Professional Documents

Culture Documents

215 Chap05 Leverage

215 Chap05 Leverage

Uploaded by

Vishal KalebarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

215 Chap05 Leverage

215 Chap05 Leverage

Uploaded by

Vishal KalebarCopyright:

Available Formats

Chapter 5

Operating and Financial

Leverage

Chapter 5 - Outline LT 5-1

What is Leverage?

Break-Even (BE) Point

Operating Leverage

Financial Leverage

Leverage Means Risk

Combined or Total Leverage

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

What is Leverage? LT 5-2

Leverage is using fixed costs to magnify the potential return

to a firm

2 types of fixed costs:

– fixed operating costs = rent, depreciation

– fixed financial costs = i costs from debt

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Leverage Means Risk LT 5-6

Leverage is a double-edged sword

It magnifies profits as well as losses

An aggressive or highly leveraged firm has high fixed costs

(and a relatively high break-even point)

A conservative or non-leveraged firm has low fixed costs

(and a relatively low break-even point)

Many Japanese firms tend to be highly leveraged

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Break-Even (BE) Point LT 5-3

Quantity where Total Revenue equals Total Cost

Company has no Profit or Loss

BE = Fixed Costs / (Price – Variable Costs)

A leveraged firm has a high BE point

A non-leveraged firm has a low BE point

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Operating Leverage LT 5-4

Measure of the amount of fixed operating costs used by a

firm

Degree of Operating Leverage (DOL) = %age in EBIT (or

OI) / %age in Sales

a in Sales a larger in EBIT (or OI)

Operating Leverage measures the sensitivity of a firm’s

operating income to a in sales

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

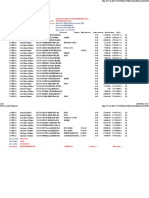

PPT 5-2

TABLE 5-2

Volume-cost-profit analysis: Leveraged firm

Price/Unit $ 2.00

VC / Unit $ 0.80

Total Operating

Variable Fixed Total Income

Units Sold Costs Costs Total Costs Revenue (Loss)

- $ - $ 60,000 $ 60,000 $ - (60,000)

20,000 $ 16,000 $ 60,000 $ 76,000 $ 40,000 (36,000)

40,000 $ 32,000 $ 60,000 $ 92,000 $ 80,000 (12,000)

50,000 $ 40,000 $ 60,000 $ 100,000 $ 100,000 -

60,000 $ 48,000 $ 60,000 $ 108,000 $ 120,000 12,000

80,000 $ 64,000 $ 60,000 $ 124,000 $ 160,000 36,000

100,000 $ 80,000 $ 60,000 $ 140,000 $ 200,000 60,000

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

FIGURE 5-1

Break-even

chart:

Leveraged

firm

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

PPT 5-4

TABLE 5-3

Volume-cost-profit analysis: Conservative firm

Price/Unit $

2.00

VC / Unit $

1.60

Total Operating

Variable Fixed Total Income

Units Sold Costs Costs Total Costs Revenue (Loss)

- $ - $ 12,000 $ 12,000 $ - (12,000)

20,000 $ 32,000 $ 12,000 $ 44,000 $ 40,000 (4,000)

30,000 $ 48,000 $ 12,000 $ 60,000 $ 60,000 -

40,000 $ 64,000 $ 12,000 $ 76,000 $ 80,000 4,000

60,000 $ 96,000 $ 12,000 $ 108,000 $ 120,000 12,000

80,000 $ 128,000 $ 12,000 $ 140,000 $ 160,000 20,000

100,000 $ 160,000 $ 12,000 $ 172,000 $ 200,000 28,000

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

FIGURE 5-2 5-3

Break-even

chart:

Conservative

firm

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

PPT 5-5

TABLE 5-4

Operating income or loss

Units Leveraged Conservative

Sold Firm Firm

- (60,000) (12,000)

20,000 (36,000) (4,000)

