Professional Documents

Culture Documents

Eligibility Criteria Salaried Individual: Documents Required

Uploaded by

Erica Lindsey0 ratings0% found this document useful (0 votes)

23 views2 pagesChecklist SAL New

Original Title

Checklist SAL New

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChecklist SAL New

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views2 pagesEligibility Criteria Salaried Individual: Documents Required

Uploaded by

Erica LindseyChecklist SAL New

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Eligibility Criteria Salaried Individual:

Nationality: Pakistani

Maximum financing Limit: Up to 75% of the property value

Minimum Monthly Income: Equivalent of PKR.45, 000/- (Forty Five Thousand) &

above (with verifiable proof).

Employment: Permanent employment of an organization with at least 3 years

experience.

Financing Tenure: 3 - 20 years

Age limit: 25-60 years (Maximum 60 years at the time of Maturity)

Documents Required

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

CNIC Copy Applicant

(Copy, Applicant)

CNIC Copy of legal hairs

(Copy)

2-passport size photograph

(Applicant)

3 Residence Utility bills Currant Months

(GAS,

KESC, PTCL)

Last 1 year bank statement

(Salary

Account)

Salary Slip Last Three Months

Salary Certificate (Tenure/Designation/Job status)

(Original)

Job Card

(Copy)

HR Email Address for Verification

Prove of all other Financing, Facilities & Liabilities(Copy)

2 References Office Colleague & Relative.

Previous Employment Letter. (If job tenure is short)

Processing Cheque 17,700/= in favor of Meezan Bank

Ltd.

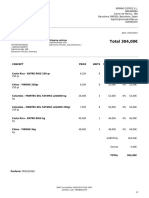

Break-up

Processing

Legal Opinion

Appraisal

Rs.5,700

Rs.9,000

Rs.3,000 (above 10 Million 6,000)

Other Documents/ Charges (After Approval)

All Relevant Property Documents Copies for verification

Search Certificates & Genuine Certificate

Public Notice Any Morning News Paper

Musharkah Agreement Fee Base on approve limit.

Mortgage Deed Amount will be decided at transaction time.

Lien Amount for (PTM & Mutation) as per below:

Category

120 to 240

yards

240 to 500

Yards

Above 500

yards

Sq

Authority

KDA & Other

Lien Amount

150,000

Sq

DHA

200,000

Sq

KDA & Other

DHA

200,000

300,000

KDA & other

DHA

100,000

For Apartments

You might also like

- Checklist Jaro SanctionDocument2 pagesChecklist Jaro Sanctionpankaj_kolekar33333No ratings yet

- Basic DocumentationDocument1 pageBasic DocumentationSurekha HolagundiNo ratings yet

- Documents Required: EligibilityDocument1 pageDocuments Required: EligibilityZeeshan AmanNo ratings yet

- Corrigendum To RFP To Empanel PIA For OSDADocument1 pageCorrigendum To RFP To Empanel PIA For OSDAIndrajit DashNo ratings yet

- PHP 659 Per Applicant Per Application (Payable in Cash To VFS Global)Document1 pagePHP 659 Per Applicant Per Application (Payable in Cash To VFS Global)Joshua CabreraNo ratings yet

- Comparative Analysis of Various Banks For Home Loans (For Self Employed People)Document6 pagesComparative Analysis of Various Banks For Home Loans (For Self Employed People)latha20No ratings yet

- HDFC List of DocsDocument1 pageHDFC List of Docsjain.gaurav7No ratings yet

- Check ListDocument2 pagesCheck ListAarthi PadmanabhanNo ratings yet

- Documents Required For Home LoanDocument3 pagesDocuments Required For Home LoanvijaysinhjagtapNo ratings yet

- Korea Visa RequirementsDocument1 pageKorea Visa RequirementsAlexandra SarmientoNo ratings yet

- Ganesh Salary CHK List 1Document2 pagesGanesh Salary CHK List 1siva.mtncNo ratings yet

- Canada SUV - Timeline and DocumentsDocument1 pageCanada SUV - Timeline and DocumentsAli ZaidiNo ratings yet

- PDF 20231226 215837 0000Document3 pagesPDF 20231226 215837 0000cheska.movestorageNo ratings yet

- List of Supporting Documents: ID Application FormDocument3 pagesList of Supporting Documents: ID Application FormMahesh SavaliyaNo ratings yet

- Canada Manpower Required: Ilver AK SsociateDocument2 pagesCanada Manpower Required: Ilver AK SsociateBalamurugan SundaramoorthyNo ratings yet

- Canada Job DetailsDocument4 pagesCanada Job DetailsyesuinbarajNo ratings yet

- Asnt ApplicationDocument6 pagesAsnt Applicationeldobie3No ratings yet

- Terms & Conditions of Consumer Loans: 1. EligibilityDocument2 pagesTerms & Conditions of Consumer Loans: 1. Eligibilityprasad89_balaNo ratings yet

