Professional Documents

Culture Documents

TX2 Advanced Personal and Corporate Taxation Assignment 2 Hints 2011

Uploaded by

Ashley Wang0 ratings0% found this document useful (0 votes)

29 views1 pageThis document provides hints for an assignment on personal and corporate taxation in Texas. It addresses three parts of the assignment:

1) Part 1 involves 18 marks and directs the student to specific paragraphs and subsections in the tax code to answer questions about deemed dividends, capital dividends, and other tax issues.

2) Part 2 involves 16 marks for a letter to the Canada Revenue Agency describing requests made and transactions at issue, including relevant tax consequences. 3 marks are for presentation, spelling, grammar and professionalism.

3) Part 3 involves 16 marks for calculations regarding a deemed dividend and share exchange, directing the student to specific subsections and definitions for the calculations.

Original Description:

cga tx2

Original Title

tx2_mod3_handout1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides hints for an assignment on personal and corporate taxation in Texas. It addresses three parts of the assignment:

1) Part 1 involves 18 marks and directs the student to specific paragraphs and subsections in the tax code to answer questions about deemed dividends, capital dividends, and other tax issues.

2) Part 2 involves 16 marks for a letter to the Canada Revenue Agency describing requests made and transactions at issue, including relevant tax consequences. 3 marks are for presentation, spelling, grammar and professionalism.

3) Part 3 involves 16 marks for calculations regarding a deemed dividend and share exchange, directing the student to specific subsections and definitions for the calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views1 pageTX2 Advanced Personal and Corporate Taxation Assignment 2 Hints 2011

Uploaded by

Ashley WangThis document provides hints for an assignment on personal and corporate taxation in Texas. It addresses three parts of the assignment:

1) Part 1 involves 18 marks and directs the student to specific paragraphs and subsections in the tax code to answer questions about deemed dividends, capital dividends, and other tax issues.

2) Part 2 involves 16 marks for a letter to the Canada Revenue Agency describing requests made and transactions at issue, including relevant tax consequences. 3 marks are for presentation, spelling, grammar and professionalism.

3) Part 3 involves 16 marks for calculations regarding a deemed dividend and share exchange, directing the student to specific subsections and definitions for the calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

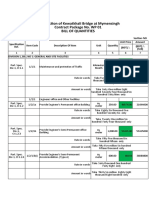

Nancy Swan

TX2 Advanced Personal and Corporate Taxation

Assignment 2 Hints 2011

1) 18 marks

A) See paragraphs 84.1(1)(b) and 84.1(2)(a.1).B) See subsection 89(1)

B) See paragraph 212.1(1)(a)

D) See subsection 86(2)

E) This is a share exchange: subsection 85.1(1) applies, paragraph for NSC?

F) See subsections 84(3), 55(2)

I) See subsection 87(4), especially paragraph (?).

2) 16 marks

Part a) The content, presentation, and style of the letter may vary from one

individual to another. However, you should include a description of the requests

made by CRA, details of the transactions, comments on the tax consequences of

the transactions.

3 marks are allocated for presentation (letter format), spelling, grammar, and

professionalism in written

communication (clarity, logical order).

3) 16 marks

Part a)

Deemed dividend [84.1(1)(b)]

(A + D) (E + F) F=$550,000

Subsection 85(2.1)

(A - B) x C / A

Where

A = increase in the PUC of all the shares of the capital stock of the corporation

B = agreed amount in excess of the FMV of the non-share consideration

C = increase in the PUC of the particular class of shares received in

consideration of the rollover = $550,000

Part b)

the provisions of subsection 84.1(1), the

non-share consideration cannot exceed the greater of the ACB or the PUC of the

shares

5) 23 marks

CDA = $184,500

You might also like

- TX2 Advanced Personal and Corporate Taxation Assignment 1 Hints 2011Document1 pageTX2 Advanced Personal and Corporate Taxation Assignment 1 Hints 2011Ashley WangNo ratings yet

- Advanced Personal and Corporate Taxation Assignment 3 Hints Question 1 (10 Marks)Document1 pageAdvanced Personal and Corporate Taxation Assignment 3 Hints Question 1 (10 Marks)Ashley WangNo ratings yet

- 1 - EBA STEP2 SCT Interface Specifications v20111121 - Updated 20110606 CleanDocument154 pages1 - EBA STEP2 SCT Interface Specifications v20111121 - Updated 20110606 CleanMarco Di Biase50% (2)

- SB Advisory On Reward STR Scheme ChangesDocument2 pagesSB Advisory On Reward STR Scheme ChangesGirish SakhalkarNo ratings yet