40,000 (12,000) -

50,000 - 4,000

60,000 12,000 12,000

80,000 36,000 20,000

100,000 60,000 28,000

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Financial Leverage LT 5-5

Measure of the amount of debt used by a firm

Degree of Financial Leverage (DFL) = %age in EPS / %age

in EBIT (or OI)

a in EBIT (or OI) a larger in EPS

Financial Leverage measures the sensitivity of a firm’s

earnings per share to a in operating income

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

5-8

TABLE 5-5

Impact of Financing plan on earnings/share

Earnings before Interest and taxes (EBIT)= $0.00

Plan A Plan B

(Leveraged) (Conservative)

Earnings before Interest and taxes (EBIT) $0 $0

Less Interest Payments (I) ($12,000) ($4,000)

equals Earnings Before Taxes (EBT) ($12,000) ($4,000)

Less Taxes (T) (assume 50%) $6,000 $2,000

equals Earnings Before Taxes (EBT) ($6,000) ($2,000)

divided by No. of Shares Outstanding $8,000 $24,000

equals Earnings Per Share (EPS) ($0.750) ($0.083)

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

5-8

TABLE 5-5

Impact of Financing plan on earnings/share

Earnings before Interest and taxes (EBIT)= $12,000.00

Plan A Plan B

(Leveraged) (Conservative)

Earnings before Interest and taxes (EBIT) $12,000 $12,000

Less Interest Payments (I) ($12,000) ($4,000)

equals Earnings Before Taxes (EBT) $0 $8,000

Less Taxes (T) (assume 50%) $0 ($4,000)

equals Earnings Before Taxes (EBT) $0 $4,000

divided by No. of Shares Outstanding $8,000 $24,000

equals Earnings Per Share (EPS) $0.000 $0.167

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

5-8

TABLE 5-5

Impact of Financing plan on earnings/share

Earnings before Interest and taxes (EBIT)= $16,000.00

Plan A Plan B

(Leveraged) (Conservative)

Earnings before Interest and taxes (EBIT) $16,000 $16,000

Less Interest Payments (I) ($12,000) ($4,000)

equals Earnings Before Taxes (EBT) $4,000 $12,000

Less Taxes (T) (assume 50%) ($2,000) ($6,000)

equals Earnings Before Taxes (EBT) $2,000 $6,000

divided by No. of Shares Outstanding $8,000 $24,000

equals Earnings Per Share (EPS) $0.250 $0.250

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

5-8

TABLE 5-5

Impact of Financing plan on earnings/share

Earnings before Interest and taxes (EBIT)= $36,000.00

Plan A Plan B

(Leveraged) (Conservative)

Earnings before Interest and taxes (EBIT) $36,000 $36,000

Less Interest Payments (I) ($12,000) ($4,000)

equals Earnings Before Taxes (EBT) $24,000 $32,000

Less Taxes (T) (assume 50%) ($12,000) ($16,000)

equals Earnings Before Taxes (EBT) $12,000 $16,000

divided by No. of Shares Outstanding $8,000 $24,000

equals Earnings Per Share (EPS) $1.500 $0.667

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

5-8

TABLE 5-5

Impact of Financing plan on earnings/share

Earnings before Interest and taxes (EBIT)= $60,000.00

Plan A Plan B

(Leveraged) (Conservative)

Earnings before Interest and taxes (EBIT) $60,000 $60,000

Less Interest Payments (I) ($12,000) ($4,000)

equals Earnings Before Taxes (EBT) $48,000 $56,000

Less Taxes (T) (assume 50%) ($24,000) ($28,000)

equals Earnings Before Taxes (EBT) $24,000 $28,000

divided by No. of Shares Outstanding $8,000 $24,000

equals Earnings Per Share (EPS) $3.000 $1.167

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

5-8

TABLE 5-5

Impact of Financing plan on earnings/share

EPS Plan A EPS Plan B

Earnings before Interest and taxes (EBIT)

(Leveraged) (Conservative)

$0 ($0.75) ($0.08)

$12,000 $0.00 $0.17

$16,000 $0.25 $0.25

$36,000 $1.50 $0.67

$60,000 $3.00 $1.17

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

PPT 5-7

FIGURE 5-4

Financing plans

and

earnings

per share

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

Combined or Total Leverage LT 5-7

Represents maximum use of leverage

Degree of Combined or Total Leverage (DCL or DTL) = %age

in EPS / %age in Sales

a in Sales a larger in EPS

Short-cut formula:

