Professional Documents

Culture Documents

Trust Receipts Law

Uploaded by

Laiza AvilaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trust Receipts Law

Uploaded by

Laiza AvilaCopyright:

Available Formats

Commercial Law Review

Trust Receipts Law

Maria Zarah Villanueva - Castro

TRUST RECEIPTS LAW

Trust Receipt is a security transaction intended to aid in

financing importers or dealers in merchandize by

allowing them to obtain delivery of goods under certain

covenants.

Q: Who executes trust receipt?

A: Buyer/Entrustee (Borrower) in favor of the lender

/entrustor (Bank)

Q: What are the relationships created?

A: 1. Entruster-entrustee; 2. Seller-buyer

Q: What is the objective of the trust receipts?

A: To release the goods in favor of the entruster.

*Trust Receipt Law does not infringe the Philippine

Constitution on non-imprisonment for non-payment of

contractual debt because what the trust receipt law

punishes is the abuse made by the entrustee.

TRUST RECEIPT TRANSACTION

Sec. 4 of the Trust Receipt Law provides that: A trust

receipt transaction, within the meaning of this Decree,

is any transaction by and between a person referred to

in this Decree as the entruster, and another person

referred to in this Decree as entrustee, whereby the

entruster, who owns or holds absolute title or security

interests over certain specified goods, documents or

instruments, releases the same to the possession of the

entrustee upon the latter's execution and delivery to

the entruster of a signed document called a "trust

receipt" wherein the entrustee binds himself to hold

the designated goods, documents or instruments in

trust for the entruster and to sell or otherwise dispose

of the goods, documents or instruments with the

obligation to turn over to the entruster the proceeds

thereof to the extent of the amount owing to the

entruster or as appears in the trust receipt or the goods,

documents or instruments themselves if they are

unsold or not otherwise disposed of, in accordance with

the terms and conditions specified in the trust receipt,

or for other purposes substantially equivalent to any of

the following: 1. In the case of goods or documents,

(a) to sell the goods or procure their sale; or (b) to

manufacture or process the goods with the purpose of

ultimate sale: Provided, That, in the case of goods

delivered under trust receipt for the purpose of

manufacturing or processing before its ultimate sale,

the entruster shall retain its title over the goods

whether in its original or processed form until the

entrustee has complied fully with his obligation under

the trust receipt; or (c) to load, unload, ship or tranship

or otherwise deal with them in a manner preliminary or

necessary to their sale; or 2. In the case of

instruments, (a) to sell or procure their sale or

exchange; or (b) to deliver them to a principal; or (c) to

effect the consummation of some transactions involving

delivery to a depository or register; or (d) to effect their

presentation, collection or renewal. The sale of goods,

documents or instruments by a person in the business

of selling goods, documents or instruments for profit

who, at the outset of the transaction, has, as against the

buyer, general property rights in such goods,

documents or instruments, or who sells the same to the

buyer on credit, retaining title or other interest as

security for the payment of the purchase price, does not

constitute a trust receipt transaction and is outside the

purview and coverage of this Decree.

FORM OF TRUST RECEIPT

Sec. 5 of the Trust Receipt Law provides that: A trust

receipt need not be in any particular form, but every

such receipt must substantially contain (a) a description

of the goods, documents or instruments subject of the

trust receipt; (2) the total invoice value of the goods

and the amount of the draft to be paid by the

entrustee; (3) an undertaking or a commitment of the

entrustee (a) to hold in trust for the entruster the

goods, documents or instruments therein described; (b)

to dispose of them in the manner provided for in the

trust receipt; and (c) to turn over the proceeds of the

sale of the goods, documents or instruments to the

entruster to the extent of the amount owing to the

entruster or as appears in the trust receipt or to return

the goods, documents or instruments in the event of

their non-sale within the period specified therein. The

trust receipt may contain other terms and conditions

agreed upon by the parties in addition to those

hereinabove enumerated provided that such terms and

conditions shall not be contrary to the provisions of this

Decree, any existing laws, public policy or morals, public

order or good customs.

PARTIES TO A TRUST RECEIPT TRANSACTION

1. Entruster release the possession of the goods

to the entrustee upon the latters execution of

the trust receipt.

