Professional Documents

Culture Documents

International Financial Accounting and Reporting

International Financial Accounting and Reporting

Uploaded by

Dave Aguila0 ratings0% found this document useful (0 votes)

3 views2 pagesfinac

Original Title

20100225105053795

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinac

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesInternational Financial Accounting and Reporting

International Financial Accounting and Reporting

Uploaded by

Dave Aguilafinac

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

International Financial Accounting and Reporting

Introduction to International Accounting

Financial and management accounting. Decision makers: The users of accounting information.

Financial accounting and reporting standardization. Major causes of international accounting

differences. Accounting models. Introduction to International Financial Reporting Standards

(IAS/IFRS).

Conceptual Framework for the preparation and presentation of financial statements

Objective of financial statements. Underlying assumptions, basic principles and concepts of

international financial accounting and reporting. Qualitative characteristics of accounting

information. Elements of financial statements and their measurement bases.

The accounting information system

Basic Equation. The Accounting Cycle.

Presentation of Financial Statements (IAS 1)

General purpose financial statements. Overall requirements for the presentation of financial

statements. Structure and content of financial statements (statement of financial position,

statement of comprehensive income, statement of changes in equity, statement of cash flows,

notes).

Revenue (IAS 18)

Definition of revenue. Revenue measurement and recognition (sale of goods, rendering of

services, interest, royalties and dividends). Related disclosures.

Inventories (IAS 2)

Definition and classification of inventories. Measurement of inventories. Techniques of

measurement of costs, cost formulas. Valuation at net realizable value. Related disclosures.

Periodic and perpetual inventory systems.

Property, plant and equipment (IAS 16)

Definition. Criteria for recognition. Measurement at recognition. Costs subsequent to acquisition.

Measurement after recognition. Depreciation and impairments. Derecognition. Related

disclosures.

Intangible assets (IAS 38)

Characteristics of intangibles and criteria for recognition. Measurement at recognition.

Measurement after recognition. Useful life and amortization. Presentation of intangibles.

Provisions, contingent liabilities, and contingent assets (IAS 37)

Classification of liabilities. Recognition and measurement of provisions. Contingent liabilities

and contingent assets. Related disclosures.

Equity

Components of equity. Dividend distributions. Treasury stocks. Related disclosures.

Cash flow statements (IAS 7)

Benefits of presenting a cash flow statement. Cash and cash equivalents. Content and format of

the cash flow statement, methods of preparation (direct versus indirect method). Related

disclosures.

Introduction to International Accounting.

Conceptual Framework for the preparation and

presentation of financial statements.

The accounting information system.

Presentation of Financial Statements (IAS 1)

Revenue (IAS 18). Inventories (IAS 2)

Lecture

5 credit hours

Lecture

Exercises

Lecture

Exercises

4 credit hours

Property, plant and equipment (IAS 16).

Intangible assets (IAS 38)

Provisions, contingent liabilities, and contingent

assets (IAS 37).

Lecture

Owners equity.

Exercises

Cash flow statements (IAS 7)

Examination

Total

4 credit hours

5 credit hours

2 credit hours

20 credit hours

Form of examination: final test with multiple-choice questions and exercises.

List of readings

1. International Financial Reporting Standards (IFRSs) 2008. IASCF, 2008.

2. Alexander D., Nobes C. Financial Accounting. An International Introduction. Pearson

Education Limited, 2001.

3. Keiso D., Weygandt J., Warfield T., Intermediate Accounting.- 12-th ed., John Wiley &

Sons, Inc., 2008

4. Websites:

www.iasb.org.uk

www.iasplus.com

You might also like

- Gap Analysis TemplateDocument7 pagesGap Analysis Templatejohn100% (1)

- Corpo Book Aquino Questions Finals 1Document25 pagesCorpo Book Aquino Questions Finals 1Alex MelegritoNo ratings yet

- IAS NotesDocument49 pagesIAS NotesSonia MenonNo ratings yet

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- International Accounting Standards (IFRS) For Banks: Who Should AttendDocument2 pagesInternational Accounting Standards (IFRS) For Banks: Who Should AttendRogerNo ratings yet

- Accounting QuizDocument3 pagesAccounting Quizmarygrace carbonelNo ratings yet

- Acc OrgDocument9 pagesAcc OrgDena Heart OrenioNo ratings yet

- A Level Accounting (9706) IAS Booklet v1 0Document58 pagesA Level Accounting (9706) IAS Booklet v1 0Mei Yi YeoNo ratings yet

- Financial Accounting and Accounting StandardsDocument51 pagesFinancial Accounting and Accounting StandardsTapas GuptaNo ratings yet

