Professional Documents

Culture Documents

Production of Shock Absorber Spring

Production of Shock Absorber Spring

Uploaded by

RajaSekarsajja0 ratings0% found this document useful (0 votes)

5 views26 pagesThis article explains the features of Shock absorber spring and how it is manufactured.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis article explains the features of Shock absorber spring and how it is manufactured.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views26 pagesProduction of Shock Absorber Spring

Production of Shock Absorber Spring

Uploaded by

RajaSekarsajjaThis article explains the features of Shock absorber spring and how it is manufactured.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 26

187.

PROFILE ON THE PRODUCTION OF SHOCK

ABSORBER (SPRING)

187-1

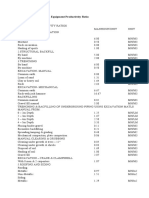

TABLE OF CONTENTS

PAGE

I. SUMMARY 187-2

II. PRODUCT DESCRIPTION & APPLICATION 187-2

III. MARKET STUDY AND PLANT CAPACITY 187-3

A. MARKET STUDY 187-3

B. PLANT CAPACITY & PRODUCTION PROGRAMME 187-6

IV. MATERIALS AND INPUTS 187-7

A. RAW & AUXILIARY MATERIALS 187-7

B. UTILITIES 187-7

V. TECHNOLOGY & ENGINEERING 187-8

A. TECHNOLOGY 187-8

B. ENGINEERING 187-8

VI. HUMAN RESOURCE & TRAINING REQUIREMENT 187-13

A. HUMAN RESOURCE REQUIREMENT 187-13

B. TRAINING REQUIREMENT 187-14

VII. FINANCIAL ANLYSIS 187-14

A. TOTAL INITIAL INVESTMENT COST 187-14

B. PRODUCTION COST 187-15

C. FINANCIAL EVALUATION 187-16

D. ECONOMIC AND SOCIAL BENEFITS 187-18

187-2

I. SUMMARY

This profile envisages the establishment of a plant for the production of shock absorber spring

with a capacity of 300, 000 pieces per annum. A spring shock absorber is a mechanical device

designed to smooth out or damp shock impulse, and dissipate kinetic energy and is used in automobile

and motorcycle suspensions, aircraft landing gear, and supports for many industrial machines.

The demand for shock absorber spring is met entirely through import. The present (2012)

demand for shock absorber spring is estimated at 140 tons. The demand for shock absorber

spring is projected to reach 206 tons and 303 tons by the year 2017 and year 2022, respectively.

The principal raw materials required are steel wire and steel plate which have to be imported.

The total investment cost of the project including working capital is estimated at Birr 181.77

million. From the total investment cost the highest share (Birr 150.38 million or 82.73%) is

accounted by fixed investment cost followed by pre operation cost (Birr 16.39 million or 9.02%)

and initial working capital (Birr 14.99 million or 8.25%). From the total investment cost Birr

110.75 million or 60.93% is required in foreign currency.

The project is financially viable with an internal rate of return (IRR) of 19.09% and a net present

value (NPV) of Birr 72.86 million discounted at 10%.

The project can create employment for 62 persons. The establishment of such factory will have a

foreign exchange saving effect to the country by substituting the current imports. The project

will also create forward linkage with the automotive, aviation, and manufacturing sub sectors

and also generates income for the Government in terms of tax revenue and payroll tax.

II. PRODUCT DESCRIPTION AND APPLICATION

A spring shock absorber is a mechanical device designed to smooth out or damp shock impulse, and

dissipate kinetic energy. The shock absorber absorbs and dissipates energy. One design

consideration, when designing or choosing a spring shock absorber, is where that energy will go. In

most dashpots, energy is converted to heat inside the viscous fluid. In hydraulic cylinders, the

187-3

hydraulic fluid heats up, while in air cylinders, the hot air is usually exhausted to the atmosphere. In

other types of dashpots, such as electromagnetic types, the dissipated energy can be stored and used

later. In general terms, shock absorbers help cushion vehicles on uneven roads.

Shock absorbers are an important part of automobile and motorcycle suspensions, aircraft

landing gear, and supports for many industrial machines. Large shock absorbers have also been

used in structural engineering to reduce the susceptibility of structures to earthquake damage and

resonance. A transverse mounted shock absorber, called a yaw damper, helps keep railcars from

swaying excessively from side to side and are important in passenger railroads, commuter rail

and rapid transit systems because they prevent railcars from damaging station platforms.

In a vehicle, shock absorbers reduce the effect of traveling over rough ground, leading to

improved ride quality and increase in comfort. While shock absorbers serve the purpose of

limiting excessive suspension movement, their intended sole purpose is to dampen spring

oscillations. Shock absorbers use valving of oil and gasses to absorb excess energy from the

springs. Spring rates are chosen by the manufacturer based on the weight of the vehicle, loaded

and unloaded.

Spring-based shock absorbers commonly use coil springs or leaf springs, though torsion bars are

used in torsional shocks as well.

III. MARKET STUDY AND PLANT CAPACITY

A. MARKET STUDY

1. Past supply and present Demand

The demand for shock absorbers is met through imports. However, there is an increasing

demand of the items due to continuous increase in road vehicles population. To estimate present

supply and effective demand for shock absorbers, data on import of the product from 2002 -

2011 is collected and analyzed (see Table 3.1).

187-4

Table 3.1

IMPORT OF SHOCK ABSORBERS (TON)

Year Quantity

2002 117

2003 157

2004 151

2005 169

2006 208

2007 219

2008 177

2009 186

2010 337

2011 178

Source: Ethiopian Revenue and Customs Authority

As can be seen from Table 3.1 during the period 2002-2011 the maximum import or total supply of

shock absorbers was 337 tons while the minimum was 117 tons in 2002. However during the period

under consideration the average total supply or apparent consumption was 190 tons. During the

same period apparent consumption of shock absorbers has registered an average annual growth rate

of 10%.

