Professional Documents

Culture Documents

Service Tax On Works Contract: New Delhi), The Tribunal, On Facts Held That

Service Tax On Works Contract: New Delhi), The Tribunal, On Facts Held That

Uploaded by

abhirocks24Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Tax On Works Contract: New Delhi), The Tribunal, On Facts Held That

Service Tax On Works Contract: New Delhi), The Tribunal, On Facts Held That

Uploaded by

abhirocks24Copyright:

Available Formats

BUDGET 2007-08

Service tax on Works Contract

he levy of tax on works contract is a complex subject and has been a matter of consideration in a lot of judicial pronouncements for levy of sales tax as well as service tax. Issues as to the nature of contract viz. contract of sale vs. works contract, contract for work vs. works contract, indivisible contract vs. divisible contract, whether sales tax can be levied on the transfer of property in goods involved in the execution of works contract, whether service tax can be levied on the service portion of an indivisible works contract etc. have been considered by the Courts and Tribunals. The issue of levy of service tax on the design and engineering portion of a turnkey contract arose before the Delhi Tribunal in the case of Daelim Industrial Co. Ltd. V. CCE, Vadodara - (155) ELT 457 (Tri-Del) wherein the Tribunal held that the appellants contract with IOC was a works contract on turnkey basis and not a consultancy contract and that a works contract cannot be vivisected and part of it subjected to service tax. Similar view was held in the case of L&T Ltd. vs. CCE 2004 (174) ELT 322 (Tri - Del). The Supreme Court dismissed the Special Leave petition of the department in CCE, Vadodara vs. M/S. Daelim Industrial Co. Ltd. 2004 (170) ELT A181 (SC). The Supreme Court did not go in to the merits of the Tribunals order but merely stated that they saw no reason to interfere. However, in the case of L&T Ltd., the appeal filed by the department has been admitted by the Apex Court in 2005(182) ELT A149 (S.C). A lot of works contractors are relying on the principle laid down in the Daelim case and the L& T case to contend that the services portion of a works contract cannot be subject to levy of service tax. Recently, in CCE v. BSBK (P) Ltd (CESTAT K. Sivarajan

New Delhi), the Tribunal, on facts held that the contracts entered into by assessee were divisible in nature and therefore, assessee was held to be rendering taxable service of consulting engineer.

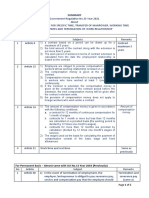

Proposed amendment

In this backdrop, the Finance Bill, 2007 proposes to introduce a levy of service tax on any service provided to any person, by any other person in relation to the execution of a works contract, excluding works contract in respect of roads, airports, railways, transport, terminals, bridges, tunnels and dams. Section 65(105) of the Finance Act, 1994 defines the taxable service in respect of various categories of services. The Finance Bill, 2007 seeks to introduce sub-clause (zzzza) to clause (105) as below: (zzzza) to any person, by any other person in relation to the execution of a works contract, excluding works contract in respect of roads, airports, railways, transport terminals, bridges, tunnels and dams. Explanation For the purposes of this sub-clause, works contract means a contract wherein, (i) transfer of property in goods involved in the execution of such contract is leviable to tax as sale of goods, and (ii) such contract is for the purposes of carrying out, a) erection, commissioning or installation of plant, machinery, equipment or structures, whether pre-fabricated or otherwise, installation of electrical and electronic devices, plumbing, drain laying or other installations for transport of fluids, heating, ventilation or air-conditioning including related pipe work, duct work and sheet metal work, thermal insulation, sound

(The author is a member of the Institute. He can be reached at sivarajan@krcca.com)

1552 The Chartered Accountant April 2007

BUDGET 2007-08

insulation, fire proofing or water proofing, lift and escalator, fire escape staircases or elevators; or b) construction of a new building or a civil structure or a part thereof, or of a pipeline or conduit, primarily for the purposes of commerce or industry; or c) construction of a new residential complex or a part thereof; or d) completion and finishing services, repair, alteration, renovation or restoration of, or similar services, in relation to (b) and (c); or e) turnkey projects including engineering, procurement and construction or commissioning (EPC) projects The issues that arise out of the proposed amendment are discussed hereunder:

(i) a building or buildings, having more than twelve residential units; (ii) .. The definition is applicable only to construction of complex service. Wherever the term residential complex appears in the Finance Act, it should have more than 12 residential units.