- (112026708) Kieso - Inter - Ch01 - IFRSDocument68 pages(112026708) Kieso - Inter - Ch01 - IFRSzozop69No ratings yet

- Mindmap - The Conceptual FrameworkDocument1 pageMindmap - The Conceptual FrameworkNURKHAIRUNNISANo ratings yet

- (Intermediate Financial (Intermediate Financial Accounting 1A) Accounting 1A)Document16 pages(Intermediate Financial (Intermediate Financial Accounting 1A) Accounting 1A)Jayne Carly CabardoNo ratings yet

- Accounting For Managerial Decisions MakingDocument3 pagesAccounting For Managerial Decisions MakingReipudaman Singh ShahiNo ratings yet

- A Study On Accounting Policies Followed byDocument23 pagesA Study On Accounting Policies Followed byhbkrakesh83% (12)

- Introduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Document3 pagesIntroduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Rachyl SacramedNo ratings yet

- Conceptual Framework SccroberDocument15 pagesConceptual Framework SccroberKazuyano DoniNo ratings yet

- Acctg 101 SyllabusDocument17 pagesAcctg 101 SyllabusMarvin CeledioNo ratings yet

- To Match The Costs of Production With Revenues As EarnedDocument3 pagesTo Match The Costs of Production With Revenues As EarnedNguyen Van DzungNo ratings yet

- ACFrOgDUtRs7JmRw3EDTUYW3ugxtBH4oAGnxIA03r8agjD1QbFoqtxFDQJb0Dqcoei7PpDJMBNinqh4YzWILzz1KaZw00pyMtMO LE1McQo4lmni32 0ljV ri0Wmshy1608IEQTnZJzDe Kd1-3Document3 pagesACFrOgDUtRs7JmRw3EDTUYW3ugxtBH4oAGnxIA03r8agjD1QbFoqtxFDQJb0Dqcoei7PpDJMBNinqh4YzWILzz1KaZw00pyMtMO LE1McQo4lmni32 0ljV ri0Wmshy1608IEQTnZJzDe Kd1-3Phebieon Mukwenha100% (1)

- Jurnal 5Document12 pagesJurnal 5Dhienna AyoeNo ratings yet

- AFADocument26 pagesAFAMAHENDRAN_CHRISTNo ratings yet

- Implementations Accounting StandartDocument11 pagesImplementations Accounting StandartShamsuddin AhmedNo ratings yet

- Accounting StandardDocument6 pagesAccounting StandardsurjitNo ratings yet

- Louw12 AuditingDocument44 pagesLouw12 Auditingredearth2929No ratings yet

- 9706 TSG IAS v2Document50 pages9706 TSG IAS v2tevNo ratings yet

- Financial Audit ManualDocument5 pagesFinancial Audit ManualHidayat AliNo ratings yet

- Financial Management Module 1Document24 pagesFinancial Management Module 1Anees SalihNo ratings yet

- CHAPTER 1 Financial Reporting-ShareDocument3 pagesCHAPTER 1 Financial Reporting-ShareCahyo PriyatnoNo ratings yet

- BAC4694 Forensic Accounting Sem 2 2013-14Document5 pagesBAC4694 Forensic Accounting Sem 2 2013-14secsmyNo ratings yet

- Double Entry System Unit2Document10 pagesDouble Entry System Unit2ARZOO MAVINo ratings yet

- Chapter 01 Intermediate AccountingDocument10 pagesChapter 01 Intermediate AccountingKelvin Kenneth ValmonteNo ratings yet

- CSS Syllabus: Subject: Accountancy & AuditingDocument6 pagesCSS Syllabus: Subject: Accountancy & AuditingHameedNo ratings yet

- Silabus Akuntansi Sektor Publik Johan Arifin Se Msi Dan Mahmudi Se Msi Ak 515Document1 pageSilabus Akuntansi Sektor Publik Johan Arifin Se Msi Dan Mahmudi Se Msi Ak 515Tri Riyadi Setyo NugrohoNo ratings yet

- International Harmonization of Financial ReportingDocument8 pagesInternational Harmonization of Financial ReportingRaghu Ck100% (1)

- Finance:: Sap - Financial Accounting and ControllingDocument4 pagesFinance:: Sap - Financial Accounting and ControllingVAIBHAV PARABNo ratings yet

- 03 IASB FrameworkDocument27 pages03 IASB FrameworkRichard LeeNo ratings yet

- Financial Accounting Course OutlineDocument2 pagesFinancial Accounting Course OutlineTanveer FarooqNo ratings yet

