Professional Documents

Culture Documents

Governmental and Non-Profit Accounting (G&NP) : Environment and Characteristic Session 1

Uploaded by

nefuri0 ratings0% found this document useful (0 votes)

89 views21 pagesThis document provides an overview and agenda for an accounting course on non-profit organizations. It discusses the characteristics and types of governmental and non-profit organizations, how they differ from businesses, their accounting and financial reporting objectives, and the authoritative sources of accounting principles and reporting standards for non-profits. The document also outlines the course introduction, topics to be covered in each session, and background information on the governmental accounting standards committee.

Original Description:

Original Title

01

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview and agenda for an accounting course on non-profit organizations. It discusses the characteristics and types of governmental and non-profit organizations, how they differ from businesses, their accounting and financial reporting objectives, and the authoritative sources of accounting principles and reporting standards for non-profits. The document also outlines the course introduction, topics to be covered in each session, and background information on the governmental accounting standards committee.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

89 views21 pagesGovernmental and Non-Profit Accounting (G&NP) : Environment and Characteristic Session 1

Uploaded by

nefuriThis document provides an overview and agenda for an accounting course on non-profit organizations. It discusses the characteristics and types of governmental and non-profit organizations, how they differ from businesses, their accounting and financial reporting objectives, and the authoritative sources of accounting principles and reporting standards for non-profits. The document also outlines the course introduction, topics to be covered in each session, and background information on the governmental accounting standards committee.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 21

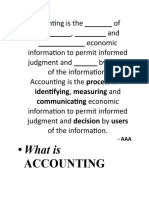

Course : F0112 - Accounting for Non-Profit Organizations

Year : February 2011

Governmental and Non-Profit Accounting (G&NP):

Environment and Characteristic

Session 1

Agenda

• Course Introduction

• Characteristics and Types of G&NP Organizations

• Objectives of G&NP accounting and financial reporting

• How do G&NP differ from business organizations?

• Accounting and Financial Reporting objective

• Authoritative Sources of G&NP Accounting Principles and

Reporting Standards

Bina Nusantara University 2

Course Introduction

Bina Nusantara University 3

Characteristic of G&NP Organizations

Government and other non-profit organizations are unique in the

following ways:

•They do not attempt to earn profit – and most are exempt from

income taxes – so typical business accounting, including income tax

accounting usually is not appropriate;

•They are owned collectively by their constituents – and because

ownership is not evidenced by equity shares that can be sold or

traded – residents who are dissatisfied with their government usually

must await a change in its elected governing body or move elsewhere

Bina Nusantara University 4

Characteristic of G&NP Organizations (2)

Government and other non-profit organizations are unique in the following

ways:

•Those contributing financial resources to the organizations do not

necessarily receive a direct or proportionate share of their services. For

example homeowners pay property taxes to finance public schools even if

they do not have children in school.

•Their major policy decisions and perhaps some operating decisions,

typically are made by majority vote of an elected or appointed governing

body (e.g. a local legislature or a hospital board of directors) whose

members serve part time, receive modest or no compensation, and have

diverse background, philosophies, capabilities and interests.

Bina Nusantara University 5

Major types of GNP*:

• Governmental: Central, local, municipal, township, village and other local

governmental authorities and special districts;

• Educational: kindergartens, elementary and secondary schools, vocational and

technical school and colleges and universities.

• Health and welfare: hospitals, child protection agencies, the Indonesia Red

Cross (PMI)

• Religious: Salvation Army, Dompet Dhuafa

• Charitable: Dana Kemanusiaan Kompas (DKK) and similar fund-raising

agencies;

• Foundations: private trusts and corporations organized for educational, religious

or charitable purposes;

• Non government organisations: Indonesia Corruption Watch (ICW), YLBHI,

Kontras etc

*This general classification scheme has much overlap among the classification. Many charitable organisations are

operated by mosque/churches, and governments are deeply involved in education, health and welfare activities.

