Professional Documents

Culture Documents

Rsi

Rsi

Uploaded by

Narendra Bhole0 ratings0% found this document useful (0 votes)

17 views2 pagesRSI ONDICATOR

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRSI ONDICATOR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesRsi

Rsi

Uploaded by

Narendra BholeRSI ONDICATOR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

R ELATIVE STRENGTH INDEX RSI

APRIL 9, 2010 BY PHILIP 4 COMMENTS

RSI OR RELATIVE STRENGTH INDEX IS AN INDICATOR THAT MEASURES OVERBOUGHT

AND OVERSOLD LEVELS . READINGS BELOW 25-30 CAN BE SEEN AS OVERSOLD AND

READINGS ABOVE 70-75 CAN BE SEEN AS OVERBOUGHT.

APPLY RELATIVE STRENGTH INDEX (RSI) TO Y OUR TRADING C HARTS

RSI WAS INVENTED BY J. WELLES WILDER AND FIRST INTRODUCED TO THE PUBLIC IN

1978. T HIS INDICATOR IS ONE OF THE MORE POPULAR ONES IN TRADING DESPITE

BEING RELATIVELY NEW. RSI MEASURES MOMENTUM BY COMPARING THE EXTENT OF

THE STOCK S RECENT GAINS AND LOSSES BY TRANSFORMING THIS INFO INTO A

NUMBER BETWEEN 0-100. M ANY TRADERS CONFUSE THIS INDICATOR WITH RELATIVE

STRENGTH BETWEEN TWO STOCKS . RSI HAS NOTHING TO DO WITH THAT THOUGH THE

NAME IMPLIES IT.

MOST USED SETTINGS

RSI IS FORMED BY USING THE AVERAGE GAIN/LOSS OVER A PREDETERMINED PERIOD

WHICH J. W ELLES W ILDER RECOMMENDED A PERIOD OF 14. THIS IS PROBABLY THE

MOST USED SETTING AND SINCE THE INVENTION OF RSI WE HAVE BEEN INTRODUCED

TO INTRADAY TRADING SO WE ARE SEEING MANY DIFFERENT SETTINGS . S CALPERS

MIGHT USE A LOWER SETTING OF 7 PERIODS BUT YOU HAVE TO FIGURE OUT WHAT

YOUR TRADING STYLE IS AND THEN BACK TEST THE SETTING TO SEE WHAT IS BEST .

RSI IS PLOTTED AS A NUMBER BETWEEN 0-100 WITH OVERBOUGHT AND OVERSOLD

LEVELS AT 70 AND 30. W ILDER RECOMMEND THESE LEVELS BUT I HAVE SEEN MANY

TRADERS PREFERRING 80-20. T HIS WILL RESULT IN FEWER BUT HIGHER ODDS

TRADES .

PROBABLY THE MOST USED TECHNIQUE WHEN USING RELATIVE STRENGTH INDEX IS A

CROSSOVER OF 50, EITHER TO THE UPSIDE OR DOWNSIDE . W HEN ABOVE 50, THE

STOCK HAS A BIGGER AVERAGE GAIN THEN AVERAGE LOSSES BUT THE OPPOSITE IS

TRUE WHEN RSI IS UNDER 50.

ANOTHER GREAT USE OF THIS TECHNIQUE IS THE OVERBOUGHT /OVERSOLD LEVELS.

MANY TRADERS WILL BE LOOKING TO ENTER THE TRADE AT THESE LEVELS IF IT S WITH

THE TREND . IT IS IMPORTANT TO TAKE NOTICE OF THE TREND AS RSI CAN STAY EITHER

OVERBOUGHT OR OVERSOLD FOR AN EXTENDED PERIOD OF TIME .

MANY TRADERS ALSO USE THE OVERBOUGHT AND OVERSOLD LEVELS FOR EITHER

TIGHTENING THEIR STOPS OR TAKING PROFIT.

TIPS AND IDEAS

NOW WE HAVE AN IDEA OF WHAT THE RSI IS TELLING US AND HOW TO USE RSI TO

INCREASE OUR ODDS FOR SUCCESS TRADING THE STOCK MARKET . S OME WAYS TO USE

IT ARE :

1. C OMBINING BOTH THE OVERBOUGHT OR OVERSOLD LEVEL WITH A CROSSOVER OF

50 INCREASES THE ODDS OF SUCCESS. B Y ONLY TAKING CROSSOVER AFTER HITTING

THE EXTREME LEVELS WILL ENSURE THAT YOUR STOCK HAS ENOUGH MOMENTUM TO

GIVE YOU A DECENT RISK TO REWARD .

