Professional Documents

Culture Documents

Cash Management Setup

Uploaded by

canjiatpCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Management Setup

Uploaded by

canjiatpCopyright:

Available Formats

Cash Management Set Up Steps

and Usage Aspects

Oracle Cash Management Release 11i Users Guide,

Chapter 2 and pages 2-2 to 2-27.

From Accounts Receivables Perspective

Amit Kumar Singh

Oracle Corporation

Metalink.oracle.com /

Top Tech Documents- Cash Management

From the website above, you can select Cash

Management to see online documentation.

Abstract

Improve your knowledge of Reconciliation Process

in Cash Management by learning how to set up Cash

Management and how to use it. This paper provides

an overview of the Manual and Auto Reconciliation

process, and basic functionalities involved in the

process for instance Reversals & Corrections.

This paper is written from the perspective of

Accounts Receivable Module although it will contain

some useful information for CE Reconciliations with

Oracle general ledger and Oracle Payables also.

All screenshots included in this paper is from AR

side.

I. Overview Of Cash Management.

Cash Management includes:

a)

Clearing manually or automatically

your uncleared transactions lying in

Accounts Receivables, Accounts

payables, Oracle Payroll & General

Ledger modules.

b) It helps the user to reconcile manually

or automatically the payments and

receipts and then review and correct the

unreconciled transactions.

c) Enter Bank Statements manually or

automatically by importing from Open

Interface tables.

d) Prepare Cash forecast.

e) Cash management also handles Multi

Currency Bank Statements and its

reconcilation.

Scope

I. Overview Of Cash Management.

II. Clearing Vs Reconciliation

III. What are the Set up Required for Manual

and Auto Reconcilations

IV. What extra sets required for Reversals and

Corrections

V. Foreign Currency Banks Reconciliations

VI. What are the Set ups for Reconciliation with

Oracle General Ledger and Oracle Payables

II. Clearing Of A Receipt Vs

Reconciliation of a Receipt

Clearing is an accounting event whereas

reconciliation is not an accounting event.

Clearing Transfers the amount from Remittance

account to Cash Account. Whereas

Reconciliation is just tallying of lines appearing

in the bank statement with the Receipts in AR.

However if you reconcile directly the transaction

then the transaction gets cleared first itself and

then in such a case reconciliation becomes an

accounting event also.

Please note that this paper does not replace your Cash

Management Users Guide. This paper is intended to

give you a quick overview of the application, and

some step-by-step setup instructions.

References

For detailed information on all the Cash Management

features, please read the following references.

Cash Management Set Up Steps

& Usage Aspects

III. What are the Set up Required for

Manual and Auto Reconciliations?

a) Set up Requirements in Accounts

Receivables for the purpose of

Manual and Auto Reconciliation

i.

ii.

iii.

iv.

Create one Account Code

Combination (CCID) for your bank

Account in Oracle General Ledger

Create a Bank account and specify

the above CCID in the Cash

Account

Create a Receipt Class and Use the

above bank and Bank Account

Create Manual Receipts Using the

above Receipt class

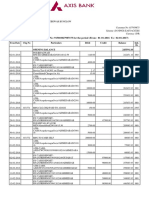

Description Figure 1 Shows Receipt class and types

of Clearance Methods.

Receivables Set up- Receipts-Receipt Class

Note: Status of a Receipt is important field from Cash

management perspective. Receipt Status depends on

three important fields in Receipt Class.

i.

ii.

Remittance Method: if this is No

Remittance then the receipt status will

be remitted and this will require

Clearing in CE. If the Remittance

method is Standard or Factoring or Std

& Factoring then the Receipt status will

be Confirmed and this will require first

Remittance which will then bring status

of receipt to Remitted and then you can

clear the same.

b) Clearing of Receipts and Payments in

CE

There are two methods to clear the receipts and/or

payments:

Matching: If the matching is Directly

then the Status will be cleared. Directly

is available only if you have no

remittance. With Remittance method

other than No Remittance this Directly

is not available. If the Method is By

Automatic Clearing then the Receipt

can be both Auto Cleared or Manually

cleared. IF the Method is By matching

then Automatic clearing is not available

only manual option can be used.

