Professional Documents

Culture Documents

Lahore Garrison University: Course Objectives

Uploaded by

Mazhar Farid ChishtiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lahore Garrison University: Course Objectives

Uploaded by

Mazhar Farid ChishtiCopyright:

Available Formats

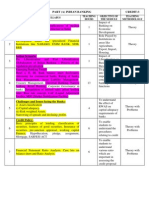

LAHORE GARRISON UNIVERSITY

Main Campus, Phase VI, Sector C, DHA, Lahore

DEPARTMENT OF BUSINESS MANAGEMENT

Syllabus Breakdown

Subject Title:

MBA

Teacher:

Financial Institutions

Mazhar Farid Chishti

Class:

Credit Hour:

COURSE OBJECTIVES

This course develops the understanding of structure and functions of financial

institutions. In economics financial markets channel funds from lenders to

borrowers. It explains the mechanism that allows people to easily buy and sell

(trade) financial securities and commodities and other fungible items.

Time period

Week One

Week Two

Week Three

Week Four

Week Five

Week Six

Week Seven

Week Eight

Week Nine

Topics to be covered

The Financial System: Introduction and basic concepts

of Financial System, Function of Financial System and

Financial Instruments.

Globalization of Financial Markets: Financial Institutions

and its classification

The Banking Sector: Introduction and main activities of

banking. Non-banking Financial Institutions, Contractual

Saving Institutions.

Finance Companies: Money Market Corporations, Nonbank Depository Institutions, Managed Funds. Public

unit trust.

The Share Market and Corporations: The Nature of

Corporations, The Share Market and its types, the

development of Share Market.

Growth in Debt Market: factors affecting the supply of

Credit, factors affecting the demand of debt, interaction

between supply and demand, short-term debt.

Trade Credit: intercompany loans, bank overdraft, Fully

drawn advances (FDA), Commercial bills, Promissory

notes, Negotiable Certificate of deposits.

Inventory Notes: Medium to long-term debt, Term Loans

and Mortgage Finance. Debentures and Unsecured

loans and subordinate debt. Leasing and types of

Lease. Project and Structured Finance.

Government Debt Market and Monetary Policy: impact

on the system liquidity. Exchange settlement accounts.

Week Ten

Week

Week

Week

Week

Week

Eleven

Twelve

Thirteen

Fourteen

Fifteen

The Foreign Exchange Market Participants and

Mechanics: market Participants, the operation of FX

Market, Spot Market Quotations.

Foreign exchange risk identification and management.

Measuring transaction exposure

Risk management:

Market base hedging techniques

Internal hedging techniques

Recommended Books:

1- Financial Markets and Institutions (Fifth Edition) by Frederic S.

Mishkin, Stanely G. Eakins

2- Financial Institutions, Instruments and Markets (Third Edition) by

Christopher Viney

Grading Policy

Grades will be awrded as per the LGU grading Policy which is given below;

Mid-term

25%

Final-term

50%

Sessional Marks 25%

You might also like

- Baf 2203Document90 pagesBaf 2203geoffrey oodhiambNo ratings yet

- Cib CoursesDocument10 pagesCib CoursesEnusah AbdulaiNo ratings yet

- Money and Banking Course at University of GujratDocument4 pagesMoney and Banking Course at University of GujratTajalli Fatima0% (1)

- Financial Markets and Institutions: Nguyen Quang Minh Nhi Email: Nhinqm@due - Edu.vnDocument52 pagesFinancial Markets and Institutions: Nguyen Quang Minh Nhi Email: Nhinqm@due - Edu.vnKhải NguyễnNo ratings yet

- Chapter_4_Regulation_of_Financial_Markets_and_Institutions_2Document12 pagesChapter_4_Regulation_of_Financial_Markets_and_Institutions_2KalkayeNo ratings yet

- Financial Markets & Institutions IntroductionDocument80 pagesFinancial Markets & Institutions IntroductionAnonymous LUvUBT60pnNo ratings yet

- UNIT-1 Financial System and Money MarketDocument28 pagesUNIT-1 Financial System and Money MarketashishNo ratings yet

- Money, Banking and Financial Markets (HS5340)Document8 pagesMoney, Banking and Financial Markets (HS5340)Amit JhaNo ratings yet

- FIMSDocument264 pagesFIMSPrakash ReddyNo ratings yet

- UNIT-1 Financial System and Money MarketDocument28 pagesUNIT-1 Financial System and Money MarketashishNo ratings yet

- Framework of Financial MarketDocument30 pagesFramework of Financial MarketAbhimanyu ChoudharyNo ratings yet

- Lectures on Financial MarketsDocument45 pagesLectures on Financial MarketsranchoreNo ratings yet

- Landscape of Financial Services: Section - ADocument12 pagesLandscape of Financial Services: Section - Aanjney050592No ratings yet

- Teaching Notes FMI 342Document162 pagesTeaching Notes FMI 342Hemanth KumarNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Course Outline For Financial Instituions and MarketsDocument2 pagesCourse Outline For Financial Instituions and MarketsAbdiNo ratings yet