1

Commercial Law Review

Trust Receipts Law

Maria Zarah Villanueva - Castro

2. Entrustee Sec. 9 of the Trust Receipt Law

provides that: The entrustee shall (1) hold the

goods, documents or instruments in trust for

the entruster and shall dispose of them strictly

in accordance with the terms and conditions of

the trust receipt; (2) receive the proceeds in

trust for the entruster and turn over the same

to the entruster to the extent of the amount

owing to the entruster or as appears on the

trust receipt; (3) insure the goods for their total

value against loss from fire, theft, pilferage or

other casualties; (4) keep said goods or

proceeds thereof whether in money or

whatever form, separate and capable of

identification as property of the entruster; (5)

return the goods, documents or instruments in

the event of non-sale or upon demand of the

entruster; and (6) observe all other terms and

conditions of the trust receipt not contrary to

the provisions of this Decree.

3. Seller of the Goods - Not strictly and actually a

party to the trust receipt transaction; but

merely a party to the contract of sale with the

buyer/importer (entrustee).

RIGHTS OF THE ENTRUSTER

Sec. 7 of the Trust Receipt Law provides that: The

entruster shall be entitled to the proceeds from the sale

of the goods, documents or instruments released under

a trust receipt to the entrustee to the extent of the

amount owing to the entruster or as appears in the

trust receipt, or to the return of the goods, documents

or instruments in case of non-sale, and to the

enforcement of all other rights conferred on him in the

trust receipt provided such are not contrary to the

provisions of this Decree. The entruster may cancel the

trust and take possession of the goods, documents or

instruments subject of the trust or of the proceeds

realized therefrom at any time upon default or failure of

the entrustee to comply with any of the terms and

conditions of the trust receipt or any other agreement

between the entruster and the entrustee, and the

entruster in possession of the goods, documents or

instruments may, on or after default, give notice to the

entrustee of the intention to sell, and may, not less than

five days after serving or sending of such notice, sell the

goods, documents or instruments at public or private

sale, and the entruster may, at a public sale, become a

purchaser. The proceeds of any such sale, whether

public or private, shall be applied (a) to the payment of

the expenses thereof; (b) to the payment of the

expenses of re-taking, keeping and storing the goods,

documents or instruments; (c) to the satisfaction of the

entrustee's indebtedness to the entruster. The

entrustee shall receive any surplus but shall be liable to

the entruster for any deficiency. Notice of sale shall be

deemed sufficiently given if in writing, and either

personally served on the entrustee or sent by post-paid

ordinary mail to the entrustee's last known business

address.

*In Rosario Textile v Home Bankers, the SC held that

ownership of the entruster of the goods is only a fiction.

The one really owns the goods are the entrustee.

*Entruster is entitled to deficiency.

*Entrustee is entitled to receive surplus.

Sec. 8 of the Trust Receipt Law provides that: The

entruster holding a security interest shall not, merely by

virtue of such interest or having given the entrustee

liberty of sale or other disposition of the goods,

documents or instruments under the terms of the trust

receipt transaction be responsible as principal or as

vendor under any sale or contract to sell made by the

entrustee.

Sec. 12 of the Trust Receipt Law provides that: The

entruster's security interest in goods, documents, or

instruments pursuant to the written terms of a trust

receipt shall be valid as against all creditors of the

entrustee for the duration of the trust receipt

agreement.

OBLIGATIONS/LIABILITIES OF THE ENTRUSTEE

Sec. 9 of the Trust Receipt Law states that: The

entrustee shall (1) hold the goods, documents or

instruments in trust for the entruster and shall dispose

of them strictly in accordance with the terms and

conditions of the trust receipt; (2) receive the proceeds

in trust for the entruster and turn over the same to the

entruster to the extent of the amount owing to the

entruster or as appears on the trust receipt; (3) insure

the goods for their total value against loss from fire,

theft, pilferage or other casualties; (4) keep said goods

or proceeds thereof whether in money or whatever

form, separate and capable of identification as property

of the entruster; (5) return the goods, documents or

instruments in the event of non-sale or upon demand of

the entruster; and (6) observe all other terms and

2

Commercial Law Review

Trust Receipts Law

Maria Zarah Villanueva - Castro

conditions of the trust receipt not contrary to the

provisions of this Decree.

*Failure to return the proceeds or failure to return the

goods in case of non-sale is equivalent to estafa.

Sec. 10 of the Trust Receipt Law states that: The risk of

loss shall be borne by the entrustee. Loss of goods,

documents or instruments which are the subject of a

trust receipt, pending their disposition, irrespective of

whether or not it was due to the fault or negligence of

the entrustee, shall not extinguish his obligation to the

entruster for the value thereof.