Effective date of levy of tax

In Para 154 of the Budget Speech of the Finance Minister has stated as under: State Govt levies tax on transfer of property in goods involved in execution of WCT. The value of such services in a WCT should attract service tax. Hence, I propose to levy service tax

Types of works contracts covered

Only works contracts involving transfer of property in goods involved in the execution of such contract leviable to tax as sale of goods, and being contracts of the nature specified in clauses (a) to (e) above are covered under the definition. Therefore, all other works contracts are not subject to levy of service tax under this category. For example, printing contracts, dyeing contracts, maintenance contracts, electrical or structural contracts etc., which are not in the nature of services specified above, are not taxable under this category.

The issue arises as to whether construction of a residential complex consisting of 12 residential units or less is taxable under the category of works contract.

on services involved in the execution of WCT. I propose an optional composition scheme under which ST will be levied at only 2% of total value of WCT. Vide clause 125 of the Finance Bill, 2007, the levy of service tax on works contracts is proposed to be levied with effect from such date to be notified by the Central Government in the official gazette. This strengthens the view that works contracts are not liable to service tax as on date.

Residential complex having less 12 units or less

Clause (c) above covers construction of new residential complex or a part thereof. Under construction of complex service, construction of a residential complex consisting of more than 12 residential units only is taxable. The issue arises as to whether construction of a residential complex consisting of 12 residential units or less is taxable under the category of works contract. Section 65(91a) defines residential complex to mean any complex comprising of

Composition scheme

An option for composition to pay service tax @ 2% on entire value is likely to be provided as stated by the Finance Minister in the Budget Speech. However, the methodology of valuation or and the conditions for composition are yet to be notified. Currently, if the services are classified under the respective categories of services, the effective rate of tax under composition works

April 2007 The Chartered Accountant 1553

BUDGET 2007-08

to 3.96% (excluding cess) i.e. 12.24% of 33% of the value of contract. However, providing for a composition rate of 2% for works contracts classified under clause (zzzza) would create inequality.

Classification

The services specified in clauses (a) to (d) above are already liable to service tax under separate categories as below: Therefore, the issue as to whether the contract should be classified under the respective categories or under works contract would arise. Further, since the composition rate proposed

section 2(h) of the Madras General Sales Tax Act was enlarged so as to include a transfer of property in goods involved in the execution of works contract. The issue arose in The State Of Madras V. Gannon Dunkerley & Co., (Madras) Ltd. (1958) 9 STC 353(SC), as to whether the provisions introduced by the Madras General sales tax Act are ultra vires the powers of the Provincial Legislature under Entry 48 in List II. The Apex Court held that there is no sale as such of materials used in a building contract, and that the Provincial Legislatures had no competence to impose a tax thereon under Entry 48. The 46th amendment to the Constitution was made thereafter to provide for a definition of tax on sale or purchase of goods, which includes transfer of property in goods (whether as goods or in some other form) involved in the execution of a works contract. Even after the amendment to the constitution, the definition of sale under the Central Sales Tax Act was not amended. The levy of sales tax on inter-state works contract by the States was challenged in Gannon Dunkerleys case (1993) 88 STC 204 (SC) where the apex court held that State Governments were not competent to levy sales tax on inter-state works contract. The Finance Act, 2002 has also amended the definition of sale under the Central Sales Tax Act, 2002 on the lines of the definition of deemed sale under the 46th amendment to the constitution. In the context of service tax, as already stated, it has been held that works contract cannot be vivisected for the purpose of levy of service tax. The landmark cases are:

v

Even after this proposed inclusion of works contract, the issue as to the requirement of an amendment in the Constitution to levy service tax on the service portion of the works contract is still unresolved.

is only 2% in respect of works contracts, classification under works contract may be more beneficial. The Government should ensure that such inequality is not created.

Cenvat credit

Assessees opting for the composition scheme are not entitled to avail CENVAT credit of capital goods, inputs and input services vide Notification 1/2006-ST dated 1.3.2006. Similar restriction is likely to be imposed in respect of works contractors opting for composition.