- Management Trainee (Instrumentation) - On Contract: RequiresDocument2 pagesManagement Trainee (Instrumentation) - On Contract: RequiresShiyas AlikunjuNo ratings yet

- Scan 0086Document1 pageScan 0086Sanket ChouguleNo ratings yet

- Thailand Visa RequiermentsDocument1 pageThailand Visa RequiermentsmohiNo ratings yet

- Sbi Housing Loan - Documents RequiredDocument1 pageSbi Housing Loan - Documents RequiredCindyNo ratings yet

- Documents For Cack LiestDocument2 pagesDocuments For Cack LiestSanoj ParajuliNo ratings yet

- Application Form MiaDocument6 pagesApplication Form MianafasPPNo ratings yet

- KOREAN VISA Updated ChecklistDocument2 pagesKOREAN VISA Updated ChecklistJosiah Emmanuel CodoyNo ratings yet

- Check ListDocument4 pagesCheck Listcasantosh8No ratings yet

- Korea Visa Requirements and Guidelines Updated 03012019Document2 pagesKorea Visa Requirements and Guidelines Updated 03012019Yisrael AshkenazimNo ratings yet

- Applicationform MIADocument6 pagesApplicationform MIAbeautyjuwitaNo ratings yet

- Business 2022Document1 pageBusiness 2022K.VENKATARAMANNo ratings yet

- SECP Digital Certificate Request Form: (Only For Non-Incorporated Companies)Document3 pagesSECP Digital Certificate Request Form: (Only For Non-Incorporated Companies)M. Zubair AlamNo ratings yet

- Document Checklist - Ver 4.0 - ChennaiDocument2 pagesDocument Checklist - Ver 4.0 - ChennaiAr JunNo ratings yet

- Latest NRI CHECKLISTDocument1 pageLatest NRI CHECKLIST9tngf6dzbhNo ratings yet

- Sop 2Document4 pagesSop 2Lalu VsNo ratings yet

- VETASSESS PresentationDocument19 pagesVETASSESS PresentationMildred MendozaNo ratings yet

- Ict Visa ChecklistDocument5 pagesIct Visa Checklistghanshyam chandrakarNo ratings yet

- Axis Bank Check ListDocument3 pagesAxis Bank Check ListAmrithavally AikkaraNo ratings yet

- Photo: Current Passport and Full Copy of Previous PassportDocument5 pagesPhoto: Current Passport and Full Copy of Previous PassportRavi M ishraNo ratings yet

- Motor Vehicle Loan ChecklistDocument2 pagesMotor Vehicle Loan ChecklistshemekaNo ratings yet

- BSHRM Membership Form 2012Document2 pagesBSHRM Membership Form 2012Edward Ebb BonnoNo ratings yet

- Ireland - Join Family PDFDocument1 pageIreland - Join Family PDFSanjeevkumar PillaiNo ratings yet

- Processing of Examination Application (Career Service Examination-Paper and Pencil Test) (Professional or Subprofessionaltest)Document7 pagesProcessing of Examination Application (Career Service Examination-Paper and Pencil Test) (Professional or Subprofessionaltest)Anonymous GRPQhJxNo ratings yet

- SGENESIS FINTECH PVT LTD - Required Documents For All Loans - New LogoDocument10 pagesSGENESIS FINTECH PVT LTD - Required Documents For All Loans - New Logodattam venkateswarluNo ratings yet

- Documents Checklist Visit VisaDocument1 pageDocuments Checklist Visit Visatayyabchoudhary700No ratings yet

- Modified Training Structure Doc Requirmentneligibilitycriteria Claim ExemptionDocument4 pagesModified Training Structure Doc Requirmentneligibilitycriteria Claim ExemptionShashankPandeyNo ratings yet

- ItalyDocument3 pagesItalyasdfseNo ratings yet

- BPI Family Housing Loans Requirements & ProcessDocument2 pagesBPI Family Housing Loans Requirements & ProcessAdrian FranciscoNo ratings yet

- Check List - New Home Loan102013Document2 pagesCheck List - New Home Loan102013ShanmugamNo ratings yet

- Documents Needed: List of Documents For Salaried IndividualsDocument3 pagesDocuments Needed: List of Documents For Salaried IndividualsWasim BariNo ratings yet

- Annexures BelDocument5 pagesAnnexures BelManikantavarma MahaliNo ratings yet

- CBOLsecuredsite CreditLimitpdfFormDocument1 pageCBOLsecuredsite CreditLimitpdfFormEr Pupone de NazaNo ratings yet