For estimating the present demand it is assumed that the average import during the recent three

years is a faire approximate. Accordingly, the present (2012) effective demand for shock absorbers

is estimated at 234 tons. Moreover, based on opinion of knowledgeable persons and observation of

the available vehicle types in the country the share of spring type shock absorbers from the total

estimated demand for shock absorbers is estimated at 60% of the total. Hence, the present demand

for spring type shock absorbers is estimated at 140 tons.

187-5

2. Demand Projection

The total number of inspected and registered vehicles in the country in 2000 was only 96,504. This

number has grown to 199,414 in 2010. During the period 2000 2010 the number of operational

vehicles has registered an average annual growth rate of 8.04%, accordingly, the future demand for

shock absorber is assumed to annually increase at the rate of 8%. (See Table 3.2)

Table 3.2

FORECASTED DEMAND FOR SPRING TYPE SHOCK ABSORBERS (TON)

Year Projected Demand

2013 151

2014 163

2015 177

2016 191

2017 206

2018 222

2019 240

2020 259

2021 280

2022 303

2023 327

2024 353

2025 381

3. Pricing and Distribution

The price of shock spring absorbers varies according to the type of vehicles. For the purpose of

financial analyses the current average retail price of Birr 400 per pieces is considered.

Accordingly, allowing 20% margin for wholesalers and retailers the recommended factory gate

price for the envisaged factory is Birr 333 per pieces.

187-6

Considering the nature of the products and the characteristics of the end users a combination

both direct distribution to end users (for bulk purchasers) and indirect distribution (using agents)

is selected as the most appropriate distribution channel.

B. PLANT CAPACITY AND PRODUCTION PROGRAMME

1. Plant Capacity

The size of shock spring absorbers varies according to the type of vehicles. But for the purpose

of this study, they are categorized in to small, medium and big size shock absorbers. Depending

on the demand forecast the plant capacity is proposed to be 300,000 pieces of shock absorbers.

Each size is produced in equal quantity.

2. Production Programme

Considering the time required to develop experience and to be acquainted with equipment,

production in year 1 of the project life is estimated to be maintained at 90% capacity utilization

and 100 % capacity utilization will be maintained during year 2 and thereafter of the project

period. Table 3.1 shows details of the production programme.

Table 3.1

PRODUCTION PROGRAMME

Product Unit Year 1 Year 2-10

Shock absorber

Small Size

Medium size

Big size

Pcs.

90,000

90,000

90,000

100,000

100,000

100,000

Total 270,000 300,000

187-7

IV. MATERIALS AND INPUTS

A. RAW MATERIALS

The major raw materials for the manufacture of spring shock absorbers are steel wire, steel plate

etc. Annual requirement of these materials at 100 % capacity utilization is given in Table 4.1.

Table 4.1

ANNUAL RAW MATERIAL REQUIREMENT AND COST

Materials and inputs

Unit of

Measure

Qty.

Cost ( in 000 Birr)

Total

FC LC

Steel plate tons 900 18,900 4,725 23,625

Steel wire 600 15,600 3,900 19,500

Grease 50 4,500 1,125 5,625

Total 39,000 9,750 48,750

B. UTILITIES

The major utility requirements of the plant are electricity and water. Annual cost is estimated at

Birr 2.84 million as indicated in Table 4.2

Table 4.2

ANNUAL UTILITY REQUIREMENTS

No Utility Unit Quantity Cost (Birr)

1 Electricity Kwh. 5,184,000 2,592,000

2 Water Meter cube 25,500 255,000

Total 2,847,000

187-8

V. TECHNOLOGY AND ENGINEERING

A. TECHNOLOGY

1. Production Process

The machining operation breaks down into the cylindrical bottom care of cast aluminum and fork

pipe as basic materials. The overall processes of spring shock absorber includes heat treatment of

the wire such as annealing and tempering, coiling and polishing work that is designed to prolong

its service life.

The assembly sector consists of the cleaning, painting and assembling conveyor lines, while the

inspection lines consists of damping force test, endurance test and other tests, making a steady

manufacturing work flow possible.

2. Environmental Impact

The production of steel tubes does not have any negative impact on the environment since the

process do not use any chemicals and the wastage, which is mainly steel scrap, can be recycled.

B. ENGINEERING

1. Machinery and Equipment

List of the required machinery and equipment is provided in Table 5.1. The total cost of

machinery and equipment is estimated at Birr 138,447,450 of which Birr 110,757,960 is

required in foreign currency.

187-9

Table 5.1

MACHINERY AND EQUIPMENT REQUIREMENTS AND COST

Sr. Description Qty.

No.

1. Welding machine 3

2. Automatic lair machine 1

3. Heat treatment furnaces 1 set

4. Polishing machine 1

5. Ultrasonic cleaning machine 1set

6. Painting shop equipment 1set

7. Baling shop equipment 1set

8. Assembly line equipment 1set

9. Sampling force tester 1set

10. Endurance tester 1set

11. Function tester 1set

12. Special tools 1set

2. Land, Building and Civil Works

A total site area of about 5,000 square meters will be required for the plant. The total built-up

area is estimated to be about 3,000 square meters. Of this area about 300 square meters is for

office complex. The unit cost for factory shed and store is Birr 3,500 and Birr 4,000 for office

complex. Therefore, the total cost of building will be Birr 10,650,000.