Bina Nusantara University 6

The G&NP Environment

G&NP organizations are similar in many ways to profit-seeking enterprise. For

example:

•They are integral part of the same economic system an use financial, capital and human

resources to accomplish their purposes;

•Both must acquire and convert scarce resources into their respective good and services

•Both must have viable information system, including excellent accounting system to

assure that managers, governing bodies and others receive relevant and timely

information for planning, controlling and evaluating sources;

•Cost analysis and other control and evaluation techniques are essential to ensure that

resources are utilized economically, effectively and efficiently;

•In some cases, both produce similar product. For example: both governments and

private enterprise may own and operate transportation systems, sanitation services and

electric utilities.

Bina Nusantara University 7

How Do Governmental and Not-For-Profit

Organizations Differ From Business Organizations?

No direct and proportional relationship between

resources provided and the benefits received

Absence or Lack of a profit motive

Absence of transferable ownership rights

Collective ownership by constituents

Policy-setting process

Bina Nusantara University 8

How Do Governmental and Not-For-Profit

Organizations Differ From Business Organizations?

For businesses, annual report is the most significant financial document. For

governments and non-profits, budget is very important.

Budget is the culmination of the political process.

Need to ensure inter-period equity for most governments and non-profits.

Revenues may not be linked to constituent demand or satisfaction.

No direct link between revenues and expenses.

Many of the assets of government and non-profits are restricted to particular

activities and purposes.

No distinguished ownership interests.

Less distinction between internal and external accounting and reporting.

Bina Nusantara University 9

How Do Governmental and Not-For-Profit

Organizations Differ From Business Organizations?

Power ultimately rests in the hands of the people

People vote and delegate that power to public officials

Created by and accountable to a higher level government –

ex. State Governments are accountable to Federal

Governments while City Governments are accountable to

State Governments, etc.

Power to tax citizens for revenue

Bina Nusantara University 10

MAJOR FINANCIAL RESOURCE

COMPARISON

AN EXAMPLE

GOVERNMENT BUSINESS

• For Operations • For Operations

– Taxes – Sales

• For Capital • For Capital

– Grants – Stock

– Debt – Debt

Bina Nusantara University 11

ACCOUNTING & FINANCIAL REPORTING

OBJECTIVES

• Making resource allocation decisions

• Setting goals and objectives

• Directing and controlling resources

• Reporting on resource custodianship

• Contributing to efficiency and effectiveness

American Accounting Association

Bina Nusantara University 12

ACCOUNTING & FINANCIAL REPORTING

OBJECTIVES

• Objectives address needs of external users of financial information

• Managers and other internal users have specialized needs for

financial information

FASB - Statement of Financial Accounting Concepts No. 4

Bina Nusantara University 13

ACCOUNTING & FINANCIAL REPORTING

OBJECTIVES

For general purpose external financial reporting:

• Making resource allocation decisions

• Assessing services and ability to continue

• Assessing management stewardship responsibilities and

performance

FASB - Statement of Financial Accounting Concepts No. 4

Bina Nusantara University 14

FINANCIAL REPORTING INFORMATION

NEEDS

• Economic resources, obligations, net resources

• Effects of transactions / events on resources

• Performance measurement of resource changes

• Service efforts and accomplishments

• Sources of cash flows and liquidity

FASB - Statement of Financial Accounting Concepts No. 4

Bina Nusantara University 15

Authoritative Sources of G&NP Accounting

Principles and Reporting Standards

• SAP (Standar Akuntansi Pemerintahan)

– Disahkan lewat Peraturan Pemerintah (PP) no 24 tahun 2005

– Diterbitkan oleh Komite Standar Akuntansi Pemerintah (KSAP)

• PSAK 45 (Pelaporan Keuangan Entitas Nirlaba)

– Direvisi tahun 2010 dengan memasukkan pilihhan standar ETAP (entitas

tanpa akuntabilitas publik) bagi entitas nirlaba

– Diterbitkan oleh Dewan Standar Akuntansi Keuangan (DSAK) Ikatan

Akuntan Indonesia

Bina Nusantara University 16

Latar belakang

• Sebelum UU Nomor 17 Tahun 2003 dan UU Nomor 1 Tahun 2004

ditetapkan, sesuai dengan tugas pokok dan fungsi Departemen

Keuangan di bidang fiskal, Menteri Keuangan RI telah menetapkan

Keputusan Menteri Keuangan Nomor 308/KMK.012/2002 tanggal

13 Juni 2002 tentang Komite Standar Akuntansi Pemerintah Pusat

dan Daerah (KSAP), sebagaimana telah beberapa kali diubah

terakhir dengan Keputusan Menteri Keuangan Nomor

379/KMK.012/2004 tanggal 6 Agustus 2004.

