Professional Documents

Culture Documents

Law of Banking Feb 2009

Law of Banking Feb 2009

Uploaded by

Krish Veni0 ratings0% found this document useful (0 votes)

10 views3 pagesThis document appears to be an exam for a law degree focused on banking law in India. It includes three parts:

Part A includes short answer questions about various banking concepts like passbooks, overdrafts, joint accounts, and the Reserve Bank of India.

Part B includes two essay questions about a banker's duty of secrecy regarding customer accounts and provisions around crossing of cheques.

Part C includes two case comment questions, one about a fraudulent raising of the amount on a cheque and another about competing claims to a deposit after a customer's death before the maturity date.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document appears to be an exam for a law degree focused on banking law in India. It includes three parts:

Part A includes short answer questions about various banking concepts like passbooks, overdrafts, joint accounts, and the Reserve Bank of India.

Part B includes two essay questions about a banker's duty of secrecy regarding customer accounts and provisions around crossing of cheques.

Part C includes two case comment questions, one about a fraudulent raising of the amount on a cheque and another about competing claims to a deposit after a customer's death before the maturity date.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesLaw of Banking Feb 2009

Law of Banking Feb 2009

Uploaded by

Krish VeniThis document appears to be an exam for a law degree focused on banking law in India. It includes three parts:

Part A includes short answer questions about various banking concepts like passbooks, overdrafts, joint accounts, and the Reserve Bank of India.

Part B includes two essay questions about a banker's duty of secrecy regarding customer accounts and provisions around crossing of cheques.

Part C includes two case comment questions, one about a fraudulent raising of the amount on a cheque and another about competing claims to a deposit after a customer's death before the maturity date.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

3367505

THREE L.L.B DEGREE EXAMINATIONS FEBRAURY-2009.

FIFTHSEMESTER

Paper -6 LAW OF BANKING

(Revised Regulations w.e.f. 2001-2002)

Time: 3 Hours

Max Marks: 100

Part-A (Short Answer Questions)

Write short notes on any six questions of the following

Each question carries 4 Marks

(Marks: 6x4=24)

1. Pass book

2. Over draft.

3. Banking companies.

4. Travelers cheque.

5. Joint account

6. Doctrine of Reinstatement.

7. Reserve Bank of India.

8. Amalgamation a Banks.

9. Garnishee order.

Part-B (ESSAY TYPE QUESTIONS)

Answer any Two of the following

Each question carries 18 marks

10.

(Marks: 2x18=36)

A Bankers is required to observe strict secrecy

in regard to his customer account explain.

11.

Discuss the previsions relating to cross of

cheques and various kinds of crossing of cheques.

12.

What are reforms in Indian Banking Law?

13.

Define a holder in due course?

What are his

privileges under the Negotiable Instrument Act?

14.

Part-c (Case Comment Type questions)

Answer any two questions

Each question carries 20 marks

(Marks: 2x20=40)

A draws a cheque for Rs 10,000 and by mistake

he left banks the amount both in words and figures

and presented to a stranger B.

the amount to Rs.

B fraudulently raised

1,00,000 on the cheques and

cashed from the Bank of the customer a. what is the

position of the Bank?

15.

X purchased goods by issuing a cheque for Rs.

5,000 from y.

When Y presented the cheque for

payment the bank has returned with the remarks

that the payment was stopped by X.

These were

sufficient funds in the account of X. Advise Y.

16.

A cheque drawn by A and payable to B passed

by endorsement through the hands of several

persons had ultimately endorsed in favour of E. The

cheque was dishonored on account of want of funds.

Advice E.

17.

A Customer of a bank deposited Rs. 10 lakhs for

a period of Ten years making believing his father that

he is entitled to that amount after maturity as he is

the nomine.

Much before the maturity date the

customer died. Both the wife and father of customer

claimed. Advise the Bank.

