Professional Documents

Culture Documents

36 It Declaration Fy1011

Uploaded by

nad1002Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

36 It Declaration Fy1011

Uploaded by

nad1002Copyright:

Available Formats

Your Company Name

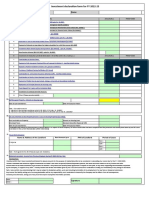

TAX SAVINGS DECLARATION FOR THE FINANCIAL YEAR 2010-11 (Assessment Year 2011- 12)

Employee Name

Emp. ID#

E - Mail ID

PAN #

I will make the following payments/ investments during April 2010 to March 2011. The same may be considered in

computing my tax liability for the financial year 2010-11.

Proofs for the same will be submitted as and when required by Your Company Name.

SI.No SECTION DETAILS AMOUNT (Rs.)

House Rent paid

-rent receipt as given by the house owner to be submitted as

proof

1

-rent receipt to be duly affixed with revenue stamp

-rent receipt can be given consolidated / monthly

-receipts to be dated between 1.4.2010 to 31.3.2011

Loss from House property

-Form 12C to be submitted

2

-Certificate from Financing Institutions(Ex. Bank/LIC/HDFC)

showing the projected interest payable should be submitted as

proof

INVESTMENT UNDER SECTION 80C and 80CCC

3 80 C

(subject to a max. of Rs. 1,00,000/- only from a to n)

a. Life insurance premium

b. Contribution / Deposits in Public provident fund

c. Investments in postal savings 10/15 years Account

d. Investments in N.S.C

e. Investment in infrastructure bonds.

f. Contribution to notified pension plans

g. Contribution to Mutual funds as notified u/s 10(23D)

h. Tution fee for education of children.

i. Repayment of Housing loan principal amount

j. Investment in unit linked Insurance plan( ULIP)

k. Term Deposit (for a fixed period of not less than five years with

a scheduled bank).

l. Deposit in an Account under the senior citizen saving scheme

Rules, 2004.

m. Deposit in an account under the post office Time Deposit

Rules 1981.

n. Others

o. investment in long-term infrastructure bonds as notified by the

Central Government (Max.Rs.20,000/- addition to Rs.1,00,000/-)

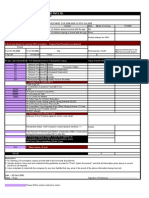

Expenditure u/s. 80 D to 80 U

4 80D Premium paid for Medical insurance (Max of Rs.20,000/-)

Amount incurred towards maintenance (including medical

treatment of Handicapped dependants ( max.allowed Rs.

5 80DD

75,000/-) (Necessary proofs of expenditure incurred to be

submitted)

Payment of Interest on Education loan.

6 80 E Certificate from Bank / Financial Institution showing the projected

Payment of interest should be submitted as proof.

Permanent physical disability/ handicapped employees

7 80 U (Max.allowed Rs. 50,000/-)(Necessary proofs to be submitted)

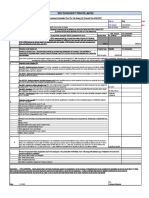

VERIFICATION

I __________________________ Emp.ID.No. _________ do hereby declare that what is stated above is true to the best of my

knowledge and belief. I further confirm that there will be no shortfall in the above payments/ investment and that the

documentary proof will be submitted as mentioned above.

Verified today the _______________ Day of _____________ 2010

Place:

Date: Signature of the Employee

You might also like

- 2-Income Tax Rules For The Year 2011-12Document6 pages2-Income Tax Rules For The Year 2011-12Nataraj PvnNo ratings yet

- Income Tax Form Guide for 2006-07Document9 pagesIncome Tax Form Guide for 2006-07Chalan B SNo ratings yet

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaNo ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- Investment Declaration Form FY 2019-20 v2Document5 pagesInvestment Declaration Form FY 2019-20 v2Rehan ElectronicsNo ratings yet

- To: Corporate Taxation, ICOMM Tele Limited, Head OfficeDocument52 pagesTo: Corporate Taxation, ICOMM Tele Limited, Head OfficesandeepNo ratings yet

- TAX Saving Investment ProofDocument1 pageTAX Saving Investment ProofAmit ShuklaNo ratings yet

- AIL-Investment Declaration Form 2013-2014Document2 pagesAIL-Investment Declaration Form 2013-2014G A PATELNo ratings yet

- Tax Benefit ProofsDocument20 pagesTax Benefit ProofsGarima2009No ratings yet

- Income-Tax Declaration FormDocument5 pagesIncome-Tax Declaration FormGanesh MaddipotiNo ratings yet

- Income Tax Proof Submission GuidelinesDocument11 pagesIncome Tax Proof Submission Guidelinesdeepakraj610No ratings yet