- Sample Questions Chapter 2Document1 pageSample Questions Chapter 2Jose Francisco Alonso MartinezNo ratings yet

- Marc of QualityDocument152 pagesMarc of Qualityrscore1No ratings yet

- Chapter 08Document19 pagesChapter 08Galih Astiansha PutraNo ratings yet

- 111-2 Microprocessor - Assignment 1Document2 pages111-2 Microprocessor - Assignment 1blackNo ratings yet

- CSEC It Theory Jun 20005Document11 pagesCSEC It Theory Jun 20005Ronaldo DegazonNo ratings yet

- DDA EC3 RegularDocument4 pagesDDA EC3 Regularsetija7490No ratings yet

- Economics: October/November Session 2001Document4 pagesEconomics: October/November Session 2001kutsofatsoNo ratings yet

- Art KG-2Document1 pageArt KG-2Aldeline SungahidNo ratings yet

- Form 8582Document3 pagesForm 8582Mira HuNo ratings yet

- Adib Damara Satria 2101808446 MM Business of Management - Excersise Season 2Document3 pagesAdib Damara Satria 2101808446 MM Business of Management - Excersise Season 2Adelua HutaraNo ratings yet

- BILL OF QUANTITIES For Bypass & Ramp Bridges Revised (Recovered) 2Document33 pagesBILL OF QUANTITIES For Bypass & Ramp Bridges Revised (Recovered) 2abdullah rahmanNo ratings yet

- Compiler DesignDocument23 pagesCompiler Design21bcs003No ratings yet

- 810 InvoiceDocument24 pages810 InvoiceJoseph Demastrie100% (1)

- Adib Damara Satria 2101808446 MM Business of Management - Exercise Season 2Document3 pagesAdib Damara Satria 2101808446 MM Business of Management - Exercise Season 2Adelua HutaraNo ratings yet

- Economics P1 Nov 2018 FINAL Memo Eng.Document22 pagesEconomics P1 Nov 2018 FINAL Memo Eng.simphiweNo ratings yet

- Cs Hy MsDocument3 pagesCs Hy Ms111abhavyabhardwajNo ratings yet

- DA Pam TemplateDocument5 pagesDA Pam TemplateJames LawsonNo ratings yet

- 4364 108 Proj MGMT 2003Document2 pages4364 108 Proj MGMT 2003yogesh_b_kNo ratings yet

- Regulation Disclosure Statement: Identifying Number Shown On ReturnDocument2 pagesRegulation Disclosure Statement: Identifying Number Shown On ReturnIRSNo ratings yet

- A2006 55Document1 pageA2006 55IRSNo ratings yet

- ChallengeDocument30 pagesChallengesanucwa6932No ratings yet

- Capital Budgeting (Work Book Question No. 01 (Part - III)Document8 pagesCapital Budgeting (Work Book Question No. 01 (Part - III)Mahwish KhanNo ratings yet

- Chapter 8Document52 pagesChapter 8raomahinNo ratings yet

- Ubmissions To Epj PlusDocument3 pagesUbmissions To Epj PlusedisontNo ratings yet

- 1 EBA STEP2 SCT Interface Specifications v20111121 Updated 20110606 Clean PDFDocument154 pages1 EBA STEP2 SCT Interface Specifications v20111121 Updated 20110606 Clean PDFDnyaneshwar PatilNo ratings yet

- Important DI 30 PDFDocument67 pagesImportant DI 30 PDFAvik DasNo ratings yet

- downloadChemistryA Levelpast PapersOCR AAS Paper 1November20202020MS20 20paper20Document16 pagesdownloadChemistryA Levelpast PapersOCR AAS Paper 1November20202020MS20 20paper20c yuNo ratings yet

- Lenguaje Ensamblador. Problemas: Capítulo 1Document8 pagesLenguaje Ensamblador. Problemas: Capítulo 1Jorge ArmasNo ratings yet

- Passive Activity Loss Limitations: See Separate Instructions. Attach To Form 1040 or Form 1041Document3 pagesPassive Activity Loss Limitations: See Separate Instructions. Attach To Form 1040 or Form 1041IRSNo ratings yet

- A211 BKAL1013 - Tutorial 1 - AnswersDocument2 pagesA211 BKAL1013 - Tutorial 1 - AnswersMuhammad SyarafuddinNo ratings yet

- GrpspecDocument11 pagesGrpspecdormenoNo ratings yet

- G02/COM106/EE/20180104: Time: 3 Hours Marks: 80Document4 pagesG02/COM106/EE/20180104: Time: 3 Hours Marks: 80shabbirNo ratings yet

