Professional Documents

Culture Documents

2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USD

Uploaded by

api-25889552Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USD

Uploaded by

api-25889552Copyright:

Available Formats

Phoenix Certificate Memory Effect on ISHARES FTSE/XINHUA CHINA 25

2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USD

Details Redemption

Issuer TBD (To Be Determined)

Guarantor EFG International (rating: Fitch A) On 14.04.2010 Client pays USD 1000 (Denomination)

or Other (minimum rating: AA- or equivalent)

Underlying ISHARES FTSE/XINHUA CHINA 25 Every Semester (1 to 10) Client receives:

Bbg Ticker FXI US Equity If the Underlying is at or above 55% of its Strike Level:

Strike Level USD 43.77 N Coupon(s) of 2% for each semester the Investor has not received a Coupon.

Barrier Level 55% of Strike Level

Trigger Level 100% of Strike Level If the Underlying is at or above 100% of its Strike Level:

Coupon Trigger Level 55% of Strike Level The Product expires and the Investor receives a Cash Settlement in the Settlement Currency equal

Trade Date 07.04.2010 to: Denomination

Payment Date 14.04.2010

Valuation Date 07.04.2015 On 14.04.2015 Client receives (if the product has not expired):

Maturity Date 14.04.2015 a. If the Final Fixing Level of the Underlying is at or above 55% of its Strike Level, the Investor will

Details Cash Settlement Semi-Annual Coupon Observations receive a Cash Settlement in the Settlement Currency equal to: Denomination

Semi-Annual Autocall Observations

ISIN CH0111528011 b. If the Final Fixing Level of the Underlying is below 55% of its Strike Level, the Investor will receive

Valoren 11152801 a Cash Settlement in the Settlement Currency equal to:

SIX Symbol not listed Denomination x Final Fixing Level of the Underlying / Strike Level of the Underlying

Characteristics

Underlying___________________________________________________________________________________________________________________________________________________________________________________________

iShares FTSE/Xinhua China 25 Index Fund is an exchange traded fund incorporated in the USA. The Fund seeks investment results that correspond to the price and yield performance of the FTSE/Xinhua China 25

Index. The Fund invests 90% of its assets in the underlying index, which represents the performance of the largest companies in the China equity market.

Opportunities__________________________________________________________________________

_ Risks____________________________________________________________________________________________

1. Each semester, the inv estor has the opportunity to receiv e an 2% Coupon w ith 1. If on the Final Fixing Date the Underlying closes below its Barrier Lev el, the Inv estor will suffer

Memory Feature a loss reflecting the performance of the Underlying

2. Early Redemption Possible each semester

3. Your capital is protected against a decrease of 45% at maturity

Best case scenario___________________________________________________________________ Worst case scenario______________________________________________________________________________

The Underlying closes between the Coupon Trigger Level and the Trigger Level on The Underlying closes below the Coupon Trigger Level on each Observ ation date, and it closes

each Observ ation Date, and it closes at or abov e the Trigger Lev el on the below the Trigger Lev el on the Valuation Date.

Valuation date.

Redemption: Denomination + 10 Coupons of 2%. Redemption: Denomination x Final Fixing Level of the Underlying / Strike Level of the Underlying

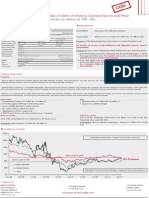

Historical Chart

importer depuis la deuxieme feuille

180%

160%

140% Coupon is paid and product

expires

120%

Autocall Level at 100%

100%

80% Coupon is paid

Barrier Level and Coupon Trigger at 55%

60%

No Coupon is paid

40% + Negative performance

20%

Apr-07 Aug-07 Dec-07 Apr-08 Aug-08 Dec-08 Apr-09 Aug-09 Dec-09

Contacts

Filippo Colombo Christophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publicatio n serves only fo r info rmatio n purpo ses and is no t research; it co nstitutes neither a reco mmendation fo r the purchase o f financial instruments nor an offer or an invitatio n fo r an o ffer. No respo nsibility is taken fo r the correctness of this informatio n. The financial instruments mentio ned in this do cument are derivative

instruments. They do no t qualify as units o f a co llective investment scheme pursuant to art. 7 et seqq. of the Swiss Federal Act on Collective Investment Schemes (CISA) and are therefo re neither registered nor supervised by the Swiss Financial M arket Superviso ry A uthority FINM A. Investo rs bear the credit risk o f the issuer/guaranto r.

