Professional Documents

Culture Documents

Dispensers of California PDF

Uploaded by

Shashank YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dispensers of California PDF

Uploaded by

Shashank YadavCopyright:

Available Formats

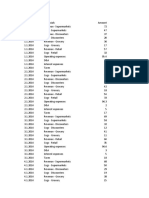

Dispensers of California, Inc

Balance Sheet Transaction Analysis

Transactions

Assets =

1a

1b

2

3

Hynes investment

Other investors

Incorporation costs

Equipment purchase

4

5

Redesign costs

Component parts purchase

Bank loan

Bank loan repaid

Loan interest

Manufacturing payroll

Other manufacturing costs

Selling general and administration

Ending inventory (cost of goods sold) *

Sales

Incorporation and redesign costs (expenses as

incurred)

Depreciation

Patent amortization

Ending work-in-progress and completed

inventory (none) (cost of goods sold)**

Dividends

Income Taxes

7

8

9

10

11

12

13

14

15

16

17

* Beginning component parts inventory

Purchases

Total available

Ending component parts inventory

Components parts used

$0

212,100

212,100

15,100

197,000

+ Patent $120,000

+ Cash 80,000

- Cash $2,500

-Cash $85,000

+ Equipment 85,000

- Cash $25,000

+ Inventory $212,100

- Cash 212,100

+ Cash $30,000

- Cash 30,000

- Cash 500

- Cash $145,000

- Cash 62,000

- Cash $63,000

- Inventory $197,000

+ Cash $598,500

See 2 and 4

Liabilities

Equity

+ Common Stock $120,000

+ Common Stock 80,000

- Retained earnings $2,500

- Retained earnings $25,000

+Bank loan $30,000

- Bank loan 30, 000

- Retained earnings $500

- Retained earnings $145,000

- Retained earnings $62,000

- Retained earnings $63,000

- Retained earnings $197,000

+ Retained earnings $598,500

- Equipment $8,500

- Patent $20,000

See 5, 7, 8, 10 and 13

- Retained earnings $8,500

- Retained earnings $20,000

- Cash $5,000

+Taxes payable $22,500

**Component parts used

Manufacturing payroll

Other manufacturing costs

Depreciation

Cost of goods sold

$197,000

145,000

62,000

8,500

412,500

- Retained earnings $5,000

- Retained earnings $22,500

Dispensers of California, Inc.

12-month Profit Plan

Sales

Cost of goods sold

Components

Mfg payroll

Other Mfg.

Depreciation

Gross margin

Selling, general and

Administration

Patent

Redesign costs

Incorporation costs

Operating profit

Interest

Profit before taxes

Tax expense

Net Income

$598,500

$197,000

145,000

62,000

8,500

412,500

$186,000

63,000

20,000

25,000

2,500

$75,500

500

$75,000

22,500

$52,500

Dispensers of California, Inc.

Projected Year-end Balance Sheet

Assets

Cash

Components inventory

Current assets

Equipment (net)

Patent (net)

$78,400

15,100

$93,500

76,500

100,000

___

$270,000

Liabilities

Taxes payable

Current liabilities

Owners Equity

Capital stock

Retained earnings

$22,500

$22,500

$200,000

47,500

$270,000

Dispensers of California, Inc.

Change in Retained Earnings

Beginning retained earnings

Net income

Dividends

Ending retained earnings

$0

52,500

(5,000)

$47,500

Dispensers of California, Inc.

Cash Reconciliation

New equity capital

Incorporation

Equipment

Redesign

Component parts

Bank loan

Bank loan

Loan interest

Manufacturing payroll

Other manufacturing

SG&A

Sales

Dividend

Total

Cash Reconciliation

Receipts

Disbursements

Ending Balance

$708,500

630,100

$78,400

Receipts

$80,000

Disbursements

$2,500

85,000

25,000

212,100

30,000

30,000

500

145,000

62,000

63,000

598,500

$708,500

5,000

$630,100

Dispensers of California, Inc.