Automatic Clearing: Submit the Automatic Clearing

program to automatically clear remitted receipts and

clear or risk eliminate factored receipts in

Receivables. Clearing remitted receipts debits your

cash account and credits your remittance or factoring

account.

Go to AR Requests Submit Automatic Clearing

of Receipts Program

Note: This Method will clear only those receipts,

which have Automatic clearing as Matching Method.

Cash Management Set Up Steps

& Usage Aspects

the dates to any date but not prior to the date of

previous clearing /reconciliation.

c) Manual and Automatic

Reconciliations in Cash

Management

I.

Manual Reconciliation

In Manual Reconciliation System works solely

on the judgment of user

i.

Enter Bank Statement

Note: Bank Statement has two parts Header and Lines.

Header details about Bank , Bank Account,

Totals-control & Actual , Number of lines

unreconciled and its amount . Complete the

statement once no further changes are

required.

Description Figure 2 running of Automatic Clearing

Program in AR.

Navigation: View-Requests

ii.

Enter Statement Line

Statement line can be either Receipt, Misc

Receipt, Payment, Misc Payment, NSF ,

Rejected, Stopped.

Note : You must define bank Transaction

codes for the bank . Although this is not a

mandatory set up but is required for Auto

Reconciliation to identify the source of the

statement line , correction method ,

matching method.

ii.

Manually Reconcile with the available

transactions or you can create manually

a AR Receipt/ Misc Receipt / Payment

from CE and then Reconcile.

iv.

Create a Receipt/ Misc Receipt/Payment

directly from CE

Description Figure 3 Shows the Output of Program

ran in Figure 2 .

Navigation : View-Requests

Note : When you create Misc Receipt system prompts

for Creation of Misc Receipt with Reconciled status

which is not in the case of Cash Receipt.

Manual Clearing: This is done by going to CE - >

Bank Reconciliation - > Manual Clearing > you can

also undo the cleared status of a cleared payment,

receipt, or open interface transaction.

Note : You cannot change the amount of Receipt

when you use Create from Statement.

Change Default Dates: You can change the Default

dates which appear at the time of selecting the

Receipt by going to Default Dates .You can change

v.

Check Receipt Status after

Reconciliation and status of line in bank

statement

Cash Management Set Up Steps

& Usage Aspects

Cash management tab gets populated with statement

details and status changes from Remitted to Cleared

if it was a remitted receipt.

Statement line gets Reconciled Amount and status

changes from Unreconciled to Reconciled.

i.

vi. Mark Statement Line: You can mark a

statement line as Error or External. Marking makes

the line not available for Reconciliation.

Tolerance: System Parameter has two

fields in Auto tab region: Amount and

Percent. Percent is calculated on

statement amount. Tolerance amount is

the lower of two. Tolerance in System

Parameters form is in Functional

Currency.

Note: Auto Reconciliation selects the transactions on

the basis of Tolerance amount.

Receipts selected will be Receipt Amount

= < Receipt Amount +/- Tolerance Amount

>

After tolerance amount system looks for the matching

Order.

vii. Unreconcile : You can unreconcile the

reconciled line by going to Reconciled and selecting

the line and then press Unreconcile. The Status of

Receipt will change back to Cleared and the

statement details will get deleted from the cash

management tab in Receipt form .

ii.

Matching Order

Transaction: If order is transaction then the system

will create Bank Charges for the difference amount.

Batch : If Batch is the Order then the system will

create a Misc Receipt for the tolerance amount.

II. Automatic Reconciliation

Note : After checking on the basis of Matching Order

value in System Parameter form it looks for the

receipts on the basis of value which was not selected.

For example if value in System parameter form is

Batch then after looking for on the basis of batch if

unable to find a batch system will then check for

transactions with the number given in statement line.

iii.

