Professional Documents

Culture Documents

Early May

Early May

Uploaded by

John Paul GroomCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Early May

Early May

Uploaded by

John Paul GroomCopyright:

Available Formats

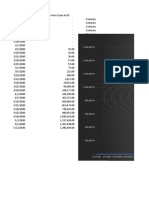

Early May – Stock Market Developments

Stock Market in Crisis

April 1 - May 6

110,0%

105,0%

100,0%

95,0%

90,0%

85,0%

2/ 201

4/ 10

6/ 010

8/ 010

2/ 201

4/ 10

6/ 010

31

10 010

12 201

14 201

16 201

18 201

20 201

22 201

24 201

26 201

28 201

30 201

4/

4/

5/

5/

5/

4/

4/

/3

/4 0

/4 0

/4 0

/4 0

/4 0

/4 0

/4 0

/4

/4 0

/4 0

/4 0

2

20 0

20

20 0

2

/

/

/

/

/

/

/

DJI FTSE CAC 40 HSI Ibovespa S&P

10

The stock markets of the world entered into panic today as the Dow Jones index fell

more than 9% at one point. The DJI closed down a more reasonable 3.2%, as did the

other USA index, the S&P, but nonetheless, the world is worried about the debt position

of the Greek Government and its repercussions in other countries such as Spain and

Portugal. In other markets, the CAC 40 was down 2.2%, the FTSE down only 1.5%,

perhaps the fall being mitigated by the expectation of a Conservative Government being

elected today. The Ibovespa was down 2.3%, and the HSI was down 1%, but with the

timing difference their market will be affected at their opening this evening.

However, looking at the time frame of the last 36 days, or since the beginning of April,

we find that the CAC 40 is down 10.5%, the IBovespa is down a full 10%, The FTSE is

down 7.4% and the HIS down 5.2%. The DJI and the S&P have fared a little better at a

loss of 3.1% and 3.5% respectively.

Taking a look at the Brazilian experience we can see funds flowing back to the safe

havens, and the dollar/ real rate, which momentarily reached 1.90 today, having been

1.73 last week, closed at 1.83. A fall in the Ibovespa of 10% can only be seen as a major

readjustment of the value of the Brazilian market.

You might also like

- Stock Market BasicsDocument22 pagesStock Market BasicsAbhishek100% (4)

- Bonds Payable 4Document6 pagesBonds Payable 4charlene kate bunaoNo ratings yet

- Warren BuffettDocument6 pagesWarren BuffettTeddy RusliNo ratings yet

- The Mergers & Acquisitions Review: Law Business ResearchDocument45 pagesThe Mergers & Acquisitions Review: Law Business ResearchKennedy OgonjiNo ratings yet

- Accounting Mechanics Basic RecordsDocument30 pagesAccounting Mechanics Basic Recordsvaibhav bhavsarNo ratings yet

- Private Placement Memorandum Template 04Document105 pagesPrivate Placement Memorandum Template 04charliep8No ratings yet

- Speaker Title, SAP AG: Risk Management in ContextDocument23 pagesSpeaker Title, SAP AG: Risk Management in ContextIvàn HernàndezNo ratings yet

- PruLink Surrender Form PDFDocument4 pagesPruLink Surrender Form PDFHui Jia JunnNo ratings yet

- Agreement With Client - SampleDocument8 pagesAgreement With Client - SampleChishty Shai Nomani100% (2)

- Employee Stock Option Agreement Template: How To Use This TemplateDocument11 pagesEmployee Stock Option Agreement Template: How To Use This TemplateZhaye100% (1)

- The Stock Market FallsDocument2 pagesThe Stock Market FallsJohn Paul GroomNo ratings yet

- SM - New YearDocument2 pagesSM - New YearJohn Paul GroomNo ratings yet

- The Stock Market in AprilDocument3 pagesThe Stock Market in AprilJohn Paul GroomNo ratings yet

- The Stock Market in AprilDocument3 pagesThe Stock Market in AprilJohn Paul GroomNo ratings yet

- The Stock Market in MayDocument2 pagesThe Stock Market in MayJohn Paul GroomNo ratings yet

- The Stock Market in MarchDocument2 pagesThe Stock Market in MarchJohn Paul GroomNo ratings yet

