Professional Documents

Culture Documents

Income Tax Rate Table For Individual Taxpayers in The Philippines

Uploaded by

Jan Mae Lumiares0 ratings0% found this document useful (0 votes)

140 views1 pageIncome Tax Rate Table for Individual Taxpayers in the Philippines This is the regular Income Tax Rate Table or schedule used for computing income TAX DUE. TAX TABLE If TAXABLE INCOME is: not Over P 10,000 Over P 10,000 but not Over P 30,000 P 2,500 + 15% of the excess Over P 70,000 Over P 70,000 Over P 140,000 Over P 140,000 Over P 250,000 P 22,500 + 25% of the excess above P 140,000.

Original Description:

Original Title

Income Tax Rate Table for Individual Taxpayers in the Philippines

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome Tax Rate Table for Individual Taxpayers in the Philippines This is the regular Income Tax Rate Table or schedule used for computing income TAX DUE. TAX TABLE If TAXABLE INCOME is: not Over P 10,000 Over P 10,000 but not Over P 30,000 P 2,500 + 15% of the excess Over P 70,000 Over P 70,000 Over P 140,000 Over P 140,000 Over P 250,000 P 22,500 + 25% of the excess above P 140,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

140 views1 pageIncome Tax Rate Table For Individual Taxpayers in The Philippines

Uploaded by

Jan Mae LumiaresIncome Tax Rate Table for Individual Taxpayers in the Philippines This is the regular Income Tax Rate Table or schedule used for computing income TAX DUE. TAX TABLE If TAXABLE INCOME is: not Over P 10,000 Over P 10,000 but not Over P 30,000 P 2,500 + 15% of the excess Over P 70,000 Over P 70,000 Over P 140,000 Over P 140,000 Over P 250,000 P 22,500 + 25% of the excess above P 140,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

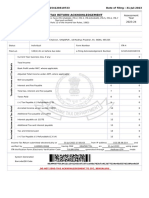

Income Tax Rate Table for Individual Taxpayers in the Philippines

This is the regular income tax rate table or schedule used for computing income tax due for

Individuals Earning Purely Compensation Income and Individuals Engaged in Business and

Practice of Profession:

TAX TABLE

If TAXABLE INCOME is:

TAX DUE is:

Not over P 10,000

5%

Over P 10,000 but not over P 30,000

P 500 + 10% of the excess over P 10,000

Over P 30,000 but not over P 70,000

P 2,500 + 15% of the excess over P 30,000

Over P 70,000 but not over P

140,000

P 8,500 + 20% of the excess over P 70,000

Over P 140,000 but not over P

250,000

P 22,500 + 25% of the excess over P

140,000

Over P 250,000 but not over P

500,000

P 50,000 + 30% of the excess over P

250,000

Over P 500,000

P 125,000 + 32% of the excess over P

500,000

You might also like

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Taxation Reviewer 2022Document2 pagesTaxation Reviewer 2022Saclao John Mark GalangNo ratings yet

- Villamor Vs Comelec and AmytisDocument6 pagesVillamor Vs Comelec and AmytisKling KingNo ratings yet

- De Minimis and FringeDocument1 pageDe Minimis and FringeAlicia Jane NavarroNo ratings yet

- Given To Messrs. Kuenzle and Streiff."Document2 pagesGiven To Messrs. Kuenzle and Streiff."Mickey RodentNo ratings yet

- Takata Philippines Corporation v. Bureau of Labor RelationsDocument2 pagesTakata Philippines Corporation v. Bureau of Labor RelationsJill BagaoisanNo ratings yet

- Cipriano v. MarcelinoDocument2 pagesCipriano v. Marcelinofangs88No ratings yet

- BIR Assessment DisputeDocument8 pagesBIR Assessment DisputeNeil FrangilimanNo ratings yet

- 027 CIR Vs BOACDocument2 pages027 CIR Vs BOACMiw CortesNo ratings yet

- Chronicles Securities Corp Vs NLRCDocument2 pagesChronicles Securities Corp Vs NLRCKitem Kadatuan Jr.No ratings yet

- CIR Vs AsalusDocument1 pageCIR Vs AsalusGracee MedinaNo ratings yet

- Tax Notes On Passive IncomeDocument4 pagesTax Notes On Passive IncomeMaria Anna M LegaspiNo ratings yet

- Eng vs. LeeDocument2 pagesEng vs. LeeJimi SolomonNo ratings yet

- Court Case over Estate of Gliceria A. del RosarioDocument7 pagesCourt Case over Estate of Gliceria A. del RosariomepilaresNo ratings yet

- Case Digest #3 - CIR Vs - Mirant PagbilaoDocument3 pagesCase Digest #3 - CIR Vs - Mirant PagbilaoMark AmistosoNo ratings yet

- Cir Vs CA, 203 Scra 72Document11 pagesCir Vs CA, 203 Scra 72Dario G. TorresNo ratings yet

