Professional Documents

Culture Documents

Appd

Appd

Uploaded by

garyberth26Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appd

Appd

Uploaded by

garyberth26Copyright:

Available Formats

D- 1

D- 2

APPENDIXD

Time Value of

Money

D- 3

Interest

Payment for the use of money.

Excess cash received or repaid over the amount

borrowed (principal).

Variables involved in financing transaction:

1. Principal (p) - Amount borrowed or invested.

2. Interest Rate (i) An annual percentage.

3. Time (n) - The number of years or portion of a year that

the principal is borrowed or invested.

SO 1 Distinguish between simple and compound interest.

Nature of Interest

D- 4

Interest computed on the principal only.

SO 1 Distinguish between simple and compound interest.

Illustration: Assume you borrow $5,000 for 2 years at a simple

interest of 12% annually. Calculate the annual interest cost.

Interest = p x i x n

= $5,000 x .12 x 2

= $1,200

FULL YEAR

Illustration D-1

Simple Interest

Nature of Interest

D- 5

Computes interest on

the principal and

any interest earned that has not been paid or

withdrawn.

Most business situations use compound interest.

SO 1 Distinguish between simple and compound interest.

Compound Interest

Nature of Interest

D- 6

Illustration: Assume that you deposit $1,000 in Bank Two, where it

will earn simple interest of 9% per year, and you deposit another

$1,000 in Citizens Bank, where it will earn compound interest of 9%

per year compounded annually. Also assume that in both cases you

will not withdraw any interest until three years from the date of deposit.

SO 1

Year 1 $1,000.00 x 9% $ 90.00 $ 1,090.00

Year 2 $1,090.00 x 9% $ 98.10 $ 1,188.10

Year 3 $1,188.10 x 9% $106.93 $ 1,295.03

Illustration D-2

Simple versus compound interest

Compound Interest

D- 7

SO 2 Identify the variables fundamental to solving present value problems.

Present value is the value now of a given amount to be paid or

received in the future, assuming compound interest.

Present value variables:

1. Dollar amount to be received in the future,

2. Length of time until amount is received, and

3. Interest rate (the discount rate).

Present Value Variables

D- 8

Present Value = Future Value / (1 + i )

n

Illustration D-3

Formula for present value

p = principal (or present value)

i = interest rate for one period

n = number of periods

SO 3 Solve for present value of a single amount.

Present Value of a Single Amount

D- 9

SO 3 Solve for present value of a single amount.

Illustration: If you want a 10% rate of return, you would

compute the present value of $1,000 for one year as follows:

Illustration D-4

Present Value of a Single Amount

D- 10

What table do we use?

SO 3 Solve for present value of a single amount.

Illustration D-4

Illustration: If you want a 10% rate of return, you can also

compute the present value of $1,000 for one year by using

a present value table.

Present Value of a Single Amount

D- 11

What factor do we use?

SO 3 Solve for present value of a single amount.

$1,000 x .90909 = $909.09

Future Value Factor Present Value

Present Value of a Single Amount

D- 12

Illustration: If you receive the single amount of $1,000 in two

years, discounted at 10% [PV = $1,000 / 1.10

2

], the present

value of your $1,000 is $826.45.

What table do we use?

SO 3 Solve for present value of a single amount.

Illustration D-5

Present Value of a Single Amount

D- 13

What factor do we use?

SO 3 Solve for present value of a single amount.

$1,000 x .82645 = $826.45

Future Value Factor Present Value

Present Value of a Single Amount

D- 14

SO 3 Solve for present value of a single amount.

Illustration: Suppose you have a winning lottery ticket and the state

gives you the option of taking $10,000 three years from now or taking the

present value of $10,000 now. The state uses an 8% rate in discounting.

How much will you receive if you accept your winnings now?

$10,000 x .79383 = $7,938.30

Future Value Factor Present Value

Present Value of a Single Amount

D- 15

SO 3 Solve for present value of a single amount.

Illustration: Determine the amount you must deposit now in a bond

investment, paying 9% interest, in order to accumulate $5,000 for a

down payment 4 years from now on a new Toyota Prius.