*In Landl & Co. (Phil.) v Metrobank, the SC held that the

entrustee is still liable to pay the entruster (bank) even

if the goods were returned to the latter.

Reason why entrustee is obligated to return the goods

to the entruster: To put the goods in the disposal of

the entruster (bank)

*The criminal liability does not infringe the Constitution

because what the law punishes is the abuse in the use

of the commercial facility made by the entrustee.

*This is not a dacion en pago because the liability of the

entrustee is not extinguished from the moment the

goods are returned to the entruster.

RIGHTS OF PURCHASER

Sec. 11 of the Trust Receipt Law provides that: Any

purchaser of goods from an entrustee with right to sell,

or of documents or instruments through their

customary form of transfer, who buys the goods,

documents, or instruments for value and in good faith

from the entrustee, acquires said goods, documents or

instruments free from the entruster's security interest.

PENALTIES

Sec. 13 of the Trust Receipt Law provides that: The

failure of an entrustee to turn over the proceeds of the

sale of the goods, documents or instruments covered by

a trust receipt to the extent of the amount owing to the

entruster or as appears in the trust receipt or to return

said goods, documents or instruments if they were not

sold or disposed of in accordance with the terms of the

trust receipt shall constitute the crime of estafa,

punishable under the provisions of Article Three

hundred and fifteen, paragraph one (b) of Act

Numbered Three thousand eight hundred and fifteen,

as amended, otherwise known as the Revised Penal

Code. If the violation or offense is committed by a

corporation, partnership, association or other juridical

entities, the penalty provided for in this Decree shall be

imposed upon the directors, officers, employees or

other officials or persons therein responsible for the

offense, without prejudice to the civil liabilities arising

from the criminal offense.

3

You might also like

- Stock Market - Black BookDocument82 pagesStock Market - Black BookHrisha Bhatt62% (52)

- FIN 3138 - Credit and Collection - SyllabusDocument9 pagesFIN 3138 - Credit and Collection - SyllabusLorey Joy Idong100% (7)

- Sneaker 2013Document6 pagesSneaker 2013Shivam Bose67% (3)

- Notes To FSDocument3 pagesNotes To FSdhez10No ratings yet

- What Questions Would You Ask To Ascertain The Nature of The Multi-Generational Issues? (10 Marks)Document2 pagesWhat Questions Would You Ask To Ascertain The Nature of The Multi-Generational Issues? (10 Marks)Aounaiza AhmedNo ratings yet

- Chennai Hotel BillDocument1 pageChennai Hotel Billkannan986533% (3)

- The Bankers Bible - 2021A - Sep - R1Document60 pagesThe Bankers Bible - 2021A - Sep - R1brianchen1993No ratings yet

- ReceivershipDocument56 pagesReceivershipLim Yew TongNo ratings yet

- SEEP FRAME Tool 2.07Document46 pagesSEEP FRAME Tool 2.07PiyushNo ratings yet

- A Surety Is An Insurer of The DebtDocument1 pageA Surety Is An Insurer of The DebtMonica Gerero - BarquillaNo ratings yet

- Module 2 Credit - CollectionDocument14 pagesModule 2 Credit - CollectionAicarl JimenezNo ratings yet

- FRIA Lerma NotesDocument2 pagesFRIA Lerma NotesMarianne AgunoyNo ratings yet

- Assignment What Is The Contract of Pledge? What Are The Requisites of A Contract of Pledge?Document9 pagesAssignment What Is The Contract of Pledge? What Are The Requisites of A Contract of Pledge?Arvin RobertNo ratings yet

- Sec. 23. The Board of Directors or Trustees. - UnlessDocument8 pagesSec. 23. The Board of Directors or Trustees. - UnlessCheivy SolimanNo ratings yet

- EXCEPTIONS To The Rule of IndivisibilityDocument2 pagesEXCEPTIONS To The Rule of IndivisibilityMich SalvatorēNo ratings yet

- Securities Regulation Code HandoutDocument15 pagesSecurities Regulation Code HandoutCiana SacdalanNo ratings yet

- Module 2 Tila & AmlaDocument23 pagesModule 2 Tila & AmlaRoylyn Joy CarlosNo ratings yet

