Professional Documents

Culture Documents

Privatisation (Journal)

Privatisation (Journal)

Uploaded by

Yogesh GupteyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Privatisation (Journal)

Privatisation (Journal)

Uploaded by

Yogesh GupteyCopyright:

Available Formats

International Journal of Advanced System and Social Engineering Research

ISSN 2278-6031,

Vol 3, Issue 1, 2013, pp18-22

http://www.bipublication.com

ADVANTAGES AND DISADVANTAGES OF PRIVATISATION IN INDIA

Anant Kousadikar and Trivender Kumar Singh*

*Jatan Swaroop PostGraduate College, Kayasthwada,Sikandrabad(U.P.), Distt: Bulandshar

[Received-05/12/2012, Published-17/01/2013]

ABSTRACT

Privatization in generic terms refers to the process of transfer of ownership, can be of both permanent or long term lease

in nature, of a once upon a time state-owned or public owned property to individuals or groups that intend to utilize it

for private benefits and run the entity with the aim of profit maximization. In other words, it is a route from public or

state ownership to private players or a group. From the other point of view, it is a strategy that provides advantages to a

few at the price of many. However, this is always subjected to the circumstances involved. In this paper, the aim is to

understand the major advantages and disadvantages of privatization in this country.

Index Terms: Privatisation, advantages, Public administration.

I. INTRODUCTION

Privatization is a managerial approach that has

attracted the interest of many categories of peopleacademicians, politicians, government employees,

players of the private sector, and public on the

whole. As per the opinion by the subject experts,

privatization can be advantageous in terms of the

higher flexibility and scope of innovation it offers

along with cost savings, many a times. However,

other specialists defiantly debate that privatization

has an adverse impact on the employee morale and

generate fear of dislocation or termination. More

likely it also adds on to the apprehensions

pertaining to accountability and quality. Experts

both advocate and criticize privatization making it

more or less a provocative decision that calls for a

diligent scrutiny by the decision makers in

assessment of pros and cons attached to the

concerned policy [20].

In India, privatization has been accepted with a lot

of resistance and has been dormant initially during

the inception period of economic liberalization in

the country [8]. The article intends to analyze the

present status of privatization in India and

summarize its advantages and disadvantages in

context with the Indian Economy.

II. PRIMARY FEATURES OF PRIVATIZATION

Espousing market principles by public policy

makers has evolved as one of the prominent

characteristics of the contemporary public

enterprise management which encompasses

privatization as a primary facet. Privatization of

State- owned enterprises has developed as a critical

tool for economic policies pertaining to progress

and development of developing countries.

One of the prominent feature of privatization is the

enhanced competitive characteristics it provides to

the enterprises which prove to be fruitful for the

ADVANTAGES AND DISADVANTAGES OF PRIVATISATION IN INDIA

business as well as the country. However,

privatization contracts are greatly influenced by

merger variables and even global issues and are

structured on the basis of manipulation of the

government and the private players along with the

administering jurisdiction [19]. Perotti and Guney

(1993) cited in Al-Zuhair[2], have supported

privatization as a vital source to enhance economic

enticements, magnetize better managerial skills of

the private sector, extend the share ownership,

lower the public borrowings in order to sustain

sustainable services. Shirley (1988) cited in AlZuhair [2], view privatization as an attempt to

enhance market potencies. Privatization is an

essentially effective tool for restructuring and

reforming the public sector enterprises running

without significant aim and mission as private

sector is perceived to be fundamentally more selfmotivated, prolific and reliable for superior quality

of products and services. Privatization can be of

three prominent types:

Delegation: Government keeps hold of

responsibility and private enterprise handles

fully or partly the delivery of product and

services.

Divestment: Government surrenders the

responsibility.

Displacement: The private enterprise

expands and gradually displaces the

government entity [15].

III. PRIVATIZATION IN INDIA: AN OVERVIEW

Privatization in India is still at a minimalist level.

Privatization by way of sale of public sector

enterprises is almost negligible while divestment is

also existent by way of selling of a portion of

shares of the 31 public sector enterprises.