- Eabtc Reason For Application For Members of Professional Bodies PDFDocument1 pageEabtc Reason For Application For Members of Professional Bodies PDFBLYNo ratings yet

- SBI Scholar Loan For MDI: Repayment Period: 12 Years (Max) - (Excluding 6 Month Moratorium For Repayment)Document1 pageSBI Scholar Loan For MDI: Repayment Period: 12 Years (Max) - (Excluding 6 Month Moratorium For Repayment)Sambit DashNo ratings yet

- Document Checklist VisitorDocument2 pagesDocument Checklist VisitorChinish KalraNo ratings yet

- Checklist Documents ROB ROC: Category Code Sub-CategoryDocument1 pageChecklist Documents ROB ROC: Category Code Sub-CategorytraveleventasiaNo ratings yet

- Khalid Cement Complex Limited: Please Carefully Read The Guidelines On The Last Page Before Filling This FormDocument10 pagesKhalid Cement Complex Limited: Please Carefully Read The Guidelines On The Last Page Before Filling This FormMahira MalikNo ratings yet

- CSEDocument8 pagesCSEMel Sherwin HadraqueNo ratings yet

- Earlier Training Structure Doc Requirmentneligibilitycriteria Claim ExemptionDocument4 pagesEarlier Training Structure Doc Requirmentneligibilitycriteria Claim ExemptionShashankPandeyNo ratings yet

- They Call Me The Refund Man: How You Can Start A Successful Tax BusinessFrom EverandThey Call Me The Refund Man: How You Can Start A Successful Tax BusinessNo ratings yet

- Student WorkbookDocument1 pageStudent WorkbookErica LindseyNo ratings yet

- Confined Space EntryDocument22 pagesConfined Space EntryErica LindseyNo ratings yet

- Atex ExplainedDocument3 pagesAtex ExplainedErica LindseyNo ratings yet

- Fire Response Procd PDFDocument69 pagesFire Response Procd PDFErica LindseyNo ratings yet

- July 20, 2017: SME Management (MGT 601) Spring, 2017 Assignment No. 1 Due Date: Total Marks: 20Document2 pagesJuly 20, 2017: SME Management (MGT 601) Spring, 2017 Assignment No. 1 Due Date: Total Marks: 20Erica LindseyNo ratings yet

- Gamechanger Casting FinancialsDocument8 pagesGamechanger Casting FinancialsErica LindseyNo ratings yet

- AuWaiLaam wrd3 3Document4 pagesAuWaiLaam wrd3 3api-3701851No ratings yet

- Assessing Marketing Opportunities: National Productivity OrganizationDocument1 pageAssessing Marketing Opportunities: National Productivity OrganizationErica LindseyNo ratings yet

- To The Point Bplan Sample WebDocument10 pagesTo The Point Bplan Sample WebErica LindseyNo ratings yet

- Bigbrutevacuumcleanersaustraliacatalogue 2014Document20 pagesBigbrutevacuumcleanersaustraliacatalogue 2014Erica LindseyNo ratings yet

- Guava Nectar PDFDocument10 pagesGuava Nectar PDFErica LindseyNo ratings yet

- Spring 2016 - PADI619 - 4Document1 pageSpring 2016 - PADI619 - 4Erica LindseyNo ratings yet

- CorrosionDocument18 pagesCorrosionErica LindseyNo ratings yet

- BB F Web BrochureDocument2 pagesBB F Web BrochureErica LindseyNo ratings yet

- W&W Homeopathic Medicines Product DetailsDocument26 pagesW&W Homeopathic Medicines Product DetailsErica Lindsey100% (3)

- Scaffolding PresentationDocument46 pagesScaffolding Presentationdox4use100% (1)

- CPECDocument21 pagesCPECAnonymous KnfjnuNo ratings yet

- Live Collaboration by Cisco TranscriptDocument1 pageLive Collaboration by Cisco TranscriptErica LindseyNo ratings yet

- REPORT of FFBLDocument11 pagesREPORT of FFBLShahzaibUsmanNo ratings yet

- Staff Fire Safety TrainingDocument2 pagesStaff Fire Safety TrainingErica LindseyNo ratings yet

- Advertising: Organizations Nonprofit Health CareDocument7 pagesAdvertising: Organizations Nonprofit Health CareErica LindseyNo ratings yet

- Workplace ADocument12 pagesWorkplace ARuppee EdwardNo ratings yet

- Fire Safety GuidanceDocument40 pagesFire Safety GuidanceErica LindseyNo ratings yet

- Case Study Coastal Power LTDDocument3 pagesCase Study Coastal Power LTDErica LindseyNo ratings yet

- Case Study Bunduq Company LimitedDocument3 pagesCase Study Bunduq Company LimitedErica LindseyNo ratings yet

- Passive Protection - Fire DoorDocument14 pagesPassive Protection - Fire DoorSharique NezamiNo ratings yet

