Professional Documents

Culture Documents

Stats Assignment

Uploaded by

Dipanshu SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stats Assignment

Uploaded by

Dipanshu SinghCopyright:

Available Formats

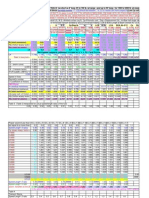

a)

TBILL

SP500

SMALLCAP

CORPBOND

USGOVT

Mean

0.0367 Mean

0.1188 Mean

0.1674 Mean

0.0623 Mean

0.0588

Standard Error

0.0034 Standard Error

0.0221 Standard Error

0.0354 Standard Error

0.0090 Standard Error

0.0103

Median

0.0314 Median

0.1431 Median

0.1839 Median

0.0473 Median

0.0370

Mode

#N/A

#N/A

#N/A

#N/A

Standard Deviation

0.0309 Standard Deviation

Sample Variance

0.0010 Sample Variance

Kurtosis

1.0374 Kurtosis

-0.0366 Kurtosis

Skewness

0.9941 Skewness

-0.3828 Skewness

Range

0.1473 Range

Mode

-0.0002 Minimum

Maximum

0.1471 Maximum

Sum

3.1154 Sum

Mode

0.0831 Standard Deviation

0.0953

0.0416 Sample Variance

0.1065 Sample Variance

0.0069 Sample Variance

0.0091

1.9398 Kurtosis

3.9671 Kurtosis

1.8415

0.5747 Skewness

1.4180 Skewness

1.0450

2.0087 Range

0.5065 Range

0.5399 Maximum

TBILL

SP500

-0.0809 Minimum

-0.1490

1.4287 Maximum

0.4256 Maximum

0.4036

10.0983 Sum

14.2322 Sum

85.0000 Count

85.0000 Count

SMALLCAP

5.2941 Sum

4.9986

85.0000 Count

85.0000

CORPBOND

USGOVT

SP500

-0.014489062

SMALLCAP

-0.098278225 0.793426709

CORPBOND

0.185050249 0.172290192

0.073416303

USGOVT

0.216673148

1

1

0.02837864 -0.069182426 0.893340571

c)

Count of SP500 Yearly Returns

18

Frequency

(1926-2010)

16

16

13

14

14

13

13

12

10

8

5

6

4

2

0

-0.4

-0.3

-0.2

-0.1

0.1

Yearly Returns Bin

Range

0.5526

-0.5801 Minimum

b)

TBILL

#N/A

0.3263 Standard Deviation

-0.4334 Minimum

85.0000 Count

Mode

0.2039 Standard Deviation

0.9733 Range

Minimum

Count

Mode

0.2

0.3

0.4

0.5

0.6

d)

Average Yearly Returns vs. Risk

0.18000

SMALLCAP

0.16000

SP500

0.14000

0.12000

0.10000

0.08000

CORPBOND

0.06000

TBILL

USGOVT

0.04000

0.02000

0.00000

0.00000

0.02000

0.04000

0.06000

0.08000

0.10000

0.12000

You might also like

- Data Set Final 2Document908 pagesData Set Final 2arber hasaNo ratings yet

- Predictive Tool: Rental Bike Hiring ServicesDocument11 pagesPredictive Tool: Rental Bike Hiring ServicesMaham ShahidNo ratings yet

- Torsion Irregularity CheckDocument9 pagesTorsion Irregularity CheckPraveen GavadNo ratings yet

- Torsion Irregularity CheckDocument9 pagesTorsion Irregularity Checkabdul khaderNo ratings yet

- Tinggi BeratDocument34 pagesTinggi BeratArlin NNo ratings yet

- Torsional IrregularityDocument5 pagesTorsional IrregularitybiniamNo ratings yet

- Thickness: A201 Model HT201 (HIGH-TEMP) Model A301 Model A401 ModelDocument2 pagesThickness: A201 Model HT201 (HIGH-TEMP) Model A301 Model A401 ModelCarlos HernandezNo ratings yet