- Essential Taxation Law Q&As from 2007-2013 Bar ExamsDocument125 pagesEssential Taxation Law Q&As from 2007-2013 Bar ExamsAxel FontanillaNo ratings yet

- SECURITY BANK CORPORATION VS CIRDocument9 pagesSECURITY BANK CORPORATION VS CIRMarife Tubilag ManejaNo ratings yet

- Raymundo Vs CADocument2 pagesRaymundo Vs CAriajuloNo ratings yet

- Alvarez - Cases On ReceivershipDocument18 pagesAlvarez - Cases On ReceivershipAlan BuenaventuraNo ratings yet

- CIR vs. BOAC Tax RulingDocument2 pagesCIR vs. BOAC Tax RulingHappy KidNo ratings yet

- About The VATDocument15 pagesAbout The VATAmie Jane MirandaNo ratings yet

- Philacor Credir Corp Vs CirDocument2 pagesPhilacor Credir Corp Vs Circrisanto perezNo ratings yet

- Philippine Tax Law Changes SummaryDocument13 pagesPhilippine Tax Law Changes SummarykeyelNo ratings yet

- CIR vs. Lancaster Phils. GR. 183408, July 12, 2017Document20 pagesCIR vs. Lancaster Phils. GR. 183408, July 12, 2017Roxanne PeñaNo ratings yet

- Components of Medical NegligenceDocument1 pageComponents of Medical NegligenceAnshul YadavNo ratings yet

- RABADILLA vs. CA DigestDocument1 pageRABADILLA vs. CA DigestjoshNo ratings yet

- VAT Powerpoint PDFDocument202 pagesVAT Powerpoint PDFRuchie EtolleNo ratings yet

- Marubeni Corp V CirDocument3 pagesMarubeni Corp V CirTintin CoNo ratings yet

- Cir V PinedaDocument1 pageCir V PinedaHoreb FelixNo ratings yet

- TUASON Vs LingadDocument5 pagesTUASON Vs LingadEANo ratings yet

- Republic vs. Salud v. HizonDocument2 pagesRepublic vs. Salud v. HizonGyelamagne EstradaNo ratings yet

- ANNEX B: INCOME TAX TABLES FOR INDIVIDUALS AND CORPORATIONS (35 CHARACTERSDocument10 pagesANNEX B: INCOME TAX TABLES FOR INDIVIDUALS AND CORPORATIONS (35 CHARACTERSChelissaRojasNo ratings yet

- 544 - Vda. de Ampil v. AlvendiaDocument1 page544 - Vda. de Ampil v. AlvendiaAiken Alagban LadinesNo ratings yet

- Active Realty Devpt V DaroyaDocument2 pagesActive Realty Devpt V DaroyaBananaNo ratings yet

- Jose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Document2 pagesJose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Iris Mikaela P. RamosNo ratings yet

- CIR v. American Express PHIL. BranchDocument2 pagesCIR v. American Express PHIL. BranchJaypoll DiazNo ratings yet

- BIR Ruling 219-93 DigestDocument1 pageBIR Ruling 219-93 Digestkim_santos_20No ratings yet

- Witholding Tax To VAT NotesDocument22 pagesWitholding Tax To VAT NoteslchieSNo ratings yet

- Taxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Document2 pagesTaxation Case Summaries - 3-Manresa 2018-2019: Distribution of Dividends or Assets by Corporations.Ergel Mae Encarnacion RosalNo ratings yet

- ME Holding Corp Vs CADocument1 pageME Holding Corp Vs CAjanhelNo ratings yet

- Cir Vs Castaneda Terminal Leave Exempt From TaxDocument1 pageCir Vs Castaneda Terminal Leave Exempt From Taxfrancis_asd2003No ratings yet

- Sec of Finance v. LazatinDocument10 pagesSec of Finance v. Lazatinana abayaNo ratings yet

- Manila Metal Container Corp v. PNBDocument1 pageManila Metal Container Corp v. PNBMaria AnalynNo ratings yet

- Case 10. Oceanic Wireless Network Inc Vs CIRDocument2 pagesCase 10. Oceanic Wireless Network Inc Vs CIRAl-MakkiHasanNo ratings yet

- 8 RCBC Vs CIR 2007Document9 pages8 RCBC Vs CIR 2007BLNNo ratings yet

- 4 CMS Logging VS CaDocument1 page4 CMS Logging VS Cak santosNo ratings yet

- Supreme Court of the Philippines examines scope of Employers' Liability ActDocument11 pagesSupreme Court of the Philippines examines scope of Employers' Liability ActMarilou GaralNo ratings yet

- Commissioner v. United Cadiz Sugar Farmers Assoc Multi-Purpose CooperativeDocument7 pagesCommissioner v. United Cadiz Sugar Farmers Assoc Multi-Purpose CooperativeKit FloresNo ratings yet

- State Marine Corporation Vs Cebu Seaman AssociationDocument6 pagesState Marine Corporation Vs Cebu Seaman AssociationGer EsparesNo ratings yet