Bina Nusantara University 17

Profil

• KSAP bertugas mempersiapkan penyusunan konsep Rancangan

Peraturan Pemerintah tentang SAP sebagai prinsip-prinsip

akuntansi yang wajib diterapkan dalam menyusun dan menyajikan

laporan keuangan pemerintah pusat dan/atau pemerintah daerah.

Dalam pelaksanaan tugas sehari-hari, KSAP melaporkan

kegiatannya secara berkala kepada Menteri Keuangan. KSAP

bertanggung jawab kepada Presiden melalui Menteri Keuangan.

Bina Nusantara University 18

Keanggotaan

• Keanggotaan KSAP berasal dari berbagai unsur pemerintahan,

praktisi, asosiasi profesi, dan akademisi yang mempunyai

kompetensi akademik di bidang akuntansi sektor publik, register

akuntan negara dan reputasi baik di bidang profesi akuntansi.

Dalam bertugas KSAP dapat bekerja sama dengan lembaga

pemerintah, swasta, dan lembaga pendidikan atau pihak lain yang

dianggap perlu.

Bina Nusantara University 19

Standar Akuntansi Pemerintahan

• Kerangka Konseptual Akuntansi Pemerintahan;

• PSAP 01: Penyajian Laporan Keuangan;

• PSAP 02: Laporan Realisasi Anggaran;

• PSAP 03: Laporan Arus Kas;

• PSAP 04: Catatan atas Laporan Keuangan;

• PSAP 05: Akuntansi Persediaan;

• PSAP 06: Akuntansi Investasi;

• PSAP 07: Akuntansi Aset Tetap;

• PSAP 08: Akuntansi Konstruksi Dalam Pengerjaan;

• PSAP 09: Akuntansi Kewajiban;

• PSAP 10: Koreksi Kesalahan, Perubahan Kebijakan Akuntansi, dan Peristiwa Luar

Biasa

• PSAP 11: Laporan Keuangan Konsolidasian

Reference: http://ksap.org/standar.php

Bina Nusantara University 20

PSAK 45 (Revisi 2010)

• Pelaporan Keuangan Entitas Nirlaba

– Tujuan

• Pernyataan ini bertujuan untuk mengatur pelaporan keuangan entitas nirlaba.

Dengan adanya standar pelaporan, diharapkan laporan keuangan entitas nirlaba

dapat lebih mudah dipahami, memiliki relevansi, dan memiliki daya banding

yang tinggi.

– Ruang lingkup:

• PSAK 45 dapat diterapkan oleh lembaga pemerintah, dan unit-unit sejenis

lainnya. Dengan ketentuan bahwa hal ini tidak bertentangan dengan peraturan

perundang-undangan yang berlaku.

– Isi

• Mayoritas menjelaskan mengenai atribut pengakuan, penyajian dan

pengungkapan

• Atribut pengukuran dan penilaian dapat menggunakan SAK ETAP atau SAK

Umum

• Lebih jelasnya akan didiskusikan pada pertemuan-2

Bina Nusantara University 21

You might also like

- John J Murphy - Technical Analysis of The Financial MarketsDocument596 pagesJohn J Murphy - Technical Analysis of The Financial Marketsbarbarajeanlavender97% (74)

- Government Accounting: Accounting For Non-Profit OrganizationsDocument28 pagesGovernment Accounting: Accounting For Non-Profit OrganizationsDe GuzmanNo ratings yet

- Module 1 Introduction To Accounting 1Document5 pagesModule 1 Introduction To Accounting 1Leona Mae Dela Cruz100% (1)

- Preparing Financial Stat. Cemba 560Document172 pagesPreparing Financial Stat. Cemba 560nanapet80No ratings yet

- Arkansas Business Rankings: Wealthiest Arkansas Families.Document64 pagesArkansas Business Rankings: Wealthiest Arkansas Families.gamypoet3380No ratings yet

