Professional Documents

Culture Documents

FINMAN

FINMAN

Uploaded by

Ralph Christer MaderazoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINMAN

FINMAN

Uploaded by

Ralph Christer MaderazoCopyright:

Available Formats

St.

Columban College

College of Business Education

MIDTERM EXAM

Name : _______________________________________________

_______________

Course and Year : _______________________

Date:

Score: _______________

1. Calculate the Total Assets Turnover given that Sales = $1095 and Total

Assets = $1434.

2. Calculate the Current Ratio given that Current Assets = $937 and Current

Liabilities = $884.

3. Calculate the Debt to Equity Ratio given that Total Assets = $2136 and

Total Owners' Equity = $1114.

4. Calculate the Return on Assets (ROA) given that Net Income = $883 and

Total Assets = $1861.

5. Suppose that the inventory period is 50 days, the accounts receivable period

is 40 days, and the accounts payable period is 35 days. What is the cash

cycle? What is the Operating Cycle?

Balance Sheet ($ in Millions)

Income Statement ($ in

Assets

1999 Liabilities and 1999

Millions)

Owners' Equity

199

Current Assets

Current

9

Liabilities

Sales

1200

Cash

200 Accounts Payable 400 Cost of Goods Sold

900

Accounts

400 Notes Payable

400 Taxable Income

300

Receivable

Taxes

90

Inventory

600 Total Current

800 Net Income

210

Liabilities

Dividends

70

Total Current

1200 Long-Term

Addition to Retained

140

Assets

Liabilities

Earnings

Long-Term Debt 500

Fixed Assets

Total Long-Term 500 Dividend Pay-out Ratio

Liabilities

= Addition to Retained

Net Fixed

800 Owners' Equity

Earnings/

Assests

Net Income

Common Stock

300

($1 Par)

Retained Earnings 400

Total Owners'

700

Equity

Total Assets

2000 Total Liab. and 2000

Owners' Equity

Using the Balance Sheet and Income Statement above, determine the EFN given

that Fixed Assets are being utilized at full capacity and the forecasted growth rate

in Sales is 25%.

GOOD LUCK!

You might also like

- Mid Term FNCE 2020Document13 pagesMid Term FNCE 2020MOHAMED JALEEL MOHAMED SIDDEEKNo ratings yet

- Chapter 14 Working Capital Current Asset Management 5 1Document77 pagesChapter 14 Working Capital Current Asset Management 5 1Ela Pelari100% (2)

- BT Chapter4Document3 pagesBT Chapter4Nguyen Trung Kien (K17 QN)No ratings yet

- Chapter 3 ROSS Corporate Finance ProblemsDocument8 pagesChapter 3 ROSS Corporate Finance ProblemsBao Ngoc PhungNo ratings yet

- Review 4: Financial Statement AnalysisDocument6 pagesReview 4: Financial Statement AnalysisÇåsäō ÄrtsNo ratings yet

- Module 5 Homework Answer KeyDocument7 pagesModule 5 Homework Answer KeyMrinmay kunduNo ratings yet

- Exercises FS AnalysisDocument24 pagesExercises FS AnalysisEuniceNo ratings yet

- AC121 Chapter 6 AssignmentDocument2 pagesAC121 Chapter 6 AssignmentUrBaN-xGaMeRx TriicKShOtZNo ratings yet

- Fundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Document2 pagesFundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Sheena RobiniolNo ratings yet

- Food Systems Case Study 3 2017Document4 pagesFood Systems Case Study 3 2017api-361134087No ratings yet

- ch3 RatioDocument18 pagesch3 RatioEman Samir100% (1)

- Tutorial 2 AnswerDocument10 pagesTutorial 2 AnswerSyuhaidah Binti Aziz ZudinNo ratings yet

- Financial Economic1Document7 pagesFinancial Economic1biancaftw90No ratings yet

- 2008-10-24 114828 AccountingDocument2 pages2008-10-24 114828 AccountingjaipurjaipurNo ratings yet

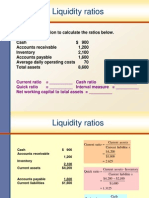

- Week1 Discussion - Liquidity Ratio ZoletDocument3 pagesWeek1 Discussion - Liquidity Ratio ZoletHannah JoyNo ratings yet

