Professional Documents

Culture Documents

Commercial: An Integration Function

Uploaded by

Neha Chikate0 ratings0% found this document useful (0 votes)

10 views8 pagesMBA

Original Title

Commercial

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMBA

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views8 pagesCommercial: An Integration Function

Uploaded by

Neha ChikateMBA

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

COMMERCIAL

An integration function

THE COMMERCIAL FUNCTION

Commercial:

- This is a highly integrated function in

an organization. It integrates the

various functional departments in the

org. so as to ensure a smooth flow of

day-to-day business.

- This function is not very discernible

to the outside trade or consumers.

- This is a controlling function.

Major Commercial functions

Smooth conduct of day to day conduct

of business as per the business policy.

Generation of periodic data for MIS and

subsequent review by management.

Centralized purchase

Centralized stores

Statutory compliance

- Customs/taxation/local laws

Major Commercial functions

(contd)

Revenue collection

Banking

Warehousing operations

stocking / indenting / stock transfers

Export / import trade

Liaisoning (with government bodies).

Some common commercial terms

WHAT IS EXCISE DUTY?

Excise is the tax on goods produced but

charged at the time of its removal, i.e. at

the time of sale.

WHAT IS VAT?

VAT is Value Added Tax. It is tax charged by

the registered dealer at the time of sale of

goods (earlier Sales Tax). A VAT dealer can

claim credit of VAT on good purchased by

him just like excise duty.

Common commercial terms

(contd)

WHAT IS C FORM D FORM?

Form C is issued by a reg. Dealer (purchaser)

to seller of goods in case of CST so as to

charge him sales tax at lesser rate. C-form is

basically issued by the central govt to transfer

the goods from one state to another with

concessional rate of tax i.e. 2% only. E.g. A(in

Delhi) purchase goods from B(in Haryana),

then A have two options i.e. either

purchase @4% tax or purchase @2% tax.

Normally to get the

tax advantage, A

should purchase the goods against the C-form.

C & D forms (contd)

D form is issued by the government to the seller

of goods for the same reason.

Example :if material purchase within State and item tax rate is

12.5%.

Item amt. :- 100.00

VAT @12.5% :- 12.50

Total purchase value is 112.50/if material purchase out of state (dealer and

purchaser both are registered )

Item amt. :100.00

CST @2% against form "C" :- 2.00

Total purchase value is 102.00/-

C form the process

declaration in C form;

Copies of C form

Contents of C form

CST rates

C form preparation

Benefits of C form

You might also like

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254No ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- VatDocument9 pagesVatmayurgharatNo ratings yet

- Vat Audit by Chetan SarafDocument33 pagesVat Audit by Chetan Sarafchetan saraf100% (1)

- India Localization With Respect To INDIA: Modus Operandi Session IDocument31 pagesIndia Localization With Respect To INDIA: Modus Operandi Session IpsroyalNo ratings yet

- Vat Vs GST FinalDocument35 pagesVat Vs GST FinalJatin GoyalNo ratings yet

- Confirm Vat Audit ProjectDocument33 pagesConfirm Vat Audit ProjectkennyajayNo ratings yet

- Value Added TaxDocument11 pagesValue Added TaxPreethi RajasekaranNo ratings yet

- CIN Overview SD ModuleDocument76 pagesCIN Overview SD ModuleCampa ColaNo ratings yet

- Vat Presentation: Nikita GanatraDocument26 pagesVat Presentation: Nikita GanatraShubham GoyalNo ratings yet

- Vat Presentation: Nikita GanatraDocument26 pagesVat Presentation: Nikita Ganatrapuneet0303No ratings yet

- Vat Presentation: RevisionDocument30 pagesVat Presentation: RevisionKartik VermaNo ratings yet

- Unit II CSTDocument28 pagesUnit II CSTAryan SethiNo ratings yet

- Business EnvironmentDocument12 pagesBusiness EnvironmentArpit JainNo ratings yet

- Registration: Without Any TaxDocument5 pagesRegistration: Without Any TaxvanitakajaleNo ratings yet

- A Value Added TaxDocument6 pagesA Value Added TaxReeta SinghNo ratings yet

- V A TDocument64 pagesV A TJennifer Garcia EreseNo ratings yet

- Value Added Tax: Master Minds - Quality Education Beyond Your ImaginationDocument14 pagesValue Added Tax: Master Minds - Quality Education Beyond Your ImaginationJishu Twaddler D'CruxNo ratings yet

- FA1 Notes: (Business Transactions and Double Entry)Document24 pagesFA1 Notes: (Business Transactions and Double Entry)Waqas KhanNo ratings yet

- Vat IndiaDocument3 pagesVat IndiarajailayaNo ratings yet

- Topic: 1. Sale of Goods and Related IncomesDocument12 pagesTopic: 1. Sale of Goods and Related IncomesUpasana MohantyNo ratings yet

- Statement of Comprehensive IncomeDocument25 pagesStatement of Comprehensive IncomeAngel Nichole ValenciaNo ratings yet

- Basic Concepts of Value Added Tax: What Is VAT ?Document9 pagesBasic Concepts of Value Added Tax: What Is VAT ?Mayank JainNo ratings yet

- Q. What Is Value Added Tax (VAT) ?Document8 pagesQ. What Is Value Added Tax (VAT) ?Akhilesh SinghNo ratings yet

- HANDOUT FOR VAT-NewDocument25 pagesHANDOUT FOR VAT-NewCristian RenatusNo ratings yet

