Professional Documents

Culture Documents

Rajiv Rinn Yojana (RRY)

Rajiv Rinn Yojana (RRY)

Uploaded by

Rahul DhimanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rajiv Rinn Yojana (RRY)

Rajiv Rinn Yojana (RRY)

Uploaded by

Rahul DhimanCopyright:

Available Formats

5/4/2015

RajivRinnYojana(RRY)

MinistryofHousingandUrbanPovertyAlleviation

GovernmentofIndia

RajivRinnYojana

RajivRinnYojana(RRY)isaninstrumenttoaddressthehousingneedsoftheEWS/LIGsegmentsinurbanareas,throughenhanced

credit flow. It is also formulated to channelize institutional credit to the poorer segments of the society and increasing home

ownership in the country along with addressing housing shortage. RRY has been formulated by modifying the Interest Subsidy

Scheme for Housing the Urban Poor (ISHUP) piloted in the 11th Plan period with enhanced scope and coverage. RRY is a Central

SectorSchemeapplicableinalltheurbanareasoftheCountry.

RRYprovidesforinterestsubsidyof5%(500basispoints)onloansgrantedtoEWSandLIGcategoriestoconstructtheirhousesor

extendtheexistingones.LoanupperlimitRs5lakhforEWSand8lakhforLIGinterestsubsidywould,however,belimitedtothe

firstRs5lakhoftheloanamount,incasetheloanexceedsthisamount.

Rajiv Rinn Yojana is a target driven scheme. The overall target for the 12th Plan period is 1 million (or 10 lakh) dwellings across

countryincludingslumandnonslumdwellers.TheTargetsfortheStatesforthecurrentFinancial Year (201314) are periodically

fixedandconveyedtotheconcerneddepartment(s).

Housing and Urban Development Corporation (HUDCO) and National Housing Bank (NHB) have been designated as the Central

NodalAgenciesfortheScheme.

http://www.mhupa.gov.in/RRY/RRY_Page.htm

ImportantLinks

Guidelines

RRYGuidelines:(English)(Hindi)

OperationalGuidelines

StateTargetsforFY201415

PresentationonRRY

MinutesofMeeting

Meetingheldon25thSeptember2013with

HeadsofBanksandHFIs

CompendiumofqueriesraisedonRRYand

responsesofMoHUPA

IncomeCertifyingOfficialsforRRY

Contacts

KeyContacts

KeyCNAContacts

CreditRiskGuaranteeFund

GazetteNotification

FAQs

GuidelinesforLendingInstitutions

ThelistofBanksthathavesignedtheMoU

forCRGF

RefinanceSchemes

UrbanHousingFundRefinanceScheme

SpecialRefinanceSchemeforLowIncome

housing

RefinanceSchemeforConstruction

FinanceforAffordableHousing

1/1

You might also like

- Poverty Alleviation Programmes in India Since 1950s-A Critical AnalysisDocument18 pagesPoverty Alleviation Programmes in India Since 1950s-A Critical Analysisalligater_007No ratings yet

- Govt SchemesDocument5 pagesGovt SchemesNavneet KumarNo ratings yet

- Ministry of Housing and Urban AffairsDocument24 pagesMinistry of Housing and Urban AffairsNeha RathoreNo ratings yet

- Poverty SchemesDocument3 pagesPoverty Schemesharsha143saiNo ratings yet

- Rural DevelopmentDocument13 pagesRural DevelopmentUpmeet SinghNo ratings yet

- Report On Trend and Progress of Housing in India 2013Document15 pagesReport On Trend and Progress of Housing in India 2013Nihar NanyamNo ratings yet

- Rajiv Rinn Yojana (RRY) : October 2013Document9 pagesRajiv Rinn Yojana (RRY) : October 2013Sudheer MacNo ratings yet

- Pradhan Mantri Awas Yojna FAQ PDFDocument2 pagesPradhan Mantri Awas Yojna FAQ PDFPratul ShindeNo ratings yet

- Rural Development Schemes Part 1Document6 pagesRural Development Schemes Part 1SatyendraYadavNo ratings yet

- Housing: Schemes For Lig/EwsDocument12 pagesHousing: Schemes For Lig/EwsKripa SriramNo ratings yet

- Swarnajayanti Gram Swarojgar Yojna: ObjectiveDocument6 pagesSwarnajayanti Gram Swarojgar Yojna: ObjectiveRaj KumarNo ratings yet

