Professional Documents

Culture Documents

Worst of Autocall Certificate With Memory Effect

Uploaded by

api-25889552Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worst of Autocall Certificate With Memory Effect

Uploaded by

api-25889552Copyright:

Available Formats

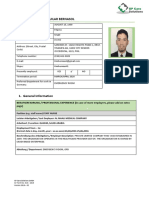

Worst Of Autocall Certificate with Memory Effect on GDF SUEZ, VEOLIA

ENVIRONNEMENT and TOTAL

6% Semestrial Conditional Coupon (12% p.a.) - European Barrier at 60% - 3 Years - EUR

Details Redemption

Issuer EFG Financial Products

Guarantor EFG International On 15.03.2010 Client pays EUR 1000 (Denomination x I ssue Price)

Rating: Fitch A

Underlying GDF SUEZ VEOLIA TOTAL SA Each semester, with N being the number of semesters since the last Coupon (or since inception if no

ENVIRONNEMENT Coupon has been paid so far)

Bbg Ticker GSZ FP Equity VIE FP Equity FP FP Equity

Spot Ref. (100%) EUR 27.115 EUR 24.02 EUR 41.31 If all the Underlyings close above their Coupon Trigger Level:

Barrier Level (60%) EUR 16.27 EUR 14.41 EUR 24.79 The Investor will receive a (N x 6%) Coupon

Autocall Level (100%) EUR 27.115 EUR 24.02 EUR 41.31

Coupon Trigger (60%) EUR 16.27 EUR 14.41 EUR 24.79 On top of the Coupon, if all the Underlyings close above their Autocall Trigger Level:

Conversion Ratio 36.8800 41.6320 24.2072 The product is early redeemed and the Investor receives a Cash Settlement in EUR equal to:

Initial Fixing Date 01.03.2010 The Denomination . The product expires

Payment Date 15.03.2010

Valuation Date 01.03.2013 On 15.03.2013 Client receiv es (if the product has not been early redeemed):

Maturity 15.03.2013

Details Physical Settlement Semestrial Coupon Observation a. If the Worst Performing Underlying closes above the Barrier Level on the Valuation date:

Semestrial Autocall Observation The Investor will receive a Cash Settlement in EUR equal to: Denomination + (N x 6%) Coupon

ISIN CH0110622658

Valoren 11062265 b. If the Worst Performing Underlying closes at or below the Barrier Level on the Valuation date: The

SIX Symbol Not listed Investor will receive a predefined round number (i.e. Conversion Ratio) of the Underlying per Product.

Characteristics

Underlying____________________________________________________________________________________________________________________________________________________________________________________________________

-GDF Suez offers a full range of natural gas and associated energy services throughout the world. GDF produces, trades, transports, stores and distributes natural gas, and offers energy management and climatic and

thermal engineering services.

- Veolia Environnement operates utility and public transportation businesses. The Company supplies drinking water, provides waste management services, manages and maintains heating and air conditioning systems,

and operates rail and road passenger transportation systems.

- Total SA explores for, produces, refines, transports, and markets oil and natural gas. The Company also operates a chemical division which produces polypropylene, polyethylene, polystyrene, rubber, paint, ink,

adhesives, and resins. Total operates gasoline filling stations in Europe, the United States, and Africa.

Opportunities___________________________________________________________________________ Risks________________________________________________________________________________________________________

1. Semestrial opportunity to receiv e a 6% Coupon 1. I f on the Valuation Date, at least one Underlying closes at or below its Barrier Lev el, the I nv estor will

2. Your capital is protected against a decrease of 40% on the Valuation Date suffer a loss reflecting the performance of the Underlying

3. Secondary market as liquid as equity markets

4. Memory effect Coupon: if the Coupon is not paid on one of the Observ ation

dates, it is not lost and the inv estor can receiv e it at one of the next Observ ation

Best case scenario___________________________________________________________________ Worst case scenario_________________________________________________________________________________________

The Worst Performing Underlying closes between the Coupon Trigger Lev el and the The Worst Performing Underlying has nev er closed abov e the Coupon Trigger Lev el on any

Autocall Trigger Lev el on each Observ ation Date. Observ ation Date, and it closes below the Barrier Lev el on the Valuation Date.