Statement of Cash Flows (Direct Method)

Collections from customers

Payments to suppliers

Payments to employees

Legal payments

Interest

Operating cash flow

Equipment purchases

Investing cash flow

Bank loan

Repayment of bank loan

Capital

Dividends

Financing cash flow

Change in cash

Beginning cash

Ending cash

$598,500

(212,100)

(295,000)

(2,500)

(500)

$89,400

(85,000)

$(85,000)

30,000

(30,000)

80,000

(5,000)

$75,000

$78,400

0

$78,400

You might also like

- Accounting For Share Capital TransactionsDocument16 pagesAccounting For Share Capital TransactionsLee Suarez100% (1)

- Case Music MartDocument23 pagesCase Music MartDarwin Dionisio Clemente75% (4)

- Case Baron CoburgDocument8 pagesCase Baron CoburgDarwin Dionisio Clemente100% (2)

- Draft For Phone RevisionsDocument10 pagesDraft For Phone RevisionsHualu Zhao100% (1)

- Solution For Lone Pine Cafe CaseDocument5 pagesSolution For Lone Pine Cafe CaseShammika Krishna75% (4)

- Chemalite SolutionHBSDocument10 pagesChemalite SolutionHBSManoj Singh0% (1)

- NYSF Leveraged Buyout Model TemplateDocument20 pagesNYSF Leveraged Buyout Model TemplateBenNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Rithesh KNo ratings yet

- Case Forest City Tennis ClubDocument9 pagesCase Forest City Tennis ClubAhmedNiaz100% (1)

- BodieDocument8 pagesBodieLinh NguyenNo ratings yet

- Case-American Connector CompanyDocument9 pagesCase-American Connector CompanyDIVYAM BHADORIANo ratings yet

- 01 Ribbons N' Bows - SolutionDocument4 pages01 Ribbons N' Bows - SolutionShivam Kanojia100% (2)

- Music Mart SolutionDocument6 pagesMusic Mart SolutionStranger Sinha50% (2)

- Maynard Company (A & B)Document9 pagesMaynard Company (A & B)akashnathgarg0% (1)

- Mid-Term Question Paper Set - 1Document17 pagesMid-Term Question Paper Set - 1Archisha Srivastava0% (1)

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariNo ratings yet

- Campus PizzeriaDocument12 pagesCampus PizzeriaSHIVAM SRIVASTAVANo ratings yet

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Davey Brothers Watch Co. SubmissionDocument13 pagesDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNo ratings yet

- Mansa Building CaseDocument14 pagesMansa Building CaseRikki DasNo ratings yet

- Garden Yoga Centre Business PlanDocument36 pagesGarden Yoga Centre Business Plandeepdeka123100% (1)

- Asian ToysDocument2 pagesAsian ToysHbbekn jjdbhh100% (1)

- Chema LiteDocument8 pagesChema LiteHàMềmNo ratings yet

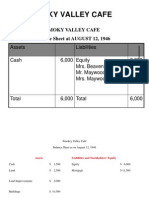

- Smoky Valley CafeDocument3 pagesSmoky Valley Cafemohit_namanNo ratings yet

- Exam 1 - Key AnswersDocument23 pagesExam 1 - Key Answersarlynajero.ckcNo ratings yet

- Case 3.1Document2 pagesCase 3.1Sandeep Agrawal100% (6)

- Lori Crump Accounting Case StudyDocument1 pageLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- Case Study 2 - ChandpurDocument11 pagesCase Study 2 - Chandpurpriyaa03100% (3)

- Boardroom GameDocument12 pagesBoardroom GameShivam SomaniNo ratings yet

- Business Failure Prediction 18 Sept 2010Document41 pagesBusiness Failure Prediction 18 Sept 2010Shariff MohamedNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Solution of Rachna BoutiqueDocument5 pagesSolution of Rachna BoutiqueShashank Patel100% (1)