- Z - Banking - 2Document41 pagesZ - Banking - 2NetweightNo ratings yet

- Unclaimed Balances Law (PD 679)Document3 pagesUnclaimed Balances Law (PD 679)MaricrisNo ratings yet

- Sec 39conditio Nal IndorsementDocument10 pagesSec 39conditio Nal IndorsementgoerginamarquezNo ratings yet

- Aquila Reviewer Updated by ZGB 1Document92 pagesAquila Reviewer Updated by ZGB 1EdvangelineManaloRodriguezNo ratings yet

- Anti Money LaunderingDocument8 pagesAnti Money LaunderingStephen Mallari100% (1)

- Module 1 Credit FundamentalsDocument24 pagesModule 1 Credit FundamentalsCaroline Grace Enteria Mella100% (1)

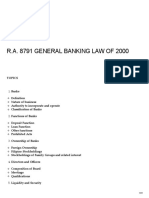

- R.A. 8791 GENERAL BANKING LAW of 2000 - Law, Politics, and Philosophy (Recovered)Document23 pagesR.A. 8791 GENERAL BANKING LAW of 2000 - Law, Politics, and Philosophy (Recovered)Michael VillalonNo ratings yet

- Fria IrrDocument53 pagesFria Irrjoselle gaviolaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument55 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress Assembledjayrkulit16No ratings yet

- Barreto Vs TuasonDocument26 pagesBarreto Vs TuasonGoodyNo ratings yet

- Week 1 Legal FormsDocument39 pagesWeek 1 Legal FormsAlfonsoNo ratings yet

- General Banking LawDocument31 pagesGeneral Banking LawMonalizts D.No ratings yet

- Hungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodDocument13 pagesHungry Jack's Vouchers: Your Ticket To Delicious and Affordable Fast FoodMonibulNo ratings yet

- Philippine Law On TrustsDocument3 pagesPhilippine Law On TrustsKayeNo ratings yet

- Kwin Transcripts - InsuranceDocument84 pagesKwin Transcripts - InsuranceMario P. Trinidad Jr.No ratings yet

- Accomodation Parties: Liability of The PrincipalDocument2 pagesAccomodation Parties: Liability of The PrincipalLucía MartínezNo ratings yet

- Guaranty and SuretyhipDocument6 pagesGuaranty and SuretyhipMic UdanNo ratings yet

- Credit DigestsDocument55 pagesCredit DigestsJerome MoradaNo ratings yet

- Banking Laws Final Examinations: Instruments (Iuis)Document2 pagesBanking Laws Final Examinations: Instruments (Iuis)Patrick D GuetaNo ratings yet

- 6.expert Travel & Tours v. CADocument24 pages6.expert Travel & Tours v. CARocelle LaquiNo ratings yet

- Letters of CreditDocument20 pagesLetters of CreditA.T.Comia100% (3)

- Chapter 6 Negotiable InstrumentsDocument23 pagesChapter 6 Negotiable InstrumentsKristelJaneDonaireBihagNo ratings yet

- Virata v. WeeDocument63 pagesVirata v. WeeTom TemprosaNo ratings yet

- Form-14 Letter of DisclaimerDocument1 pageForm-14 Letter of DisclaimerSankar Nath ChakrabortyNo ratings yet

- B. Definition and Attributes of A CorporationDocument62 pagesB. Definition and Attributes of A CorporationPduys16No ratings yet

- Sample NODDocument3 pagesSample NODSteve Mun GroupNo ratings yet

- Long Form Audit ReportDocument10 pagesLong Form Audit Reportchitrank10100% (3)

- Bod and by LawsDocument13 pagesBod and by LawsNayra DizonNo ratings yet

- Anti-Red Tape Act of 2007 - RA 9485Document5 pagesAnti-Red Tape Act of 2007 - RA 9485Rudy OrteaNo ratings yet

- Getz Corp vs. Court of Appeals (Case Digest)Document4 pagesGetz Corp vs. Court of Appeals (Case Digest)Jian CerreroNo ratings yet

- Negotiable Instruments Law Prefinals Joan MagasoDocument5 pagesNegotiable Instruments Law Prefinals Joan MagasoJovita Andelescia MagasoNo ratings yet

- Actions and Jurisdiction 2021Document16 pagesActions and Jurisdiction 2021reese93No ratings yet

- Administrative LawDocument4 pagesAdministrative LawDorothy Ann De La Pena100% (1)