Befo re investing in derivative instruments, Investors are highly reco mmended to ask their financial advisor fo r advice specifically focused o n the Investo r´s financial situatio n; the info rmatio n co ntained in this do cument do es not substitute such advice. This publicatio n do es not co nstitute a simplified pro spectus pursuant to art. 5 CISA,

o r a listing pro spectus pursuant to art. 652a o r 1156 of the Swiss Co de o f Obligatio ns. The relevant pro duct do cumentation can be o btained directly at EFG Financial Products A G: Tel. +41(0)58 800 1111, Fax +41 (0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictio ns apply fo r Europe, Ho ng Ko ng, Singapo re, the USA, US

perso ns, and the United Kingdom (the issuance is subject to Swiss law). The Underlyings´ perfo rmance in the past do es no t co nstitute a guarantee for their future perfo rmance.

The financial products' value is subject to market fluctuatio n, what can lead to a partial o r to tal loss o f the invested capital. The purchase o f the financial pro ducts triggers co sts and fees. EFG Financial Products AG and/or ano ther related co mpany may o perate as market maker fo r the financial pro ducts, may trade as principal, and may

co nclude hedging transactions. Such activity may influence the market price, the price mo vement, o r the liquidity o f the financial pro ducts. © EFG Financial Products AG A ll rights reserved.

You might also like

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- 148% Strike - 136% Stop Loss - 3 Months - USD: Bearish Mini-Future On ISHARES FTSE/XINHUA CHINA 25Document1 page148% Strike - 136% Stop Loss - 3 Months - USD: Bearish Mini-Future On ISHARES FTSE/XINHUA CHINA 25api-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDocument1 pageCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552No ratings yet

- 83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010Document1 page83% Strike - 89% Stop Loss - 2 Months - USD: Bullish Mini-Future On WTI CRUDE Future of June 2010api-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- Coupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCDocument1 pageCoupon 20% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On GOLDMAN SACHS GROUP INCapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDocument1 page6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552No ratings yet

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Document1 page75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552No ratings yet

- Coupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECDocument1 pageCoupon 11% P.A. - American Barrier at 80% - 6 Months - EUR: Single Barrier Reverse Convertible On VALLOURECapi-25889552No ratings yet

- 67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEDocument1 page67% Strike - 94% Stop Loss - 3 Months - USD: Bullish Mini-Future On GBP-USD X-RATEapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Coupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDDocument1 pageCoupon 13.15% P.A. - American Barrier at 70% - 3 Months - USDapi-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- Coupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%Document1 pageCoupon 4.40% (17.60% P.a.) 3 Months USD Barrier at 80%api-25890856No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDocument1 page6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552No ratings yet

- Credit Linked Note TitleDocument12 pagesCredit Linked Note TitleKeval ShahNo ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- 14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDDocument1 page14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDapi-25889552No ratings yet

- 74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010Document1 page74% Strike - 88% Stop Loss - 2 Months - EUR: Bullish Mini-Future On NASDAQ 100 E-Mini June 2010api-25889552No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- 95% Capital Protection - 100% Participation - 3 Years and 3 Months - Quanto CHFDocument1 page95% Capital Protection - 100% Participation - 3 Years and 3 Months - Quanto CHFapi-25889552No ratings yet

- 94% Strike - 98% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EUR-CHF X-RATEDocument1 page94% Strike - 98% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EUR-CHF X-RATEapi-25889552No ratings yet

- 111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEDocument1 page111% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEapi-25889552No ratings yet

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552No ratings yet

- 61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010Document1 page61% Strike - 79% Stop Loss - 1 Month - USD: Bullish Mini-Future On COMEX Division Gold Future of June 2010api-25889552No ratings yet

- 98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010Document1 page98% Strike - 93% Stop Loss - 2 Months - EUR: Bullish Mini-Future On EURO STOXX 50 of June 2010api-25889552No ratings yet

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- 108% Strike - 105% Stop Loss - 6 Months - EUR: Bullish Mini-Future On AUD-USD X-RATEDocument1 page108% Strike - 105% Stop Loss - 6 Months - EUR: Bullish Mini-Future On AUD-USD X-RATEapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- xs2396247079 Phoenix Autocall Stepdown Memory On Aal Dal UalDocument6 pagesxs2396247079 Phoenix Autocall Stepdown Memory On Aal Dal UalvmakeienkoNo ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552No ratings yet

- 89% Strike - 94% Stop Loss - 2.5 Months - EUR: Bullish Mini-Future On AUD-USD Spot Exchange RateDocument1 page89% Strike - 94% Stop Loss - 2.5 Months - EUR: Bullish Mini-Future On AUD-USD Spot Exchange Rateapi-25889552No ratings yet

- Capital Protection On EUR/CHF Foreign Exchange RateDocument1 pageCapital Protection On EUR/CHF Foreign Exchange Rateapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- 107% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On GBP-AUD Exchange RateDocument1 page107% Strike - 102% Stop Loss - 2 Months - EUR: Bearish Mini-Future On GBP-AUD Exchange Rateapi-25889552No ratings yet

