Professional Documents

Culture Documents

PVT Vs Pub

PVT Vs Pub

Uploaded by

Upps Victory0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

pvt vs pub

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesPVT Vs Pub

PVT Vs Pub

Uploaded by

Upps VictoryCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 2

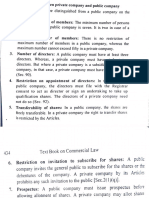

Difference between a Private Ltd.

And Public

Ltd. Company

Base Private Ltd. Public Ltd.

1. Minimum Paid-up A company to be Incorporated A Public Company must have

Capital : as a Private Company must a minimum paid-up capital of

have a minimum paid-up Rs. 5,00,000

capital of Rs. 1,00,000

2. Minimum number of Minimum number of members A Public Company requires

members : required to form a private atleast 7 members.

company is 2

3. Maximum number of Maximum number of There is no restriction of

members : members in a Private maximum number of

Company is restricted to 50 members in a Public

Company.

4. Transerferability of There is complete restriction There is no restriction on the

shares : on the transferability of the transferability of the shares of

shares of a Private Company a Public company

through its Articles of

Association

5 .Issue of Prospectus : A Private Company is A Public Company is free to

prohibited from inviting the invite public for subscription

public for subscription of its i.e., a Public Company can

shares, i.e. a Private issue a Prospectus.

Company cannot issue

Prospectus

6. Number of Directors : A Private Company may have A Public Company must have

2 directors to manage the atleast 3 directors.

affairs of the company

7. Consent of the directors : There is no need to give the The Directors of a Public

consent by the directors of a Company must have file with

Private Company the Registrar a consent to act

as Director of the company.

8. Qualification shares : The Directors of a Private The Directors of a Public

Company need not sign an Company are required to sign

undertaking to acquire the an undertaking to acquire the

qualification shares qualification shares of the

public Company

9. Commencement of A Private Company can A Public Company cannot

Business : commence its business start its business until a

immediately after its Certificate to commencement

incorporation of business is issued to it.

10. Shares Warrants : A Private Company cannot A Public Company can issue

issue Share Warrants against Share Warrants against its

its fully paid shares fully paid up shares.

11. Further issue of shares : A Private Company need not A Public Company has to offer

offer the further issue of the further issue of shares to

shares to its existing share its existing share holders as

holders right shares. Further issue of

shares can only be offer to the

general public with the

approval of the existing share

holders in the general meeting

of the share holders only.

12. Statutory meeting : A Private Company has no Public Company must call its

obligation to call the Statutory statutory Meeting and file

Meeting of the member, Statutory Report with the

Register of Companies.

13. Quorum : The quorum in the case of a In the case of a Public

Private Company is TWO Company FIVE members

members present personally must be present personally to

constitute quorum. However,

the Articles of Association

may provide and number of

members more than the

required under the Act.

14. Managerial These restrictions do not Total managerial

remuneration : apply on a Private Company. remuneration in the case of a

Public Company cannot

exceed 11% of the net profits,

and in case of inadequate

profits a maximum of Rs.

87,500 can be paid

15. Special privileges: A Private Company enjoys Are not available to a Public

some special privileges Company

You might also like

- Fixed Asset Management SOPDocument10 pagesFixed Asset Management SOPirene100% (1)

- Kinds of CompanyDocument20 pagesKinds of CompanyTshewang DemaNo ratings yet

- Littlefield - Strategy For SimulationDocument2 pagesLittlefield - Strategy For Simulationvarun manwanshNo ratings yet

- Assignment On: Business & Corporate LawDocument4 pagesAssignment On: Business & Corporate LawShahzad MalikNo ratings yet

- Law Implications in BusinessDocument5 pagesLaw Implications in Businessrocken samiunNo ratings yet

- Public & Private Co DistinguishDocument2 pagesPublic & Private Co Distinguishsaravana pandianNo ratings yet

- Difference Between A Public Company and A Private CompanyDocument1 pageDifference Between A Public Company and A Private CompanySutama ChowdhuryNo ratings yet

- Introdcution To LawDocument28 pagesIntrodcution To LawMonika KauraNo ratings yet

- Kinds of CompaniesDocument7 pagesKinds of CompaniesAt JainNo ratings yet

- Share Capital Materials-1 (Theory and Framework)Document18 pagesShare Capital Materials-1 (Theory and Framework)Joydeep DuttaNo ratings yet

- SKN Companies Act 1956Document65 pagesSKN Companies Act 1956Santosh DsNo ratings yet

- Public and Private CompanyDocument3 pagesPublic and Private CompanyGarima GarimaNo ratings yet

- Corporate Accounting Notes - FinalDocument211 pagesCorporate Accounting Notes - Finalvik jainNo ratings yet

- Company LawDocument15 pagesCompany Lawpreetibajaj100% (2)