Matching Criteria

When Transaction is matching Order : ( Difference

goes to Bank Charges)

1.

2.

Description Figure 4 System Parameters form .The

Matching Criterias are set up in this form which is

then used in Reconciliation Process.

Navigation: Cash Management Set up-System

parameters

3.

Automatic Reconciliation matches the Statement

lines of a statement with the Sub ledger Transactions

automatically on the basis of following:

Receipt Number should match Statement

Number or

Invoice Number , Customer Name and

Customer Bank Account in statement line

should match the Receipt Details or

Invoice Number and Customer Bank Account

in statement line should match the Receipt

Details

When Batch is matching Order then Deposit Number

is the matching Criteria in the absence of Deposit

Number batch Name. ( For the difference Misc

receipt is created)

Cash Management Set Up Steps

& Usage Aspects

Reconciliation first clears the receipt and reconciles

the receipt line in bank with the cleared line of

Receipt and then it reverses the receipt and reconciles

the NSF line with the reversal line of Receipt.

Simulation Cases on Auto Reconciliation

Tolerance : Amount = 100 and Percent 20%

Reversal can be ( NSF Action in Auto Recon

parameters) :

Case 1 Create a bank Statement , statement line

Amount = 1000

Create a AR receipt of Rs 850

Run Auto Reconciliation from Submit Request in CE

Result - Line will not be reconciled

1. Reverse Payment

2. Debit memo reversal

Steps :

1.

Case 2 - Now change the Amount above to 900

Run Auto Reconciliation from Submit Request in CE

Result Line will be reconciled.

Check the bank charges field - 100 is in bank charges

2.

3.

4.

Create a bank transaction code with NSF as

type

Create a bank statement line with Receipt

type and second line with NSF type. Use the

NSF code.

Run Auto Recon.

Select NSF Action

Case 3 - create a remittance batch with three receipts

amounting to 1000

Create a statement line with amount = 1050

Run Auto Reconciliation from Submit Request in CE

Result : system will create a Misc Receipt of Rs. 50

Note : Incase of Remittance batch ensure that while

running Auto Recon you must specify the payment

method and Receivable activity other wise Auto

Recon will fail.

IV.

What extra sets

required for Reversals

and Corrections

Description Figure 5 Shows bank transaction Code

screen.

Navigation : Cash Management Set up- Bank

transaction Code

Reversals and Corrections

Reversals take place when the check clearing done by

bank is reversed due to following reasons:

1.

2.

3.

NSF ( Non Sufficient funds)

Rejected

Stopped ( this is for AP payments only )

If the receipt is not reversed in the AR and in Bank

statement there is a reversal line then Auto

Cash Management Set Up Steps

& Usage Aspects

transaction number as the adjustment line. However,

the statement line can be a payment, receipt,

miscellaneous payment, or miscellaneous receipt, as

long as the

amount netted out is within the tolerance of the

original transaction.

Description Figure 6 Shows the NSF line created to

demonstrate the Reversal functionality with type as

NSF

Navigation : Cash Management Bank

Reconciliations-Bank Statements

Corrections takes place when bank gives wrong

credit and then to correct the error it either reverses

the original credit and then gives a new credit

(Reversal Correction method) or gives differential

credit or debit to correct the mistake (Adjustment

method)

1.

2.

3.

Description Figure 7

Create a bank transaction code for Misc

Payment type line with Reversal as

correction method and another for

Adjustment correction method.

Select matching against stt /stt, misc

/misc/misc,stt

Create lines for reversal method (one

original, one Misc Payment for reversal and

then

Reversal Method: Tries to match the reversal entry

to a statement line that contains the same transaction

number and opposite transaction type. For example,

if the reversal entry is a miscellaneous receipt, then

the program matches to a payment or miscellaneous

payment. If the amounts net out to zero, then the

program assumes there is a match and reconciles the

statement lines.

