Professional Documents

Culture Documents

Tokenization Best Practices

Tokenization Best Practices

Uploaded by

mail4290Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tokenization Best Practices

Tokenization Best Practices

Uploaded by

mail4290Copyright:

Available Formats

VISA BEST PRACTICES

14 July 2010

Visa Best Practices for Tokenization Version 1.0

Introduction

In October 2009, Visa published the Visa Best Practices for Data Field Encryption to promote the proper encryption of

sensitive card data that is transmitted, processed or stored by stakeholders throughout the payment system. As part of

these best practices, Visa recommended that entities use tokens (such as a transaction ID or a surrogate value) to

replace the Primary Account Number (PAN) for use in payment-related and ancillary business functions.

Tokenization can be implemented in isolation or in concert with data field encryption to help merchants eliminate the

need to store sensitive cardholder data after authorization. Entities that properly implement and execute a tokenization

process to support their payment functions may be able to reduce the scope, risks and costs associated with ongoing

compliance with the Payment Card Industry Data Security Standards (PCI DSS).

How Tokenization Works

Tokenization defines a process through which PAN data is replaced with a surrogate value known as a token. The

security of an individual token relies on properties of uniqueness and the infeasibility to determine the original PAN knowing

only the surrogate value. As a reference or surrogate value for the original PAN, a token can be used freely by systems

and applications within a merchant environment.

Where properly implemented, tokenization allows merchants to limit the storage of cardholder data to within the

tokenization system, potentially simplifying an entitys assessment against the PCI DSS. As a reference or surrogate value

for the original PAN, a token can be used by systems and applications within a merchant environment without having to

consider the security implications associated with the use of cardholder data.

The security and robustness of a tokenization system is dependent upon the secure implementation of four critical

components, and the overall management of the system and any historical data:

Token Generation: Defines the process through which a token is generated.

Token Mapping: Defines the process for associating a token to its original PAN value.

Card Data Vault: Defines the central repository of cardholder data used by the token mapping process.

Cryptographic Key Management: Defines the process through which cryptographic keys are managed and how

they are used to protect cardholder and account data.

Visa Public

1

Visa Best Practices for Tokenization, Version 1.0

The following are best practices for use of tokenization technology to protect cardholder data:

Domain

Best Practice

1. Network Segmentation: The tokenization system must be adequately

segmented from the rest of the network. The tokenization system must be

deployed within a fully PCI DSS compliant environment and be subject to

a full PCI DSS assessment.

2. Authentication: Only authenticated entities shall be allowed access to

the tokenization system.

3. Monitoring: The tokenization system must implement monitoring to

detect malfunctions or anomalies and suspicious activities in token-to-PAN

mapping requests. Upon detection, the monitoring system should alert

Tokenization

System

administrators and actively block token-to requests or implement a rate

limiting function to limit PAN data disclosure.

4. Token Distinguishability: The tokenization system must be able to

identify and distinguish between tokenized and cleartext cardholder data and

avoid the propagation of tokens to

systems expecting cleartext cardholder data.

Note: In accordance with the Visa Best Practices for Data Field

Encryption, cardholder data must remain encrypted from the point where it

enters an entitys system up to the point it is tokenized to achieve the

full benefits of a tokenization solution.

5. Token Generation: Knowing only the token, the recovery of the original

PAN must not be computationally feasible. Token generation can be

conducted utilizing either:

Token Generation

A known strong cryptographic algorithm (with a secure mode of

operation and padding mechanism), or

A one-way irreversible function (e.g., as a sequence number, using a

hash function with salt or as a randomly generated number)

Visa Public

2

6. Single-use vs. Multi-use Tokens: Tokens can be generated as a

single- or multi-use surrogate value, the choice of which depends largely

on business processes:

A single-use token should be used when there is no business need to

track an individual PAN for multiple transactions. Acceptable methods

for producing a single-use token include, but are not limited to, hashing

of the PAN with a transaction-unique salt

value, using a unique sequence number, or encrypting the PAN with an

ISO- or ANSI-approved encryption algorithm using a transaction-unique

key.

A multi-use token should be used when there is a business need to

track an individual PAN for multiple transactions. A multi-use token will

always map the same input PAN to the same token. An acceptable

method for producing a multi-use token includes, but is not limited to,

hashing of the cardholder data using a fixed but unique salt value per

merchant.

Notes: If a salt value is used, the salt must be kept secret and appropriately

protected. A salt should have a minimum length of 64-bits.

If a token is generated as a result of using a hash function, truncated PAN

data must not be stored or transmitted in conjunction with the tokenized

data.

7. PAN Processing: In order to limit / eliminate storage of PAN data, the

tokenization system should not provide PAN data to a token recipient (e.g., a

merchant). If PAN data is returned, the receiving system will be in the scope

of the PCI DSS. The token mapping should perform the following:

Processes should not return the PAN as part of any response to the

merchant.