Privatization got tremendous boost by the

introduction of new economic policy in 1991 that

allowed delicensing, relaxing entry restrictions and

equity funding [4]. This heightened the competition

in the industries that were monopolized by the

public sector earlier. State owned enterprises were

lacking the finesse that private enterprises

Anant Kousadikar and Trivender Kumar Singh

employed as the competitive edge. Deregulation in

India was facilitated by laws like the Industries

(Development & Regulation) Act, 1951 (IDRA),

Monopolies & Restrictive Trade Practices Act,

1969, (MRTPA), Foreign Exchange regulation Act,

1973 (FERA), Capital Issues Control and technical

scrutiny by the Directorate General of Technical

Development (DGTD) (Goyal, n.d.). Postindependence, the Indian government adopted

socialistic economic strategies. It was in 1980s, that

Rajiv Gandhi initiated economic restructuring.

With the help of IMF, Indian government

commenced a sequential economic reorganization.

P.V. Narasimha Rao brought in the revolutionary

economic developments with the help of Dr.

Manmohan Singh. The results of these reforms can

be assessed statistically by comparing the total

overseas investment in terms of portfolio

investment, FDI and investments from foreign

equity capital markets. In 1995-1996, it was $5.3

billion as compared to $ 132 million in 1991-1992.

The highlights of the reforms including eradicating

license raj for all except 18 critical sectors for

licensing; tempering the control on industries;

Foreign Technology Agreements; FDI & FII;

amendment of MRTP Act, 1969; Deregulation;

Regulation of Inflation; Tax restructuring;

encouraging overseas business relations [11]. Few

examples of privatization in India are Lagan Jute

Machinery Company Limited, Modern Food

Industries Limited, BALCO, Hotel Corporation of

India Limited, Hindustan Zinc Limited, Paradeep

Phosphates Limited, BSNL etc.

IV. GOVERNMENT OPPOSITION TO COMPLETE

PRIVATIZATION

In the 1990s, the budgeting process adopted by

Indian government, fiscal deficits, and negative

balance of payments boosted the governments

desire and necessity to extract and release the

massive investments made in the state owned

enterprises and this led to privatization in India.

This paved way for Foreign Direct Investments and

liberalization of business practices and protocols as

19

ADVANTAGES AND DISADVANTAGES OF PRIVATISATION IN INDIA

well [10]. However, being a socialistic economy,

the government has not ever favored complete

privatization for the very basic reason that private

players shall enter into the strategically important

industries and shall use them for their own benefits

and profit maximization [13].

Experts are of the view that Indian government

wrongly positioned their disinvestment strategy by

dangling

between

the

principles

and

accommodating approaches. Though all political

parties acknowledged the doctrine of privatization

but all adopted an escapist attitude towards

complete privatization for safe guarding their vote

banks. They employed tactics of videshi and

swadeshi, and strategies like getting a strategic

partner or enlarge the equity base through and

initial public offer before divesting [10]. Indian

government has been conservative in allowing

partial privatization of strategic sectors like power

supply, telecom, banking, roadways, insurance,

civil aviation, postage and telegraph services etc.

Mostly, both state owned enterprises and privately

run enterprises co-exist in these sectors.

Government uses the shield of social interests of

the employees of the PSUs to camouflage the

interest of the bureaucrats and politicians.

However, intensified competition of the delicensed and liberalized sectors have surely made

the lethargic state owned enterprises to pull up

their socks and shedding the complacency of

monopoly to face the competition [14].

V. ADVANTAGES OF PRIVATIZATION

Privatization indeed is beneficial for the growth

and sustainability of the state-owned enterprises.

The advantages of privatization can be perceived

from both microeconomic and macroeconomic

impacts that privatization exerts.

A. Microeconomic advantages:

State owned enterprises usually are outdone by

the private enterprises competitively. When

compared the latter show better results in terms of

revenues and efficiency and productivity. Hence,

Anant Kousadikar and Trivender Kumar Singh

privatization can provide the necessary impetus to

the underperforming PSUs [16].

Privatization brings about radical structural

changes providing momentum in the competitive

sectors [16].

Privatization leads to adoption of the global best

practices along with management and motivation of

the best human talent to foster sustainable

competitive advantage and improvised management

of resources.

B. Macroeconomic advantages:

Privatization has a positive impact on the

financial health of the sector which was previously

state dominated by way of reducing the deficits and

debts [6,3].

The net transfer to the State owned Enterprises is

lowered through privatization [6,3].

Helps in escalating the performance benchmarks

of the industry in general [6,3].

Can initially have an undesirable impact on the

employees but gradually in the long term, shall

prove beneficial for the growth and prosperity of

the employees [6,3].

Privatized enterprises provide better and prompt

services to the customers and help in improving the

overall infrastructure of the country.