According to the Federal Legislation on the Lease Holding of Urban Land (Proclamation No

721/2004) in principle, urban land permit by lease is on auction or negotiation basis, however,

the time and condition of applying the proclamation shall be determined by the concerned

regional or city government depending on the level of development.

187-10

The legislation has also set the maximum on lease period and the payment of lease prices. The

lease period ranges from 99 years for education, cultural research health, sport, NGO , religious

and residential area to 80 years for industry and 70 years for trade while the lease payment

period ranges from 10 years to 60 years based on the towns grade and type of investment.

Moreover, advance payment of lease based on the type of investment ranges from 5% to

10%.The lease price is payable after the grace period annually. For those that pay the entire

amount of the lease will receive 0.5% discount from the total lease value and those that pay in

installments will be charged interest based on the prevailing interest rate of banks. Moreover,

based on the type of investment, two to seven years grace period shall also be provided.

However, the Federal Legislation on the Lease Holding of Urban Land apart from setting the

maximum has conferred on regional and city governments the power to issue regulations on the

exact terms based on the development level of each region.

In Addis Ababa, the Citys Land Administration and Development Authority is directly

responsible in dealing with matters concerning land. However, regarding the manufacturing

sector, industrial zone preparation is one of the strategic intervention measures adopted by the

City Administration for the promotion of the sector and all manufacturing projects are assumed

to be located in the developed industrial zones.

Regarding land allocation of industrial zones if the land requirement of the project is below

5,000 m

2

,

the land lease request is evaluated and decided upon by the Industrial Zone

Development and Coordination Committee of the Citys Investment Authority. However, if the

land request is above 5,000 m

2

, the request is evaluated by the Citys Investment Authority and

passed with recommendation to the Land Development and Administration Authority for

decision, while the lease price is the same for both cases.

Moreover, the Addis Ababa City Administration has recently adopted a new land lease floor

price for plots in the city. The new prices will be used as a benchmark for plots that are going to

187-11

be auctioned by the city government or transferred under the new Urban Lands Lease Holding

Proclamation.

The new regulation classified the city into three zones. The first Zone is Central Market District

Zone, which is classified in five levels and the floor land lease price ranges from Birr 1,686 to

Birr 894 per m

2

. The rate for Central Market District Zone will be applicable in most areas of the

city that are considered to be main business areas that entertain high level of business activities.

The second zone, Transitional Zone, will also have five levels and the floor land lease price

ranges from Birr 1,035 to Birr 555 per m

2

. This zone includes places that are surrounding the city

and are occupied by mainly residential units and industries.

The last and the third zone, Expansion Zone, is classified into four levels and covers areas that

are considered to be in the outskirts of the city, where the city is expected to expand in the future.

The floor land lease price in the Expansion Zone ranges from Birr 355 to Birr 191 per m

2

(see

Table 5.2).

Table 5.2

NEW LAND LEASE FLOOR PRICE FOR PLOTS IN ADDIS ABABA

Zone Level Floor price/m

2

Central Market

District

1

st

1686

2

nd

1535

3

rd

1323

4

th

1085

5

th

894

Transitional zone

1

st

1035

2

nd

935

3

rd

809

4

th

685

5

th

555

Expansion zone

1

st

355

2

nd

299

3

rd

217

4

th

191

187-12

Accordingly, in order to estimate the land lease cost of the project profiles it is assumed that all

new manufacturing projects will be located in industrial zones located in expansion zones.

Therefore, for the profile a land lease rate of Birr 266 per m

2

,

which is equivalent to the average

floor price of plots located in expansion zone, is adopted.

On the other hand, some of the investment incentives arranged by the Addis Ababa City

Administration on lease payment for industrial projects are granting longer grace period and

extending the lease payment period. The criterions are creation of job opportunity, foreign

exchange saving, investment capital and land utilization tendency etc. Accordingly, Table 5.3

shows incentives for lease payment.

Table 5.3

INCENTIVES FOR LEASE PAYMENT OF INDUSTRIAL PROJECTS

Scored point

Grace

period

Payment

Completion

Period

Down

Payment

Above 75% 5 Years 30 Years 10%

From 50 - 75% 5 Years 28 Years 10%

From 25 - 49% 4 Years 25 Years 10%

For the purpose of this project profile the average i.e. five years grace period, 28 years payment

completion period and 10% down payment is used. The land lease period for industry is 60

years.

Accordingly, the total land lease cost at a rate of Birr 266 per m

2

is estimated at Birr 1,330,000 of

which 10% or Birr 133,000 will be paid in advance. The remaining Birr 1,197,000 will be paid in

equal installments with in 28 years i.e. Birr 42,750 annually.

187-13

VI. HUMAN RESOURCE AND TRAINING REQUIREMENTS

A. HUMAN RESOURCE REQUIREMENT

The total human resource for the plant is estimated to be about 62 persons the human resource

requirement along with monthly and annual salaries is provided in table 6.1.

Table 6.1

HUMAN RESOURCE REQUIREMENT & LABOUR COST

Sr.

No.

Job Position Req.

No.

Salary per

Month

Salary per

Year

1.

2.

3.

4.

5.

6.

A. Production

Manger

Production and maintenance

supervisor

Production clerk

Operator

Mechanic

Labour

1

3

1

36

6

6

6,000

13,500

1,250

48,600

15,000

5,100

72,000

162,000

15,000

583,200

180,000

61,200

1.

2.

3.

4.

5.

6.

7.

8.