- Cs Explovent GuideDocument16 pagesCs Explovent GuideErica LindseyNo ratings yet

- Jack MaDocument3 pagesJack MaErica Lindsey100% (1)

- Case Study Naphtha Cracker ProjectDocument4 pagesCase Study Naphtha Cracker ProjectErica LindseyNo ratings yet

- Safety Signs GuideDocument49 pagesSafety Signs GuideMohan PrasadNo ratings yet

- Project-Kotak BankDocument63 pagesProject-Kotak BankAli SaqlainNo ratings yet

- Rate Shock Pandemic Spreading - Juggling DynamiteDocument3 pagesRate Shock Pandemic Spreading - Juggling DynamiteOwm Close CorporationNo ratings yet

- F214733 Armin Zandieh Iaro IarocoffeeDocument2 pagesF214733 Armin Zandieh Iaro IarocoffeeCristian CoffeelingNo ratings yet

- JS Bank Swot AnalysisDocument21 pagesJS Bank Swot AnalysisToHeed Shah50% (2)

- Wireless Terminal Placement Program: 9/30/2010 - Build #PF003Document6 pagesWireless Terminal Placement Program: 9/30/2010 - Build #PF003Roger JackNo ratings yet

- Reaction Paper Aseo, SuariDocument3 pagesReaction Paper Aseo, Suariaseosuari aseoNo ratings yet

- Notes For Sale - February 10, 2019 - Shipping and Insurance Is ExtraDocument3 pagesNotes For Sale - February 10, 2019 - Shipping and Insurance Is Extrahanzo1260No ratings yet

- Federal Reserve What Everyone Needs To Know (Axilrod)Document156 pagesFederal Reserve What Everyone Needs To Know (Axilrod)bassfreakstirsNo ratings yet

- Chapter 1Document21 pagesChapter 1Sam SoniteNo ratings yet

- Frequently Asked Questions: What Is An Own A Philippine Home Loan (OPHL) Program?Document4 pagesFrequently Asked Questions: What Is An Own A Philippine Home Loan (OPHL) Program?Jasper CruzNo ratings yet

- Internship Report On MCB BankDocument80 pagesInternship Report On MCB Bankfaezaiqbal100% (10)

- Using Technology To Generate An Amortization Table: InquireDocument5 pagesUsing Technology To Generate An Amortization Table: InquireAdam MikitzelNo ratings yet

- Analyze The Roles of International Payment in An Open EconomyDocument22 pagesAnalyze The Roles of International Payment in An Open EconomyNgô Giang Anh ThưNo ratings yet

- BSM Sakshi Garg FT 3 BDocument10 pagesBSM Sakshi Garg FT 3 BSakshi GargNo ratings yet

- Sbi Ifsc CodeDocument1,141 pagesSbi Ifsc CodeManoj K C0% (1)

- April 2018 PDFDocument16 pagesApril 2018 PDFPallaviNo ratings yet

- Branch Banking IBP Stage 1 PDFDocument216 pagesBranch Banking IBP Stage 1 PDFSarim Shahid67% (3)

- SWIFT Credit Dnepr Bank ListDocument2 pagesSWIFT Credit Dnepr Bank Listtarungupta1986_66389No ratings yet

- Wami Nduka Kingsley: Customer StatementDocument188 pagesWami Nduka Kingsley: Customer StatementNowwe HireNo ratings yet

- Focused On What Matters NBT BankDocument1 pageFocused On What Matters NBT BankElizabeth LewisNo ratings yet

- Banking OmbudsmanDocument4 pagesBanking OmbudsmanAshok SutharNo ratings yet

- Swift copy-5B-L2L-MAB AGDocument2 pagesSwift copy-5B-L2L-MAB AGB KNo ratings yet

- Buku eDocument5 pagesBuku eAfiful IchwanNo ratings yet

- N SpecDocument61 pagesN SpecJonathan GalorioNo ratings yet

- Draft BG Swift Mt760 - Oct21 - InvemaDocument3 pagesDraft BG Swift Mt760 - Oct21 - InvemaEduardo JimenezNo ratings yet

- CMDocument84 pagesCMMuhammad NiazNo ratings yet

- Cca Questions All Merged by VKG PDFDocument75 pagesCca Questions All Merged by VKG PDFabhishekNo ratings yet

- CRF Non IndividualDocument2 pagesCRF Non IndividualShyam Manohar Singh67% (3)

- A Study On Customer Relationship Management at Bandhan Bank LimitedDocument55 pagesA Study On Customer Relationship Management at Bandhan Bank LimitedNitinAgnihotriNo ratings yet

- Finance Current Affairs March RevisionDocument47 pagesFinance Current Affairs March RevisionRte FrthNo ratings yet