Professional Documents

Culture Documents

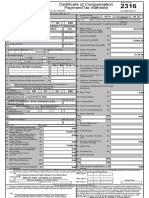

Bir Form 2316

Bir Form 2316

Uploaded by

Mireille KirstenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Form 2316

Bir Form 2316

Uploaded by

Mireille KirstenCopyright:

Available Formats

DLN:

Certificate of Compensation

Payment/Tax Withheld

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For the Year

( YYYY )

Part I

Employee Information

3 Taxpayer

Identification No.

4 Employee's Name (Last Name, First Name, Middle Name)

For the Period

From (MM/DD)

To (MM/DD)

Details of Compensation Income and Tax Withheld from Present Employer

Part IV-B

Amount

A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

5 RDO Code

32 Basic Salary/

Statutory Minimum Wage

6 Registered Address

6A Zip Code

6B Local Home Address

6C Zip Code

6D Foreign Address

6E Zip Code

7 Date of Birth (MM/DD/YYYY)

8 Telephone Number

9 Exemption Status

Single

2316

July 2008 (ENCS)

For Compensation Payment With or Without Tax Withheld

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1

BIR Form No.

32

Minimum Wage Earner (MWE)

33 Holiday Pay (MWE)

33

34 Overtime Pay (MWE)

34

35 Night Shift Differential (MWE)

35

36 Hazard Pay (MWE)

36

37 13th Month Pay

and Other Benefits

37

38 De Minimis Benefits

38

39 SSS, GSIS, PHIC & Pag-ibig

Contributions, & Union Dues

39

Married

9A Is the wife claiming the additional exemption for qualified dependent children?

Yes

10 Name of Qualified Dependent Children

No

11 Date of Birth (MM/DD/YYYY)

(Employee share only)

12 Statutory Minimum Wage rate per day

12

13 Statutory Minimum Wage rate per month

13

Minimum Wage Earner whose compensation is exempt from

withholding tax and not subject to income tax

Part II

Employer Information (Present)

15 Taxpayer

Identification No.

16 Employer's Name

40 Salaries & Other Forms of

Compensation

40

41 Total Non-Taxable/Exempt

Compensation Income

41

14

42 Basic Salary

42

43 Representation

43

44 Transportation

44

45 Cost of Living Allowance

45

46 Fixed Housing Allowance

46

47 Others (Specify)

47A

47A

47B

47B

SUPPLEMENTARY

48 Commission

48

49 Profit Sharing

49

50 Fees Including Director's

Fees

50

51 Taxable 13th Month Pay

and Other Benefits

51

52 Hazard Pay

52

28

53 Overtime Pay

53

29

54 Others (Specify)

17 Registered Address

17A Zip Code

Main Employer

Secondary Employer

Part III

Employer Information (Previous)

18 Taxpayer

Identification No.

19 Employer's Name

20 Registered Address

20A Zip Code

Part IV-A

21 Gross Compensation Income from

B. TAXABLE COMPENSATION INCOME

REGULAR

Summary

21

Present Employer (Item 41 plus Item 55)

22 Less: Total Non-Taxable/

22

Exempt (Item 41)

23 Taxable Compensation Income

23

from Present Employer (Item 55)

24 Add: Taxable Compensation

Income from Previous Employer

25 Gross Taxable

Compensation Income

26 Less: Total Exemptions

24

27 Less: Premium Paid on Health

27

25

26

and/or Hospital Insurance (If applicable)

28 Net Taxable

Compensation Income

29 Tax Due

30 Amount of Taxes Withheld

30A Present Employer

30A

30B Previous Employer

30B

31 Total Amount of Taxes Withheld

As adjusted

54A

54A

54B

54B

55 Total Taxable Compensation

Income

31

55

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

Date Signed

56

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57

CTC No.

of Employee

Date Signed

Employee Signature Over Printed Name

Place of Issue

Amount Paid

Date of Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury, that the information herein stated are reported

under BIR Form No. 1604CF which has been filed with the Bureau of Internal Revenue.

58

Present Employer/ Authorized Agent Signature Over Printed Name

(Head of Accounting/ Human Resource or Authorized Representative)

I declare,under the penalties of perjury that I am qualified under substituted filing of

Income Tax Returns(BIR Form No. 1700), since I received purely compensation income

from only one employer in the Phils. for the calendar year; that taxes have been

correctly withheld by my employer (tax due equals tax withheld); that the BIR Form

No. 1604CF filed by my employer to the BIR shall constitute as my income tax return;

and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700

had been filed pursuant to the provisions of RR No. 3-2002, as amended.

59

Employee Signature Over Printed Name

You might also like

- Bir 2303Document1 pageBir 2303Melissa Baday80% (5)

- 2019 SEC Cover Sheet For Financial StatementsDocument1 page2019 SEC Cover Sheet For Financial StatementsKim Balauag74% (19)

- Globe BillDocument3 pagesGlobe BillJL D CT0% (1)

- CONVERGE Proof of Internet SubscriptionDocument1 pageCONVERGE Proof of Internet SubscriptionJayrald Delos SantosNo ratings yet

- Credit Card - COE 198141Document1 pageCredit Card - COE 198141Richmon Felix Trance67% (3)

- Authorization Letter - QC FormDocument2 pagesAuthorization Letter - QC FormCharina Marie Cadua78% (9)

- Bir 1701Document2 pagesBir 1701RAYNAN MARCELO100% (1)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- E SalesDocument58 pagesE Salesgrini gunayan50% (2)

- Pagibig Member's Data Form (MDF)Document2 pagesPagibig Member's Data Form (MDF)wawawiwap71% (73)