- PHY221 F13 Activity 8 L8 Collisions TableDocument24 pagesPHY221 F13 Activity 8 L8 Collisions TableAhmedNo ratings yet

- Turbofan ProblemaDocument2 pagesTurbofan ProblemaFernanda MoralesNo ratings yet

- DescriptivesDocument2 pagesDescriptivesTik JelantikNo ratings yet

- Section 12 Method DevelopmentDocument21 pagesSection 12 Method DevelopmentNtombizodwa VincenthNo ratings yet

- BCS-CRM 113 Mar2014Document3 pagesBCS-CRM 113 Mar2014Ishmael WoolooNo ratings yet

- Plate Load Test DIN 18134 Ev1Ev2 - LAb FormDocument1 pagePlate Load Test DIN 18134 Ev1Ev2 - LAb FormPedja0% (1)

- Statistics FinalDocument15 pagesStatistics FinalRiya PandeyNo ratings yet

- Bari PracticeDocument8 pagesBari PracticeALAMGIR HOSSAINNo ratings yet

- Diffraction Grating: Average AverageDocument1 pageDiffraction Grating: Average AverageLara El BezraNo ratings yet

- Results DiffractionDocument1 pageResults DiffractionLara El BezraNo ratings yet

- Row1 Row2 Row3 Row4 Row5Document17 pagesRow1 Row2 Row3 Row4 Row5Warner BullecerNo ratings yet

- Final Analisis Cuantitativo - LFSDocument5 pagesFinal Analisis Cuantitativo - LFSISABEL CRISTINA ECHEVERRY OSORIONo ratings yet

- Boot StrapDocument251 pagesBoot StrapEman MazharNo ratings yet

- BS Practice Assignment 1Document10 pagesBS Practice Assignment 1ArpitaNo ratings yet

- Two-Way Slab Check Slab Mark: Analysis CriteriaDocument8 pagesTwo-Way Slab Check Slab Mark: Analysis CriteriaAnonymous PVQdLoYnpNo ratings yet

- QM - Ii Assignment - 3: Submitted By: Group 2 (Sec-B)Document6 pagesQM - Ii Assignment - 3: Submitted By: Group 2 (Sec-B)swaNo ratings yet

- Price Crime - Rate Resid - Area Air - Qual Room - NumDocument48 pagesPrice Crime - Rate Resid - Area Air - Qual Room - NumVampireNo ratings yet

- BCS-CRM 114 Mar2014Document3 pagesBCS-CRM 114 Mar2014Ishmael WoolooNo ratings yet

- H2O2Document36 pagesH2O2Cris SoaresNo ratings yet

- Sampling Distribution TemplateDocument4 pagesSampling Distribution TemplateMAYANK JINDAL BD22024No ratings yet

- Viscosity of c5h802 - 28Document1 pageViscosity of c5h802 - 28CharlesNo ratings yet

- MODULO 6 Analisis Sismico EstaticoDocument11 pagesMODULO 6 Analisis Sismico EstaticoLUIZ FERNANDO ALARCÓN ROJASNo ratings yet

- Isobaric Vapor-Liquid and Liquid-Liquid Equilibria For Chloroform + Methanol + 1-Ethyl-3-Methylimidazolium Trifluoromethanesulfonate at 100 KpaDocument6 pagesIsobaric Vapor-Liquid and Liquid-Liquid Equilibria For Chloroform + Methanol + 1-Ethyl-3-Methylimidazolium Trifluoromethanesulfonate at 100 Kpaluis fernando muro cordovaNo ratings yet

- Mean of Vanuatu and TongaDocument2 pagesMean of Vanuatu and TongaTieboa Tiibora TarekauaNo ratings yet

- Exp ThermflDocument3 pagesExp Thermflcanastasiou6No ratings yet

- KRIBIOLISA Anti-Trastuzumab ELISA Validation - Ver 1 0 Validation FileDocument3 pagesKRIBIOLISA Anti-Trastuzumab ELISA Validation - Ver 1 0 Validation FileKRISHGEN BIOSYSTEMSNo ratings yet

