Professional Documents

Culture Documents

Itr 23-24

Uploaded by

Ruloans VaishaliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr 23-24

Uploaded by

Ruloans VaishaliCopyright:

Available Formats

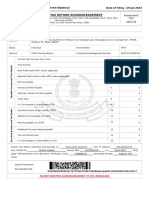

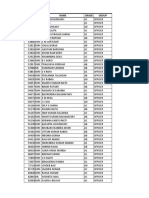

Acknowledgement Number:660879620240723 Date of filing : 29-Aug-2023*

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment

[Where the data of the Return of Income in Form ITR-1(SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 Year

filed and verified]

(Please see Rule 12 of the Income-tax Rules, 1962) 2023-24

PAN AXRPR2960E

Name RAJU

1,BANJARA DHANI KANKAR , VIDARKHYA , GANGAPUR CITY,SAWAI MADHOPUR , 27-Rajasthan, 91- INDIA,

Address

322201

Status Individual Form Number ITR-4

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 660879620240723

Current Year business loss, if any 1 0

Total Income 2 4,30,530

Taxable Income and Tax Details

Book Profit under MAT, where applicable 3 0

Adjusted Total Income under AMT, where applicable 4 0

Net tax payable 5 0

Interest and Fee Payable 6 0

Total tax, interest and Fee payable 7 0

Taxes Paid 8 1,000

(+) Tax Payable /(-) Refundable (7-8) 9 (-) 1,000

Accreted Income and Tax Detail

Accreted Income as per section 115TD 10 0

Additional Tax payable u/s 115TD 11 0

12

Interest payable u/s 115TE 0

Additional Tax and interest payable 13 0

Tax and interest paid 14 0

(+) Tax Payable /(-) Refundable (13-14) 15 0

Income Tax Return submitted electronically on 24-Jul-2023 19:32:15 from IP address 10.130.38.1 and

verified by RAJU having PAN AXRPR2960E on 29-Aug-2023 using paper ITR-

Verification Form /Electronic Verification Code generated through mode

System Generated

Barcode/QR Code

AXRPR2960E0466087962024072360f2e8fa71d6f74280f48b665da9b487be0b4299

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

*If the return is verified after 30 days of transmission of return data electronically, then date of verification will be considered as date of

filing the return (Notification No.05 of 2022 dated 29-07-2022 issued by the DGIT (Systems), CBDT).”

You might also like

- ITR-1 Filing AcknowledgementDocument1 pageITR-1 Filing AcknowledgementRavi KumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:924503630310723 Date of Filing: 31-Jul-2023bluetrans expressNo ratings yet

- PundlinkDocument1 pagePundlinkSHAIKH IBRAHIMNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDattatraya JoshiNo ratings yet

- ITR-4 Acknowledgement for AY 2021-22Document1 pageITR-4 Acknowledgement for AY 2021-22Aditya Adi SinghNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearBrajesh kumar sharmaNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- Ack Aalcs4258c 2022-23 448872891271023Document1 pageAck Aalcs4258c 2022-23 448872891271023deepakNo ratings yet

- Namdev ITR ACK 2022-23Document1 pageNamdev ITR ACK 2022-23cagopalofficebackupNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- Worldwide SolutionsDocument1 pageWorldwide SolutionsKamlesh NandanwarNo ratings yet

- Telangana State Board of Intermediate Education: Hyderabad: Online Memorandum of MarksDocument1 pageTelangana State Board of Intermediate Education: Hyderabad: Online Memorandum of MarksSaikishore Naidu100% (1)

- Ashok ITR 2022-23Document1 pageAshok ITR 2022-23SHIFAZ SULAIMANNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageVarun KandoiNo ratings yet

- ITR Form AY 21-22Document96 pagesITR Form AY 21-22Anurag Kumar ReloadedNo ratings yet

- Udyam Registration Certificate Details for Mushroom Plant in HaridwarDocument1 pageUdyam Registration Certificate Details for Mushroom Plant in HaridwarDeepanshu Singh PanwarNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:611395890220723 Date of Filing: 22-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:611395890220723 Date of Filing: 22-Jul-2023Respect InfinityNo ratings yet

- Itr 2021-22Document1 pageItr 2021-22Vishakha PalNo ratings yet

- NETWOERTHSDocument3 pagesNETWOERTHSVIJAY PAREEKNo ratings yet

- ITR Acknowledgement AY 21-22Document1 pageITR Acknowledgement AY 21-22Rimple SanchlaNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementNANDAN SALESNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Itr 2023 2024Document1 pageItr 2023 2024Deepak ThangamaniNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEr.Ramesh GuptaNo ratings yet

- PDF 254872900180623Document1 pagePDF 254872900180623Sachin KumarNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGagan Sales Agencies SunamNo ratings yet