- 112% Strike - 104% Stop Loss - 2.5 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEDocument1 page112% Strike - 104% Stop Loss - 2.5 Months - EUR: Bearish Mini-Future On EUR-USD X-RATEapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- NullDocument6 pagesNullapi-25889552No ratings yet

- NullDocument10 pagesNullapi-25889552No ratings yet

- Weekly Markets UpdateDocument39 pagesWeekly Markets Updateapi-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- NullDocument15 pagesNullapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- NullDocument41 pagesNullapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument38 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- NullDocument6 pagesNullapi-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- NullDocument1 pageNullapi-25889552No ratings yet

- NullDocument1 pageNullapi-25889552No ratings yet

- NullDocument3 pagesNullapi-25889552No ratings yet

- NullDocument39 pagesNullapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Acctg. Equation Puring CompanyDocument8 pagesAcctg. Equation Puring CompanyAngelNo ratings yet

- TLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENDocument1 pageTLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENAndrei NitaNo ratings yet

- Financial Position and Performance 2016-2018Document3 pagesFinancial Position and Performance 2016-2018Amr MekkawyNo ratings yet

- P3 Trades From Formation, Entry and Exit:: GMCR Green Mountain Coffee RoastersDocument7 pagesP3 Trades From Formation, Entry and Exit:: GMCR Green Mountain Coffee Roasterscwines03No ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- Cost Accounting FundamentalsDocument6 pagesCost Accounting FundamentalsLourdes Sabuero TampusNo ratings yet

- Tutorial EPSDocument3 pagesTutorial EPSRil LlNo ratings yet

- Fundamentals of Corporate Finance Canadian 9th Edition Brealey Test BankDocument25 pagesFundamentals of Corporate Finance Canadian 9th Edition Brealey Test BankMadelineTorresdazb100% (59)

- Corporate Restructuring ConceptDocument7 pagesCorporate Restructuring ConceptBhoomika MithraNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessDocument8 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessNinia Cresil Ann JalagatNo ratings yet

- Financial Management Assignment - 4.18.20Document9 pagesFinancial Management Assignment - 4.18.20Yao KoumanNo ratings yet

- Ia 1BDocument553 pagesIa 1BTipsywinkieNo ratings yet

- Income Tax Act - UgandaDocument157 pagesIncome Tax Act - Ugandafnyeko100% (11)

- Tax Quiz BeeDocument10 pagesTax Quiz BeeMitchelle DumlaoNo ratings yet

- Intermediate Acctng. AR Online ResorcesDocument14 pagesIntermediate Acctng. AR Online ResorcesDos BuenosNo ratings yet

- Case Study - HP and Compact Failed MergerDocument26 pagesCase Study - HP and Compact Failed MergerpujaskawaleNo ratings yet

- RMC No. 50-2018 WTWDocument21 pagesRMC No. 50-2018 WTWAris Basco DuroyNo ratings yet

- Navdeep Dua-Omniscience CapitalDocument8 pagesNavdeep Dua-Omniscience CapitalnavdeepNo ratings yet

- Comprehensive ProblemDocument17 pagesComprehensive ProblemVianca FernilleNo ratings yet

- Gillette and P&GDocument6 pagesGillette and P&GAbhishek PandaNo ratings yet

- Private Equity Master Thesis TopicsDocument8 pagesPrivate Equity Master Thesis Topicsjessicaspellfayetteville100% (2)

- Chapter 2 Governance and ManagementDocument32 pagesChapter 2 Governance and Managementlmmh100% (2)

- Homework Capital BudgetingDocument4 pagesHomework Capital BudgetingChristy AngkouwNo ratings yet

- Accounting and Finance Exam SolutionsDocument6 pagesAccounting and Finance Exam SolutionsWaseim KhanNo ratings yet

- Percy Anderson Financial Disclosure Report For 2009Document8 pagesPercy Anderson Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Bond Management StrategiesDocument5 pagesBond Management StrategiesManju MudakaviNo ratings yet

- Question Bank For NPODocument17 pagesQuestion Bank For NPOSanyam BohraNo ratings yet

- SFM Theory Notes - Addendum - Nov 20 To Dec 21 - New Ques - Bhavik ChokshiDocument32 pagesSFM Theory Notes - Addendum - Nov 20 To Dec 21 - New Ques - Bhavik ChokshiAswaniNo ratings yet

- FINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Document20 pagesFINAL 2021 Financial Performance Analysis For MICROSOFT INC Company - R3Nicole BabatundeNo ratings yet

- Annual Report 2017 PDFDocument147 pagesAnnual Report 2017 PDFRamanReet SinghNo ratings yet