Description Figure 8 Shows the Adjustment Method

Navigation : Cash Management Bank

Reconciliations-Bank Statements

Note : in Reversal method reversal statement line and

original line matches with each other

And new correct entry matches with original receipt.

Adjustment Method: Tries to find both a statement

line and a transaction to match to the adjustment

entry. The statement line must contain the same

Cash Management Set Up Steps

& Usage Aspects

VI. What are the Set ups for

Reconciliation with Oracle General

Ledger and Oracle Payables

i.

Create a Bank Transaction Code for AP and

Gl Source

Create a Receipt or Payment Type in Bank

transaction code screen with Source as Journals

Matching Criteria

1 CCID of Bank Account in Journal Line must

be same as Cash Account in the Bank Definition

2 Journal Line must be Posted

3 Description field and the Number Field is

the Matching Criteria used

Description Figure 9 Shows the Adjustment Method

Navigation : Cash Management Bank

Reconciliations-Bank Statements

Reconciliation of AP to CE

Steps

1 Assign a Payables Document to the bank

2 Define one Supplier

3 Create one Invoice and make payment in

full

4 Create Bank Transaction Code with Source

as Payables

5 Enter one Bank statement line of Type

Payment in Bank Statement.

6 Either Manually Reconcile or Auto

7 For any Stopped Payment line in Bank

Statement define bank transaction code for

Stopped as type and source payables and

then use this code in statement line.

V. Foreign Currency Banks

Reconciliations

Foreign Currency Transactions

Receipt is in Foreign Currency / Bank is Functional

Currency

In this case the tolerance amount will be the

difference in Converted Amount of Receipt and

Statement amount.

Both Receipt and Bank is in foreign Currency

In this case the Tolerance amount will first be

converted into foreign currency using Rate type and

Rate date as specified in System Parameters form.

Note : Rest will remain same as covered till now.

Cash Management Set Up Steps

& Usage Aspects

The bank records both the original payment and the

stopped payment on the same statement. In this

case, the two transactions would null out and have no

effect on the closing balance. This is the basis for the

treatment of stopped payments by the method

described above.

Description Figure 10 Shows Payment created in AP.

Navigation Payables- Payments-Payment

Description Figure 12 Shows Reconciliation of

Stopped line with AP void payment

Navigation : Cash Management Bank

Reconciliations-Bank Statements

Case 2

The bank records the original payment and the

stopped payment on two different statements or just

records the stopped payment and not the original

payment. In this case, the closing balance would be

impacted.

Description Figure 11 Shows Payment created in AP.

Navigation Payables- Payments-Payment

Cash Management treats Payments as a source of

Cash Outflow and Stopped Payments

as a source of Cash Inflows. Since the Bank

Statement Header has one field for

Cash Inflow Sources (Receipts) and one for Outflow

sources (Payments), Stopped

Payments show up in the Receipts Field.

There could be two scenarios, which would affect the

Bank Statement Balance:

Case 1

Cash Management Set Up Steps

& Usage Aspects

Description Figure 15 Shows the Journal Created in

oracle general Ledger with Description field

populated .

Navigation Oracle General Ledger Journals-Enter

Description Figure 13 Shows bank transaction code

for Journal as Source .

Navigation : Cash Management Set up- Bank

transaction Code

Conclusions

It is our hope that this paper has helped you

understand what Cash Management Reconciliations

is , and how to set it up.

Description Figure 14 Shows the Lines in Cash

Management reconciliation with Journals in Oracle

General Ledger.

Navigation : Cash Management Bank

Reconciliations-Bank Statements

Cash Management Set Up Steps

& Usage Aspects

Cash Management Set Up Steps and Usage Aspects

From Accounts Receivables Perspective

January 2005

Author : Amit Kumar Singh

Oracle Corporation

World Headquarters

500 Oracle Parkway

Redwood Shores, CA 94065

U.S.A.

Worldwide Inquiries:

Phone: +1.650.506.7000

Fax: +1.650.506.7200

www.oracle.com

Copyright 2003, Oracle. All rights reserved.

