Professional Documents

Culture Documents

Emergency Rates 2012 2015

Uploaded by

enlasnubes1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Emergency Rates 2012 2015

Uploaded by

enlasnubes1Copyright:

Available Formats

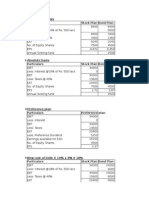

The Emergency Basis of Tax & USC Deduction

Emergency Basis of Tax Deduction 2015

Tax Rates

Standard Rate of Tax

20%

Higher Rate of Tax

40%

Where employee does not provide a PPS Number

Week or Month

Cut-Off Point

Tax Credit

All

0.00

0.00

Where employee provides a PPS Number

Weeks 1 to 4

Weekly

Cut-Off Point

650

Weekly

Tax Credit

32

Weeks 5 to 8

650

0.00

Week 9 onwards

0.00

0.00

Month 1

Monthly

Cut-Off Point

2,817

Monthly

Tax Credit

138

Month 2

2,817

0.00

Month 3 onwards

0.00

0.00

Weekly paid

Monthly Paid

Other Pay Frequencies

Pay Frequency

Cut-Off Point

Tax Credits

4-Weekly

33,800 / 13 = 2,600

1,650 / 13 = 127

Twice-Monthly

33,800 / 24 = 1,409

1,650 / 24 = 69

Fortnightly

33,800 / 26 = 1,300

1,650 / 26 = 64

Emergency Basis of USC Deduction 2015

Week or Month

USC Cut-Off Point

USC Rate

All

0.00

8%

Emergency Basis of Tax Deduction 2012 - 2014

Tax Rates

Standard Rate of Tax

20%

Higher Rate of Tax

41%

Where employee does not provide a PPS Number

Week or Month

Cut-Off Point

Tax Credit

All

0.00

0.00

Where employee provides a PPS Number

Weeks 1 to 4

Weekly

Cut-Off Point

631

Weekly

Tax Credit

32

Weeks 5 to 8

631

0.00

Week 9 onwards

0.00

0.00

Month 1

Monthly

Cut-Off Point

2,734

Monthly

Tax Credit

138

Month 2

2,734

0.00

Month 3 onwards

0.00

0.00

Weekly paid

Monthly Paid

Other Pay Frequencies

Pay Frequency

Cut-Off Point

Tax Credits

4-Weekly

32,800 / 13 = 2,524

1,650 / 13 = 127

Twice-Monthly

32,800 / 24 = 1,367

1,650 / 24 = 69

Fortnightly

32,800 / 26 = 1,262

1,650 / 26 = 64

Emergency Basis of USC Deduction 2012 - 2014

Week or Month

USC Cut-Off Point

USC Rate

All

0.00

7%

You might also like

- FDA Guide To Pension Tax Relief 2021Document15 pagesFDA Guide To Pension Tax Relief 2021FDAunionNo ratings yet

- Wilkinskennedy-Taxrates2015 2016Document8 pagesWilkinskennedy-Taxrates2015 2016MARIENo ratings yet

- JobsDocument2 pagesJobsapi-246393723No ratings yet

- Emergency Basis of Tax Deduction 2022Document6 pagesEmergency Basis of Tax Deduction 2022HaruGloryNo ratings yet

- Philippine Income Tax Rates GuideDocument17 pagesPhilippine Income Tax Rates GuideCharie Mae YdNo ratings yet

- Emergency Rates 2011Document1 pageEmergency Rates 2011Kieran RussellNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Resolucion Caso Mba PlantillaDocument2 pagesResolucion Caso Mba PlantillaWendy CedeñoNo ratings yet

- F6 Tec ArticlesDocument140 pagesF6 Tec ArticlesFloyd DaltonNo ratings yet

- PAYE Tax 2022 - Anand Chennai2LondonDocument34 pagesPAYE Tax 2022 - Anand Chennai2Londonpremkumar krishnanNo ratings yet

- Fabm2 Q2 W4 5Document8 pagesFabm2 Q2 W4 5maeesotoNo ratings yet

- BMA Guidance On Restricting Pensions Tax Relief - October 2010Document6 pagesBMA Guidance On Restricting Pensions Tax Relief - October 2010fernandofloridoNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Essential guide to the Tax Reform for Acceleration and Inclusion Act (TRAINDocument28 pagesEssential guide to the Tax Reform for Acceleration and Inclusion Act (TRAINWilliam Alexander Matsuhara AlegreNo ratings yet

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- 2015 Brackets & Planning Limits (Janney)Document5 pages2015 Brackets & Planning Limits (Janney)John CortapassoNo ratings yet

- Retirement SpreadsheetDocument3 pagesRetirement SpreadsheetMira V.No ratings yet

- Week 4 FA Lecture BBDocument24 pagesWeek 4 FA Lecture BBkk23212No ratings yet

- Goal Setting CalculatorDocument9 pagesGoal Setting CalculatorPradeep BishtNo ratings yet

- UK Taxation GuideDocument26 pagesUK Taxation GuideAnton BessonovNo ratings yet

- Sample Monthly Subscription ForecastDocument5 pagesSample Monthly Subscription Forecastdolpiro43No ratings yet