$5,000 x .70843 = $3,542.15

Future Value Factor Present Value

Present Value of a Single Amount

D- 16

The value now of a series of future receipts or payments,

discounted assuming compound interest.

0 1

Present Value

2 3 4 19 20

$100,000 100,000 100,000 100,000 100,000

. . . . .

100,000

SO 4 Solve for present value of an annuity.

Present Value of an Annuity

D- 17

Illustration: Assume that you will receive $1,000 cash

annually for three years at a time when the discount rate is

10%.

What table do we use?

SO 4 Solve for present value of an annuity.

Illustration D-8

Present Value of an Annuity

D- 18

What factor do we use?

$1,000 x 2.48685 = $2,486.85

Future Value Factor Present Value

SO 4 Solve for present value of an annuity.

Present Value of an Annuity

D- 19

Illustration: Kildare Company has just signed a capitalizable lease

contract for equipment that requires rental payments of $6,000 each, to

be paid at the end of each of the next 5 years. The appropriate discount

rate is 12%. What is the amount used to capitalize the leased

equipment?

$6,000 x 3.60478 = $21,628.68

SO 4 Solve for present value of an annuity.

Present Value of an Annuity

D- 20

Illustration: When the time frame is less than one year, you need to

convert the annual interest rate to the applicable time frame. Assume

that the investor received $500 semiannually for three years instead

of $1,000 annually when the discount rate was 10%.

$500 x 5.07569 = $2,537.85

SO 4

Time Periods and Discounting

D- 21

SO 5 Compute the present value of notes and bonds.

Two Cash Flows:

Periodic interest payments (annuity).

Principal paid at maturity (single-sum).

0 1 2 3 4 9 10

5,000 5,000 5,000 $5,000

. . . . .

5,000 5,000

100,000

Present Value of a Long-term Note or Bond

D- 22

Illustration: Assume a bond issue of 10%, five-year bonds with

a face value of $100,000 with interest payable semiannually on

January 1 and July 1. Calculate the present value of the

principal and interest payments.

SO 5 Compute the present value of notes and bonds.

0 1 2 3 4 9 10

5,000 5,000 5,000 $5,000

. . . . .

5,000 5,000

100,000

Present Value of a Long-term Note or Bond

D- 23

$100,000 x .61391 = $61,391

Principal Factor Present Value

SO 5 Compute the present value of notes and bonds.

PV of Principal

Present Value of a Long-term Note or Bond

D- 24

$5,000 x 7.72173 = $38,609

Principal Factor Present Value

SO 5 Compute the present value of notes and bonds.

PV of Interest

Present Value of a Long-term Note or Bond

D- 25

Illustration: Assume a bond issue of 10%, five-year bonds with

a face value of $100,000 with interest payable semiannually on

January 1 and July 1.

Present value of Principal $61,391

Present value of Interest 38,609

Bond current market value $100,000

Account Title Debit Credit

Cash 100,000

Bonds Payable 100,000

Date

SO 5 Compute the present value of notes and bonds.

Present Value of a Long-term Note or Bond

D- 26

Illustration: Now assume that the investors required rate of return

is 12%, not 10%. The future amounts are again $100,000 and

$5,000, respectively, but now a discount rate of 6% (12% / 2) must

be used. Calculate the present value of the principal and interest

payments.

SO 5 Compute the present value of notes and bonds.

Illustration D-14

Present Value of a Long-term Note or Bond

D- 27

Illustration: Now assume that the investors required rate of

return is 8%. The future amounts are again $100,000 and $5,000,

respectively, but now a discount rate of 4% (8% / 2) must be used.

Calculate the present value of the principal and interest

payments.

SO 5 Compute the present value of notes and bonds.

Illustration D-15

Present Value of a Long-term Note or Bond

D- 28

Copyright 2011 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written permission of the copyright owner is unlawful.

Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser

may make back-up copies for his/her own use only and not for

distribution or resale. The Publisher assumes no responsibility for

errors, omissions, or damages, caused by the use of these

programs or from the use of the information contained herein.