- 2G Cell Level 20180608 1513Document252 pages2G Cell Level 20180608 1513NangNo ratings yet

- Cut List - Bill of Materials: Finish Size Rough Size FeetDocument1 pageCut List - Bill of Materials: Finish Size Rough Size Feetbhstudent_537083349No ratings yet

- Dorm 3 3RD Term 2024Document2 pagesDorm 3 3RD Term 2024niyomugaba eustacheNo ratings yet

- Stock Market DevelopmentsDocument2 pagesStock Market DevelopmentsJohn Paul GroomNo ratings yet

- Semana de Acostumbramiento: Topoli Cachona Muñeca Bonita Negra MariposaDocument3 pagesSemana de Acostumbramiento: Topoli Cachona Muñeca Bonita Negra Mariposadeisy contrerasNo ratings yet

- Final Porfolio PaperDocument15 pagesFinal Porfolio PaperDeep DualNo ratings yet

- Cross Asset Technical VistaDocument20 pagesCross Asset Technical VistaanisdangasNo ratings yet

- Notas Corte III PUBLICADADocument4 pagesNotas Corte III PUBLICADAloaizaj969No ratings yet

- VC Fund Tear SheetDocument1 pageVC Fund Tear SheetVik LNo ratings yet

- Anti-Crisis Measures of Economic Policy in Lithuania and in Other Baltic CountriesDocument8 pagesAnti-Crisis Measures of Economic Policy in Lithuania and in Other Baltic CountriesDragan KaranovicNo ratings yet

- Google TrendsDocument65 pagesGoogle TrendsAshish GondaneNo ratings yet

- 3 Form 20 Format CorrectedDocument1 page3 Form 20 Format CorrectedNor-jaypah Maca-acoNo ratings yet

- Cross Asset Technical VistaDocument19 pagesCross Asset Technical VistaanisdangasNo ratings yet

- Cotton: World Markets and Trade: Franc-Zone Africa Exportable Supplies StabilizeDocument26 pagesCotton: World Markets and Trade: Franc-Zone Africa Exportable Supplies Stabilizemlganesh666No ratings yet

- Día Horas Normales Horas Extras Total Horas LaboradasDocument5 pagesDía Horas Normales Horas Extras Total Horas LaboradasJames BrownNo ratings yet

- Actual Daily Cash Disbursement: 1.regional Office Proper 2. Division of AuroraDocument24 pagesActual Daily Cash Disbursement: 1.regional Office Proper 2. Division of AuroraMaria Salmiyah Cruz CruzNo ratings yet

- UT Performance 24-04-2018Document13 pagesUT Performance 24-04-2018AnilkumarGopinathanNairNo ratings yet

- EN Memo Meat Processing Plant in Ukraine Confidential PDFDocument32 pagesEN Memo Meat Processing Plant in Ukraine Confidential PDFТарас ГолубNo ratings yet

- Complex Gantt Chart Template: Project Title Project Manager Company Name Project Start DateDocument25 pagesComplex Gantt Chart Template: Project Title Project Manager Company Name Project Start DatehichemokokNo ratings yet

- Penggantian Jambatan Ft136/014/50 Chelong, Bandar Baharu, KedahDocument2 pagesPenggantian Jambatan Ft136/014/50 Chelong, Bandar Baharu, KedahKyoko ChanNo ratings yet

- AVO - Avocado Tree Growth CycleDocument34 pagesAVO - Avocado Tree Growth CycleMeggie DuongNo ratings yet

- Coating Rejection Report April 2024 GmailDocument49 pagesCoating Rejection Report April 2024 Gmailquality3No ratings yet

- GEP June 2020 Chapter1 Fig1.1 1.10Document242 pagesGEP June 2020 Chapter1 Fig1.1 1.10Ronald Pally OrtizNo ratings yet

- Phil IRI-APPENDIX-B1-Pangkatang Pagtatasa Sa PagbasaDocument30 pagesPhil IRI-APPENDIX-B1-Pangkatang Pagtatasa Sa PagbasaLorielee May PadillaNo ratings yet

- Covid19 CoahuilaDocument2 pagesCovid19 CoahuilaPERLA MARBELLA GUTIERREZ MARTINEZNo ratings yet

- Effects of Food Price Inflation On Infant and Child Mortality in Developing CountriesDocument17 pagesEffects of Food Price Inflation On Infant and Child Mortality in Developing CountriesbibrevNo ratings yet