- Lilac Flour Mills: Managerial Accounting and Control - IIDocument9 pagesLilac Flour Mills: Managerial Accounting and Control - IISoni Kumari50% (4)

- Dispensers of California Case AnalysisDocument10 pagesDispensers of California Case AnalysisAvinash Singh100% (1)

- Chapter 15 PDFDocument29 pagesChapter 15 PDFKimNo ratings yet

- Understanding From Case: Marketing Brand Aava: Not As Simple As WaterDocument4 pagesUnderstanding From Case: Marketing Brand Aava: Not As Simple As Waterdebashreeta swainNo ratings yet

- Amaranth Advisors: Burning Six Billion in Thirty DaysDocument24 pagesAmaranth Advisors: Burning Six Billion in Thirty DaysRosalina MaharanaNo ratings yet

- Case Study 2 ChandpurDocument11 pagesCase Study 2 ChandpurTarun Imandi83% (6)

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Making A Tough Personnel Decision at Nova Waterfront HotelDocument11 pagesMaking A Tough Personnel Decision at Nova Waterfront HotelSiddharthNo ratings yet

- Industrial Relations at Asian Paints - ePGPX03 - Group - 9Document13 pagesIndustrial Relations at Asian Paints - ePGPX03 - Group - 9manik singh0% (2)

- Northboro Machine Tools CorporationDocument9 pagesNorthboro Machine Tools Corporationsheersha kkNo ratings yet

- Cavincare Case Study Decision SheetDocument1 pageCavincare Case Study Decision SheetNENCY PATELNo ratings yet

- Waltham Oil and Lube CentreDocument5 pagesWaltham Oil and Lube CentreAnirudh Singh0% (2)

- Case Study 4 - 3 Copies ExpressDocument8 pagesCase Study 4 - 3 Copies ExpressJZ0% (1)

- Stafford Press CaseDocument4 pagesStafford Press CaseAmit Kumar AroraNo ratings yet

- Hi-Ho, Yo-Yo, Inc. ReportDocument4 pagesHi-Ho, Yo-Yo, Inc. ReportEdyta OdorowskaNo ratings yet

- Solman 12 Second EdDocument23 pagesSolman 12 Second Edferozesheriff50% (2)

- Case Analysis - Nitish@Solutions Unlimited 1Document5 pagesCase Analysis - Nitish@Solutions Unlimited 1Piyush SahaNo ratings yet

- Lone Pine CafeDocument13 pagesLone Pine CafeCynthia Anggi Maulina100% (1)

- Srishti Jain Section A Draft 2Document6 pagesSrishti Jain Section A Draft 2Srishti JainNo ratings yet

- Case 7 3 StaffordDocument5 pagesCase 7 3 StaffordArjun Khosla0% (2)

- Cable Contractor - Aishwarya - Anand - SolankiDocument1 pageCable Contractor - Aishwarya - Anand - SolankiAishwarya SolankiNo ratings yet

- Case Problem EZ Trailers, Inc.Document3 pagesCase Problem EZ Trailers, Inc.Something ChicNo ratings yet

- IIM Ranchi Junior Placement Committee 2016-18 Application FormDocument6 pagesIIM Ranchi Junior Placement Committee 2016-18 Application FormDebmalya DuttaNo ratings yet

- Usha Martin: Competitive Advantage Through Vertical IntegrationDocument9 pagesUsha Martin: Competitive Advantage Through Vertical IntegrationsafwanhossainNo ratings yet

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDocument14 pagesAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniNo ratings yet

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- Jawaban 11 - Statement of Cash FlowDocument2 pagesJawaban 11 - Statement of Cash FlowBie SapuluhNo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- AFM AssignmentDocument7 pagesAFM AssignmentMudit BhargavaNo ratings yet

- Gym BudgetDocument3 pagesGym BudgetJOHN MANTHINo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Krystal Guile Dagatan - Activity 2Document6 pagesKrystal Guile Dagatan - Activity 2Krystal Guile DagatanNo ratings yet