- Test Name: Determination of Tensile Properties of Geotextile Using Wide Strip ScopeDocument3 pagesTest Name: Determination of Tensile Properties of Geotextile Using Wide Strip ScopeSwapan PaulNo ratings yet

- Test Plan: Pump SpecificationDocument2 pagesTest Plan: Pump Specificationmecanik.veracruzNo ratings yet

- Agilent Digital-Multimeters TES-34401A DatasheetDocument4 pagesAgilent Digital-Multimeters TES-34401A DatasheetTeq ShoNo ratings yet

- Accuracy and Precision in Micropipettor MeasurementDocument9 pagesAccuracy and Precision in Micropipettor MeasurementMARIA CARMELA GUERRANo ratings yet

- MS1723 Performance Evaluation of Mechanical Dust Collector PDFDocument36 pagesMS1723 Performance Evaluation of Mechanical Dust Collector PDFSyahfiq YusofNo ratings yet

- Engine Mechanical (2Rz-Fe, 3Rz-Fe) : Service DataDocument4 pagesEngine Mechanical (2Rz-Fe, 3Rz-Fe) : Service DataDavid R PaucaraNo ratings yet

- Exercise 8 SOLUTIONDocument6 pagesExercise 8 SOLUTIONLeng ChaiNo ratings yet

- Resolver Smart SynDocument12 pagesResolver Smart SynLeon de RuijterNo ratings yet

- Local Tuition Starting SalaryDocument4 pagesLocal Tuition Starting SalaryJames HamiltonNo ratings yet

- SUZUKI DF40 50 Servisnaya InformatsiyaDocument8 pagesSUZUKI DF40 50 Servisnaya Informatsiyapaul_portegeNo ratings yet

- Sports ShoesDocument17 pagesSports ShoesKocic GradnjaNo ratings yet

- KAUT16 WebDocument15 pagesKAUT16 WebNakkolopNo ratings yet

- 阻力與推進HWDocument3 pages阻力與推進HWKuo1018No ratings yet

- Bab 4Document191 pagesBab 4Jessica AnggreniNo ratings yet

- Generic TST Protocol Distributed Annexes KNCVDocument14 pagesGeneric TST Protocol Distributed Annexes KNCVtheresiaNo ratings yet

- AMI 300 Data SheetDocument4 pagesAMI 300 Data SheetPatNo ratings yet

- Torsional IrregularityDocument4 pagesTorsional IrregularityMohammed Junaid ShaikhNo ratings yet

- Engine Mechanical: Service DataDocument1 pageEngine Mechanical: Service DataClodoaldo Biassio100% (1)

- Mander Sap2000 Vs ExelDocument6 pagesMander Sap2000 Vs ExelMario FloresNo ratings yet

- Project StatisticsDocument6 pagesProject StatisticsGupta AdityaNo ratings yet

- 5 lps q: Manning 'n' value n = 0.01 φ 200 mm A = 0.0314 m2 0.0050 m3/s R = 0.050Document2 pages5 lps q: Manning 'n' value n = 0.01 φ 200 mm A = 0.0314 m2 0.0050 m3/s R = 0.050navneet3bawaNo ratings yet

- Supplementary Table S4. Number of Novel Autosome Variants Grouped by Impact and FrequencyDocument2 pagesSupplementary Table S4. Number of Novel Autosome Variants Grouped by Impact and FrequencykjhgfghjkNo ratings yet

- Column1 Column2 Column3 Column4Document35 pagesColumn1 Column2 Column3 Column4Shiva Kumar DunaboinaNo ratings yet

- Torsional IrregularityDocument4 pagesTorsional IrregularityAgim ZiberiNo ratings yet

- 1tr-Fe Engine MechanicalDocument1 page1tr-Fe Engine MechanicalHoangthuong798010No ratings yet

- BoothstrappingDocument231 pagesBoothstrappingJefry AndreanNo ratings yet