNo ratings yet

- Introduction to Financial ManagementDocument7 pagesIntroduction to Financial ManagementMicah ErguizaNo ratings yet

- Mastery in Management Advisory ServicesDocument12 pagesMastery in Management Advisory ServicesPrincess Claris Araucto0% (1)

- Multiple Choices 1Document2 pagesMultiple Choices 1ssg2No ratings yet

- Test Bank For International Corporate Finance 0073530662 Full DownloadDocument29 pagesTest Bank For International Corporate Finance 0073530662 Full Downloadnataliewallyfcgxdbeaq100% (39)

- Exam Questions Fina4810Document9 pagesExam Questions Fina4810Bartholomew Szold75% (4)

- Chap 4Document52 pagesChap 4Ella Mae LayarNo ratings yet

- 10 28 QuestionsDocument5 pages10 28 QuestionstikaNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement AnalysisJhuneth DominguezNo ratings yet

- Chapter 1 StudentsDocument7 pagesChapter 1 StudentsArah Opalec0% (1)

- Income Statement and Related Information: Chapter Learning ObjectivesDocument53 pagesIncome Statement and Related Information: Chapter Learning Objectivesheyhey100% (1)

- Financial Institutions Instruments and Markets 7th Edition Viney Test BankDocument48 pagesFinancial Institutions Instruments and Markets 7th Edition Viney Test Bankbunkerlulleruc3s100% (29)

- GbsDocument8 pagesGbsPavan DeshpandeNo ratings yet

- Multiple Choice QuestionshDocument5 pagesMultiple Choice QuestionshHischa Ubri De JesusNo ratings yet

- FINMAN QUIZ 1 SOLUTIONSDocument5 pagesFINMAN QUIZ 1 SOLUTIONSMicah ErguizaNo ratings yet

- Ch2 Multiple Choice QuestionsDocument9 pagesCh2 Multiple Choice QuestionsAfsana ParveenNo ratings yet

- Accounting TheoryDocument5 pagesAccounting TheoryMichelle ANo ratings yet

- Intermediate Accounting Testbank 2Document419 pagesIntermediate Accounting Testbank 2SOPHIA97% (30)

- Financial Institutions Instruments and Markets 7Th Edition Viney Test Bank Full Chapter PDFDocument68 pagesFinancial Institutions Instruments and Markets 7Th Edition Viney Test Bank Full Chapter PDFhieudermotjm7w100% (10)

- Test Bank For International Corporate Finance 0073530662Document30 pagesTest Bank For International Corporate Finance 0073530662arianluufjs100% (17)

- DBC FinquizDocument6 pagesDBC FinquizAshutosh SatapathyNo ratings yet

- FIN622 Online Quiz - PdfaDocument531 pagesFIN622 Online Quiz - Pdfazahidwahla1100% (3)

- Multiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionsDocument8 pagesMultiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionsRandy ManzanoNo ratings yet

- AnswersDocument11 pagesAnswershoney arguellesNo ratings yet

- MCQ TestDocument10 pagesMCQ TestcalliemozartNo ratings yet

- PROBLEMSDocument8 pagesPROBLEMSSaeym SegoviaNo ratings yet

- Chapter 1 3Document17 pagesChapter 1 3Hieu Duong Trong100% (3)

- FIN1S Prelim ExamDocument7 pagesFIN1S Prelim ExamYu BabylanNo ratings yet

- Baba2 Fin MidtermDocument8 pagesBaba2 Fin MidtermYu BabylanNo ratings yet

- International Corporate Finance 1St Edition Robin Test Bank Full Chapter PDFDocument50 pagesInternational Corporate Finance 1St Edition Robin Test Bank Full Chapter PDFlyeliassh5100% (9)

- International Corporate Finance 1st Edition Robin Test BankDocument29 pagesInternational Corporate Finance 1st Edition Robin Test Bankchristabeldienj30da100% (24)

- Introduction To Financial Management Quiz 1 - CompressDocument3 pagesIntroduction To Financial Management Quiz 1 - CompressLenson NatividadNo ratings yet

- File Tổng Hợp Quizz Ktqt 1: File này mấy bạn muốn sao chép, chia sẻ, hay đi phô tô thì thoải mái nhaDocument38 pagesFile Tổng Hợp Quizz Ktqt 1: File này mấy bạn muốn sao chép, chia sẻ, hay đi phô tô thì thoải mái nhaDANH LÊ VĂNNo ratings yet

- 1st PB-TADocument12 pages1st PB-TAGlenn Patrick de LeonNo ratings yet

- FINA201 Main Exam paper June 2023 (3)Document13 pagesFINA201 Main Exam paper June 2023 (3)AyandaNo ratings yet

- Management Advisory ServicesDocument5 pagesManagement Advisory ServicesJL Favorito YambaoNo ratings yet

- MGT3580: Global Enterprise Management (Simulation Questions)Document3 pagesMGT3580: Global Enterprise Management (Simulation Questions)Chan JohnNo ratings yet

- Managerial Accounting IntroductionDocument24 pagesManagerial Accounting IntroductionCharla SuanNo ratings yet

- Answer The Following QuestionsDocument8 pagesAnswer The Following QuestionsTaha Wael QandeelNo ratings yet

- Possible Test1Document32 pagesPossible Test1Azim Jivani100% (3)

- International AccountingDocument26 pagesInternational AccountingOwen ZhangNo ratings yet

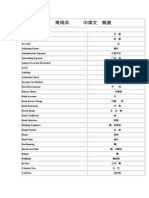

- 常用会计词汇中英文对照表Document8 pages常用会计词汇中英文对照表Owen ZhangNo ratings yet

- AuditingDocument2 pagesAuditingOwen ZhangNo ratings yet

- 508 HW1Document1 page508 HW1Owen ZhangNo ratings yet

- New Microsoft PowerPoint 演示文稿Document1 pageNew Microsoft PowerPoint 演示文稿Owen ZhangNo ratings yet

- AuditingDocument1 pageAuditingOwen ZhangNo ratings yet

- Tax2 HWDocument1 pageTax2 HWOwen ZhangNo ratings yet

- Hello WorldDocument1 pageHello WorldOwen ZhangNo ratings yet

- Hello WorldDocument1 pageHello WorldOwen ZhangNo ratings yet

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (799)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Faith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateFrom EverandFaith Driven Entrepreneur: What It Takes to Step Into Your Purpose and Pursue Your God-Given Call to CreateRating: 5 out of 5 stars5/5 (33)

- Summary of The 33 Strategies of War by Robert GreeneFrom EverandSummary of The 33 Strategies of War by Robert GreeneRating: 3.5 out of 5 stars3.5/5 (20)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchFrom EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchRating: 4 out of 5 stars4/5 (114)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 5 out of 5 stars5/5 (24)