Constitutional validity

Even after this proposed inclusion of works contract, the issue as to the requirement of an amendment in the Constitution to levy service tax on the service portion of the works contract is still unresolved. Entry 48 in List II of Sch. VII to the Government of India Act, 1935, included the item taxes on the sale of goods but the definition of sale in

1554 The Chartered Accountant April 2007

Daelim Industrial Co. Ltd. Vs. CCE (155) ELT 457 (Tri-Del) CCE, Vadodara vs. M/S. Daelim Industrial Co. Ltd. 2004 (170) ELT A181 (SC) SLP filed by department dismissed Larsen & Toubro Ltd. vs. CCE 2004 (174) E.L.T. 322 (Tri. - Del.) Commissioner vs. Larsen & Toubro Ltd (182) ELT A149 (SC)- Supreme Court admitted the

BUDGET 2007-08

appeal filed by the Commissioner of Central Excise against the decision of the Tribunal

v

Emerson Process Management Power & Water Solution Inc. vs. CCE 2006 (3) STR 508 (Tri. Del.) CCE vs. Larsen & Toubro Ltd. 2005 (69) RLT 62 (CESTAT-Che.) CCE vs. Shapoorji Pollanji And Co. Ltd. 2005TIOL-892-CESTAT-DEL

In Rolls Royce Industrial Power (I) Ltd. & Anr. Vs. CCE 2004 (95) ECC 441 (Tri-Del), it was held that service tax was not applicable in respect of an agreement for operation and maintenance of a Power Station under the category consulting engineer and that the 46th Amendment and the Apex Courts decision in Builders Association of India and Ors. had no application to the case since a deemed definition similar to tax on sale or purchase of goods did not exist in the case of job work, as has taken place in regard to project contracts in sales tax. In Builders Association of India Vs. UOI (1989) 73 STC 370 (SC) the apex court held that the 46th Amendment does no more than making it possible for the States to levy sales tax on the price of goods and materials used in works contracts as if there was a sale of such goods and materials. Sub-clause (b) of article 366(29A) should not be read as being equivalent to a separate entry in List II of the Seventh Schedule to the Constitution enabling the States to levy tax on sales and purchases independent of entry 54 thereof. As the Constitution exists today the power of the States to levy taxes on sales and purchases of goods including the deemed sales and purchases of goods under clause (29A) of article 366 is to be found only in entry 54 and not outside it. In Geo Miller & Co. Pvt. Ltd. and others Vs. State of M.P. and others [2004] 136 STC 241 (SC), the Apex Court held that the definition of tax on the sale or purchase of goods as provided by the 46th Amendment through article 366(29A) does not apply to the M.P. Entry Tax Act. The

court observed that sale as it appears in article 366(29A) is with reference to the Sales Tax Act and that in the absence of definition of sale in the M.P. Entry Tax Act the Constitutional definition as provided in article 366(29A) must not be imported. Further, since the M.P. General Sales Tax Act was covered by entry 54 whereas the M.P. Entry Tax Act was covered by entry 52 it was held that both these Acts are covered by different entries in the Constitution and hence, the incidence of taxation in both cases is different. There is a deeming fiction in the constitution to treat the transfer of property in goods involved in the execution of works contract as liable to sales tax. However, there is no such deeming fiction to provide for a tax on the service component of works contract. Therefore, the imposition of tax on the service component in a works contract can still be challenged.

Service provided by sub-contractor

The issue as to whether both sub-contractor and main contractor would be liable to pay service tax on the works contract would arise in view of the decision of the Andhra Pradesh High Court in L& T and another Vs. State of AP - 148 STC 616 (AP). The Court observed that in a transaction of works contract, the property in goods passes directly to the employer by the theory of accretion and that the sub-contractor is only an agent of the contractor and the property in goods passes directly from the subcontractor to the employer and therefore there can only be one sale which is recognized by the legal fiction created under sub-Article 29A of Article 366. The court further observed that there is no principle of law which establishes that the property in goods passes to the contractor at any stage of the execution of the works contract in the event of a contractor awarding the contract to a sub-contractor and that there are two taxable events in such a transaction, enabling the State to levy and collect tax both from the sub-contractor and the contractor. r