B. Others

Stores, Finance ,administration

and sales head

Salesman

Secretary

Cashier/ clerk

Store clerk

Security guard

Messenger/ cleaner

Driver

1

1

1

1

1

2

1

1

5,500

2,500

2,500

2,500

1,350

1,700

750

1,250

66,000

30,000

30,000

30,000

16,200

20,400

9,000

15,000

Total 62 107,500 1,290,000

187-14

B. TRAINING REQUIREMENT

All operators need basic training so that they can be acquainted to the operation. This can be

done during the commissioning period of the plant. The cost of such training is estimated at Birr

150,000.

VII. FINANCIAL ANALYSIS

The financial analysis of the shock absorber spring project is based on the data presented in the

previous chapters and the following assumptions:-

Construction period 1 year

Source of finance 30 % equity and 70% loan

Tax holidays 3 years

Bank interest 10%

Discount cash flow 10%

Accounts receivable 30 days

Raw material imported 120 days

Work in progress 1 day

Finished products 30 days

Cash in hand 5 days

Accounts payable 30 days

Repair and maintenance 5% of machinery cost

A. TOTAL INITIAL INVESTMENT COST

The total investment cost of the project including working capital is estimated at Birr 181.77

million (See Table 7.1). From the total investment cost the highest share (Birr 150.38 million or

82.73%) is accounted by fixed investment cost followed by pre operation cost (Birr 16.39 million

or 9.02%) and initial working capital (Birr 14.99 million or 8.25%). From the total investment

cost Birr 110.75 million or 60.93% is required in foreign currency.

187-15

Table 7.1

INITIAL INVESTMENT COST ( 000 Birr)

Sr. No Cost Items

Local

Cost

Foreign

Cost

Total

Cost

%

Share

1 Fixed investment

1.1 Land Lease 133.00

133.00 0.07

1.2 Building and civil work 10,650.00

10,650.00 5.86

1.3 Machinery and equipment 27,689.49 110,757.96 138,447.45 76.16

1.4 Vehicles 900.00

900.00 0.50

1.5 Office furniture and equipment 250.00

250.00 0.14

Sub total 39,622.49 110,757.96 150,380.45 82.73

2 Pre operating cost *

2.1 Pre operating cost 4,503.42

4,503.42 2.48

2.2 Interest during construction 11,891.76

11,891.76 6.54

Sub total 16,395.18

16,395.18 9.02

3 Working capital ** 14,998.37

14,998.37 8.25

Grand Total 71,016.03 110,757.96 181,773.99 100

* N.B Pre operating cost include project implementation cost such as installation, startup,

commissioning, project engineering, project management etc and capitalized interest during

construction.

** The total working capital required at full capacity operation is Birr 16.66 million. However,

only the initial working capital of Birr 14.99 million during the first year of production is

assumed to be funded through external sources. During the remaining years the working

capital requirement will be financed by funds to be generated internally (for detail working

capital requirement see Appendix 7.A.1).

B. PRODUCTION COST

The annual production cost at full operation capacity is estimated at Birr 100.41 million (see

Table 7.2). The cost of raw material account for 48.55% of the production cost. The other major

components of the production cost are depreciation, financial cost and repair and maintenance

which account for 29.10%, 13.03% and 4.14% respectively. The remaining 5.19% is the share of

direct labour, cost of marketing and distribution, labour overhead and administration cost. For

detail production cost see Appendix 7.A.2.

187-16

Table 7.2

ANNUAL PRODUCTION COST AT FULL CAPACITY (year two)

Items Cost

(000 Birr)

%

Raw Material and Inputs

48,750.00 48.55

Utilities

2,847.00 2.84

Maintenance and repair

4,153.00 4.14

Labour direct

1,290.00 1.28

Labour overheads

323.00 0.32

Administration Costs

250.00 0.25

Land lease cost

- -

Cost of marketing and distribution

500.00 0.50

Total Operating Costs

58,113.00 57.87

Depreciation

29,221.17 29.10

Cost of Finance

13,080.93 13.03

Total Production Cost

100,415.11 100

C. FINANCIAL EVALUATION

1. Profitability

Based on the projected profit and loss statement, the project will generate a profit through out its

operation life. Annual net profit after tax will grow from Birr 685 thousand to Birr 29.74 million

during the life of the project. Moreover, at the end of the project life the accumulated net cash

flow amounts to Birr 207.31 million. For profit and loss statement and cash flow projection see

Appendix 7.A.3 and 7.A.4, respectively.

2. Ratios

In financial analysis financial ratios and efficiency ratios are used as an index or yardstick for

evaluating the financial position of a firm. It is also an indicator for the strength and weakness of

the firm or a project. Using the year-end balance sheet figures and other relevant data, the most

187-17

important ratios such as return on sales which is computed by dividing net income by revenue,

return on assets (operating income divided by assets), return on equity (net profit divided by

equity) and return on total investment (net profit plus interest divided by total investment) has

been carried out over the period of the project life and all the results are found to be satisfactory.

3. Break-even Analysis

The break-even analysis establishes a relationship between operation costs and revenues. It

indicates the level at which costs and revenue are in equilibrium. To this end, the break-even

point for capacity utilization and sales value estimated by using income statement projection are

computed as followed.

Break Even Sales Value = Fixed Cost + Financial Cost = Birr 69,096,757

Variable Margin ratio (%)

Break Even Capacity utilization = Break even Sales Value X 100 = 68%

Sales revenue

4. Pay-back Period

The pay- back period, also called pay off period is defined as the period required for recovering

the original investment outlay through the accumulated net cash flows earned by the project.

Accordingly, based on the projected cash flow it is estimated that the projects initial investment

will be fully recovered within 5 years.

