Professional Documents

Culture Documents

Bond Duration

Uploaded by

Tan WlOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Duration

Uploaded by

Tan WlCopyright:

Available Formats

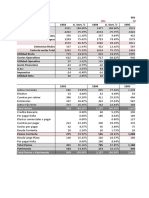

Macaulay Duration

Face Value = 100

N = 10

Coupon = 1.875%

Discount rate =

2.5% per year

0 1 2 3 4 5 6 7 8 9 10

Cash flows 0.9375 0.9375 0.9375 0.9375 0.9375 0.9375 0.9375 0.9375 0.9375 100.9375

Discount rate 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25% 1.25%

PV of cashflows 0.926 0.914 0.903 0.892 0.881 0.870 0.859 0.849 0.838 89.146

Price 97.080

Time weights 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5

Time x PV of CF 0.463 0.914 1.355 1.784 2.203 2.610 3.008 3.395 3.772 445.730

0.005 0.009 0.014 0.018 0.023 0.027 0.031 0.035 0.039 4.591

Macaulay Durati 4.792

0.95% 0.94% 0.93% 0.92% 0.91% 0.90% 0.89% 0.87% 0.86% 91.83%

4.792 0.0048 0.0094 0.0140 0.0184 0.0227 0.0269 0.0310 0.0350 0.0389 4.5914

Find the Value of a Bond

Settlement Da ###

Maturity Date ###

Annual Coupon 0.01875

Yield to Maturi 0.01875

Redemption 100

Coupon Paymen 2

Basis 0

Bond Price =

You might also like

- BoostrappingDocument23 pagesBoostrappingHarshit DwivediNo ratings yet

- Solutions Format BDocument23 pagesSolutions Format BBineeta SahooNo ratings yet

- FIS Class WorkbookDocument8 pagesFIS Class WorkbookNarutoNo ratings yet

- Ejercicio 13 Suavizacion Exponencial CompletisimoDocument4 pagesEjercicio 13 Suavizacion Exponencial CompletisimoSergio Humberto Rivera CastroNo ratings yet

- Ch4 AdditionalDocument14 pagesCh4 AdditionalAsif Abdullah KhanNo ratings yet

- Calculating All-In Cost Over 5 Years: Principal Coupon Yrs 1-2 Coupon Yrs 3-5Document38 pagesCalculating All-In Cost Over 5 Years: Principal Coupon Yrs 1-2 Coupon Yrs 3-5OUSSAMA NASRNo ratings yet

- Boots Trapping ExDocument2 pagesBoots Trapping ExvivekNo ratings yet

- Bond Portfolio OptimizationDocument8 pagesBond Portfolio Optimizationmayank1010No ratings yet

- BDT Assignmnet 2019 QuestionsDocument4 pagesBDT Assignmnet 2019 Questionsxc123544No ratings yet

- Diseño HidrologicoDocument19 pagesDiseño HidrologicoCHRISTIAN ANIBAL SANTA CRUZ AVILANo ratings yet

- Problem Set 1 SolutionsDocument14 pagesProblem Set 1 Solutionsjponc17No ratings yet

- CDS ValuationDocument1 pageCDS ValuationsunyeqiNo ratings yet

- Uncertainty Budget 2023Document3 pagesUncertainty Budget 2023Aaron Matthew BasteNo ratings yet

- Dev ClassDocument25 pagesDev Classhrithik choudharyNo ratings yet

- Mean Reversion Model of Stock Price: Estimated ParametersDocument2 pagesMean Reversion Model of Stock Price: Estimated ParametersKUMPULAN PENULIS REVOLUSINo ratings yet

- MA Mock - Questions S20-A21Document15 pagesMA Mock - Questions S20-A21Abdinasir HassanNo ratings yet

- Artikel 24J BerekeningeDocument4 pagesArtikel 24J Berekeningesenari3164No ratings yet

- Ejercicio 14 Suavizacion ExponencialDocument2 pagesEjercicio 14 Suavizacion ExponencialSergio Humberto Rivera CastroNo ratings yet

- Fmi Assignment2Document140 pagesFmi Assignment2Ankit TiwariNo ratings yet

- Lecture 10 CmaDocument8 pagesLecture 10 CmaUmair HayatNo ratings yet

- A2a - 4 - Present Value Formula in ExcelDocument12 pagesA2a - 4 - Present Value Formula in ExcelShubhankar ShuklaNo ratings yet

- Spot Rate CurveDocument15 pagesSpot Rate CurveEduardo FélixNo ratings yet

- Book 1Document6 pagesBook 1LNo ratings yet

- DM Auto Financing Scheme: Installment CalculationsDocument9 pagesDM Auto Financing Scheme: Installment CalculationsZainab RaufNo ratings yet

