Professional Documents

Culture Documents

Disinvestment Policy in India: Progress and Challenges: Management

Uploaded by

K MOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Disinvestment Policy in India: Progress and Challenges: Management

Uploaded by

K MCopyright:

Available Formats

Research Paper Management Volume : 3 | Issue : 8 | Aug 2013 | ISSN - 2249-555X

Disinvestment Policy in India: Progress and

Challenges

Keywords Disinvestment, Progress, Objectives and Challenges

Kiran Kumar Chetan Kumar T M

Assistant Professor, Department of Management Assistant Professor, Raja Lakahmgouda Law College,

Studies, Karnatak Arts College, Dharwad. Belgaum

ABSTRACT In the nineties, India’s budgeting, fiscal deficits, and balance of payments problems kick started the govern-

ment’s urge to unlock the huge investments chained in the state owned enterprises (SOEs). The major thrust

for Disinvestment Policy in India came through the Industrial Policy Statement 1991.The policy stated that the government

would disinvest part of their equities in selected PSEs. However it did not stake any cap or limit on the extent of disinvest-

ment. It also did not restrict disinvestment to any class of investors. The main objective was to improve overall performance

of the PSEs. In eighties the model of privatization/divestment was initiated by Margaret Thatcher in UK and implemented by

other countries including Germany (Unified), and other socialist countries. The Four Ps of disinvestment are Policy, Promise,

Prognosis and Performance. In recent past, we have been witnessing a lot of debate on the disinvestments scenario sug-

gesting dynamic movement.

Introduction that reason, they feel, public exchequer in lieu of funding the

The founding fathers of our republic used the public sec- PSUs should better be utilized for basic education, primary

tor as an essential and vibrant element in the building-up health, family welfare etc. of the country for which Govern-

of India’s economy. The founding father of PSEs, Jawaharlal ment has at present hardly any surplus to allocate. After all it

Nehru called the public enterprises set-up in various parts of is inapt and ridiculous for the Government to become indus-

the country as temples of modern India. India was not alone trialist, trader or businessman instead of becoming a Govern-

in ascribing an important role to the public sector. Many in ment itself. Having aforesaid socio-economic dimension in

the developed countries, who saw the devastation caused the back-drop the Central Government likes to go by popular

by inefficient and myopic managements of private sector en- maxim “your business is your business and my business is

terprises, voted strongly for a growing public sector in U.K., mine” and wants to disassociate itself with the PSUs through

France, Germany and even in U.S.A. The objective of accel- disinvestment policy in a phased manner.6

erating the pace of economic development and the political

ideology led to rapid growth of the state-owned enterprises Evolution of the Disinvestment Policy

sector in India.3 The benefits of partial disinvestment of equity were envis-

aged for the first time by the Estimates Committee of the first

The public sector presence is predominant in public utilities Lok Sabha in its 16th report entitled Nationalized Industrial

and infrastructure. Railways, post & telegraph, ports, airports Undertakings, as early as 1955. The committee recommend-

and power are dominated by CPSEs or department-owned ed that at lest 25% of the share capital of government com-

enterprises. In telecom, the public sector continues to be panies should be available for subscription by the public, and

dominant in the provision of fixed line telephone services, the government could fix a ceiling for individual holdings as

while private licencees are operating in some urban areas. well as on the dividends to be declared by those companies.