- 01.08.2022 FIM Outline 3 CreditDocument3 pages01.08.2022 FIM Outline 3 CreditRAUSHAN KUMARNo ratings yet

- Financial Market and Services Bba 2 Notes 1Document18 pagesFinancial Market and Services Bba 2 Notes 1Sneha AroraNo ratings yet

- Unit 1 MBS FIMDocument16 pagesUnit 1 MBS FIMSarun ChhetriNo ratings yet

- Issue ManagementDocument194 pagesIssue ManagementBubune KofiNo ratings yet

- FDB103_MODULE-1Document51 pagesFDB103_MODULE-1knwb9ny78jNo ratings yet

- Money & Banking BBA 5thDocument2 pagesMoney & Banking BBA 5thMehmud Raffæy0% (1)

- Financial Institutions, Markets and SurveysDocument79 pagesFinancial Institutions, Markets and SurveysTyson KhanNo ratings yet

- Af-302 - Financial Markets and InstitutionsDocument2 pagesAf-302 - Financial Markets and InstitutionsFuadNo ratings yet

- Module 1-5 in Financial MarketsDocument55 pagesModule 1-5 in Financial MarketsMixx MineNo ratings yet

- Module 1-3 in Financial MarketsDocument34 pagesModule 1-3 in Financial MarketsMixx MineNo ratings yet

- 09 Chapter 2Document76 pages09 Chapter 2Roshan RahejaNo ratings yet

- Module 1-2 in Financial MarketsDocument25 pagesModule 1-2 in Financial MarketsMixx MineNo ratings yet

- Course OutlineDocument2 pagesCourse Outlineraina mattNo ratings yet

- Chapter 5 - Overview of The Financial SystemDocument12 pagesChapter 5 - Overview of The Financial SystemMerge MergeNo ratings yet

- Management of Financial ServicesDocument76 pagesManagement of Financial ServicesVickey Chouhan100% (2)

- JSK 888@Document23 pagesJSK 888@YomboNo ratings yet

- Bharathidasan University MBA Elective Course Merchant BankingDocument257 pagesBharathidasan University MBA Elective Course Merchant BankingParivel ParivelNo ratings yet

- Financial Ins & MKTDocument7 pagesFinancial Ins & MKTdkaluale16No ratings yet

- Banking Practice & Proc. Course OutlineDocument5 pagesBanking Practice & Proc. Course OutlineSuresh Vadde50% (2)

- FINANCIAL INSTITUTIONS AND CAPITAL MARKETS course outlineDocument2 pagesFINANCIAL INSTITUTIONS AND CAPITAL MARKETS course outlineAbdifatah Ahmed HurreNo ratings yet

- Saunders Notes PDFDocument162 pagesSaunders Notes PDFJana Kryzl DibdibNo ratings yet

- Issue Management Ebook PDFDocument247 pagesIssue Management Ebook PDFLefty RenewangNo ratings yet

- Financial Market and Services Bba 2 NotesDocument5 pagesFinancial Market and Services Bba 2 Notesisha.raghuwanshi25No ratings yet

- FIM Course Outline and Lesson PlanDocument2 pagesFIM Course Outline and Lesson Plansehrish iqbalNo ratings yet

- Module 1 in Financial MarketsDocument8 pagesModule 1 in Financial MarketsMixx MineNo ratings yet

- Financial Markets, Institutions and Services (SAPR)Document4 pagesFinancial Markets, Institutions and Services (SAPR)VampireNo ratings yet

- Financial Markets and InstitutionsDocument5 pagesFinancial Markets and InstitutionsEng Abdikarim WalhadNo ratings yet

- Web Lesson 1Document3 pagesWeb Lesson 1api-3733468No ratings yet

- Chapter 3 The Role of Financial Institutions in The Economic Development of Malawi: Commercial Banks PerspectiveDocument27 pagesChapter 3 The Role of Financial Institutions in The Economic Development of Malawi: Commercial Banks PerspectiveBasilio MaliwangaNo ratings yet

- Introduction Financial System (Recovered) - 1Document76 pagesIntroduction Financial System (Recovered) - 1MaridasrajanNo ratings yet

- Week 2 - Monetary Policy and Central BankingDocument7 pagesWeek 2 - Monetary Policy and Central BankingRestyM PurcaNo ratings yet

- FICM Ch-IDocument27 pagesFICM Ch-IGuda GudetaNo ratings yet

- Introduction To Financial MarketDocument25 pagesIntroduction To Financial MarketMinh NguyễnNo ratings yet

- FINN 341A-Financial Institutions and Markets - Fall 2011Document8 pagesFINN 341A-Financial Institutions and Markets - Fall 2011BurakNo ratings yet

- ResearchDocument31 pagesResearchVerven Dela CruzNo ratings yet

- IFM ASSIGNMENT (FinalDocument24 pagesIFM ASSIGNMENT (Final0012 Shah Md. Arafat [C]No ratings yet

- Advanced Finance, Banking and Insurance SamenvattingDocument50 pagesAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNo ratings yet

- Financial ServicesDocument2 pagesFinancial ServicesRasika KambliNo ratings yet

- MBA 915-18 International Finance and Financial Derivatives: Unit IDocument3 pagesMBA 915-18 International Finance and Financial Derivatives: Unit IRk BainsNo ratings yet