VI. DISADVANTAGES OF PRIVATIZATION

Privatization in spite of the numerous benefits it

provides to the state owned enterprises, there is the

other side to it as well. Here are the prominent

disadvantages of privatization:

Private sector focuses more on profit

maximization and less on social objectives unlike

public sector that initiates socially viable

adjustments in case of emergencies and criticalities

[9,1].

There is lack of transparency in private sector

and stakeholders do not get the complete

information about the functionality of the

enterprise [9,1].

Privatization has provided the unnecessary

support to the corruption and illegitimate ways of

accomplishments of licenses and business deals

20

ADVANTAGES AND DISADVANTAGES OF PRIVATISATION IN INDIA

amongst the government and private bidders.

Lobbying and bribery are the common issues

tarnishing

the

practical

applicability

of

privatization [1].

Privatization loses the mission with which the

enterprise was established and profit maximization

agenda encourages malpractices like production of

lower quality products, elevating the hidden

indirect costs, price escalation etc. [9].

Privatization results in high employee turnover

and a lot of investment is required to train the

lesser-qualified staff and even making the existing

manpower of PSU abreast with the latest business

practices [9].

There can be a conflict of interest amongst

stakeholders and the management of the buyer

private company and initial resistance to change

can hamper the performance of the enterprise [1].

Privatization escalates price inflation in general

as privatized enterprises do not enjoy government

subsidies after the deal and the burden of this

inflation affects the common man.

VII. FUTURE PROSPECTS FOR INDIA

Indian economy is a dynamic economy that is

showing tremendous potential of growth.

Globalization, liberalization and privatization are

the key strategic mandates for economic policies.

Market oriented reforms are sustainable and are

gaining acceptance with resistance to privatization

going down due to the benefits like enhanced

efficiency through target oriented management and

disposition of public funds into social and physical

infrastructure of the country. Privatization has

shown great outcomes in the development of

sectors like banking, insurance, telecom, power,

civil aviation etc. However, the lobbying in

domestic circuits was enfeebled by the surprising

reversal of the Indian economy in present time.

Indian economy registered an average growth of

8.5 per cent in the past four years and it is evidence

enough to highlight the potential of privatization

and its need and likelihoods of privatization [12].

However, it is disheartening to acknowledge that

Anant Kousadikar and Trivender Kumar Singh

India is not a very alluring destination for foreign

investors. Bureaucracy, red tapism, political

hiccups, corruption are also prominent hindrances

in the development of India that offers ample of

skilled and cheap labor and inadequate capital. In

spite of all the hurdles, it is a viable to expect

higher rate of returns as compared to capital

intensive industrialized countries. With more

liberal reforms in the making, future of

privatization seems to be bright and a salubrious

flow of foreign investment and even development

of domestic private players to take charge of the

struggling PSUs and turn them around [17].

VIII. CONCLUSION

Over the time, Indian policy makers have shed their

inhibitions about privatization and have formulated

liberal reforms to divest the huge capital

investment in PSUs and enhance the efficiency and

profit generation of the state owned enterprises.

Many sectors wherein entry barriers were too high

were loosened up to welcome investments from

both domestic as well as international investors.

Sectors that showed tremendous success after

privatization are insurance, banking, civil aviation,

telecom, power etc. However, complete

privatization is still a far-fetched dream. In most of

the liberalized sectors, government control is still

evident and there is more of delegation or joint

ventures between public and private sector are

functional like Maruti Suzuki etc.

REFERENCES

1. Ahmad, F., 2011. Privatization : A View at

Developing Countries, Degree Thesis, International

Business, Arcada

2. Al-Zuhair, M., 2008. Privatization Programs,

Ownership Structures and Market Development: The

Role of Country Characteristics on Defining

Corporate Governance Standards, Ann Arbor:

ProQuest

3. Filipovic, A., 2005. Impact of Privatization on

Economic Growth, Issues in Political Economy, 14,

Pp. 1-22

4. Gouri, G., 1996. Privatization and Public Sector

Enterprises in India: Analysis of Impact of a Non-

21

ADVANTAGES AND DISADVANTAGES OF PRIVATISATION IN INDIA

Policy, Economic and Political Weekly, 31(48), Pp.

63-74

5. Goyal, S., n.d. Privatization in India, [pdf], Available

at:

http://www.ilo.org/public/english/region/asro/bangk

ok/paper/privatize/chap3-1.pdf

[Accessed

27

December 2012]

6. Guriev, S. and Megginson, W., 2005. Privatization:

What have we learnt?, ABCDE Conference, St.