- Test of Whether Something Is An Asset IsDocument9 pagesTest of Whether Something Is An Asset IsMehrose AhmedNo ratings yet

- CIN India LocalizationSD Ver 1Document76 pagesCIN India LocalizationSD Ver 1YogeshNo ratings yet

- Interview QuestionsDocument12 pagesInterview QuestionsnadeemNo ratings yet

- Latest Development in Indirect TaxDocument15 pagesLatest Development in Indirect TaxMuthuprakash.TNo ratings yet

- Service TaxDocument10 pagesService TaxMonika GuptaNo ratings yet

- Value Avatdded TaxDocument13 pagesValue Avatdded TaxJanani ParameswaranNo ratings yet

- Excise Duty: and Distribution (SD), and Posts Them in Financial Accounting (FI)Document6 pagesExcise Duty: and Distribution (SD), and Posts Them in Financial Accounting (FI)Tuhin DuttaNo ratings yet

- Id TaxesDocument28 pagesId TaxesVasim AhmadNo ratings yet

- Value Added by Subtractive MethodDocument17 pagesValue Added by Subtractive MethodmurtadhoNo ratings yet

- Indirect Taxes Before GSTDocument11 pagesIndirect Taxes Before GSTMark LouisNo ratings yet

- Value Added Tax (VAT) : A Presentation by Sanjay JagarwalDocument39 pagesValue Added Tax (VAT) : A Presentation by Sanjay JagarwalJishu Twaddler D'CruxNo ratings yet

- Value Added Tax PPT at Bec Doms Bagalkot MbaDocument22 pagesValue Added Tax PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)No ratings yet

- Changes Faces of Vat TaxDocument103 pagesChanges Faces of Vat TaxArvind MahandhwalNo ratings yet

- VAT in IndiaDocument2 pagesVAT in IndiagundujumpuNo ratings yet

- Value Added Tax PPT PGDMDocument23 pagesValue Added Tax PPT PGDMPuneet Srivastav100% (4)

- Workshop On Finance For Non-Finance Executives: Mining & BeneficiationDocument36 pagesWorkshop On Finance For Non-Finance Executives: Mining & BeneficiationSaikumar SelaNo ratings yet

- SEBI Grade A 2020 Economics Balance of PaymentsDocument11 pagesSEBI Grade A 2020 Economics Balance of PaymentsThabarak ShaikhNo ratings yet

- Public RevenueDocument12 pagesPublic Revenueaneesh trade7No ratings yet

- Value Added Tax (VAT)Document33 pagesValue Added Tax (VAT)chirag_nrmba15No ratings yet

- Central Sales TaxDocument3 pagesCentral Sales TaxRahul JainNo ratings yet

- Sales Tax & VATDocument30 pagesSales Tax & VATAnonymous sfAOc3TKNo ratings yet

- Studying A Procedure On Central Sales Tax: Submitted By:-Rimpy Rana Mba 3 SEMDocument12 pagesStudying A Procedure On Central Sales Tax: Submitted By:-Rimpy Rana Mba 3 SEMrimpyNo ratings yet

- 39 - Implementation of Excise DutyDocument39 pages39 - Implementation of Excise DutyrsnNo ratings yet

- 5.taxation SlidesDocument125 pages5.taxation SlidesAditya DetheNo ratings yet

- Overview of Excise DutyDocument36 pagesOverview of Excise DutysumitNo ratings yet

- AccountingDocument14 pagesAccountingSUNNY SIDE UPNo ratings yet

- Notes On Central Sales TaxDocument5 pagesNotes On Central Sales TaxApoorva ChandraNo ratings yet

- Value Added Tax - VatDocument37 pagesValue Added Tax - VatTimoth MbwiloNo ratings yet

- Guidance Note On Book-KeepingDocument15 pagesGuidance Note On Book-Keeping201CO021 JESSY SAINICA.WNo ratings yet

- Goods & Service Tax CompleteDocument76 pagesGoods & Service Tax CompleteAyesha khanNo ratings yet

- Chapter 1 Introduction To Consumption TaxDocument15 pagesChapter 1 Introduction To Consumption TaxNesrill Joyce AntonioNo ratings yet

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezNo ratings yet

- Company Law 1956Document85 pagesCompany Law 1956Neha ChikateNo ratings yet

- Barriers of Communication: BY MD & SDDocument9 pagesBarriers of Communication: BY MD & SDNeha ChikateNo ratings yet

- Business LAWDocument164 pagesBusiness LAWNeha ChikateNo ratings yet

- Communication SkillsDocument24 pagesCommunication SkillsNeha ChikateNo ratings yet

- AEP CSR Report June2009Document9 pagesAEP CSR Report June2009swaps1912No ratings yet

- AEP CSR Report June2009Document9 pagesAEP CSR Report June2009swaps1912No ratings yet

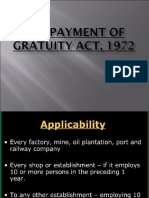

- The Payment of Gratuity Act, 1972Document16 pagesThe Payment of Gratuity Act, 1972Neha ChikateNo ratings yet

- Epaymentofwages 090603143420 Phpapp01Document18 pagesEpaymentofwages 090603143420 Phpapp01Neha SrivastavaNo ratings yet

- A Brief Check List of Labour Laws: Satish KumarDocument17 pagesA Brief Check List of Labour Laws: Satish KumargirishtvktdNo ratings yet