Professional Documents

Culture Documents

Jawaban 11 - Statement of Cash Flow

Uploaded by

Bie Sapuluh0 ratings0% found this document useful (0 votes)

22 views2 pagesakuntasi

Original Title

JAWABAN 11_STATEMENT OF CASH FLOW

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentakuntasi

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesJawaban 11 - Statement of Cash Flow

Uploaded by

Bie Sapuluhakuntasi

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

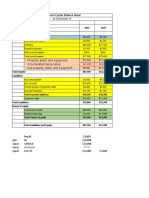

UTAMA COMPANY

Statement of Cash Flow

For the Year Ended December 31,2014

(Direct Method)

Cash flows from operating activities

Cash receipt :

Cash received from customer $1,152,450 a

Dividends received 2,400 $1,154,850

Cash payments :

Cash paid to suppliers $765,000 b

Cash paid for operating expenses $226,350 c

Taxes paid $38,400 d

Interest paid $57,300 $1,087,050

Net cash provided by operating activities $67,800

Cash flows from investing activities

Sale of short-term investment $12,000

Sale of land 58,000

Purchase of equipment (125,000)

Net cash used by investing activities ($55,000)

Cash flows from financing activities

Proceed from issuance of ordinary shares $27,500

Principal payment on long-term debt (10,000)

Dividends paid (24,300)

Net cash used by financing activities ($6,800)

Net increase in cash $6,000

Cash, January 1, 2014 4,000

Cash, December 31, 2014 $10,000

a sales revenue $1,160,000

increase in accounts receivable (7,550)

cash received from customers $1,152,450

b cost of goods sold $748,000

increase in inventory 7,000

decrease in accounts payable 10,000

cash paid to suppliers $765,000

c operating expense $276,400

depreciation/amortization expense (40,500)

decrease in prepaid rent (9,000)

increase in prepaid insurance 1,200

increase in office supplies 250

increase in wages payable (2,000)

cash paid for operating expenses $226,350

d income tax expense $39,400

increase income taxes payable (1,000)

taxes paid $38,400

e interest expense $51,750

decrease in bond premium 5,550

interest paid $57,300

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Cash Flow ExampleDocument10 pagesCash Flow ExampleewaidaebaaNo ratings yet

- Chapter 23Document59 pagesChapter 23boboandiandiNo ratings yet

- Assignment 6Document8 pagesAssignment 6Lara Lewis AchillesNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- Annisa Nabila Kanti - Task 17Document4 pagesAnnisa Nabila Kanti - Task 17Annisa Nabila KantiNo ratings yet

- Cash Flow Activities of 5 CompaniesDocument6 pagesCash Flow Activities of 5 CompaniesFariha tamannaNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Fairchild SA statement of cash flows 2019Document3 pagesFairchild SA statement of cash flows 2019ulil alfarisyNo ratings yet

- Kelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)Document3 pagesKelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)ulil alfarisyNo ratings yet

- Yohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4Document3 pagesYohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Akm 2 Week 11Document3 pagesAkm 2 Week 11Ahsan FirdausNo ratings yet

- ASSESSMENTSDocument23 pagesASSESSMENTSJoana TrinidadNo ratings yet

- Cashflow Statement AnalysisDocument12 pagesCashflow Statement AnalysisKatrina EustaceNo ratings yet

- Glenn's Glue Stick Inc. Income Statement and FinancialsDocument5 pagesGlenn's Glue Stick Inc. Income Statement and FinancialsHenry KimNo ratings yet

- AsdasdsadwqrqewqerDocument4 pagesAsdasdsadwqrqewqerAdrian AranoNo ratings yet

- Statement of Cash Flows AnswerDocument3 pagesStatement of Cash Flows Answeranber mohammadNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- Ex 09 Electro ProductsDocument6 pagesEx 09 Electro ProductsRiznel Anthony CapaladNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Problem 23 2Document5 pagesProblem 23 2Muhammad SyahbinNo ratings yet

- Tugas PAKDocument4 pagesTugas PAKTedo Arsa NanditamaNo ratings yet

- Problem Cash FlowDocument3 pagesProblem Cash FlowKimberly AnneNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Akuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Document2 pagesAkuntansi Keuangan Menengah 2 Asistensi - Tim Asdos Akm 2Muhamad Rizal DinyatNo ratings yet

- Crystal Meadows of TahoeDocument5 pagesCrystal Meadows of TahoeNikitha Andrea Saldanha80% (5)

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Adhila Sandra Devy - LF53 - Cash in FlowsDocument4 pagesAdhila Sandra Devy - LF53 - Cash in FlowsLydia limNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Question 2 Water CorporationDocument7 pagesQuestion 2 Water Corporationyusuf pashaNo ratings yet

- Valix Vol. 3 2014 edition problem analysisDocument10 pagesValix Vol. 3 2014 edition problem analysisJenyl Mae NobleNo ratings yet

- Solution Aassignments CH 13Document2 pagesSolution Aassignments CH 13RuturajPatilNo ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- IAS 7 Cash Flow Statement QuestionDocument3 pagesIAS 7 Cash Flow Statement QuestionamitsinghslideshareNo ratings yet

- Traditional HW 10, 11Document1 pageTraditional HW 10, 11gShOnEy8No ratings yet

- Sadecki Corp ratios reveal improved profitabilityDocument9 pagesSadecki Corp ratios reveal improved profitabilitymohitgaba19No ratings yet

- Julian Group 2014 Statements of Cash FlowsDocument1 pageJulian Group 2014 Statements of Cash FlowsarafatNo ratings yet