Petersburg, January, 2005.

7. Jain, R., Raghuram, G. and Gangwar, R., 2007.

Airport Privatization in India: Lessons from the

bidding Process in Delhi and Mumbai, Working

Paper No. 2007- 05-01, Research and Publications,

Indian Institute of Management, Ahmedabad.

8. Kapur, D. and Ramamurti, R., 2002. Privatization in

India: The Imperatives and Consequences of

Gradualism, White Paper, Conference on Policy

Reform in India, Stanford University, June3-4, 2002,

Pp. 1- 40

9. Lokyo, S., 2012. Privatization Study, LWVSJC,

February 18, 2012.

10. Malik, V., 2003. Disinvestments in India: Needed

Change in Mindset, Interfaces, Vikalpa, 28(3), Pp.

57-63.

11. Maps of India, 2010. Liberalisation, Privatization

and Globalisation in India, [online], Available at:

http://business.mapsofindia.com/indiapolicy/liberalization-privatization-globalization.html

[Accessed 27 December 2012]

12. Mohan, T., 2007. Privatization and FDI: The Indian

Experience, Working Paper 2007-20, Indian

Institute of Management, Ahmedabad.

13. Ohri, M., n.d. Airport Privatization in India- A

Study of Different Modes of Infrastructure

Provision, Paper, University of Delhi, Faculty of

Management Studies

14. Raghunathan, V., 2006.

Leave Behind the

Monopoly Mindset, Times of India, February 17,

2006.

15. Savas, E., 2006. Privatization and Public- Private

Partnerships,

[pdf]

Available

at:

http://www.cesmadrid.es/documentos/sem200601_m

d02_in.pdf [Accessed 27 December 2012]

16. Sheshinski, E. and Lopez-Calva, L., 2003.

Privatization and Its Benefits: Theory and Evidence,

CESifo Economic Studies, 49(3), Pp. 429-459

Anant Kousadikar and Trivender Kumar Singh

17. Srinivasan, T., 2003. Indian Economy: Current

Problems and Future Prospects, ICFAI Journal of

Applied Economics, 2003, Pp.1- 24

18. Star, P., 1988. The Meaning of Privatization, Yale

Law & Policy Review, 6(1), Pp.6-41.

19. Ullman, A. and Lewis, A., 1997. Privatization and

Entrepreneurship: The Managerial Challenge in

Central and Eastern Europe, New York: Haworth

20. Young, R., 2005. On Privatization- Competitive

Sourcing in State Government, IPSPR E Journal,

May 2005: Institute of Public Service and Policy

Research, University of South Carolina.

22

You might also like

- RSM230 Cheat SheetDocument2 pagesRSM230 Cheat Sheets_786886338No ratings yet

- Cash App - Statement 2020Document4 pagesCash App - Statement 2020ss ds0% (1)

- Tax Invoice: Invoice Number Invoice DateDocument1 pageTax Invoice: Invoice Number Invoice DateAdnan KargıcıNo ratings yet

- LPG Policy of India and Its EffectsDocument15 pagesLPG Policy of India and Its EffectsAsifNo ratings yet

- Common Prefixes and SuffixesDocument2 pagesCommon Prefixes and SuffixesChanthini Vinayagam100% (1)

- Quiz#5 - Wacc-Levrage Student 25q-25ptsDocument4 pagesQuiz#5 - Wacc-Levrage Student 25q-25ptsVinícius AlvesNo ratings yet

- Advantages and Disadvantages of Privatisation in IndiaDocument5 pagesAdvantages and Disadvantages of Privatisation in Indianikita mukeshNo ratings yet

- Advantages and Disadvantages of Privatisation in IndiaDocument1 pageAdvantages and Disadvantages of Privatisation in IndiaZuraida RamzanNo ratings yet

- Divestment and PrivatisationDocument16 pagesDivestment and Privatisationlali62No ratings yet

- LPG Policy of India and Its EffectsDocument18 pagesLPG Policy of India and Its EffectsFACTS YOU MISSED -हिंदीNo ratings yet

- Disinvestment Synopsis ImpDocument10 pagesDisinvestment Synopsis ImpSarita GautamNo ratings yet

- Positive Impact of Privatization On Indian Economy: (Volume3, Issue7)Document4 pagesPositive Impact of Privatization On Indian Economy: (Volume3, Issue7)nikita mukeshNo ratings yet