- Bank statement summary for Rayudu PeyyalaDocument12 pagesBank statement summary for Rayudu PeyyalaDr V SaptagiriNo ratings yet

- Account STMT XX2127 19122023Document7 pagesAccount STMT XX2127 19122023Subramania YuvaraajNo ratings yet

- Statement of Axis Account No:912010049541859 For The Period (From: 01-05-2022 To: 23-05-2022)Document4 pagesStatement of Axis Account No:912010049541859 For The Period (From: 01-05-2022 To: 23-05-2022)Rahul BansalNo ratings yet

- Account Statement For Account:2962002100013400: Branch DetailsDocument3 pagesAccount Statement For Account:2962002100013400: Branch DetailsBest Auto TechNo ratings yet

- Bhanu Pay SlipDocument1 pageBhanu Pay SlipShyam ChouhanNo ratings yet

- Certificate of Net Wealth and Annual IncomeDocument4 pagesCertificate of Net Wealth and Annual IncomeSimran MehraNo ratings yet

- Chartered Accountant Full Set of Tourist VisaDocument4 pagesChartered Accountant Full Set of Tourist VisaManikandanNo ratings yet

- Ack 504547400170723Document1 pageAck 504547400170723varsha sardesaiNo ratings yet

- 01 04 2016 - 18 03 2017 PDFDocument3 pages01 04 2016 - 18 03 2017 PDFRamsai ChigurupatiNo ratings yet

- PDF 974069050240722Document1 pagePDF 974069050240722tax advisorNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- HDFC YsDocument2 pagesHDFC YsAkshat ShahNo ratings yet

- Itr - TCSDocument3 pagesItr - TCSsivaNo ratings yet

- STATEMENT OF ACCOUNT FOR YADAV ENGINEERING WORKSDocument9 pagesSTATEMENT OF ACCOUNT FOR YADAV ENGINEERING WORKSsanjay sharmaNo ratings yet

- Udyog AadhaarDocument1 pageUdyog AadhaarRahul GuptaNo ratings yet

- Account Statement From 1 Jan 2012 To 30 Jun 2012: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Jan 2012 To 30 Jun 2012: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRavi AgarwalNo ratings yet

- Renewal Premium ReceiptDocument1 pageRenewal Premium ReceiptRakesh KumarNo ratings yet

- Itr 22 23Document1 pageItr 22 23biswa chakrabortyNo ratings yet

- Bank Statement SummaryDocument2 pagesBank Statement Summaryravi_seth_9No ratings yet

- Salary Slip SriwatiDocument2 pagesSalary Slip SriwatiFauziliza JayaNo ratings yet

- Salry DecDocument1 pageSalry DecAnkush KumarNo ratings yet

- March StaffDocument5 pagesMarch StaffMp MandyaNo ratings yet

- TurnoverDocument7 pagesTurnoverVivek KumarNo ratings yet

- Indian Income Tax Return Acknowledgement for AY 2022-23Document1 pageIndian Income Tax Return Acknowledgement for AY 2022-23santy309No ratings yet

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateeksha SharmaNo ratings yet

- Rochak Agrawal-Offer PDFDocument4 pagesRochak Agrawal-Offer PDFrochak agrawalNo ratings yet

- PDF 230861000130623Document1 pagePDF 230861000130623Sunil AccountsNo ratings yet

- Ack 657892140240723Document1 pageAck 657892140240723ravindraNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Itr 22-23Document1 pageItr 22-23Ruloans VaishaliNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Coi 22-23Document2 pagesCoi 22-23Ruloans VaishaliNo ratings yet

- Coi 22-23Document2 pagesCoi 22-23Ruloans VaishaliNo ratings yet

- Print - Udyam Registration CertificateDocument5 pagesPrint - Udyam Registration CertificateRuloans VaishaliNo ratings yet

- Hey Bhanwar,: Here Is Your Credit Report For Jul '23Document31 pagesHey Bhanwar,: Here Is Your Credit Report For Jul '23Ruloans VaishaliNo ratings yet

- Print - Udyam Registration CertificateDocument5 pagesPrint - Udyam Registration CertificateRuloans VaishaliNo ratings yet

- IOCL Data 575Document52 pagesIOCL Data 575Ruloans VaishaliNo ratings yet

- Jaipur - Rajasthan India - Business Industrial Directory Database List of Companies Small & Medium Enterprises - SME & Industries (.XLSX Excel Format) 7th EditionDocument3 pagesJaipur - Rajasthan India - Business Industrial Directory Database List of Companies Small & Medium Enterprises - SME & Industries (.XLSX Excel Format) 7th EditionRohit BalaniNo ratings yet

- Computation 22-23Document2 pagesComputation 22-23Ruloans VaishaliNo ratings yet

