Professional Documents

Culture Documents

Annisa Nabila Kanti - Task 17

Uploaded by

Annisa Nabila KantiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annisa Nabila Kanti - Task 17

Uploaded by

Annisa Nabila KantiCopyright:

Available Formats

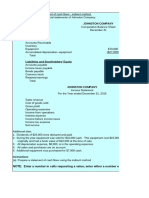

P23-1

SULLIVAN CORP

Statement of Cash Flows

For the Year Ended December 31, 2014

Cash flows from operating activities

Net Income $370,000

Adjustment to reconcile net income

to net cash provided by operating activities:

Depreciation $147,000

Gain on sale of equipment -2,000

Equity in earnings of Myers Co. -35,000

Decrease in accounts receivable 40,000

Increase in inventory -135,000

Increase in accounts payable 60,000

Decrease in income taxes payable -20,000 55,000

Net cash provided by operating activities 425,000

Cash flows from investing activities:

Proceeds from sale of equipment 40,000

Loan to TCL Co -300,000

Principal payment of loan receiveable 50,000

Net cash used by investing activities -210,000

Cash flows from financing activities

Dividends paid -100,000

Net cash used by financing activities -100,000

Net increase in cash 115,000

Cash, January 1, 2014 700,000

Cash, December 31, 2014 815,000

Schedule at bottom of statement of cash flows:

Noncash investing and financing activities:

Issuance of capital lease liability for

office building $400,000

Explanation of Amount

(a) Depreciation

Net Increase in accumulated

depreciation for the year ended

31-Dec-14 $125,000

Accumulated depreciation on equipment sold:

Cost $60,000

Carrying value -38,000 22,000

Depreciation for 2014 $147,000

(b) Gain on sale equipment

Proceeds $40,000

Carrying value -38,000

Gain $2,000

(c) Equity in earnings of Myers Co.

Myers' net income for 2014 $140,000

Sullivan's ownership 25%

Undistributed earnings of Myers Co $35,000

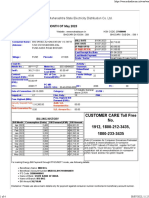

P23-2

Cash flows from operating activities

Net income $14,750 (a)

Adjustment to reconcile net income

to net cash provided by operating activities:

Los on sales of equipment $4,100 (b)

Gain from flood damage -8,250

Depreciation expense 1,900 (c)

Patent amortization 1,250

Gain on sale of investment -1,700

Increase in accounts receivable (net) -3,750

Increase inventory -3,000

Increase in accpunts payable 2,000 -7,450

Net cash provided by operating activities 7,300

Cash flows from investing activities

Sale of investments 4,700

Sale of equipment 2,500

Purchase of equipment -20,000

Proceeds from flood damage to building 32,000

Net cash provided by investing activities 19,200

Cash flows from financing activities

Payment of dividends -5,000

Payment of short-term note payable -1,000

Net cash used by financing activities -6,000

Increase in cash 20,500

Cash, January 1, 2014 13,000

Cash, December 31, 2014 33,500

Supplemental disclosures of cash flow information

Cash paid during the year for:

Interest

Income taxes

Noncash investing and financing activities

Retired notes payable by issuing commons stock

Purchased equipment by issuing notes payable

SupportingComputations:

(a) Ending retained earnings

You might also like

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDocument3 pagesQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNo ratings yet

- Assignment - CASH FLOWDocument6 pagesAssignment - CASH FLOWFariha tamannaNo ratings yet

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- Jawaban 11 - Statement of Cash FlowDocument2 pagesJawaban 11 - Statement of Cash FlowBie SapuluhNo ratings yet

- 01 eLMS Activity 3 - ARGDocument2 pages01 eLMS Activity 3 - ARGJilliane MaineNo ratings yet

- Llagas 01 eLMS Activity 3Document3 pagesLlagas 01 eLMS Activity 3Angela Fye LlagasNo ratings yet

- ASSESSMENTSDocument23 pagesASSESSMENTSJoana TrinidadNo ratings yet

- BSB110 Solutions To RevisionDocument20 pagesBSB110 Solutions To RevisionSiyuan JiNo ratings yet

- Problem 23 2Document5 pagesProblem 23 2Muhammad SyahbinNo ratings yet

- ACT320 Assignment ProjectDocument11 pagesACT320 Assignment ProjectMd. Shakil Ahmed 1620890630No ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- Problem No 1Document5 pagesProblem No 1shabNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- TP 2 Acct For BusinessDocument5 pagesTP 2 Acct For BusinessLuna AnggrainiNo ratings yet

- Adhila Sandra Devy - LF53 - Cash in FlowsDocument4 pagesAdhila Sandra Devy - LF53 - Cash in FlowsLydia limNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- CH 13 Study Guide AnsDocument1 pageCH 13 Study Guide AnsLo Ka ChunNo ratings yet