- Vision IAS Mains Test 5 2021Document22 pagesVision IAS Mains Test 5 2021Amar GoswamiNo ratings yet

- Shri. K.M. Savjani & Smt. K.K. Savjani B.B.A./B.C.A College, VeravalDocument26 pagesShri. K.M. Savjani & Smt. K.K. Savjani B.B.A./B.C.A College, VeravalKaran DalkiNo ratings yet

- Privatisation and DisinvestmentDocument10 pagesPrivatisation and DisinvestmentSachin MangutkarNo ratings yet

- Stages of InternationalizationDocument28 pagesStages of InternationalizationIshita KheriaNo ratings yet

- Ravi Bang's Eco Final DraftDocument30 pagesRavi Bang's Eco Final DraftRavi BangNo ratings yet

- Disinvestment in IndiaDocument32 pagesDisinvestment in IndiaDixita ParmarNo ratings yet

- National Law Institute UniversityDocument18 pagesNational Law Institute UniversityHrishika NetamNo ratings yet

- PrivatisationDocument19 pagesPrivatisationNishil MehraNo ratings yet

- DBB1103-Unit 10-PrivatizationDocument17 pagesDBB1103-Unit 10-PrivatizationaishuNo ratings yet

- RSTV The Big Picture Privatisation of Public Sector EnterprisesDocument4 pagesRSTV The Big Picture Privatisation of Public Sector EnterprisesAbhishekNo ratings yet

- Disinvestment An OverviewDocument8 pagesDisinvestment An OverviewRavindra GoyalNo ratings yet

- Privatization Can Be of Three Prominent TypesDocument2 pagesPrivatization Can Be of Three Prominent TypesLeslin BruttusNo ratings yet

- Privatization and Disinvestment: BY: Apala Gupta Garima Soni Minakshi Sinha Shraddha ChapekarDocument39 pagesPrivatization and Disinvestment: BY: Apala Gupta Garima Soni Minakshi Sinha Shraddha ChapekarvinodkumardasNo ratings yet

- Privatization of GOVERNMENT ASSETS: Good or BadDocument21 pagesPrivatization of GOVERNMENT ASSETS: Good or BadProf. R V SinghNo ratings yet

- Competition LawDocument18 pagesCompetition Lawmuhammed farzinNo ratings yet

- Privatization of Public Assets - Rough-1Document5 pagesPrivatization of Public Assets - Rough-121BEC153Subiksha MerinNo ratings yet

- Business Env.. PrivatizationDocument8 pagesBusiness Env.. Privatizationklair_deepika5602No ratings yet

- Privatization & Disinvestment'sDocument13 pagesPrivatization & Disinvestment'sarifshaikh99No ratings yet

- Ijarm: International Journal of Advanced Research in Management (Ijarm)Document13 pagesIjarm: International Journal of Advanced Research in Management (Ijarm)IAEME PublicationNo ratings yet

- Role of Public SectorDocument13 pagesRole of Public SectorPrince RathoreNo ratings yet

- IJCRT2004624Document8 pagesIJCRT2004624mrdarshin48No ratings yet

- Disinvestment and PrivatisationDocument40 pagesDisinvestment and Privatisationpiyush909No ratings yet

- Disinvestment and PrivatisationDocument30 pagesDisinvestment and PrivatisationSantosh MashalNo ratings yet

- 6398-Article Text-10418-2-10-20171207 PDFDocument8 pages6398-Article Text-10418-2-10-20171207 PDFSajeel AhmedNo ratings yet

- C 10 Hindustan Petroleum Company LimitedDocument4 pagesC 10 Hindustan Petroleum Company LimitedNakshtra DasNo ratings yet

- Disinvestment of 23 Psus: Rstv-Big PictureDocument3 pagesDisinvestment of 23 Psus: Rstv-Big PictureAbhishekNo ratings yet

- Besd 702Document13 pagesBesd 702Sweta BastiaNo ratings yet

- Disinvestment Policy in India: Progress and Challenges: ManagementDocument3 pagesDisinvestment Policy in India: Progress and Challenges: ManagementK MNo ratings yet

- TLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayDocument10 pagesTLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayShivran RoyNo ratings yet

- Question Bank: Short Answer QuestionsDocument29 pagesQuestion Bank: Short Answer QuestionsPayal GoswamiNo ratings yet