Redemption: Denomination + 6 Coupons of 6% (total return: 136%) Redemption: Shares of the Worst performing Underlying

Historical Chart

200%

importer depuis la deuxieme feuille

Observation date scenario

180% GDF Suez N semesters since last Coupon

160% Veolia

140%

Total Early Redemption:

Denomination

120%

Autocall Level at 100%

100%

80% (N x 6% ) Coupon is paid

Coupon Trigger and Barrier Level at 60%

60%

On the Maturity Date:

40% Shares of the Worst performing

Underlying

20%

May-08 Aug-08 Nov-08 Feb-09 May-09 Aug-09 Nov-09 Feb-10

Contacts

Filippo Colombo Christophe Spanier Nathanael Gabay

Bruno Frateschi +41 58 800 10 45 Sofiane Zaiem

Stanislas Perromat +41 22 918 70 05

Alejandro Pou Cuturi Live prices at www.efgfp.com

+377 93 15 11 66

This publication serves only fo r informatio n purpo ses and is no t research; it constitutes neither a reco mmendation for the purchase o f financial instruments nor an o ffer or an invitation fo r an o ffer. No respo nsibility is taken for the correctness of this information. The financial instruments mentio ned in this document are derivative instruments. They do

no t qualify as units o f a collective investment scheme pursuant to art. 7 et seqq. o f the Swiss Federal A ct on Co llective Investment Schemes (CISA) and are therefore neither registered no r supervised by the Swiss Financial M arket Supervisory A uthority FINM A . Investors bear the credit risk of the issuer/guaranto r. B efo re investing in derivative

instruments, Investors are highly recommended to ask their financial adviso r fo r advice specifically focused on the Investo r´s financial situation; the information contained in this document do es not substitute such advice. This publication do es not constitute a simplified pro spectus pursuant to art. 5 CISA , or a listing pro spectus pursuant to art. 652a

or 1156 o f the Swiss Code of Obligatio ns. The relevant pro duct do cumentatio n can be obtained directly at EFG Financial P roducts A G: Tel. +41(0)58 800 1111, Fax +41(0)58 800 1010, o r via e-mail: termsheet@efgfp.co m. Selling restrictions apply fo r Euro pe, Ho ng Ko ng, Singapore, the USA , US persons, and the United Kingdo m (the issuance is subject to Swis

law). The Underlyings´ performance in the past do es no t co nstitute a guarantee fo r their future perfo rmance. The financial products' value is subject to market fluctuation, what can lead to a partial or total lo ss of the invested capital. The purchase o f the financial products triggers co sts and fees. EFG Financial P roducts A G and/o r another related

co mpany may operate as market maker fo r the financial products, may trade as principal, and may conclude hedging transactions. Such activity may influence the market price, the price movement, o r the liquidity o f the financial products. © EFG Financial P ro ducts A G A ll rights reserved.

You might also like

- Worst of Autocall Certificate With Memory EffectDocument1 pageWorst of Autocall Certificate With Memory Effectapi-25889552No ratings yet

- 6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURDocument1 page6%p.a. Quarterly Conditional Coupon - European Barrier at 60% - 1.5 Year - EURapi-25889552No ratings yet

- 6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURDocument1 page6%p.a. Monthly Conditional Coupon - European Barrier at 70% - 1 Year - EURapi-25889552No ratings yet

- Coupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURDocument1 pageCoupon 12,40% P.A. - 6 Months - European Barrier at 75% - EURapi-25889552No ratings yet

- 12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURDocument1 page12.6% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 60% - 1 Year and 3 Months - EURapi-25889552No ratings yet

- 1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURDocument1 page1.65% Monthly Conditional Coupon - European Barrier at 90% - 1 Year - EURapi-25889552No ratings yet

