Professional Documents

Culture Documents

Roles and Functions: Central Bank of Malaysia Act 2009

Uploaded by

Khairy IsmailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Roles and Functions: Central Bank of Malaysia Act 2009

Uploaded by

Khairy IsmailCopyright:

Available Formats

BANK NEGARA MALAYSIA

Established on 26 January 1959 under the Central Bank of Malaysia Act 1958 (CBA 1958).

The CBA 1958 has been repealed by the Central Bank of Malaysia Act 2009 which became

effective on 25 November 2009. It is a statutory body wholly owned by the Government of

Malaysia with the paid-up capital progressively increased, currently at RM100 million. The

Bank reports to the Minister of Finance, Malaysia and keeps the Minister informed of matters

pertaining to monetary and financial sector policies.

Roles and Functions

Among the major role of the Bank is the prudent conduct of monetary policy, which has

seen generally low and stable inflation for decades and thereby, preserving the purchasing

power of the ringgit. The Bank is also responsible for bringing about financial system

stability and fostering a sound and progressive financial sector. There is now in place a well

diversified, comprehensive and resilient financial sector, that is able to meet the increasingly

sophisticated needs of consumers and businesses, and which has become a growth driver in

the economy.

The Bank also plays a significant developmental role, including development of financial

system infrastructure with major emphasis placed on building the nation\'s efficient and

secured payment systems as well as the necessary institutions (including Securities

Commission, KLSE, now known as Bursa Malaysia and Credit Guarantee Corporation) which

are important towards building a comprehensive, robust and resilient financial system.

The Bank actively promotes financial inclusion, which has led to improved access to

financial services for all economic sectors and segments of society, thereby supporting

balanced economic growth.

Other important roles of the Bank are being a banker and adviser to the Government,

playing an active role in advising on macroeconomic policies and managing the public debt. It

is also the sole authority in issuing currency as well as managing the country\'s international

reserves.

The roles of the Bank are supported by 37 departments/units in the Bank covering seven

functional areas as follows:

Economics & Monetary Policy

Primarily provides good technical and research support on growth-related issues to enhance

formulation of monetary and credit policies in promoting monetary stability and ensuring the

availability of adequate credit to finance economic growth.

Investment and operations

Manage domestic liquidity and exchange rates to ensure that monetary policy targets are

achieved as well as managing external reserves to safeguard its value and optimise its returns.

It also has the responsibility of providing advice and assistance to the Government in the area

of debt and fund management and contributing to domestic financial market development.

Regulation

Promote financial sector stability through the progressive development of sustainable, robust

and sound financial institutions and financial infrastructure, thus enabling a competitive local

financial industry to be resilient against the changing future environment as well as leads

initiatives to enhance access to financing. It also formulates and implements policies and

strategies towards building and positioning Malaysia as a premier integrated Islamic Financial

Centre and enhance the financial capability of consumers.

Payment systems

Develop policies and strategies to promote reliable, secure and efficient clearing, settlement

and payment systems in the country.

Supervision

Develop, enhance and implement an effective surveillance framework to ensure safety and

soundness of financial institutions and to enforce sound practices in them.

Organisational development

Spearhead the Bank\'s strategic management, organisational-performance management and

programme management functions to drive its performance-improvement processes and

strengthening the capacity building of the Bank. It also leads and drives human resources

initiatives and other strategic activities to ensure that the overall Human Capital Management

framework is implemented effectively.

Communications

The communications function has assumed increasing importance in response to the

heightened demands of the various stakeholders, seeking greater transparency and disclosure.

You might also like

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaFrom EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaNo ratings yet

- BD20203 - Lecture Note Week 4 - Bank Negara MalaysiaDocument40 pagesBD20203 - Lecture Note Week 4 - Bank Negara MalaysiaLim ShengNo ratings yet

- Monetary Policy StatementDocument6 pagesMonetary Policy StatementAnaszNazriNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Topic 4 Central Bank (BNM)Document56 pagesTopic 4 Central Bank (BNM)Ing HongNo ratings yet

- Q4 Finance AssignmentDocument4 pagesQ4 Finance AssignmentWEI SZI LIMNo ratings yet

- The Banking System in MalaysiaDocument6 pagesThe Banking System in MalaysiaHong Tat HengNo ratings yet

- Financial Sector Master Plan Malaysia 2001Document12 pagesFinancial Sector Master Plan Malaysia 2001Junhuey ShanNo ratings yet