- Financial Statement Analysis-SampleDocument39 pagesFinancial Statement Analysis-Samplefchemtai4966No ratings yet

- Business Accountant CertificationDocument0 pagesBusiness Accountant CertificationVskills CertificationNo ratings yet

- The Cpa Licensure Examination Syllabus Management ServicesDocument8 pagesThe Cpa Licensure Examination Syllabus Management ServicesCaraigMichaelNo ratings yet

- Indian Accounting Standards (Ind AS) : Semester VIDocument19 pagesIndian Accounting Standards (Ind AS) : Semester VIChirag GadiaNo ratings yet

- Syllabus First YearDocument12 pagesSyllabus First Yearpakshal19No ratings yet

- Changed Course Outlines With Old OneDocument10 pagesChanged Course Outlines With Old OneRana ToseefNo ratings yet

- Cash Flow and Company Valuation Analysis PDFDocument20 pagesCash Flow and Company Valuation Analysis PDFDHe DestyNo ratings yet

- Ind AS1Document33 pagesInd AS1SaibhumiNo ratings yet

- Accounting Information SystemDocument55 pagesAccounting Information SystemMd. Nurunnabi SarkerNo ratings yet

- Financial Reporting Course (Scrib)Document173 pagesFinancial Reporting Course (Scrib)Nguyen Dac ThichNo ratings yet

- Management Advisory Services SyllabusDocument16 pagesManagement Advisory Services SyllabuskaderderkaNo ratings yet

- International Business Management: AssignmentDocument16 pagesInternational Business Management: AssignmentkeshavNo ratings yet

- Notes Link Notes Link: Risk Assessment Link Risk Response LinkDocument4 pagesNotes Link Notes Link: Risk Assessment Link Risk Response Linkmentor_muhaxheriNo ratings yet

- Riffat 12 16204 3 Lecture 1 Financial AccountingDocument52 pagesRiffat 12 16204 3 Lecture 1 Financial Accountingaimen aminNo ratings yet

- Advanced Financial Management: Corporate Finance: Laurent BARTHE CetiaDocument76 pagesAdvanced Financial Management: Corporate Finance: Laurent BARTHE CetiaHo Nguyen Nhat TanNo ratings yet

- 7 CPA FINANCIAL REPORTING Paper 7Document13 pages7 CPA FINANCIAL REPORTING Paper 7dennis greenNo ratings yet

- Home Assignment - Avik SinhaDocument11 pagesHome Assignment - Avik SinhamdgulfamansariNo ratings yet

- Syllabus Accounting and Auditing CSSDocument4 pagesSyllabus Accounting and Auditing CSSHaaroon ZahoorNo ratings yet

- Chap - STD Setting in Malaysia - Updated - Apr 13Document15 pagesChap - STD Setting in Malaysia - Updated - Apr 13practikaltranninnngNo ratings yet

- BSBFIN401 Assessment 2Document10 pagesBSBFIN401 Assessment 2Kitpipoj PornnongsaenNo ratings yet

- A As Ias BookletDocument50 pagesA As Ias BookletBhavik ShahNo ratings yet

- Principles of Accounting - POA - Semester (Spring 2023)Document2 pagesPrinciples of Accounting - POA - Semester (Spring 2023)Umer SiddiquiNo ratings yet

- Alert: Developments in Preparation, Compilation, and Review Engagements, 2017/18From EverandAlert: Developments in Preparation, Compilation, and Review Engagements, 2017/18No ratings yet

- Chapter 15: Short-Term Liabilities QuestionsDocument191 pagesChapter 15: Short-Term Liabilities QuestionslibraolrackNo ratings yet

- Joint VentureDocument28 pagesJoint VentureJovani TomaleNo ratings yet

- CashDocument29 pagesCashlibraolrackNo ratings yet

- Chapter 15: Short-Term Liabilities QuestionsDocument191 pagesChapter 15: Short-Term Liabilities QuestionslibraolrackNo ratings yet

- Fundamentals of Advanced Accounting: (Check Figures For Multiple Choice Questions Not Provided.)Document1 pageFundamentals of Advanced Accounting: (Check Figures For Multiple Choice Questions Not Provided.)libraolrackNo ratings yet

- Philippine Tax FactsDocument9 pagesPhilippine Tax FactsAizel MaronillaNo ratings yet

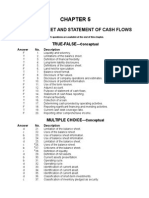

- Balance Sheet and Statement of Cash FlowsDocument45 pagesBalance Sheet and Statement of Cash Flowslibraolrack100% (1)

- Chapter 4: General Principles of AccountingDocument4 pagesChapter 4: General Principles of AccountinglibraolrackNo ratings yet