- 7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDDocument1 page7.5% Quarterly Conditional Coupon - European Barrier at 66% - 1 Year - USDapi-25889552No ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On CREDIT AGRICOLE SAapi-25889552No ratings yet

- 1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%Document1 page1 Year - EUR: 8% P.A. Quarterly Conditional Coupon With Memory Effect - European Barrier at 100%api-25889552No ratings yet

- Coupon 10% P.A. - 6 Months - European Barrier at 70% - USDDocument1 pageCoupon 10% P.A. - 6 Months - European Barrier at 70% - USDapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVADocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ING GROEP NV-CVAapi-25889552No ratings yet

- Coupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURDocument1 pageCoupon 15.40% P.A. - 6 Months - American Barrier at 75% - EURapi-25889552No ratings yet

- Express Certificate On CITIGROUP 8% P.A. QuarterlyDocument1 pageExpress Certificate On CITIGROUP 8% P.A. Quarterlyapi-25889552No ratings yet

- Coupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFDocument1 pageCoupon 12.7% P.A. - 1 Year - American Barrier at 70% - Quanto CHFapi-25889552No ratings yet

- Coupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURDocument1 pageCoupon 13.2% P.A. - American Barrier at 75% - 6 Months - EURapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 6% P.A. - American Barrier at 80% - 3 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- 14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDDocument1 page14% P.A. Semestrial Conditional Coupon With Memory Effect - European Barrier at 70% - 2 Years - USDapi-25889552No ratings yet

- 6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDDocument1 page6% Guaranteed Coupon in Fine - American Barrier at 70.5% - 6 Months - USDapi-25889552No ratings yet

- 6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDDocument1 page6% P.A. Semi-Annual Conditional Coupon - European Barrier at 68% - 2 Years - Quanto USDapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Coupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFDocument1 pageCoupon 17.42% P.A. - American Barrier at 70% - 6 Months - CHFapi-25889552No ratings yet

- Format - Termsheet - CE18029CAWDocument5 pagesFormat - Termsheet - CE18029CAWBuchotNo ratings yet

- Coupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURDocument1 pageCoupon 15.57%p.a. - Daily On The Close Barrier at 80% - 3.5 Months - EURapi-25889552No ratings yet

- Coupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURDocument1 pageCoupon 13.25% P.A. - 1 Year - European Barrier at 80% - EURapi-25889552No ratings yet

- 4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDDocument1 page4.55% Quarterly Conditional Coupon - European Barrier at 80% - 2 Years - USDapi-25889552No ratings yet

- 86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010Document1 page86% Strike - 97% Stop Loss - 2 Months - EUR: Bullish Mini-Futures On The German Stock Index Future of June 2010api-25889552No ratings yet

- Coupon 20% P.A. - 6 Months - American Barrier at 75% - GBPDocument1 pageCoupon 20% P.A. - 6 Months - American Barrier at 75% - GBPapi-25889552No ratings yet

- 15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDDocument1 page15% Annual Conditional Coupon With Memory Effect - US Barrier at 50% - 5 Years - USDapi-25889552No ratings yet

- xs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLDocument6 pagesxs2396246931 Phoenix Autocall Stepdown Memory On CCL NCLH RCLvmakeienkoNo ratings yet

- Doubled-Up Worst of Barrier Reverse ConvertibleDocument1 pageDoubled-Up Worst of Barrier Reverse Convertibleapi-25889552No ratings yet

- 95% Capital Protected Autocallable Certificate With MemoryDocument1 page95% Capital Protected Autocallable Certificate With Memoryapi-25889552No ratings yet

- Coupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKDocument1 pageCoupon 9% P.A. - American Barrier at 70% - 1 Year - EUR: Single Barrier Reverse Convertible On DEUTSCHE BANKapi-25889552No ratings yet

- Single Barrier Reverse Convertible On GERDAU SADocument1 pageSingle Barrier Reverse Convertible On GERDAU SAapi-25889552No ratings yet

- Coupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDDocument1 pageCoupon 21.4% P.A. 3 Months EUR Barrier at 80%: Single Barrier Reverse Convertible On DEUTSCHE BANK AG-REGISTEREDapi-25890856No ratings yet

- Coupon 16% in Fine - 1 Year - American Barrier at 75% - CHFDocument1 pageCoupon 16% in Fine - 1 Year - American Barrier at 75% - CHFapi-25889552No ratings yet

- 7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURDocument1 page7.6% P.A. Annual Conditional Coupon - Capital Guaranteed at 100% - 5 Years - EURapi-25889552No ratings yet

- Coupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius BaerDocument1 pageCoupon 6% P.A. - American Barrier at 70% - 1 Year - CHF: Single Barrier Reverse Convertible On Julius Baerapi-25889552No ratings yet

- 11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDDocument1 page11.80% P.A. Quarterly Conditional Coupon - European Barrier at 80% - 1 Year - USDapi-25889552No ratings yet

- Coupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRDocument1 pageCoupon 8% P.A. - American Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On LUKOIL OAO-SPON ADRapi-25889552No ratings yet

- xs2396247079 Phoenix Autocall Stepdown Memory On Aal Dal UalDocument6 pagesxs2396247079 Phoenix Autocall Stepdown Memory On Aal Dal UalvmakeienkoNo ratings yet

- Coupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDDocument1 pageCoupon 13.44% P.A. - 6 Months - American Barrier at 75% - USDapi-25889552No ratings yet

- Coupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTDocument1 pageCoupon 5.625% in Fine - Strike at 90% - 1.5 Year - USD: Low Strike Reverse Convertible On CONSUMER DISCRETIONARY SELTapi-25889552No ratings yet

- 262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onDocument1 page262.5% Participation - 4 Months - EUR: Uncapped Outperformance Certificate On E.onapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- 75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10Document1 page75% Strike - 97% Stop Loss - 3 Months - EUR: Bullish Mini-Future On DAX INDEX FUTURE of June 10api-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Product Agreement - Credit Linked Note: Final Documentation May 03, 2016Document12 pagesProduct Agreement - Credit Linked Note: Final Documentation May 03, 2016Keval ShahNo ratings yet

- Coupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCDocument1 pageCoupon 6.4% P.A. - European Barrier at 80% - 3 Months - USD: Single Barrier Reverse Convertible On CITIGROUP INCapi-25889552No ratings yet

- 153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010Document1 page153% Strike - 133% Stop Loss - 1.5 Month - EUR: Bearish Mini-Future On STOXX 600 Insurance Future of June 2010api-25889552No ratings yet

- Coupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNDocument1 pageCoupon 13.4% P.A. - American Barrier at 80% - 6 Months - PLNapi-25889552No ratings yet

- Coupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On ArcelormittalDocument1 pageCoupon 8.5% P.A. - American Barrier at 65% - 1 Year - Eur: Single Barrier Reverse Convertible On Arcelormittalapi-25889552No ratings yet

- 2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDDocument1 page2% Conditional Semestrial Coupon - European Barrier at 55% - 5 Years - USDapi-25889552No ratings yet

- Coupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGDocument1 pageCoupon 5.25% P.A. - American Barrier at 69% - 1 Year - CHF: Single Barrier Reverse Convertible On SYNGENTA AG-REGapi-25889552No ratings yet

- Coupon 10% P.A. - American Barrier at 80% - 3 Months - USDDocument1 pageCoupon 10% P.A. - American Barrier at 80% - 3 Months - USDapi-25889552No ratings yet

- Termsheet Ch1261616994 enDocument5 pagesTermsheet Ch1261616994 entomerNo ratings yet

- Coupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALDocument1 pageCoupon 9% P.A. - European Barrier at 83% - 6 Months - EUR: Single Barrier Reverse Convertible On ARCELORMITTALapi-25889552No ratings yet