- BBEM1103 Topic 8Document16 pagesBBEM1103 Topic 8NorilahNo ratings yet

- Case Study FnanceDocument12 pagesCase Study FnanceusmanNo ratings yet

- Makerere University Business SchoolDocument6 pagesMakerere University Business SchoolCeacer Julio SsekatawaNo ratings yet

- Bank ManagementDocument20 pagesBank Managementamirahhani najmaNo ratings yet

- MDM Chuah Evolution Msian Banking Industry 130411 ABM PDFDocument37 pagesMDM Chuah Evolution Msian Banking Industry 130411 ABM PDFtcngaiNo ratings yet

- Financial System in MalaysiaDocument8 pagesFinancial System in MalaysiaqairunnisaNo ratings yet

- BNM Ar2019 en Full PDFDocument124 pagesBNM Ar2019 en Full PDFRoslan.Affandi2351No ratings yet

- 1st Assignment of Business StudiesDocument5 pages1st Assignment of Business StudiesTionge BandaNo ratings yet

- Chapter 2Document26 pagesChapter 2trevorsum123No ratings yet

- Corporate International FinanceDocument14 pagesCorporate International FinanceFariz Herlambang ResyaputraNo ratings yet

- Imf and How Imf Plays Role in Governance of PakisatnDocument4 pagesImf and How Imf Plays Role in Governance of Pakisatnsuhailar608No ratings yet

- Central Bank of SrilankaDocument14 pagesCentral Bank of Srilankadharadhakan99No ratings yet

- Interview DataDocument8 pagesInterview DataFaisi GikianNo ratings yet

- FIN536Document14 pagesFIN536Farah DiyanahNo ratings yet

- BodyDocument104 pagesBodySantosh ChhetriNo ratings yet

- Indian Financial SystemDocument4 pagesIndian Financial SystemLbsim-akash100% (2)

- Financial System in PakistanDocument13 pagesFinancial System in PakistanMuhammad IrfanNo ratings yet

- Unit 1: ObjectivesDocument21 pagesUnit 1: ObjectivesbibijackyNo ratings yet

- BBBM4103 Bank Management Assignment - 150722Document16 pagesBBBM4103 Bank Management Assignment - 150722Kalis WaranNo ratings yet

- Swot AnalysisDocument7 pagesSwot AnalysisSikandar AkramNo ratings yet

- Role of Banking System in Malaysia EconodocxDocument15 pagesRole of Banking System in Malaysia EconodocxAkai GunnerNo ratings yet

- Shah Abdul Latif University Khairpur: Department of Business AdministrationDocument28 pagesShah Abdul Latif University Khairpur: Department of Business AdministrationFurqan ShafiqNo ratings yet

- From-Nikunjkumar Sanghavi ROLL NO.140 Sybba C'Document18 pagesFrom-Nikunjkumar Sanghavi ROLL NO.140 Sybba C'Nik SanghviNo ratings yet

- My Internship Report of AlfalahDocument81 pagesMy Internship Report of AlfalahZara MaryemNo ratings yet

- Basic ConceptsDocument30 pagesBasic Conceptsjoslin12100% (1)

- Other Financial Institutions (Non-Bank)Document35 pagesOther Financial Institutions (Non-Bank)trevorsum123No ratings yet

- ROLE OF BANKS IN ECONOMIC DEVELOPMENTDocument25 pagesROLE OF BANKS IN ECONOMIC DEVELOPMENTZabed HossenNo ratings yet

- Role of FIs and capital markets in Pakistan's economyDocument6 pagesRole of FIs and capital markets in Pakistan's economyShakil KhanNo ratings yet

- Subsidiaries of SBP: Banking Service Corporation (SBP-BSC)Document17 pagesSubsidiaries of SBP: Banking Service Corporation (SBP-BSC)hunzakhalidNo ratings yet

- Issue Management Ebook PDFDocument247 pagesIssue Management Ebook PDFLefty RenewangNo ratings yet

- Exm - 26842 Financial ManagementDocument20 pagesExm - 26842 Financial ManagementAbdul AshrafNo ratings yet

- The Philippine Financial System ReportDocument28 pagesThe Philippine Financial System Reportvalerie joy camemoNo ratings yet

- Shanto-Mariam University of Creative Technology: Module Name: Shipping and Banking Module Code: AMM-4323Document16 pagesShanto-Mariam University of Creative Technology: Module Name: Shipping and Banking Module Code: AMM-4323Batch 27No ratings yet

- 2.5.3 Zenith Bank PLC HistoryDocument3 pages2.5.3 Zenith Bank PLC HistoryOyeleye TofunmiNo ratings yet