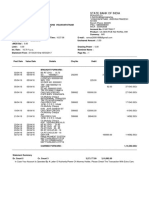

- HDFCDocument9 pagesHDFCRuloans VaishaliNo ratings yet

- 2017 Trump Carousel LLC New York City Vendor FilingDocument46 pages2017 Trump Carousel LLC New York City Vendor FilingjpeppardNo ratings yet

- How Many Days Since July 24 2023 - Google SearchDocument1 pageHow Many Days Since July 24 2023 - Google Searchcq5kd7hxcbNo ratings yet

- MTOP Permit Renewal ProcessDocument3 pagesMTOP Permit Renewal Processc lazaroNo ratings yet

- EventDocuments Afbc2001 6b70 4b9a 9d95 245ba1352efb 2Document8 pagesEventDocuments Afbc2001 6b70 4b9a 9d95 245ba1352efb 279mbvkv67yNo ratings yet

- Acquisory News Chronicle September 2020Document8 pagesAcquisory News Chronicle September 2020Acquisory Consulting LLPNo ratings yet

- RMC No. 117-2021Document1 pageRMC No. 117-2021Em SantosNo ratings yet

- 2.5 - Rep - Identity Staff - CIC - 14.03.2021Document3 pages2.5 - Rep - Identity Staff - CIC - 14.03.2021Parth BindalNo ratings yet

- Wcms 747413Document40 pagesWcms 747413Yudit PuspitariniNo ratings yet

- 2018 Accounting Templates For Accounting Officers of CGDocument38 pages2018 Accounting Templates For Accounting Officers of CGkasozi martinNo ratings yet

- Complaint (D.E. 1-SCH V FAB-17-80728-S.D.F.L.) June 13, 2017Document78 pagesComplaint (D.E. 1-SCH V FAB-17-80728-S.D.F.L.) June 13, 2017larry-612445100% (1)

- Mpkby FormsDocument8 pagesMpkby FormsmrinankadharlillyNo ratings yet

- Socialscience Set 1 QPDocument8 pagesSocialscience Set 1 QPpk6215776No ratings yet

- 19aaacw4132g1zg Gstr1 Detailed Report Summary (2021-2022)Document68 pages19aaacw4132g1zg Gstr1 Detailed Report Summary (2021-2022)Manprit MahalNo ratings yet

- Eight Questions about CorruptionDocument50 pagesEight Questions about CorruptionPierre Chavez AlcoserNo ratings yet

- Order 49Document14 pagesOrder 49NURADRIANA OMAR BAHSIRNo ratings yet

- Three Models of Corporate Governance JanuaryDocument14 pagesThree Models of Corporate Governance JanuaryNguyễn Diệu HuyềnNo ratings yet

- IKEA Order Details ConfirmationDocument2 pagesIKEA Order Details ConfirmationVivek JainNo ratings yet

- Ivery Store LLCDocument2 pagesIvery Store LLCtcamon26No ratings yet

- 2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPODocument6 pages2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPOVernn100% (1)

- Pakistan Country Strategy Paper (2002-2006)Document41 pagesPakistan Country Strategy Paper (2002-2006)Irshad DsiNo ratings yet

- Supreme Court of the Philippines rules on Atlas Consolidated Mining VAT refund claimsDocument20 pagesSupreme Court of the Philippines rules on Atlas Consolidated Mining VAT refund claimsmarc abellaNo ratings yet

- KYC - Part1 Archna Share KhanDocument27 pagesKYC - Part1 Archna Share Khanshashwat shuklaNo ratings yet

- Mulakath Cafe Labour LicenceDocument1 pageMulakath Cafe Labour LicencesrikanthNo ratings yet

- Typical Details of Switchyard RequirementDocument364 pagesTypical Details of Switchyard RequirementEspro100% (1)

- Panggilan RUPS 2021 EngDocument3 pagesPanggilan RUPS 2021 EngFani Dwi Putra100% (1)

- Construction Sites Safety Regulations Hoist Report FormDocument1 pageConstruction Sites Safety Regulations Hoist Report FormChen ManNo ratings yet

- Master Sub-Fee Protection Agreement With Participants' Full DetailsDocument8 pagesMaster Sub-Fee Protection Agreement With Participants' Full DetailsAlexandre Poignant-spalikowski100% (7)

- Ghana Revenue Authority - WikipediaDocument4 pagesGhana Revenue Authority - Wikipediaako akoNo ratings yet

- Registration Act, 1908 SummaryDocument56 pagesRegistration Act, 1908 SummaryaskNo ratings yet

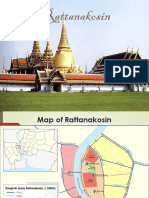

- Early Rattanakosin PeriodDocument54 pagesEarly Rattanakosin Periodputana kesornsitNo ratings yet