Mobile services are predominantly private, particularly in ur- The government which was in no mood to dilute its stake in

ban areas, while inter-state and international linking services PEs, argued that the private investor will not be interested in

are significantly privately managed and owned.4 investing in PEs, and that the committee’s recommendation

would have to be seen in the light of paras 7-9 of the Indus-

Public enterprise policy patterned on the Nehru-Mahalanobis trial Policy Resolution of 1956.7

mode has been experiencing drastic changes since July 24,

1991. The new policy announced as a constituent of the New The committee did not agree with this reply and remarked

Industrial Policy, 1991 is governed more by the philosophy of that the Industrial Policy Resolution did not bar public partici-

market forces rather than planning. This policy has initiated pation, as even for Schedule ‘A’ industries, which were to be

five types of reforms; dereservation; disinvestment; perfor- the exclusive responsibility of the state, the possibility of the

mance contract system; review of sick units; and enhanced state securing private cooperation in establishing new units,

autonomy to public enterprises. Out of these disinvestment where national interest so required, was not precluded. The

emerge as the most favoured reform by the government.5 13. committee added that public participation would help

in efficient functioning of PEs and it would also evoke the

The aims of disinvestment policy are i). raising of resources to enthusiasm of the public for participation in the national de-

meet fiscal deficit ii). Encouraging wider public participation velopment. It further argued that PEs themselves would func-

including that of workers iii). Penetrating market discipline tion effectively under the vigil of a body of shareholders, who

within public enterprises and iv). Improving performance. would in their own interest keep a watchful eye on the work-

ing of the undertaking. But the government did not relent.

The premise accepted by most of the high-ups in the top

echelon of the Central Government is that the PSUs which About the same time, the Krishna Menon Committee rec-

were once created for “Public Interest” should gradually be ommended 25% equity participation in PEs by the public at

disinvested in the “Public Interest” only. The logic and ration- large because: (i) it was a method of financing the capital, (ii)

ale behind such disinvestment policy are therefore, accord- it would help in mopping up of additional earnings of lower

ing to them, now stand well defined and transparent. It is for income groups and was thus an anti-inflationary measure,

424 X INDIAN JOURNAL OF APPLIED RESEARCH

Research Paper Volume : 3 | Issue : 8 | Aug 2013 | ISSN - 2249-555X

and (iii) it enabled people to participate in profit of PEs or It is imperative that both the bidding firm, if it is a company,

to share their burden. But this recommendation was also ig- and the PSU Itself have to comply the requirements of various

nored by the government. Accounting Standards already in vogue. But in many of the

PSUs, as is very often experienced, ascertainment of figures

In October 1960, a committee headed by the then secre- with exatitude so far the liabilities are concerned are hardly

tary of the Department of Company Affairs recommended made thereby leaving a vulnerable scope for hidden liability.

to the Planning Commission that 25% of PE equity be disin- Barring a few most of the PSUs have huge landed property

vested to the public. The Chandrashekar government took on which there will always be an “eagle eye” of the pseudo

the bold decision on disinvestment on 4th March, 1991. Its bidders or “fly-by-night operators”, who instead of carrying

finance minister, Mr. Yashwant Sinha presenting the budget out the business will only be interested in asset stripping of

for 1991-928 stated: The Congress government’s Industrial the newly acquired PSU. Further, closing of branches or sales

Policy Statement of 25th July, 1991 gave the reasons for eq- offices situated in the posh business localities of the vari-

uity disinvestment. It made no mention about the extent of ous Metros with the plea of cost control is an area of orphic

disinvestment.9 nature which should entice the vigilant eyes of the auditors

for proper dissection of each case. Since the possibilities of

On 12th October, 1991 the finance minister also announced transaction taking an untoward, undesirable and wanton turn

at the IMF World Bank meeting his government’s decision to benefiting some interested quarters rather than the PSU itself

raise Rs. 2,500 crores through PE disinvestment in two install- cannot be ruled out. Therefore to provide proper safeguard

ments of Rs. 1,250 crores each by 31st December and end of to the Government, shareholders, employees of the PSU and