- Bonus Certificate On The EURO STOXX 50Document1 pageBonus Certificate On The EURO STOXX 50api-25889552No ratings yet

- CG European Capital Growth Fund: StrategyDocument2 pagesCG European Capital Growth Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: StrategyDocument2 pagesCG European Income Fund: Strategyapi-25889552No ratings yet

- Daily Markets UpdateDocument35 pagesDaily Markets Updateapi-25889552No ratings yet

- Daily Markets UpdateDocument30 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 1 June 2010Document3 pagesMorning News 1 June 2010api-25889552No ratings yet

- 1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50Document1 page1 Year - Eur: Tracker Certificate On Ishares Euro Stoxx 50api-25889552No ratings yet

- Global Financial Centres: March 2010Document41 pagesGlobal Financial Centres: March 2010api-25889552No ratings yet

- Daily Markets UpdateDocument33 pagesDaily Markets Updateapi-25889552No ratings yet

- Morning News 28 May 2010Document3 pagesMorning News 28 May 2010api-25889552No ratings yet

- United Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, AustriaDocument65 pagesUnited Nations Convention Against Corruption: Vienna International Centre, PO Box 500, A 1400 Vienna, Austriaapi-25889552No ratings yet

- Guy Butler Limited: AUD NZD CAD Denominated BondsDocument1 pageGuy Butler Limited: AUD NZD CAD Denominated Bondsapi-25889552No ratings yet

- Daily Markets UpdateDocument36 pagesDaily Markets Updateapi-25889552No ratings yet

- 1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40Document1 page1 Year - EUR: Tracker Certificate On Lyxor ETF CAC 40api-25889552No ratings yet

- Worldwide Real Estates: Gibraltar LettingsDocument8 pagesWorldwide Real Estates: Gibraltar Lettingsapi-25889552No ratings yet

- Coupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGDocument1 pageCoupon 10.29% P.A. - 3.5 Months - EUR - Strike at 78%: Low Strike Reverse Convertible On COMMERZBANK AGapi-25889552No ratings yet

- Coupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGDocument1 pageCoupon 8.25% P.A. - American Barrier at 60% - 1 Year - EUR: Single Barrier Reverse Convertible On E.ON AGapi-25889552No ratings yet

- Daily Market Update: EquitiesDocument3 pagesDaily Market Update: Equitiesapi-25889552No ratings yet

- 97% Capital Protection 45% Participation 115% Cap 2 Year CHFDocument1 page97% Capital Protection 45% Participation 115% Cap 2 Year CHFapi-25889552No ratings yet

- Daily Markets UpdateDocument37 pagesDaily Markets Updateapi-25889552No ratings yet

- CG European Income Fund: April 2010Document2 pagesCG European Income Fund: April 2010api-25889552No ratings yet

- Morning News 12 May 2010Document3 pagesMorning News 12 May 2010api-25889552No ratings yet

- 62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEDocument1 page62% Strike - 68% Stop Loss - 3 Months - USD: Bullish Mini-Future On USD-JPY X-RATEapi-25889552No ratings yet

- TDS-PE-102-UB5502H (Provisional) 2019Document2 pagesTDS-PE-102-UB5502H (Provisional) 2019Oktaviandri SaputraNo ratings yet

- Unit: 3 - Vouching: by Mahitha VasanthiDocument15 pagesUnit: 3 - Vouching: by Mahitha VasanthianuragNo ratings yet

- Boost Listening 1 Teacher S Edition PDFDocument96 pagesBoost Listening 1 Teacher S Edition PDFHuy Lê QuangNo ratings yet

- Bituminous MixesDocument13 pagesBituminous MixesRanjit SinghNo ratings yet

- Aswani Construction R 07102013Document3 pagesAswani Construction R 07102013Balaji RathinavelNo ratings yet

- 200 State Council Members 2010Document21 pages200 State Council Members 2010madhu kanna100% (1)

- Drug StudyDocument4 pagesDrug Studysnowyfingers100% (1)