5. Internal Rate of Return

The internal rate of return (IRR) is the annualized effective compounded return rate that can be

earned on the invested capital, i.e., the yield on the investment. Put another way, the internal rate

of return for an investment is the discount rate that makes the net present value of the

investment's income stream total to zero. It is an indicator of the efficiency or quality of an

investment. A project is a good investment proposition if its IRR is greater than the rate of return

187-18

that could be earned by alternate investments or putting the money in a bank account.

Accordingly, the IRR of this project is computed to be 19.09% indicating the viability of the

project.

6. Net Present Value

Net present value (NPV) is defined as the total present (discounted) value of a time series of cash

flows. NPV aggregates cash flows that occur during different periods of time during the life of a

project in to a common measuring unit i.e. present value. It is a standard method for using the

time value of money to appraise long-term projects. NPV is an indicator of how much value an

investment or project adds to the capital invested. In principal a project is accepted if the NPV is

non-negative.

Accordingly, the net present value of the project at 10% discount rate is found to be Birr 72.86

million which is acceptable. For detail discounted cash flow see Appendix 7.A.5.

D. ECONOMIC AND SOCIAL BENEFITS

The project can create employment for 62 persons. The project will generate Birr 61.68 million

in terms of tax revenue. The establishment of such factory will have a foreign exchange saving

effect to the country by substituting the current imports. The project will also create forward

linkage with the automotive and aviation sub sectors generate other income for the government.

187-19

Appendix 7.A

FINANCIAL ANALYSES SUPPORTING TABLES

187-20

Appendix 7.A.1

NET WORKING CAPITAL ( in 000 Birr)

Items Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

Total inventory 10,968.75 12,187.50 12,187.50 12,187.50 12,187.50 12,187.50 12,187.50 12,187.50 12,187.50 12,187.50

Accounts receivable 4,362.64 4,842.75 4,842.75 4,842.75 4,846.31 4,846.31 4,846.31 4,846.31 4,846.31 4,846.31

Cash-in-hand 75.20 83.56 83.56 83.56 84.15 84.15 84.15 84.15 84.15 84.15

CURRENT ASSETS 15,406.59 17,113.81 17,113.81 17,113.81 17,117.96 17,117.96 17,117.96 17,117.96 17,117.96 17,117.96

Accounts payable 408.23 453.58 453.58 453.58 453.58 453.58 453.58 453.58 453.58 453.58

CURRENT

LIABILITIES 408.23 453.58 453.58 453.58 453.58 453.58 453.58 453.58 453.58 453.58

TOTAL WORKING

CAPITAL 14,998.37 16,660.22 16,660.22 16,660.22 16,664.38 16,664.38 16,664.38 16,664.38 16,664.38 16,664.38

187-21

Appendix 7.A.2

PRODUCTION COST ( in 000 Birr)

Item Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11

Raw Material and Inputs 43,875 48,750 48,750 48,750 48,750 48,750 48,750 48,750 48,750 48,750

Utilities 2,562 2,847 2,847 2,847 2,847 2,847 2,847 2,847 2,847 2,847

Maintenance and repair 3,738 4,153 4,153 4,153 4,153 4,153 4,153 4,153 4,153 4,153

Labour direct 1,161 1,290 1,290 1,290 1,290 1,290 1,290 1,290 1,290 1,290

Labour overheads 291 323 323 323 323 323 323 323 323 323

Administration Costs 225 250 250 250 250 250 250 250 250 250

Land lease cost 0 0 0 0 43 43 43 43 43 43

Cost of marketing

and distribution 500 500 500 500 500 500 500 500 500 500

Total Operating Costs 52,352 58,113 58,113 58,113 58,156 58,156 58,156 58,156 58,156 58,156

Depreciation 29,221 29,221 29,221 29,221 29,221 451 451 451 451 451

Cost of Finance 0 13,081 11,446 9,811 8,176 6,540 4,905 3,270 1,635 0

Total Production Cost 81,573 100,415 98,780 97,145 95,553 65,147 63,512 61,877 60,242 58,607

187-22

Appendix 7.A.3

INCOME STATEMENT ( in 000 Birr)

Item

Year

2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9

Year

10 Year 11

Sales revenue 90,990 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100

Less variable costs 51,852 57,613 57,613 57,613 57,613 57,613 57,613 57,613 57,613 57,613

VARIABLE MARGIN 39,138 43,487 43,487 43,487 43,487 43,487 43,487 43,487 43,487 43,487

in % of sales revenue 43.01 43.01 43.01 43.01 43.01 43.01 43.01 43.01 43.01 43.01

Less fixed costs 29,721 29,721 29,721 29,721 29,764 994 994 994 994 994

OPERATIONAL

MARGIN 9,417 13,766 13,766 13,766 13,723 42,493 42,493 42,493 42,493 42,493

in % of sales revenue 10.35 13.62 13.62 13.62 13.57 42.03 42.03 42.03 42.03 42.03

Financial costs 13,081 11,446 9,811 8,176 6,540 4,905 3,270 1,635 0

GROSS PROFIT 9,417 685 2,320 3,955 5,547 35,953 37,588 39,223 40,858 42,493

in % of sales revenue 10.35 0.68 2.29 3.91 5.49 35.56 37.18 38.80 40.41 42.03

Income (corporate) tax 0 0 0 1,187 1,664 10,786 11,276 11,767 12,257 12,748

NET PROFIT 9,417 685 2,320 2,769 3,883 25,167 26,312 27,456 28,601 29,745

in % of sales revenue 10.35 0.68 2.29 2.74 3.84 24.89 26.03 27.16 28.29 29.42

187-23

Appendix 7.A.4

CASH FLOW FOR FINANCIAL MANAGEMENT ( in 000 Birr)

Item Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Scrap

TOTAL CASH

INFLOW 154,884 118,288 101,145 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 35,079