April 2007 The Chartered Accountant

1555

You might also like

- Assignment 3 - Lien ProceduresDocument12 pagesAssignment 3 - Lien Proceduresrajnishatpec100% (2)

- Works Contract Under GST (Bare Framework)Document6 pagesWorks Contract Under GST (Bare Framework)Sanjay DwivediNo ratings yet

- Work Contracts in GSTDocument4 pagesWork Contracts in GSTakshayjain93No ratings yet

- Service Tax ConclusionDocument9 pagesService Tax ConclusionAbhas JaiswalNo ratings yet

- Works Contract and Principle of AccretionDocument5 pagesWorks Contract and Principle of AccretionNeeladri CNo ratings yet

- Construction Services Under GST - A Detailed InformationDocument27 pagesConstruction Services Under GST - A Detailed InformationMukul Yadav100% (1)

- Construction Contracts Works Contract From The Point of View of Value Added Tax Service TaxDocument6 pagesConstruction Contracts Works Contract From The Point of View of Value Added Tax Service TaxjohnsonNo ratings yet

- Detailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateDocument27 pagesDetailed Analysis of Tds For Contractor 194c by KC Singhal AdvocateAnkit SainiNo ratings yet

- 13 - Microsoft PowerPoint - 20071229-Servicetax-Works ContractDocument26 pages13 - Microsoft PowerPoint - 20071229-Servicetax-Works ContractSenthil KumarNo ratings yet

- Works Contract - Concept and ValuationDocument31 pagesWorks Contract - Concept and ValuationArun AroraNo ratings yet

- 194C Detailed AnalysisDocument18 pages194C Detailed AnalysisPuneet kumarNo ratings yet

- 12.1 History of Works ContractDocument21 pages12.1 History of Works ContractSubhasish ChatterjeeNo ratings yet

- Article On Works ContractDocument20 pagesArticle On Works ContractRafeek ShaikhNo ratings yet

- Preparing Interim Payment Valuations For Construction Works - Wor PDFDocument23 pagesPreparing Interim Payment Valuations For Construction Works - Wor PDFOumer ShaffiNo ratings yet

- Preparing Interim Payment Valuations For Construction Works - Wor PDFDocument23 pagesPreparing Interim Payment Valuations For Construction Works - Wor PDFBeni N SoloNo ratings yet

- Extension of Relief Periods Under The Covid 19 (Temporary Measures) Act For Relevant Contracts in The Built Environment SectorDocument6 pagesExtension of Relief Periods Under The Covid 19 (Temporary Measures) Act For Relevant Contracts in The Built Environment SectorKahHoe ChongNo ratings yet

- Workshop On: Taxability of Works ContractsDocument33 pagesWorkshop On: Taxability of Works ContractsSumit Kumar GhoshNo ratings yet

- Assignment 1 - Project Communication SkillsDocument8 pagesAssignment 1 - Project Communication SkillsrajnishatpecNo ratings yet

- What Is Works Contract?Document10 pagesWhat Is Works Contract?Naga BhushanNo ratings yet

- Impact of GST On Construction and Real EstateDocument7 pagesImpact of GST On Construction and Real Estatesahilkaushik0% (1)

- As 7Document11 pagesAs 7ZerefNo ratings yet

- GST Issues For Works Contract CA Yashwant Kasar - 31st July 2021Document73 pagesGST Issues For Works Contract CA Yashwant Kasar - 31st July 2021fintech ConsultancyNo ratings yet

- Works Contract - GSTDocument3 pagesWorks Contract - GSTkoushiki mishraNo ratings yet

- SKRINE - Law Firm, Legal Service, Intellectual Property, Trade Mark, MalaysiaDocument3 pagesSKRINE - Law Firm, Legal Service, Intellectual Property, Trade Mark, MalaysiazulNo ratings yet

- Works Contract Under: VAT, Service Tax & GSTDocument27 pagesWorks Contract Under: VAT, Service Tax & GSTJoe ThomasNo ratings yet

- Adjudication Construction Disputes MalaysiaDocument6 pagesAdjudication Construction Disputes MalaysiaDKNo ratings yet

- Construction Industry and Service Tax Amendments in Union Budget 2010Document16 pagesConstruction Industry and Service Tax Amendments in Union Budget 2010coolchaserNo ratings yet