- Punjab 55ndcDocument29 pagesPunjab 55ndcAbhishek RampalNo ratings yet

- Self-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeDocument7 pagesSelf-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeVirender KulhariaNo ratings yet

- GHJHJKDocument16 pagesGHJHJKCheGanJiNo ratings yet

- Popular Schemes: Swarnajayanti Gram Swarojgar Yojna TopDocument6 pagesPopular Schemes: Swarnajayanti Gram Swarojgar Yojna TopTania SahaNo ratings yet

- Poverty Alleviation Programmes in IndiaDocument17 pagesPoverty Alleviation Programmes in IndiaAppa TikoreNo ratings yet

- Poverty Alleviation Programmes in IndiaDocument6 pagesPoverty Alleviation Programmes in IndiaMohana Ramasamy100% (1)

- Priority Sector Financing and Government InitiativesDocument25 pagesPriority Sector Financing and Government InitiativesgokulNo ratings yet

- Self-Employment Programmes-Integrated Rural Development Programme (IRDP)Document7 pagesSelf-Employment Programmes-Integrated Rural Development Programme (IRDP)Amit KumarNo ratings yet

- Low Cost HousingDocument20 pagesLow Cost HousingYashvardhan Singh RajawatNo ratings yet

- Chapter-4 Housing and Basic ServicesDocument3 pagesChapter-4 Housing and Basic ServicesRitik GuptaNo ratings yet

- CLSS EWS LIG English Guidelines WBDocument36 pagesCLSS EWS LIG English Guidelines WBAnurag BabuNo ratings yet

- Salient Features of Indira Awas YojanaDocument6 pagesSalient Features of Indira Awas Yojanashardulpatil123No ratings yet

- Housing & Land EconomicDocument66 pagesHousing & Land EconomicDarshan BNo ratings yet

- 6 Banking and Financial ServicesDocument5 pages6 Banking and Financial ServicesSatish MehtaNo ratings yet

- Deendayal Antyodaya Yojana (National Urban Livelihoods Mission)Document18 pagesDeendayal Antyodaya Yojana (National Urban Livelihoods Mission)krishnaNo ratings yet

- Nabard - A New High: Highlights of NABARD's Operations During 2009-10Document6 pagesNabard - A New High: Highlights of NABARD's Operations During 2009-10Rohitt MathurNo ratings yet

- Rajiv Awas YojanaDocument23 pagesRajiv Awas YojanaRitika KherotiaNo ratings yet

- Guidelines For Himachal Pradesh State Rural Livelihoods Mission ImplementationDocument3 pagesGuidelines For Himachal Pradesh State Rural Livelihoods Mission ImplementationNitishNo ratings yet

- Status Guidelines PDFDocument3 pagesStatus Guidelines PDFNitishNo ratings yet

- Status Guidelines PDFDocument3 pagesStatus Guidelines PDFNitishNo ratings yet

- Mahatma Gandhi National Rural Employment Guarantee Ac1-1Document10 pagesMahatma Gandhi National Rural Employment Guarantee Ac1-1maneeshamberNo ratings yet

- 9TH Five Year PlanDocument4 pages9TH Five Year PlanPriyankPurwarNo ratings yet

- Rajiv Rinnyojana (Rry) : Operational GuidelinesDocument23 pagesRajiv Rinnyojana (Rry) : Operational Guidelinespavan6595No ratings yet

- Chapter - 11 Rural Development & Special Area ProgrammeDocument29 pagesChapter - 11 Rural Development & Special Area Programmemanoj kumarNo ratings yet

- Andhra Pradesh Social Welfare SchemesDocument8 pagesAndhra Pradesh Social Welfare SchemesranganadhaNo ratings yet

- Poverty Alleviation Programmes in India - WikipediaDocument6 pagesPoverty Alleviation Programmes in India - WikipediaSavitha SumathiNo ratings yet

- Strategizing Slum Improvement in India: A Method To Monitor and Refocus Slum Development ProgramsDocument31 pagesStrategizing Slum Improvement in India: A Method To Monitor and Refocus Slum Development ProgramsBabu Reddy ArNo ratings yet

- Development Programs in Budget 2009Document3 pagesDevelopment Programs in Budget 2009kirang gandhiNo ratings yet