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Letter To Car LoanDocument3 pagesLetter To Car Loanfreetradezone100% (5)

- Mastering Credit - The Ultimate DIY Credit Repair GuideFrom EverandMastering Credit - The Ultimate DIY Credit Repair GuideRating: 1 out of 5 stars1/5 (1)

- TA Handbook 2017Document50 pagesTA Handbook 2017Krish Veni100% (2)

- San Sebastian College - Recoletos College of Law Final Examination - Commercial Laws June 4, 2021Document4 pagesSan Sebastian College - Recoletos College of Law Final Examination - Commercial Laws June 4, 2021Eddie Jet TamondongNo ratings yet

- Model Question Paper Class 11 AccountsDocument97 pagesModel Question Paper Class 11 AccountsAbel Soby Joseph100% (3)

- Class Notes On Constitutional LawDocument21 pagesClass Notes On Constitutional LawKrish Veni100% (2)

- Case Studies - Banking Law&PracticeDocument5 pagesCase Studies - Banking Law&PracticeRedSun50% (4)

- Bangayan V RCBC G.R. No. 149193Document27 pagesBangayan V RCBC G.R. No. 149193Gen GrajoNo ratings yet

- Bangayan v. RCBC and Philip Saria Ponente: Sereno, J. Nature of The CaseDocument4 pagesBangayan v. RCBC and Philip Saria Ponente: Sereno, J. Nature of The CaseElizabeth Dela CruzNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Bangayan vs. RCBCDocument12 pagesBangayan vs. RCBCanajuanitoNo ratings yet

- December 2019 Banking Law (OLD/NEW)Document1 pageDecember 2019 Banking Law (OLD/NEW)Nagalikar LawNo ratings yet

- Company Law 2022 Question PaperDocument2 pagesCompany Law 2022 Question PaperPraveen Kumar KokkantiNo ratings yet

- Recording of Financial TransactionsDocument8 pagesRecording of Financial TransactionsbarakaNo ratings yet

- 02 Cases On Banker Customer RelationshipDocument4 pages02 Cases On Banker Customer RelationshipVikashKumar100% (1)

- Bad Debts Recovered Some TimesDocument4 pagesBad Debts Recovered Some TimesBRAINSTORM Haroon RasheedNo ratings yet

- SBI V Shyama DeviDocument10 pagesSBI V Shyama DeviAtulNo ratings yet

- 11th Accounts Mock Paper-1Document2 pages11th Accounts Mock Paper-1Aliasgar ZaverNo ratings yet

- Malayan Banking BHD V Ching Suit Fee - (2012Document9 pagesMalayan Banking BHD V Ching Suit Fee - (2012Norlia Md DesaNo ratings yet

- 2018-JAIBB LPB NovDocument3 pages2018-JAIBB LPB NovMashiur RahmanNo ratings yet

- Supreme CourtDocument22 pagesSupreme CourtChris MartinNo ratings yet

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- 28902cpt Fa SM Cp7 Part3Document49 pages28902cpt Fa SM Cp7 Part3BasappaSarkarNo ratings yet

- Banking Law Pre University Question Paper LLBDocument4 pagesBanking Law Pre University Question Paper LLBKRISHNA VIDHUSHANo ratings yet

- Chapter 15 - Accounting For Bills of ExchangeDocument44 pagesChapter 15 - Accounting For Bills of ExchangeArshita KarayatNo ratings yet

- Mbl1 Key AnswersDocument22 pagesMbl1 Key Answerspatanjali9No ratings yet

- BankingLaw 2022Document2 pagesBankingLaw 2022Praveen Kumar KokkantiNo ratings yet

- Banking & InsuranceDocument10 pagesBanking & InsuranceMinhas AliNo ratings yet

- Negotiable Instruments Act 1881Document27 pagesNegotiable Instruments Act 1881Chowdhury Ahsan UllahNo ratings yet

- 01 Caselets On Banker Customer RelationshipDocument3 pages01 Caselets On Banker Customer RelationshipSTUTI SHRIVASTAVA-DM 21DM201No ratings yet