February, 1992. In pursuance to this decision, the govern- to the nation at large, stock of the situation should be taken

ment had to hurriedly complete the first round of disinvest- without further delay and befitting guidelines and standards

ment before the end of fiscal 1991-92.10 be evolved. Then only we shall be able to fulfill our profes-

sional commitment to the society.13

The Statement of Industrial Policy of July 24, 1991 stated that

in order to raise resources and encourage wider public partic- Disinvestment and Privatization

ipation, a part of the government’s shareholding in the public Disinvestment was initiated by selling undisclosed bundles of

sector would be offered to mutual funds, financial institu- equity shares of selected central PSEs to public investment

tions, general public and workers. After 1996, sale through institutions (like the UTI), which were free to dispose off these

the GDR route was also initiated and MTNL (1997-98), VSNL shares in the booming secondary stock market. The process

(1996-97 and 1998-99) and GAIL (1999-2000) all used the op- however came to an abrupt halt when the market collapsed

portunity to access the GDR market.11 in the aftermath of Harshad Mehta led scam, as the asking

prices plummeted below the reserve prices. (Though disin-

Process of Disinvestment – Guidelines vestment was not part of the scandal, the process got some

As of today the Government’s decision to go for disinvest- what discredited as some officials associated with the policy

ment of its PSUs has created a phenomenal impact over the reforms were found have had an association with Harshad

economy of the country. This is an endeavour by the Cen- Mehta).14

tral Government to govern the economy through applied

approach thereby bridging the gap of deficit financing and The change of government at the Centre in 1996 led to some

gradually do away with control and regulatory measures. rethinking about the policy, but not a reversal. A Disinvest-

Since the process of disinvestment involves a number of com- ment Commission was constituted to advise the government

plex procedures, it is absolutely necessary to have standard on whether to disinvest in a particular enterprise, its mo-

guidelines for proper accomplishment of various activities at dalities and the utilization of the proceeds. The commission,

different levels. The council of ICAI is perhaps the most ap- among other things, recommended:

propriate authority in the country to evolve just and equitable

guidelines and Accounting Standards for the various stages • Restructuring and reorganization of PSEs before disin-

of disinvestment to serve the purpose best. vestment,

• Strengthening of the well-functioning enterprises, and

The initial steps involved in mooting a proposal for disinvest- • To utilize the disinvestment proceeds to create a fund for

ment, which may emerge from the policy of the Government restructuring of PSEs.

of India or a proposal made by the Disinvestment Commis-

sion and clearance of the same by the Cabinet Committee of In response to the public debate, and to the commission’s

Disinvestment (CCD) incorporate procedural aspects of the recommendations, some large and well-functioning PSEs

Government. Outsiders get involved in the picture when Ad- were declared “jewels” (Navaratnas) in the government’s

visor is appointed generally through paper advertisements. crown, and were granted greater managerial and financial

“Advisor” does not stand to signify any singular entity rather autonomy. However, disinvestment did not pick up as the

reputed and established firms of professionals, Consultants, share prices remained subdued because of the scandals that

Banks, NBFCs etc. having national and international back- rocked the financial markets.10 But, by the turn of the dec-

ground may qualify for the task. So far the question of a ade, there was some improvement mainly in response to the

firm of Chartered Accountants and consultants is concerned stock boom engineered by Ketan Parikh. Apparently some

ICAI has enough justifiable prudence and wisdom to issue PSEs stocks were part of the scandal, which this time also in-

guidelines on important and “the must” areas to be covered volved the UTI. (It is perhaps worth reminding ourselves that

by the Advisor while making due diligence of the PSU con- the 1990s witnessed a series of frauds in the financial sec-

cerned. The same set of guidelines may also apply when a tor that seriously dented the credibility of the stock market,

prospective bidder would undertake due diligence before which is yet to recover in terms of participation of domestic

bidding for the PSU. PSUs as we all know, are Government “small” investors. After the Harshad Mehta scam, there was,

Companies under the Companies Act, 1956, since the Gov- MS Shoe scam, collapse of NBFCs, vanishing companies

ernment, State or Central, holds more than 51% of its equity. scam, teakwood plantation scam, collapse of CRB group of

Companies Act however, it is interesting to note, does not financial companies, collapse of housing bubble in 1996, and

define a PSU nor the same has been defined under any other finally the Ketan Parikh scam in 2000).