- Insurance NotesDocument9 pagesInsurance Notespaul_jurado18No ratings yet

- PNB vs. Sps. RocamoraDocument11 pagesPNB vs. Sps. Rocamorayan_saavedra_1No ratings yet

- Notes On Negotiable Instruments 01Document12 pagesNotes On Negotiable Instruments 01Roni Mangalus50% (2)

- Tax ReviewerDocument68 pagesTax Reviewerviva_33No ratings yet

- Business Law Week 6Document20 pagesBusiness Law Week 6s wNo ratings yet

- Commercial Law Review: Maria Zarah Villanueva - CastroDocument3 pagesCommercial Law Review: Maria Zarah Villanueva - CastroTinn ApNo ratings yet

- Part II Trust Receipt and Warehouse Receipt LawsDocument12 pagesPart II Trust Receipt and Warehouse Receipt LawsSimmonette Lim100% (1)

- PD 115Document20 pagesPD 115diamajolu gaygonsNo ratings yet

- Doawphi1.Nétboa Letter of Credit Is A Separate Document From A Trust Receipt. While The Trust Receipt May Have Been ExecutedDocument6 pagesDoawphi1.Nétboa Letter of Credit Is A Separate Document From A Trust Receipt. While The Trust Receipt May Have Been ExecutedJoona Kis-ingNo ratings yet

- Trust ReceiptDocument5 pagesTrust ReceiptMyna Zosette MesiasNo ratings yet

- PD 115 Trust Receipt LawDocument5 pagesPD 115 Trust Receipt LawDenise LabagnaoNo ratings yet

- Loc and Trust ReceiptsDocument86 pagesLoc and Trust ReceiptsSam B. PinedaNo ratings yet

- Trust Receipts Law: Atty. Myra-Diwata A. Rivera-CaroyDocument31 pagesTrust Receipts Law: Atty. Myra-Diwata A. Rivera-CaroyMarishiel Rendon ReañoNo ratings yet

- P.D. No 115 Trust Receipt LawDocument4 pagesP.D. No 115 Trust Receipt LawAries MatibagNo ratings yet

- Law On TrustDocument7 pagesLaw On Trust19950323No ratings yet

- P.D. 115 (Trust Receipts Law)Document6 pagesP.D. 115 (Trust Receipts Law)An JoNo ratings yet

- 2022 AUSL LMT Civil Law and Practical Exercises Updated With ErratumDocument30 pages2022 AUSL LMT Civil Law and Practical Exercises Updated With ErratumEzekiel EnriquezNo ratings yet

- Copy of Hernando Cases PDFDocument136 pagesCopy of Hernando Cases PDFEzekiel EnriquezNo ratings yet

- 2022 AUSL Last Minute Tips Commercial Law 1Document19 pages2022 AUSL Last Minute Tips Commercial Law 1Ezekiel EnriquezNo ratings yet

- Assignment Labor Law Review 001-2021 Dean Porfirio Panganiban, JRDocument2 pagesAssignment Labor Law Review 001-2021 Dean Porfirio Panganiban, JREzekiel EnriquezNo ratings yet

- Performance Enhancement Assessment: Atty. Porfirio Dg. Panganiban, JRDocument3 pagesPerformance Enhancement Assessment: Atty. Porfirio Dg. Panganiban, JREzekiel EnriquezNo ratings yet

- Frozen Exchange (Import & Export Inc.) AGENT: EZEKIEL ENRIQUEZ (09685612583) (09175053195)Document2 pagesFrozen Exchange (Import & Export Inc.) AGENT: EZEKIEL ENRIQUEZ (09685612583) (09175053195)Ezekiel EnriquezNo ratings yet

- Liga VS AtienzaDocument2 pagesLiga VS AtienzaEzekiel EnriquezNo ratings yet

- Extention LetterDocument1 pageExtention LetterEzekiel EnriquezNo ratings yet

- 2019 Alas Bar Notes Civil LawDocument16 pages2019 Alas Bar Notes Civil LawEzekiel EnriquezNo ratings yet

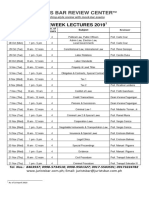

- 2019 Schedule of Preweek LecturesDocument1 page2019 Schedule of Preweek LecturesEzekiel EnriquezNo ratings yet