- New IT Declaration FormDocument2 pagesNew IT Declaration FormMahakaal Digital PointNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- PL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)Document3 pagesPL - NO. Name: Corporate Id: Pan No. Mob - No.: Savings Declaration (Other Than Through Salary)TA ED,SafetyNo ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- Income Tax Declaration Form FY 22023 24 AY2024 25Document1 pageIncome Tax Declaration Form FY 22023 24 AY2024 25mrleftyftwNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- CLUBBING OF INCOME AND DEDUCTIONS UNDER CHAPTER VI-ADocument8 pagesCLUBBING OF INCOME AND DEDUCTIONS UNDER CHAPTER VI-ASiddharth VaswaniNo ratings yet

- Tax Savings Declaration Form 2010-11Document1 pageTax Savings Declaration Form 2010-11Priyanka KhemkaNo ratings yet

- Employees Declaration For IncomeDocument1 pageEmployees Declaration For Incomehareesh13hNo ratings yet

- Guidelines For Income Tax Deduction FY15-16Document14 pagesGuidelines For Income Tax Deduction FY15-16Sharad ShahNo ratings yet

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellNo ratings yet

- BUFIN ITDeclarationFormDocument2 pagesBUFIN ITDeclarationFormdpfsopfopsfhopNo ratings yet

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- Pensioners - IT Declaration Form - Annexure1Document3 pagesPensioners - IT Declaration Form - Annexure1Sudeep MitraNo ratings yet

- IT Declaration Form 2014-15 - After BudgetDocument2 pagesIT Declaration Form 2014-15 - After BudgetAkram M. AlmotaaNo ratings yet

- SR - No Description Amount Rs A. Investment U/S 80 CDocument1 pageSR - No Description Amount Rs A. Investment U/S 80 CMohit ChavanNo ratings yet

- Example of Financial ProposalDocument4 pagesExample of Financial ProposalElisa MisolaNo ratings yet

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunNo ratings yet

- Tax Calculator 7.1 (T) 2012 13Document17 pagesTax Calculator 7.1 (T) 2012 13karthickNo ratings yet

- UmeshDocument1 pageUmeshanon-561280No ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- CHECKLIST FOR FY 2016-17 IT DEDUCTIONSDocument38 pagesCHECKLIST FOR FY 2016-17 IT DEDUCTIONSSiva NaiduNo ratings yet

- Government Accounting Quiz 1 Write The Letter Pertaining To Best AnswerDocument4 pagesGovernment Accounting Quiz 1 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Investment Declaration Form For The Financial Year 2014 - 15Document7 pagesInvestment Declaration Form For The Financial Year 2014 - 15devanyaNo ratings yet

- Tax Investments Format 2010-11Document2 pagesTax Investments Format 2010-11mcnavineNo ratings yet

- IT Declaration Format-05-12-2023Document6 pagesIT Declaration Format-05-12-2023somaNo ratings yet

- Atc AtuDocument9 pagesAtc AtuKeshav SagarNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuNo ratings yet

- Tax filing title generatorDocument1 pageTax filing title generatorAkshay AcchuNo ratings yet

- Tax form guideDocument2 pagesTax form guideSrinivas KosuruNo ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SNo ratings yet

- Tax Calculator FASTDocument20 pagesTax Calculator FASTdamani.manojNo ratings yet

- IT DeclarationDocument2 pagesIT Declarationummar farooqNo ratings yet

- Investment Proof Submission Form23 24Document6 pagesInvestment Proof Submission Form23 24Bindu madhaviNo ratings yet

- D1 Explanatory NotesDocument11 pagesD1 Explanatory NotesnagallanraoNo ratings yet

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Investment proof submission guidelinesDocument40 pagesInvestment proof submission guidelinesSundar PabbareddyNo ratings yet

- Tax Declaration FormatDocument1 pageTax Declaration FormatrameshbabumeelaNo ratings yet

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNo ratings yet

- 06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansDocument40 pages06 Housing Finance - 2, (S-2) Auto, Personal, Edu LoansTarannum Aurora 20DM226No ratings yet

- Investment Declaration Guidelines For The Fy 2020-21: Important NoteDocument8 pagesInvestment Declaration Guidelines For The Fy 2020-21: Important NoteGeetha ArunNo ratings yet

- Investment GuidelineDocument3 pagesInvestment GuidelineBuchi YarraNo ratings yet

- Investment Declaration FY 22-23Document2 pagesInvestment Declaration FY 22-23Ahfaz ShaikhNo ratings yet

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranNo ratings yet

- INVESTMENT DECLARATIONDocument1 pageINVESTMENT DECLARATIONShishir RoyNo ratings yet

- A Guide To Your Personal Income TaxDocument7 pagesA Guide To Your Personal Income TaxRekha SinghNo ratings yet