Professional Documents

Culture Documents

Assignment B

Assignment B

Uploaded by

Manish Patel0%(1)0% found this document useful (1 vote)

7 views2 pagesElectron Control currently sells voltage regulators to other manufacturers for $200 per unit, earning a $50 profit per unit. Management is considering customizing the units themselves and selling directly to quality assurance labs for $275 per unit.

While no additional investment in facilities would be required, there would be $50 in added variable expenses per unit from direct labor, variable overhead, and variable selling expenses. Additionally, there would be $100,000 in annual fixed selling expenses.

Selling directly at $275 per unit would generate $75 profit per unit compared to the current $50. With 15,000 units annually, total profit would increase from the current $7,500,000 to $11,250,000, a

Original Description:

ECONOMICS FOR MANAGER

Original Title

Assignment b

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentElectron Control currently sells voltage regulators to other manufacturers for $200 per unit, earning a $50 profit per unit. Management is considering customizing the units themselves and selling directly to quality assurance labs for $275 per unit.

While no additional investment in facilities would be required, there would be $50 in added variable expenses per unit from direct labor, variable overhead, and variable selling expenses. Additionally, there would be $100,000 in annual fixed selling expenses.

Selling directly at $275 per unit would generate $75 profit per unit compared to the current $50. With 15,000 units annually, total profit would increase from the current $7,500,000 to $11,250,000, a

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

7 views2 pagesAssignment B

Assignment B

Uploaded by

Manish PatelElectron Control currently sells voltage regulators to other manufacturers for $200 per unit, earning a $50 profit per unit. Management is considering customizing the units themselves and selling directly to quality assurance labs for $275 per unit.

While no additional investment in facilities would be required, there would be $50 in added variable expenses per unit from direct labor, variable overhead, and variable selling expenses. Additionally, there would be $100,000 in annual fixed selling expenses.

Selling directly at $275 per unit would generate $75 profit per unit compared to the current $50. With 15,000 units annually, total profit would increase from the current $7,500,000 to $11,250,000, a

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Case Detail :

Please read the case study given below and answer questions given.

Case Study

Electron Control, Inc., sells voltage regulators to other manufacturers, who then customize

and distribute the products to quality assurance labs for their sensitive test equipment. The

yearly volume of output is 15,000 units. The selling price and cost per unit are shown below:

Selling price

Costs:

Direct material

Direct labor

Variable overhead

Variable selling expenses

Fixed selling expenses

Unit profit before tax

$200

$35

50

25

25

15

150

$ 50

Management is evaluating the alternative of performing the necessary customizing to allow

Electron Control to sell its output directly to Q/A labs for $275 per unit. Although no added

investment is required in productive facilities, additional processing costs are estimated as:

Direct labor

Variable overhead

Variable selling expenses

Fixed selling expenses

$25 per unit

$15 per unit

$10 per unit

$100,000 per year

SOLUTION:

No. Of units produced annually

= 15,000

Profit On Selling Price Of 200 Is 50 Per Unit.

So Total Profit Earned Is

15,000 X 50

= 7, 50,000

If they sell it @ 275 to Q/A labs then:

Added variable expenses

= 50 per unit

Total variable expense

150 + 50

Total profit per unit

=SP-CP

= 275-200

= 75 per unit

Added profit per unit

= Total profit profit on SP of 200

= 75-50

= 25

TOTAL PROFIT

= 200 per unit

= 75 x 15,000 = Rs.11,25,000

Net profit = Total profit - Fixed selling expenses

Net profit = 11,25,000 - 1,00,000

= Rs. 10,25,000

Incremental profit = 10,25,000 7,50,000

= Rs.2,75,000

You might also like

- Variable Absorption CostingDocument26 pagesVariable Absorption CostingSarahAdriano100% (1)

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsFrom EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsRating: 3.5 out of 5 stars3.5/5 (3)

- Breakeven Analysis 0Document35 pagesBreakeven Analysis 0Nistha Bisht100% (1)

- Support Department Cost AllocationDocument44 pagesSupport Department Cost AllocationAwan Wibowo100% (1)

- Accounting Problems and SolutionsDocument3 pagesAccounting Problems and SolutionsKavitha Ragupathy100% (1)

- Virginia Tech ACIS Study GuideDocument10 pagesVirginia Tech ACIS Study Guidebilly bobNo ratings yet

- Chapter7 Problems MySolutionsDocument12 pagesChapter7 Problems MySolutionssindhuja21100% (1)

- Group 6 PPT CaseDocument33 pagesGroup 6 PPT CaseRavNeet KaUr100% (1)

- Akuntansi Manajaemen Chapter 15Document15 pagesAkuntansi Manajaemen Chapter 15lullasangadNo ratings yet

- CH 11 SolDocument6 pagesCH 11 SolEdson EdwardNo ratings yet

- AccountingDocument14 pagesAccountingHelpline100% (1)

- LMUmicroDocument17 pagesLMUmicroSunil CoelhoNo ratings yet

- 202E12Document16 pages202E12Ashish BhallaNo ratings yet

- Investment and BEP AnalysisDocument31 pagesInvestment and BEP AnalysisSuhadahafiza ShafieeNo ratings yet

- Short Term Decision Making: Vincent Joseph D. Disu, CPPS, MbaDocument22 pagesShort Term Decision Making: Vincent Joseph D. Disu, CPPS, MbaMaria Maganda MalditaNo ratings yet

- CH 011 AIA 5e PDFDocument7 pagesCH 011 AIA 5e PDFfaizthemeNo ratings yet

- Measurement ConceptsDocument46 pagesMeasurement ConceptsPrabal Pratap Singh TomarNo ratings yet

- SCM Sol 05 14Document14 pagesSCM Sol 05 14bloomshing0% (1)