- Complete Prerequisite Program v2Document78 pagesComplete Prerequisite Program v2Ramasubramanian Sankaranarayanan100% (1)

- Biological ClassificationDocument21 pagesBiological ClassificationdeviNo ratings yet

- ES9-62 Ingestive Cleaning PDocument9 pagesES9-62 Ingestive Cleaning PIfran Sierra100% (1)

- CV TemplateDocument5 pagesCV TemplateLopezDistrict FarmersHospitalNo ratings yet

- Cat 4401 UkDocument198 pagesCat 4401 UkJuan Ignacio Sanchez DiazNo ratings yet

- Clase No. 24 Nouns and Their Modifiers ExercisesDocument2 pagesClase No. 24 Nouns and Their Modifiers ExercisesenriquefisicoNo ratings yet

- Filipino Concept of Health and IllnessDocument43 pagesFilipino Concept of Health and IllnessFelisa Lacsamana Gregorio50% (2)

- DENSO Diagnostic TipsDocument1 pageDENSO Diagnostic TipsVerona MamaiaNo ratings yet

- Measurement and Correlates of Family Caregiver Self-Efficacy For Managing DementiaDocument9 pagesMeasurement and Correlates of Family Caregiver Self-Efficacy For Managing DementiariskhawatiNo ratings yet

- Excavation Trench Permit Ex 1 F0206Document5 pagesExcavation Trench Permit Ex 1 F0206emeka2012No ratings yet

- WW.04.05 Contraction Stress Test (Oxytocin Challenge Test) PDFDocument3 pagesWW.04.05 Contraction Stress Test (Oxytocin Challenge Test) PDFDiah Kurniawati100% (1)

- Saving AccountDocument9 pagesSaving AccountpalkhinNo ratings yet

- Biecco Lawrie Ece Gec Reyrolle Burn Jyoti SwitchgearDocument18 pagesBiecco Lawrie Ece Gec Reyrolle Burn Jyoti SwitchgearSharafat AliNo ratings yet

- TEC3000 Series On/Off or Floating Fan Coil and Individual Zone Thermostat Controllers With Dehumidification CapabilityDocument48 pagesTEC3000 Series On/Off or Floating Fan Coil and Individual Zone Thermostat Controllers With Dehumidification CapabilityIvar Denicia DelgadilloNo ratings yet

- Evaluation of Bond Strenght of Dentin Adhesive at Dry and Moist Dentin-Resin Interface PDFDocument4 pagesEvaluation of Bond Strenght of Dentin Adhesive at Dry and Moist Dentin-Resin Interface PDFOpris PaulNo ratings yet

- CGG Book 1Document34 pagesCGG Book 1api-245318709No ratings yet

- Info-Delict-Violencia Contra Las Mujeres - Dic22Document181 pagesInfo-Delict-Violencia Contra Las Mujeres - Dic22LPF / SKOUL BASQUETBOLNo ratings yet

- Assignment 4Document4 pagesAssignment 4ShabihNo ratings yet

- Evaluation and Comparison of Highly Soluble Sodium Stearyl Fumarate With Other Lubricants in VitroDocument8 pagesEvaluation and Comparison of Highly Soluble Sodium Stearyl Fumarate With Other Lubricants in VitroSvirskaitė LaurynaNo ratings yet

- Plumbing Design Calculation - North - Molino - PH1 - 5jun2017Document5 pagesPlumbing Design Calculation - North - Molino - PH1 - 5jun2017Jazent Anthony RamosNo ratings yet

- Paramagnetic Article PDFDocument5 pagesParamagnetic Article PDFJonathan SinclairNo ratings yet

- Improving Communication Skills of Pharmacy StudentDocument13 pagesImproving Communication Skills of Pharmacy StudentAbdul QadirNo ratings yet

- Jepretan Layar 2022-11-30 Pada 11.29.09Document1 pageJepretan Layar 2022-11-30 Pada 11.29.09Muhamad yasinNo ratings yet