Professional Documents

Culture Documents

Expand

Expand

Uploaded by

Pramod kOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expand

Expand

Uploaded by

Pramod kCopyright:

Available Formats

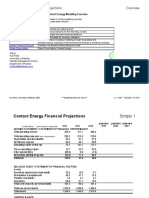

OPTION WORKSHEET: LONG TERM OPTIONS

VALUINGANEXPANSIONOPTION

Thisprogramcalculatesthevalueofanexpansionoption

inaninvestmentanalysis.

Inputsrelatingtheunderlyingasset

Enterthepresentvalueofexpansionpotential(asassessedtoday)=

$100.00

(incurrency)

Entettheannualizedstandarddeviationinln(presentvalueofCF)

31.62%

(in%)

Entertheinitialinvestmentneededforexpansionoption(inPV$)=

$150.00

(incurrency)

10

(inyears)

Enterthenumberofyearsyouhaverightstoproject

Enterthecostassociatedwithwaitinganextrayeartoexpand=

0.00%

GeneralInputs

Entertherisklessratethatcorrespondstotheoptionlifetime=

6.50%

(in%)

VALUINGALONGTERMOPTION/WARRANT

StockPrice=

$100.00

T.Bondrate=

StrikePrice=

$150.00

Variance=

Expiration(inyears)=

10

Costofdelay=

6.50%

0.10

0.00%

OPTION WORKSHEET: LONG TERM OPTIONS

d1=

0.7445348919

N(d1)=

0.7717235298

d2=

0.2554651081

N(d2)=

0.3991819447

ValueofOptiontoExpand=

$45.91

You might also like

- Trading SardinesDocument6 pagesTrading Sardinessim tykesNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Degree Polynomial:: Generic Yield Interpolation ChartDocument9 pagesDegree Polynomial:: Generic Yield Interpolation Chartapi-3763138No ratings yet

- Bond Duration - Dynamic ChartDocument3 pagesBond Duration - Dynamic Chartapi-3763138No ratings yet

- Why Do Sponsors Use Project Finance?: 2. How Does Project Finance Create Value? Justify With An ExampleDocument3 pagesWhy Do Sponsors Use Project Finance?: 2. How Does Project Finance Create Value? Justify With An Examplekumsisa kajelchaNo ratings yet

- ExpandDocument2 pagesExpandPro ResourcesNo ratings yet

- Valuing An Option To Abandon A Project: Inputs Relating The Underlying AssetDocument4 pagesValuing An Option To Abandon A Project: Inputs Relating The Underlying Assetapi-3763138No ratings yet

- Valuing An Option To Abandon A Project: Inputs Relating The Underlying AssetDocument3 pagesValuing An Option To Abandon A Project: Inputs Relating The Underlying AssetPro ResourcesNo ratings yet

- Valuing An Expansion Option This Program Calculates The Value of An Expansion Option in An Investment AnalysisDocument2 pagesValuing An Expansion Option This Program Calculates The Value of An Expansion Option in An Investment AnalysisAlok P SinghNo ratings yet

- EquityDocument8 pagesEquityapi-3701114No ratings yet

- OptltDocument3 pagesOptltapi-3763138No ratings yet

- NatresDocument3 pagesNatresapi-3701114No ratings yet

- DelayDocument2 pagesDelayapi-3763138No ratings yet

- Financial Management Bruce HonniballDocument3 pagesFinancial Management Bruce HonniballjanelleNo ratings yet

- Real Options Teaching NotesDocument11 pagesReal Options Teaching NotesTwinkle ChettriNo ratings yet

- Year FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34Document19 pagesYear FCFF Terminal Value Present Value 1 2 3 4 5 6 7 8 9 10 $318.13 $60,899.33 $19,986.47 $16,041.34api-3763138No ratings yet

- Financial Reading 2 - ScribdDocument2 pagesFinancial Reading 2 - ScribdSanjay KumarNo ratings yet

- BFD - Sensitivity Analysis by Taha PopatiaDocument4 pagesBFD - Sensitivity Analysis by Taha PopatiaMuhammad TaimoorNo ratings yet

- Capital Budgeting ReportDocument29 pagesCapital Budgeting ReportJermaine Carreon100% (1)

- Straight Bond Value $834.79 Conversion Option $325.49 Value of Convertible Bond $1,160.28Document6 pagesStraight Bond Value $834.79 Conversion Option $325.49 Value of Convertible Bond $1,160.28nitin vermaNo ratings yet