- Joint Stock Company 1Document8 pagesJoint Stock Company 1MR PRONo ratings yet

- BOM Notes Ch-2Document39 pagesBOM Notes Ch-2Nivedita GoswamiNo ratings yet

- Public Company and Private Company by Prof. ReyazuddinDocument6 pagesPublic Company and Private Company by Prof. ReyazuddinSiddhesh BhosleNo ratings yet

- MCOW S22 011 Nouman AliDocument5 pagesMCOW S22 011 Nouman AliRumman IrfanNo ratings yet

- Corporate Environment NOTESDocument81 pagesCorporate Environment NOTESAoisheek Das83% (6)

- Chapter 6 Chapter 6 Accounting For Share Capital 1599071971656Document23 pagesChapter 6 Chapter 6 Accounting For Share Capital 1599071971656gyannibaba2007No ratings yet

- Chapter One:: What Is Company Act?Document6 pagesChapter One:: What Is Company Act?sakibarsNo ratings yet

- 4 6035054763190521470Document9 pages4 6035054763190521470Bulloo DheekkamaaNo ratings yet

- Difference Between Single Member CompanyDocument2 pagesDifference Between Single Member CompanySyed Kamran Bukhari100% (1)

- Steps and Procedure For Incorporation of The CompanyDocument34 pagesSteps and Procedure For Incorporation of The CompanyKiran KumarNo ratings yet

- Steps and Procedure For Incorporation of The CompanyDocument34 pagesSteps and Procedure For Incorporation of The Companysharukh1No ratings yet

- Assignment On Private Company Vs Public Company in eDocument5 pagesAssignment On Private Company Vs Public Company in eSaravanagsNo ratings yet

- Block II - Company AccountsDocument32 pagesBlock II - Company AccountsA Kaur MarwahNo ratings yet

- Different Between A Private Limited Company and A Public Limited CompanyDocument2 pagesDifferent Between A Private Limited Company and A Public Limited CompanyArslan SaleemNo ratings yet

- Isbr College: Bba 3 SEMESTER (2019-2020)Document13 pagesIsbr College: Bba 3 SEMESTER (2019-2020)bhargava-reddyNo ratings yet

- CBSE Quick Revision Notes and Chapter Summary: Book Recommended: WarningDocument23 pagesCBSE Quick Revision Notes and Chapter Summary: Book Recommended: WarningdharshinipriyaNo ratings yet

- Private Company Vs Public CompanyDocument7 pagesPrivate Company Vs Public CompanykanikaNo ratings yet

- Company Law Notes KNECDocument172 pagesCompany Law Notes KNECodewafasaha5No ratings yet

- ISSUE OF SHARES - SACHIN TheoryDocument8 pagesISSUE OF SHARES - SACHIN Theorydakshparashar973No ratings yet

- BUS 360 - Lecture 12Document8 pagesBUS 360 - Lecture 12JabirNo ratings yet

- Information of CompaniesDocument11 pagesInformation of CompaniesAli AliNo ratings yet

- L-11-17 Company - ActDocument90 pagesL-11-17 Company - ActVanshika KapoorNo ratings yet

- CHAPTER 14 Corporations Basic ConsiderationsDocument8 pagesCHAPTER 14 Corporations Basic ConsiderationsGabrielle Joshebed AbaricoNo ratings yet

- Unit 2Document11 pagesUnit 2Nishi SaikiaNo ratings yet

- Company Law Notes For MCCDocument38 pagesCompany Law Notes For MCCAllan StanleyNo ratings yet

- Classification of CompaniesDocument3 pagesClassification of CompaniesPriyanshu GuptaNo ratings yet

- Notes - Share CapitalDocument32 pagesNotes - Share CapitalHeer SirwaniNo ratings yet

- Csa Unit 1Document18 pagesCsa Unit 1shubhamNo ratings yet

- ExamDocument6 pagesExamNaga Kiran V HNo ratings yet

- The Shareholders Are General Agents of The Business. Pre-Emptive RightDocument20 pagesThe Shareholders Are General Agents of The Business. Pre-Emptive RightSaeym SegoviaNo ratings yet

- Partnership (Hand Out)Document43 pagesPartnership (Hand Out)Roy Kenneth LingatNo ratings yet

- CL Unit 1Document13 pagesCL Unit 1Jasjeet SinghNo ratings yet

- PANIES IncorporationDocument62 pagesPANIES IncorporationSiti Aisyah MokhtarNo ratings yet

- K.R. Mangalam University: Company Law-1Document6 pagesK.R. Mangalam University: Company Law-1NEHANo ratings yet

- Corporation Law CompleteDocument130 pagesCorporation Law CompleteQueenVictoriaAshleyPrieto92% (12)

- Introduction To Business Administration: BS MathematicsDocument12 pagesIntroduction To Business Administration: BS Mathematicskanwal hafeezNo ratings yet

- Compapy Act 5moduleDocument21 pagesCompapy Act 5moduleBasappaSarkarNo ratings yet