Act. When shareholding of the Government in a Government

Company goes below 51% the Company loses its entity as a The new government that came to power in 1998 preferred

Government Company. But even then will it be called a PSU? to sell large chunks of equity in selected enterprises to “stra-

Such type of relevant questions in PSU disinvestment should tegic” partners – a euphemism for transfer of managerial

draw the attention of ICAI at the time of framing the prospec- control to private enterprises. A separate ministry was cre-

tive and justified guidelines to cover these areas.12 ated to speed up the process, as it was widely believed that

INDIAN JOURNAL OF APPLIED RESEARCH X 425

Research Paper Volume : 3 | Issue : 8 | Aug 2013 | ISSN - 2249-555X

the operating ministries are often reluctant to part with PSEs The industry and business express their doubts about raising

for disinvestments as it means loss of power for the con- such huge funds to buy out and acquire PSUs. The foreign

cerned ministers and civil servants. The sales were organized investors are critical of the entire process and are often seen

through auctions or by inviting bids, bypassing the stock withdrawing from the bidding process. In essence, there is

market (which continued to be sluggish), justified on the something seriously wrong in India’s approach to disinvest-

grounds of better price realisation. Notwithstanding the seri- ment and implementation.

ous discussion on the utilization of disinvestment proceeds,

they continued to be used only to bridge the fiscal deficit.15 Conclusion

The public sector enterprises’ contribution to national devel-

Strategic sale in many countries have been controversial as opment is widely acknowledged, their poor financial return

it is said to give rise to a lot of corruption, discrediting the has been a matter of deep and enduring concern, especially

policy process. Aware of such pitfalls, efforts were made to since the mid-1980s when, for the first time, the central gov-

be transparent in all the stages of the process: selection of ernment’s current revenues were found inadequate to meet

consultants to advice on the sale, invitation of bids, opening its current expenditure. Though firm and industry level stud-

of tenders and so on. Between 1999 and 2003, much greater ies of PSEs have often highlighted gross inefficiencies and

quantum of public assets were sold in this manner, compared poor profitability, many of them have also suggested their

to the earlier process, though the realized amounts were con- unquantifiable (or difficult to quantify) non-economic ben-

sistently less than the targets – except in 2003. efits. However, macroeconomic discourse in India has largely

focused on the “crowding-in” effects of public investment,

Nonetheless, there are series of allegations of corruption and and the need for institutional structures to insulate the PSEs

malpractice in many of these deals that have been widely from political and bureaucratic interference to improve their

discussed in the press and the parliament. Instances of under financial returns. Deeper analyses have sought to offer politi-

pricing of assets, favouring preferred buyers, non-compliance cal economic explanations for continuation of such a state of

of agreement with respect to employment and retrenchment, affairs.

and many incomplete contracts with respect to sale of land,

and assets have been widely reported. The following five-point agenda may be useful for policy-

makers.

Thus, during the last 13 years Rs. 29,520 crores were real-

ized by sale of equity in selected central government PSEs, • Trust the homegrown expert: If we look at the domains of

(in some cases) relinquishing managerial control as well. This cutting edge expertise, the lead players whose initiatives

formed less than one per cent of central government’s cumu- the advanced countries have trusted are products of our

lative fiscal deficit in this period. own institutions.

• Place administrative control in the hands of the Finance

Amid disinvestment and privatization, some new PSEs are Minister: This would enable him to complete the disin-

also created. For instance, many departmental activities were vestment process focusing on FDI which could be depos-

being corporatized (setting up of BSNL for instance) with a ited in the Disinvestments Fund.

view to disinvestment. New PSEs are also formed to take up • Hand over companies that are a burden on the govern-

newer activities like road development corporations. ment to the employees: This could be done on a token

share price of one paisa per share. They may turn the

Disinvestment : Scenario of Indian Mindset company around or resell it for scrap or close down the

