Professional Documents

Culture Documents

Dos and Don'ts For Printing and Submitting of ITR-Vs To ITD-CPC Bangalore

Dos and Don'ts For Printing and Submitting of ITR-Vs To ITD-CPC Bangalore

Uploaded by

Akshay Chandna0 ratings0% found this document useful (0 votes)

2 views2 pagesA guide to what to do or not

Original Title

ITR-V_Dos_and_Donts

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA guide to what to do or not

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesDos and Don'ts For Printing and Submitting of ITR-Vs To ITD-CPC Bangalore

Dos and Don'ts For Printing and Submitting of ITR-Vs To ITD-CPC Bangalore

Uploaded by

Akshay ChandnaA guide to what to do or not

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

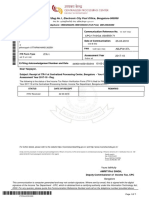

Dos and Donts for printing and submitting of ITR-Vs to

ITD-CPC Bangalore

1)

Please use Ink Jet /Laser printer to print the ITR-V Form.

2)

The ITR-V Form should be printed only in black ink.

3)

Do not use any other ink option to print ITR V.

4)

Use of Dot Matrix printer should be avoided.

5)

Ensure that print out is clear and not light print/faded copy.

6)

Please do not print any water marks on ITR-V. The only permissible

watermark is that of Income tax Department which is printed

automatically on each ITR V.

7)

The document that is mailed to CPC should be signed in original.

8)

Photocopy of signatures will not be accepted.

9)

The signatures or any handwritten text should not be written on Bar

code.

10)

Bar code and numbers below barcode should be clearly visible.

11)

Only A4 size white paper should be used.

12)

Avoid typing anything at the back of the paper.

13)

Perforated paper or any other size paper should be avoided.

14)

Do not use stapler on ITR V acknowledgement.

15)

In case you are submitting original and revised returns, do not print

them back to back. Use two separate papers for printing ITR-Vs

separately.

16)

Please do not submit any annexures, covering letter, pre stamped

envelopes etc. along with ITR-V.

17)

The ITR-V form is required to be sent to Post Bag No.1, Electronic

City Post Office, Bengaluru, Karnataka-560100, by ordinary post.

18)

ITR-Vs that do not conform to the above specifications may get

rejected or acknowledgement of receipt may get delayed.

CBDT Press Release

The Central Board of Direct Taxes had, vide circular No.3/2009 dated

21.05.2009, allowed assessees who file their income tax returns in

electronic form without digital signature to submit their verified ITR-V

form, within a period of 30 days, thereafter. The ITR-V form was required

to be sent to Post Bag No.1, Electronic City Post Office, Bengaluru,

Karnataka-560100, by ordinary post.

It has now been decided to extend the time limit for filing the ITR-V

form by relaxing the stipulations in the circular dated 21.05.2009. The ITRV form relating to returns which have been filed electronically (without

digital signature) on or after 1st April, 2009 can now be filed on or before

the 30th September, 2009 or within a period of 60 days of uploading of

the electronic return data, whichever is later. The ITR-V should continue to

be sent by ordinary post to Post Bag No.1, Electronic City Post Office,

Bengaluru, Karnataka-560100.

You might also like

- CAMSKRA Latest Form New KYC FormDocument4 pagesCAMSKRA Latest Form New KYC FormVivek SinghalNo ratings yet

- ATM-e-Banking Mobile Banking Request Form For CBS Customers PDFDocument1 pageATM-e-Banking Mobile Banking Request Form For CBS Customers PDFSupdt. of Post offices Kanpur (M) Dn. KanpurNo ratings yet

- ITRV Dos DontsDocument1 pageITRV Dos DontsShambhu SharanNo ratings yet

- Dos and Donts For ITRV (Efiling Acknowledgement Form)Document2 pagesDos and Donts For ITRV (Efiling Acknowledgement Form)bh_mehta_06No ratings yet

- EXPORT Licence ProceduresDocument9 pagesEXPORT Licence ProceduresdheerajdorlikarNo ratings yet