- Financial Institutional Framework in BangladeshDocument10 pagesFinancial Institutional Framework in BangladeshSadman SafayetNo ratings yet

- Monetary Policy and Banking ReformsDocument18 pagesMonetary Policy and Banking ReformsabdullahkhalilgNo ratings yet

- Summit BankDocument53 pagesSummit BankJaved Iqbal50% (2)

- Waris AssignmntDocument4 pagesWaris AssignmntSameerNo ratings yet

- Malaysia NKEA - Financial ServicesDocument16 pagesMalaysia NKEA - Financial ServiceschonglongchooNo ratings yet

- Finincial Analysis of Butwal Finance CompanyDocument71 pagesFinincial Analysis of Butwal Finance CompanyKharel KamalNo ratings yet

- Central Bank SFSDocument9 pagesCentral Bank SFSKanchana Geeth SamaraweeraNo ratings yet

- Iaran Khbar: Financial Stability and Payment Systems Report 2010Document7 pagesIaran Khbar: Financial Stability and Payment Systems Report 2010Widya ArwitaNo ratings yet

- Undercover EconomistDocument14 pagesUndercover EconomistAreeba AfridiNo ratings yet

- The Role of Banks in Developing Countries and Strategies for Promoting Financial InclusionDocument6 pagesThe Role of Banks in Developing Countries and Strategies for Promoting Financial InclusionSuccess NyamhindaNo ratings yet

- Malaysia - Financial Stability and Payment Systems Report - 2018Document160 pagesMalaysia - Financial Stability and Payment Systems Report - 2018Krit KPNo ratings yet

- Studies in Economics and FinanceDocument17 pagesStudies in Economics and FinanceAbdul SattarNo ratings yet

- FM 105 - Banking and Financial Institutions: Expanding BSP's Regulatory Power Under The New Central Bank ActDocument23 pagesFM 105 - Banking and Financial Institutions: Expanding BSP's Regulatory Power Under The New Central Bank ActKimberly Solomon JavierNo ratings yet

- Banking Law and PracticeDocument8 pagesBanking Law and PracticewasoooNo ratings yet

- KEBIJAKAN MAKROPUDENSIAL BANK INDONESIA UNTUK MENDORONG PEMBIAYAAN INKLUSIF - HARI MURTI & HARDINI TRISTYA - Id.enDocument7 pagesKEBIJAKAN MAKROPUDENSIAL BANK INDONESIA UNTUK MENDORONG PEMBIAYAAN INKLUSIF - HARI MURTI & HARDINI TRISTYA - Id.enHari MurtiNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsCristel TannaganNo ratings yet

- Neo-Classical (Solow) Growth Model: Mohd Khairi Ismail Universiti Tun Abdul Razak (UNIRAZAK)Document14 pagesNeo-Classical (Solow) Growth Model: Mohd Khairi Ismail Universiti Tun Abdul Razak (UNIRAZAK)Khairy IsmailNo ratings yet

- Soalan Budget Line MicroDocument5 pagesSoalan Budget Line MicroKhairy IsmailNo ratings yet

- T8 AMOS Structural Equation Modeling IPSASDocument44 pagesT8 AMOS Structural Equation Modeling IPSASKhairy IsmailNo ratings yet

- AD As MechanicsDocument19 pagesAD As MechanicsKhairy IsmailNo ratings yet

- Sets and Set Operations DalesandroDocument13 pagesSets and Set Operations DalesandroKhairy IsmailNo ratings yet

- And Now For Something Completely DifferentDocument21 pagesAnd Now For Something Completely DifferentKhairy IsmailNo ratings yet

- P1M1Document29 pagesP1M1karanveer89No ratings yet

- T Distribution Table: DF/PRDocument2 pagesT Distribution Table: DF/PRKhairy IsmailNo ratings yet

- Econometrics DataDocument6 pagesEconometrics DataKhairy IsmailNo ratings yet

- Cadangan Problem STMNTDocument1 pageCadangan Problem STMNTKhairy IsmailNo ratings yet

- P1M1Document29 pagesP1M1karanveer89No ratings yet

- Econometrics Data SetDocument7 pagesEconometrics Data SetKhairy IsmailNo ratings yet

- Econometrics Data SetDocument7 pagesEconometrics Data SetKhairy IsmailNo ratings yet