- Banking Law Short QuestionsDocument4 pagesBanking Law Short QuestionsDEEPAKNo ratings yet

- Accountancy Sample Paper Final ImportantDocument18 pagesAccountancy Sample Paper Final ImportantChitra Vasu100% (1)

- Business Law CIA 2Document10 pagesBusiness Law CIA 2anushamagaviNo ratings yet

- G.R. No. 149193 April 4, 2011 RICARDO B. BANGAYAN, Petitioner, Rizal Commercial Banking Corporation and Philip SARIA, RespondentsDocument16 pagesG.R. No. 149193 April 4, 2011 RICARDO B. BANGAYAN, Petitioner, Rizal Commercial Banking Corporation and Philip SARIA, RespondentsJVMNo ratings yet

- TRẮC NGHIỆM TTQTDocument39 pagesTRẮC NGHIỆM TTQTHuyền MaiNo ratings yet

- Unit 4Document7 pagesUnit 4nguyen thuyduongNo ratings yet

- Banking OmbudsmanDocument96 pagesBanking OmbudsmanVijay RajaNo ratings yet

- Anant Prasad Jain v. Standard CharteredDocument3 pagesAnant Prasad Jain v. Standard CharteredSaahiel SharrmaNo ratings yet

- Bangayan vs. RCBCDocument27 pagesBangayan vs. RCBCjonbelzaNo ratings yet

- Banking Law KSLU Notes Grand FinalDocument83 pagesBanking Law KSLU Notes Grand FinalSherminasNo ratings yet

- MT Mock Test 1 To 8Document42 pagesMT Mock Test 1 To 8praveenparthivNo ratings yet

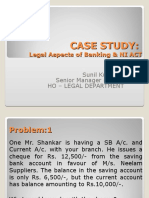

- Case Study Legal Aspects & NI ActDocument23 pagesCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- Test PaperDocument3 pagesTest PaperHaseeb Mehmood AwanNo ratings yet

- CA FND N22 - SAP 3 Acc BOE QP RevisedDocument2 pagesCA FND N22 - SAP 3 Acc BOE QP RevisedAravind SNo ratings yet

- Introduction To Financial Products - Mid Term Set 1Document3 pagesIntroduction To Financial Products - Mid Term Set 1Harsha OjhaNo ratings yet

- NI ACT With CasesDocument27 pagesNI ACT With CasesTaisir MahmudNo ratings yet

- Banking Situational ProblemDocument11 pagesBanking Situational ProblemKunalJhaNo ratings yet

- Circular Judgments 13.11.2015Document8 pagesCircular Judgments 13.11.2015g9769916102No ratings yet

- Corporate LawDocument13 pagesCorporate LawkhyathiNo ratings yet

- Cheques 1Document8 pagesCheques 1hippop kNo ratings yet

- Banking Law AssignmentDocument18 pagesBanking Law AssignmentDivya RaoNo ratings yet

- Assignment-1 - Banking and Insurance LawDocument3 pagesAssignment-1 - Banking and Insurance LawMitali ChaureNo ratings yet

- Mba: Sem-Iv - Business Law Assignment - IiDocument6 pagesMba: Sem-Iv - Business Law Assignment - IiPremos Ily0% (1)

- JAIIB - Principles and Practices of Banking: CreditDocument15 pagesJAIIB - Principles and Practices of Banking: CreditBiswajit DasNo ratings yet

- Lesson 12 Banks and Their CustomersDocument11 pagesLesson 12 Banks and Their Customersڕێبازی کۆکتێلNo ratings yet

- Test Your Credit Knowledge: DirectionsDocument4 pagesTest Your Credit Knowledge: DirectionsAna SolisNo ratings yet

- Citibank N.A Vs Standard Chartered Bank AppellantDocument13 pagesCitibank N.A Vs Standard Chartered Bank AppellantUMANG COMPUTERSNo ratings yet