- TAX 301 – SELF EMPLOYED AND/OR PROFESSIONALS (SEPDocument3 pagesTAX 301 – SELF EMPLOYED AND/OR PROFESSIONALS (SEPChristine Merry AbionNo ratings yet

- Budget 2016 Summary 30 11 2015Document4 pagesBudget 2016 Summary 30 11 2015api-301855106No ratings yet

- Budget Summary 2015: Income Tax Tax Rates and Tax BandsDocument4 pagesBudget Summary 2015: Income Tax Tax Rates and Tax BandsArehman JamalNo ratings yet

- Net Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!Document7 pagesNet Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!abhi1648665No ratings yet

- Tax Data Card 30 June 2014Document9 pagesTax Data Card 30 June 2014api-300877373No ratings yet

- Your Money Plan: Matthew Jones, UK, Undergraduate, 14 / 15Document3 pagesYour Money Plan: Matthew Jones, UK, Undergraduate, 14 / 15matthewrjonesrugbyNo ratings yet

- ACCA P6 SMART Compendium Notes (40 Pages) For June 2016Document62 pagesACCA P6 SMART Compendium Notes (40 Pages) For June 2016Aziz Ur Rehman100% (2)

- Savings Interest Calculator: Savings Plan Inputs Summary of ResultsDocument2 pagesSavings Interest Calculator: Savings Plan Inputs Summary of ResultsAzim Khan BiplobNo ratings yet

- Investment 1 Investment 2 Investment 3Document5 pagesInvestment 1 Investment 2 Investment 3G_murtaza90No ratings yet

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- Financial Professional Factsheet Jan 14Document4 pagesFinancial Professional Factsheet Jan 14peakdotieNo ratings yet

- 2014 Tax TablesDocument1 page2014 Tax Tableszimbo2No ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross SalaryDeyzan HusainNo ratings yet

- 2013 AustralianTax Bracket CalculatorDocument1 page2013 AustralianTax Bracket Calculatormsimbolon32No ratings yet

- Personal Taxation and Budget Summary 2012/13Document16 pagesPersonal Taxation and Budget Summary 2012/13Michael FelthamNo ratings yet

- Pay SlipDocument50 pagesPay SlipSushil Shrestha100% (1)

- Bill Invoice UF-2486-001 3337 GenericDocument3 pagesBill Invoice UF-2486-001 3337 GenericsselveeswaranNo ratings yet

- Material BudgetDocument37 pagesMaterial BudgetRahul SardaNo ratings yet

- 2010 - Easy - Guide For Foreigner's Year-End Tax SettlementDocument94 pages2010 - Easy - Guide For Foreigner's Year-End Tax Settlement안수현No ratings yet

- Amended Tax Credit Certificate: 2217905KA Pps NoDocument2 pagesAmended Tax Credit Certificate: 2217905KA Pps Nobroken bunny 191100% (1)

- RG146 Pocket GuideDocument30 pagesRG146 Pocket GuideMentor RG146No ratings yet

- Susquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6Document6 pagesSusquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6EdTan RagadioNo ratings yet

- Which Braces Can I Afford? Monthly Payments ExplainedDocument11 pagesWhich Braces Can I Afford? Monthly Payments ExplainedIlovestraightteethNo ratings yet

- Section Vi: Financial A. Financial ForecastDocument4 pagesSection Vi: Financial A. Financial ForecastYna mae BonsolNo ratings yet

- OECD Report on Growth-enhancing Tax Reform in FranceDocument14 pagesOECD Report on Growth-enhancing Tax Reform in FranceSyed Muhammad Ali SadiqNo ratings yet

- Compound Interest Explained: Calculating Future and Present Value of AnnuitiesDocument30 pagesCompound Interest Explained: Calculating Future and Present Value of AnnuitiesAshia12No ratings yet

- Consumer Theory Example 10: Income Tax and The Budget ConstraintDocument4 pagesConsumer Theory Example 10: Income Tax and The Budget Constraintjackie.chanNo ratings yet

- Taxation RevisionDocument15 pagesTaxation Revisionapi-302252730No ratings yet

- Chapter 5 - Residual Income Valuation Calculation of Residual Income Using A Given EBITDocument11 pagesChapter 5 - Residual Income Valuation Calculation of Residual Income Using A Given EBITbingoNo ratings yet

- Home Office: WWW - Ukba.homeoffice - Gov.ukDocument7 pagesHome Office: WWW - Ukba.homeoffice - Gov.ukMuhammad A. NaeemNo ratings yet

- F6rom Jun 2011 QuDocument13 pagesF6rom Jun 2011 Qusorin8488No ratings yet

- Amway Marketing Plan(安利商业企划)Document111 pagesAmway Marketing Plan(安利商业企划)ellen9233% (3)

- Retirement CalculatorDocument2 pagesRetirement CalculatorstriplejacobsNo ratings yet

- Discretionary Housing Payments News Letter: DHP Funding by YearDocument3 pagesDiscretionary Housing Payments News Letter: DHP Funding by Yearapi-278051282No ratings yet

- Continental Carrier Abhishek Singh Pgp30006Document4 pagesContinental Carrier Abhishek Singh Pgp30006Abhishek SinghNo ratings yet

- FileDocument5 pagesFileRonnel RosalesNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet