Professional Documents

Culture Documents

Analyzing Transactions Journal

Uploaded by

Narits Muhammad SyafrudinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing Transactions Journal

Uploaded by

Narits Muhammad SyafrudinCopyright:

Available Formats

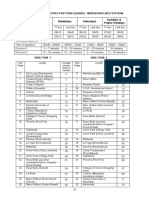

Chapter 2

75

Analyzing Transactions

Solution 1., 2., and 3.

Journal

Date

Post.

Ref. Debit

Description

2009

Apr. 1

Rent Expense

Cash

Paid ofce rent for April.

53

11

800

Equipment

Accounts Payable

Purchased equipment

on account.

18

22

2,100

Cash

Accounts Receivable

Received cash on

account.

11

12

Supplies

Accounts Payable

Purchased supplies.

13

22

245

Accounts Payable

Equipment

Returned defective

equipment.

22

18

325

12 Accounts Payable

Cash

Paid creditors on account.

22

11

1,250

17 Prepaid Insurance

Cash

Renewed six-month

property policy.

14

11

370

20 Accounts Payable

Cash

Recorded March payment

to creditor.

22

11

200

Account Cash

Date

Item

2009

Apr. 1

1

5

12

17

20

24

27

30

30

30

30

Balance

Credit

27

27

27

27

27

28

28

28

28

28

28

Date

800

3,150

1,250

370

200

545

1,250

1,720

1,725

360

132

Post.

Ref. Debit

Description

55

11

545

27 J. F. Outz, Drawing

Cash

J. F. Outz withdrew cash

for personal use.

32

11

1,250

11

41

1,720

245

30 Cash

Professional Fees

Received fees from

patients.

51

11

1,725

325

30 Salary Expense

Cash

Paid salaries.

56

11

360

1,250

30 Utilities Expense

Cash

Paid utilities.

12

41

5,145

370

30 Accounts Receivable

Professional Fees

Recorded fees earned

on account.

30 Miscellaneous Expense

Cash

Paid expenses.

59

11

132

200

800

2,100

3,150

Apr. 24 Laboratory Expense

Cash

Paid for laboratory

analysis.

Credit

545

1,250

3,150

Account Accounts Receivable

Balance

Credit

Page 28

2009

Account No. 11

Post.

Ref. Debit

Journal

Page 27

Debit

4,123

3,323

6,473

5,223

4,853

4,653

4,108

2,858

4,578

2,853

2,493

2,361

Credit

Date

Item

2009

Apr. 1

5

30

Balance

Post.

Ref. Debit

27

28

Date

Item

2009

Apr. 1

8

Balance

1,725

360

5,145

132

Account No. 12

Balance

Credit

Debit

3,150

6,725

3,575

8,720

5,145

Account Supplies

1,720

Credit

Account No. 13

Post.

Ref. Debit

27

245

Balance

Credit

Debit

290

535

Credit

You might also like

- 110 - Pdfsam - Accounting 23ed - WarrenDocument1 page110 - Pdfsam - Accounting 23ed - WarrenNarits Muhammad SyafrudinNo ratings yet

- Exercise For Chapter 2Document6 pagesExercise For Chapter 2Dĩm MiNo ratings yet

- Quiz 2 AnswerDocument4 pagesQuiz 2 AnswerJessa Mae Banse Limosnero100% (4)

- Date Description F Debit Credit: General JournalDocument32 pagesDate Description F Debit Credit: General JournalSukh GillNo ratings yet

- Financial Accounting (1) : SectionDocument24 pagesFinancial Accounting (1) : SectionAbdalrhman MahmoudNo ratings yet

- Ulidsonlen 5Document11 pagesUlidsonlen 5api-239547380100% (5)

- Chapter 2Document52 pagesChapter 2Cagla DerseNo ratings yet

- Business Transaction AnalysisDocument35 pagesBusiness Transaction AnalysisBianca Jane Gaayon100% (1)

- Exercise For Chapter 2Document2 pagesExercise For Chapter 2Bui AnhNo ratings yet

- On July 1 K Resser Opened Resser S Business Services Resser SDocument1 pageOn July 1 K Resser Opened Resser S Business Services Resser Strilocksp SinghNo ratings yet

- Week6 AComprehensiveIllustrationDocument86 pagesWeek6 AComprehensiveIllustrationyow jing pei89% (28)

- 1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4Document4 pages1101AFE Accounting Principles - Workshop Chapter 2: Page 1 of 4张兆宇No ratings yet

- 4 5805514475188521062Document3 pages4 5805514475188521062eferem100% (5)

- Bookkeeping Quiz #2 SolutionsDocument6 pagesBookkeeping Quiz #2 SolutionsJohn Vincent D. ReyesNo ratings yet

- Business Accounting Topic 3 - The Recording ProcessDocument27 pagesBusiness Accounting Topic 3 - The Recording Processnooramisa100% (2)

- The Accounting Cycle: Capturing Economic EventsDocument37 pagesThe Accounting Cycle: Capturing Economic EventsMasood MehmoodNo ratings yet

- Assignment No. 01 FAPDocument4 pagesAssignment No. 01 FAPUmar FaridNo ratings yet

- Problem Set 1 SolutionsDocument15 pagesProblem Set 1 SolutionsCosta Andrea67% (3)

- CH 03 Alt ProbDocument8 pagesCH 03 Alt ProbMuhammad Usman25% (4)

- Accounting journals and transactionsDocument4 pagesAccounting journals and transactionsTOWFIQ TusharNo ratings yet

- Week 6 - Solutions (Some Revision Questions)Document13 pagesWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- Accounting Questions and AnswersDocument24 pagesAccounting Questions and Answersbplus729No ratings yet

- 1Document9 pages1Shah Alam Badshah100% (1)

- CH 03Document7 pagesCH 03Bind Prozt100% (1)

- BT NhómDocument28 pagesBT NhómTrần Hường100% (1)

- Lesson 2 (Basic Accounting Equation)Document47 pagesLesson 2 (Basic Accounting Equation)GRADE TEN EMPATHYNo ratings yet

- WRD Ab - Az.ch02 SV Analyzing TransactionDocument41 pagesWRD Ab - Az.ch02 SV Analyzing TransactionJames Ade AlexanderNo ratings yet

- Management and Financial AcctgDocument10 pagesManagement and Financial AcctgVishnu RoyNo ratings yet

- Journalizing, Posting, Preparing Trial Balance Week 2 CheckPointDocument6 pagesJournalizing, Posting, Preparing Trial Balance Week 2 CheckPointmrnick1102No ratings yet

- Class Exercise Session 1,2Document7 pagesClass Exercise Session 1,2sheheryar50% (4)

- Presentation1 AutosavedDocument19 pagesPresentation1 AutosavedJoefet PatalotNo ratings yet

- Accounting Cycle Upto Trial BalanceDocument60 pagesAccounting Cycle Upto Trial BalancejobwangaNo ratings yet

- BeloAvril's First Month OperationsDocument8 pagesBeloAvril's First Month OperationsHelen Mae Baroma BeloNo ratings yet

- Accounting Cycle Review ProblemDocument33 pagesAccounting Cycle Review ProblemReginald Horton83% (54)

- Fiji National University ACC501 Computerized AccountingDocument3 pagesFiji National University ACC501 Computerized AccountingRoy GastroNo ratings yet

- UIC-SHS 5th Monthly Exam Journal EntriesDocument4 pagesUIC-SHS 5th Monthly Exam Journal EntriesJonavi LuyongNo ratings yet

- Diagnostic QuizDocument3 pagesDiagnostic QuizXENA LOPEZNo ratings yet

- Accounting Q and ADocument20 pagesAccounting Q and Afirehiwotmisganaw3No ratings yet

- Bablad Brokerage Services General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Document9 pagesBablad Brokerage Services General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447No ratings yet

- The Accounting Cycle ExplainedDocument61 pagesThe Accounting Cycle ExplainedHottie-Hot SoniNo ratings yet

- The Accounting CycleDocument23 pagesThe Accounting CycleJessica CorpuzNo ratings yet

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- Chapter 2 PowerPointDocument37 pagesChapter 2 PowerPointhosie.oqbeNo ratings yet

- The Accounting Cycle StepsDocument60 pagesThe Accounting Cycle StepsJessica CorpuzNo ratings yet

- Preparing Adjusting EntriesDocument12 pagesPreparing Adjusting Entriesshoaiba167% (3)

- Accounting Records and SystemsDocument22 pagesAccounting Records and SystemsMarai ParativoNo ratings yet

- Payment For Remaining Balance For The Purchase of Supplies On AccountDocument3 pagesPayment For Remaining Balance For The Purchase of Supplies On AccountJessa Mae Banse LimosneroNo ratings yet

- Journal and PostingDocument20 pagesJournal and PostingRakhaNo ratings yet

- Edexcel IGCSE Accounting AnswersDocument92 pagesEdexcel IGCSE Accounting Answerskwakwa480% (5)

- Cash Books QuestionsDocument15 pagesCash Books QuestionsSigei Leonard57% (7)

- Chapter - Ii: Accounting ProcessDocument7 pagesChapter - Ii: Accounting ProcessPilau SinghNo ratings yet

- Exercises AccountingDocument3 pagesExercises AccountingAmalia BejenariuNo ratings yet

- Chapter 02Document38 pagesChapter 02Mrbroken92No ratings yet

- Accounting exercises from Weygandt, Kieso, Kimmel 6th editionDocument14 pagesAccounting exercises from Weygandt, Kieso, Kimmel 6th editionAmber Nicole Forgey NormanNo ratings yet

- AccountingDocument57 pagesAccountingSyed ImranNo ratings yet

- Homework 1Document5 pagesHomework 1Vineet KhandelwalNo ratings yet

- Recording Business TransactionsDocument48 pagesRecording Business TransactionsShahzeb RaheelNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Analyzing Transactions and Trial BalanceDocument1 pageAnalyzing Transactions and Trial BalanceNarits Muhammad Syafrudin50% (2)

- 8 MotivasiDocument20 pages8 MotivasiNarits Muhammad SyafrudinNo ratings yet

- 7 KepemimpinanDocument18 pages7 KepemimpinanNarits Muhammad SyafrudinNo ratings yet

- 118 - Pdfsam - Accounting 23ed - WarrenDocument1 page118 - Pdfsam - Accounting 23ed - WarrenNarits Muhammad SyafrudinNo ratings yet

- 117 - Pdfsam - Accounting 23ed - WarrenDocument2 pages117 - Pdfsam - Accounting 23ed - WarrenNarits Muhammad SyafrudinNo ratings yet

- 116 - Pdfsam - Accounting 23ed - WarrenDocument1 page116 - Pdfsam - Accounting 23ed - WarrenNarits Muhammad SyafrudinNo ratings yet

- Analyzing Transactions and Unadjusted Trial BalanceDocument1 pageAnalyzing Transactions and Unadjusted Trial BalanceNarits Muhammad SyafrudinNo ratings yet

- 115 - Pdfsam - Accounting 23ed - WarrenDocument1 page115 - Pdfsam - Accounting 23ed - WarrenNarits Muhammad SyafrudinNo ratings yet

- 107 - Pdfsam - Accounting 23ed - WarrenDocument1 page107 - Pdfsam - Accounting 23ed - WarrenNarits Muhammad SyafrudinNo ratings yet

- Course-Structure-Syllabi-BCom 1-76-100Document25 pagesCourse-Structure-Syllabi-BCom 1-76-100Ram YadavNo ratings yet

- TA Form (AIIMS Rishikesh)Document4 pagesTA Form (AIIMS Rishikesh)JoseNo ratings yet

- One Saving Account PPT Group-3Document8 pagesOne Saving Account PPT Group-3Shanu SinghNo ratings yet

- 5G RAN SharingDocument76 pages5G RAN SharingTiago SilvaNo ratings yet

- A222 Tutorial 2QDocument4 pagesA222 Tutorial 2Qnur afrinaNo ratings yet

- Directory Medical Inst West BengalDocument249 pagesDirectory Medical Inst West BengalAshok PatoleNo ratings yet

- RFP Sewa Gudang Adib Feb 2021Document3 pagesRFP Sewa Gudang Adib Feb 2021Sulis SetioriniNo ratings yet

- DCB Project Part 2Document5 pagesDCB Project Part 2CharuJagwaniNo ratings yet

- BestRun DatasetDocument4,623 pagesBestRun Datasetpurnima100No ratings yet

- Appendixes FORMSDocument116 pagesAppendixes FORMSErnie LahaylahayNo ratings yet

- Philippine high school student's accounting worksheetDocument7 pagesPhilippine high school student's accounting worksheetCha Eun WooNo ratings yet

- Tax Card 2022-23 KpraDocument9 pagesTax Card 2022-23 KpraAnushka SNo ratings yet

- E-Business in The Health Care IndustryDocument17 pagesE-Business in The Health Care Industryshalabhs4uNo ratings yet

- CN Unit-IDocument167 pagesCN Unit-I18W91A0C0No ratings yet

- Family Travel Planner: Trip Overview & ItineraryDocument4 pagesFamily Travel Planner: Trip Overview & ItineraryRJNo ratings yet

- The Endgame - A Thesis On The Future of Chainlink and Web 3.0Document44 pagesThe Endgame - A Thesis On The Future of Chainlink and Web 3.0GideonEmmanuelNo ratings yet

- American Medical AssociationDocument2 pagesAmerican Medical AssociationHector Y Janet OrtizNo ratings yet

- Cisco System Case StudyDocument2 pagesCisco System Case Studyaman KumarNo ratings yet

- Local Governments Financial and Accounting Manual 2007Document248 pagesLocal Governments Financial and Accounting Manual 2007markogenrwot100% (1)

- Tourist Packages - West Godavari District, Government of Andhra Pradesh - IndiaDocument2 pagesTourist Packages - West Godavari District, Government of Andhra Pradesh - IndiaVenkat KvNo ratings yet

- AccountingDocument26 pagesAccountingMuhammad Jaafar AbinalNo ratings yet

- Perfect BlackJack and Card CountingDocument15 pagesPerfect BlackJack and Card Countinglame_michaelNo ratings yet

- Cdcs Sample Questions 1Document38 pagesCdcs Sample Questions 1Muthu Selvan100% (1)

- Design A Parking LotDocument6 pagesDesign A Parking LotDinesh YadavNo ratings yet

- FixedDepositsDocument1 pageFixedDepositsTiso Blackstar GroupNo ratings yet

- Drills on Cash and Cash EquivalentsDocument18 pagesDrills on Cash and Cash EquivalentsMae Jessa0% (1)

- Ratio Analysis of Selected Insurance Co: Rupali LifeDocument3 pagesRatio Analysis of Selected Insurance Co: Rupali LifeAmitNo ratings yet

- Account StatementDocument22 pagesAccount Statement18 Shivam SharmaNo ratings yet

- INR A2 Form - GIC-20010184Document2 pagesINR A2 Form - GIC-20010184JP0% (1)

- Route 198 Bocs (S) & Ubs: Weekdays Saturdays Sundays & Public HolidaysDocument70 pagesRoute 198 Bocs (S) & Ubs: Weekdays Saturdays Sundays & Public HolidaysWa WiNo ratings yet