Inflow funds 154,884 27,298 45 0 0 0 0 0 0 0 0 0

Inflow operation 0 90,990 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 0

Other income 0 0 0 0 0 0 0 0 0 0 0 35,079

TOTAL CASH

OUTFLOW 154,884 79,650 89,252 85,910 85,461 84,351 91,833 90,689 89,544 88,399 70,904 0

Increase in fixed

assets 154,884 0 0 0 0 0 0 0 0 0 0 0

Increase in current

assets 0 15,407 1,707 0 0 4 0 0 0 0 0 0

Operating costs 0 51,852 57,613 57,613 57,613 57,656 57,656 57,656 57,656 57,656 57,656 0

Marketing and

Distribution cost 0 500 500 500 500 500 500 500 500 500 500 0

Income tax 0 0 0 0 1,187 1,664 10,786 11,276 11,767 12,257 12,748 0

Financial costs 0 11,892 13,081 11,446 9,811 8,176 6,540 4,905 3,270 1,635 0 0

Loan repayment 0 0 16,351 16,351 16,351 16,351 16,351 16,351 16,351 16,351 0 0

SURPLUS

(DEFICIT) 0 38,638 11,893 15,190 15,639 16,749 9,267 10,411 11,556 12,701 30,196 35,079

CUMULATIVE

CASH

BALANCE 0 38,638 50,531 65,721 81,360 98,109 107,376 117,787 129,343 142,044 172,240 207,319

187-24

Appendix 7.A.5

DISCOUNTED CASH FLOW ( in 000 Birr)

Item Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9

Year

10

Year

11 Scrap

TOTAL CASH INFLOW 0 90,990 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 35,079

Inflow operation 0 90,990 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 101,100 0

Other income 0 0 0 0 0 0 0 0 0 0 0 35,079

TOTAL CASH OUTFLOW 169,882 54,014 58,113 58,113 59,304 59,820 68,942 69,432 69,923 70,413 70,904 0

Increase in fixed assets 154,884 0 0 0 0 0 0 0 0 0 0 0

Increase in net working capital 14,998 1,662 0 0 4 0 0 0 0 0 0 0

Operating costs 0 51,852 57,613 57,613 57,613 57,656 57,656 57,656 57,656 57,656 57,656 0

Marketing and Distribution

cost 0 500 500 500 500 500 500 500 500 500 500 0

Income (corporate) tax 0 0 0 1,187 1,664 10,786 11,276 11,767 12,257 12,748 0

NET CASH FLOW -169,882 36,976 42,987 42,987 41,796 41,280 32,158 31,668 31,177 30,687 30,196 35,079

CUMULATIVE NET CASH

FLOW -169,882 -132,906 -89,919 -46,932 -5,135 36,145 68,303 99,971 131,148 161,835 192,031 227,110

Net present value -169,882 33,615 35,526 32,297 28,547 25,632 18,153 16,251 14,544 13,014 11,642 13,525

Cumulative net present value -169,882 -136,267 -100,741 -68,444 -39,897 -14,265 3,888 20,138 34,683 47,697 59,339 72,863

NET PRESENT VALUE 72,863

INTERNAL RATE OF

RETURN 19.09%

NORMAL PAYBACK 5 years

187-25

You might also like

- Soap Making BusinessDocument8 pagesSoap Making Businessak123456100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Equipment Rental Business PlanDocument1 pageEquipment Rental Business Plansolomon50% (2)

- Investment Advisory Business Plan TemplateDocument22 pagesInvestment Advisory Business Plan TemplatesolomonNo ratings yet

- Spring and CoilsDocument25 pagesSpring and CoilsLuis ZambranoNo ratings yet

- Corrected Business Plan ReportDocument45 pagesCorrected Business Plan ReportJeorge PaxNo ratings yet

- Study Id68387 Two and Three Wheelers in IndiaDocument37 pagesStudy Id68387 Two and Three Wheelers in IndiaSARANSH NAUGRAIYANo ratings yet

- Bikes SpecificationsDocument2 pagesBikes Specificationssuresh_gs9999100% (1)

- Philippine Manpower and Equipment Productivity RatioDocument4 pagesPhilippine Manpower and Equipment Productivity RatioMaricel Santos AdNo ratings yet

- Competency MappingDocument32 pagesCompetency MappingShallu AggarwalNo ratings yet

- BiscuitDocument27 pagesBiscuitPrabin MedhiNo ratings yet

- Business Plan - A TeahouseDocument6 pagesBusiness Plan - A TeahouseJoe DNo ratings yet

- NARC Garli G1 PresentationDocument17 pagesNARC Garli G1 PresentationJF 17No ratings yet

- Portfolio Performance EvaluationDocument28 pagesPortfolio Performance Evaluationleolau2015No ratings yet

- SMEDA Light Weight Roof Tiles Manufacturing UnitDocument23 pagesSMEDA Light Weight Roof Tiles Manufacturing UnitMuhammad AbubakarNo ratings yet

- Cpar M2Document64 pagesCpar M2Allan AñonuevoNo ratings yet

- Project Proposal On The Production of Industrial Adhesive Feasibility Study - Business Plan in Ethiopia PDFDocument1 pageProject Proposal On The Production of Industrial Adhesive Feasibility Study - Business Plan in Ethiopia PDFSulemanNo ratings yet

- Penerapan Algoritma First Come First Served Dalam Menentukan Penyewaan Lapangan Futsal Berbasis WebDocument9 pagesPenerapan Algoritma First Come First Served Dalam Menentukan Penyewaan Lapangan Futsal Berbasis WebJurnal JTIK (Jurnal Teknologi Informasi dan Komunikasi)No ratings yet