- Corporate Income Tax GuideDocument46 pagesCorporate Income Tax GuideCanapi AmerahNo ratings yet

- Wilson Vs Rear - DigestDocument2 pagesWilson Vs Rear - DigestRowena GallegoNo ratings yet

- CRISTOBAL BONNEVIE, ET AL., Plaintiffs-Appellants, vs. JAIME HERNANDEZ, Defendant-Appellee. G.R. No. L-5837 FactsDocument2 pagesCRISTOBAL BONNEVIE, ET AL., Plaintiffs-Appellants, vs. JAIME HERNANDEZ, Defendant-Appellee. G.R. No. L-5837 FactsMayoree FlorencioNo ratings yet

- CIR vs JAL Tax RulingDocument8 pagesCIR vs JAL Tax RulingDarrel John Sombilon100% (1)

- Atty Ligon Tx2Document92 pagesAtty Ligon Tx2karlNo ratings yet

- Tax Rev. Outline CompilationDocument23 pagesTax Rev. Outline CompilationMichael James Madrid MalinginNo ratings yet

- FAQ Bank Secrecy LawDocument11 pagesFAQ Bank Secrecy LawVan ClacioNo ratings yet

- What Is The Income Tax Rate in The Philippines?Document4 pagesWhat Is The Income Tax Rate in The Philippines?Anonymous zQNRQq2YNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Document41 pagesTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Train LawDocument41 pagesTrain LawJoana Lyn GalisimNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ruloans VaishaliNo ratings yet

- All Staff Tax Calculation 2022 23Document19 pagesAll Staff Tax Calculation 2022 23Venu NNo ratings yet

- Income Tax Rates For The Past 10 YearsDocument10 pagesIncome Tax Rates For The Past 10 YearsTarang DoshiNo ratings yet

- PDF 121154120310723Document1 pagePDF 121154120310723Steve BurnsNo ratings yet

- PDF 808478730140722Document1 pagePDF 808478730140722Vishakha BhureNo ratings yet

- ARVINDDocument1 pageARVINDSourabh YadavNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- Form10BE - ALPNA VARMA - 2021 - AABTK6329H06221000050Document1 pageForm10BE - ALPNA VARMA - 2021 - AABTK6329H06221000050hemalatha aNo ratings yet

- AOA SUBJECT CODE Subject Description 2020 2021 Week No - TAX 1Document5 pagesAOA SUBJECT CODE Subject Description 2020 2021 Week No - TAX 1Arlea AsenciNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementtaramaNo ratings yet

- ITR Acknowledgement T Durga PrasadDocument1 pageITR Acknowledgement T Durga PrasadEdu KondaluNo ratings yet

- Itr2019 2022Document3 pagesItr2019 2022CHANDANNo ratings yet

- Top 500 Taxpayers in The Philippines 2012Document8 pagesTop 500 Taxpayers in The Philippines 2012Mykiru IsyuseroNo ratings yet

- Itr Ay 22-23Document1 pageItr Ay 22-23Bandari GoverdhanNo ratings yet

- Samana Tatheer-Assign 7-20U00323.Ipynb - ColaboratoryDocument9 pagesSamana Tatheer-Assign 7-20U00323.Ipynb - ColaboratorySamana TatheerNo ratings yet

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- Itr 1 Sahaj Form Ay 2023 24Document4 pagesItr 1 Sahaj Form Ay 2023 24kishoreNo ratings yet

- For Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument2 pagesFor Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionLhyraNo ratings yet

- DBM Compensation Policy Guidelines No. 98-1 (Page 1 of 2)Document1 pageDBM Compensation Policy Guidelines No. 98-1 (Page 1 of 2)Rej Francisco100% (1)

- Collected Data ADocument504 pagesCollected Data Aአስምሮ ላቂያዉNo ratings yet

- Acknowledgement AY 22-23Document1 pageAcknowledgement AY 22-23Nirav RavalNo ratings yet

- Residential Status 6246611305Document10 pagesResidential Status 6246611305Adharsh K ANo ratings yet

- Foreign Tax CreditDocument2 pagesForeign Tax CreditSophiaFrancescaEspinosaNo ratings yet

- Ack Cafpk4156a 2022-23 489614981130922Document1 pageAck Cafpk4156a 2022-23 489614981130922aditya_kavangalNo ratings yet

- Income Tax - RulesDocument18 pagesIncome Tax - RulesMathew YoyakkyNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormVikash SoniNo ratings yet

- C5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersDocument11 pagesC5 - To - C6 - Suggested - Answers - PDF Filename UTF-8''C5 To C6 - Suggested AnswersJessa De GuzmanNo ratings yet

- Ack Afcpy3063l 2021-22 163749600170721Document1 pageAck Afcpy3063l 2021-22 163749600170721Rakesh SinghNo ratings yet

- Aacpt8112a 2021 110889938Document77 pagesAacpt8112a 2021 110889938vnpNo ratings yet

- CPALE ReviewersDocument6 pagesCPALE ReviewersElla Mae FamisanNo ratings yet