The Indian approach to disinvestments seems to have gone outfit.

wrong being positioned in the middle between the doctri- • Do not involve a PSU/SOE in the bidding process: A PSU/

narian extreme on the one end and the laissez faire extreme SOE should not be allowed to invest or control manage-

on the other. The country seems to have lost both the op- ment interest in a PSU/SOE disinvestment candidate.

portunity and the direction, and the pace is poor, lethargic, This in effect is asset stripping by the GOI and a transfer

and lacklustre. While all political parties and economists be- payment (one government pocket to another pocket)

lieve in the principle of divestments/privatization, they devise from the bidder PSU to the government treasury.

escape routes for non-implementation by taking recourse to • Manage revivals: Any revivals must be professionally

statements such as: “We agree in principle but differ in the managed on a lease basis.

details;” “First bring in a strategic partner and then divest;”

“First increase the equity base through a public offer and

then divest;” “It is videshi, swadeshi;” etc.16

REFERENCE 1. P.P. Arya and B.B. Tandon “Economic Reforms in India – From the First to Second Generation and Beyond” Neelam Jain – “Privatization

and Disinvestment in Public Sector Undertakings in India”, 2003. | | 2. “WHITE PAPER ON DISINVESTMENT OF CENTRAL PUBLIC SECTOR

ENTERPRISES” GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF DISINVESTMEN, http://www.divest.nic.in/white%20paper.pdf | | 3. P.P. Arya

and B.B. Tandon “Economic Reforms in India – From the First to Second Generation and Beyond” B.S. Ghuman – “Disinvestment policy in India: Rhetoric and

Reality”, “Economic Reforms in India – From the First to Second Generation and Beyond” 2003, | | 4. Harijiban Banerjee – “PSU Disinvestment- Need for Guidelines

and Accounting Standards” http://220.227.161.86/11320p608-612.pdf | | 5. Laxmi Narain – “Principles and Practice of Public Enterprise Management”, 1995. | | 6.

R Nagaraj – “Disinvestment and Privatisation in India Assessment and Options” http://www2.adb.org/Documents/Reports/Consultant/TAR-IND-4066/Trade/nagaraj.

pdf | | 7. Vipin Malik – “Disinvestment in India : Needed the Change in the Mindset” http://www.vikalpa.com/pdf/articles/2003/2003_july_sep_57_63.pdf |

426 X INDIAN JOURNAL OF APPLIED RESEARCH

You might also like

- MGT 103 Chap 1Document75 pagesMGT 103 Chap 1Le Quoc Khanh100% (1)

- Disinvestment Policy of IndiaDocument7 pagesDisinvestment Policy of Indiahusain abbasNo ratings yet

- Chapter - 2 Disinvestment and Public Sector Undertakings in IndiaDocument24 pagesChapter - 2 Disinvestment and Public Sector Undertakings in Indiamohd sheerafNo ratings yet

- Disinvestment in IndiaDocument32 pagesDisinvestment in IndiaDixita ParmarNo ratings yet

- Economics Project 2020-2021: By: - G. Kishore Ganapathi Roll Number: - 12410Document22 pagesEconomics Project 2020-2021: By: - G. Kishore Ganapathi Roll Number: - 12410Itisme ItisnotmeNo ratings yet

- Slump SaleDocument16 pagesSlump SaleGovardhan VaranasiNo ratings yet

- Disinvestment An OverviewDocument8 pagesDisinvestment An OverviewRavindra GoyalNo ratings yet

- Privatisation and DisinvestmentDocument10 pagesPrivatisation and DisinvestmentSachin MangutkarNo ratings yet

- Public Private and Joint SectorsDocument11 pagesPublic Private and Joint SectorskocherlakotapavanNo ratings yet

- Public, Private and Joint SectorsDocument10 pagesPublic, Private and Joint SectorsAMITKUMARJADONNo ratings yet