- Straight Bond Value $834.79 Conversion Option $325.49 Value of Convertible Bond $1,160.28Document6 pagesStraight Bond Value $834.79 Conversion Option $325.49 Value of Convertible Bond $1,160.28J RodriguezNo ratings yet

- Option Valuation: Numerical ExampleDocument15 pagesOption Valuation: Numerical ExampleMarwa HassanNo ratings yet

- Lecture 1 IntroductionDocument19 pagesLecture 1 IntroductionLuisLoNo ratings yet

- Mini Case Chapter 8Document8 pagesMini Case Chapter 8William Y. OspinaNo ratings yet

- FBL5Document12 pagesFBL5FaleeNo ratings yet

- Capital Budgeting PDFDocument2 pagesCapital Budgeting PDFqwertNo ratings yet

- Risk and Return For PrintDocument30 pagesRisk and Return For PrintTahir DestaNo ratings yet

- Valuing Management Options or Warrants When There Is DilutionDocument4 pagesValuing Management Options or Warrants When There Is DilutionPro ResourcesNo ratings yet

- CH 02Document13 pagesCH 02Praveen BVSNo ratings yet

- AmazonDocument16 pagesAmazonEsteban Camilo Ortiz ZambranoNo ratings yet

- Capital Budgeting and FinancingDocument21 pagesCapital Budgeting and FinancingCérine AbedNo ratings yet

- CSI FormulasDocument8 pagesCSI Formulasgrz7gtqq9bNo ratings yet

- Which One You Go For??: Nokia E-71 Nokia 6030 Nokia 3310Document25 pagesWhich One You Go For??: Nokia E-71 Nokia 6030 Nokia 3310Ghulam MustafaNo ratings yet

- Bond Market 2 QuestionsDocument3 pagesBond Market 2 QuestionsSofia BoggsNo ratings yet

- CHAPTER 9 - Investment AppraisalDocument37 pagesCHAPTER 9 - Investment AppraisalnaurahimanNo ratings yet

- FMECO CONCEPT NOTES by Ca Test SeriesDocument329 pagesFMECO CONCEPT NOTES by Ca Test SeriesTanvirNo ratings yet

- DelayDocument2 pagesDelayPro ResourcesNo ratings yet

- Answer 1. The Correct Answers Are A and BDocument9 pagesAnswer 1. The Correct Answers Are A and BBadihah Mat SaudNo ratings yet

- Coursework Assignment Strategic Financial ManagementDocument9 pagesCoursework Assignment Strategic Financial ManagementaliNo ratings yet

- Risk & ReturnDocument36 pagesRisk & ReturnNocturnal BeeNo ratings yet

- A2 Business Formula SheetDocument2 pagesA2 Business Formula SheetThana YoyoNo ratings yet

- EBW1063 Managerial Finance Tutorial - StockValuation - AnswerDocument3 pagesEBW1063 Managerial Finance Tutorial - StockValuation - AnswerJune JoysNo ratings yet

- FinanceDocument39 pagesFinancenamien koneNo ratings yet

- Net Present Value (NPV)Document28 pagesNet Present Value (NPV)KAORU AmaneNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument41 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskSheikh OsamaNo ratings yet

- Discounting Cash FlowsDocument5 pagesDiscounting Cash FlowsDriton BinaNo ratings yet

- FM ASM Bao Khanh 2023 1Document8 pagesFM ASM Bao Khanh 2023 1Đức ChínhNo ratings yet

- CA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirDocument48 pagesCA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirYedu KrishnanNo ratings yet

- Introducing Financial Analysis: T.Venkataramanan. Ficwa - FcsDocument43 pagesIntroducing Financial Analysis: T.Venkataramanan. Ficwa - Fcsvenkataramanan_thiru100% (1)

- Hybrid Financing: Centre For Financial Management, BangaloreDocument19 pagesHybrid Financing: Centre For Financial Management, Bangalorejeeta_8No ratings yet

- Interpretation of Financial StatementDocument5 pagesInterpretation of Financial StatementHuế ThùyNo ratings yet

- 4-Risk and Return-PART 1Document22 pages4-Risk and Return-PART 1ANUJA RAPURKARNo ratings yet