- Chapter - 5 Analysis of Problems and Prospects of DisinvestmentDocument15 pagesChapter - 5 Analysis of Problems and Prospects of Disinvestmentmohd sheerafNo ratings yet

- PrivatizationDocument11 pagesPrivatizationKrisha Mae CaguranganNo ratings yet

- 6.18, DR Nayan DeepDocument10 pages6.18, DR Nayan Deepramzan.khadim89No ratings yet

- Lect Topic 3.1 PrivatizationDocument22 pagesLect Topic 3.1 PrivatizationKertik SinghNo ratings yet

- Paper-II (Part-2)Document3 pagesPaper-II (Part-2)focusahead.broNo ratings yet

- Causes of PrivatisationDocument9 pagesCauses of PrivatisationNipunNo ratings yet

- The New Industrial POLICY-1991Document26 pagesThe New Industrial POLICY-1991bbhoeeNo ratings yet

- 20CH10064 - Sneha MajumderDocument16 pages20CH10064 - Sneha MajumderRashi GoyalNo ratings yet

- Disinvestment Policy in India: Progress and Challenges: Assistant Professor, S.A. Jain College, Ambala CityDocument12 pagesDisinvestment Policy in India: Progress and Challenges: Assistant Professor, S.A. Jain College, Ambala CitySid SharmaNo ratings yet

- Economic Issue - Concentration of Economic PowerDocument8 pagesEconomic Issue - Concentration of Economic PowerAmandeep KaurNo ratings yet

- Objective of DisinvestmentDocument9 pagesObjective of Disinvestmentsaketms009No ratings yet

- Disinvestment in India 2Document111 pagesDisinvestment in India 2Kunjan GandhiNo ratings yet

- Dis InvestmentDocument16 pagesDis Investmentsree.funyanNo ratings yet

- DISINVESTMENTDocument6 pagesDISINVESTMENTR SURESH KUMAR IINo ratings yet

- Competition LawDocument6 pagesCompetition Lawmuhammed farzinNo ratings yet

- Disinvestment in Public SectorDocument7 pagesDisinvestment in Public SectorRajs MalikNo ratings yet

- Chapter 3 - Global Trading EnvironmentDocument46 pagesChapter 3 - Global Trading Environmentkirthi nairNo ratings yet

- Disinvestment NeelamDocument39 pagesDisinvestment NeelamvaidwaraNo ratings yet

- Rishikesh Raj Singh (Muthoot Group)Document58 pagesRishikesh Raj Singh (Muthoot Group)Rishikesh Raj SinghNo ratings yet

- Chapter - 23Document14 pagesChapter - 23rjvmafiaNo ratings yet

- Public Private Partnership-: Lessons from Gujarat for Uttar PradeshFrom EverandPublic Private Partnership-: Lessons from Gujarat for Uttar PradeshNo ratings yet

- The Maruti Story: How A Public Sector Company Put India On WheelsFrom EverandThe Maruti Story: How A Public Sector Company Put India On WheelsRating: 3 out of 5 stars3/5 (1)

- 30 Days Push Up ChallengeDocument3 pages30 Days Push Up ChallengeChanthini VinayagamNo ratings yet

- GM DietDocument8 pagesGM DietChanthini Vinayagam100% (1)

- StorytellingDocument5 pagesStorytellingChanthini VinayagamNo ratings yet

- Mohr V WilliamDocument5 pagesMohr V WilliamChanthini VinayagamNo ratings yet

- Perception Online NotesDocument13 pagesPerception Online NotesChanthini VinayagamNo ratings yet

- BCG Growth-Share Matrix: Invest in and Which Ones Should Be DivestedDocument5 pagesBCG Growth-Share Matrix: Invest in and Which Ones Should Be DivestedChanthini VinayagamNo ratings yet

- A Survey of TQM Application in Healthcare - Case Analysis: Chanthini.VDocument15 pagesA Survey of TQM Application in Healthcare - Case Analysis: Chanthini.VChanthini VinayagamNo ratings yet

- Sterilization Methods and PrinciplesDocument11 pagesSterilization Methods and PrinciplesChanthini VinayagamNo ratings yet

- First Aid - CPR - AED Adult Ready ReferenceDocument12 pagesFirst Aid - CPR - AED Adult Ready Referenceadamiam100% (1)

- Concept and Principles of HomeopathyDocument2 pagesConcept and Principles of HomeopathyChanthini Vinayagam100% (1)