- Activity 2 Example 1.2 PunzalanHarseyJoyDocument14 pagesActivity 2 Example 1.2 PunzalanHarseyJoyHarsey Joy PunzalanNo ratings yet

- Guide To Managerial AccountingDocument23 pagesGuide To Managerial AccountingTai LeNo ratings yet

- PPT2 Accounting For Not For Profit OrganizationDocument27 pagesPPT2 Accounting For Not For Profit Organizationratna sulistianaNo ratings yet

- 2 Branches of AccountingDocument28 pages2 Branches of Accountingapi-267023512100% (2)

- Dokumen - Tips - Accounting Auditing Board of Ethiopia Aabe A Ipsas Are Being DevelopedDocument34 pagesDokumen - Tips - Accounting Auditing Board of Ethiopia Aabe A Ipsas Are Being DevelopedOUSMAN SEIDNo ratings yet

- 2 Branches of AccountingDocument46 pages2 Branches of AccountingAdrianChrisArciagaArevalo100% (1)

- TOPIC 2 - Fundamenatals To PSAFDocument52 pagesTOPIC 2 - Fundamenatals To PSAFEric KumaNo ratings yet

- Cffras-Conceptualframeworkppt S1sy2022-2023Document48 pagesCffras-Conceptualframeworkppt S1sy2022-2023Razel De DiosNo ratings yet

- LMT School of Management, Thapar University Masters of Business AdministrationDocument21 pagesLMT School of Management, Thapar University Masters of Business Administrationgursimran jit singhNo ratings yet

- UTS ReviewDocument9 pagesUTS ReviewRyan FajriNo ratings yet

- Report On Public Sector AccountingDocument2 pagesReport On Public Sector AccountingBELENGA GEOFREYNo ratings yet

- IPSASB Conceptual Framework For General Purpose Financial ReportingDocument39 pagesIPSASB Conceptual Framework For General Purpose Financial Reportingnemz2593No ratings yet

- Environment CharacteristicsDocument59 pagesEnvironment CharacteristicsMoheieldeen SamehNo ratings yet

- Intermediate Financial Accounting: Canadian Financial Reporting EnvironmentDocument27 pagesIntermediate Financial Accounting: Canadian Financial Reporting EnvironmentSteveKingNo ratings yet

- ASP-Pertemuan - 1Document43 pagesASP-Pertemuan - 1fahruNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 1Document26 pagesACCY901 Accounting Foundations For Professionals: Topic 1venkatachalam radhakrishnan100% (1)

- Lecture 01 - Introduction To AccountingDocument44 pagesLecture 01 - Introduction To AccountingMALIK ABDUL RAFAYNo ratings yet

- Accounting For Public OrganizationsDocument54 pagesAccounting For Public Organizationstame kibruNo ratings yet

- Acc 101 ExamDocument20 pagesAcc 101 Examedward peraltaNo ratings yet

- 1 FAR.401402 Intro To Standard Setting Process FrameworkDocument90 pages1 FAR.401402 Intro To Standard Setting Process FrameworkAbby UmipigNo ratings yet

- The Environment of Financial Accounting and Reporting IasbDocument7 pagesThe Environment of Financial Accounting and Reporting IasbvhuusbcNo ratings yet

- Ae3 Ae6 ReviewDocument7 pagesAe3 Ae6 ReviewvhuusbcNo ratings yet

- Essay # 2Document1 pageEssay # 2Alexa De Villena DionisioNo ratings yet

- PPT1-IPSAS and Government Accounting SystemDocument23 pagesPPT1-IPSAS and Government Accounting Systemratna sulistianaNo ratings yet

- Lesson Proper For Week 1Document6 pagesLesson Proper For Week 1Kisura GraphicsNo ratings yet

- ToA.201 Conceptual FrameworkDocument27 pagesToA.201 Conceptual Frameworknaztig_017No ratings yet

- NIOS Accountancy CH 16 Not For Profit Organisations Part 1Document4 pagesNIOS Accountancy CH 16 Not For Profit Organisations Part 1KandaroliNo ratings yet