- Tutorial 10 - Short-Term Financial PlanningDocument2 pagesTutorial 10 - Short-Term Financial PlanningomarrfaisalNo ratings yet

- Fleet Training and Doctrines Center Fleet Warfare School: Philippine Navy Philippine FleetDocument2 pagesFleet Training and Doctrines Center Fleet Warfare School: Philippine Navy Philippine FleetDan Bryle Diaz MadridNo ratings yet

- Guia FinanzasDocument3 pagesGuia FinanzasArturo QuiñonesNo ratings yet

- Lecture 2 - Answer Part 2Document6 pagesLecture 2 - Answer Part 2Thắng ThôngNo ratings yet

- Assessment of Learnings Part2Document3 pagesAssessment of Learnings Part2MJ Botor50% (2)

- LS 4 Worksheet EditedDocument6 pagesLS 4 Worksheet EditedJoana May Celmar100% (1)

- Lecture 2 - Answer Part 1Document3 pagesLecture 2 - Answer Part 1Thắng ThôngNo ratings yet

- Cash Flow and Working Capital Management - Module 2 - Comprehensive Liquidity Index, Cash Conversion CycleDocument63 pagesCash Flow and Working Capital Management - Module 2 - Comprehensive Liquidity Index, Cash Conversion CyclecarlofgarciaNo ratings yet

- ACC Learning Journal 5Document3 pagesACC Learning Journal 5Kennedy BandaNo ratings yet

- Post Fin2004 Final Sem 2 2010Document11 pagesPost Fin2004 Final Sem 2 2010Bi ChenNo ratings yet

- 6 - 262728 - Short-Term Finance and PlanningDocument5 pages6 - 262728 - Short-Term Finance and PlanningPham Ngoc VanNo ratings yet

- Chapter 3: Financial Statements and Ratio AnalysisDocument5 pagesChapter 3: Financial Statements and Ratio Analysishana osmanNo ratings yet

- Chapter 2 Classwork 1Document2 pagesChapter 2 Classwork 1ErikaNicoleDumoranGumilinNo ratings yet

- CORILLA - Learning Activity 4 M5Document3 pagesCORILLA - Learning Activity 4 M5Francheska Imie R. CorillaNo ratings yet

- BUS 1102 Unit 5 Learning JournalDocument3 pagesBUS 1102 Unit 5 Learning JournalSaiba NurNo ratings yet

- FIN 571 Final Exam: FIN 571 Final Exam Ansers For Uop - UOP E Tutorsinal ExamDocument17 pagesFIN 571 Final Exam: FIN 571 Final Exam Ansers For Uop - UOP E Tutorsinal ExamUOP E TutorsNo ratings yet

- Tax A1 QCF Feb 2014 UteDocument8 pagesTax A1 QCF Feb 2014 UteAi Em DoNo ratings yet

- Chapter 3 Tutorial Questions - 1Document3 pagesChapter 3 Tutorial Questions - 1Goran Burhan RostamNo ratings yet

- Financial Statement AnalysisDocument27 pagesFinancial Statement AnalysisConikka Jane LagamayoNo ratings yet

- Simplecompound Interest Worksheet 18 Aug 2016Document2 pagesSimplecompound Interest Worksheet 18 Aug 2016rishiNo ratings yet

- CCC American ProductsDocument7 pagesCCC American ProductsStefano TumburNo ratings yet

- 13 Fin571 Complete Practce QuizzesDocument23 pages13 Fin571 Complete Practce QuizzesGreg FowlerNo ratings yet

- Performance Task 1 4th QuarterDocument1 pagePerformance Task 1 4th QuarterlorensbaylosisNo ratings yet

- Chapter 17 - AnswerDocument6 pagesChapter 17 - Answerwynellamae67% (3)

- Course 1 - Evaluating Financial PerformanceDocument4 pagesCourse 1 - Evaluating Financial PerformanceYukidoNo ratings yet

- Mid-Term Exam - AccountingDocument9 pagesMid-Term Exam - AccountingRuba MohamedNo ratings yet

- Year 11 To 12 Chemistry Bridging Work 2022Document16 pagesYear 11 To 12 Chemistry Bridging Work 2022nhussain1747No ratings yet

- Fabm L6 L8Document45 pagesFabm L6 L8Arcelyn RodasNo ratings yet

- Unit 7 Working Capital ManagementDocument36 pagesUnit 7 Working Capital ManagementNabin JoshiNo ratings yet