- FinancialDocument2 pagesFinancialCikgu Mohd Zaki AliNo ratings yet

- Nota Kuliah 03 IEEP2023Document18 pagesNota Kuliah 03 IEEP2023Khairy IsmailNo ratings yet

- LNG Vaporizers Using Various Refrigerants As Intermediate FluidDocument15 pagesLNG Vaporizers Using Various Refrigerants As Intermediate FluidFrandhoni UtomoNo ratings yet

- Ringkasan LaguDocument4 pagesRingkasan LaguJoe PyNo ratings yet

- XXCCCDocument17 pagesXXCCCwendra adi pradanaNo ratings yet

- Week 1 Gec 106Document16 pagesWeek 1 Gec 106Junjie FuentesNo ratings yet

- OPHTHALDocument8 pagesOPHTHALVarun ChandiramaniNo ratings yet

- A61C00100 Communication and Employee Engagement by Mary Welsh 2Document19 pagesA61C00100 Communication and Employee Engagement by Mary Welsh 2Moeshfieq WilliamsNo ratings yet

- Service Positioning and DesignDocument3 pagesService Positioning and DesignSaurabh SinhaNo ratings yet

- Variables in Language Teaching - The Role of The TeacherDocument34 pagesVariables in Language Teaching - The Role of The TeacherFatin AqilahNo ratings yet

- BOQ - Hearts & Arrows Office 04sep2023Document15 pagesBOQ - Hearts & Arrows Office 04sep2023ChristianNo ratings yet

- 96 Amazing Social Media Statistics and FactsDocument19 pages96 Amazing Social Media Statistics and FactsKatie O'BrienNo ratings yet

- PrintDocument18 pagesPrintHookandcrookNo ratings yet

- 2nd QUARTER EXAMINATION IN P. E 2019-2020Document3 pages2nd QUARTER EXAMINATION IN P. E 2019-2020Lyzl Mahinay Ejercito MontealtoNo ratings yet

- Evolution Packet FinalDocument24 pagesEvolution Packet FinalJoaquinNo ratings yet

- InteliLite AMF20-25Document2 pagesInteliLite AMF20-25albertooliveira100% (2)

- Chronological OrderDocument5 pagesChronological OrderDharWin d'Wing-Wing d'AriestBoyzNo ratings yet

- 16 Week Mountain Marathon Training Plan: WWW - Brutalevents.co - UkDocument2 pages16 Week Mountain Marathon Training Plan: WWW - Brutalevents.co - UkCristina CrsNo ratings yet

- Load Frequency Control of Hydro and Nuclear Power System by PI & GA ControllerDocument6 pagesLoad Frequency Control of Hydro and Nuclear Power System by PI & GA Controllerijsret100% (1)

- Clarinet Lecture Recital - Jude StefanikDocument35 pagesClarinet Lecture Recital - Jude Stefanikapi-584164068No ratings yet

- Software Client Linux 21 01Document81 pagesSoftware Client Linux 21 01BronskyNo ratings yet

- The Mars ForceDocument249 pagesThe Mars Forceridikitty100% (2)

- Structural IfpDocument4 pagesStructural IfpDanny NguyenNo ratings yet

- Galambos 1986Document18 pagesGalambos 1986gcoNo ratings yet

- Ahu, Chiller, Fcu Technical Bid TabulationDocument15 pagesAhu, Chiller, Fcu Technical Bid TabulationJohn Henry AsuncionNo ratings yet

- Interesting Facts (Compiled by Andrés Cordero 2023)Document127 pagesInteresting Facts (Compiled by Andrés Cordero 2023)AndresCorderoNo ratings yet

- European Business in China Position Paper 2017 2018 (English Version)Document408 pagesEuropean Business in China Position Paper 2017 2018 (English Version)Prasanth RajuNo ratings yet

- Chirag STDocument18 pagesChirag STchiragNo ratings yet

- True False Survey FinalDocument2 pagesTrue False Survey Finalwayan_agustianaNo ratings yet

- Telephone Triggered SwitchesDocument22 pagesTelephone Triggered SwitchesSuresh Shah100% (1)

- Translation of Japanese Onomatopoeia Into Swedish (With Focus On Lexicalization)Document20 pagesTranslation of Japanese Onomatopoeia Into Swedish (With Focus On Lexicalization)Aldandy OckadeyaNo ratings yet

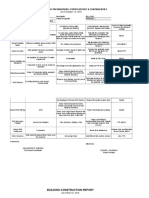

- Class Opening Preparations Status ReportDocument3 pagesClass Opening Preparations Status ReportMaria Theresa Buscato86% (7)