- Case ResearchDocument8 pagesCase ResearchEzekiel EnriquezNo ratings yet

- Sales ReviewerDocument24 pagesSales ReviewerEzekiel EnriquezNo ratings yet

- Trust Receipts Law PDFDocument4 pagesTrust Receipts Law PDFEzekiel EnriquezNo ratings yet

- Agan Vs PIATCODocument1 pageAgan Vs PIATCOEzekiel EnriquezNo ratings yet

- Damages Case DigestDocument9 pagesDamages Case DigestEzekiel Enriquez0% (1)

- Public UtilitiesDocument15 pagesPublic UtilitiesEzekiel EnriquezNo ratings yet

- FINAL Rodriguez Public-UtilitiesDocument7 pagesFINAL Rodriguez Public-UtilitiesEzekiel EnriquezNo ratings yet

- Case Digest Compiilation ATAPDocument62 pagesCase Digest Compiilation ATAPEzekiel EnriquezNo ratings yet

- Letters of CreditDocument3 pagesLetters of CreditEzekiel Enriquez0% (1)

- Filed: Patrick FisherDocument12 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- BSAFDocument132 pagesBSAFzahra naheedNo ratings yet

- Abm 11 - Group 4 - Chapter 6Document8 pagesAbm 11 - Group 4 - Chapter 6Ivy BatocabeNo ratings yet

- Banking Law ProjectDocument23 pagesBanking Law ProjectAkasa Seth0% (1)

- 67078bos54071 Inter gp1Document104 pages67078bos54071 Inter gp1Hari AdabalaNo ratings yet

- Topic 1 - IntroductionDocument19 pagesTopic 1 - Introductionalvaroriva6No ratings yet

- AnnualReport 2019-20Document80 pagesAnnualReport 2019-20Akshat GoelNo ratings yet

- ReportDocument56 pagesReportMd Khaled NoorNo ratings yet

- Industry Multiples in India Report 2023 21st EditionDocument107 pagesIndustry Multiples in India Report 2023 21st Editionvkiran_1989No ratings yet

- IFRS 15 Garuda - AnalysisDocument8 pagesIFRS 15 Garuda - Analysisratu shaviraNo ratings yet

- Cankids... Kidscan Donation Form: Donor DetailsDocument2 pagesCankids... Kidscan Donation Form: Donor DetailsdpfsopfopsfhopNo ratings yet

- Instruction: at The End of Each Case, You Are Required To Answer Each RequirementDocument3 pagesInstruction: at The End of Each Case, You Are Required To Answer Each RequirementWendelyn TutorNo ratings yet

- BLC Plantations Recycle Palm Oil Fronds Project PrposalDocument15 pagesBLC Plantations Recycle Palm Oil Fronds Project Prposalzakuan79No ratings yet

- Income Tax Complete - E-Notes - Udesh Regular - Group 1Document250 pagesIncome Tax Complete - E-Notes - Udesh Regular - Group 1Uday Tomar100% (1)

- Triple Entry AccountingDocument37 pagesTriple Entry AccountingdiasjonaNo ratings yet

- Apm Terminals Bahrain Ipo Prospectus October 2018Document308 pagesApm Terminals Bahrain Ipo Prospectus October 2018TestoNo ratings yet

- Inland Revenue Board of Malaysia: Public Ruling No. 10/2015Document26 pagesInland Revenue Board of Malaysia: Public Ruling No. 10/2015Ken ChiaNo ratings yet

- Budgeting ProcessDocument16 pagesBudgeting ProcessJohnson BrisbaneNo ratings yet

- Payroll and PayslipDocument2 pagesPayroll and PayslipKrisha TubogNo ratings yet

- Private Banking and Money Laundering: A Case Study of Opportunities and VulnerabilitiesDocument1,128 pagesPrivate Banking and Money Laundering: A Case Study of Opportunities and VulnerabilitiesScribd Government DocsNo ratings yet

- Fnstpb402 Task 2Document19 pagesFnstpb402 Task 2Rabin BidariNo ratings yet

- Progressive Varela Feb 2016 Complete PDFDocument10 pagesProgressive Varela Feb 2016 Complete PDFRenelyn Esteban ClementeNo ratings yet

- Collector v. Goodrich International (Bad Debt)Document2 pagesCollector v. Goodrich International (Bad Debt)Argel CosmeNo ratings yet

- Chandigarh - Stamp DutyDocument5 pagesChandigarh - Stamp DutyVirajNo ratings yet