- Assignment ChemalitDocument8 pagesAssignment ChemalitVinay JajuNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- 286practice Questions - AnswerDocument17 pages286practice Questions - Answerma sthaNo ratings yet

- Disadvantage and Advantage of PartnershipDocument9 pagesDisadvantage and Advantage of PartnershipErick MeguisoNo ratings yet

- Financial Accounting Ifrs 4e Chapter 4 SolutionDocument50 pagesFinancial Accounting Ifrs 4e Chapter 4 SolutionSana SoomroNo ratings yet

- Test Bank For Accounting Principles Volume 1 8th Canadian Edition WeygandtDocument37 pagesTest Bank For Accounting Principles Volume 1 8th Canadian Edition Weygandtdupuisheavenz100% (11)

- KLBFDocument2 pagesKLBFKhaerudin RangersNo ratings yet

- Solution Manual For Financial Accounting Fifth Canadian Edition 5 e 5th Edition Walter T Harrison T Horngren C William Thomas Greg Berberich Catherine Seguin DownloadDocument55 pagesSolution Manual For Financial Accounting Fifth Canadian Edition 5 e 5th Edition Walter T Harrison T Horngren C William Thomas Greg Berberich Catherine Seguin DownloadMrJosephCruzMDqpet100% (37)

- Both Statements Are TrueDocument30 pagesBoth Statements Are TrueSaeym SegoviaNo ratings yet

- Instant Download Ebook PDF Financial Accounting 7th Edition by Robert Libby PDF ScribdDocument41 pagesInstant Download Ebook PDF Financial Accounting 7th Edition by Robert Libby PDF Scribdrobert.gourley486100% (49)

- Afar de Leon/De Leon/De Leon/Tan 3006-Consosolidated Statements M A Y 2 0 2 1Document5 pagesAfar de Leon/De Leon/De Leon/Tan 3006-Consosolidated Statements M A Y 2 0 2 1TatianaNo ratings yet

- Module 2 - Financial StatementsDocument25 pagesModule 2 - Financial StatementsHạnh Nhân VănNo ratings yet

- Exercise Problem 3 - Shareholder's EquityDocument5 pagesExercise Problem 3 - Shareholder's EquityLLYOD FRANCIS LAYLAYNo ratings yet

- ch03 Part9Document6 pagesch03 Part9Sergio HoffmanNo ratings yet

- Simulated LECPA 1 - FAR - Answer KeyDocument9 pagesSimulated LECPA 1 - FAR - Answer KeyMitchel Dane CabilanNo ratings yet

- Stocks & More: What Is The Difference Between Par and No Par Value Stock?Document8 pagesStocks & More: What Is The Difference Between Par and No Par Value Stock?Bato RockNo ratings yet

- 1.2 114. Exercise - BefDocument38 pages1.2 114. Exercise - BefMi TvNo ratings yet

- Ejemplo de Analisis Vertical y Horizontal Caso NikeDocument14 pagesEjemplo de Analisis Vertical y Horizontal Caso NikeDiego Blanco CastroNo ratings yet

- Master Budget Worksheets - Merchandiser - 22-5BDocument7 pagesMaster Budget Worksheets - Merchandiser - 22-5BFiraol NemeNo ratings yet

- F1 Answers May 2010Document12 pagesF1 Answers May 2010mavkaziNo ratings yet

- Chapter 17Document52 pagesChapter 17Ivo_NichtNo ratings yet

- PT Chandra Asri Petrochemical TBKDocument2 pagesPT Chandra Asri Petrochemical TBKIshidaUryuuNo ratings yet

- Consolidation TutorialDocument8 pagesConsolidation TutorialPrageeth Roshan WeerathungaNo ratings yet

- Financial Statement Analysis On BEXIMCO and SQUAREDocument33 pagesFinancial Statement Analysis On BEXIMCO and SQUAREYolowii XanaNo ratings yet