- 02 Advanced AccountingDocument9 pages02 Advanced AccountinglibraolrackNo ratings yet

- Financial Management: Course OutlineDocument3 pagesFinancial Management: Course OutlinelibraolrackNo ratings yet

- Accounting and Finance Financial Accounting: Intermediate 2Document103 pagesAccounting and Finance Financial Accounting: Intermediate 2libraolrackNo ratings yet

- Chapter 11 (Income Tax of Individuals)Document12 pagesChapter 11 (Income Tax of Individuals)libraolrackNo ratings yet

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackNo ratings yet

- Chapter 10 - Vat On Goods2013Document8 pagesChapter 10 - Vat On Goods2013libraolrack100% (4)

- Chapter 17 Local TaxDocument4 pagesChapter 17 Local TaxjhienellNo ratings yet

- TeoriAkuntansiKeuangan - Ch6 - Accounting Measurement SystemDocument32 pagesTeoriAkuntansiKeuangan - Ch6 - Accounting Measurement SystemZaerudin SidiqNo ratings yet

- Tata Digital India Fund Sid 2021Document58 pagesTata Digital India Fund Sid 2021Koushik BhaumikNo ratings yet

- Chapter08 PDFDocument22 pagesChapter08 PDFBabuM ACC FIN ECONo ratings yet

- 7.lease Vs FinanceDocument6 pages7.lease Vs FinanceShiva AroraNo ratings yet

- Xii Mcqs CH - 14 Comparative & Common Size StatementsDocument4 pagesXii Mcqs CH - 14 Comparative & Common Size StatementsJoanna Garcia100% (1)

- Problem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesDocument6 pagesProblem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesBona Christanto SiahaanNo ratings yet

- Aurobindo Sept19Document15 pagesAurobindo Sept19free meNo ratings yet

- FAR 4 ASSIGNMENT Last Edit by LoviDocument39 pagesFAR 4 ASSIGNMENT Last Edit by LoviDIVA RTHININo ratings yet

- Angala - Term PaperDocument9 pagesAngala - Term PapermiguelNo ratings yet

- Job Order Costing SeatworkDocument7 pagesJob Order Costing SeatworksarahbeeNo ratings yet

- Individual Assignment: Financial and Management AccountingDocument9 pagesIndividual Assignment: Financial and Management AccountingNisarg RupaniNo ratings yet

- Banking IndustryDocument33 pagesBanking IndustryJOHN PAUL DOROINNo ratings yet

- Early in The Year Debra Deal and Several Friends OrganizedDocument1 pageEarly in The Year Debra Deal and Several Friends Organizedtrilocksp SinghNo ratings yet

- Adjusting ProbsDocument6 pagesAdjusting ProbsKrisha JohnsonNo ratings yet

- A Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Document19 pagesA Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Adama KoneNo ratings yet

- Inventory Lecture NotesDocument9 pagesInventory Lecture NotesMinh ThưNo ratings yet

- S2 2016 341866 BibliographyDocument5 pagesS2 2016 341866 BibliographydhynaNo ratings yet

- Capital Gains Income Tax PDFDocument110 pagesCapital Gains Income Tax PDFJoy BoseNo ratings yet

- Accounting Skills in Recording Business Transactions-1 - 074113Document60 pagesAccounting Skills in Recording Business Transactions-1 - 074113shabanzuhura706No ratings yet

- FAC1601-partnerships - LiquidationDocument12 pagesFAC1601-partnerships - Liquidationtommy tazvityaNo ratings yet

- Ajanta Pharma Q4 FY22Document36 pagesAjanta Pharma Q4 FY22nitin2khNo ratings yet

- 9 Basic Principles That Commercial Banks FollowDocument6 pages9 Basic Principles That Commercial Banks FollowfareedNo ratings yet

- Edelweiss Maiden Opportunities Fund Presentation Jan 2018Document23 pagesEdelweiss Maiden Opportunities Fund Presentation Jan 2018shailabhNo ratings yet

- Chapter Five: Tax Avoidance and EvasionDocument14 pagesChapter Five: Tax Avoidance and Evasionembiale ayaluNo ratings yet

- FMP Assignement Key - Cases Fall 10Document16 pagesFMP Assignement Key - Cases Fall 10ahsan_anwar_1No ratings yet

- Financial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFDocument61 pagesFinancial Accounting Reporting Analysis and Decision Making 5Th Edition Carlon Solutions Manual Full Chapter PDFthomasowens1asz100% (10)

- Firms With Negative EarningsDocument10 pagesFirms With Negative Earningsakhil reddy kalvaNo ratings yet