This document is provided for information purposes only

and the contents hereof are subject to change without notice.

This document is not warranted to be error-free, nor subject to

any other warranties or conditions, whether expressed orally

or implied in law, including implied warranties and conditions of

merchantability or fitness for a particular purpose. We specifically

disclaim any liability with respect to this document and no

contractual obligations are formed either directly or indirectly

by this document. This document may not be reproduced or

transmitted in any form or by any means, electronic or mechanical,

for any purpose, without our prior written permission.

Oracle is a registered trademark of Oracle Corporation and/or its

affiliates. Other names may be trademarks of their respective owners.

10

Cash Management Set Up Steps

& Usage Aspects

You might also like

- Automatic Receipts and Remittance A Complete Guide For R12 Oracle Receivables Users Document 745996.1Document32 pagesAutomatic Receipts and Remittance A Complete Guide For R12 Oracle Receivables Users Document 745996.1Tino PiazzardiNo ratings yet

- Oracle Receivables An OverviewDocument69 pagesOracle Receivables An OverviewmanukleoNo ratings yet

- R12 Features and Late Charges FunctionalityDocument6 pagesR12 Features and Late Charges FunctionalitysivaramsvNo ratings yet

- Oracle Payment Processing Request (PPR) in AP - R12Document9 pagesOracle Payment Processing Request (PPR) in AP - R12manukleoNo ratings yet

- Emerson Process Management - Employee Onboarding PlanDocument18 pagesEmerson Process Management - Employee Onboarding PlanSneha Singh100% (1)

- Oracle R12 Payables Interview QuestionsDocument13 pagesOracle R12 Payables Interview QuestionsPrashanth KatikaneniNo ratings yet

- Cash Pools - in Oracle Cash ManagementDocument17 pagesCash Pools - in Oracle Cash ManagementAvijit BanerjeeNo ratings yet

- R12 Receivable Implemention GuideDocument348 pagesR12 Receivable Implemention Guideravisaini0907764No ratings yet

- SLA Case StudyDocument33 pagesSLA Case Studymohanivar77No ratings yet

- Sap Fico Training: by Rajeev KumarDocument115 pagesSap Fico Training: by Rajeev KumarRajeev Kumar90% (10)

- Inventory Period ClosingDocument8 pagesInventory Period ClosingUmair MehmoodNo ratings yet

- IExpense SetupsDocument22 pagesIExpense SetupssoireeNo ratings yet

- Oracle Applications - Oracle Account Receivable (AR) Functional Training GuideDocument31 pagesOracle Applications - Oracle Account Receivable (AR) Functional Training GuideMostafa Taha100% (1)

- Oracle Adjust PrepaymentDocument69 pagesOracle Adjust PrepaymentAli x100% (4)

- Oracle AR Interview QuestionsDocument10 pagesOracle AR Interview QuestionsMrityunjay Kant AggarwalNo ratings yet

- Oracle Cash Management SystemDocument36 pagesOracle Cash Management SystemAbdulsayeedNo ratings yet

- TCA (Trading Community Architecture) in R12 and Beyond: Presenter: Malik AzizDocument36 pagesTCA (Trading Community Architecture) in R12 and Beyond: Presenter: Malik Azizt.hemant2007No ratings yet

- R12 GL StudyDocument60 pagesR12 GL StudySingh Anish K.No ratings yet

- R12 - New Features in Financial ModulesDocument8 pagesR12 - New Features in Financial Modulessurinder_singh_69No ratings yet

- Period CloseDocument6 pagesPeriod CloseSuman BeemisettyNo ratings yet

- Bank Acct Trans White PaperDocument30 pagesBank Acct Trans White Paperyoursashok_giriNo ratings yet

- Oracle Advanced CollectionsDocument3 pagesOracle Advanced CollectionsVinita BhatiaNo ratings yet

- Period Close (CM) 12Document5 pagesPeriod Close (CM) 12jabar aliNo ratings yet

- R12.2 Oracle Receivables Management Fundamentals: DurationDocument4 pagesR12.2 Oracle Receivables Management Fundamentals: DurationVijendra MlNo ratings yet