- Lec02 SwayamDocument19 pagesLec02 Swayamkushal srivastavaNo ratings yet

- Mgac 04.24.17Document22 pagesMgac 04.24.17Ann SerratoNo ratings yet

- Capital Budgeting: Part I Investment CriteriaDocument49 pagesCapital Budgeting: Part I Investment Criteriarani namdevNo ratings yet

- Chap 4: Comparing Net Present Value, Decision Trees, and Real OptionsDocument51 pagesChap 4: Comparing Net Present Value, Decision Trees, and Real OptionsPrabhpuneet PandherNo ratings yet

- Cost Benefit AnalysisDocument15 pagesCost Benefit AnalysissudharsonkumarNo ratings yet

- FIN3218 2B Valuation 2Document24 pagesFIN3218 2B Valuation 2Mandy NgueNo ratings yet

- Section OneDocument31 pagesSection OneJehan OsamaNo ratings yet

- 1521strategic Cost Management K-3-ADocument15 pages1521strategic Cost Management K-3-APratham KochharNo ratings yet

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisFrom EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisNo ratings yet

- Discounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceFrom EverandDiscounted Cash Flow Budgeting: Simplified Your Path to Financial ExcellenceNo ratings yet

- SchwartzMoon (2000) Rational Pricing Internet CpyDocument14 pagesSchwartzMoon (2000) Rational Pricing Internet Cpyapi-3763138No ratings yet

- Estimating Growth Rates (Teaching Model)Document4 pagesEstimating Growth Rates (Teaching Model)api-3763138No ratings yet

- Stiglitz Weiss 1981 Implementation by Kurt HessDocument20 pagesStiglitz Weiss 1981 Implementation by Kurt Hessapi-3763138No ratings yet

- Endowment - Warrant - Valuer (McVerry) DDocument244 pagesEndowment - Warrant - Valuer (McVerry) Dapi-3763138No ratings yet

- Refresh Worksheet ListDocument14 pagesRefresh Worksheet Listapi-3763138No ratings yet

- Δr=α b−r Δt+σε Δt: Simulation of short-term interest ratesDocument19 pagesΔr=α b−r Δt+σε Δt: Simulation of short-term interest ratesapi-3763138No ratings yet

- Term Structure JP Morgan Model (Feb04)Document7 pagesTerm Structure JP Morgan Model (Feb04)api-3763138No ratings yet

- Contact - Main 2006Document89 pagesContact - Main 2006api-3763138No ratings yet

- Spline Basis Function Approximating Discount Function Fitting Bond UniverseDocument5 pagesSpline Basis Function Approximating Discount Function Fitting Bond Universeapi-3763138No ratings yet

- Bond Price With Excel FunctionsDocument6 pagesBond Price With Excel Functionsapi-3763138No ratings yet

- Relative Value Models (Feb04)Document18 pagesRelative Value Models (Feb04)api-3763138No ratings yet

- Longstaff Schwartz (95) Risky Debt (P)Document18 pagesLongstaff Schwartz (95) Risky Debt (P)api-3763138No ratings yet

- Bond Pricing - Dynamic ChartDocument4 pagesBond Pricing - Dynamic Chartapi-3763138No ratings yet

- RV YTM Model PDFDocument47 pagesRV YTM Model PDFAllen LiNo ratings yet

- Bond Duration - Price Sensitivity Using DurationDocument3 pagesBond Duration - Price Sensitivity Using Durationapi-3763138No ratings yet

- Converts PrimerDocument6 pagesConverts Primerjunjun07_01No ratings yet

- Bond Pricing - System of Five Bond VariablesDocument2 pagesBond Pricing - System of Five Bond Variablesapi-3763138No ratings yet

- PvtdiscrateDocument4 pagesPvtdiscrateapi-3763138No ratings yet

- Bond Convexity - Dynamic ChartDocument3 pagesBond Convexity - Dynamic Chartapi-3763138No ratings yet

- Inputs: Before Restructuring After RestructuringDocument4 pagesInputs: Before Restructuring After Restructuringapi-3763138No ratings yet

- Bond Pricing - BasicsDocument2 pagesBond Pricing - Basicsapi-3763138No ratings yet

- Bond Duration - BasicsDocument2 pagesBond Duration - Basicsapi-3763138No ratings yet

- Bond Convexity - BasicsDocument2 pagesBond Convexity - Basicsapi-3763138No ratings yet