- Contract-I Feb 2006 (Sem Pateern 2001-02)Document2 pagesContract-I Feb 2006 (Sem Pateern 2001-02)Krish Veni100% (1)

- ALM MootDocument12 pagesALM MootGENERAL SECRETARYNo ratings yet

- Mohd Saufi W-02-432-02-2013Document21 pagesMohd Saufi W-02-432-02-2013Lu BingaiNo ratings yet

- CII Letter For Industries in Vadoara and Nearby Districts-1 PDFDocument1 pageCII Letter For Industries in Vadoara and Nearby Districts-1 PDFKrish VeniNo ratings yet

- IPCasebook2016 Ch16Document27 pagesIPCasebook2016 Ch16Krish VeniNo ratings yet

- Contribution of Indian Pharmaceutical Industry 1586404314 PDFDocument6 pagesContribution of Indian Pharmaceutical Industry 1586404314 PDFKrish VeniNo ratings yet

- Requirements For Patent Protection: NoveltyDocument25 pagesRequirements For Patent Protection: NoveltyKrish VeniNo ratings yet

- Patentable Subject Matter: Chapter EighteenDocument46 pagesPatentable Subject Matter: Chapter EighteenKrish VeniNo ratings yet

- Bulk DrugsDocument2 pagesBulk DrugsKrish VeniNo ratings yet

- IPCasebook2016 Ch13 PDFDocument92 pagesIPCasebook2016 Ch13 PDFKrish VeniNo ratings yet

- Infringement & Safe Harbors in The Digital Age: Sony Corp. of America v. Universal City Studios, IncDocument41 pagesInfringement & Safe Harbors in The Digital Age: Sony Corp. of America v. Universal City Studios, IncKrish VeniNo ratings yet

- Chapter Twelve: of Highly Effective People, Lean in and What Color Is Your Parachute? Then SheDocument41 pagesChapter Twelve: of Highly Effective People, Lean in and What Color Is Your Parachute? Then SheKrish VeniNo ratings yet

- IPCasebook2016 Ch13 PDFDocument92 pagesIPCasebook2016 Ch13 PDFKrish VeniNo ratings yet

- Defenses To Trademark Infringement: Fair & Nominative UseDocument18 pagesDefenses To Trademark Infringement: Fair & Nominative UseKrish VeniNo ratings yet

- False Advertising, Dilution & Cyberpiracy': 1.) False Advertising: False or Misleading Statements of FactDocument39 pagesFalse Advertising, Dilution & Cyberpiracy': 1.) False Advertising: False or Misleading Statements of FactKrish VeniNo ratings yet

- Intellectual Property & The Constitution: Chapter TwoDocument45 pagesIntellectual Property & The Constitution: Chapter TwoKrish VeniNo ratings yet

- Trademark Infringement: 1.) Use in CommerceDocument35 pagesTrademark Infringement: 1.) Use in CommerceKrish VeniNo ratings yet

- Theory & History: Shades of Grey From A "Warez" Site. But You Wish To Encourage Authors (And Publishers)Document25 pagesTheory & History: Shades of Grey From A "Warez" Site. But You Wish To Encourage Authors (And Publishers)Krish VeniNo ratings yet

- Administrative Law IIDocument6 pagesAdministrative Law IIKrish VeniNo ratings yet

- Subject Matter: Requirements For Trademark Protection: 1.) Use As A Mark in CommerceDocument34 pagesSubject Matter: Requirements For Trademark Protection: 1.) Use As A Mark in CommerceKrish VeniNo ratings yet

- Grounds For Refusing RegistrationDocument26 pagesGrounds For Refusing RegistrationKrish VeniNo ratings yet

- Constitution: Art 107. Provisions As To Introduction and Passing of Bills. - (1) Subject ToDocument32 pagesConstitution: Art 107. Provisions As To Introduction and Passing of Bills. - (1) Subject ToKrish VeniNo ratings yet