- Web ADI Template For Asset Retirements: RequirementsDocument2 pagesWeb ADI Template For Asset Retirements: RequirementssudhakarNo ratings yet

- New Features in R12 Oracle Cash ManagementDocument50 pagesNew Features in R12 Oracle Cash Managementerpswan100% (1)

- Overview of Credit ManagementDocument25 pagesOverview of Credit Management060920720No ratings yet

- R12 BankDocument13 pagesR12 BankSOMU REDDYNo ratings yet

- White Paper On Prepare and Record PaymentsDocument22 pagesWhite Paper On Prepare and Record PaymentsObaid Ul AleemNo ratings yet

- Oracle Fusion Payables I SupplierDocument6 pagesOracle Fusion Payables I SuppliernareshpulgamoracleNo ratings yet

- Letter of Credit in Payables ModuleDocument10 pagesLetter of Credit in Payables ModuleChandan BhangaleNo ratings yet

- Employee RetensionDocument73 pagesEmployee RetensionTech Yuva100% (1)

- Projet ERP E-Business Suite R12: - Notes BF 020Document14 pagesProjet ERP E-Business Suite R12: - Notes BF 020Ad ElouNo ratings yet

- I ExpensesDocument21 pagesI ExpensesmanitenkasiNo ratings yet

- Oracle R12 Suppliers and CustomersDocument44 pagesOracle R12 Suppliers and CustomersTina Floyd100% (1)

- Oracle Fusion Complete Self-Assessment GuideFrom EverandOracle Fusion Complete Self-Assessment GuideRating: 4 out of 5 stars4/5 (1)

- Unit 2 Consumer BehaviourDocument14 pagesUnit 2 Consumer Behaviournileshstat5No ratings yet

- Ar Setup 12Document48 pagesAr Setup 12soireeNo ratings yet

- Setting Up Transaction Types in Oracle ReceivablesDocument35 pagesSetting Up Transaction Types in Oracle Receivablesredro0% (1)

- Oracle CM - Business ProcessDocument12 pagesOracle CM - Business ProcessAhmed ElhendawyNo ratings yet

- 1 CISSP 1er Dummy Examen Respuestas y Explicaciones - QADocument58 pages1 CISSP 1er Dummy Examen Respuestas y Explicaciones - QAIvan MartinezNo ratings yet

- Bim WhitepaperDocument21 pagesBim WhitepaperpeterhwilliamsNo ratings yet

- Bank Statement Reconciliation Process in Oracle Cash ManagementDocument23 pagesBank Statement Reconciliation Process in Oracle Cash Managementgagan2001No ratings yet

- Oracle Fixed AssetsDocument8 pagesOracle Fixed AssetsRakesh NatarajNo ratings yet

- Gem Procurement ManualDocument16 pagesGem Procurement ManualHari AnnepuNo ratings yet

- Assessing ROI On CloudDocument6 pagesAssessing ROI On CloudLeninNairNo ratings yet

- Oracle Cash ManagementDocument11 pagesOracle Cash ManagementSeenu DonNo ratings yet

- Oracle AP - AR Netting - R12 Overview PDFDocument40 pagesOracle AP - AR Netting - R12 Overview PDFappsloaderNo ratings yet

- P2P Lifecycle:: Procuer To Pay Life CycleDocument2 pagesP2P Lifecycle:: Procuer To Pay Life CycleSureshNo ratings yet

- Recurring Invoices:-: Step1:-Define The Recurring Invoice Special Calendar Navigation:-Setup Calendar Special CalendarDocument38 pagesRecurring Invoices:-: Step1:-Define The Recurring Invoice Special Calendar Navigation:-Setup Calendar Special Calendarprabhu181No ratings yet

- Receiving Receipts FAQ'sDocument13 pagesReceiving Receipts FAQ'spratyusha_3No ratings yet