- Dispensers of CaliforniaDocument4 pagesDispensers of CaliforniaShweta GautamNo ratings yet

- Sharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowDocument4 pagesSharp Screen Films, Inc., Is Developing Its Annual Financial Statements Cash FlowKailash KumarNo ratings yet

- Cash Flow Statement Direct and Indirect MethodsDocument2 pagesCash Flow Statement Direct and Indirect MethodsAlhassan ShakirNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Practice Set 2 SCFDocument10 pagesPractice Set 2 SCFDiya BasuNo ratings yet

- Cash Flow Statement AnalysisDocument4 pagesCash Flow Statement Analysisashraf hossain saifNo ratings yet

- Practice Set 2 SCFDocument10 pagesPractice Set 2 SCFAtul DarganNo ratings yet

- Practice Set 3 SCFDocument10 pagesPractice Set 3 SCFNISHA BANSALNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Cashflow (Direct Method)Document7 pagesCashflow (Direct Method)Umair ShahzadNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Kelompok 5 - Cash Flow - ALKDocument16 pagesKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarNo ratings yet

- Professor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsDocument3 pagesProfessor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsPrecious Uminga100% (1)

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Chemalite (B)Document1 pageChemalite (B)Aimane BeggarNo ratings yet

- Financial Statement Analysis Questions ExplainedDocument4 pagesFinancial Statement Analysis Questions ExplainedRisha OsfordNo ratings yet

- Goodlife Zero Vat Items 14062022Document345 pagesGoodlife Zero Vat Items 14062022kidusNo ratings yet

- Surat Sponsorship Merck (Iliadin)Document1 pageSurat Sponsorship Merck (Iliadin)goblok goblokinNo ratings yet

- AppendicesDocument6 pagesAppendicesMark James Bugarin BarayugaNo ratings yet

- What is Special EducationDocument2 pagesWhat is Special EducationImelda Nantin GarciaNo ratings yet

- 23Document4 pages23ANIL SINGHNo ratings yet

- Parents Awarded Damages for Death of Son in Collision CaseDocument491 pagesParents Awarded Damages for Death of Son in Collision CaseJon SnowNo ratings yet

- Lwtech HR Management FlyerDocument2 pagesLwtech HR Management FlyerAshlee RouseyNo ratings yet

- Ecb Recovery PlanningDocument20 pagesEcb Recovery PlanningMohamed MostafaNo ratings yet

- Clay Types PDFDocument40 pagesClay Types PDFHafiz Mudaser AhmadNo ratings yet

- External Beam Planning RGDocument870 pagesExternal Beam Planning RGrubenNo ratings yet

- ReptileDocument4 pagesReptileDratonius 101No ratings yet

- HSI Calculator 3Document3 pagesHSI Calculator 3Diah Ayu Wulandari Sulistyaningrum0% (1)

- The Sinew (Tendino-Muscular) Meridians - Jade Institute ClassesDocument10 pagesThe Sinew (Tendino-Muscular) Meridians - Jade Institute ClassespanisajNo ratings yet

- KT 470Document4 pagesKT 470Fabian PzvNo ratings yet

- HB Synthesis, Degradation, Jaundice, Iron Metabolism by Dr. RoomiDocument23 pagesHB Synthesis, Degradation, Jaundice, Iron Metabolism by Dr. RoomiMudassar Roomi100% (1)

- F&G Mapping Study - MethodologyDocument6 pagesF&G Mapping Study - MethodologyRiyaz ahamedNo ratings yet

- Molykote: 111 CompoundDocument2 pagesMolykote: 111 CompoundEcosuministros ColombiaNo ratings yet

- What Is Newborn ScreeningDocument2 pagesWhat Is Newborn ScreeningroksanmiNo ratings yet

- School Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Document2 pagesSchool Form 2 Daily Attendance Report of Learners For Senior High School (SF2-SHS)Charly Mint Atamosa IsraelNo ratings yet

- Housekeeping in The Dental OfficeDocument45 pagesHousekeeping in The Dental OfficeJhaynerzz Padilla AcostaNo ratings yet

- Electrometallurgy NptelDocument23 pagesElectrometallurgy NptelChayon MondalNo ratings yet

- Long-Term Memory - ProcessDocument30 pagesLong-Term Memory - ProcessALEXANDRA SAN PEDRONo ratings yet

- RCOG Guidelines - Gestational Trophoblastic DiseaseDocument12 pagesRCOG Guidelines - Gestational Trophoblastic Diseasemob3100% (1)

- Intro To Psychology Crash Course Psychology 1Document3 pagesIntro To Psychology Crash Course Psychology 1Hahaha YeahNo ratings yet

- 1 - KSU Research Methodology Overview (A Mandil, Oct 2009)Document25 pages1 - KSU Research Methodology Overview (A Mandil, Oct 2009)Fatamii IiiNo ratings yet

- CALIMOVEDocument46 pagesCALIMOVERasheedAladdinNGuiomala0% (1)

- TheEconomist 2020 12 10Document296 pagesTheEconomist 2020 12 10merlindebergNo ratings yet

- ASME I & ASME VIII FundamentalsDocument55 pagesASME I & ASME VIII FundamentalsFabio Peres de Lima100% (2)

- Inserto de Concreto PZI - Sellsheet - 2006Document1 pageInserto de Concreto PZI - Sellsheet - 2006CardenasNo ratings yet

- 2009 The Neuroanatomic Basis of The Acupuncture Principal MeridiansDocument21 pages2009 The Neuroanatomic Basis of The Acupuncture Principal MeridiansAna Maria MartinsNo ratings yet