Professional Documents

Culture Documents

02at Aiv291010

02at Aiv291010

Uploaded by

Kabir AbdulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02at Aiv291010

02at Aiv291010

Uploaded by

Kabir AbdulCopyright:

Available Formats

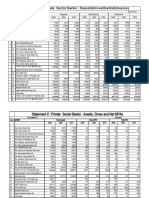

Appendix Table IV.

2(A): Non-Performing Assets of Public Sector Banks - Sector-wise

(As at end-March 2010)

(Amount in ` crore)

Sr. Name of the Bank Priority Sector NPAs Of which, Of which, Of which, Others Public Sector NPAs Non-Priority Sector Total NPAs

No. Agriculture Small Scale Industries NPAs

Amount Per cent Amount Per cent Amount Per cent Amount Per cent Amount Per cent Amount Per cent Amount

to total to total to total to total to total to total 15 =

(3+11+13)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Public Sector Banks 30,848 53.8 8,330 14.5 11,537 20.1 10,981 19.2 524 0.9 25,929 45.3 57,301

Nationalised Banks 19,908 56.1 5,741 16.2 8,668 24.4 5,499 15.5 280 0.8 15,283 43.1 35,470

1. Allahabad Bank 713 58.4 215 17.6 311 25.4 187 15.3 119 9.8 389 31.9 1,221

2. Andhra Bank 218 44.7 26 5.4 66 13.5 126 25.9 - - 270 55.3 488

3. Bank of Baroda 1,444 65.8 636 29.0 530 24.1 279 12.7 85 3.9 667 30.4 2,196

4. Bank of India 2,147 47.9 490 10.9 1,360 30.4 297 6.6 18 0.4 2,317 51.7 4,481

5. Bank of Maharashtra 795 65.7 232 19.2 363 30.0 200 16.6 - - 415 34.3 1,210

6. Canara Bank 1,423 56.8 462 18.4 394 15.7 568 22.7 - - 1,081 43.2 2,505

7. Central Bank of India 1,658 67.5 421 17.1 922 37.5 315 12.8 8 0.3 792 32.2 2,458

8. Corporation Bank 398 61.1 122 18.7 79 12.1 197 30.3 - - 253 38.9 651

9. Dena Bank 379 59.0 83 13.0 74 11.5 222 34.6 - - 263 41.0 642

10. Indian Bank 249 54.2 55 12.0 163 35.5 31 6.7 - - 210 45.8 459

11. Indian Overseas Bank 1,192 34.6 276 8.0 606 17.6 310 9.0 2 - 2,248 65.3 3,442

12. Oriental Bank of Commerce 911 62.0 276 18.8 385 26.2 250 17.0 - - 558 38.0 1,469

161

13. Punjab and Sind Bank 138 67.1 42 20.4 85 41.2 11 5.5 - - 68 32.9 206

14. Punjab National Bank 2,471 76.9 977 30.4 1,165 36.3 328 10.2 4 0.1 739 23.0 3,214

15. Syndicate Bank 1,091 54.4 176 8.8 238 11.9 677 33.8 12 0.6 902 45.0 2,005

16. UCO Bank 976 58.6 289 17.4 339 20.4 348 20.9 15 0.9 674 40.5 1,665

17. Union Bank of India 1,632 61.3 369 13.9 895 33.6 367 13.8 - - 1,032 38.7 2,664

18. United Bank of India 894 65.1 204 14.9 283 20.6 407 29.6 - - 478 34.9 1,372

19. Vijaya Bank 394 39.6 93 9.4 190 19.1 110 11.1 17 1.7 583 58.7 994

20. IDBI Bank Ltd. 785 36.9 297 13.9 221 10.4 267 12.6 - - 1,344 63.1 2,129

State Bank Group 10,940 50.1 2,589 11.9 2,869 13.1 5,482 25.1 244 1.1 10,646 48.8 21,831