2. DIVERGENCE IS ANOTHER GREAT WAY TO INCREASE YOUR ODDS FOR SUCCESS. BY

COMBINING THE ABOVE MENTIONED ENTRY WITH DIVERGENCE YOU ARE INCREASING

YOUR ODDS FOR A FAST PROFIT. I F PRICE MAKES A NEW LOW BUT RSI MAKES A

HIGHER LOW IT TELLS US THAT MOMENTUM TO THE DOWNSIDE IS DRYING UP AND A

SIGNIFICANT BOUNCE CAN OCCUR ANY TIME NOW. W AIT FOR CONFIRMATION OF THE

50 CROSSOVER AND YOU HAVE YOURSELF A HIGH ODDS TRADE.

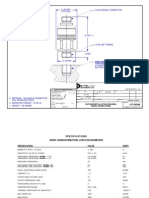

R ELATIVE STRENGTH INDEX RSI C HART

OUR IMPLEMENTATION

RSI IS A GREAT MOMENTUM INDICATOR BUT IT HAS ITS WEAKNESSES AS IT DOES NOT

TELL YOU IF YOU ARE GOING AGAINST THE LONGER TERM TREND. I THEREFORE ALWAYS

ADD A MOVING AVERAGE TO DETERMINE THE TREND AND THEN TAKE THE RSI SIGNALS

IN ALIGNMENT WITH THE MOVING AVERAGE .

HERE IS ANOTHER OVERBOUGHT OVERSOLD SIGNAL TECHNICAL INDICATOR

(OSCILLATOR ) COMING UP FOR YOU IN OUR NEXT STOCK MARKET EDUCATION

TECHNICAL ANALYSIS SECTION S TOCHASTIC

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 189 Tony Crabels Intraday Signal ChartDocument13 pages189 Tony Crabels Intraday Signal ChartNarendra BholeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Klokov Training ProgramDocument3 pagesKlokov Training ProgramRaul Terry Lauto100% (2)

- Modified Put Butterfly - FidelityDocument6 pagesModified Put Butterfly - FidelityNarendra BholeNo ratings yet

- Demand Supply AflDocument2 pagesDemand Supply AflNarendra BholeNo ratings yet

- English GrammarDocument44 pagesEnglish Grammarkareen100% (2)

- Amibroker AflDocument10 pagesAmibroker AflNarendra BholeNo ratings yet

- Short Iron CondorDocument5 pagesShort Iron CondorNarendra Bhole100% (1)

- Amibroker FileDocument9 pagesAmibroker FileNarendra BholeNo ratings yet

- The Man Who Invented Qigong 1 PDFDocument6 pagesThe Man Who Invented Qigong 1 PDFLuis Gomes100% (2)

- A History of Evangelical American Protestant Missionaries and Their Missions To Ottoman IstanbulDocument165 pagesA History of Evangelical American Protestant Missionaries and Their Missions To Ottoman IstanbulbosLooKiNo ratings yet

- 11 Online Trading Academy PDFDocument16 pages11 Online Trading Academy PDFNarendra Bhole100% (3)

- CAPE V Form InstructionsDocument7 pagesCAPE V Form InstructionsElise KathrynNo ratings yet

- Rahul Mohindar Oscillator: - Seasoned Trader - Panelist For CNBC and CNN IndiaDocument55 pagesRahul Mohindar Oscillator: - Seasoned Trader - Panelist For CNBC and CNN IndiaNarendra Bhole100% (1)

- African Theology As A Theology of LiberationDocument9 pagesAfrican Theology As A Theology of LiberationestifanostzNo ratings yet

- Automatic Frequency Control of An Induction FurnaceDocument4 pagesAutomatic Frequency Control of An Induction FurnaceNarendra BholeNo ratings yet

- 4 Simple RTL (VHDL) Project With VivadoDocument6 pages4 Simple RTL (VHDL) Project With VivadoNarendra BholeNo ratings yet

- Inductance CalculatorDocument2 pagesInductance CalculatorNarendra BholeNo ratings yet

- Igbt Half Bridge: Inputs InputsDocument4 pagesIgbt Half Bridge: Inputs InputsNarendra BholeNo ratings yet