- 24.3 - Principles of AccountingDocument3 pages24.3 - Principles of AccountingDuong Ha ThuyNo ratings yet

- 2208 ch22Document7 pages2208 ch22Clyde Ian Brett PeñaNo ratings yet

- Chegg SolutionsDocument4 pagesChegg SolutionsZenika PetersNo ratings yet

- Assignment 03Document7 pagesAssignment 03Nadeera GalagedarageNo ratings yet

- Chapter 16Document72 pagesChapter 16Sour CandyNo ratings yet

- Chapter 23Document59 pagesChapter 23boboandiandiNo ratings yet

- 39.1 SolutionDocument5 pages39.1 SolutionJeanelle ColaireNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Practice Problems, CH 5 SolutionDocument6 pagesPractice Problems, CH 5 SolutionscridNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Teaching Note - Cash FlowDocument21 pagesTeaching Note - Cash Flowmohit rajputNo ratings yet

- AsdasdsadwqrqewqerDocument4 pagesAsdasdsadwqrqewqerAdrian AranoNo ratings yet

- Statement of Cash Flows AnswerDocument3 pagesStatement of Cash Flows Answeranber mohammadNo ratings yet

- Problem - 1: (A) WorkingsDocument4 pagesProblem - 1: (A) Workingsashraf hossain saifNo ratings yet

- Garing, Aireen - Sa No.13 Statement of CashflowsDocument3 pagesGaring, Aireen - Sa No.13 Statement of CashflowsAireen GaringNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Assignment 6Document8 pagesAssignment 6Lara Lewis AchillesNo ratings yet

- Practice Set 2 SCFDocument10 pagesPractice Set 2 SCFDiya BasuNo ratings yet

- Tugas PAKDocument4 pagesTugas PAKTedo Arsa NanditamaNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Ex 09 Electro ProductsDocument6 pagesEx 09 Electro ProductsRiznel Anthony CapaladNo ratings yet

- Practice Set 2 SCFDocument10 pagesPractice Set 2 SCFAtul DarganNo ratings yet

- Asdos Jawaban 4Document5 pagesAsdos Jawaban 4mutiaoooNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- (IFA 6) - Rendy Filiang - 1402210324Document6 pages(IFA 6) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Cashflow A. Indirect Method: KM Manufacturing CompanyDocument2 pagesCashflow A. Indirect Method: KM Manufacturing CompanyArnold AdanoNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Practice Set 3 SCFDocument10 pagesPractice Set 3 SCFNISHA BANSALNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- BUS 142 - Exercises CH 14Document17 pagesBUS 142 - Exercises CH 14Jess IcaNo ratings yet

- Exercise 9 Statement of Cash Flows - 054915Document2 pagesExercise 9 Statement of Cash Flows - 054915Hoyo VerseNo ratings yet

- Finman AssignmentDocument3 pagesFinman AssignmentRaul Soriano CabantingNo ratings yet

- ch04 PDFDocument5 pagesch04 PDFĐào Quốc Anh100% (1)

- Tugas Cash Flow (Kel 4) KelarDocument23 pagesTugas Cash Flow (Kel 4) KelarRamaNo ratings yet

- Solution Aassignments CH 13Document2 pagesSolution Aassignments CH 13RuturajPatilNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Marcus AgDocument4 pagesMarcus AgMosesNo ratings yet

- Clarke Inc. HighlightedDocument4 pagesClarke Inc. HighlightedAdams BruinsNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- (IFA 6) - Rendy Filiang - 1402210324Document6 pages(IFA 6) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Annisa Nabila Kanti - 155020307121021Document1 pageAnnisa Nabila Kanti - 155020307121021Annisa Nabila KantiNo ratings yet

- Financial Analysis - Chapter 9 - Annisa Nabila Kanti - 155020307121021Document3 pagesFinancial Analysis - Chapter 9 - Annisa Nabila Kanti - 155020307121021Annisa Nabila KantiNo ratings yet

- Type of Audit, Auditor, and Recipients of The ReportDocument1 pageType of Audit, Auditor, and Recipients of The ReportAnnisa Nabila KantiNo ratings yet

- Lintang - Nabila - Audit Internal (FA) - Business Process AuditDocument15 pagesLintang - Nabila - Audit Internal (FA) - Business Process AuditAnnisa Nabila KantiNo ratings yet

- Auditing 2 Middle ExamDocument2 pagesAuditing 2 Middle ExamAnnisa Nabila KantiNo ratings yet

- UAS PajakDocument2 pagesUAS PajakAnnisa Nabila KantiNo ratings yet

- Annisa Nabila Kanti - Task 16Document3 pagesAnnisa Nabila Kanti - Task 16Annisa Nabila KantiNo ratings yet

- Task 1 (Employee Benefits)Document6 pagesTask 1 (Employee Benefits)Annisa Nabila KantiNo ratings yet

- Annisa Nabila Kanti - Task 16Document3 pagesAnnisa Nabila Kanti - Task 16Annisa Nabila KantiNo ratings yet