Token Mapping

The tokenization platform should allow for chargeback and refund

processing without the need for the merchant to retain or have access

to full PAN.

8. PAN data must be encrypted in storage.

Card Data Vault

9. The card data vault must be managed and protected per PCI DSS

requirements.

Cryptographic Key

10. Encryption keys shall use a minimum bit strength of 112 bits.

Visa Public

3

Management

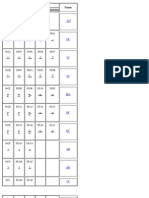

The following table summarizes equivalent bit strengths for commonly

used approved algorithms:

Algorithms

Bit Length

TDES

1121

AES

1282

RSA

2048

ECC

224

SHA

224

11. Any cryptographic keys used by the tokenization system must be

managed in accordance with PCI DSS.

Management of

Historical Data

12. Any retained historical or existing repositories of cardholder data must

be protected (per PCI DSS requirements), tokenized

or eliminated as part of the implementation.

Conclusion

Visa supports tokenization as a means of replacing Primary Account Numbers (PANs) with non-sensitive surrogate values

(known as tokens) to eliminate or reduce storage of cardholder data. Tokenization can be implemented independently or

in concert with data field encryption for the protection of cardholder information. To support marketplace adoption of

tokenization, Visa has developed best practices to assist merchants and other stakeholders in evaluating and adopting

tokenization solutions. These best practices should be viewed as high level guidance to be considered for any such solution

to assist stakeholders in the Visa payment system.

Respond With Comments by August 31, 2010

Visa would appreciate stakeholder feedback on these best practices by August 31, 2010. Please submit any comments via

e-mail to inforisk@visa.com with "Best Practices for Tokenization" in the subject line.

Related Documents

Visa Best Practices for Data Field Encryption October 2009

Visa Best Practices for Primary Account Number Storage and Truncation July 2010

For the purpose of these best practices, two key TDES (112-bits) should not process more than 1 million transactions. In cases where

the number of transactions potentially processed through the system using a single 112-bits TDES key greatly exceeds 1 million, three

key TDES (168-bits) or AES should be used. Key management schemes that greatly limit the number of transactions processed by a

single key, such as Derived Unique Key Per Transaction (DUKPT), can be used to ensure that any individual key is used only a limited

number of times..

2

The smallest key size usable with AES is 128 bits. This key size is stronger than needed, but if AES is to be used, it is

the smallest available. Longer keys may be used if so desired.

Visa Public

4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CISSP Study Guide PDFDocument100 pagesCISSP Study Guide PDFSK TuNo ratings yet

- EMV CPS v1.1Document104 pagesEMV CPS v1.1Hafedh Trimeche67% (3)

- OpenVAS ManualDocument347 pagesOpenVAS ManualwetcomNo ratings yet

- Amex Global Credit Auth Guide ISO Apr2011Document350 pagesAmex Global Credit Auth Guide ISO Apr2011Hafedh Trimeche100% (2)

- PCI HSM Security Requirements v3 2016 FinalDocument47 pagesPCI HSM Security Requirements v3 2016 FinalRifat Hasif Putrafebrian100% (1)

- Complete Hacking Crash CourseDocument60 pagesComplete Hacking Crash CourseRahul Kumar100% (1)

- User Manual: 4-4-2 Enrollment ScannerDocument11 pagesUser Manual: 4-4-2 Enrollment ScannerHafedh TrimecheNo ratings yet

- Essentials API - v1.1 - ENDocument24 pagesEssentials API - v1.1 - ENHafedh TrimecheNo ratings yet

- Passport Reader SDK User ManualDocument6 pagesPassport Reader SDK User ManualHafedh TrimecheNo ratings yet

- Intelligent Portable Control System: Project PresentationDocument14 pagesIntelligent Portable Control System: Project PresentationHafedh TrimecheNo ratings yet

- Mightygps Itrack Gold: Gps Tracking For Fleet & SecurityDocument32 pagesMightygps Itrack Gold: Gps Tracking For Fleet & SecurityHafedh TrimecheNo ratings yet

- Kelio V14Document36 pagesKelio V14Hafedh TrimecheNo ratings yet

- Writing ActiveX ControlsDocument6 pagesWriting ActiveX ControlsHafedh TrimecheNo ratings yet

- Arabic GlyphsDocument4 pagesArabic GlyphsHafedh TrimecheNo ratings yet

- TimestampDocument5 pagesTimestampHafedh TrimecheNo ratings yet

- Anexo 5 Major US Bank Replaces Base24 With OmniPayments - 1335820935474Document4 pagesAnexo 5 Major US Bank Replaces Base24 With OmniPayments - 1335820935474Hafedh TrimecheNo ratings yet