21. State Bank of Bikaner and Jaipur 269 43.9 7 1.1 124 20.2 139 22.6 - - 343 56.1 612

22. State Bank of Hyderabad 290 44.9 55 8.4 102 15.8 134 20.7 - - 356 55.1 646

23. State Bank of India 9,073 50.9 2,322 13.0 2,168 12.2 4,583 25.7 235 1.3 8,529 47.8 17,836

24. State Bank of Indore 210 42.6 19 3.8 57 11.6 134 27.1 - - 283 57.4 493

25. State Bank of Mysore 291 49.0 43 7.2 120 20.1 129 21.6 3 0.5 301 50.5 595

26. State Bank of Patiala 543 54.0 119 11.8 212 21.1 212 21.1 - - 463 46.0 1,007

27. State Bank of Travancore 264 41.1 25 3.8 87 13.6 152.00 23.7 6 1.0 372 57.9 642

-: Nil/Negligible.

Source : Off-site returns (domestic).

Appendix Tables

You might also like

- Non Performing Assets Project MBADocument69 pagesNon Performing Assets Project MBAsrikanthmogilla1285% (34)

- How To Price Swaps in Your Head An Interest Rate Swap & Asset Swap PrimerDocument96 pagesHow To Price Swaps in Your Head An Interest Rate Swap & Asset Swap Primerswinki3No ratings yet

- BankWise Performance 2021-22Document3 pagesBankWise Performance 2021-22sgrfgrNo ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument25 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesmkapoor5686No ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesSyed Mahammad AshifNo ratings yet

- Foreignsecbanks 3806Document8 pagesForeignsecbanks 3806sanjay_1234No ratings yet

- Statement I: Foreign Banks in India: Deposits/Investments/AdvancesDocument8 pagesStatement I: Foreign Banks in India: Deposits/Investments/Advancesramkumar6388No ratings yet

- Private Sec Banks 3806Document9 pagesPrivate Sec Banks 3806Ganesh RamaiyerNo ratings yet

- Samples DetailsDocument4 pagesSamples Detailsswaroop shettyNo ratings yet

- Private Sector Banks 2020-22Document8 pagesPrivate Sector Banks 2020-22Sidharth Sankar RathNo ratings yet

- UntitledghDocument1 pageUntitledghMichaelNo ratings yet

- Appendix: Table 8.1: Non Performing Assets of Different BanksDocument8 pagesAppendix: Table 8.1: Non Performing Assets of Different Banksshreeya salunkeNo ratings yet

- 8.5. Agriculture Advances As at DECEMBER 2019Document2 pages8.5. Agriculture Advances As at DECEMBER 2019samNo ratings yet

- CLSA Valuation Matrix 20131127Document3 pagesCLSA Valuation Matrix 20131127mkmanish1No ratings yet

- KFI Poush 20791 PDFDocument1 pageKFI Poush 20791 PDFRajendra NeupaneNo ratings yet

- AppendicesDocument105 pagesAppendicesshani807No ratings yet

- 51 Acp-March2015Document3 pages51 Acp-March2015Projects ScholarsDenNo ratings yet

- Some Key Indicators of Indian Banking BusinessDocument20 pagesSome Key Indicators of Indian Banking BusinessPratik PatilNo ratings yet

- Vi.5. Posisi Pinjaman Luar Negeri Swasta (Juta USD) : 2007 2008 2009 2010 2011 Bank Kelompok BankDocument2 pagesVi.5. Posisi Pinjaman Luar Negeri Swasta (Juta USD) : 2007 2008 2009 2010 2011 Bank Kelompok BankIzzuddin AbdurrahmanNo ratings yet

- NRB KFI-Ashwin-2079 PDFDocument1 pageNRB KFI-Ashwin-2079 PDFLikesh ShresthaNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/Advancesprakasht_1No ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesGyanendra AgrawalNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesanandbhawanaNo ratings yet

- TB6 STST1118Document3 pagesTB6 STST1118rajsirwaniNo ratings yet

- Year Bank Total Assets I.Interest Earned Iii. Interest Expend Ed Net Interest Income (I-III)Document57 pagesYear Bank Total Assets I.Interest Earned Iii. Interest Expend Ed Net Interest Income (I-III)RITIKANo ratings yet

- Annexure - 2 (A) - IDocument12 pagesAnnexure - 2 (A) - IUttamJainNo ratings yet