- FractalDocument55 pagesFractalNarendra BholeNo ratings yet

- AmiBroker Users' Knowledge Base AFL ProgrammingDocument18 pagesAmiBroker Users' Knowledge Base AFL ProgrammingNarendra BholeNo ratings yet

- Vibration Sensor/Transmitter: ApplicationsDocument2 pagesVibration Sensor/Transmitter: ApplicationsNarendra BholeNo ratings yet

- Solid State Equipment For Bright Annealing of Stainless Steel PipesDocument1 pageSolid State Equipment For Bright Annealing of Stainless Steel PipesNarendra BholeNo ratings yet

- Figure 1 - Terminal ConnectionsDocument6 pagesFigure 1 - Terminal ConnectionsNarendra BholeNo ratings yet

- MT4Document17 pagesMT4Narendra BholeNo ratings yet

- Port Preparation:: Outline/Installation Drawing, Model Series 3030BDocument2 pagesPort Preparation:: Outline/Installation Drawing, Model Series 3030BNarendra BholeNo ratings yet

- EscapismDocument2 pagesEscapismmuhammad shahidNo ratings yet

- Arcserve Whitepaper - UDP TechnicalDocument24 pagesArcserve Whitepaper - UDP TechnicalApple PieNo ratings yet

- T-02. Barthes - Critical EssaysDocument6 pagesT-02. Barthes - Critical EssaysEliseoJ0% (1)

- SC Promulgates Special ADR RulesDocument1 pageSC Promulgates Special ADR RulesverkieNo ratings yet

- Low Floor Bus Design - ReportDocument52 pagesLow Floor Bus Design - ReportMd DeVillierNo ratings yet

- MoodleTMB 2019-20 Seminar 4 Relative GroundsDocument36 pagesMoodleTMB 2019-20 Seminar 4 Relative GroundsJohn SheldonNo ratings yet

- Plug and Control': Adaptive PID Controller For Industrial ApplicationsDocument9 pagesPlug and Control': Adaptive PID Controller For Industrial ApplicationsCarlos Iván RuedaNo ratings yet

- Saved QueriesDocument3 pagesSaved Queriesspace 4 meNo ratings yet

- Igich Emergency CommiteeDocument46 pagesIgich Emergency CommiteeSultan QuranmalNo ratings yet

- ReflectiveModelRolf 4Document2 pagesReflectiveModelRolf 4solar_powerNo ratings yet

- Lecture 3 - Linear ProgrammingDocument14 pagesLecture 3 - Linear ProgrammingSakshi Khatri100% (1)

- Environmental Extra Texts GlossaryDocument47 pagesEnvironmental Extra Texts GlossaryAVXNo ratings yet

- Module The Contemporary WorldDocument11 pagesModule The Contemporary WorldGwaiy AhaneNo ratings yet

- Time Study EquipmentsDocument6 pagesTime Study EquipmentsGanesh ZopeNo ratings yet

- Euch - Easter VigilDocument8 pagesEuch - Easter VigilBrian Jay GimanNo ratings yet

- Leica CM1850 UV IFU 1v5C enDocument56 pagesLeica CM1850 UV IFU 1v5C enSteveNo ratings yet

- CS367 Logic For Computer ScienceDocument2 pagesCS367 Logic For Computer ScienceSuryajith NairNo ratings yet

- Session 4 - English ViDocument11 pagesSession 4 - English ViJhefNo ratings yet

- MGT 420 Management Case Study - Motivation: Present To: Roseamilda BT MansorDocument4 pagesMGT 420 Management Case Study - Motivation: Present To: Roseamilda BT MansorkimimuraNo ratings yet

- 2010B (D10) B1 Question PaperDocument17 pages2010B (D10) B1 Question PaperGiorgos VarnavasNo ratings yet

- Week 2 Day 1 English 7Document5 pagesWeek 2 Day 1 English 7Vergel Bacares BerdanNo ratings yet

- Antiaging QuizDocument8 pagesAntiaging QuizJavier De Aramburú PalermoNo ratings yet

- Jian Liu: The Composite Theorem of Ternary Quadratic Inequalities and Its ApplicationsDocument11 pagesJian Liu: The Composite Theorem of Ternary Quadratic Inequalities and Its ApplicationsPanagiote LigourasNo ratings yet

- Eapp Module4 2QW7Document11 pagesEapp Module4 2QW7Lireea GhustaNo ratings yet