- Abc in CPRDocument3 pagesAbc in CPRChanthini VinayagamNo ratings yet

- Cardinal Utility ApproachDocument5 pagesCardinal Utility ApproachChanthini VinayagamNo ratings yet

- Revised Sterilization Methods and Principles PDFDocument21 pagesRevised Sterilization Methods and Principles PDFSiva Raman100% (1)

- MBE NotesDocument154 pagesMBE NotesSimson SimNo ratings yet

- Simulink TutDocument19 pagesSimulink TutChanthini VinayagamNo ratings yet

- Change Management Leadership GuideDocument30 pagesChange Management Leadership GuideChanthini Vinayagam100% (2)

- Microprocessor 80386Document5 pagesMicroprocessor 80386Chanthini VinayagamNo ratings yet

- Registration of Collective Bargaining Agreement: Ureau of Abor ElationsDocument4 pagesRegistration of Collective Bargaining Agreement: Ureau of Abor ElationsQueen Ann NavalloNo ratings yet

- Blades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)Document8 pagesBlades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)raihans_dhk337894% (18)

- Rera BookDocument80 pagesRera BookRahul O Agrawal100% (1)

- Project Report UpdatedDocument49 pagesProject Report Updatedआकाश जायसवाल100% (2)

- Case 6 - Retailing in IndiaDocument22 pagesCase 6 - Retailing in IndiaSanjay NayakNo ratings yet

- MeryemLemich CVDocument1 pageMeryemLemich CVAbdelhadi TvNo ratings yet

- Case 1Document5 pagesCase 1Rahul DalviNo ratings yet

- The IS Auditor's Consideration of IrregularitiesDocument4 pagesThe IS Auditor's Consideration of IrregularitiesJerome B. AgliamNo ratings yet

- Profit and Loss Account of Friends Flower and ShopDocument11 pagesProfit and Loss Account of Friends Flower and ShopHitesh BalNo ratings yet

- Samruddhi ProjectDocument17 pagesSamruddhi ProjectPooja R Aakulwad0% (1)

- Sample - 2 Procedure For Management ReviewDocument6 pagesSample - 2 Procedure For Management ReviewKauser Kazmi100% (1)

- Session 3 SlidesDocument25 pagesSession 3 SlidesPatrick Ferguson AssuahNo ratings yet

- Add-Course ReportDocument93 pagesAdd-Course Reportmaltemayur37No ratings yet

- KLS Indicator Guide For Profitable TradingDocument7 pagesKLS Indicator Guide For Profitable Tradingmohammad.paiman.azimiNo ratings yet

- ANA Online Event Marketing Technology OverviewDocument15 pagesANA Online Event Marketing Technology OverviewDemand Metric100% (1)

- Swot Analysis InfosysDocument17 pagesSwot Analysis InfosysAlia AkhtarNo ratings yet

- Bonds Valuation 2017 STUDocument4 pagesBonds Valuation 2017 STUAnissa GeddesNo ratings yet

- Income Tax Vol-2 48th EditionDocument540 pagesIncome Tax Vol-2 48th EditionVipul VatsNo ratings yet

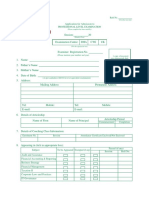

- BDO PersonalLoanAKAppliFormDocument4 pagesBDO PersonalLoanAKAppliFormAirMan ManiagoNo ratings yet

- FORM No: 22-23' Application For Admission To Professional Level ExaminationDocument5 pagesFORM No: 22-23' Application For Admission To Professional Level ExaminationMd. Rubayet RahmanNo ratings yet

- State Bank of India: Recruitment of Specialist Cadre Officers in Sbi On Regular BasisDocument5 pagesState Bank of India: Recruitment of Specialist Cadre Officers in Sbi On Regular BasisDebashis MahantaNo ratings yet

- Afar302 A - PD 3Document5 pagesAfar302 A - PD 3Nicole TeruelNo ratings yet

- Case 1 sTUDYDocument3 pagesCase 1 sTUDYianiroy13No ratings yet

- Most Active Investors in The Indian Startup EcosyDocument1 pageMost Active Investors in The Indian Startup EcosyShashank MishraNo ratings yet

- Project Human Resource Development: "Apple"Document16 pagesProject Human Resource Development: "Apple"cjksdbvjkcsbNo ratings yet

- Supplier Development at SWPDocument82 pagesSupplier Development at SWPalma millaniaNo ratings yet