- Barops Digest Leonen CasesDocument16 pagesBarops Digest Leonen CasesAudrey Kristina MaypaNo ratings yet

- Dagem Kennedy Installation AgreementsDocument5 pagesDagem Kennedy Installation AgreementseliasNo ratings yet

- (Updated On 5 November 2020) : An MND Statutory BoardDocument3 pages(Updated On 5 November 2020) : An MND Statutory BoardWilliamNo ratings yet

- 3 CE Construction VS AranetaDocument13 pages3 CE Construction VS AranetaKrisia OrenseNo ratings yet

- Calculating LDDocument13 pagesCalculating LDk1l2d3No ratings yet

- IAS 11 PresentationDocument33 pagesIAS 11 PresentationMoiez AliNo ratings yet

- Relevant Contracts Tax: Relevant Operations: Part 18-02-01Document9 pagesRelevant Contracts Tax: Relevant Operations: Part 18-02-01dadaNo ratings yet

- Dewan Chand Builders and Contractors Vs Union of Is111215COM816349Document11 pagesDewan Chand Builders and Contractors Vs Union of Is111215COM816349Arjun ParasharNo ratings yet

- Exp NoteDocument5 pagesExp NoteAbdullah AkbulutNo ratings yet

- G.R. No. 192725, August 09, 2017Document35 pagesG.R. No. 192725, August 09, 2017Anonymous XigeQsI4GZNo ratings yet

- Article On Works Contract Ilovepdf Compressed 10Document20 pagesArticle On Works Contract Ilovepdf Compressed 10Arif GokakNo ratings yet

- WORK CONTRACTS AND IMPLICATIONS FOR ROADS OR HIGHWAYS. - Kanoon For AllDocument10 pagesWORK CONTRACTS AND IMPLICATIONS FOR ROADS OR HIGHWAYS. - Kanoon For AllRaviNo ratings yet

- Westlaw Document 05-35-01 LADDocument16 pagesWestlaw Document 05-35-01 LADWen SiNo ratings yet

- Con MGTDocument9 pagesCon MGTIRSNo ratings yet

- Fa - Topic 3 Contract AccountDocument9 pagesFa - Topic 3 Contract AccountERICK ABDINo ratings yet

- RVNL GST CircularDocument10 pagesRVNL GST CircularAmul GuptaNo ratings yet

- Sector GSTDocument105 pagesSector GSTKunalKumarNo ratings yet

- Factors Affecting Production:: More Technological IntegrationDocument7 pagesFactors Affecting Production:: More Technological IntegrationDevarshNo ratings yet

- Public Works Department 2.1 Execution of Government Works Through Public Sector UndertakingsDocument22 pagesPublic Works Department 2.1 Execution of Government Works Through Public Sector UndertakingsjunovargheseNo ratings yet

- As LB 17764Document27 pagesAs LB 17764ratiNo ratings yet

- 17 - Circular No.681 Dated 8-3-1994Document10 pages17 - Circular No.681 Dated 8-3-1994BINNINo ratings yet

- GST On Construction of Solar Power System/Plant: Cma Utpal Kumar SahaDocument3 pagesGST On Construction of Solar Power System/Plant: Cma Utpal Kumar Sahachandra mouliNo ratings yet

- The Cost of Delay and DisruptionDocument11 pagesThe Cost of Delay and DisruptionAmir Shaik100% (1)

- 2022 Taisei DMCI - Joint - Venture20220922 12 13fnp5dDocument4 pages2022 Taisei DMCI - Joint - Venture20220922 12 13fnp5dVince Lupango (imistervince)No ratings yet

- Clarification 341Document16 pagesClarification 341Gunji Venkata Srinivasa BabuNo ratings yet

- DOJ Opinion No. 72, S. 2003Document15 pagesDOJ Opinion No. 72, S. 2003Roberto Miguel RamiroNo ratings yet

- Practical Illustrations On Indirect TaxationDocument9 pagesPractical Illustrations On Indirect Taxationsridharan1969No ratings yet

- Handbook On Works Contract ManagementDocument173 pagesHandbook On Works Contract ManagementRohit100% (1)