- Activity Based CostingDocument8 pagesActivity Based CostingSaumyaNo ratings yet

- Eng Econ - Inv An N BEP - L9Document31 pagesEng Econ - Inv An N BEP - L9Ayesha RalliyaNo ratings yet

- Process Costing: This Is On The Other Side of The Continuum From Job CostingDocument28 pagesProcess Costing: This Is On The Other Side of The Continuum From Job CostingRajeev NairNo ratings yet

- WilkersonDocument4 pagesWilkersonVarun Gogia67% (3)

- Unit - 3 Cost Output RelationshipDocument11 pagesUnit - 3 Cost Output RelationshipKshitiz BhardwajNo ratings yet

- MB 112 Cost OutputDocument12 pagesMB 112 Cost OutputVeniNo ratings yet

- Lecture 9 ABC, CVP PDFDocument58 pagesLecture 9 ABC, CVP PDFShweta SridharNo ratings yet

- Solutions - Chapter 5Document12 pagesSolutions - Chapter 5Parul AbrolNo ratings yet

- CHAPTER 2 Cost Terms and PurposeDocument31 pagesCHAPTER 2 Cost Terms and PurposeRose McMahonNo ratings yet

- P10 CMA RTP Dec2013 Syl2012Document44 pagesP10 CMA RTP Dec2013 Syl2012MsKhan0078No ratings yet

- Decision Regarding Alternative ChoicesDocument29 pagesDecision Regarding Alternative ChoicesrhldxmNo ratings yet

- Lec#5 Week#5 ECODocument33 pagesLec#5 Week#5 ECOZoha MughalNo ratings yet

- ACT3110 - Introduction To CVP Analysis (S)Document30 pagesACT3110 - Introduction To CVP Analysis (S)Adani MustaffaNo ratings yet

- Lecture 6 - Full CostingDocument36 pagesLecture 6 - Full Costingmohammedakbar88No ratings yet

- Cost-Volume-Profit Analysis and Relevant CostingDocument39 pagesCost-Volume-Profit Analysis and Relevant CostingJai AceNo ratings yet

- PDFDocument3 pagesPDFTrisna KusumayantiNo ratings yet

- Chapter Five: Activity-Based Costing and Customer Profitability AnalysisDocument48 pagesChapter Five: Activity-Based Costing and Customer Profitability AnalysisSupergiant EternalsNo ratings yet

- HorngrenIMA14eSM ch13Document73 pagesHorngrenIMA14eSM ch13Piyal Hossain100% (1)

- Costs Terms, Concepts and ClassificationsDocument32 pagesCosts Terms, Concepts and Classificationsjeela1No ratings yet

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- Benefit To Compensation Ratio CalculationsDocument6 pagesBenefit To Compensation Ratio CalculationsRamkishor PandeyNo ratings yet

- Bcom MADocument21 pagesBcom MAAbl SasankNo ratings yet

- MasDocument14 pagesMasgnim1520100% (1)

- Chapter 13 Costs Production MankiwDocument54 pagesChapter 13 Costs Production MankiwKenneth Sanchez100% (1)

- ABC-sample ProblemDocument5 pagesABC-sample ProblemLee Jap OyNo ratings yet

- Theory of Production and Costs - 5Document14 pagesTheory of Production and Costs - 5Atiqul IslamNo ratings yet

- Chapter 2 - Cost Concepts and Design EconomicsDocument54 pagesChapter 2 - Cost Concepts and Design EconomicsShayne Aira Anggong75% (4)

- Absorption & Variable CostingDocument40 pagesAbsorption & Variable CostingKaren Villafuerte100% (1)

- MAHM6e Ch04.Ab - AzDocument49 pagesMAHM6e Ch04.Ab - Azlita2703No ratings yet

- HM ch15 Variable Costing Dan Full CostingDocument20 pagesHM ch15 Variable Costing Dan Full CostingSekarNo ratings yet

- Decision Making - Relevant Costs & BenefitsDocument19 pagesDecision Making - Relevant Costs & BenefitsSujit Kumar PandaNo ratings yet

- Practice - Sensitivity and ScenarioDocument10 pagesPractice - Sensitivity and ScenariorthedthbdethNo ratings yet

- Cost of ProductionDocument79 pagesCost of ProductionMeena IyerNo ratings yet

- Managerial Accounting Sample QuestionsDocument5 pagesManagerial Accounting Sample QuestionsScholarsjunction.comNo ratings yet

- Activity Based CostingDocument10 pagesActivity Based CostingEdi Kristanta PelawiNo ratings yet

- Activity Based CostingDocument33 pagesActivity Based CostingJeetesh Kumar SinghNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Making Your Home More Energy Efficient: A Practical Guide to Saving Your Money and Our PlanetFrom EverandMaking Your Home More Energy Efficient: A Practical Guide to Saving Your Money and Our PlanetNo ratings yet

- Distinguish Between The Following: Industry Demand and Firm (Company) Demand, AnsDocument2 pagesDistinguish Between The Following: Industry Demand and Firm (Company) Demand, AnsManish PatelNo ratings yet

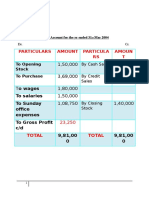

- 1,50,000 61,000 3,69,000 7,80,000 To Wages 1,80,000 1,50,000 1,08,750 1,40,000Document5 pages1,50,000 61,000 3,69,000 7,80,000 To Wages 1,80,000 1,50,000 1,08,750 1,40,000Manish PatelNo ratings yet

- Assignment ADocument1 pageAssignment AManish PatelNo ratings yet

- Solution 6Document1 pageSolution 6Manish PatelNo ratings yet

- Case Study Ans-2Document1 pageCase Study Ans-2Manish PatelNo ratings yet