- Financial Markets and Services-1Document117 pagesFinancial Markets and Services-1Nagu BabuNo ratings yet

- MBA-4year P-III 2nd Semester OutlineDocument5 pagesMBA-4year P-III 2nd Semester OutlineAnaassNo ratings yet

- 08 - Chapter 3 PDFDocument68 pages08 - Chapter 3 PDFJavedNo ratings yet

- Advanced Financial Instruments and Markets Course Guide BookDocument6 pagesAdvanced Financial Instruments and Markets Course Guide Bookfinancecottage100% (1)

- Books On Hazrat Khawja Moeen Ud Din Chishti R in EnglishDocument15 pagesBooks On Hazrat Khawja Moeen Ud Din Chishti R in EnglishMazhar Farid ChishtiNo ratings yet

- Capital Structure - Trda... and MMDocument18 pagesCapital Structure - Trda... and MMMazhar Farid ChishtiNo ratings yet

- Kse DataDocument115 pagesKse DataMazhar Farid ChishtiNo ratings yet

- Imporatnt Political Crimes Facebok and WebsitesDocument1 pageImporatnt Political Crimes Facebok and WebsitesMazhar Farid ChishtiNo ratings yet

- CF C 1Document26 pagesCF C 1Mazhar Farid ChishtiNo ratings yet

- Finance Courses Student Learning Outcomes: Updated August 2015Document19 pagesFinance Courses Student Learning Outcomes: Updated August 2015Mazhar Farid ChishtiNo ratings yet

- Beh. Finance and Capital StructureDocument20 pagesBeh. Finance and Capital StructureMazhar Farid ChishtiNo ratings yet

- Emerging Markets and The Future of Business History: Gareth Austin Carlos Dávila Geoffrey JonesDocument52 pagesEmerging Markets and The Future of Business History: Gareth Austin Carlos Dávila Geoffrey JonesMazhar Farid ChishtiNo ratings yet

- General Course Syllabus - MGT604 - Strategy MangementDocument7 pagesGeneral Course Syllabus - MGT604 - Strategy MangementRodrigo Uribe BravoNo ratings yet

- Cashflow Forecasting With Zero and Constant GrowthDocument36 pagesCashflow Forecasting With Zero and Constant GrowthMazhar Farid ChishtiNo ratings yet

- Mange. Beh and Capital StructureDocument21 pagesMange. Beh and Capital StructureMazhar Farid ChishtiNo ratings yet

- On ImperialismDocument4 pagesOn ImperialismMazhar Farid ChishtiNo ratings yet

- Kouba A 2013Document11 pagesKouba A 2013Mazhar Farid ChishtiNo ratings yet

- Regression Make SimpleDocument13 pagesRegression Make SimpleMazhar Farid ChishtiNo ratings yet

- Arbitrage InForeign CurrienciesDocument5 pagesArbitrage InForeign CurrienciesMazhar Farid ChishtiNo ratings yet

- 1 M & Pakistan BankingDocument11 pages1 M & Pakistan BankingMazhar Farid ChishtiNo ratings yet

- Be Hell For, Tanvir AnjumDocument22 pagesBe Hell For, Tanvir AnjumtanvirNo ratings yet

- ProspectTheory PDFDocument29 pagesProspectTheory PDFMazhar Farid ChishtiNo ratings yet

- 2Document10 pages2Mazhar Farid ChishtiNo ratings yet

- Alessandro Santoni and Arun R. KelshikerDocument1 pageAlessandro Santoni and Arun R. KelshikerMazhar Farid ChishtiNo ratings yet

- Forex 25 Aug 17Document12 pagesForex 25 Aug 17Mazhar Farid ChishtiNo ratings yet

- List of Ssci Journals PDFDocument57 pagesList of Ssci Journals PDFalicorpanaoNo ratings yet

- 3Document17 pages3Mazhar Farid ChishtiNo ratings yet

- 4 Top 571Document116 pages4 Top 571Mazhar Farid ChishtiNo ratings yet

- List of Library BooksDocument72 pagesList of Library BooksMazhar Farid Chishti0% (2)

- Vol. VII Issue - 12 December, 2016: Forward Premium and Forward ContractsDocument5 pagesVol. VII Issue - 12 December, 2016: Forward Premium and Forward ContractsMazhar Farid ChishtiNo ratings yet

- DR Obi Paper Derivatives in Islamic Finance - An Overview - Bank Negara-24th June 05Document35 pagesDR Obi Paper Derivatives in Islamic Finance - An Overview - Bank Negara-24th June 05SihamNo ratings yet

- Quantum Physics and SpiritualityDocument4 pagesQuantum Physics and SpiritualityMazhar Farid ChishtiNo ratings yet

- WCM Pro CTSX 2010Document13 pagesWCM Pro CTSX 2010Nguyen Xuan NguyenNo ratings yet

- Stock Market Volatility and Weak-Form Efficiency EvidenceDocument8 pagesStock Market Volatility and Weak-Form Efficiency Evidencemalik45No ratings yet