Professional Documents

Culture Documents

Jul-18-Dj Market Talk - U.S. Summary

Uploaded by

Miir ViirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jul-18-Dj Market Talk - U.S. Summary

Uploaded by

Miir ViirCopyright:

Available Formats

DJ MARKET TALK: U.S.

Summary

Sun Jul 18 16:18:00 EDT 2010

2018 GMT [Dow Jones] U.S. SUMMARY: Dollar fell Friday to lowest level since December

against yen, as disappointing economic news cast further doubt on pace of U.S. recovery. Euro

rose above $1.30 to 2-month high as concerns over euro-zone sovereign debt crisis continued to

fade with successful auctions of Portuguese and Spanish government debt. Disappointing U.S.

data, including Friday's worse-than-expected consumer sentiment figures, illustrate threat of

global economies lurching into "double-dip" recession, said Roberto Mialich, foreign-exchange

strategist at Unicredit MIB in Milan, noting his firm did not share such a pessimistic view of

global recovery. EUR/USD at 1.2927 late Friday vs 1.2900 late Thursday, USD/JPY at 86.61 vs

87.46, EUR/JPY at 111.95 vs 112.81, GBP/USD at 1.5298 vs 1.5412, USD/CHF at 1.0519 vs

1.0439. USD index at 82.535 vs 82.555. Stocks fell as decline in consumer sentiment added to

market's disappointment over weaker-than-expected 2Q revenue at Bank of America, down

9.2%. General Electric fell 4.6%, also on weaker-than-expected 2Q revenue. Citigroup fell 6.3%

after missing revenue expectations. Dow down 2.5%, Nasdaq down 3.1%, Philly semicons down

3.3%. Prices of Treasurys rose as soft consumer-sentiment report added to concerns about U.S.

economic outlook, bolstering demand for safe assets; 5-year yield down 6.5 bps to 1.678%, 10-

year yield down 4.7 bps to 2.932%. Gold futures slid to 8-week lows as strength in euro, weak

economic sentiment reduced demand. August comex gold settled down $20.10 to $1,188.20/oz.

Crude futures dropped, unable to resist following a sharp turn lower in U.S. equities; August

Nymex crude settled 61 cents lower at $76.01/bbl.

Disclaimer

(This article is general financial information, not personalized investment advice, as it does not

consider the unique circumstances affecting an individual reader's decision to buy or sell a

specific security. Dow Jones does not warrant the accuracy, completeness or timeliness of the

information in this article, and any errors will not be made the basis for any claim against Dow

Jones. The author does not invest in the instruments or markets cited in this article.)

You might also like

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceFrom EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceRating: 4 out of 5 stars4/5 (1)

- Aug 01 DJ Market Talk Us SummaryDocument1 pageAug 01 DJ Market Talk Us SummaryMiir ViirNo ratings yet

- Jul-16-DJ Forex Week AheadDocument2 pagesJul-16-DJ Forex Week AheadMiir ViirNo ratings yet

- Rally Momentum Fades After US GDP Data DisappointsDocument6 pagesRally Momentum Fades After US GDP Data DisappointsgkapurNo ratings yet

- Aug-01-Dj Forex Week AheadDocument2 pagesAug-01-Dj Forex Week AheadMiir ViirNo ratings yet

- 8-15-11 Steady As She GoesDocument3 pages8-15-11 Steady As She GoesThe Gold SpeculatorNo ratings yet

- Jun 29-6-06 00 Edt DJ World ForexDocument3 pagesJun 29-6-06 00 Edt DJ World ForexMiir ViirNo ratings yet

- N12 12062020 Safe-Haven Currencies Gain On Worries of Lingering Economic Pain by ReutersDocument3 pagesN12 12062020 Safe-Haven Currencies Gain On Worries of Lingering Economic Pain by ReutersSiddhant AggarwalNo ratings yet

- USD-Has The King Lost Its CrownDocument2 pagesUSD-Has The King Lost Its CrownriddhitodiNo ratings yet

- BPI Philippines - The Weekly Market Wrap 07/06/15Document4 pagesBPI Philippines - The Weekly Market Wrap 07/06/15Ian Kenneth BorjaNo ratings yet

- IBT Markets Outlook 31 January 2012Document3 pagesIBT Markets Outlook 31 January 2012Lawrence VillamarNo ratings yet

- JUL 07 DJ Forex FocusDocument3 pagesJUL 07 DJ Forex FocusMiir ViirNo ratings yet

- Regulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Document15 pagesRegulators Shut 5 Banks As 2010 Tally Hits 78: 3 Fla. Banks, 1 Each in Nev., Calif. Shut Down (AP)Albert L. PeiaNo ratings yet

- Degussa Marktreport Engl 22-07-2016Document11 pagesDegussa Marktreport Engl 22-07-2016richardck61No ratings yet

- Impact of U.S. Recession On India - An Empirical StudyDocument22 pagesImpact of U.S. Recession On India - An Empirical StudyashokdgaurNo ratings yet