- Acc 290 Acc290 PDFDocument46 pagesAcc 290 Acc290 PDFCourse HelpNo ratings yet

- FINAL EXAM FABM 2.doc 2Document2 pagesFINAL EXAM FABM 2.doc 2LeylaNo ratings yet

- Ws RNK Pp-FirstclassDocument7 pagesWs RNK Pp-FirstclassJERRY AURELLONo ratings yet

- Fundamentals of Accountancy, Business, and Management 2 SY 2020-2021 QTR1 WK 7 Financial Statement (FS) Analysis MELC/sDocument8 pagesFundamentals of Accountancy, Business, and Management 2 SY 2020-2021 QTR1 WK 7 Financial Statement (FS) Analysis MELC/sAlma Dimaranan-AcuñaNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument22 pagesChapter 3 - Financial Statement AnalysisReyes JonahNo ratings yet

- Quiz Working Cap-StudentsDocument4 pagesQuiz Working Cap-StudentsJennifer RasonabeNo ratings yet

- ACC Group Assignment 1Document13 pagesACC Group Assignment 1aregahegn bisetNo ratings yet

- Fin Stat MtsDocument27 pagesFin Stat MtsJurcelinho Axel IwangouNo ratings yet

- Busfi Chp17 Oddnum ProblemsDocument8 pagesBusfi Chp17 Oddnum ProblemsmaggieNo ratings yet

- IphitechDocument8 pagesIphitechJohn ValenciaNo ratings yet

- Developacareerplan 1Document3 pagesDevelopacareerplan 1api-319844662No ratings yet

- Business Finance Semi ExamDocument1 pageBusiness Finance Semi ExamAimelenne Jay Aninion100% (1)

- 3.0 Revised Accounting and FinanceDocument13 pages3.0 Revised Accounting and Financekevin kipkemoi100% (1)

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Regents Physics Practice Questions: New York Regents Physical Science Physics Practice Questions with Detailed ExplanationsFrom EverandRegents Physics Practice Questions: New York Regents Physical Science Physics Practice Questions with Detailed ExplanationsNo ratings yet

- Rrlgroup 5Document12 pagesRrlgroup 5Ralph Christer MaderazoNo ratings yet

- Opening Remarks - CFC AnniversaryDocument1 pageOpening Remarks - CFC AnniversaryRalph Christer MaderazoNo ratings yet

- Lateral Transfer LetterDocument1 pageLateral Transfer LetterRalph Christer MaderazoNo ratings yet

- Lateral Transfer LetterDocument1 pageLateral Transfer LetterRalph Christer MaderazoNo ratings yet

- General ProvsionsDocument21 pagesGeneral ProvsionsRalph Christer MaderazoNo ratings yet

- 00 - Case Study and InstructionsDocument2 pages00 - Case Study and InstructionsRalph Christer MaderazoNo ratings yet

- Maderazo - Crim Law MidtermsDocument3 pagesMaderazo - Crim Law MidtermsRalph Christer MaderazoNo ratings yet

- Case Digests Bill of RightsDocument50 pagesCase Digests Bill of RightsRalph Christer MaderazoNo ratings yet

- 01 - ANNEX 1 - List of PopulationDocument15 pages01 - ANNEX 1 - List of PopulationRalph Christer MaderazoNo ratings yet

- Case Study: Seminar On Audit Sampling Session 4Document3 pagesCase Study: Seminar On Audit Sampling Session 4Ralph Christer MaderazoNo ratings yet

- 03 - WORKING PAPER 1 - Audit Sampling For Test of DetailsDocument2 pages03 - WORKING PAPER 1 - Audit Sampling For Test of DetailsRalph Christer MaderazoNo ratings yet

- A Married Filipino Remains Married Even If A Divorce Is Obtained Abroad Because Divorce Is Generally Not Recognized in The PhilippinesDocument2 pagesA Married Filipino Remains Married Even If A Divorce Is Obtained Abroad Because Divorce Is Generally Not Recognized in The PhilippinesRalph Christer MaderazoNo ratings yet

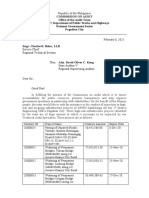

- Letter Request - Inspect of High RiskDocument2 pagesLetter Request - Inspect of High RiskRalph Christer MaderazoNo ratings yet