- Task 1 (Employee Benefits)Document6 pagesTask 1 (Employee Benefits)Annisa Nabila KantiNo ratings yet

- Task 1 (Employee Benefits)Document6 pagesTask 1 (Employee Benefits)Annisa Nabila KantiNo ratings yet

- Task 6Document2 pagesTask 6Annisa Nabila KantiNo ratings yet

- Auditing 2 Middle ExamDocument2 pagesAuditing 2 Middle ExamAnnisa Nabila KantiNo ratings yet

- Task 1 (Employee Benefits)Document6 pagesTask 1 (Employee Benefits)Annisa Nabila KantiNo ratings yet

- (Acb) SFRDocument57 pages(Acb) SFRVu Thi NinhNo ratings yet

- DocxDocument9 pagesDocxReiah RongavillaNo ratings yet

- Simarleen Kaur 1222Document4 pagesSimarleen Kaur 1222simar leenNo ratings yet

- Loan Contract OrnopiaDocument5 pagesLoan Contract OrnopiaaizhelarcipeNo ratings yet

- Bodie Investments 12e IM CH13Document3 pagesBodie Investments 12e IM CH13lexon_kbNo ratings yet

- 8-7-2019 Press Release - Historic General Management Merger Between Un Swissindo (Uns) and Diruna (Dra)Document2 pages8-7-2019 Press Release - Historic General Management Merger Between Un Swissindo (Uns) and Diruna (Dra)UN Swissindo50% (2)

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersNo ratings yet

- Coursework For International Finance (AutoRecovered)Document24 pagesCoursework For International Finance (AutoRecovered)Noble NwabiaNo ratings yet

- Financial Commercial Banks Commercial BanksDocument37 pagesFinancial Commercial Banks Commercial BanksJaky AdibNo ratings yet

- Investment Center and Transfer PricingDocument10 pagesInvestment Center and Transfer Pricingrakib_0011No ratings yet

- Business Finance Module 5Document3 pagesBusiness Finance Module 5acegutierrezNo ratings yet

- TNPSC Group 1 Maths Solution by Appolo Study CenterDocument19 pagesTNPSC Group 1 Maths Solution by Appolo Study CenterKUMARESANNo ratings yet

- HT - Ltip e Bill May 2023Document4 pagesHT - Ltip e Bill May 2023Prashanta Kumar BeheraNo ratings yet

- Mancosa Mid Year Undergraduate Fee 2023Document2 pagesMancosa Mid Year Undergraduate Fee 2023John-ray HendricksNo ratings yet

- KR GXGW MYcgdq 0 V1 FDocument2 pagesKR GXGW MYcgdq 0 V1 FRakshit KandpalNo ratings yet

- Thermalnet Methodology Guideline On Techno Economic AssessmentDocument25 pagesThermalnet Methodology Guideline On Techno Economic Assessmentskywalk189No ratings yet

- Case AnalysisDocument3 pagesCase AnalysisJoshua Adorco75% (12)

- AFME Guide To Infrastructure FinancingDocument99 pagesAFME Guide To Infrastructure Financingfunction_analysisNo ratings yet

- Case Study 4.. Mariam Sharaf Al-Deen-MIS505Document3 pagesCase Study 4.. Mariam Sharaf Al-Deen-MIS505AbduNo ratings yet

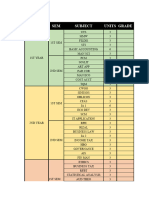

- Summary of Grades Gwa CalculatorDocument4 pagesSummary of Grades Gwa CalculatorRenelyn FiloteoNo ratings yet

- 18security Trading StatisticsDocument410 pages18security Trading StatisticsYasith WeerasingheNo ratings yet

- Unit 3.7. Cash FlowDocument18 pagesUnit 3.7. Cash FlowMMN LegendNo ratings yet

- Business Credit EbookDocument14 pagesBusiness Credit EbookNeal R Vreeland92% (13)

- Entrepreneurship: Financing The New Venture and BeyondDocument31 pagesEntrepreneurship: Financing The New Venture and BeyondSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Impact of Demonetisation On Indian Economy: A Critical StudyDocument7 pagesImpact of Demonetisation On Indian Economy: A Critical StudyVirendra RaiNo ratings yet

- INFODocument1 pageINFOJeff MaysNo ratings yet

- Ch20 Guan CM Aise TBDocument35 pagesCh20 Guan CM Aise TBHero CourseNo ratings yet

- Money Banking and Financial Markets 4th Edition Cecchetti Test Bank DownloadDocument119 pagesMoney Banking and Financial Markets 4th Edition Cecchetti Test Bank DownloadJean Standridge100% (23)

- NorQuant Multi-Asset Fund White Paper 2023Document24 pagesNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikNo ratings yet

- Auditing ProblemsDocument8 pagesAuditing ProblemsKheianne DaveighNo ratings yet