- R12 SEPA Core Direct Debit WhitepaperDocument12 pagesR12 SEPA Core Direct Debit WhitepaperAliNo ratings yet

- I SupplierDocument16 pagesI Suppliersravani_chandra2008100% (1)

- New Features in R12 Oracle PayablesDocument157 pagesNew Features in R12 Oracle Payableserpswan100% (1)

- Procure To Pay P2P Accounting EntriesDocument10 pagesProcure To Pay P2P Accounting EntriesAkash100% (1)

- Bank Account Balance MigrationDocument1 pageBank Account Balance Migrationanishokm2992No ratings yet

- Cash Management BPA Questionnaire 8.8 NMDocument6 pagesCash Management BPA Questionnaire 8.8 NMdeepikag50% (1)

- Encumbrance Accounting, Budgetary Accounting and Budgetary ControlDocument33 pagesEncumbrance Accounting, Budgetary Accounting and Budgetary ControlasdfNo ratings yet

- Cash Management: Training GuideDocument25 pagesCash Management: Training Guidedevender_bharatha3284No ratings yet

- Autolock Box Concepts in r12Document21 pagesAutolock Box Concepts in r12devender_bharatha3284No ratings yet

- Release 11i: Encumbrance AccountingDocument18 pagesRelease 11i: Encumbrance Accountingsbhati100% (1)

- Receipt AccountingDocument38 pagesReceipt AccountingVishal Bhanudas PatilNo ratings yet

- Public Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionFrom EverandPublic Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionNo ratings yet

- Material CasesDocument15 pagesMaterial Casesvinay sharmaNo ratings yet

- Stock TradingDocument7 pagesStock TradingJared RobisonNo ratings yet

- Ifc IdaDocument10 pagesIfc IdaShyama KakkatNo ratings yet

- F 54Document10 pagesF 54madyeid31No ratings yet

- Circular 25 2019Document168 pagesCircular 25 2019jonnydeep1970virgilio.itNo ratings yet

- Qa DocumentDocument40 pagesQa Documentapi-260228939No ratings yet

- Xylia's Xylia's Cup Cup Hunt Hunt: Racing RoyaltyDocument64 pagesXylia's Xylia's Cup Cup Hunt Hunt: Racing RoyaltyadamdobbinNo ratings yet

- CHECKLISTDocument3 pagesCHECKLISTKalepu SridharNo ratings yet

- ASQ ISO Infographic DigitalDocument1 pageASQ ISO Infographic Digitalinder_sandhuNo ratings yet

- PDFDocument7 pagesPDFNikhilAKothariNo ratings yet

- 4A. Financial Proposal Submission Form. 4B. Summary of Costs. 4C. Breakdown of CostDocument6 pages4A. Financial Proposal Submission Form. 4B. Summary of Costs. 4C. Breakdown of Costpankaj kadkolNo ratings yet

- LTE World Summit 2014 Brochure PDFDocument16 pagesLTE World Summit 2014 Brochure PDFMoussa Karim AlioNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

- Building and Managing Successfully Businesses in The Middle EastDocument12 pagesBuilding and Managing Successfully Businesses in The Middle EastbooksarabiaNo ratings yet

- LIP Case DigestDocument5 pagesLIP Case DigestJett LabillesNo ratings yet

- B40Document7 pagesB40ambujg0% (1)

- Engineering Economy - EEDocument68 pagesEngineering Economy - EEMaricarLogronioSalazar100% (1)

- Broker Name Address SegmentDocument6 pagesBroker Name Address SegmentabhaykatNo ratings yet

- Fall 2021 BIS Publishers CatalogDocument25 pagesFall 2021 BIS Publishers CatalogChronicleBooksNo ratings yet

- Tutorial - Ex20.2, 20.3 and 20.6 - SolutionsDocument2 pagesTutorial - Ex20.2, 20.3 and 20.6 - SolutionsCarson WongNo ratings yet

- Report On Business LetterDocument28 pagesReport On Business LetterAnum SheikhNo ratings yet