- Acp 2015 16 March16Document2 pagesAcp 2015 16 March16L Sudhakar ReddyNo ratings yet

- Annexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020Document2 pagesAnnexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020JNR ENTERPRISESNo ratings yet

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaNo ratings yet

- OropDocument1 pageOropkapsicumadNo ratings yet

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- Vi.1. Posisi Pinjaman Luar Negeri (Juta USD) : Keterangan 2007 2008 2009 2010 2011 Pemerintah Dan Otoritas MoneterDocument2 pagesVi.1. Posisi Pinjaman Luar Negeri (Juta USD) : Keterangan 2007 2008 2009 2010 2011 Pemerintah Dan Otoritas MoneterIzzuddin AbdurrahmanNo ratings yet

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandeNo ratings yet

- A Comparative Study of Loan Performance SandraDocument23 pagesA Comparative Study of Loan Performance SandraSandra DennyNo ratings yet

- NPA2008Document2 pagesNPA2008vishwanathNo ratings yet

- SPI September 2019Document818 pagesSPI September 2019DewiNo ratings yet

- 12.1 Scheduled Banks Operating in Pakistan: 12. BankingDocument6 pages12.1 Scheduled Banks Operating in Pakistan: 12. Bankingh4hasnainNo ratings yet

- Dividend Yield Stocks 6 JanDocument2 pagesDividend Yield Stocks 6 JanIndrayani NimbalkarNo ratings yet

- Important Banking Indicators - Regional Rural Banks - OutstandingDocument8 pagesImportant Banking Indicators - Regional Rural Banks - OutstandingAkshay Yadav Student, Jaipuria LucknowNo ratings yet

- NPASDocument2 pagesNPASMaiyakabetaNo ratings yet

- Earnings Projection of BanksDocument2 pagesEarnings Projection of Banksmahfuz69No ratings yet

- 5.Off-Balance Sheet CommitmentsDocument2 pages5.Off-Balance Sheet CommitmentsAbdelkebir BelkhayNo ratings yet

- TABLE 5.1 Components of Monetary AssetsDocument9 pagesTABLE 5.1 Components of Monetary AssetsfaysalNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesNirmal SinghNo ratings yet

- Top 50 World BanksDocument1 pageTop 50 World BanksKicki AnderssonNo ratings yet

- Strategy: Portfolio Perspectives: Safe and SelectiveDocument15 pagesStrategy: Portfolio Perspectives: Safe and SelectiveRecrea8 EntertainmentNo ratings yet

- Asset Classsification 2005-10Document2 pagesAsset Classsification 2005-10Anoop MohantyNo ratings yet

- Data Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)Document13 pagesData Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)vivek adkineNo ratings yet

- Source: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIDocument4 pagesSource: Off-Site Returns (Domestic) of Banks, Department of Banking Supervision, RBIManikanda Bharathi SNo ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Other STRBI Table No 20. Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial BanksDocument6 pagesOther STRBI Table No 20. Bank-Wise and Bank Group-Wise Gross Non-Performing Assets, Gross Advances, and Gross NPA Ratio of Scheduled Commercial BanksPrasad KhandekarNo ratings yet

- Div Yield 10Document2 pagesDiv Yield 10Hardik SompuraNo ratings yet

- 2080 - 01indicators of BaisakhDocument1 page2080 - 01indicators of BaisakhRaman GautaNo ratings yet

- Specialized Bank DataDocument11 pagesSpecialized Bank DataTalha A SiddiquiNo ratings yet

- Trending Value Portfolio Implementation-GoodDocument260 pagesTrending Value Portfolio Implementation-Gooddheeraj nautiyalNo ratings yet

- Roa Roe 2012 2013 2014 2015 2016 2012Document76 pagesRoa Roe 2012 2013 2014 2015 2016 2012Aditya RahmanNo ratings yet

- Clearance of RA Bill 2 Final LetterDocument3 pagesClearance of RA Bill 2 Final LetterNiraj BholeNo ratings yet

- FinposDocument1 pageFinposmahfuz699No ratings yet

- Topic 11 (Money, Banking)Document35 pagesTopic 11 (Money, Banking)a191318No ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- RoughDocument2 pagesRoughketansanwalNo ratings yet