- The Monarch Report 8-15-11Document4 pagesThe Monarch Report 8-15-11monarchadvisorygroupNo ratings yet

- Research Report 20 Dec 2023Document21 pagesResearch Report 20 Dec 2023tanmaymaltarNo ratings yet

- Questioning USD As Global Reserve CurrencyDocument8 pagesQuestioning USD As Global Reserve CurrencyVincentiusArnoldNo ratings yet

- Wall Street Rally Extends on Hopes for Eurozone ActionDocument4 pagesWall Street Rally Extends on Hopes for Eurozone ActionSusana Estefania Zurita NunezNo ratings yet

- Signs of Risk Aversion ReturnsDocument5 pagesSigns of Risk Aversion ReturnsValuEngine.comNo ratings yet

- The Day Ahead - April 10th 2013Document8 pagesThe Day Ahead - April 10th 2013wallstreetfoolNo ratings yet

- ArticleDocument2 pagesArticleLaura IacobNo ratings yet

- Jul 19 DJ Market Talk Asia OutlookDocument1 pageJul 19 DJ Market Talk Asia OutlookMiir ViirNo ratings yet

- Influencing On Worldwide Financial Markets, Recommendation and ConclusionDocument7 pagesInfluencing On Worldwide Financial Markets, Recommendation and Conclusionrahul_dipaniNo ratings yet

- Economic Report DailyDocument2 pagesEconomic Report DailySyamsul Huda PratamaNo ratings yet

- Weekly currency performance and outlookDocument5 pagesWeekly currency performance and outlookdineshganNo ratings yet

- 3Q2011 Markets Outlook USDocument12 pages3Q2011 Markets Outlook USsahil-madhani-3137No ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Us Debt Ceiling Crisis 1Document5 pagesUs Debt Ceiling Crisis 1Prakriti GuptaNo ratings yet

- Fundamental Analysis 23 October 08Document3 pagesFundamental Analysis 23 October 08Robert PetrucciNo ratings yet

- Weekly Commentary 5-14-12Document3 pagesWeekly Commentary 5-14-12Stephen GierlNo ratings yet

- US Stocks Fall 12%Document4 pagesUS Stocks Fall 12%perete69No ratings yet

- Market Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearDocument4 pagesMarket Commentary January 7, 2013 The Markets: 1-Week Y-T-D 1-Year 3-Year 5-Year 10-YearCLORIS4No ratings yet

- The Monarch Report 4/1/2013Document3 pagesThe Monarch Report 4/1/2013monarchadvisorygroupNo ratings yet

- 2014 October 17 Weekly Report UpdateDocument4 pages2014 October 17 Weekly Report UpdateAnthony WrightNo ratings yet

- Jun-10-DJ Asia Daily Forex OutlookDocument3 pagesJun-10-DJ Asia Daily Forex OutlookMiir ViirNo ratings yet

- Special Report USDINRDocument7 pagesSpecial Report USDINRtanishaj86No ratings yet

- Forex Round Up 06.12.09Document11 pagesForex Round Up 06.12.09Neha DhuriNo ratings yet

- The Monarch Report 4/29/2013Document3 pagesThe Monarch Report 4/29/2013monarchadvisorygroupNo ratings yet

- Today We Look at The Weekly ChartsDocument4 pagesToday We Look at The Weekly ChartsValuEngine.comNo ratings yet

- The Monarch Report 9-12-11Document4 pagesThe Monarch Report 9-12-11monarchadvisorygroupNo ratings yet

- Daily Currency Briefing: Agreement But No Happy EndDocument4 pagesDaily Currency Briefing: Agreement But No Happy EndtimurrsNo ratings yet

- 2012-06-04 LPL CommentaryDocument3 pages2012-06-04 LPL CommentarybgeltmakerNo ratings yet

- A Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. - The New York TimesDocument4 pagesA Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. - The New York TimesSunny YaoNo ratings yet

- The Day Ahead - April 17th 2013Document7 pagesThe Day Ahead - April 17th 2013wallstreetfoolNo ratings yet

- US Treasury Yields Going Up and US Dollar Fall-VRK100-30052009Document2 pagesUS Treasury Yields Going Up and US Dollar Fall-VRK100-30052009RamaKrishna Vadlamudi, CFANo ratings yet

- Sterling Outlook 2009Document8 pagesSterling Outlook 2009Drew WinterNo ratings yet

- Market Outlook Report 10 December 2012Document4 pagesMarket Outlook Report 10 December 2012zenergynzNo ratings yet

- DailyFX - US Dollar Index October 14 - 2014Document3 pagesDailyFX - US Dollar Index October 14 - 2014Helen BrownNo ratings yet

- Market Week-June 4, 2012Document2 pagesMarket Week-June 4, 2012Janet BarrNo ratings yet

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDocument2 pagesRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470No ratings yet

- Coronavirus: Fear Returns To Stock MarketsDocument47 pagesCoronavirus: Fear Returns To Stock MarketsFloramae PasculadoNo ratings yet

- Weekly Commentary 5-21-12Document3 pagesWeekly Commentary 5-21-12Stephen GierlNo ratings yet