- Unit 1Document25 pagesUnit 1Dipen DhakalNo ratings yet

- PronouncementDocument23 pagesPronouncementPhilipa Meilinda PutriNo ratings yet

- Financial Reporting SystemDocument78 pagesFinancial Reporting SystemSayedzahir SadatNo ratings yet

- Chapter 2 Accounting Principles and Reporting StandardsDocument23 pagesChapter 2 Accounting Principles and Reporting StandardsCelyn DeañoNo ratings yet

- Introudction To Management Accounting RevisedDocument27 pagesIntroudction To Management Accounting RevisedraghbendrashahNo ratings yet

- IPSASB CF Seminar Feb15 - 180193Document38 pagesIPSASB CF Seminar Feb15 - 180193Derek SnowNo ratings yet

- 1 Handout Accounting 1 Partnership Formation Operation Dissolution LiquidationDocument53 pages1 Handout Accounting 1 Partnership Formation Operation Dissolution LiquidationAira Nhaire Cortez MecateNo ratings yet

- Management Accounting Notes 20.02.2024Document11 pagesManagement Accounting Notes 20.02.2024damienmugabo3No ratings yet

- CH 3-Constructing Financial StatementsDocument61 pagesCH 3-Constructing Financial StatementsGizachewNo ratings yet

- Cfas 1Document10 pagesCfas 1Bea charmillecapiliNo ratings yet

- Accounting Is The - Of: - , - and - EconomicDocument48 pagesAccounting Is The - Of: - , - and - EconomicKristia AnagapNo ratings yet

- L1 - Intro. & Accounting Concepts-1Document25 pagesL1 - Intro. & Accounting Concepts-1Intan SyuhadaNo ratings yet

- ppt01 - OnDocument27 pagesppt01 - OnnowayNo ratings yet

- Raya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuDocument15 pagesRaya University Business and Economics Accounting and Finance Program Course Title: Financial Accounting I By: Mr. Fantay AlemayehuFantayNo ratings yet

- Accrual Accounting CPSA 1 Jul 2019Document24 pagesAccrual Accounting CPSA 1 Jul 2019JOHN TUMWEBAZENo ratings yet

- Chapter One Overview of Financial Reporting For Government and NFP EntitiesDocument11 pagesChapter One Overview of Financial Reporting For Government and NFP Entitiescherinetbirhanu8No ratings yet

- Cfas P1Document15 pagesCfas P1Munchq NoriegaNo ratings yet

- BAANDocument33 pagesBAANLavanya LakhwaniNo ratings yet

- Topic 1 Intermediate AccountingDocument48 pagesTopic 1 Intermediate AccountingFoni NancyNo ratings yet

- 01 GNFP Chapter OneDocument20 pages01 GNFP Chapter Onesabit hussenNo ratings yet

- Governmental and Not Profit AccountingDocument4 pagesGovernmental and Not Profit AccountingPahladsingh100% (1)

- ACCOUNTINGDocument6 pagesACCOUNTINGFe VhieNo ratings yet

- SLLC - 2021 - Acc - Lecture Note - 01Document43 pagesSLLC - 2021 - Acc - Lecture Note - 01Chamela MahiepalaNo ratings yet

- OSX FinancialAccounting Ch01Document12 pagesOSX FinancialAccounting Ch01John Elrick PelayoNo ratings yet

- IFRS-Based Financial ReportingDocument47 pagesIFRS-Based Financial ReportingAyu Etika SNo ratings yet

- WK 1 Introduction To Accounting - 2024T1Document31 pagesWK 1 Introduction To Accounting - 2024T1orokonoNo ratings yet

- Accounting, Auditing and ReportingDocument12 pagesAccounting, Auditing and ReportingJhon GonzalesNo ratings yet

- Scope of Practice (Sectors)Document14 pagesScope of Practice (Sectors)Marielle Mae BurbosNo ratings yet

- Business Essentials: The Role of Accountants and Accounting InformationDocument43 pagesBusiness Essentials: The Role of Accountants and Accounting InformationDarmawan faridNo ratings yet

- F1.3-FinancialAccounting Notes 2Document280 pagesF1.3-FinancialAccounting Notes 2seremcornelius24No ratings yet