- Input All Yellow Shaded AreasDocument6 pagesInput All Yellow Shaded Areasapi-3763138No ratings yet

- Put - Call Parity Model: Synthetic SecuritiesDocument3 pagesPut - Call Parity Model: Synthetic Securitiesapi-3763138No ratings yet

- OptltDocument3 pagesOptltapi-3763138No ratings yet

- Analysis of Ceres Gardening Company QuestionsDocument4 pagesAnalysis of Ceres Gardening Company QuestionsAnonymous 1997No ratings yet

- Nalin JainDocument1 pageNalin JainSatish AnnaldasNo ratings yet

- PEVC Group No.9 Abraaj CapitalDocument4 pagesPEVC Group No.9 Abraaj CapitalAbhishek GaikwadNo ratings yet

- International Finance - MG760-144 Week 9 - Chapter 14 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolDocument4 pagesInternational Finance - MG760-144 Week 9 - Chapter 14 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolKiranNo ratings yet

- Oil & Gas Financial Journal - 2013.06Document73 pagesOil & Gas Financial Journal - 2013.06Eric YvesNo ratings yet

- Term Paper FinalDocument15 pagesTerm Paper FinalHardik JainNo ratings yet

- The Monetary System: © 2008 Cengage LearningDocument31 pagesThe Monetary System: © 2008 Cengage LearningLuthfia ZulfaNo ratings yet

- Understanding Income Statements: Presenter's Name Presenter's Title DD Month YyyyDocument58 pagesUnderstanding Income Statements: Presenter's Name Presenter's Title DD Month YyyyAbdulelah AlhamayaniNo ratings yet

- Sample ESOP PlanDocument6 pagesSample ESOP PlanAnjali SharmaNo ratings yet

- Lender ListDocument1 pageLender ListKrist LlöydNo ratings yet

- Stock Swap Transaction - Ratio of Exchange & Effect On EPS: Acquiring Company Target CompanyDocument3 pagesStock Swap Transaction - Ratio of Exchange & Effect On EPS: Acquiring Company Target Companypriyal patelNo ratings yet

- 1-4thsem All 3spe PapersDocument10 pages1-4thsem All 3spe PapersSantoshkumar YandamuriNo ratings yet

- Filed DRHP - 20200825121338Document436 pagesFiled DRHP - 20200825121338SubscriptionNo ratings yet

- Currency Options MarketDocument17 pagesCurrency Options MarketTajrian Ahmmed 1512588630No ratings yet

- Lesson 3: Financial System and Economic Development: Learning ObjectivesDocument4 pagesLesson 3: Financial System and Economic Development: Learning Objectivesnotes.mcpuNo ratings yet

- Assignment 1Document6 pagesAssignment 1keithxiaoxiao096No ratings yet

- Investment Banking Interview Questions: StreetofwallsDocument33 pagesInvestment Banking Interview Questions: StreetofwallsVinay JainNo ratings yet

- BCG MatrixDocument8 pagesBCG MatrixAsh ZafarNo ratings yet

- 100 Finance MCQs RBI SEBI PDFDocument267 pages100 Finance MCQs RBI SEBI PDFGeethaNo ratings yet

- Purchasing Power Parity PPP Purchasing PowerDocument5 pagesPurchasing Power Parity PPP Purchasing PowerInnocent MollaNo ratings yet

- Tax True or False Not FinalDocument3 pagesTax True or False Not FinalAdah Micah PlarisanNo ratings yet

- Pfe Chap25Document36 pagesPfe Chap25bhabani348No ratings yet

- Insurance Industry in BangladeshDocument17 pagesInsurance Industry in BangladeshArifuzzaman khan100% (5)

- A Study On Investment Behavior of Women InvestorsDocument1 pageA Study On Investment Behavior of Women InvestorsMegha PatelNo ratings yet

- NSE IndexogramDocument2 pagesNSE IndexogramPeter SamualNo ratings yet

- Cash and Marketable Securities ManagementDocument13 pagesCash and Marketable Securities ManagementRAIZA GRACE OAMILNo ratings yet

- Week 1 2 Introduction To Forward and Options LMSDocument24 pagesWeek 1 2 Introduction To Forward and Options LMSKastral KokNo ratings yet

- RBI Balance SheetDocument10 pagesRBI Balance SheetporuterNo ratings yet