- CCMDocument29 pagesCCMprashantkshatriyaNo ratings yet

- Project Management For Procurement Management ModuleFrom EverandProject Management For Procurement Management ModuleNo ratings yet

- ICO LetterDocument3 pagesICO LetterLola HeaveyNo ratings yet

- Terence - Comedies (Ed. With Intro. and Notes by Ashmore)Document728 pagesTerence - Comedies (Ed. With Intro. and Notes by Ashmore)Verónica Díaz Pereyro100% (3)

- Mobile Banking ApplicationDocument4 pagesMobile Banking ApplicationR GanesanNo ratings yet

- EW 2016 Handbook v3Document294 pagesEW 2016 Handbook v3Carla AquinoNo ratings yet

- History of ZUMBADocument2 pagesHistory of ZUMBACandace Mae Oporto50% (2)

- Chapter-Ii Review of LiteratureDocument6 pagesChapter-Ii Review of Literaturesreekutty A SNo ratings yet

- Talcott Parsons - Toward A General Theory of Action (1962, Harvard University Press) - Páginas-9-15,19-45Document34 pagesTalcott Parsons - Toward A General Theory of Action (1962, Harvard University Press) - Páginas-9-15,19-45yasmin uchimaNo ratings yet

- In Re PurisimaDocument6 pagesIn Re PurisimabeayaoNo ratings yet

- SUMMARY of Goverment Regulation No 35 - 2021Document5 pagesSUMMARY of Goverment Regulation No 35 - 2021De Aris DerismanNo ratings yet

- Brave New World Chapter QuestionsDocument5 pagesBrave New World Chapter QuestionsNancy HoangNo ratings yet

- Display PDFDocument6 pagesDisplay PDFAnkur SrivastavaNo ratings yet

- FIDIC Red Book - ClausesDocument1 pageFIDIC Red Book - ClausesDINESHNo ratings yet

- Nakshatras Pushya 150410Document3 pagesNakshatras Pushya 150410Anthony WriterNo ratings yet

- Call For Participants EYFDocument5 pagesCall For Participants EYFEdukativni Centar KruševacNo ratings yet

- People V SalasDocument4 pagesPeople V SalasPaulo Miguel GernaleNo ratings yet

- 19 Ayala - Corp. - v. - MadayagDocument4 pages19 Ayala - Corp. - v. - MadayagJakie CruzNo ratings yet

- Arogya Sanjeevani PremiumDocument16 pagesArogya Sanjeevani PremiumGiriMahaNo ratings yet

- File No:: Recruitment - Aptonline.inDocument3 pagesFile No:: Recruitment - Aptonline.inMEDIDA DURGARAONo ratings yet

- Case Digest - Act 4103 - Intermediate Sentence LawDocument4 pagesCase Digest - Act 4103 - Intermediate Sentence LawMingNo ratings yet

- Pantaloons Loyalty ProgramDocument5 pagesPantaloons Loyalty ProgramJiya Kanoo0% (1)

- Chapter-2A Farmer SuicidesDocument6 pagesChapter-2A Farmer SuicidesSabyasachi MohantyNo ratings yet

- J Assmann Cultural MemoryDocument10 pagesJ Assmann Cultural MemoryXavierNo ratings yet

- Application For Payment of Unclaimed FundsDocument5 pagesApplication For Payment of Unclaimed FundsCarla DiCapriNo ratings yet

- Cheat SheetDocument35 pagesCheat SheetJordan MahabirNo ratings yet

- A10 AX Confguration GuideDocument960 pagesA10 AX Confguration GuideRenataEMJNo ratings yet

- Pharaoh Will Not Listen To GodDocument2 pagesPharaoh Will Not Listen To GodSigilfredo Patiño C.No ratings yet

- Communications Plan Template: PurposeDocument4 pagesCommunications Plan Template: PurposeDung NgoNo ratings yet

- Class ScheduleDocument8 pagesClass ScheduleMikhaila FernandezNo ratings yet

- Zscaler Databee Solution BriefDocument2 pagesZscaler Databee Solution Brieftablet02agonzalezNo ratings yet

- 07 de Julio Cuarto de Secundaria Segunda Clase ContinuaDocument9 pages07 de Julio Cuarto de Secundaria Segunda Clase ContinuaelvisNo ratings yet