- Documents To Be Submitted:: Dear Samdason JoysonantonyDocument8 pagesDocuments To Be Submitted:: Dear Samdason JoysonantonySam DawsonNo ratings yet

- ATM-e-Banking, Mobile Banking Request Form For CBS CustomersDocument1 pageATM-e-Banking, Mobile Banking Request Form For CBS CustomersTarak Nath PalNo ratings yet

- Importer Exporter Code Number or IEC Code No in India. - DGFTDocument6 pagesImporter Exporter Code Number or IEC Code No in India. - DGFTparas_devendraNo ratings yet

- Himgiri TradersDocument2 pagesHimgiri Traderssantosh raiNo ratings yet

- POSY OddiceDocument1 pagePOSY Oddicekumar nNo ratings yet

- Vendor Registration Form: GeneralDocument17 pagesVendor Registration Form: GeneralAayush GoelNo ratings yet

- New Card Design IndivDocument1 pageNew Card Design Indivanuvab85No ratings yet

- DGFTDocument35 pagesDGFTgagan15095895No ratings yet

- Public Notice No 2Document98 pagesPublic Notice No 2Rajat MehtaNo ratings yet

- RCU - Trigger ListDocument13 pagesRCU - Trigger Listmanoj guptaNo ratings yet

- Brickwood Infratech Co DetailsDocument2 pagesBrickwood Infratech Co DetailsSarvajeet VermaNo ratings yet

- Trinity ITRDocument1 pageTrinity ITRkkunni210839No ratings yet

- EFT Detail Submission Form Word 97 Format0.1Document1 pageEFT Detail Submission Form Word 97 Format0.1nani3388No ratings yet

- Adobe Scan 15 Sep 2023Document8 pagesAdobe Scan 15 Sep 2023patilvr3578No ratings yet

- New Telephone Connection FormDocument2 pagesNew Telephone Connection FormRajagopal RaoNo ratings yet

- PSL53Document3 pagesPSL53Nenad MarkovićNo ratings yet

- Form N3 DDO Registration NORDocument2 pagesForm N3 DDO Registration NORYogi173No ratings yet

- Iec License Guide LineDocument33 pagesIec License Guide LineJohn AlexanderNo ratings yet

- Import Export Code NumberDocument8 pagesImport Export Code NumberShailesh DsouzaNo ratings yet

- Frequently Asked Questions (Faqs) (Online Payment of Stamp Duty and Registration Fees.)Document4 pagesFrequently Asked Questions (Faqs) (Online Payment of Stamp Duty and Registration Fees.)Aryan KNo ratings yet

- FAQs Online Payment of Stamp Duty and Registration FeesDocument4 pagesFAQs Online Payment of Stamp Duty and Registration FeesAryan KNo ratings yet

- Import Export Code Reg Procedure PP 01Document1 pageImport Export Code Reg Procedure PP 01sahuanNo ratings yet

- EN - WIRE INSTRUCTION NOT FOR PAYMENT ASSIGNMENT-202312 - BackupDocument3 pagesEN - WIRE INSTRUCTION NOT FOR PAYMENT ASSIGNMENT-202312 - BackupcomprasNo ratings yet

- Export DocumentationDocument148 pagesExport DocumentationNitesh AgarwalNo ratings yet

- IEC GuidelinesDocument5 pagesIEC Guidelinesiyer_prakashsNo ratings yet

- Epcg Closing Documents & Third Party Feb21Document2 pagesEpcg Closing Documents & Third Party Feb21colden clementeNo ratings yet

- CAMSKRA Latest FormDocument4 pagesCAMSKRA Latest FormVijay PNo ratings yet

- CAMSKRA - Latest - Form Sept 23-1-2Document2 pagesCAMSKRA - Latest - Form Sept 23-1-2Suresh SharmaNo ratings yet

- Screenshot 2024-02-19 at 4.59.54 PMDocument2 pagesScreenshot 2024-02-19 at 4.59.54 PMnikhilnagpalNo ratings yet