- OFXDocument665 pagesOFXHafedh TrimecheNo ratings yet

- Remote Key LoadDocument8 pagesRemote Key LoadHafedh TrimecheNo ratings yet

- SGWDocument42 pagesSGWHafedh TrimecheNo ratings yet

- ICC AdminDocument182 pagesICC Admincvlucian50% (2)

- EMV (Chip and PIN) ProjectDocument166 pagesEMV (Chip and PIN) ProjectSali Lala100% (1)

- PayPass - MChip (V1.3)Document125 pagesPayPass - MChip (V1.3)vijayasimhasNo ratings yet

- World-Text API SMPP Intergration SpecificationDocument8 pagesWorld-Text API SMPP Intergration SpecificationHafedh TrimecheNo ratings yet

- ActivexDocument2 pagesActivexHafedh Trimeche100% (1)

- Assignment On E-Commerce: Hailey College of Commerce University of The Punjab LahoreDocument7 pagesAssignment On E-Commerce: Hailey College of Commerce University of The Punjab LahoreSabir RazaNo ratings yet

- Iam UgDocument475 pagesIam Ugprasadpra17100% (1)

- AWS IAM-Cheet-SheetDocument11 pagesAWS IAM-Cheet-SheetamarmudirajNo ratings yet

- Security Breach: The Case of TJX Companies, IncDocument18 pagesSecurity Breach: The Case of TJX Companies, Inchammad78No ratings yet

- Enterprise Analytics in The CloudDocument12 pagesEnterprise Analytics in The CloudAnonymous gUySMcpSqNo ratings yet

- Cloud Advocate - 3 - Fundamentals of IBM CloudDocument42 pagesCloud Advocate - 3 - Fundamentals of IBM CloudGabriel PessineNo ratings yet

- Data PrivacyDocument9 pagesData PrivacyRodrick Sonajo RamosNo ratings yet

- VMware 3V0-21.21 Updated Questions and AnswersDocument8 pagesVMware 3V0-21.21 Updated Questions and AnswersJasmine DengNo ratings yet

- Isaca Cisa CismDocument49 pagesIsaca Cisa CismKavithaRamchandranNo ratings yet

- The Protection of Consumers' Personal Data in The Era of E-Commerce in NigeriaDocument41 pagesThe Protection of Consumers' Personal Data in The Era of E-Commerce in NigeriaOmoruyi RachealNo ratings yet

- Activeserver: Frictionless Fraud Prevention With 3D Secure 2Document9 pagesActiveserver: Frictionless Fraud Prevention With 3D Secure 2karlosm84No ratings yet

- Coalfire PCI 3 On AWS With Vormetric White Paper 2014 0312PCIDSSDocument22 pagesCoalfire PCI 3 On AWS With Vormetric White Paper 2014 0312PCIDSSval shaNo ratings yet

- Security Chaos Engineering VericaDocument92 pagesSecurity Chaos Engineering VericaAli DayaniNo ratings yet

- Ebook The Definitive Guide To Cloud Acceleration - HTMDocument119 pagesEbook The Definitive Guide To Cloud Acceleration - HTMaustinfru7No ratings yet

- OmniToken Product SheetDocument1 pageOmniToken Product SheetRishi SrivastavaNo ratings yet

- UL White Paper - Tokenization ExplainedDocument16 pagesUL White Paper - Tokenization ExplainedacpereraNo ratings yet

- Delivery TermsDocument60 pagesDelivery TermsTarush GoelNo ratings yet

- Restaurants Risk Management Guide UKDocument9 pagesRestaurants Risk Management Guide UKSarika JindalNo ratings yet

- Self-Assessment Questionnaire A: and Attestation of ComplianceDocument19 pagesSelf-Assessment Questionnaire A: and Attestation of ComplianceMinh Nhat TranNo ratings yet

- Cyber Breach at TargetDocument12 pagesCyber Breach at TargetVarun LalaNo ratings yet

- Implementing ISO Format 4 PIN Blocks Information SupplementDocument23 pagesImplementing ISO Format 4 PIN Blocks Information SupplementallNo ratings yet

- File ListDocument7 pagesFile Listnatan petraNo ratings yet

- Data MaskingDocument2 pagesData Maskingpavan79No ratings yet

- Welcome To Clearent Mobile Payment Solution With Restaurant Operation SystemDocument14 pagesWelcome To Clearent Mobile Payment Solution With Restaurant Operation SystemJames LeeNo ratings yet

- Change Opera Supervisor Password: BackgroundDocument5 pagesChange Opera Supervisor Password: BackgroundEliecer Francisco Marenco UrbinaNo ratings yet

- Navigating PCI DSS v4.0Document24 pagesNavigating PCI DSS v4.0Ivan DoriNo ratings yet