- Italy Campaign History (1942)Document32 pagesItaly Campaign History (1942)CAP History Library100% (1)

- Profile On Production of Socks & StockingDocument17 pagesProfile On Production of Socks & Stockinggetachew liger100% (1)

- IHS Automotive Global Sales OutlookDocument21 pagesIHS Automotive Global Sales OutlookDetroit Free PressNo ratings yet

- CGAP Occasional Paper Cost Allocation For Multi Service Microfinance Institutions Apr 1998Document28 pagesCGAP Occasional Paper Cost Allocation For Multi Service Microfinance Institutions Apr 1998Henok mekuriaNo ratings yet

- Construction IndustryDocument7 pagesConstruction IndustryVishal RastogiNo ratings yet

- Profile On The Production of Mosaic TilesDocument26 pagesProfile On The Production of Mosaic TilesabateNo ratings yet

- Bajaj Auto CaseDocument35 pagesBajaj Auto CaserhumblineNo ratings yet

- TERM - REPORT - FINAL-Kerry LogisticsDocument32 pagesTERM - REPORT - FINAL-Kerry Logisticsshahrukh AliyaNo ratings yet

- Project Profile On Tyre RetreadingDocument5 pagesProject Profile On Tyre RetreadingBinu Balakrishnan100% (2)

- Coastal Transport Corporation ProfileDocument10 pagesCoastal Transport Corporation ProfileSHAHARA ZAID MOLLERNo ratings yet

- AFM (GROUP - D) Case AssignmentDocument9 pagesAFM (GROUP - D) Case AssignmentSangeetha K SNo ratings yet

- Silica Sand Promotion Document Final2Document18 pagesSilica Sand Promotion Document Final2yonathan tsegayeNo ratings yet

- Raw Materials For Socks Making BusinessDocument7 pagesRaw Materials For Socks Making BusinessNajiya shakiraNo ratings yet

- Automotive Assembling AemroDocument41 pagesAutomotive Assembling AemroTesfaye Degefa100% (1)

- Preamble: Foton Power Trucks Which Shall Be Deployed in Logistics/freight Services. ToDocument15 pagesPreamble: Foton Power Trucks Which Shall Be Deployed in Logistics/freight Services. Togonfe dhunfaNo ratings yet

- Dairy FarmDocument18 pagesDairy FarmSohaib KhanNo ratings yet

- INLAND PORT PROJECT FinalDocument16 pagesINLAND PORT PROJECT FinalJonathan Williams100% (3)

- Agriculture Equipment Manufacturing Business Plan (Sample Template For 2022)Document2 pagesAgriculture Equipment Manufacturing Business Plan (Sample Template For 2022)Kassim FiteNo ratings yet

- Pre-Feasibility Study: (Stone Crushing)Document22 pagesPre-Feasibility Study: (Stone Crushing)Kassa Hailu0% (1)

- Auto Assembleing Indirsi FinalDocument39 pagesAuto Assembleing Indirsi FinalTesfaye DegefaNo ratings yet

- Price List For GabrielDocument5 pagesPrice List For GabrielVarun SharmaNo ratings yet

- The Crane Sales ProspectusDocument27 pagesThe Crane Sales ProspectusRyan Briggs100% (2)

- 2013 Final AMPDocument194 pages2013 Final AMPDereje AberaNo ratings yet

- Automobile Car Industry ProposalDocument6 pagesAutomobile Car Industry Proposalsavaliyamahesh100% (1)

- System DevelopmentDocument20 pagesSystem Developmentabel_kayelNo ratings yet

- Ethiopia CementupdatesDocument6 pagesEthiopia CementupdatessisaydiscoNo ratings yet

- Coffee Supply Chain Planning Under Climate ChangeDocument16 pagesCoffee Supply Chain Planning Under Climate Changerusman714No ratings yet

- PPRC Pipes Manufacturing UnitDocument18 pagesPPRC Pipes Manufacturing UnitFaran ShahidNo ratings yet

- Detailed Project Report For Setting Up EV Assembly Facility: Back GroundDocument8 pagesDetailed Project Report For Setting Up EV Assembly Facility: Back GroundSaurav MitraNo ratings yet

- Tesfaye CorectttDocument4 pagesTesfaye CorectttTesfaye DegefaNo ratings yet

- Maneklal and Sons (Exports) : H S A W N M MDocument3 pagesManeklal and Sons (Exports) : H S A W N M MhattaliNo ratings yet

- Federal Republic of Nigeria Official Gazette: No. 67 21 December 1992 Vol. 79Document17 pagesFederal Republic of Nigeria Official Gazette: No. 67 21 December 1992 Vol. 79chijiblazeNo ratings yet

- 2836 - SR - Proposed Development of A Marble and Granite Mine - Quarry by Tipton InvestmentsDocument108 pages2836 - SR - Proposed Development of A Marble and Granite Mine - Quarry by Tipton InvestmentsYared AlazarNo ratings yet

- Domestic LPG Stove PDFDocument11 pagesDomestic LPG Stove PDFRizal DeriNo ratings yet

- 171.concrete Batching PlantDocument23 pages171.concrete Batching Plantabel_kayelNo ratings yet

- Baby FoodDocument48 pagesBaby FoodTesfaye DegefaNo ratings yet

- Project Report Palouge-2 - SudanDocument17 pagesProject Report Palouge-2 - SudanAmmara AliNo ratings yet

- Supriya Corn Products Project ReportDocument13 pagesSupriya Corn Products Project ReportRahul RankaNo ratings yet