- What Is Affordable HousingDocument4 pagesWhat Is Affordable HousingRanjani RavichandranNo ratings yet

- A Study On Reverse Mortgage Loan in Indian Prospects: Dr. K. Bal, Pooja KansalDocument9 pagesA Study On Reverse Mortgage Loan in Indian Prospects: Dr. K. Bal, Pooja KansalPooja KansalNo ratings yet

- Rathor SinghDocument16 pagesRathor SinghRajeev ChauhanNo ratings yet

- DAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Document9 pagesDAY - NULM (DAY - National Urban Livelihoods Mission) 'राष्ट्रीय शहरी आजीविका मिशन'Abinash MandilwarNo ratings yet

- Rajiv Awas Yojana (RAY) : Ar 503 Housing Slums in India 1Document11 pagesRajiv Awas Yojana (RAY) : Ar 503 Housing Slums in India 1RashiVarshneyNo ratings yet

- Schemes For Rural DevelopmentDocument11 pagesSchemes For Rural DevelopmentVyas NikhilNo ratings yet

- SGSY Redesigned As National Rural Livelihood MissionDocument8 pagesSGSY Redesigned As National Rural Livelihood Missionmanish_khabarNo ratings yet

- Government of Punjab: Captain Amarinder Singh Chief Minister, PunjabDocument20 pagesGovernment of Punjab: Captain Amarinder Singh Chief Minister, Punjabanon-826913No ratings yet

- Yojana Summary July '2018 Affordable Housing: Future of Urban DevelopmentDocument16 pagesYojana Summary July '2018 Affordable Housing: Future of Urban DevelopmentKARTIK DHARMANINo ratings yet

- RHISSDocument1 pageRHISSNehaNo ratings yet

- National Housing BankDocument13 pagesNational Housing BankRajasree VarmaNo ratings yet

- Rural and Ews SchemesDocument16 pagesRural and Ews SchemesprachiNo ratings yet

- Model State Affordable Housing Policy DraftDocument16 pagesModel State Affordable Housing Policy DraftShreyali AgarwalNo ratings yet

- Housing PolicyDocument31 pagesHousing PolicyxirochromeNo ratings yet

- DAY - NRLM (DAY - National Rural Livelihoods Mission) 'राष्ट्रीय ग्रामीण आजीविका मिशन'Document12 pagesDAY - NRLM (DAY - National Rural Livelihoods Mission) 'राष्ट्रीय ग्रामीण आजीविका मिशन'Abinash MandilwarNo ratings yet

- Indira Awas YojanaDocument13 pagesIndira Awas Yojanashardulpatil123No ratings yet

- Poverty Alleviation-List of Poverty Alleviation Programmes in in PDFDocument18 pagesPoverty Alleviation-List of Poverty Alleviation Programmes in in PDFJesusNo ratings yet

- Pmay UDocument37 pagesPmay UNikita AntonyNo ratings yet

- The Social Protection Indicator for the Pacific: Assessing ProgressFrom EverandThe Social Protection Indicator for the Pacific: Assessing ProgressNo ratings yet

- Wok Bung Wantaim: Using Subnational Government Partnerships to Improve Infrastructure Implementation in Papua New GuineaFrom EverandWok Bung Wantaim: Using Subnational Government Partnerships to Improve Infrastructure Implementation in Papua New GuineaNo ratings yet

- Bangkok, Thailand, Rapid Transit System Case Study (Transportation)Document8 pagesBangkok, Thailand, Rapid Transit System Case Study (Transportation)Rahul DhimanNo ratings yet

- Bachelor of Technology (Civil Engineering), SEVENTH Semester, April-2015Document1 pageBachelor of Technology (Civil Engineering), SEVENTH Semester, April-2015Rahul DhimanNo ratings yet

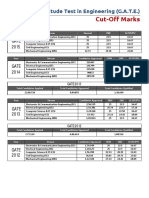

- Cut-Off Marks: Graduate Aptitude Test in Engineering (G.A.T.E.)Document2 pagesCut-Off Marks: Graduate Aptitude Test in Engineering (G.A.T.E.)Rahul DhimanNo ratings yet

- Policies: Housing and Urban Policy in IndiaDocument1 pagePolicies: Housing and Urban Policy in IndiaRahul DhimanNo ratings yet

- One World Trade CenterDocument1 pageOne World Trade CenterRahul DhimanNo ratings yet