- On Bajaj Vs Hero HondaDocument17 pagesOn Bajaj Vs Hero HondaketansanwalNo ratings yet

- On Bajaj Vs Hero HondaDocument17 pagesOn Bajaj Vs Hero HondaketansanwalNo ratings yet

- Psu Npa BanksDocument1 pagePsu Npa BanksketansanwalNo ratings yet

- Understanding The Insurgency in FATADocument8 pagesUnderstanding The Insurgency in FATAketansanwalNo ratings yet

- MembershipQue&Faq FlowDocument3 pagesMembershipQue&Faq FlowgeevadsmlNo ratings yet

- Development Bank of The Philippines vs. Arcilla: Truth in Lending ActDocument4 pagesDevelopment Bank of The Philippines vs. Arcilla: Truth in Lending ActJosiebethAzueloNo ratings yet

- Documentary Stamp TaxDocument2 pagesDocumentary Stamp TaxMary Therese Anne DequiadoNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasSNRBTNo ratings yet

- Statement 13-NOV-23 GH 63962504 26043107Document5 pagesStatement 13-NOV-23 GH 63962504 26043107workgonchar87No ratings yet

- Memo Pract - 2Document1 pageMemo Pract - 2Ulises TranquilinoNo ratings yet

- JAIIB Principles of Banking MCQ MOD BDocument4 pagesJAIIB Principles of Banking MCQ MOD BChandru Mba100% (1)

- MCB Can Be Divided Into Three Phases: University of Central PunjabDocument39 pagesMCB Can Be Divided Into Three Phases: University of Central PunjabAhmed RiiazNo ratings yet

- Chapter 11 AISDocument4 pagesChapter 11 AISMyka ManalotoNo ratings yet

- Imp. Instructions For JoSAA R6Document2 pagesImp. Instructions For JoSAA R6Anurag MandloiNo ratings yet

- Statement MAR2021 125323533 (1)Document9 pagesStatement MAR2021 125323533 (1)Bakibillah MollaNo ratings yet

- Bank Statement: Account HolderDocument2 pagesBank Statement: Account HolderYurii OmeliukhNo ratings yet

- Kotak Mahindra BankDocument113 pagesKotak Mahindra BankAryan GouthamNo ratings yet

- Swift PDF DataDocument618 pagesSwift PDF DataSaddam Hussaian Guddu100% (1)

- Alpen Bank: Launching The Credit Card in Romania: Group - 1Document13 pagesAlpen Bank: Launching The Credit Card in Romania: Group - 1vijay kumarNo ratings yet

- CWAG - Payment Information FormDocument28 pagesCWAG - Payment Information Formjontengugi83No ratings yet

- General Banking of National Bank LimitedDocument52 pagesGeneral Banking of National Bank LimitedBishal IslamNo ratings yet

- 1519545495372Document6 pages1519545495372sumit malikNo ratings yet

- STD X CH 3 Money and Credit Notes (21-22)Document6 pagesSTD X CH 3 Money and Credit Notes (21-22)Dhwani ShahNo ratings yet

- Account Statement From 1 Apr 2022 To 3 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Apr 2022 To 3 Jun 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancethealkpNo ratings yet

- Fs Question BankDocument2 pagesFs Question BanksonaNo ratings yet

- Excel 19Document6 pagesExcel 19debojyotiNo ratings yet

- Status Report of Jocer Sacco 2020Document4 pagesStatus Report of Jocer Sacco 2020Tuyite Yudah100% (1)

- HDFC Bank LTDDocument2 pagesHDFC Bank LTDAkshay PatilNo ratings yet

- HDFC FirstDocument20 pagesHDFC FirstTotmolNo ratings yet

- XNTDocument4 pagesXNTKha LidNo ratings yet

- Fave Hotel Braga 8-10juni 17 (Kabag)Document1 pageFave Hotel Braga 8-10juni 17 (Kabag)PEP Kecamatan Taktakan100% (1)

- Interest Rate CollarDocument3 pagesInterest Rate Collarinaam mahmoodNo ratings yet