- Schedules For Non-Stock, Non-Profit Organizations Sworn StatementDocument8 pagesSchedules For Non-Stock, Non-Profit Organizations Sworn StatementKateNo ratings yet

- Preferential TaxationDocument7 pagesPreferential TaxationJane100% (2)

- BIR Form No. 1701Document4 pagesBIR Form No. 1701blesypNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- Certificate of Deposit (Metrobank)Document2 pagesCertificate of Deposit (Metrobank)Westly Juco100% (2)

- Requirements For Summary List of Sales and PurchasesDocument2 pagesRequirements For Summary List of Sales and PurchasesMary Joy Villanueva100% (2)

- BIR Form 1903Document2 pagesBIR Form 1903Earl LarroderNo ratings yet

- Letter of Retirement Brgy LevelDocument1 pageLetter of Retirement Brgy Leveljayar medicoNo ratings yet

- MayniladDocument1 pageMayniladTheo AmadeusNo ratings yet

- 2316 139520 PDFDocument1 page2316 139520 PDFAnonymous EVdPq3NlNo ratings yet

- 2316 (1) 1Document2 pages2316 (1) 1dolores100% (1)

- DocumentDocument2 pagesDocumentZandie Garcia0% (1)

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- SM TAYTAY - New Tenant Profile Form PDFDocument2 pagesSM TAYTAY - New Tenant Profile Form PDFtokstutonNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleErick Echual75% (4)

- How To File Form 2316 and Annex FDocument4 pagesHow To File Form 2316 and Annex FIvan Benedicto100% (1)

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- COEDocument1 pageCOEChristian Casalan100% (2)

- Certification of EmploymentDocument2 pagesCertification of EmploymentArafat Tocalo100% (1)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldTrish CalumaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGeorgia HolstNo ratings yet

- Bir Form 2316Document2 pagesBir Form 2316Benjie T Madayag100% (1)

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldIan Jay BahiaNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- 28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Document4 pages28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Kenneth Vallejos CesarNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Bir Form 2316 BlankDocument296 pagesBir Form 2316 BlankRomeda ValeraNo ratings yet

- New 2316 Annex ADocument1 pageNew 2316 Annex AGeram ConcepcionNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldSafferon SaffronNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- LandDocument19 pagesLandvaishnavi AgarwalNo ratings yet

- Tax Form W-8BEN-E PDFDocument17 pagesTax Form W-8BEN-E PDFNEWKHALSA ENTNo ratings yet

- Accounting For Business CombinationsDocument52 pagesAccounting For Business CombinationsEliza Beth100% (1)

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- 30Document4 pages30Carlo ParasNo ratings yet

- Cost SheetDocument5 pagesCost Sheetpooja45650% (2)

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document20 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB Cloyd100% (1)

- To Study The Financial and Ratio Analysis of Ambuja Cement Ltd.Document92 pagesTo Study The Financial and Ratio Analysis of Ambuja Cement Ltd.Nikhil Ghadigaonkar100% (1)

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument16 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelFarbeen Satira MirzaNo ratings yet

- Governmental Entities: Introduction and General Fund AccountingDocument99 pagesGovernmental Entities: Introduction and General Fund AccountingSamah Refa'tNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- STATEMENT OF ACCOUNT RevisedDocument2 pagesSTATEMENT OF ACCOUNT RevisedJose VillarealNo ratings yet

- 660 Final Assignment (Maruf)Document29 pages660 Final Assignment (Maruf)Maruf ChowdhuryNo ratings yet

- Old Mutual Money Market Fund-ZimselectorDocument2 pagesOld Mutual Money Market Fund-ZimselectorYell GeorgeNo ratings yet

- Final Exam Sbac 3aDocument4 pagesFinal Exam Sbac 3aRiza Mae AlceNo ratings yet

- DocxDocument11 pagesDocxClyden Jaile RamirezNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- R&D Expense As A Percentage of Total Revenue: Sample Content & Da TADocument4 pagesR&D Expense As A Percentage of Total Revenue: Sample Content & Da TAGabriel FreitasNo ratings yet

- 08 Sample-ActivitiesDocument19 pages08 Sample-ActivitiesPrincess Anne MendozaNo ratings yet

- Chapter 1 Double Entry System For Income & ExpensesDocument2 pagesChapter 1 Double Entry System For Income & ExpensesDeveender Kaur JudgeNo ratings yet

- Case Study (Answer Any 6) : 1. Ham Brook V Stokes Bros (1925)Document5 pagesCase Study (Answer Any 6) : 1. Ham Brook V Stokes Bros (1925)DiptoDCastleNo ratings yet

- BT Cau DKDocument6 pagesBT Cau DKHa TranNo ratings yet

- Signed By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Document8 pagesSigned By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Aviral SankhyadharNo ratings yet

- AFA Students Qut Bank For Reference-1Document19 pagesAFA Students Qut Bank For Reference-1PrithviNo ratings yet

- Account TitlesDocument8 pagesAccount TitleskdjasldkajNo ratings yet

- The Private Insurance Industry: Financial Operations of InsurersDocument11 pagesThe Private Insurance Industry: Financial Operations of InsurersSunny SunnyNo ratings yet

- 3rd Quizzer 1st Sem SY 2020-2021 - AKDocument6 pages3rd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNo ratings yet

- Lecture 6 Accruals and PrepaymentsDocument21 pagesLecture 6 Accruals and PrepaymentsazizbektokhirbekovNo ratings yet

- Financial Crimes - ACC 404 Fraud Examination - 19 October 2021Document98 pagesFinancial Crimes - ACC 404 Fraud Examination - 19 October 2021Bernadette Ruiz AlbinoNo ratings yet