- Privitisation and Disinvestment of PsusDocument11 pagesPrivitisation and Disinvestment of Psusnarasimaa100% (1)

- Disinvestment and PrivatisationDocument30 pagesDisinvestment and PrivatisationSantosh MashalNo ratings yet

- Disinvestment and PrivatisationDocument40 pagesDisinvestment and Privatisationpiyush909No ratings yet

- Economics ProjectDocument12 pagesEconomics ProjectVaishnavi CNo ratings yet

- Objective of DisinvestmentDocument9 pagesObjective of Disinvestmentsaketms009No ratings yet

- Divestment and PrivatisationDocument16 pagesDivestment and Privatisationlali62No ratings yet

- 10 Joint Sector in IndiaDocument17 pages10 Joint Sector in IndiaAkash JainNo ratings yet

- Privatization & Disinvestment'sDocument13 pagesPrivatization & Disinvestment'sarifshaikh99No ratings yet

- Ecomonic Project PDFDocument15 pagesEcomonic Project PDFGarv RathiNo ratings yet

- Katoch Bahri State EnterprisesDocument30 pagesKatoch Bahri State Enterprisesrahul sharmaNo ratings yet

- Disinvestment Process in IndiaDocument11 pagesDisinvestment Process in IndiaRiyaz ShaikNo ratings yet

- Dod - Final ReportDocument30 pagesDod - Final ReportRaunak GokhaleNo ratings yet

- Privatization and Disinvestment: BY: Apala Gupta Garima Soni Minakshi Sinha Shraddha ChapekarDocument39 pagesPrivatization and Disinvestment: BY: Apala Gupta Garima Soni Minakshi Sinha Shraddha ChapekarvinodkumardasNo ratings yet

- Disinvestment PolicyDocument13 pagesDisinvestment PolicyARYAN GUPTANo ratings yet

- Disinvestment Synopsis ImpDocument10 pagesDisinvestment Synopsis ImpSarita GautamNo ratings yet

- RSTV The Big Picture Privatisation of Public Sector EnterprisesDocument4 pagesRSTV The Big Picture Privatisation of Public Sector EnterprisesAbhishekNo ratings yet

- Disinvestment NeelamDocument39 pagesDisinvestment NeelamvaidwaraNo ratings yet

- Dis InvestmentDocument16 pagesDis Investmentsree.funyanNo ratings yet

- Eco ProjectDocument13 pagesEco ProjectJayshree BurnwalNo ratings yet

- DISINVESTMENTDocument6 pagesDISINVESTMENTR SURESH KUMAR IINo ratings yet

- Group 1Document24 pagesGroup 1Pooja UndeNo ratings yet

- 20CH10064 - Sneha MajumderDocument16 pages20CH10064 - Sneha MajumderRashi GoyalNo ratings yet

- Rivatisation: Privatization Means A Change in Ownership Resulting in A Change in ManagementDocument10 pagesRivatisation: Privatization Means A Change in Ownership Resulting in A Change in ManagementRadha Mohan GiriNo ratings yet

- Dis InvestmentDocument35 pagesDis Investmentkindomk85No ratings yet

- Disinvesment: Prepared By: Manoj Jaymin SumantaDocument26 pagesDisinvesment: Prepared By: Manoj Jaymin SumantaNischal Singh AttriNo ratings yet

- Ecoshastra - 2014 - Disinvestment Policy of Indian Government - Scope and Limitations - TabishAltafDocument4 pagesEcoshastra - 2014 - Disinvestment Policy of Indian Government - Scope and Limitations - TabishAltaftabish_altafNo ratings yet

- Disinvestment in Public SectorDocument7 pagesDisinvestment in Public SectorRajs MalikNo ratings yet

- Disinvestment Petrochemical Industry: Boon or A BaneDocument7 pagesDisinvestment Petrochemical Industry: Boon or A BanePrachi PawarNo ratings yet

- Strategic Disinvestment 1Document5 pagesStrategic Disinvestment 1AbhishekNo ratings yet