- What Is The Economic Outlook For OECD Countries?: An Interim AssessmentDocument17 pagesWhat Is The Economic Outlook For OECD Countries?: An Interim AssessmentJohn RotheNo ratings yet

- Tottenham Case SolutionDocument14 pagesTottenham Case SolutionVivek SinghNo ratings yet

- Borang Transit Sains T2Document6 pagesBorang Transit Sains T2NITTIE HASNIDAR BINTI MD JASIN MoeNo ratings yet

- IMF - WEO - 202004 - Statistical Appendix - Tables A PDFDocument15 pagesIMF - WEO - 202004 - Statistical Appendix - Tables A PDFAnna VassilovskiNo ratings yet

- A452 2020 16 - GadzhiDocument17 pagesA452 2020 16 - GadzhiAdina GamaNo ratings yet

- Abril: Data Português Informática Matemática Total MédiaDocument2 pagesAbril: Data Português Informática Matemática Total MédiaJorginio GomesNo ratings yet

- EP ModelDocument17 pagesEP ModelToby ChungNo ratings yet

- data-export-UV PV Headline (Dec 10-16) FinalDocument433 pagesdata-export-UV PV Headline (Dec 10-16) Finalamos amosNo ratings yet

- Economic Outlook: Converging HigherDocument19 pagesEconomic Outlook: Converging HigherTomTomNo ratings yet

- OECD's Interim AssessmentDocument23 pagesOECD's Interim AssessmentTheGlobeandMailNo ratings yet

- Economic Update and Outlook: Key Issues For 2011Document21 pagesEconomic Update and Outlook: Key Issues For 2011TrevorCrouchNo ratings yet

- Data Interpretation - 1Document6 pagesData Interpretation - 1Sahil AroraNo ratings yet

- Corn Flakes Producing PlantDocument28 pagesCorn Flakes Producing PlantLakew100% (1)

- Monthly Report: 1. General InformationDocument1 pageMonthly Report: 1. General InformationBeatrice NicoletaNo ratings yet

- Doing Business in China Doing Business in China Doing Business in China Doing Business in ChinaDocument19 pagesDoing Business in China Doing Business in China Doing Business in China Doing Business in ChinaMichael BussNo ratings yet

- Corona Virus Cases USADocument3 pagesCorona Virus Cases USAIrakli SaliaNo ratings yet

- IIF Portfolio Equity Flows Tracker IIF Portfolio Debt Flows TrackerDocument10 pagesIIF Portfolio Equity Flows Tracker IIF Portfolio Debt Flows TrackerLenuta CekaNo ratings yet

- IIFLAMC Multicap Advantage Presentation Online Version December 2017Document32 pagesIIFLAMC Multicap Advantage Presentation Online Version December 2017paresh revarNo ratings yet

- Fitness Progress Chart For Saleem: Height (Feet) Height (Inches) Estimated Body Mass Index (BMI)Document4 pagesFitness Progress Chart For Saleem: Height (Feet) Height (Inches) Estimated Body Mass Index (BMI)ehusainNo ratings yet

- January 2012 Market UpdateDocument10 pagesJanuary 2012 Market UpdateCaio Henrique GonçalvesNo ratings yet

- Monthly Economic Bulletin: January 2011Document15 pagesMonthly Economic Bulletin: January 2011lrochekellyNo ratings yet

- Eficiencias Conver B p2Document14 pagesEficiencias Conver B p2Ervin NietoNo ratings yet

- Darren Weekly Report 47Document6 pagesDarren Weekly Report 47DarrenNo ratings yet

- Slide 1: Global Fiscal Crisis of 2007-08Document12 pagesSlide 1: Global Fiscal Crisis of 2007-08RUSHABH DESAINo ratings yet

- Kpi SheetDocument18 pagesKpi SheetkajalNo ratings yet

- Unit 1 Introduction To International Economics August 2023Document16 pagesUnit 1 Introduction To International Economics August 2023fernandoNo ratings yet

- The Stock Market in MayDocument2 pagesThe Stock Market in MayJohn Paul GroomNo ratings yet

- The Stock Market FallsDocument2 pagesThe Stock Market FallsJohn Paul GroomNo ratings yet