- ECO3002 AssignmentsDocument6 pagesECO3002 AssignmentsanthsamNo ratings yet

- Class:Fybsc Actuarial Science College:Thakur College of Science & Commerce Paper Name:Actuarial Statistics 1 Exam: Ce 2Document11 pagesClass:Fybsc Actuarial Science College:Thakur College of Science & Commerce Paper Name:Actuarial Statistics 1 Exam: Ce 2Anonymous ReaperNo ratings yet

- Scheduling Agreement DocumentationDocument7 pagesScheduling Agreement DocumentationselvijaiNo ratings yet

- R Cheat Sheet: Basic SyntaxDocument2 pagesR Cheat Sheet: Basic SyntaxJF SVNo ratings yet

- Rehabilitation and Upgradation of Qadirabad BarrageDocument1 pageRehabilitation and Upgradation of Qadirabad Barrageadeel jahangirNo ratings yet

- Assessing Exchange Rate RiskIIDocument28 pagesAssessing Exchange Rate RiskIIwilliamsandyNo ratings yet

- CMA 2017-1 January Marking ScreamDocument12 pagesCMA 2017-1 January Marking Screamchit myo100% (1)

- NormalizationDocument23 pagesNormalizationJusil T. GaiteNo ratings yet

- Asme B31.1Document4 pagesAsme B31.1Florante NoblezaNo ratings yet

- Ab Bhi Naa Aaye 20 Marks Coa Me Toh Dub MarnaDocument4 pagesAb Bhi Naa Aaye 20 Marks Coa Me Toh Dub MarnaLavya PunjabiNo ratings yet

- ING Format Description MT.940 Customer Statement Message: Usage GuidelineDocument33 pagesING Format Description MT.940 Customer Statement Message: Usage GuidelineTestspotyfireal EsyNo ratings yet

- Bill of Quantities For Iloilo Convention Center (Fits-Out To Complete The Operation and Management of The Iloilo Convention Center)Document5 pagesBill of Quantities For Iloilo Convention Center (Fits-Out To Complete The Operation and Management of The Iloilo Convention Center)Manuel MejoradaNo ratings yet

- 6354 01 Ms 20060616Document13 pages6354 01 Ms 20060616golddust2012No ratings yet

- MO14 Time Is Money DataDocument16 pagesMO14 Time Is Money DataothergregNo ratings yet

- Format Description Sepa Credit Transfer Pain 001 001 03 OktDocument16 pagesFormat Description Sepa Credit Transfer Pain 001 001 03 Oktalinm24No ratings yet

- Economics Exam-2Document2 pagesEconomics Exam-2MachelMDotAlexanderNo ratings yet

- Batch Advantage File SpecificationsDocument12 pagesBatch Advantage File SpecificationsM J RichmondNo ratings yet

- Enter The Appropriate Account Titles in The Shaded Cells in Columns C and D. Enter The Appropriate Amounts in The Shaded Cells in Columns F and HDocument1 pageEnter The Appropriate Account Titles in The Shaded Cells in Columns C and D. Enter The Appropriate Amounts in The Shaded Cells in Columns F and HElsa MendozaNo ratings yet

- ETS2.2 Monitoring Plan Template: The Greenhouse Gas Emissions Trading Scheme Regulations 2005 Confidentiality StatementDocument21 pagesETS2.2 Monitoring Plan Template: The Greenhouse Gas Emissions Trading Scheme Regulations 2005 Confidentiality StatementAsebaho BadrNo ratings yet

- RTR Notes Part 2Document2 pagesRTR Notes Part 2nishankyadavNo ratings yet

- Return of Excise Tax On Undistributed Income of Regulated Investment CompaniesDocument2 pagesReturn of Excise Tax On Undistributed Income of Regulated Investment CompaniesIRSNo ratings yet

- Strategic Risk Management: Designing Portfolios and Managing RiskFrom EverandStrategic Risk Management: Designing Portfolios and Managing RiskNo ratings yet

- CGA To CPA Course Mapping Chart: CAREER ELECTIVES (Two of The Following)Document1 pageCGA To CPA Course Mapping Chart: CAREER ELECTIVES (Two of The Following)Ashley WangNo ratings yet

- Cga tx2 Module 1 NotesDocument30 pagesCga tx2 Module 1 NotesAshley WangNo ratings yet

- Advanced Personal & Corporate Taxation Corporate Reorganizations (Part 2)Document15 pagesAdvanced Personal & Corporate Taxation Corporate Reorganizations (Part 2)Ashley WangNo ratings yet

- Advanced Personal & Corporate Taxation Corporate ReorganizationsDocument9 pagesAdvanced Personal & Corporate Taxation Corporate ReorganizationsAshley WangNo ratings yet