- Insurance LawDocument8 pagesInsurance LawRohit KumarNo ratings yet

- 1.5 Partneship LawDocument9 pages1.5 Partneship LawGastor Hilary MtweveNo ratings yet

- Corporate Administration Notes For Unit 1Document15 pagesCorporate Administration Notes For Unit 1NEEPANo ratings yet

- Companies ACt, 2063 Simplified 1 Day Revision BookDocument61 pagesCompanies ACt, 2063 Simplified 1 Day Revision Bookteam aspirantsNo ratings yet

- Topic 1 (Law303)Document28 pagesTopic 1 (Law303)carazamanNo ratings yet

- Public Vs Private Company NotesDocument3 pagesPublic Vs Private Company NotesBilal akbarNo ratings yet

- Presentation 1 A AshuDocument5 pagesPresentation 1 A AshusaifNo ratings yet

- Business FormationDocument7 pagesBusiness FormationsyafiqahNo ratings yet

- Kim2012 PDFDocument21 pagesKim2012 PDFwesayNo ratings yet

- Chapter 1,2,3Document35 pagesChapter 1,2,3bj_raj064No ratings yet

- Aicpa Draft-Inventory-Valuation-GuidanceDocument50 pagesAicpa Draft-Inventory-Valuation-GuidanceOmar OteroNo ratings yet

- Intellectual CapitalDocument10 pagesIntellectual CapitalManish ChaudharyNo ratings yet

- Competitive Strategies For Market LeadersDocument24 pagesCompetitive Strategies For Market LeadersNaveen Stephen LoyolaNo ratings yet

- Mission StatementDocument6 pagesMission Statementlavrock32No ratings yet

- Stock Report of Solera Holdings Inc (Read With Its Financial Model)Document8 pagesStock Report of Solera Holdings Inc (Read With Its Financial Model)Hongrui (Henry) ChenNo ratings yet

- Case 1: Control Account and Subsidiary Ledger ReconciliationDocument5 pagesCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleNo ratings yet

- STF Final Rule Summary & User Guide WEB 2.0Document11 pagesSTF Final Rule Summary & User Guide WEB 2.0AfnanParkerNo ratings yet

- Verifying The Effectiveness of Corrective ActionDocument46 pagesVerifying The Effectiveness of Corrective ActionLedo Houssien100% (4)

- Financial Accounting Objectives Sem V PDFDocument14 pagesFinancial Accounting Objectives Sem V PDFAyman MalikNo ratings yet

- Ganesh Kumar Parashar: Mobile: 8630022560Document2 pagesGanesh Kumar Parashar: Mobile: 8630022560Shakeeb HashmiNo ratings yet

- Adventure Works CyclesDocument2 pagesAdventure Works Cyclesnitin.1n11599No ratings yet

- Chap 003Document37 pagesChap 003fadikaradshehNo ratings yet

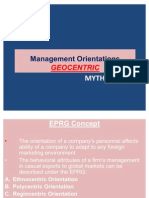

- MYTHEEN Management OrientationsDocument9 pagesMYTHEEN Management OrientationsMytheen MuhammedNo ratings yet

- SolDocument23 pagesSolkarthu48No ratings yet

- GhostPay WhitepaperDocument10 pagesGhostPay WhitepaperGhostPayNo ratings yet

- Performance Appraisal of Gold ETFS in India: Finance ManagementDocument4 pagesPerformance Appraisal of Gold ETFS in India: Finance ManagementpatelaxayNo ratings yet

- The University of DodomaDocument4 pagesThe University of DodomaMesack SerekiNo ratings yet

- Topic Two The Price System and The MicroeconomyDocument25 pagesTopic Two The Price System and The MicroeconomyRashid okeyoNo ratings yet

- Max Flex & Imaging Systems Ltd.Document383 pagesMax Flex & Imaging Systems Ltd.GaneshNo ratings yet

- Auto Secure Private Car Package Policy: Tata AIG General Insurance Company LimitedDocument6 pagesAuto Secure Private Car Package Policy: Tata AIG General Insurance Company LimitedSuffah Education CenterNo ratings yet

- NZ Marketing - Issue 74, March-April 2023Document116 pagesNZ Marketing - Issue 74, March-April 2023Dan AlexandruNo ratings yet

- OTS Hospital Training Solution Pitch DeckDocument25 pagesOTS Hospital Training Solution Pitch DeckonisalNo ratings yet

- Big Basket - Product Teardown - Sanjeet SahuDocument19 pagesBig Basket - Product Teardown - Sanjeet SahuJaya ShankarNo ratings yet

- Free Download Research Papers On Human Resource ManagementDocument8 pagesFree Download Research Papers On Human Resource ManagementafeawqynwNo ratings yet

- Accounting Fraud World ComDocument10 pagesAccounting Fraud World ComSriram RajasekaranNo ratings yet

- HR Question & SolutionsDocument19 pagesHR Question & SolutionsHossain ZakirNo ratings yet