DCL or DTL = DOL x DFL

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

TABLE 5-6 PPT 5-9

Income statement

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

PPT 5-10

FIGURE 5-5

Combining

operating

and financial

leverage

McGraw-Hill/Irwin © 2005 The McGraw-Hill Companies, Inc., All Rights Reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Hi Smile PDF SubmitDocument1 pageHi Smile PDF Submitx9h69kt6g8No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- CIMB BANK Products and Services PresentationDocument20 pagesCIMB BANK Products and Services PresentationAzwin YusoffNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Royal Enfield ProjectDocument69 pagesRoyal Enfield Projectamaljithsithu623846No ratings yet

- Kumar Et Al. (2019)Document17 pagesKumar Et Al. (2019)Lance HuendersNo ratings yet

- Thank YouDocument7 pagesThank Youminh trang lêNo ratings yet

- MR PANG JUN JIE Bill 6Document4 pagesMR PANG JUN JIE Bill 6Jun Jie PangNo ratings yet

- Trade BarriersDocument27 pagesTrade BarriersEmily GudinoNo ratings yet

- Module III: DerivativesDocument18 pagesModule III: Derivativessantucan1No ratings yet

- Week 10 - Tutorial QuestionsDocument8 pagesWeek 10 - Tutorial Questionsqueeen of the kingdomNo ratings yet

- Flegg & BolandDocument2 pagesFlegg & BolandNoel GallagherNo ratings yet

- Aggregate Planning in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument12 pagesAggregate Planning in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiNo ratings yet

- Agrani Bank Limited: Wasa Corp. Branch4786Document2 pagesAgrani Bank Limited: Wasa Corp. Branch4786farjana khatunNo ratings yet

- OCC BANK LIST National by NameDocument30 pagesOCC BANK LIST National by NameTHEYDONTWINNo ratings yet

- TASK PERFORMANCE-Strategic Cost Acctg-PrelimDocument5 pagesTASK PERFORMANCE-Strategic Cost Acctg-PrelimAnonymouslyNo ratings yet

- December 2022 InvoiceDocument2 pagesDecember 2022 InvoiceMegha NandiwalNo ratings yet

- TS23020665Document1 pageTS23020665Khaidir FirmansyahNo ratings yet

- Complete Knife Stella For CombineDocument4 pagesComplete Knife Stella For CombineVolodymyr KuruchNo ratings yet

- 1A Ch01 WS LevelBoosting EDocument25 pages1A Ch01 WS LevelBoosting EWinson TangNo ratings yet

- Channel MGT Handout CH 1-8Document65 pagesChannel MGT Handout CH 1-8asfawNo ratings yet

- Governance-: The World Bank's ExperienceDocument86 pagesGovernance-: The World Bank's ExperienceSuresh KumarNo ratings yet

- Branch Accounting Lecture... 1 1Document84 pagesBranch Accounting Lecture... 1 1WILBROAD THEOBARDNo ratings yet

- Bella Drops Website FinalDocument9 pagesBella Drops Website FinalLitto WillyNo ratings yet

- Materi Presentasi DDIDocument14 pagesMateri Presentasi DDIANNISA FARADIBANo ratings yet

- Mhban01285390000015876 2023Document2 pagesMhban01285390000015876 2023AIX CONNECT PVT LTDNo ratings yet

- Ielts Writing Task 1 VocabularyDocument6 pagesIelts Writing Task 1 VocabularyTrần Thuận HiếuNo ratings yet

- Organizational Customers' Retention Strategies On CustomerDocument10 pagesOrganizational Customers' Retention Strategies On CustomerDon CM WanzalaNo ratings yet

- Assignment # 5 Formation of COSDocument2 pagesAssignment # 5 Formation of COSIron FeathersNo ratings yet

- Chapter 3 Interest RateDocument15 pagesChapter 3 Interest RateEhab HosnyNo ratings yet

- Sps. Sinamban v. China Banking Corporation, G.R. 193890, March 11, 2015Document10 pagesSps. Sinamban v. China Banking Corporation, G.R. 193890, March 11, 2015Albertjohn ZamarNo ratings yet

- Lean Six SigmaDocument15 pagesLean Six SigmaJoão Victor RoconNo ratings yet