Copyright

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Prediction Paper 2 0580 May 2024 SolutionsDocument11 pagesPrediction Paper 2 0580 May 2024 Solutionsminati0830100% (4)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- G5 Real Estate RecapitalizationDocument30 pagesG5 Real Estate RecapitalizationSylvia MiraNo ratings yet

- Amg - TRM - BBP - V2.0.Document43 pagesAmg - TRM - BBP - V2.0.Molli Deva83% (6)

- StatementDocument5 pagesStatementanikaNo ratings yet

- NCR JudgementDocument12 pagesNCR JudgementRudra ChennaiNo ratings yet

- Chapter 6 Bank ReportsDocument6 pagesChapter 6 Bank ReportsMariel Crista Celda MaravillosaNo ratings yet

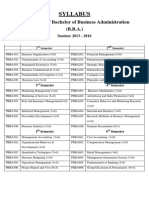

- Syllabus BbaDocument59 pagesSyllabus BbaGauravsNo ratings yet

- Gen Math FINALS KEY - Given To MercyDocument2 pagesGen Math FINALS KEY - Given To Mercyjun del rosario100% (5)

- (FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Document17 pages(FE) REFNNCE 273 LECTURE JULY 31 2021 (Canvas)Michelle GozonNo ratings yet

- The Curious Case of Vijay Mallya and His Bailout. and One More Scam!Document6 pagesThe Curious Case of Vijay Mallya and His Bailout. and One More Scam!s745No ratings yet

- Bank Management and Financial Services 9th Edition Rose Test Bank 1Document36 pagesBank Management and Financial Services 9th Edition Rose Test Bank 1jennifermillsfayspngcqt100% (27)

- QuizDocument7 pagesQuizJennifer Rasonabe100% (1)

- Securities Analysis and Portfolio Management PDFDocument64 pagesSecurities Analysis and Portfolio Management PDFShreya s shetty100% (1)

- Engineering Economy: Consumer Goods and Services Producer Goods and ServicesDocument31 pagesEngineering Economy: Consumer Goods and Services Producer Goods and ServicesZsyroll Matthew MendezNo ratings yet

- Sid - Sbi Multi Asset Allocation Fund PDFDocument95 pagesSid - Sbi Multi Asset Allocation Fund PDFANo ratings yet

- Final Exam Auditing With Answer UcpDocument7 pagesFinal Exam Auditing With Answer UcpJelyn RuazolNo ratings yet

- Arev 420 Preliminary ExaminationDocument6 pagesArev 420 Preliminary ExaminationLiza Magat MatadlingNo ratings yet

- Combinepdf - Input-Output - Cost of CapitalDocument11 pagesCombinepdf - Input-Output - Cost of CapitalNaomi DazaiNo ratings yet

- Applied EconomicsDocument3 pagesApplied EconomicsDel RosarioNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAkriti JhaNo ratings yet

- General Mathematics: DefinitionDocument69 pagesGeneral Mathematics: Definitionabigail raccaNo ratings yet

- Chapter 01 Lasher PFMDocument20 pagesChapter 01 Lasher PFMShibin Jayaprasad100% (1)

- Apti Num PDFDocument55 pagesApti Num PDFB SHANKARNo ratings yet

- Raj Kumar, MBA 3rd Sem, FMI AssignmentDocument4 pagesRaj Kumar, MBA 3rd Sem, FMI AssignmentRaj KumarNo ratings yet

- Relationship Between Money and Goods MarketsDocument115 pagesRelationship Between Money and Goods Marketsapi-3825580No ratings yet

- 9Document9 pages9Ruby Anna TorresNo ratings yet

- Debt RestructuringDocument2 pagesDebt RestructuringVicong PogiNo ratings yet

- G.R. No. 159709Document6 pagesG.R. No. 159709Delsie FalculanNo ratings yet

- Relevant Cost AnalysisDocument5 pagesRelevant Cost AnalysisSushanta Kumar RoyNo ratings yet

- Determinants of Interest RatesDocument33 pagesDeterminants of Interest RatesEsther SinagaNo ratings yet