- Chapter - 5 Analysis of Problems and Prospects of DisinvestmentDocument15 pagesChapter - 5 Analysis of Problems and Prospects of Disinvestmentmohd sheerafNo ratings yet

- Privatization of Public Enterprises and Its Implication On Economic Policy and DevelopmentDocument10 pagesPrivatization of Public Enterprises and Its Implication On Economic Policy and DevelopmentIPROJECCTNo ratings yet

- Privatation in MalaysiaDocument14 pagesPrivatation in MalaysiaPokong Potok100% (1)

- DisinvestmentDocument15 pagesDisinvestmentPatel Krisha KushangNo ratings yet

- Economics AssignmentDocument16 pagesEconomics AssignmentgorigirlNo ratings yet

- Disinvestment of Public Sector Enterprises in IndiaDocument14 pagesDisinvestment of Public Sector Enterprises in IndiaAlen Augustine100% (1)

- Reading Material Veda File-4Document73 pagesReading Material Veda File-4bharat.deubaNo ratings yet

- Advantages and Disadvantages of Privatisation in IndiaDocument5 pagesAdvantages and Disadvantages of Privatisation in Indianikita mukeshNo ratings yet

- Disinvestment Policy in India: Progress and Challenges: Assistant Professor, S.A. Jain College, Ambala CityDocument12 pagesDisinvestment Policy in India: Progress and Challenges: Assistant Professor, S.A. Jain College, Ambala CitySid SharmaNo ratings yet

- SSRN Id4442920Document13 pagesSSRN Id4442920karsiv28No ratings yet

- In India, - Hence, ,: DisinvestmentDocument11 pagesIn India, - Hence, ,: DisinvestmentRahulSinghaniNo ratings yet

- TLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayDocument10 pagesTLP Phase 1 - Day 13 Synopsis: Challenges of PSU's in India TodayShivran RoyNo ratings yet

- PSU Disinvestment-Need For Guidelines and Accounting StandardsDocument5 pagesPSU Disinvestment-Need For Guidelines and Accounting StandardsArnav SinghNo ratings yet

- Acknowledgemnt: Department of Management, BIT MesraDocument28 pagesAcknowledgemnt: Department of Management, BIT Mesraanuj191087No ratings yet

- In India, - Hence, ,: DisinvestmentDocument11 pagesIn India, - Hence, ,: DisinvestmentDeep Raj JangidNo ratings yet

- Privatisation and Commercialisation of Government Enterprises inDocument4 pagesPrivatisation and Commercialisation of Government Enterprises inabiola soliuNo ratings yet

- Vision IAS Mains Test 5 2021Document22 pagesVision IAS Mains Test 5 2021Amar GoswamiNo ratings yet

- Disinvestment PolicyDocument87 pagesDisinvestment PolicyShyam Dawda100% (1)

- Nava Rat NasDocument12 pagesNava Rat Nasmypri_23No ratings yet

- Unit 5Document16 pagesUnit 5Amisha GargNo ratings yet

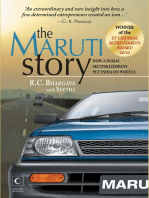

- The Maruti Story: How A Public Sector Company Put India On WheelsFrom EverandThe Maruti Story: How A Public Sector Company Put India On WheelsRating: 3 out of 5 stars3/5 (1)

- Somaliland: Private Sector-Led Growth and Transformation StrategyFrom EverandSomaliland: Private Sector-Led Growth and Transformation StrategyNo ratings yet

- LSSGB Lesson0 Course OverviewDocument16 pagesLSSGB Lesson0 Course OverviewNax ScNo ratings yet

- The Current Indian Fintech Industry: Exploring The Expansion, Confusions, and Opportunities For Msme'sDocument11 pagesThe Current Indian Fintech Industry: Exploring The Expansion, Confusions, and Opportunities For Msme'sINSTITUTE OF LEGAL EDUCATIONNo ratings yet