- Public Sector Accounting: CUAC 406 by ChengeramangaDocument101 pagesPublic Sector Accounting: CUAC 406 by ChengeramangaTanyahl MatumbikeNo ratings yet

- Understanding Principles of Accounting: A High School Student’S Companion.From EverandUnderstanding Principles of Accounting: A High School Student’S Companion.No ratings yet

- The Wall Street Journal - 31-07-2021Document42 pagesThe Wall Street Journal - 31-07-2021SEBASNo ratings yet

- Partnership AccountingDocument3 pagesPartnership AccountingDan RyanNo ratings yet

- Test Bank For Principles of Macroeconomics 11 e 11th Edition Karl e Case Ray C Fair Sharon e OsterDocument47 pagesTest Bank For Principles of Macroeconomics 11 e 11th Edition Karl e Case Ray C Fair Sharon e OsterJonMartinezrdtob100% (43)

- Cash CycleDocument11 pagesCash CycleMuhammad MansoorNo ratings yet

- Group 4 ResearchDocument65 pagesGroup 4 ResearchZonith ValleNo ratings yet

- Unit 2 Banking Innovations: Evolution of Banking in IndiaDocument8 pagesUnit 2 Banking Innovations: Evolution of Banking in IndiaAnitha RNo ratings yet

- Invoice To Kimbraly A Hostetter - #96-935975Document1 pageInvoice To Kimbraly A Hostetter - #96-935975Imalka PriyadarshaniNo ratings yet

- Circular CGST 199Document4 pagesCircular CGST 199Jaipur-B Gr-2No ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- MujiDocument5 pagesMujiHương PhanNo ratings yet

- Nigeria's Business Environment: Issues Challenges and ProspectsDocument7 pagesNigeria's Business Environment: Issues Challenges and ProspectsShólànké Ezekiel ShówúnmiNo ratings yet

- Entrep Handout Wk2Document5 pagesEntrep Handout Wk2julialynsantos008No ratings yet

- Mr. Ezhil S/o Perumal Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Document7 pagesMr. Ezhil S/o Perumal Annexure (A) To The Project Cost of Project and Means of Finance Cost of Project Amount (RS)Babufarmer123No ratings yet

- Sample of Doctoral Thesis On Corporate Governance and Financial PerformanceDocument5 pagesSample of Doctoral Thesis On Corporate Governance and Financial Performancexgkeiiygg100% (2)

- Understanding Customer Requirements-CrmDocument47 pagesUnderstanding Customer Requirements-CrmBenedict MuringakumweNo ratings yet

- GJTL Annual Report 2019 RevisiDocument272 pagesGJTL Annual Report 2019 RevisiRiza DwiNo ratings yet

- Eshopbox Pricing For Your BusinessDocument19 pagesEshopbox Pricing For Your Businesspavan kumar tNo ratings yet

- APC Partner Direct Team CLA Contest For Jun'23Document17 pagesAPC Partner Direct Team CLA Contest For Jun'23menakaNo ratings yet

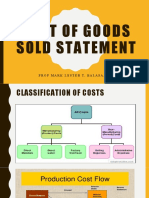

- Cost of Goods Sold StatementDocument18 pagesCost of Goods Sold StatementCherrylane EdicaNo ratings yet

- Facilitation Agreement (Airoli)Document2 pagesFacilitation Agreement (Airoli)cinemaupdatesforuNo ratings yet

- Slide1 Slide 2 What Is Competition ActDocument2 pagesSlide1 Slide 2 What Is Competition Actrobin hoodNo ratings yet

- Peaklife: Indexed Universal Life InsuranceDocument31 pagesPeaklife: Indexed Universal Life InsuranceJoseAliceaNo ratings yet

- Statement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Document37 pagesStatement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Iris NguNo ratings yet

- Introduction To Marketing: Reena Roy SastraDocument96 pagesIntroduction To Marketing: Reena Roy SastraGopi KrishnanNo ratings yet

- History of Indian EconomyDocument3 pagesHistory of Indian EconomyNILESH KUMARNo ratings yet

- V F Corporation NYSE VFC FinancialsDocument10 pagesV F Corporation NYSE VFC FinancialsvipinNo ratings yet