- Shahzabeen Irsa Latif Tayyab MazharDocument29 pagesShahzabeen Irsa Latif Tayyab MazharErsa LatifNo ratings yet

- Tractor Case StudyDocument24 pagesTractor Case StudyMazen BackupNo ratings yet

- Full ProjectDocument58 pagesFull ProjectKing KrishNo ratings yet

- Attachment 3 - Cost ScheduleDocument5 pagesAttachment 3 - Cost ScheduleJoel Koma EmesangeNo ratings yet

- Strategy - Toyota ND Ford - FinalDocument20 pagesStrategy - Toyota ND Ford - FinalNikita AgarwalNo ratings yet

- Industrial Ethernet Planning and Installation GuideDocument63 pagesIndustrial Ethernet Planning and Installation GuideEdward Napanga ZentenoNo ratings yet

- GAZ 2014 Catalogue IssueDocument20 pagesGAZ 2014 Catalogue IssueMauricio Xavier OjedaNo ratings yet

- Precision Turned Products World Summary: Market Values & Financials by CountryFrom EverandPrecision Turned Products World Summary: Market Values & Financials by CountryNo ratings yet

- Desk Break LiningDocument15 pagesDesk Break Liningbig johnNo ratings yet

- Shock Absorber (Hydraulic) FinalDocument27 pagesShock Absorber (Hydraulic) FinalRobel KefelewNo ratings yet

- Profile On RivetsDocument18 pagesProfile On RivetsElnathan SamsonNo ratings yet

- Inner Tubes and Outer TiresDocument28 pagesInner Tubes and Outer TiresRobel KefelewNo ratings yet

- Car BatteryDocument29 pagesCar BatteryRobel KefelewNo ratings yet

- Making Soil Block PDFDocument55 pagesMaking Soil Block PDFak123456No ratings yet

- EC Council Product Job Role SheetDocument1 pageEC Council Product Job Role Sheetak123456No ratings yet

- Medical Waste IncineratorDocument2 pagesMedical Waste Incineratorak123456No ratings yet

- Compressed Soil BlocksDocument2 pagesCompressed Soil Blocksak123456No ratings yet

- Ethiopia Province MapDocument1 pageEthiopia Province Mapak123456No ratings yet

- Vitamin D Larut AirDocument21 pagesVitamin D Larut AirCatherineYavonitaPutriEzafganismeNo ratings yet

- TOS-GRADE-10 4th QuarterDocument2 pagesTOS-GRADE-10 4th QuarterAngela RuleteNo ratings yet

- 5ОМ англ ВОП 1Document22 pages5ОМ англ ВОП 1p69b24hy8pNo ratings yet

- Introduction To Machine Learning PDFDocument17 pagesIntroduction To Machine Learning PDFMoTech100% (1)

- Cast Application Form 2023Document1 pageCast Application Form 2023arvin supanNo ratings yet

- Upside Down Pineapple Cake Parsi Style by Tanaz Daruwalla Medhora - Bawi BrideDocument2 pagesUpside Down Pineapple Cake Parsi Style by Tanaz Daruwalla Medhora - Bawi BridefatduckNo ratings yet

- Lista Verbelor NeregulateDocument77 pagesLista Verbelor NeregulateHilda ClevelandNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)prateekNo ratings yet

- Biology 11 00381 v2Document11 pagesBiology 11 00381 v2paolaNo ratings yet

- BSC Iiyr IV Sem Dbms Total NotesDocument110 pagesBSC Iiyr IV Sem Dbms Total NotesVistasNo ratings yet

- February 14, 2020Document20 pagesFebruary 14, 2020Anonymous KMKk9Msn5No ratings yet

- The 10 Essential Elements of PaintingDocument5 pagesThe 10 Essential Elements of PaintingRiza Jean HitiayonNo ratings yet

- FAQ Partitions and Isolation Groups in SAP CPS by RedwoodDocument2 pagesFAQ Partitions and Isolation Groups in SAP CPS by Redwoodshashidhar thummaNo ratings yet

- Material Downloaded From - 1 / 4Document4 pagesMaterial Downloaded From - 1 / 4NihalSoniNo ratings yet

- Technical Manual 50UB-2014Document41 pagesTechnical Manual 50UB-2014SHNODANo ratings yet

- Verbal Tests: Inserting of Missing LetterDocument4 pagesVerbal Tests: Inserting of Missing LetterSarmad MalikNo ratings yet

- Activity 7: Writing A Business PlanDocument5 pagesActivity 7: Writing A Business PlanDIVYANSHI PHOTO STATENo ratings yet

- Porplastic Race Ep CourtDocument2 pagesPorplastic Race Ep CourtPratista HighlanderNo ratings yet

- Wind Effects PDFDocument17 pagesWind Effects PDFVivekCivilNo ratings yet

- MA1 First Test UpdatedDocument14 pagesMA1 First Test UpdatedHammad KhanNo ratings yet

- 4.1 Murphy Fuel ValveDocument5 pages4.1 Murphy Fuel ValveCARLOS SARMIENTONo ratings yet

- Perbandingan Respon Hemodinamik 3 Menit Dan 5 Menit Setelah Pemberian Fentanyl 2 MCG/KGBB IV Saat Intubasi Di RSUD DR Saiful Anwar MalangDocument10 pagesPerbandingan Respon Hemodinamik 3 Menit Dan 5 Menit Setelah Pemberian Fentanyl 2 MCG/KGBB IV Saat Intubasi Di RSUD DR Saiful Anwar MalangTigi HereNo ratings yet

- ET420 ET 420 Ice Stores in RefrigerationDocument2 pagesET420 ET 420 Ice Stores in RefrigerationMijhael Anatholi Romero MamaniNo ratings yet