- Frequently Asked QuestionsDocument2 pagesFrequently Asked QuestionsBaap Tera 3No ratings yet

- Guidelines RCMCDocument10 pagesGuidelines RCMCBharathi RajaNo ratings yet

- IGBC's Advanced Training Programme On Green Buildings: 2 & 3 November 2018 at HyderabadDocument2 pagesIGBC's Advanced Training Programme On Green Buildings: 2 & 3 November 2018 at HyderabadSameera BommisettyNo ratings yet

- For Queries Please Contact:::: All Fields Marked With Are Mandatory Manage Stamp SalesDocument4 pagesFor Queries Please Contact:::: All Fields Marked With Are Mandatory Manage Stamp SalessrenathNo ratings yet

- AMIE Chartered EngineerDocument9 pagesAMIE Chartered Engineerankit789No ratings yet

- SBI ATMDebit Card Application FormDocument4 pagesSBI ATMDebit Card Application Formrajeev11juneNo ratings yet

- Payment Instruction: TrxidDocument2 pagesPayment Instruction: TrxidGolam Rabbani SujonNo ratings yet

- Please Follow The Guidelines To Avoid Discrepancies in The FormDocument1 pagePlease Follow The Guidelines To Avoid Discrepancies in The FormSathyaSathyaNo ratings yet

- Form A PDFDocument2 pagesForm A PDFSundar SethNo ratings yet

- New CVL-KRA-Individual-FormDocument2 pagesNew CVL-KRA-Individual-FormTrilokynathNo ratings yet

- eBRC Manual 28.12.2023Document23 pageseBRC Manual 28.12.2023Ilesh GhevariyaNo ratings yet

- Usage of Atm CardDocument5 pagesUsage of Atm CardLokesh SPNo ratings yet

- Bnkwireoutinternational FinalDocument2 pagesBnkwireoutinternational FinalbasavarajghiremathNo ratings yet

- Aof Nrc299feDocument11 pagesAof Nrc299feameenmalik27No ratings yet

- PND Digisign: (Notary & SEO Attestation Will Not Acceptable)Document4 pagesPND Digisign: (Notary & SEO Attestation Will Not Acceptable)RupakDasNo ratings yet

- Quoteplus I3 CNS CNR 27448958Document3 pagesQuoteplus I3 CNS CNR 27448958PranhitaNo ratings yet

- Importer Exporter Code Number FINALDocument10 pagesImporter Exporter Code Number FINALVishal PhullNo ratings yet

- Customer Request FormDocument1 pageCustomer Request FormshadowNo ratings yet

- Procedure For Registration of IT Units in MaharashtraDocument17 pagesProcedure For Registration of IT Units in MaharashtraHarie JamesNo ratings yet

- NSDLDocument13 pagesNSDLSrini VasanNo ratings yet

- ABJxxxxx7L G4Document1 pageABJxxxxx7L G4MOHD ISMAILNo ratings yet

- Application Format Chartered Engineer Certificate 01Document1 pageApplication Format Chartered Engineer Certificate 01Campus ConnectNo ratings yet

- INVOICEDocument2 pagesINVOICEAvik ModakNo ratings yet

- Non-Probability Sampling TechniquesDocument3 pagesNon-Probability Sampling TechniquesjishamanojNo ratings yet

- Course Syllabus: Assistant Professor Dr. Qadri HamarshehDocument7 pagesCourse Syllabus: Assistant Professor Dr. Qadri Hamarshehjishamanoj0% (1)

- What Is Multimedia?Document8 pagesWhat Is Multimedia?jishamanojNo ratings yet

- Data Segment Data Ends Code Segment Assume Ds:Data, Cs:Code: 1) 8086/masm Program On Fibonacci SeriesDocument15 pagesData Segment Data Ends Code Segment Assume Ds:Data, Cs:Code: 1) 8086/masm Program On Fibonacci Seriespremaims75% (4)