- Topics On CB AssignmentDocument2 pagesTopics On CB Assignmentakmohideen100% (1)

- Departmentation: The Functional StructureDocument3 pagesDepartmentation: The Functional Structurep.sankaranarayananNo ratings yet

- Assessment Report On Asset ManagementDocument29 pagesAssessment Report On Asset ManagementMuhammad ArifNo ratings yet

- Current State AnalysisDocument2 pagesCurrent State AnalysisprateekNo ratings yet

- Tricks of The TradeDocument4 pagesTricks of The TradeMohammed Abdul MoiedNo ratings yet

- Senior CapstoneDocument47 pagesSenior CapstonePa'oneakaiLee-Namakaeha0% (2)

- NCFM Beginners ModuleDocument92 pagesNCFM Beginners ModuleSidharth TripathiNo ratings yet

- ICRA, Credit Enhanced Ratings, Aug 2022Document8 pagesICRA, Credit Enhanced Ratings, Aug 2022Adarsh Reddy GuthaNo ratings yet

- App LeaveDocument2 pagesApp Leavekhalid_faqeerNo ratings yet

- Case Study of Dell Computers EcommerceDocument9 pagesCase Study of Dell Computers EcommerceRaj DubeyNo ratings yet

- An Introduction To Human Resource ManagementDocument7 pagesAn Introduction To Human Resource ManagementMohammad Al-arrabi AldhidiNo ratings yet

- Module 21 Professional Responsi Ilities: MU EADocument1 pageModule 21 Professional Responsi Ilities: MU EAHazem El SayedNo ratings yet

- Um Scenario NDocument3 pagesUm Scenario Nmansha99No ratings yet

- PGUIN - Digital Marketing Service AgreementDocument6 pagesPGUIN - Digital Marketing Service AgreementshahnazzNo ratings yet

- Impact of Reforms in Capital Market On Indian Capital MarketDocument30 pagesImpact of Reforms in Capital Market On Indian Capital MarketNiketu Shah0% (1)

- 3DP CostingDocument4 pages3DP CostingAdam SzabolcsNo ratings yet

- 2Document3 pages2gurdev1825No ratings yet

- University of ZimbabweDocument14 pagesUniversity of ZimbabweZvikomborero Lisah KamupiraNo ratings yet

- Clicks IAR2023 Integrated+ReportDocument84 pagesClicks IAR2023 Integrated+Reporttf9wgz2ysdNo ratings yet

- Tasnim Rezoana Tanim: Human Resource Practices in The Context of IDLC Finance Limited Letter of TransmittalDocument25 pagesTasnim Rezoana Tanim: Human Resource Practices in The Context of IDLC Finance Limited Letter of TransmittalAnowarul IslamNo ratings yet

- WTK Annual ReportDocument135 pagesWTK Annual ReportWL LeeNo ratings yet

- My Save All CardsDocument166 pagesMy Save All CardsVero EntertainmentNo ratings yet

- The Role of Mobile Banking in PakistanDocument37 pagesThe Role of Mobile Banking in PakistanSaad Bin Mehmood100% (1)

- Sanraa Annual Report 08 09Document49 pagesSanraa Annual Report 08 09chip_blueNo ratings yet

- HRM-2022 P S SanjanaDocument16 pagesHRM-2022 P S SanjanaSanjanaNo ratings yet

- If, Cost of Machine Rs.400, 000 Useful Life 5 Years Rate of Depreciation 40%Document13 pagesIf, Cost of Machine Rs.400, 000 Useful Life 5 Years Rate of Depreciation 40%Narang NewsNo ratings yet

- Most of The Companies Do Have An Overall Organizational Structure To Cope Up With The Variety of Work That Is To Be HandledDocument7 pagesMost of The Companies Do Have An Overall Organizational Structure To Cope Up With The Variety of Work That Is To Be HandledLewis C Figo100% (1)