- The Stock Market in AprilDocument3 pagesThe Stock Market in AprilJohn Paul GroomNo ratings yet

- The Stock Market in AprilDocument3 pagesThe Stock Market in AprilJohn Paul GroomNo ratings yet

- The Brazilian Balance of PaymentsDocument2 pagesThe Brazilian Balance of PaymentsJohn Paul GroomNo ratings yet

- The Stock Market in MarchDocument2 pagesThe Stock Market in MarchJohn Paul GroomNo ratings yet

- Pac 2Document2 pagesPac 2John Paul GroomNo ratings yet

- Its Well To Remember That Risk EvaluationDocument2 pagesIts Well To Remember That Risk EvaluationJohn Paul GroomNo ratings yet

- Stock Market Parts Feb 10Document2 pagesStock Market Parts Feb 10John Paul GroomNo ratings yet

- A Primer - Part 1Document4 pagesA Primer - Part 1John Paul GroomNo ratings yet

- Compaign 2010Document2 pagesCompaign 2010John Paul GroomNo ratings yet

- SM - New YearDocument2 pagesSM - New YearJohn Paul GroomNo ratings yet

- Stock Market DevelopmentsDocument2 pagesStock Market DevelopmentsJohn Paul GroomNo ratings yet

- FM-2 - Course Outline 2019Document4 pagesFM-2 - Course Outline 2019NikhilaNo ratings yet

- XADVAC2 Notes To Buscom PDFDocument4 pagesXADVAC2 Notes To Buscom PDFbrianneNo ratings yet

- F 2553Document3 pagesF 2553alpinetigerNo ratings yet

- Dynamic Asset AllocationDocument29 pagesDynamic Asset AllocationAmaan Al WaasiNo ratings yet

- F-2019 PSC Annual Report With FS SR - PSE3Document251 pagesF-2019 PSC Annual Report With FS SR - PSE3Peter ParkerNo ratings yet

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- Managerial Finance - Ch. 1 - May 2022Document11 pagesManagerial Finance - Ch. 1 - May 2022thomasNo ratings yet

- Fairchem Organics LimitedDocument16 pagesFairchem Organics Limitedsaipavan999No ratings yet

- Code Ethics Nov 2022Document28 pagesCode Ethics Nov 2022Priyam KatariaNo ratings yet

- Ratio AnalysisDocument11 pagesRatio AnalysispalowanNo ratings yet

- Sproutfi Fee ScheduleDocument4 pagesSproutfi Fee Schedulediego MendesNo ratings yet

- Negotiable Instruments Outline Chapter 1 3Document22 pagesNegotiable Instruments Outline Chapter 1 3Nina Beatrice MasilangNo ratings yet

- The Relationship of Compliance with the Philippine Stock Exchange Corporate Governance Guidebook and Return Of Equity of Selected Publicly Listed Companies in The Philippines For The Reporting Years 2012 and 2013Document86 pagesThe Relationship of Compliance with the Philippine Stock Exchange Corporate Governance Guidebook and Return Of Equity of Selected Publicly Listed Companies in The Philippines For The Reporting Years 2012 and 2013dyanmerz.tolentinoNo ratings yet

- Hold Hold Hold Hold: VST Industries LimitedDocument10 pagesHold Hold Hold Hold: VST Industries LimitedSwamiNo ratings yet

- Part II Incorporation and Corporate ExistenceDocument7 pagesPart II Incorporation and Corporate ExistenceMeAnn TumbagaNo ratings yet

- Institutions Assisting EntrepreneursDocument60 pagesInstitutions Assisting EntrepreneursVaibhav Arwade0% (1)

- Simple Interest Worksheet 1Document2 pagesSimple Interest Worksheet 1vajoorbiNo ratings yet

- English 2 ExercisesDocument12 pagesEnglish 2 Exercisesislam hamdyNo ratings yet

- GrizzlyRock 2013 Annual Investor LetterDocument12 pagesGrizzlyRock 2013 Annual Investor Letterfab62No ratings yet

- 1285760544turn092910webDocument32 pages1285760544turn092910webCoolerAdsNo ratings yet

- National Feed Mill Limited: Date Paltan Community CenterDocument2 pagesNational Feed Mill Limited: Date Paltan Community CenterNavid Anjum AaditNo ratings yet