- Trabajo en Clase-Propiedades de Mezcla - 22-02-2021Document4 pagesTrabajo en Clase-Propiedades de Mezcla - 22-02-2021Diego Alejandro Medina RodriguezNo ratings yet

- Control Limits and Centerline Data (Measurement) Using S ChartDocument8 pagesControl Limits and Centerline Data (Measurement) Using S Chartprakash patelNo ratings yet

- SPC SpreadsheetDocument8 pagesSPC Spreadsheethow2beliveNo ratings yet

- Practica Dirigida 5 Finanzas Corporativas 2022 II-SOLDocument31 pagesPractica Dirigida 5 Finanzas Corporativas 2022 II-SOLEdgard FretelNo ratings yet

- Mohanur Head Work LevelDocument4 pagesMohanur Head Work LevelMathiTwadCNo ratings yet

- Initial investment Time horizon (years) Return µ σ Stock marketDocument17 pagesInitial investment Time horizon (years) Return µ σ Stock marketvaskoreNo ratings yet

- AmortizationDocument11 pagesAmortizationJoen SinamagNo ratings yet

- BondsDocument22 pagesBondsSuchit Backup1No ratings yet

- TablesTime ValueofMoneyDocument2 pagesTablesTime ValueofMoneycNo ratings yet

- Bond ValuationDocument18 pagesBond ValuationApurva KarnNo ratings yet

- EWMA ChartDocument8 pagesEWMA ChartshagsNo ratings yet

- PV and Annuity TableDocument2 pagesPV and Annuity TableChirag Kashyap100% (1)

- PV and Annuity TableDocument2 pagesPV and Annuity TableChirag KashyapNo ratings yet

- Session 7.4 Present Value Formula in Excel - AsyncDocument12 pagesSession 7.4 Present Value Formula in Excel - AsyncAnyone SomeoneNo ratings yet

- SPC SpreadsheetDocument8 pagesSPC SpreadsheetRS MANIKANDANNo ratings yet

- EportfolioexcelDocument4 pagesEportfolioexcelapi-311464761No ratings yet

- Control Limits and Centerline Data (Measurement) Using S ChartDocument8 pagesControl Limits and Centerline Data (Measurement) Using S Chartravindra erabattiNo ratings yet

- SPC SpreadsheetDocument8 pagesSPC Spreadsheetikesh mNo ratings yet

- Table: Cumulative Binomial Probabilities: P P X N C X PDocument7 pagesTable: Cumulative Binomial Probabilities: P P X N C X PFitri HandayaniNo ratings yet

- Reliability: Case Processing SummaryDocument1 pageReliability: Case Processing SummaryKhoirul HudaNo ratings yet

- SPC SpreadsheetDocument10 pagesSPC SpreadsheetSpyros IliakisNo ratings yet

- 001 Spreadsheet Solution (Delta of A Forward Contract)Document4 pages001 Spreadsheet Solution (Delta of A Forward Contract)Swapnil SinghNo ratings yet

- TKHMEXAMRENTAVIZCADocument40 pagesTKHMEXAMRENTAVIZCAavrmexico4x4No ratings yet

- Table Binomial + Normal + Tabel-T + Tabel-F + Chi-22Document25 pagesTable Binomial + Normal + Tabel-T + Tabel-F + Chi-22Prima zolaNo ratings yet

- Duration & ConDocument63 pagesDuration & Consanket patilNo ratings yet

- Calculadora 1Document45 pagesCalculadora 1Fatima LuyandoNo ratings yet

- SEIR Model: Værdierne I de Gule Felter Kan ÆndresDocument12 pagesSEIR Model: Værdierne I de Gule Felter Kan ÆndresHilario Flores GonzálezNo ratings yet

- HullOFOD11eProblem 24Document1 pageHullOFOD11eProblem 24yichan0519No ratings yet

- Blackstone SolutionsDocument2 pagesBlackstone SolutionsBianca KangNo ratings yet

- A B C D e F G H 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29Document4 pagesA B C D e F G H 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29Manoj JosephNo ratings yet

- Module 9 Time Value of Money: Present Value (PV) - This Is Your Current Starting Amount. It Is TheDocument4 pagesModule 9 Time Value of Money: Present Value (PV) - This Is Your Current Starting Amount. It Is ThePaul Anthony AspuriaNo ratings yet

- Sungreen PresentationDocument24 pagesSungreen PresentationSANJOY MONDALNo ratings yet

- Excel Clarkson LumberDocument9 pagesExcel Clarkson LumberCesareo2008No ratings yet

- LATIHANDocument1 pageLATIHANriska augustNo ratings yet

- VerteilungstabellenDocument6 pagesVerteilungstabellenzhengtianyu0No ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)