- Treasury Daily 01 14 16Document5 pagesTreasury Daily 01 14 16patrick-lee ellaNo ratings yet

- Weekly Investment Commentary en UsDocument4 pagesWeekly Investment Commentary en UsbjkqlfqNo ratings yet

- The Diminshing USD ($) TrendDocument5 pagesThe Diminshing USD ($) TrendGilani, ObaidNo ratings yet

- Asian MarketsDocument3 pagesAsian MarketsDynamic LevelsNo ratings yet

- Nasty Day For Stocks: Dow Drops Over 200 Points: China and Cheap Oil Are Seriously Spooking The Markets. AgainDocument3 pagesNasty Day For Stocks: Dow Drops Over 200 Points: China and Cheap Oil Are Seriously Spooking The Markets. AgainAndres1984No ratings yet

- Market Outlook Report 26 November 2012Document4 pagesMarket Outlook Report 26 November 2012zenergynzNo ratings yet

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697No ratings yet

- AUG-10 Mizuho Technical Analysis EUR JPYDocument1 pageAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirNo ratings yet

- AUG 11 UOB Asian MarketsDocument2 pagesAUG 11 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 11 UOB Global MarketsDocument3 pagesAUG 11 UOB Global MarketsMiir ViirNo ratings yet

- AUG 11 DBS Daily Breakfast SpreadDocument6 pagesAUG 11 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis EUR USDDocument1 pageAUG-10 Mizuho Technical Analysis EUR USDMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis USD JPYDocument1 pageAUG-10 Mizuho Technical Analysis USD JPYMiir Viir100% (1)

- AUG 10 UOB Asian MarketsDocument2 pagesAUG 10 UOB Asian MarketsMiir ViirNo ratings yet

- AUG 10 UOB Global MarketsDocument3 pagesAUG 10 UOB Global MarketsMiir ViirNo ratings yet

- Westpack AUG 11 Mornng ReportDocument1 pageWestpack AUG 11 Mornng ReportMiir ViirNo ratings yet

- AUG-10 - Mizuho - Start The DayDocument2 pagesAUG-10 - Mizuho - Start The DayMiir ViirNo ratings yet

- Jyske Bank Aug 10 Equities DailyDocument6 pagesJyske Bank Aug 10 Equities DailyMiir ViirNo ratings yet

- AUG-10 Mizuho Technical Analysis GBP USDDocument1 pageAUG-10 Mizuho Technical Analysis GBP USDMiir ViirNo ratings yet

- Jyske Bank Aug 10 em DailyDocument5 pagesJyske Bank Aug 10 em DailyMiir ViirNo ratings yet

- AUG 10 DBS Daily Breakfast SpreadDocument8 pagesAUG 10 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- JYSKE Bank AUG 10 Corp Orates DailyDocument2 pagesJYSKE Bank AUG 10 Corp Orates DailyMiir ViirNo ratings yet

- AUG 10 DanskeTechnicalUpdateDocument1 pageAUG 10 DanskeTechnicalUpdateMiir ViirNo ratings yet

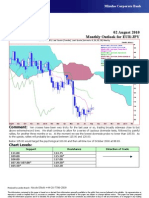

- AUG-02 Mizuho Monthly Outlook For USD JPYDocument1 pageAUG-02 Mizuho Monthly Outlook For USD JPYMiir ViirNo ratings yet

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDocument5 pagesMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirNo ratings yet

- Danske Daily: Key NewsDocument4 pagesDanske Daily: Key NewsMiir ViirNo ratings yet

- AUG 10 Danske Commodities DailyDocument8 pagesAUG 10 Danske Commodities DailyMiir ViirNo ratings yet

- Jyske Bank Aug 10 Market Drivers CommoditiesDocument3 pagesJyske Bank Aug 10 Market Drivers CommoditiesMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - JPYDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - JPYMiir ViirNo ratings yet

- AUG 10 Danske FlashCommentFOMC PreviewDocument7 pagesAUG 10 Danske FlashCommentFOMC PreviewMiir ViirNo ratings yet

- AUG-02 Mizuho Monthly Outlook For GBP USDDocument1 pageAUG-02 Mizuho Monthly Outlook For GBP USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR JPY GBPMiir ViirNo ratings yet

- Westpack AUG 10 Mornng ReportDocument1 pageWestpack AUG 10 Mornng ReportMiir ViirNo ratings yet

- AUG 10 Danske EMEADailyDocument3 pagesAUG 10 Danske EMEADailyMiir ViirNo ratings yet

- AUG-02 - Mizuho - Monthly Outlook For EUR - USDDocument1 pageAUG-02 - Mizuho - Monthly Outlook For EUR - USDMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURDocument1 pageAUG-09 Mizuho Weekly Technical Commentary GBP USD GBP EURMiir ViirNo ratings yet

- AUG-09 Mizuho Weekly Technical Commentary EUR USD JPYDocument1 pageAUG-09 Mizuho Weekly Technical Commentary EUR USD JPYMiir ViirNo ratings yet